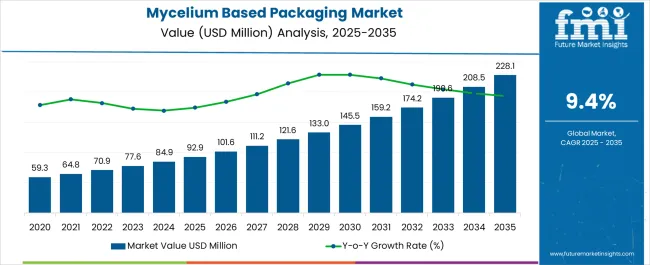

The mycelium based packaging market, valued at USD 92.9 million in 2025 and projected to reach USD 228.1 million by 2035, is expected to expand at a CAGR of 9.4%. From 2020 to 2024, the market grows steadily from USD 59.3 million to USD 84.9 million, reflecting rising demand for eco-friendly packaging solutions driven by regulatory pressure on plastics, corporate sustainability goals, and consumer interest in biodegradable alternatives.

Annual progress shows USD 64.8 million in 2021, USD 70.9 million in 2022, USD 77.6 million in 2023, and USD 84.9 million in 2024, signaling consistent momentum ahead of mainstream adoption. Between 2025 and 2030, the market expands significantly from USD 92.9 million to USD 145.5 million, accounting for nearly 38% of total growth. This stage is shaped by stronger penetration in the food, beverage, personal care, and electronics industries, where demand for sustainable packaging with cost-efficient scalability accelerates adoption. Investments in advanced cultivation and molding processes further enhance production efficiency and material performance.

From 2031 to 2035, the market advances sharply from USD 159.2 million to USD 228.1 billion, contributing about 36% of the total increase. This phase reflects global standardization, wider integration into supply chains, and expansion in industrial packaging applications. The mycelium-based packaging market demonstrates a strong long-term trajectory, fueled by regulatory frameworks, corporate commitments, and technological innovation in biomaterials.

| Metric | Value |

|---|---|

| Mycelium Based Packaging Market Estimated Value in (2025 E) | USD 92.9 million |

| Mycelium Based Packaging Market Forecast Value in (2035 F) | USD 228.1 million |

| Forecast CAGR (2025 to 2035) | 9.4% |

The mycelium based packaging market occupies a strategic niche within the global packaging industry, contributing an estimated 3–4% share of the overall sustainable and alternative packaging materials category. Within the broader biodegradable packaging segment, its presence is stronger at nearly 7–8%, supported by demand for eco-friendly substitutes to single-use plastics and polystyrene. In the specialty protective packaging category, mycelium accounts for approximately 5–6%, as its lightweight, shock-absorbing, and compostable qualities make it ideal for electronics, wine bottles, and fragile goods transportation. Within food and beverage packaging, its share stands at around 2–3%, limited by shelf-life requirements but gradually expanding due to trials in meal kits and quick-service restaurants.

The industrial goods packaging sector contributes nearly 4–5% toward adoption, where mycelium’s moldable structure is being tested as an alternative to styrofoam and thermocol. Growth is being shaped by rising consumer awareness, corporate commitments to reduce plastic waste, and supportive regulatory measures across the EU and North America.

Manufacturers are investing in scaling production facilities, improving moisture resistance, and optimizing molding techniques to expand applications. Although still an emerging segment in terms of absolute dollar sales and share, mycelium packaging is gaining traction as companies reposition portfolios toward natural material integration, offering long-term potential in the packaging ecosystem.

The market is experiencing accelerated growth, driven by increasing demand for sustainable alternatives to plastic and petroleum-based packaging. Regulatory initiatives promoting biodegradable materials, combined with heightened consumer awareness of environmental impacts, are influencing adoption across industries. Advancements in biotechnology have improved the scalability, durability, and versatility of mycelium packaging, making it suitable for a range of applications from consumer goods to industrial shipments.

Manufacturers are leveraging local agricultural waste as feedstock for mycelium cultivation, reducing material costs and carbon footprints. Strategic collaborations between biotechnology firms and packaging producers are enabling faster commercialization and market penetration.

The market is also benefiting from the growing interest of large corporations in meeting ESG commitments through sustainable packaging transitions. As infrastructure for compostable materials expands and new design possibilities emerge, mycelium-based packaging is positioned to capture significant market share from traditional materials, ensuring strong long-term growth prospects in both mature and emerging economies.

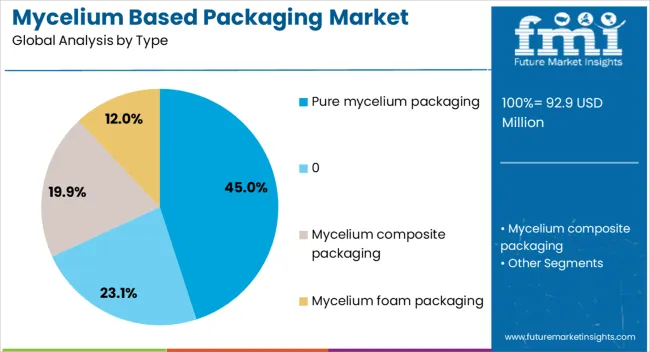

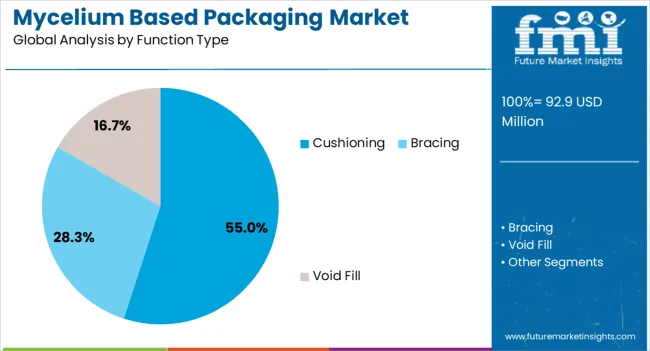

The mycelium based packaging market is segmented by type, function type, packaging format, end use industry, and geographic regions. By type, mycelium based packaging market is divided into Pure mycelium packaging, Mycelium composite packaging, Mycelium foam packaging, and Others. In terms of function type, mycelium based packaging market is classified into Cushioning, Bracing, and Void Fill.

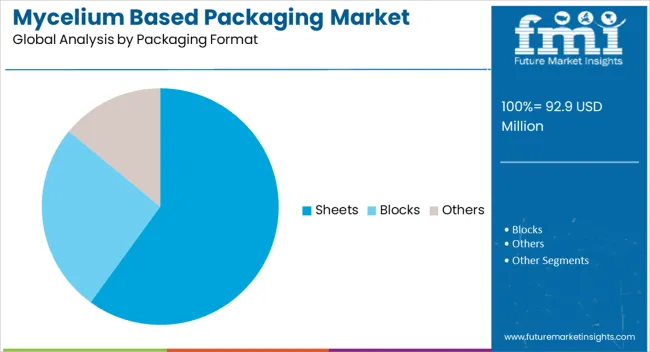

Based on packaging format, mycelium based packaging market is segmented into Sheets, Blocks, and Others. By end use industry, mycelium based packaging market is segmented into Consumer goods, Food and beverage, Healthcare, Construction, and Others. Regionally, the mycelium based packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pure mycelium packaging type segment is expected to hold 45% of the market revenue share in 2025, establishing it as the leading type segment. Its dominance is supported by the material’s superior biodegradability, structural integrity, and insulation properties, which meet the performance requirements of both protective and decorative packaging applications. Pure mycelium products are valued for their ability to be molded into custom shapes, ensuring secure product fit and enhanced protection during transit.

Their naturally derived composition has aligned with stringent sustainability goals adopted by global brands, leading to broader acceptance across retail, electronics, and specialty goods. The absence of synthetic binders and additives in pure mycelium packaging has further strengthened its appeal among environmentally conscious consumers.

Scalable production methods and compatibility with various end-use formats have reinforced its competitive edge. As cost efficiencies improve through optimized cultivation and processing techniques, pure mycelium packaging is anticipated to sustain its leadership position in the market.

The cushioning function type segment is projected to account for 55% of the market revenue share in 2025, making it the most prominent functional category. Its leadership is driven by the ability of mycelium materials to absorb shocks and vibrations during handling and transportation, reducing product damage rates. This performance advantage has been particularly significant for industries shipping fragile or high-value items.

Mycelium cushioning products have gained preference due to their lightweight nature, which helps reduce shipping costs, while also being compostable and non-toxic. Continuous innovations in molding techniques have enabled manufacturers to create cushioning solutions with tailored density and flexibility, ensuring performance parity with synthetic foams.

The combination of environmental benefits and reliable protection has encouraged adoption among e-commerce operators, logistics companies, and product manufacturers As regulations tighten around single-use plastics, the demand for biodegradable cushioning solutions is expected to accelerate, securing this segment’s dominant role in the overall market.

The sheets packaging format segment is estimated to hold 60% of the Mycelium Based Packaging market revenue share in 2025, positioning it as the leading packaging format. Its dominance can be attributed to its versatility in various applications, ranging from protective layering in shipping crates to inserts for product displays. Mycelium sheets are favored for their uniform thickness, durability, and ability to be cut or shaped according to specific packaging requirements.

Their production efficiency allows for scalable output without compromising structural performance. The use of agricultural waste substrates in sheet production supports a circular economy model, enhancing market appeal among sustainability-focused enterprises. Additionally, sheets offer ease of integration into existing packaging workflows, reducing the need for equipment modifications.

The balance of cost-effectiveness, functional adaptability, and environmental compliance has strengthened their adoption across multiple sectors. With increasing investment in eco-friendly packaging solutions, mycelium sheets are expected to retain their market leadership in the coming years.

Mycelium based packaging is advancing through biodegradable alternatives, brand-driven commitments, material improvements, and regulatory support. These dynamics collectively drive adoption, reinforcing its role as a competitive substitute to plastics.

The rise of mycelium based packaging is strongly tied to growing acceptance of biodegradable alternatives within global packaging sectors. As industries reduce reliance on plastics, mycelium is increasingly viewed as a practical substitute due to its compostable nature and strength. Adoption has gained traction in protective packaging where fragile goods such as glass, ceramics, and electronics require shock resistance. Food delivery companies and quick-service restaurants are also exploring mycelium trays and boxes to minimize plastic use. The category’s positioning as both lightweight and moldable ensures flexibility in applications. This expansion reflects demand from corporates looking for distinctive packaging solutions with consumer appeal.

Corporate procurement strategies are shaping the growth of mycelium packaging, with global brands prioritizing materials that enhance brand image while meeting regulatory standards. Mycelium offers a unique visual and textural identity that resonates with consumers associating natural packaging with authenticity and responsibility. Large consumer goods companies are initiating pilot projects with startups, boosting visibility in mainstream retail channels.

Commitments to reduce plastic footprints are fostering collaborations between packaging producers and food, beverage, and e-commerce industries. These partnerships allow scaling of production capacity, thereby improving cost efficiency. Market traction is reinforced by promotional campaigns that emphasize the innovative appeal of fungi-derived packaging solutions.

The growth trajectory of mycelium based packaging is supported by continuous improvements in material processing and performance. Early limitations around moisture sensitivity and shelf-life stability are being addressed through treatments that enhance barrier properties. Producers are experimenting with hybrid formats by combining mycelium with paper, starch, or bio-polymers to expand usability across food, electronics, and industrial packaging.

Moldability into complex shapes and durability under varying load conditions strengthen its case as a replacement for styrofoam. Incremental improvements in cost reduction and scalability are gradually bringing it closer to commercial viability. These advancements are expanding their application scope and supporting broader acceptance in competitive packaging markets.

Regulatory environments are playing an essential role in accelerating the adoption of mycelium packaging. Many regions, including the EU and certain USA states, have introduced restrictions on single-use plastics, which is opening avenues for fungal-based packaging. Incentives for biodegradable and compostable materials provide a further push to scale production.

Standardized certifications for compostability and recyclability are enhancing consumer trust and acceptance across retail and industrial packaging. Policy support combined with consumer advocacy is encouraging retailers and logistics companies to trial mycelium-based solutions. The convergence of regulatory compliance and shifting consumption preferences ensures a steady trajectory for the packaging industry toward natural-based substitutes.

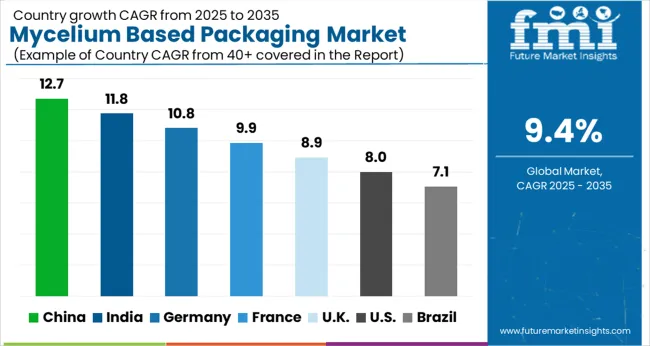

| Country | CAGR |

|---|---|

| China | 12.7% |

| India | 11.8% |

| Germany | 10.8% |

| France | 9.9% |

| UK | 8.9% |

| USA | 8.0% |

| Brazil | 7.1% |

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

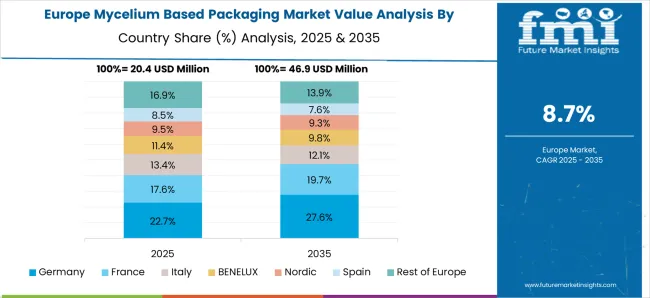

The mycelium based packaging market is projected to grow globally at a CAGR of 9.4% from 2025 to 2035, supported by rising demand for biodegradable and natural alternatives to plastic packaging across industries. China leads with a CAGR of 12.7%, driven by large-scale investments in eco-friendly packaging initiatives and strong adoption in e-commerce and consumer goods. India follows at 11.8%, fueled by expanding food delivery services, increased consumer awareness, and government-backed waste reduction targets. France records 9.9%, benefiting from luxury goods and gourmet food sectors exploring eco-conscious solutions. The United Kingdom grows at 8.9%, driven by retail and quick-service restaurants adopting compostable options. The United States records 8.0%, reflecting steady uptake through consumer brands and industrial packaging, though at a moderate pace compared to Asia and Europe. This growth outlook underscores Asia as the center of momentum, while Europe drives regulatory-led adoption and North America steadily progresses with niche and branded applications.

The CAGR for the mycelium based packaging market in the United Kingdom was 7.6% during 2020–2024 and rose to 8.9% in the 2025–2035 period, showing a gradual improvement in growth pace. Early adoption remained modest due to higher costs and limited production scalability, which restricted its penetration into mainstream packaging categories. However, the following decade brought stronger acceptance as food service operators, supermarkets, and e-commerce retailers began integrating compostable packaging alternatives to meet compliance pressures. Growing investment in pilot projects and partnerships with startups specializing in fungi-based materials strengthened availability and affordability. The trend was also supported by corporate commitments to reduce plastic usage, which helped position mycelium packaging as a viable long-term solution.

China’s CAGR for the mycelium based packaging market stood at 10.8% during 2020–2024 and further advanced to 12.7% during 2025–2035, underlining its leadership position. Early adoption was supported by strong government focus on reducing plastic waste, coupled with large-scale research investments in biodegradable packaging alternatives. Over the next decade, rapid uptake was witnessed across e-commerce, electronics, and consumer goods industries where demand for protective yet eco-friendly solutions surged. Regional startups and collaborations with global material innovators enabled production scalability and competitive pricing, making adoption easier for mainstream companies. The integration of mycelium packaging into high-volume retail distribution networks positioned China as the global frontrunner.

The CAGR for the Indian mycelium based packaging market was recorded at 9.7% during 2020–2024 and accelerated to 11.8% during 2025–2035, highlighting its fast-growing trajectory. Initial adoption remained steady due to the availability of cost-effective alternatives and limited awareness among manufacturers. In the subsequent decade, the surge in online food delivery platforms, consumer packaged goods, and regulatory pressure on plastic reduction fueled significant momentum. Domestic startups introduced localized fungi-based packaging tailored to Indian market needs, supporting both affordability and functionality. Stronger export opportunities also reinforced production expansion, positioning India as a vital hub for mycelium packaging in Asia.

The CAGR for the French mycelium based packaging market was 8.2% during 2020–2024 and rose to 9.9% between 2025 and 2035, indicating increased acceptance in premium sectors. Early growth was modest as costs remained higher than traditional materials, limiting its presence to niche applications. The following decade was defined by luxury food and beverage companies, gourmet packaging, and cosmetics brands adopting mycelium for its premium look and compostability benefits. This trend enhanced consumer recognition and reinforced supply chain investments by local players. Stronger partnerships with European distributors expanded product accessibility, giving mycelium packaging a wider footprint in both retail and industrial use cases.

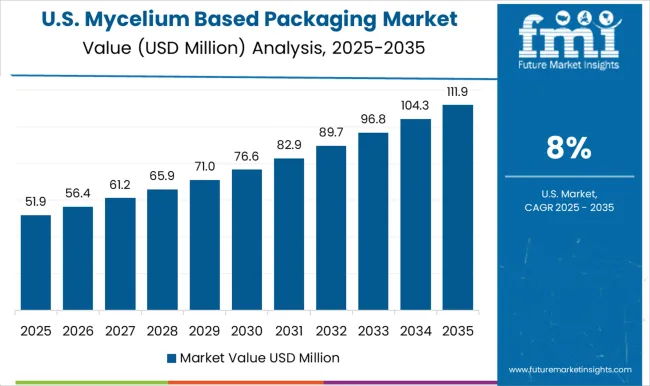

The CAGR for the USA mycelium based packaging market was 7.1% in 2020–2024 and advanced to 8.0% for 2025–2035, reflecting steady yet moderate progress compared to Asia and Europe. Initial adoption was limited to niche startups and pilot initiatives in sustainable packaging. In the next decade, growing awareness among consumer goods companies, e-commerce packaging trials, and food chains experimenting with fungi-based trays created incremental demand. Though growth remained slower due to competitive bio-material alternatives, mycelium packaging carved out a consistent presence in high-value applications. Domestic production expansion and consumer advocacy groups further supported its position in the evolving USA packaging landscape.

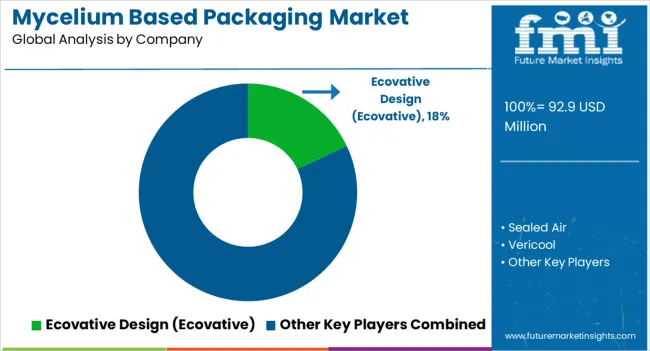

The mycelium based packaging market is evolving with both pioneering innovators and established packaging firms pushing advancements in material science and commercial applications. Ecovative Design (Ecovative) stands out as a pioneer, developing scalable mycelium-based solutions for protective and food packaging with partnerships across consumer goods industries.

Sealed Air, a global leader in packaging, leverages its strong distribution network and R&D capabilities to integrate fungi-derived packaging alternatives into its broader portfolio, strengthening industrial adoption. Vericool focuses on compostable and recyclable packaging for food delivery, pharmaceuticals, and cold-chain logistics, offering competitive alternatives to styrofoam.

MycoWorks emphasizes biofabrication, specializing in fungi-derived materials tailored for both packaging and luxury applications, benefiting from its expertise in biotechnology. BioFab / Magical Mushroom Company is recognized in Europe for its cost-effective mycelium packaging solutions that are customizable, lightweight, and compostable, catering to retail and e-commerce markets. Key strategies across the competitive landscape include enhancing scalability of mycelium production, reducing costs through localized manufacturing, and expanding partnerships with retailers and food service providers.

Companies are focusing on unique design flexibility, consumer appeal, and compliance with compostability standards to drive broader adoption. Investments in material improvements, supply chain efficiency, and collaborations with global brands are expected to shape the future trajectory of this market.

| Item | Value |

|---|---|

| Quantitative Units | USD 92.9 Million |

| Type | Pure mycelium packaging, Mycelium composite packaging, Mycelium foam packaging, and Others |

| Function Type | Cushioning, Bracing, and Void Fill |

| Packaging Format | Sheets, Blocks, and Others |

| End Use Industry | Consumer goods, Food and beverage, Healthcare, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ecovative Design (Ecovative), Sealed Air, Vericool, MycoWorks, and BioFab / Magical Mushroom Company |

| Additional Attributes | Dollar sales, share by region, end-use sector, and application, competitive positioning, pricing trends, production scalability, regulatory policies, consumer adoption drivers, and partnerships shaping future growth. |

The global mycelium based packaging market is estimated to be valued at USD 92.9 million in 2025.

The market size for the mycelium based packaging market is projected to reach USD 228.1 million by 2035.

The mycelium based packaging market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in mycelium based packaging market are pure mycelium packaging, mycelium composite packaging, mycelium foam packaging and others.

In terms of function type, cushioning segment to command 55.0% share in the mycelium based packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mycelium Leather Market Trends & Industry Growth Forecast 2024-2034

Mycelium Packaging Market Size and Share Forecast Outlook 2025 to 2035

Si-based Hall Effect Sensors Market Size and Share Forecast Outlook 2025 to 2035

AI-based 3D reconstruction Tools Market Size and Share Forecast Outlook 2025 to 2035

AI based Triage Tools Market Size and Share Forecast Outlook 2025 to 2035

Ph Based Lip Balm Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Driving Systems (L2 to L5) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biobased And Synthetic Polyamides Market Size and Share Forecast Outlook 2025 to 2035

AI-based Research Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

AI-based Atrial Fibrillation AFib Detection Market Size and Share Forecast Outlook 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

AI-based Surgical Robots Market Size and Share Forecast Outlook 2025 to 2035

Biobased Degreaser Market Size and Share Forecast Outlook 2025 to 2035

pH Based Lipstick Market Size and Share Forecast Outlook 2025 to 2035

Biobased Biodegradable Plastic Market Growth - Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

AI-based Clinical Trials Solution Provider Market Trends – Growth & Forecast 2024-2034

Biobased Transformer Oil Market

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Oat-based Snacks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA