The rapid microbiology testing market is experiencing robust expansion driven by increasing demand for faster diagnostic outcomes, stringent regulatory requirements for product safety, and growing adoption across clinical and industrial applications. Market growth is supported by advancements in molecular diagnostics, automation, and data integration technologies that enhance accuracy and turnaround time.

Rising incidences of infectious diseases and heightened focus on early detection are fueling the need for reliable testing solutions. The current landscape is characterized by continuous investment in research and development aimed at improving assay sensitivity and operational efficiency.

Future growth is expected to be influenced by expanding healthcare infrastructure in emerging markets and broader implementation of quality assurance frameworks across industries such as pharmaceuticals, food safety, and environmental monitoring The overall growth rationale is grounded in the market’s capacity to deliver precise, rapid, and scalable testing methods that support both patient care and compliance requirements, ensuring consistent adoption and sustained revenue expansion over the forecast period.

| Metric | Value |

|---|---|

| Rapid Microbiology Testing Market Estimated Value in (2025 E) | USD 5.5 billion |

| Rapid Microbiology Testing Market Forecast Value in (2035 F) | USD 13.4 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

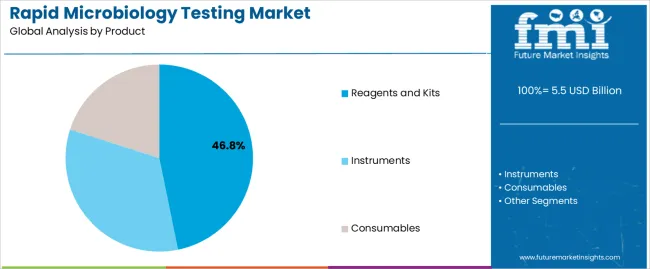

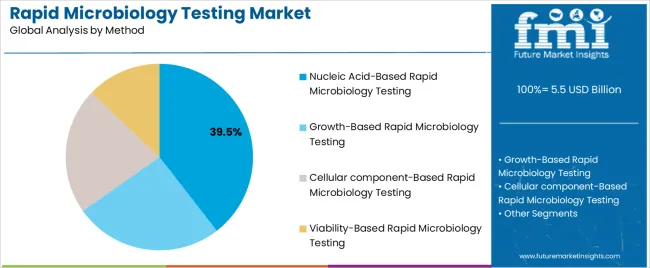

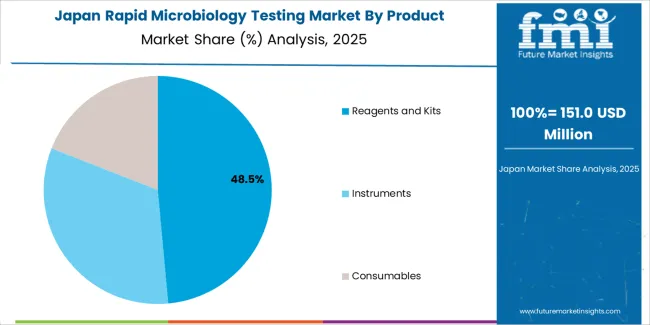

The market is segmented by Product, Method, Applications, and End Users and region. By Product, the market is divided into Reagents and Kits, Instruments, and Consumables. In terms of Method, the market is classified into Nucleic Acid-Based Rapid Microbiology Testing, Growth-Based Rapid Microbiology Testing, Cellular component-Based Rapid Microbiology Testing, and Viability-Based Rapid Microbiology Testing.

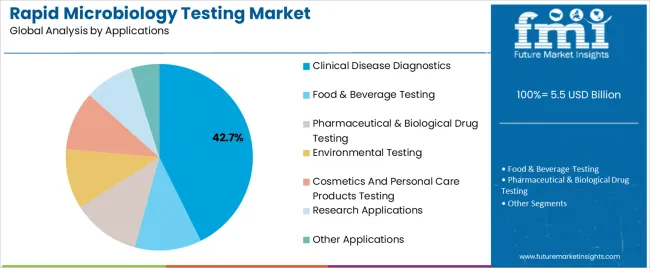

Based on Applications, the market is segmented into Clinical Disease Diagnostics, Food & Beverage Testing, Pharmaceutical & Biological Drug Testing, Environmental Testing, Cosmetics And Personal Care Products Testing, Research Applications, and Other Applications.

By End Users, the market is divided into Laboratories And Hospitals, Food And Beverage Companies, Pharmaceutical and Biotechnology Companies, Contract Research Organizations, and Other End-Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reagents and kits segment, holding 46.80% of the product category, has established dominance due to its essential role in facilitating rapid, accurate, and cost-effective testing processes. Continuous improvements in reagent formulation and kit design have enhanced sensitivity, reduced error rates, and optimized user convenience.

Demand has been supported by increased testing volumes in hospitals, diagnostic centers, and pharmaceutical manufacturing facilities. The segment benefits from recurring consumable purchases that ensure stable revenue generation for market players.

Integration of ready-to-use reagent kits with automated systems has streamlined laboratory workflows, reducing turnaround times and supporting compliance with quality standards Ongoing product innovation, coupled with expanding distribution networks and heightened awareness regarding infection control, is expected to sustain the segment’s leadership and drive continued growth across diverse application domains.

The nucleic acid-based rapid microbiology testing segment, accounting for 39.50% of the method category, has gained prominence due to its superior precision, rapid detection capability, and ability to identify pathogens at the genetic level. Adoption has been fueled by technological advancements in polymerase chain reaction (PCR), quantitative nucleic acid amplification, and next-generation sequencing platforms.

The method’s high sensitivity and specificity have made it a preferred choice for critical diagnostic applications where early and accurate detection is essential. Increased investment in molecular testing infrastructure and ongoing cost reductions in reagent production are further enhancing accessibility.

Regulatory support for molecular diagnostics and the integration of digital data management systems are strengthening operational reliability The segment’s continued evolution is expected to sustain its market share, supporting broader clinical and industrial applications.

The clinical disease diagnostics segment, representing 42.70% of the applications category, has maintained its leadership owing to the increasing global burden of infectious diseases and the necessity for rapid pathogen identification. Its growth has been driven by the demand for early diagnosis, patient management efficiency, and infection control in hospital settings.

Integration of rapid microbiology testing into routine clinical workflows has enhanced treatment precision and reduced hospitalization durations. The segment has also benefited from government initiatives promoting disease surveillance and advanced diagnostic capabilities.

Ongoing technological developments, combined with training programs for laboratory professionals, have improved test reliability and operational proficiency Expanding healthcare access in developing regions and continued public health investments are expected to reinforce the segment’s dominance and ensure long-term growth momentum in the global market.

| Attributes | Details |

|---|---|

| Product | Instruments |

| CAGR of ( 2025 to 2035) | 9.1% |

| Attributes | Details |

|---|---|

| Top Application | Clinical Disease Diagnosis |

| CAGR of ( 2025 to 2035) | 8.8% |

| Countries | Forecasted CAGR from 2025 to 2035 |

|---|---|

| United States | 9.7% |

| United Kingdom | 10.8% |

| China | 8.6% |

| Japan | 10.6% |

| South Korea | 11.7 % |

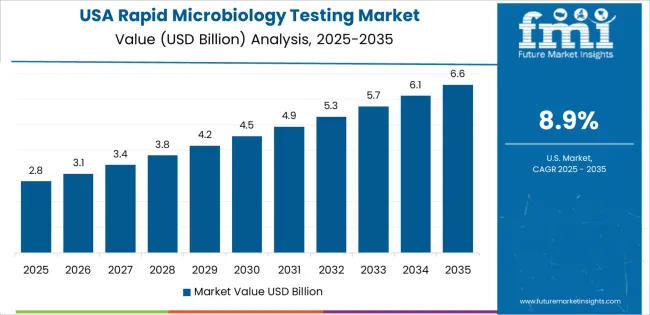

The rapid microbiology testing market in the United States is experiencing steady growth, with a CAGR of 9.7% from 2025 to 2035.

The United Kingdom is experiencing a 10.8% CAGR in the rapid microbiology testing market, showcasing its agility in adopting advanced testing solutions.

The rapid microbiology testing market is shaped by technological advancements, regulatory compliance, strategic alliances, and market segmentation.

Recent Development Rapid Microbiology Testing market

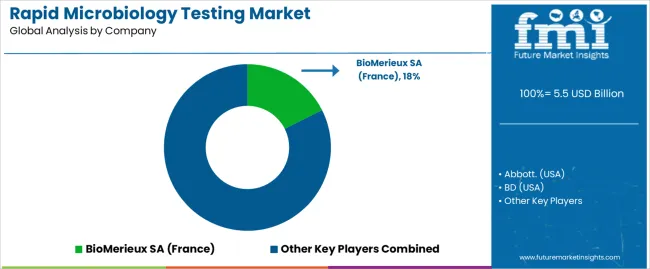

The global rapid microbiology testing market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the rapid microbiology testing market is projected to reach USD 13.4 billion by 2035.

The rapid microbiology testing market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in rapid microbiology testing market are reagents and kits, instruments and consumables.

In terms of method, nucleic acid-based rapid microbiology testing segment to command 39.5% share in the rapid microbiology testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rapid RNA Testing Kits Market Trends- Growth & Forecast 2025 to 2035

Rapid Antigen Testing Market - Demand, Growth & Forecast 2025 to 2035

Mono Rapid Testing Market Size and Share Forecast Outlook 2025 to 2035

Rapid Hepatitis Testing Market – Demand & Forecast 2025 to 2035

Rapid Coagulation Testing Market

Malaria Ag Rapid Testing Market - Growth & Forecast 2025 to 2035

Candida Vaginitis Rapid Testing Market

Rapid U-drills Market Size and Share Forecast Outlook 2025 to 2035

Rapid Test Cards Market Size and Share Forecast Outlook 2025 to 2035

Rapid Prototyping Materials Market Size and Share Forecast Outlook 2025 to 2035

Rapid Test Readers Market Size and Share Forecast Outlook 2025 to 2035

Rapid Strength Concrete Market Size and Share Forecast Outlook 2025 to 2035

Rapid Self-Healing Gel Market Size and Share Forecast Outlook 2025 to 2035

Rapid Infuser Market Size, Growth, and Forecast 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Market Leaders & Share in the Rapid Infuser Industry

Rapid Plasma Reagin Test Market

Rapid Cook-High Speed Ovens Market

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA