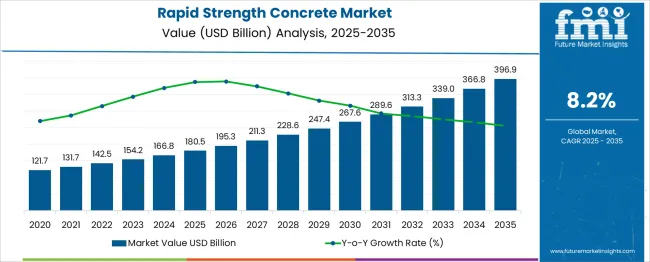

The Rapid Strength Concrete Market is estimated to be valued at USD 180.5 billion in 2025 and is projected to reach USD 396.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. During the first five-year phase (2025–2030), the market is expected to increase from USD 180.5 billion to USD 267.6 billion, adding USD 87.1 billion, which accounts for 40.2% of the total incremental growth. This early expansion is driven by rising investments in infrastructure modernization, high-speed rail projects, and road rehabilitation programs that demand rapid-setting concrete to minimize project timelines. The second phase (2030–2035) will contribute USD 129.3 billion, representing 59.8% of incremental growth, signaling accelerated adoption in large-scale commercial and industrial projects, including airport expansions and smart city developments. Annual increments during the early phase average USD 17.4 billion per year, while later years see a stronger push with increasing use of advanced admixtures and performance-enhancing additives. Manufacturers focusing on eco-friendly rapid-strength solutions, regional batching plant expansion, and collaboration with government infrastructure agencies will be well-positioned to capture maximum value in this USD 216.4 billion growth window, particularly in Asia-Pacific, North America, and the Middle East.

| Metric | Value |

|---|---|

| Rapid Strength Concrete Market Estimated Value in (2025 E) | USD 180.5 billion |

| Rapid Strength Concrete Market Forecast Value in (2035 F) | USD 396.9 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The papid strength concrete market holds a specialized but increasingly important share within its broader segments. In the Construction Materials Market, it accounts for about 3%, as traditional concrete and aggregates still dominate. Within the Ready-Mix Concrete Market, its share is approximately 6%, reflecting growing adoption for time-sensitive projects. For the Infrastructure Development Market, it represents around 4%, driven by its use in highways, bridges, and repair works requiring accelerated curing. In the Specialty Concrete Market, rapid strength variants hold nearly 12%, as this category includes performance-specific concretes like high-strength and self-compacting types. Within the Building and Civil Engineering Materials Market, its share is close to 2%, given the diversity of products used in large-scale construction.

Growth is influenced by increasing demand for reduced project timelines, cost savings from early formwork removal, and enhanced durability in critical structures. Applications in transportation infrastructure, precast elements, and emergency repair projects are expanding, particularly in regions with dense urban development and stringent deadlines. Technological improvements in admixtures and binder formulations have further optimized setting times and compressive strength. These factors position rapid strength concrete as a strategic solution for modern construction challenges, emphasizing speed, reliability, and structural integrity across diverse building and infrastructure projects.

The rapid strength concrete market is witnessing significant momentum, primarily fueled by rising demand for time-sensitive construction projects, enhanced repair turnaround expectations, and growing infrastructure modernization initiatives. Increasing urban redevelopment programs, coupled with labor and time cost pressures, have driven contractors to adopt materials that accelerate project timelines without compromising structural integrity.

Regulatory focus on minimizing public disruption during construction activities, particularly in transport and utility sectors, has further supported the market’s growth trajectory. Technological advancements in admixture formulations, along with enhanced availability of pre-blended mixes, have improved adoption across varied climatic conditions and geographies.

Looking forward, heightened interest in green certifications and sustainable building practices is expected to influence product innovation and procurement decisions across public and private construction projects.

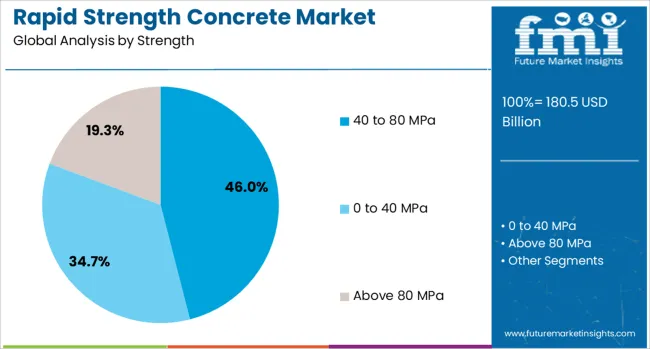

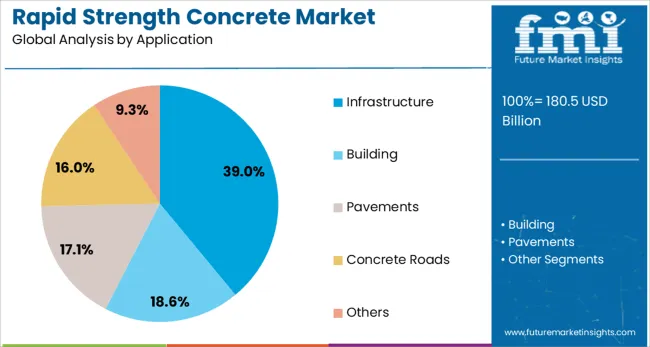

The rapid strength concrete market is segmented by strength, application, and geographic regions. The rapid strength concrete market is divided into 40 to 80 MPa, 0 to 40 MPa, and above 80 MPa. In terms of application, the rapid strength concrete market is classified into Infrastructure, Building, Pavements, Concrete Roads, and Others. Regionally, the rapid strength concrete industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 40 to 80 MPa strength range is anticipated to hold 46.0% of the total market share in 2025, making it the dominant segment in the rapid strength concrete market. This strength category strikes a critical balance between durability and setting time, making it well-suited for a wide range of use cases including pavement overlays, highway patching, and precast structures.

Contractors have favored this range due to its compatibility with both vertical and horizontal construction needs. Its performance under varying stress loads and environmental exposures supports applications in both urban and remote settings.

Additionally, improved shelf-life, reduced curing times, and ease of mixing on-site have contributed to the growing preference for this strength class, particularly where early load-bearing capacity is crucial.

The infrastructure segment is expected to account for 39.0% of the overall market revenue in 2025, leading in application-based segmentation. This dominance is attributed to widespread government investments in roads, bridges, rail, and airport upgrades projects where construction speed and longevity are critical.

Rapid strength concrete enables quicker reopening of public assets, reducing congestion and operational downtime. Furthermore, infrastructure projects often operate under tight schedules and environmental constraints, where traditional concrete curing timelines are impractical.

The material’s high early compressive strength has enabled authorities to meet project deadlines without compromising on quality or safety, encouraging its continued adoption across large-scale civil works globally.

The rapid strength concrete market is expanding due to increasing demand for fast-track construction in transportation, industrial, and commercial projects. Growth in 2024 and 2025 was driven by accelerated road repairs, airport runway rehabilitation, and precast applications requiring early load-bearing capacity. Opportunities are emerging in high-traffic infrastructure, emergency maintenance solutions, and modular construction. Key trends include fiber-reinforced mixes, improved admixture formulations, and automation in mixing processes. However, high production costs, material availability issues, and quality control challenges in on-site preparation remain key restraints, limiting large-scale adoption in cost-sensitive projects globally.

The major growth driver is the surge in time-sensitive construction projects across developed and emerging economies. In 2024 and 2025, rapid strength concrete was widely deployed in metro expansions, expressways, and airport runways to minimize downtime and enhance operational efficiency. Precast segments, including bridge girders and tunnel linings, increasingly adopted this material for quick turnaround. Its early compressive strength allowed structures to open for use within hours rather than days, reducing project delays significantly. These factors demonstrate that efficiency-driven construction requirements will remain central to rapid strength concrete adoption worldwide.

Significant opportunities exist in emergency infrastructure repairs and modular building solutions. In 2025, governments prioritized rapid pavement repair technologies to maintain traffic flow during highway maintenance, creating strong demand for quick-setting concrete formulations. Modular housing and prefabricated commercial units also incorporated these mixes for accelerated construction timelines. The product’s compatibility with advanced admixtures enabled customized performance for diverse environments, from urban bridges to industrial floors. These developments suggest that suppliers focusing on flexible formulations and on-site deployment solutions will capture emerging segments demanding speed and structural integrity.

Emerging trends point toward the adoption of fiber-reinforced rapid strength concrete and automation in batching processes. In 2024, synthetic and steel fibers were integrated into quick-setting mixes to enhance crack resistance and durability in high-load applications. Automated batching systems gained popularity on large-scale projects to ensure consistency in material proportions and curing performance. Admixture innovations targeting hydration control and improved workability were also commercialized for challenging climates. These advancements indicate a shift toward performance-oriented formulations supported by process automation, aligning with industry requirements for reliability and precision in critical infrastructure projects.

Market restraints are driven by elevated production costs, limited raw material availability, and quality control challenges. In 2024 and 2025, higher pricing for specialized cement blends and admixtures restricted adoption in low-budget infrastructure projects. Inconsistent mixing at on-site locations often compromised early strength performance, increasing the risk of structural failures. Transportation costs for pre-mixed solutions further limited feasibility for remote projects. These challenges highlight the necessity for cost optimization strategies, advanced portable batching systems, and robust contractor training programs to improve reliability and encourage wider adoption of rapid strength concrete.

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

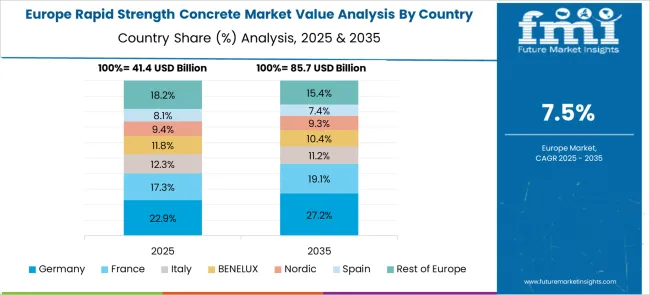

The global rapid strength concrete market is forecasted to grow at 8.2% CAGR between 2025 and 2035. China leads at 11.1% CAGR, driven by massive infrastructure development and high-speed railway projects. India follows at 10.3%, supported by urban housing demand and government-backed infrastructure initiatives. France records 8.6% CAGR, emphasizing sustainable construction practices and advanced precast solutions. The United Kingdom grows at 7.8%, while the United States posts 7.0%, reflecting steady demand for repair and rehabilitation projects in mature markets. Asia-Pacific dominates global growth due to large-scale government investments and rapid urbanization, while Europe and North America focus on green construction and high-performance concrete mixes for durability.

The rapid strength concrete market in China is expected to grow at 11.1% CAGR, driven by large-scale transportation projects, including high-speed rail, bridges, and expressways. Government initiatives promoting accelerated construction timelines favor high-performance concrete solutions. Domestic manufacturers introduce mixes with advanced admixtures to deliver strength within hours while ensuring durability under heavy loads. Demand for rapid strength concrete also rises in airport expansions and smart city developments. Continuous investment in precast manufacturing facilities supports large-scale modular construction, reducing project completion time significantly.

The rapid strength concrete market in India is forecasted to grow at 10.3% CAGR, supported by rising demand in urban infrastructure, metro rail projects, and highway construction. Government programs like Bharatmala and Smart Cities Mission increase procurement of rapid setting mixes for time-bound projects. Local manufacturers focus on cost-efficient solutions with superior early strength performance to cater to both public and private sector projects. Precast concrete elements gain popularity for residential and commercial construction due to faster assembly and reduced labor costs. Adoption of green cement additives aligns with India’s sustainable building initiatives.

The rapid strength concrete market in France is projected to expand at 8.6% CAGR, driven by EU sustainability directives and growing investment in public infrastructure modernization. Use of rapid setting concrete in bridge repairs, airport runways, and emergency restoration projects ensures minimal downtime. French manufacturers integrate low-carbon cement technologies and recycled aggregates to meet stringent environmental standards. Advanced precast and 3D-printed concrete solutions gain traction in housing projects, accelerating delivery and reducing waste. Digital tools for concrete mix optimization further enhance operational efficiency.

The rapid strength concrete market in the United Kingdom is expected to grow at 7.8% CAGR, supported by infrastructure renewal programs and rising demand for accelerated construction methods. Applications in road maintenance, tunnel works, and railway station upgrades dominate the market. Manufacturers focus on formulations that ensure quick curing under varying weather conditions. Precast concrete panels integrated with energy-efficient materials cater to sustainability-driven building codes. Increasing adoption of automation and digital monitoring in mixing plants improves consistency and quality assurance across projects.

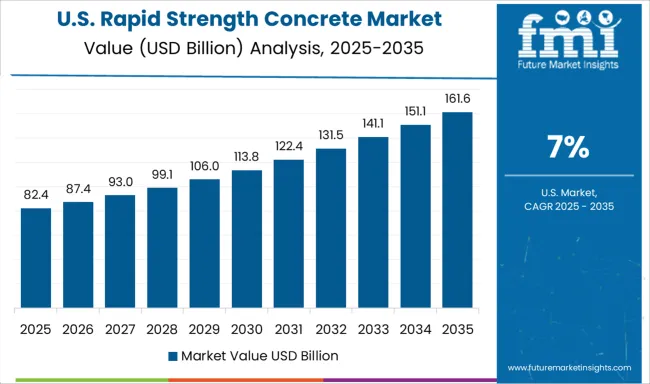

The rapid strength concrete market in the United States is projected to grow at 7.0% CAGR, reflecting strong adoption in rehabilitation and emergency repair projects. Aging transportation networks create demand for quick-setting concrete mixes for highways, airport runways, and bridge repairs. Federal funding for infrastructure modernization supports large-scale use of advanced concrete technologies. Manufacturers develop proprietary blends with high early strength for overnight repairs, reducing traffic disruptions. Integration of fiber reinforcement and nano-modifiers improves durability and crack resistance in extreme climates.

The rapid strength concrete market is dominated by BASF SE, which leads through its high-performance admixtures and advanced chemical solutions designed to accelerate concrete setting times for infrastructure, industrial, and repair applications. BASF secures its dominance with global manufacturing capabilities, strong technical support, and a portfolio tailored to deliver durability, reduced downtime, and early strength development. Key players such as Sika Corporation, Cemex S.A.B, Tarmac, and CTS Cement hold significant shares by offering specialized formulations for highways, bridges, airport runways, and precast components. These companies emphasize consistent performance, compliance with international construction standards, and ease of application to meet the growing need for rapid repair and fast-track construction projects. Emerging suppliers focus on niche solutions such as ultra-rapid-setting blends, fiber-reinforced concrete, and eco-friendly additives that deliver high early strength while minimizing shrinkage and cracking. Their strategies include regional distribution expansion and partnerships with contractors for customized project-specific mixes. Market growth is driven by increasing investments in infrastructure upgrades, urgent repair of transportation networks, and rising demand for time-efficient construction techniques in urban redevelopment and industrial settings. Innovation in cement chemistry and integration of advanced admixture technologies are expected to further accelerate adoption, reinforcing the market’s critical role in minimizing downtime and ensuring long-term structural performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 180.5 Billion |

| Strength | 40 to 80 MPa, 0 to 40 MPa, and Above 80 MPa |

| Application | Infrastructure, Building, Pavements, Concrete Roads, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Sika Corporation, CTS Cement, Cemex S.A.B, and Tarmac |

| Additional Attributes | Dollar sales divided into pre‑mixed, ready‑mix, and admixture-based rapid strength concretes, with infrastructure and repair sectors driving demand. North America emphasizes cold-weather performance, while Asia-Pacific sees strong urban infrastructure growth. Innovations focus on proprietary accelerator chemistries, low‑carbon binders, and sustainable cement alternatives. Regulatory compliance and emergency repair applications shape adoption. |

The global rapid strength concrete market is estimated to be valued at USD 180.5 billion in 2025.

The market size for the rapid strength concrete market is projected to reach USD 396.9 billion by 2035.

The rapid strength concrete market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in rapid strength concrete market are 40 to 80 mpa, 0 to 40 mpa and above 80 mpa.

In terms of application, infrastructure segment to command 39.0% share in the rapid strength concrete market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rapid U-drills Market Size and Share Forecast Outlook 2025 to 2035

Rapid Microbiology Testing Market Forecast Outlook 2025 to 2035

Rapid Test Cards Market Size and Share Forecast Outlook 2025 to 2035

Rapid Prototyping Materials Market Size and Share Forecast Outlook 2025 to 2035

Rapid Test Readers Market Size and Share Forecast Outlook 2025 to 2035

Rapid Self-Healing Gel Market Size and Share Forecast Outlook 2025 to 2035

Rapid Infuser Market Size, Growth, and Forecast 2025 to 2035

Rapid RNA Testing Kits Market Trends- Growth & Forecast 2025 to 2035

Rapid Hepatitis Testing Market – Demand & Forecast 2025 to 2035

Rapid Antigen Testing Market - Demand, Growth & Forecast 2025 to 2035

Market Leaders & Share in the Rapid Infuser Industry

Rapid Plasma Reagin Test Market

Rapid Coagulation Testing Market

Rapid Cook-High Speed Ovens Market

Mono Rapid Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

Malaria Ag Rapid Testing Market - Growth & Forecast 2025 to 2035

Trichomonas Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

Chloramphenicol Rapid Test Strip Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA