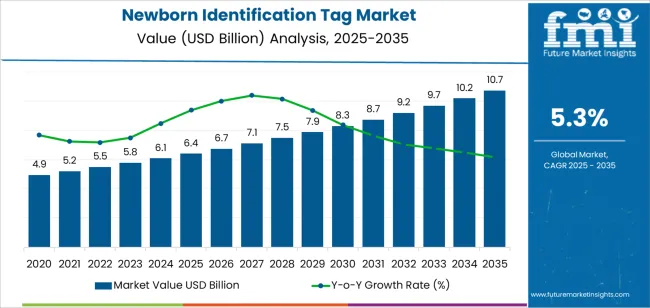

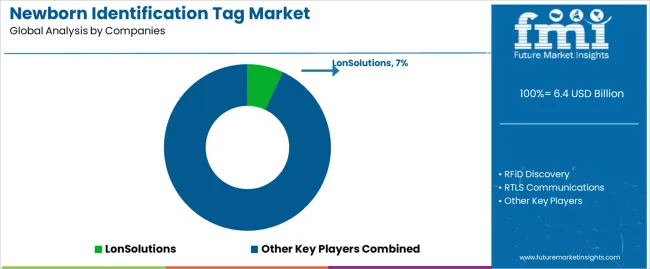

The global newborn identification tag market is expected to grow from USD 6.4 billion in 2025 to approximately USD 10.7 billion by 2035, recording an absolute increase of USD 432.77 million over the forecast period. This translates into a total growth of 67.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.7X during the same period, supported by increased emphasis on patient safety protocols in healthcare facilities, the growing adoption of real-time location-tracking technologies in maternity wards, and rising regulatory requirements for newborn identification standards across hospital networks.

The market expansion reflects fundamental shifts in neonatal care practices, as traditional identification methods come under scrutiny from healthcare regulators and quality assurance programs that demand enhanced security measures. Modern identification systems integrate multiple technologies, including barcode scanning, radio frequency identification, and real-time tracking, to prevent infant abduction and misidentification incidents. These systems support comprehensive documentation requirements while enabling immediate verification of mother-infant matching throughout hospital stays.

Technological advancement continues to reshape product offerings, with manufacturers developing integrated platforms that combine wristband identification with electronic health record systems and nurse call applications. Advanced RFID-enabled tags provide continuous monitoring capabilities, alerting staff to unauthorized movement or security breaches while maintaining comfortable fit for newborn wear. The integration of antimicrobial materials and hypoallergenic adhesives addresses clinical concerns regarding skin sensitivity and infection prevention in neonatal populations.

Regional dynamics demonstrate varied adoption patterns influenced by healthcare infrastructure maturity, regulatory frameworks governing patient identification, and budget allocation for hospital security systems. Developed markets show steady replacement cycles and technology upgrades, while emerging economies experience accelerated adoption as maternity facilities implement standardized safety protocols. Healthcare accreditation requirements and malpractice liability concerns drive investment decisions across different geographies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.4 billion |

| Market Forecast Value (2035) | USD 10.7 billion |

| Forecast CAGR (2025-2035) | 5.3% |

| PATIENT SAFETY DRIVERS | TECHNOLOGY ADVANCEMENT | REGULATORY REQUIREMENTS |

|---|---|---|

| Infant Security Emphasis | RFID Integration | Accreditation Standards |

| Growing awareness of infant abduction risks and misidentification incidents driving hospital investments in comprehensive security systems. | Radio frequency identification technology enabling real-time tracking and automated alerts for unauthorized movement detection. | Healthcare facility accreditation programs establishing mandatory identification protocols for neonatal care units. |

| Medical Error Prevention | Electronic Integration | Documentation Standards |

| Hospital quality initiatives prioritizing elimination of patient identification errors throughout neonatal care pathways. | Seamless integration with electronic health records and hospital information systems supporting workflow efficiency. | Regulatory requirements mandating comprehensive documentation of mother-infant matching and verification procedures. |

| Liability Risk Management | Material Innovation | Quality Benchmarks |

| Malpractice concerns and insurance requirements motivating healthcare facilities to implement proven identification technologies. | Development of antimicrobial, hypoallergenic materials addressing clinical safety requirements for newborn skin contact. | Performance standards requiring reliable identification systems resistant to tampering and environmental stresses. |

| Category | Segments Covered |

|---|---|

| By Technology Type | Ordinary Wristbands, Barcoded Wristbands, RFID-enabled Wristbands, Others |

| By Application | Hospital, Clinic, Other |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Ordinary Wristbands |

|

| Barcoded Wristbands |

|

| RFID-enabled Wristbands |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Hospital |

|

| Clinic |

|

| Other |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Patient Safety Initiatives | Implementation Costs | Real-time Tracking Integration |

| Healthcare facility emphasis on preventing infant abduction and misidentification driving investments in comprehensive security systems. | High capital requirements for RFID infrastructure and ongoing consumable expenses affecting adoption in budget-constrained facilities. | Integration of location tracking technologies enabling continuous monitoring and automated security alerts throughout hospital premises. |

| Regulatory Compliance | Technical Complexity | Electronic Health Record Integration |

| Accreditation standards and quality benchmarks mandating standardized identification protocols across maternity and neonatal care facilities. | System integration challenges and staff training requirements creating implementation barriers in facilities with limited technical resources. | Seamless connectivity with hospital information systems supporting workflow efficiency and documentation accuracy. |

| Malpractice Prevention | Infrastructure Requirements | Material Innovation |

| Liability concerns and insurance requirements motivating hospitals to implement proven identification technologies reducing error risks. | Reader network installation and maintenance demands affecting feasibility in facilities with distributed or older physical infrastructure. | Development of antimicrobial, hypoallergenic materials and comfortable designs addressing clinical safety requirements for newborn applications. |

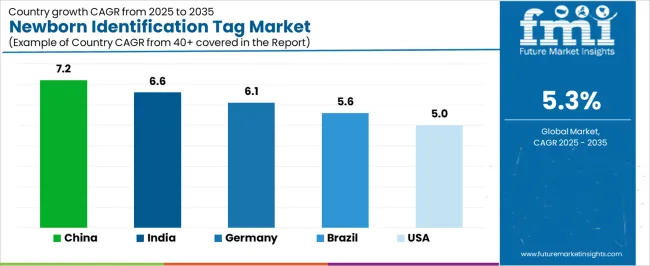

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| United States | 5.0% |

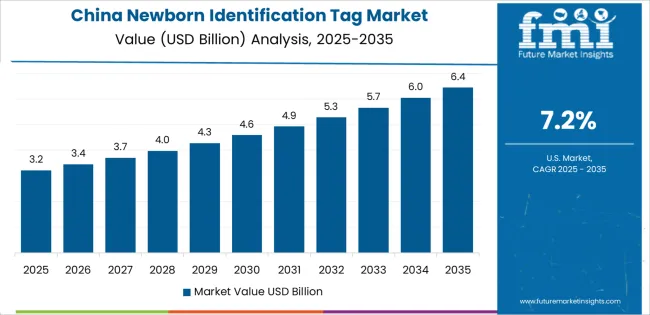

Revenue from newborn identification tags in China is projected to exhibit strong growth with substantial market value by 2035, driven by comprehensive maternal and child health program development and expanding hospital network modernization creating opportunities for patient safety technology suppliers. The country's birth rate management policies and healthcare quality improvement initiatives are creating demand for standardized identification systems across public and private maternity facilities. Major hospital groups in Beijing, Shanghai, Guangzhou, and provincial capitals are implementing comprehensive security protocols.

Hospital construction programs and maternity ward expansion are supporting widespread adoption of identification technologies across tier-one through tier-three cities. Government healthcare reform initiatives emphasizing patient safety and quality standards are creating substantial opportunities for security system suppliers. Medical equipment localization programs and domestic manufacturer development are facilitating adoption through competitive pricing and local service networks. Maternal and child hospital accreditation programs are driving demand for proven identification technologies meeting international safety standards.

Revenue from newborn identification tags in India is expanding substantially by 2035, supported by private hospital network growth and government healthcare initiatives creating sustained demand across metropolitan and emerging urban centers. The country's corporate hospital development and medical tourism industry are driving adoption of international patient safety standards. Major healthcare groups including Apollo Hospitals, Fortis Healthcare, and Cloudnine Hospitals are implementing comprehensive maternity security systems.

Government programs focused on safe childbirth and neonatal mortality reduction are facilitating technology adoption across public and private healthcare facilities. Hospital accreditation initiatives and quality certification programs are creating requirements for standardized identification systems. Urban maternity facility expansion and birthing center development are driving demand for cost-effective identification solutions. Clinical protocol standardization and staff training programs are enhancing implementation capabilities throughout major healthcare networks.

Demand for newborn identification tags in Germany is projected to reach substantial levels by 2035, supported by the country's stringent healthcare quality standards and comprehensive patient safety regulations requiring advanced identification systems. German hospitals maintain rigorous protocols for maternal and neonatal care with integrated security measures. The market is characterized by emphasis on system reliability, data privacy compliance, and integration with electronic health records.

University hospital networks and specialized maternity centers prioritize proven technologies demonstrating superior performance and regulatory compliance. Healthcare digitalization initiatives and hospital information system modernization are driving adoption of integrated identification platforms. Clinical quality assurance programs and accreditation requirements are facilitating adoption of advanced tracking capabilities. Regulatory emphasis on data protection and patient privacy is creating opportunities for secure identification systems throughout academic medical centers and community hospitals.

Revenue from newborn identification tags in Brazil is growing substantially by 2035, driven by private hospital network expansion and public healthcare system modernization creating opportunities for patient safety technology suppliers. The country's maternal health programs and urban hospital development are creating demand for identification systems. Major hospital groups in São Paulo, Rio de Janeiro, and regional capitals are implementing security protocols.

Healthcare quality initiatives and hospital accreditation programs are facilitating adoption of standardized identification technologies. Private healthcare sector growth and expanding middle-class access to maternity services are supporting investments in patient safety systems. Medical equipment import policies and local manufacturing development are enabling market access for international and domestic suppliers. Government programs focused on reducing neonatal mortality and improving maternal care outcomes are creating opportunities for comprehensive identification solutions across metropolitan healthcare facilities.

Demand for newborn identification tags in the United States is expanding to reach substantial levels by 2035, driven by stringent regulatory requirements and comprehensive liability concerns creating sustained demand across hospital networks. The country's established maternity care infrastructure and patient safety emphasis support adoption of advanced identification technologies. Healthcare facility accreditation standards through The Joint Commission mandate comprehensive infant security protocols.

Hospital risk management programs and malpractice insurance requirements are driving investments in proven identification systems. Electronic health record integration requirements and meaningful use criteria are influencing technology selection decisions. Maternal and neonatal care specialization and birthing center development are creating demand for scalable identification solutions. Clinical quality improvement initiatives and patient safety organizations are facilitating adoption of best-practice security protocols across hospital networks and independent birthing facilities.

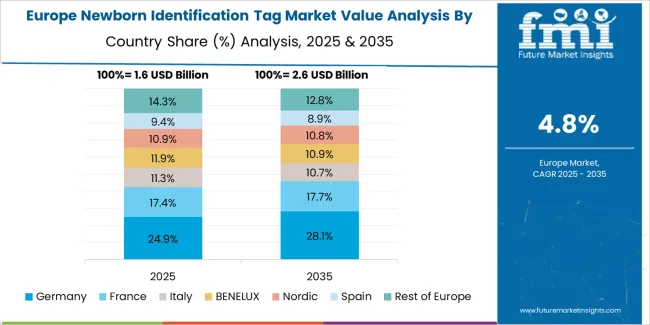

The newborn identification tag market in Europe is projected to grow from USD 164.23 million in 2025 to USD 274.58 million by 2035, registering a CAGR of 5.3% over the forecast period. Germany is expected to maintain its leadership position with a 29.6% market share in 2025, growing slightly to 30.1% by 2035, supported by stringent patient safety regulations and comprehensive maternal care standards across university hospitals and community maternity facilities.

France follows with a 22.4% share in 2025, projected to reach 22.8% by 2035, driven by national healthcare quality programs and maternity facility modernization initiatives. The United Kingdom holds a 19.7% share in 2025, expected to maintain 19.5% through 2035 as National Health Service facilities implement standardized identification protocols. Italy commands a 15.8% share in 2025, while Spain accounts for 12.5% in 2025, both showing steady growth through enhanced hospital accreditation requirements. The Rest of Europe region is anticipated to maintain momentum at approximately 10.0% share, attributed to healthcare infrastructure investments in Nordic countries and Eastern European hospital network modernization programs implementing patient safety technologies.

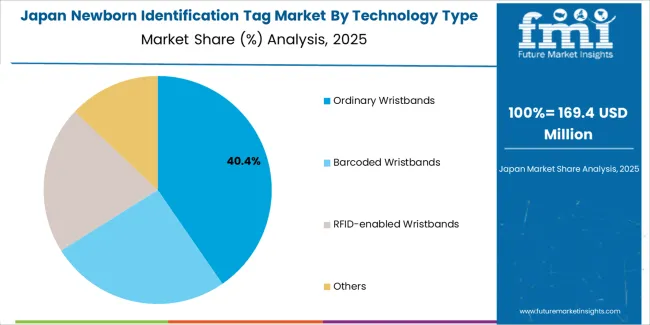

Japanese newborn identification tag operations reflect the country's rigorous healthcare quality standards and comprehensive patient safety culture. Major hospital networks maintain advanced maternity facilities with integrated security systems exceeding international benchmarks. The regulatory framework through the Ministry of Health, Labour and Welfare establishes stringent performance requirements and safety standards that favor proven technologies with demonstrated reliability.

Healthcare facilities emphasize system integration and workflow efficiency, with procurement decisions prioritizing compatibility with existing hospital information systems and electronic health records. Major medical equipment distributors provide comprehensive technical support and maintenance services essential for sustained system performance. The Japanese market demonstrates preference for user-friendly systems with minimal staff training requirements and reliable operation in high-volume maternity environments. Clinical protocols emphasize comprehensive documentation and verification procedures, creating demand for identification systems supporting standardized workflows and quality assurance programs.

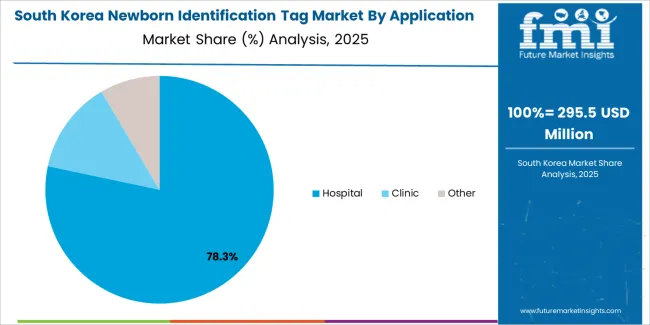

South Korean newborn identification tag operations reflect the country's technologically advanced healthcare sector and emphasis on maternal and child health. Major hospital groups including Seoul National University Hospital, Samsung Medical Center, and specialized women's hospitals maintain state-of-the-art maternity facilities with comprehensive security protocols. The regulatory environment through the Ministry of Food and Drug Safety emphasizes product safety and clinical validation.

Healthcare digitalization initiatives and hospital information system integration requirements drive demand for connected identification platforms. Maternity facilities prioritize system reliability and ease of use, with procurement strategies emphasizing total cost of ownership and ongoing support capabilities. The market benefits from government healthcare policies supporting maternal health programs and hospital security investments. Local manufacturers and international suppliers compete across segments, with market dynamics favoring systems demonstrating superior performance and seamless integration with hospital workflows in high-volume clinical environments.

Market structure reflects fragmentation across technology segments, with specialized security technology providers competing against medical device manufacturers offering broader product portfolios. Value creation centers on system reliability, regulatory compliance capabilities, and integration with hospital information systems. Leading suppliers maintain competitive positions through comprehensive offerings combining hardware, software platforms, and implementation services that establish long-term customer relationships extending beyond initial equipment sales.

Profit pools concentrate in RFID-enabled solutions where advanced tracking capabilities and real-time monitoring features command premium pricing. Recurring revenue streams from consumables and maintenance contracts provide stable cash flows supporting competitive equipment placement strategies. System integration services and technical support enhance customer retention while generating predictable revenue. Smaller facilities and emerging markets favor cost-effective barcoded and ordinary wristbands, creating volume opportunities with lower margins.

Competitive dynamics demonstrate increasing emphasis on software capabilities and data analytics as product differentiation shifts beyond hardware specifications. Suppliers invest in user interface development and workflow optimization features addressing hospital operational requirements. Integration capabilities with electronic health records and hospital security systems become essential rather than optional features. Cloud-based platforms and mobile applications enable remote monitoring and management capabilities attractive to multi-facility healthcare networks.

Market consolidation occurs through acquisitions targeting complementary technologies and geographic expansion. Established medical device companies acquire specialized identification technology providers to broaden maternal and neonatal care portfolios. Distribution partnerships provide market access in regions requiring local support capabilities and regulatory expertise. Switching costs created through staff training, system integration, and standardized protocols create customer retention advantages limiting competitive displacement in established hospital accounts.

| Items | Values |

|---|---|

| Quantitative Units | USD 6.4 billion |

| Technology Type | Ordinary Wristbands, Barcoded Wristbands, RFID-enabled Wristbands, Others |

| Application | Hospital, Clinic, Other |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

| Key Companies Profiled | LonSolutions, RFiD Discovery, RTLS Communications, Xtag Medical, Hugs, Litum, Xtec, Reflex Systems, CenTrak, Borda Technology, GuardRFID, Accutech, Cadi, Elpas, Secure Care, RF Technologies, Asia Avid, BioEnable, Interface |

| Additional Attributes | Dollar sales by technology type and application, regional demand across North America, Europe, Asia Pacific, competitive landscape, RFID technology advancement, electronic health record integration, and patient safety initiatives driving identification system adoption, workflow optimization, and healthcare facility security enhancement |

The global newborn identification tag market is estimated to be valued at USD 6.4 billion in 2025.

The market size for the newborn identification tag market is projected to reach USD 10.7 billion by 2035.

The newborn identification tag market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in newborn identification tag market are ordinary wristbands, barcoded wristbands, rfid-enabled wristbands and others.

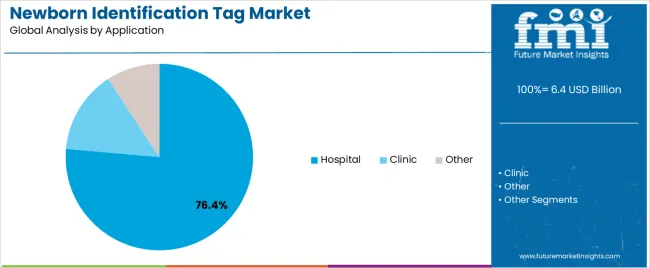

In terms of application, hospital segment to command 76.4% share in the newborn identification tag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Newborn Jaundice Treatment Market Size and Share Forecast Outlook 2025 to 2035

Newborn Name Tag Market Size and Share Forecast Outlook 2025 to 2035

Human Identification Market Size and Share Forecast Outlook 2025 to 2035

Visitor Identification Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Identification Wristbands Market Analysis – Size, Trends & Forecast 2025 to 2035

Automatic Identification and Data Capture Market Size and Share Forecast Outlook 2025 to 2035

Automatic Identification System Market Analysis by Category, Application, and Region through 2035

Microbial Identification Market Report – Growth & Forecast 2025-2035

Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Positive Patient Identification Market Size and Share Forecast Outlook 2025 to 2035

Biometric Driver Identification System Market Growth - Trends & Forecast 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Printed Chipless RFID Radio Frequency Identification Market Size and Share Forecast Outlook 2025 to 2035

Tags Market Insights - Growth & Demand 2025 to 2035

Tagatose Market Analysis by Application, Sweetness Profile, Industry Demand, and Regional Forecast from 2025 to 2035

Metagenomics Market Trends - Industry Analysis & Forecast 2025 to 2035

Outage Management System Market Insights – Forecast 2025-2035

Voltage Tester Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Voltage Regulator For Advanced Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA