The oligonucleotide API market is experiencing strong expansion. Increasing adoption of nucleic acid–based therapeutics, rising investment in genetic research, and expanding clinical applications of oligonucleotide drugs are driving consistent demand. Current dynamics are defined by growing partnerships between biotech firms and pharmaceutical manufacturers, aimed at scaling production capacity and improving manufacturing efficiency.

Regulatory approvals for new oligonucleotide-based treatments are strengthening commercialization potential, while advanced synthesis technologies are enhancing product purity and scalability. The future outlook remains positive as precision medicine continues to gain momentum across oncology, rare diseases, and chronic disorder management.

Market growth is supported by rising demand for customized oligonucleotide sequences, expanding R&D pipelines, and the development of cost-effective, high-throughput synthesis platforms Strategic collaborations, strong patent portfolios, and investments in regulatory-compliant facilities are expected to sustain steady revenue growth and reinforce the market’s positioning within the broader pharmaceutical API landscape.

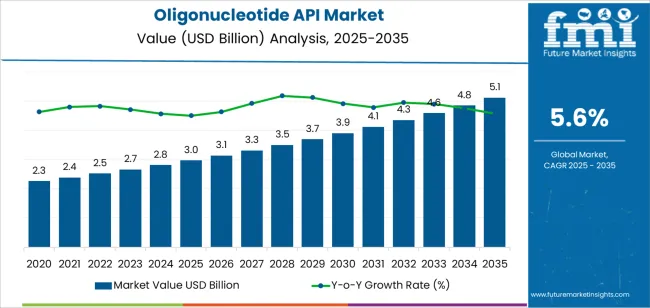

| Metric | Value |

|---|---|

| Oligonucleotide API Market Estimated Value in (2025 E) | USD 3.0 billion |

| Oligonucleotide API Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

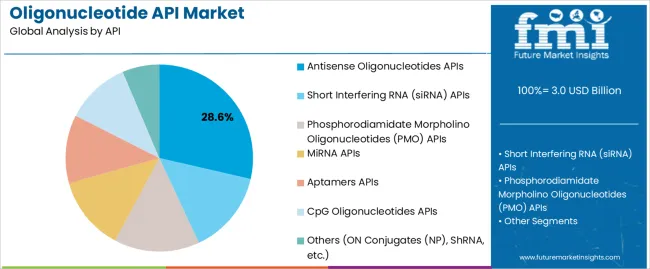

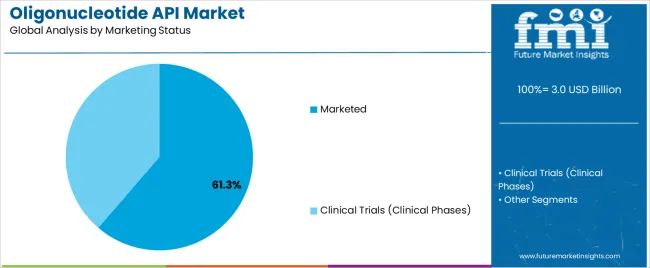

The market is segmented by API, Marketing Status, and End User and region. By API, the market is divided into Antisense Oligonucleotides APIs, Short Interfering RNA (siRNA) APIs, Phosphorodiamidate Morpholino Oligonucleotides (PMO) APIs, MiRNA APIs, Aptamers APIs, CpG Oligonucleotides APIs, and Others (ON Conjugates (NP), ShRNA, etc.). In terms of Marketing Status, the market is classified into Marketed and Clinical Trials (Clinical Phases). Based on End User, the market is segmented into Pharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Biopharmaceutical Companies, and Contract Development & Manufacturing Organizations (CDMOs). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The antisense oligonucleotides APIs segment, accounting for 28.60% of the API category, has been leading due to its established role in gene expression modulation and therapeutic precision. Its prominence is supported by increasing approvals of antisense-based drugs and rising clinical research focused on genetic disorders and oncology.

Continuous advancements in oligonucleotide synthesis technology have enhanced yield, purity, and scalability, ensuring consistent product availability for both clinical and commercial supply. Pharmaceutical manufacturers have been expanding production lines dedicated to antisense APIs, supported by favorable regulatory pathways and intellectual property protection.

The segment’s share is further strengthened by its therapeutic versatility and proven efficacy across diverse molecular targets, positioning antisense oligonucleotides as a cornerstone of next-generation genetic therapies.

The marketed segment, representing 61.30% of the marketing status category, has maintained dominance due to the growing number of approved oligonucleotide therapeutics entering commercial distribution. This leadership is reinforced by established regulatory frameworks that facilitate faster approvals for safe and effective oligonucleotide-based APIs.

The availability of marketed products has driven large-scale production investments and global supply chain optimization. Pharmaceutical and biotech firms have expanded their portfolios to include multiple marketed oligonucleotide APIs, increasing accessibility and fostering clinician confidence.

The segment’s growth is further propelled by post-approval research, lifecycle management strategies, and expansion into new therapeutic areas, ensuring continued dominance and strong revenue contribution.

The pharmaceutical companies segment, holding 46.70% of the end user category, has been leading the market due to extensive capabilities in scaling, formulation, and global distribution of oligonucleotide-based products. Demand from pharmaceutical manufacturers has been supported by a steady pipeline of drug candidates progressing through late-stage trials and commercialization phases.

Strategic collaborations with contract development and manufacturing organizations have improved production efficiency and quality assurance. Regulatory compliance and investment in advanced analytical technologies have enhanced the reliability of large-scale oligonucleotide manufacturing.

The segment’s continued leadership is expected to persist as pharmaceutical companies expand their therapeutic portfolios and strengthen partnerships in genetic medicine, reinforcing their pivotal role in driving the global oligonucleotide API market.

The increasing number of oligonucleotide-active pharmaceutical ingredients in medication pipelines around the world is a major driver of market growth. Pharma businesses have benefited from the ongoing trend toward harmonization of oligonucleotide development and marketing over the last 10-15 years. Several other reasons are also leading to the growth of the oligonucleotide API market:

The antisense oligonucleotide APIs category is projected to hold the largest share of the market in the year 2025. This segment holds 78% of the global oligonucleotide API market.

| Attributes | Details |

|---|---|

| API | Antisense Oligonucleotides API |

| Market Share | 78% |

The oligonucleotide API market is also categorized by end-users into CMOs, pharmaceutical and biopharmaceutical companies, and contract development & manufacturing organizations. The pharmaceutical and biopharmaceutical companies segment dominates the market with a share of 49% in 2025.

| Attributes | Details |

|---|---|

| End User | Pharmaceutical and Biopharmaceutical Companies |

| Market Share | 49% |

This section offers a comprehensive analysis of the oligonucleotide APIs market across various countries, including India, Thailand, Malaysia, Indonesia, and France. The table presents the Compound Annual Growth Rate (CAGR) for each country, depicting the estimated market growth in these regions until 2035.

| Countries | CAGR |

|---|---|

| India | 7.80% |

| Thailand | 6.20% |

| Malaysia | 5.90% |

| Indonesia | 5.40% |

| France | 4.20% |

India is expected to exhibit significant market growth over the forecast period. The Indian market for oligonucleotide APIs is anticipated to grow at a CAGR of 7.80%.

Thailand is also one of the lucrative markets in the oligonucleotide APIs industry. The Thai market for oligonucleotide APIs is anticipated to grow at a CAGR of 6.20%.

Malaysia also is a promising market in the global oligonucleotide APIs industry. Over the next ten years, the Malaysian demand for oligonucleotide APIs is projected to rise at a 5.90% CAGR.

Indonesia is also one of the countries that is filled with potential in this market. The Indonesian oligonucleotide API market is anticipated to retain its dominance by progressing at a growth rate of 5.40% till 2035.

France also exhibits a promising future in the global oligonucleotide APIs market. The oligonucleotide APIs market in France is anticipated to retain its dominance by progressing at a growth rate of 4.20% till 2035.

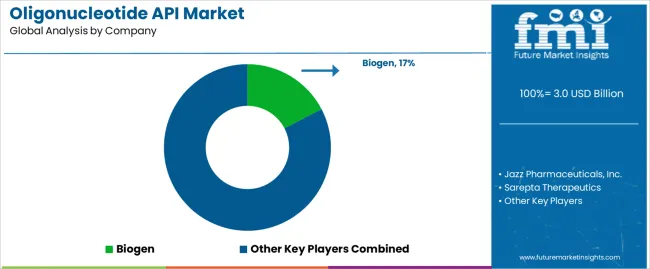

The global oligonucleotide active pharmaceutical ingredient (API) market is still in its early stages and is dominated by a few key players. These include Jazz Pharmaceuticals, Inc., Sarepta Therapeutics, Biogen, Dynavax Technologies, Akcea Therapeutics, and Alnylam Pharmaceuticals, Inc.

However, the market is expected to grow with strategic partnerships and the introduction of new products by industry leaders. To stay competitive in this market, companies need to have a strong creative and innovative capacity.

Recent Developments

The global oligonucleotide api market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the oligonucleotide api market is projected to reach USD 5.1 billion by 2035.

The oligonucleotide api market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in oligonucleotide api market are antisense oligonucleotides apis, short interfering rna (sirna) apis, phosphorodiamidate morpholino oligonucleotides (pmo) apis, mirna apis, aptamers apis, cpg oligonucleotides apis and others (on conjugates (np), shrna, etc.).

In terms of marketing status, marketed segment to command 61.3% share in the oligonucleotide api market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antisense Oligonucleotides Market Size and Share Forecast Outlook 2025 to 2035

Apigenin Market Size and Share Forecast Outlook 2025 to 2035

API Monetization Platform Market by Component, Enterprise Size, Industry & Region Forecast till 2035

Rapid Microbiology Testing Market Forecast Outlook 2025 to 2035

Rapid Test Cards Market Size and Share Forecast Outlook 2025 to 2035

Rapid Prototyping Materials Market Size and Share Forecast Outlook 2025 to 2035

Rapid Test Readers Market Size and Share Forecast Outlook 2025 to 2035

Papillary Thyroid Cancer Market Size and Share Forecast Outlook 2025 to 2035

Tapioca Pearls Market Analysis - Size, Share, and Forecast 2025 to 2035

Rapid Strength Concrete Market Size and Share Forecast Outlook 2025 to 2035

Rapid Self-Healing Gel Market Size and Share Forecast Outlook 2025 to 2035

Tapioca Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rapid Infuser Market Size, Growth, and Forecast 2025 to 2035

Capillary Electrophoresis Market Size, Growth, and Forecast 2025 to 2035

Rapid RNA Testing Kits Market Trends- Growth & Forecast 2025 to 2035

Rapid Hepatitis Testing Market – Demand & Forecast 2025 to 2035

Rapid Antigen Testing Market - Demand, Growth & Forecast 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Market Leaders & Share in the Rapid Infuser Industry

Rapid Plasma Reagin Test Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA