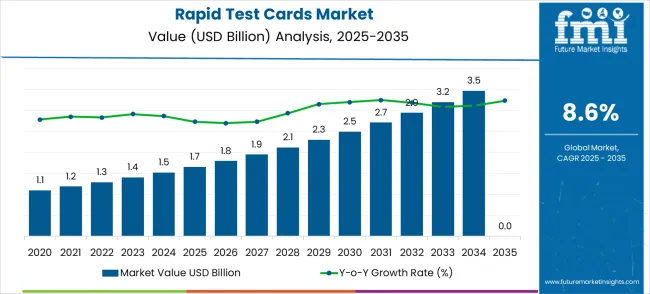

The Rapid Test Cards Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

| Metric | Value |

|---|---|

| Rapid Test Cards Market Estimated Value in (2025 E) | USD 1.7 billion |

| Rapid Test Cards Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The Rapid Test Cards market is experiencing significant growth, driven by the increasing demand for quick and reliable diagnostic tools in healthcare settings. Rising awareness of early detection and preventive healthcare practices is supporting adoption across both urban and rural areas. Technological advancements in lateral flow assays, immunoassay techniques, and bio-sensing technologies have enhanced the sensitivity, accuracy, and reliability of rapid test cards, enabling timely decision-making by healthcare professionals.

The market is further supported by expanding healthcare infrastructure, rising patient footfall in clinics and hospitals, and increasing investments in diagnostic solutions by public and private healthcare providers. Rapid test cards offer cost-effective, portable, and user-friendly solutions, reducing dependency on centralized laboratories and facilitating point-of-care testing.

Regulatory approvals and standardization of quality parameters have improved confidence among practitioners and patients, encouraging wider utilization As demand for efficient diagnostic solutions continues to rise, particularly for pregnancy, infectious disease, and other clinical screenings, the Rapid Test Cards market is expected to maintain robust growth, supported by technological innovation, healthcare awareness, and accessibility improvements.

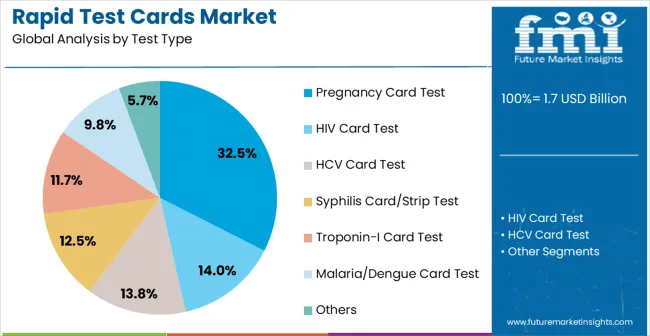

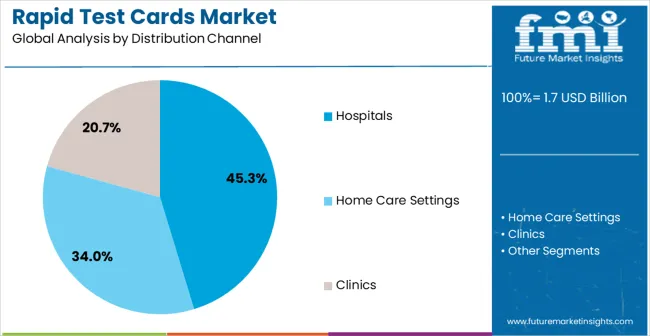

The rapid test cards market is segmented by test type, distribution channel, and geographic regions. By test type, rapid test cards market is divided into Pregnancy Card Test, HIV Card Test, HCV Card Test, Syphilis Card/Strip Test, Troponin-I Card Test, Malaria/Dengue Card Test, and Others. In terms of distribution channel, rapid test cards market is classified into Hospitals, Home Care Settings, and Clinics.

Regionally, the rapid test cards industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pregnancy card test segment is projected to hold 32.5% of the market revenue in 2025, establishing it as the leading test type. Growth is being driven by increasing awareness of early pregnancy detection, expanding access to home-based and clinical testing, and the convenience offered by rapid test cards. These tests provide quick results with high sensitivity, allowing timely decision-making and reducing the need for laboratory visits.

Rising awareness campaigns by healthcare providers and public health organizations have further strengthened adoption, especially among first-time mothers and urban populations. The affordability and portability of pregnancy rapid test cards make them accessible to a broad range of consumers, including in remote or resource-limited areas.

Additionally, continuous product innovation, including improvements in detection accuracy and ease of use, has reinforced market preference As healthcare systems continue to prioritize preventive care and patient empowerment, the pregnancy card test segment is expected to maintain its leading position, supported by accessibility, reliability, and increasing consumer awareness.

The hospitals distribution channel segment is anticipated to account for 45.3% of the market revenue in 2025, making it the leading distribution route. Growth in this segment is driven by the integration of rapid test cards into routine hospital workflows for diagnostics, patient screening, and emergency care. Hospitals benefit from the quick turnaround times provided by rapid tests, enabling faster patient triage and improved clinical decision-making.

Adoption is further supported by the need for reliable point-of-care testing in maternity wards, outpatient clinics, and diagnostic centers. Hospitals increasingly invest in high-quality rapid test solutions that meet regulatory standards, ensuring accuracy and safety in patient care. The ability to handle high patient volumes efficiently and reduce laboratory burden reinforces the appeal of hospital distribution.

Rising awareness of preventive healthcare and the increasing number of hospital admissions globally further support market growth As healthcare facilities continue to adopt efficient diagnostic solutions for better patient management, the hospital segment is expected to remain the dominant distribution channel in the Rapid Test Cards market.

Rapid test card is a medical diagnostic test card that qualitatively detects the presence of pathogens in a sample (blood/serum). Rapid test cards are widely used in clinical settings as they offer quick results. Quick tests are utilized as a part of an assortment of purpose of care-settings including homes to essential care centers or emergency rooms.

Some of the common rapid test cards available in the market are Hepatitis test cards, pregnancy test card, HIV test, HCV test, syphilis card/strip test, troponin-I test, and malaria/dengue test cards. Owing to advances in rapid testing technology, today, these tests are widely used in clinics and hospitals.

Rapid test cards usually encompass the interface of an immovable reagent of any of the target antigen or antibody that is associated to certain category of detector which later on reacts with the loaded patient sample. Rapid test cards enable a rapid screening of a possibly affected population, and can be applied for various applications to determine the complications leading for infections or pregnancy.

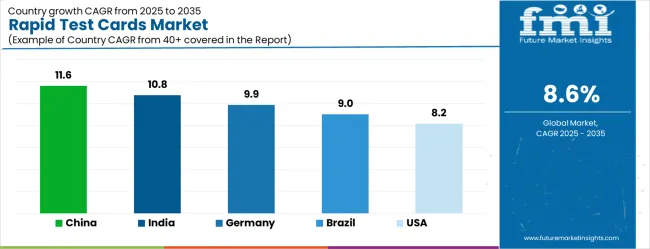

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| Brazil | 9.0% |

| USA | 8.2% |

| UK | 7.3% |

| Japan | 6.5% |

The Rapid Test Cards Market is expected to register a CAGR of 8.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.6%, followed by India at 10.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 6.5%, yet still underscores a broadly positive trajectory for the global Rapid Test Cards Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.9%.

The USA Rapid Test Cards Market is estimated to be valued at USD 580.6 million in 2025 and is anticipated to reach a valuation of USD 580.6 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 84.5 million and USD 46.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Test Type | Pregnancy Card Test, HIV Card Test, HCV Card Test, Syphilis Card/Strip Test, Troponin-I Card Test, Malaria/Dengue Card Test, and Others |

| Distribution Channel | Hospitals, Home Care Settings, and Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

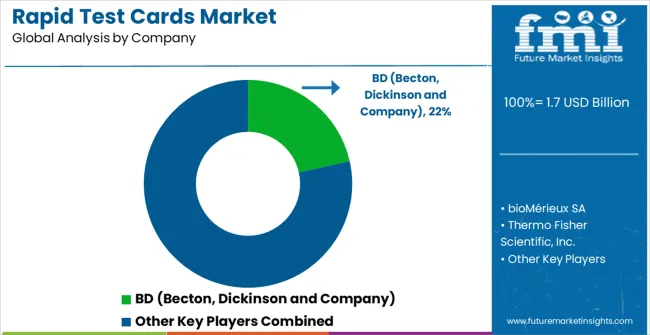

| Key Companies Profiled | BD (Becton, Dickinson and Company), bioMérieux SA, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd., Danaher Corporation, DiaSorin S.P.A, and Abbott |

The global rapid test cards market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the rapid test cards market is projected to reach USD 3.8 billion by 2035.

The rapid test cards market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in rapid test cards market are pregnancy card test, hiv card test, hcv card test, syphilis card/strip test, troponin-i card test, malaria/dengue card test and others.

In terms of distribution channel, hospitals segment to command 45.3% share in the rapid test cards market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rapid U-drills Market Size and Share Forecast Outlook 2025 to 2035

Rapid Prototyping Materials Market Size and Share Forecast Outlook 2025 to 2035

Rapid Strength Concrete Market Size and Share Forecast Outlook 2025 to 2035

Rapid Self-Healing Gel Market Size and Share Forecast Outlook 2025 to 2035

Rapid Infuser Market Size, Growth, and Forecast 2025 to 2035

Market Leaders & Share in the Rapid Infuser Industry

Rapid Cook-High Speed Ovens Market

Rapid Test Readers Market Size and Share Forecast Outlook 2025 to 2035

Rapid RNA Testing Kits Market Trends- Growth & Forecast 2025 to 2035

Rapid Antigen Testing Market - Demand, Growth & Forecast 2025 to 2035

Rapid Hepatitis Testing Market – Demand & Forecast 2025 to 2035

Rapid Coagulation Testing Market

Rapid Microbiology Testing Market Forecast Outlook 2025 to 2035

Rapid Plasma Reagin Test Market

Mono Rapid Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

Malaria Ag Rapid Testing Market - Growth & Forecast 2025 to 2035

Trichomonas Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

Chloramphenicol Rapid Test Strip Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA