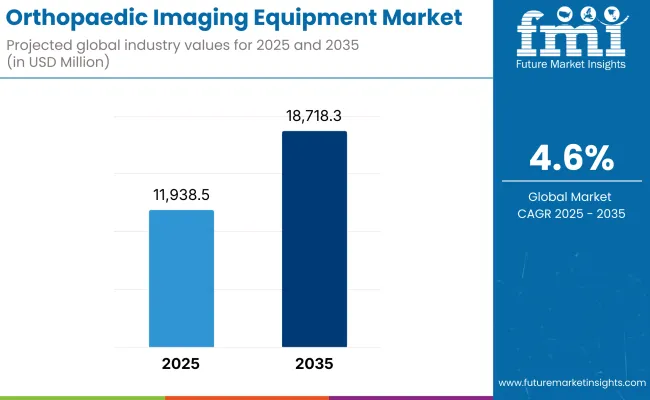

The Orthopaedic Imaging Equipment was valued at USD 9,409.1 million in 2020. It is estimated to reach USD 11,938.5 million by 2025. Between 2025 and 2035, the market is expected to grow at a CAGR of 4.6%, reaching a total value of USD 18,718.3 million by the end of the assessment period. Rising musculoskeletal disorder prevalence, rapid expansion of orthopedic surgeries and growing elderly population worldwide.

Increasing incidence of conditions such as osteoarthritis, traumatic fractures, and spinal deformities is generating consistent demand for advanced diagnostic imaging tools. The growing preference for minimally invasive procedures and pre-operative imaging accuracy is further influencing equipment upgrades across healthcare facilities.

AI-powered imaging platforms, along with real-time 3D visualization and lower radiation technologies, are forecasted to accelerate adoption rates. Moreover, strategic investments in radiology and diagnostic centers by private hospitals and imaging labs are expanding the market footprint.

Integration with surgical planning systems and tele-imaging tools is enabling real-time orthopedic assessments in outpatient and rural care setups. Future opportunities are expected to be driven by innovations in hybrid imaging solutions, portable X-ray systems, and orthopedic-specific MRI platforms that allow early-stage detection and therapy guidance.

Major manufacturers driving the orthopaedic imaging equipment market include GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems Corporation, and Fujifilm Holdings Corporation. These companies are actively investing in orthopedic-specific imaging platforms that deliver high-resolution 3D bone and joint scans with low radiation exposure.

GE HealthCare’s integration of AI-based orthopedic software with its MRI systems and Siemens' expansion of digital twin technology into orthopedic imaging are examples of forward-looking strategies. In 2025, Adaptix, is set to launch is latest 3D Imaging System, Ortho350, that will speed up vital diagnoses, reducing waiting times and bringing imaging services into medical office and community settings for greater accessibility.

“We truly believe that our unique, 3D X-ray technology has the potential to revolutionize imaging services for orthopedic patients, helping clinicians diagnose conditions more quickly and accurately, reducing stressful waits for patients and ensuring they receive the very best treatment as quickly as possible at a lower cost than traditional imaging methods” says Sarah Small, CEO of Adaptix. The The market is also being driven by OEM collaborations with orthopedic surgery device companies and growing demand for ambulatory care imaging systems optimized for bone and joint visualization.

North America market is being driven by the high procedural volume of joint replacements and spine surgeries, combined with the early adoption of AI-enhanced diagnostic imaging. The USA-based hospitals are increasingly integrating orthopedic imaging solutions with robotic-assisted surgical systems, enabling data-driven surgical assessments.

The reimbursement landscape supports advanced diagnostic imaging undergoing orthopedic surgeries. In Europe, the demand is supported by government investments in digital radiography and point-of-care diagnostics across orthopedic care units. Germany and the UK. are leading the adoption of orthopedic MRI and CT platforms, especially in public hospitals managing trauma and geriatric care. Europe is also focussing on early detection of osteoporosis and musculoskeletal disorders along with cost-optimization which is accelerating market growth.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the orthopaedic imaging equipment industry outlook between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global orthopaedic imaging equipment industry analysis from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics.

H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.7%, followed by a slightly lower growth rate of 4.4% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 4.7% (2024 to 2034) |

| H2 | 4.4% (2024 to 2034) |

| H1 | 4.0% (2025 to 2035) |

| H2 | 3.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.0% in the first half and projected to lower at 3.5% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

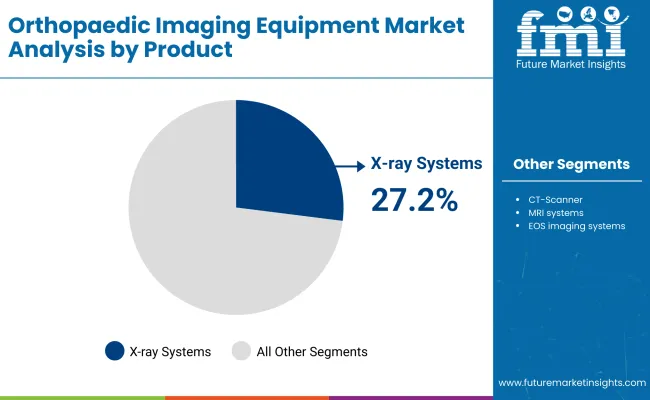

In 2025, X-ray systems are anticipated to lead the orthopaedic imaging equipment market with a 27.2% revenue share due to their widespread clinical utility, cost-effectiveness, and technological evolution. Their dominant position is being reinforced by increasing demand for first-line imaging in orthopedic injuries, particularly in emergency and outpatient settings.

Advancements in digital radiography (DR) and portable X-ray technologies have expanded point-of-care capabilities, allowing quicker diagnosis and enhanced workflow efficiency. Moreover, integration with AI-based bone fracture detection software and automated image enhancement tools has improved diagnostic accuracy and reduced inter-observer variability.

Hospitals and ambulatory surgical centers continue to favor X-ray systems owing to their shorter imaging times, high throughput, and lower operating costs compared to advanced modalities. The ability to conduct dynamic and weight-bearing studies-critical in orthopaedic assessments-has also strengthened their clinical relevance. Additionally, favorable reimbursement frameworks in developed markets are contributing to sustained demand, particularly for musculoskeletal and trauma-focused imaging applications.

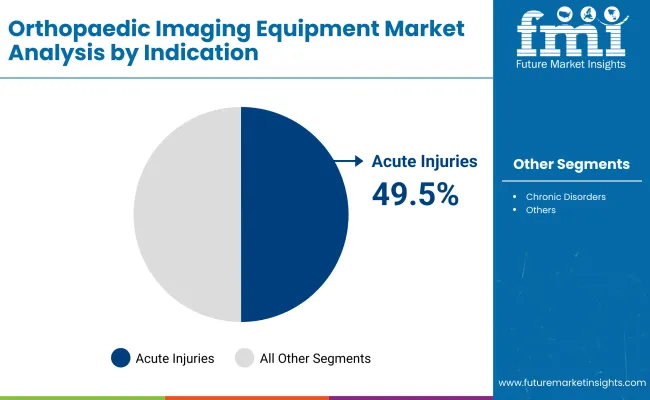

The acute injuries segment is expected to dominate the orthopaedic imaging equipment market in 2025, accounting for 49.5% of total revenue. This leadership is being driven by the high global incidence of trauma cases, sports-related injuries, and workplace accidents requiring rapid and accurate musculoskeletal assessment.

Orthopaedic imaging plays a pivotal role in the diagnosis of fractures, dislocations, and ligament tears, making it indispensable in trauma care. Emergency departments and orthopedic urgent care clinics are increasingly relying on advanced imaging systems to make time-sensitive decisions for acute injury management. The integration of portable imaging solutions in field settings and operating rooms has also expanded access to immediate diagnostics.

Further, increasing investments in trauma centers and specialized orthopaedic hospitals are accelerating the adoption of high-throughput imaging systems. The segment’s growth is being supported by government programs focusing on road safety, sports injury prevention, and elderly fall-related injury management, particularly in North America and Europe.

Rising Adoption of Cone Beam Computed Tomography (CBCT) in Orthopaedic Imaging

Adoption of the Cone Beam Computed Tomography technology has become a major driving factor in the orthopaedic imaging equipment market. The CBCT ensures better three-dimensional visualization of bony structures and, therefore, higher diagnostic accuracy for complicated musculoskeletal pathologies than is allowed by conventional two-dimensional X-rays.

Capable of delivering highly detailed pictures with low radiation dosages, this modality finds its perfect place both for diagnostics in traumatology and chronic pathologies like arthritis and osteoporosis.

Perhaps the most impactful role of CBCT in orthopedic imaging is extremity imaging, particularly that of the hand, wrist, and foot, where conventional imaging often lacks sufficient diagnostic detail. CBCT devices also support faster scan times and improved patient comfort, enhancing workflow efficiency in both outpatient and emergency settings.

Additionally, CBCT is increasingly integrated with surgical navigation systems that provide real-time imaging guidance for minimally invasive procedures. This has led to better surgical planning and reduced post-operative complications. As health facilities emphasize diagnostic precision and speed, CBCT technology's singular advantages continue to fuel its adoption across hospitals, specialty clinics, and sports medicine centers, thereby driving the market growth.

Integration of Hybrid Imaging Systems for Comprehensive Musculoskeletal Diagnosis

One of the major trends that will keep altering the dynamics of the orthopaedic imaging equipment market is the integration of hybrid imaging systems. Advanced systems like PET-CT and MRI-CT platforms provide comprehensive information about musculoskeletal conditions by scanning both anatomical and functional data in one setting, hence improving diagnostic accuracy for complicated conditions.

Such systems have been especially helpful in early diagnosis of tumors of the bone, infections, and degenerative joint disorders that require both a clarity of structure and visualization of metabolic activity. For example, PET-CT technology provides simultaneous information about cellular activity combined with high-resolution anatomic images, which is especially effective in orthopaedic cases related to oncology.

This also steers the demand for hybrid systems because of their efficiency in diagnostic workflow streamlining. Single comprehensive imaging minimizes radiation exposure and helps avoid undue delay in diagnosis. The expanding need for precise diagnostics and personalized treatment planning has driven the growing use of hybrid imaging platforms, hence hybrid imaging is the future game-changer in modern musculoskeletal care.

Expanding Use of Portable Orthopaedic Imaging Devices in Trauma Care

A very significant market opportunity could be seen in the increasing adoption of portable orthopaedic imaging devices, particularly for trauma care and emergency settings. Various examples include handheld ultrasound scanners, mini C-arms, and portable X-ray units that have revolutionized point-of-care diagnostics and thus enabled musculoskeletal imaging on the spot in acute situations.

Portable imaging offers the advantage of rapid diagnosis, thereby allowing clinicians to assess fractures, dislocations, and soft tissue injuries directly at the point of care, such as in ambulances, emergency rooms, and on-field sports settings. This capability is particularly important in time-sensitive conditions where immediate visualization can guide faster treatment decisions and prevent further complications.

The growing number of sports injuries and car accidents that necessitate prompt and precise diagnosis fuels this demand. Furthermore, portable imaging machines are also being outfitted with wireless data transmission capabilities that allow for real-time consultation with specialists for remote diagnosis and treatment advice. This widening circle of use of compact, efficient, and cost-effective imaging solutions opens a sizeable avenue of growth for manufacturers targeting trauma care and remote healthcare markets.

High Capital Costs and Limited Accessibility in Emerging Markets

A key restraint in the orthopaedic imaging equipment market is the significant capital investment required for advanced imaging technologies. Systems like CBCT, MRI, and 3D imaging platforms involve high upfront procurement costs, ongoing maintenance expenses, and periodic software upgrades. These financial barriers can be particularly restrictive for smaller healthcare facilities and diagnostic centers in emerging markets where budget constraints are more pronounced.

Moreover, the operational costs tied to orthopaedic imaging equipment extend beyond initial investment. For example, advanced systems require specialized installation, infrastructure modifications, and the recruitment of trained personnel capable of handling complex imaging procedures and data interpretation. This need for specialized expertise often leads to increased operational costs and restricts the adoption of advanced technologies in regions with limited healthcare resources.

Additionally, the import tariffs and regulatory complexities associated with high-end medical equipment further complicate market expansion in cost-sensitive regions. Unless addressed through cost-effective innovations or government funding programs, the high capital costs and limited accessibility will continue to hinder market penetration, especially in underserved areas where advanced diagnostics are critically needed.

The global orthopaedic imaging equipment industry recorded a CAGR of 4.0% during the historical period between 2020 and 2024. The growth of the orthopaedic imaging equipment industry was positive as it reached a value of USD 11,023.7 million in 2024 from USD 9,300.0 million in 2020.

From 2020 to 2024, remarkable changes hit the orthopaedic imaging equipment market as technology in health has undergone unprecedented growth in speed and in shifting priorities. The broad diffusion of flat-panel detectors and digital radiography further improves the quality of the image during this period while accelerating diagnostic workflow for quicker and more precise musculoskeletal diagnosis.

The demand for non-invasive diagnostic solutions increased significantly, majorly due to the increasing prevalence of musculoskeletal disorders, rising elderly population, and growing focus toward early detection and preventive care.

The global pandemic further catalyzed sector changes, accelerating developments in remote imaging and the integration of telehealth. The transition has highlighted the need of portable and point-of-care imaging technologies in facilitating real-time diagnosis without necessitating extensive patient travel or hospital visits.

In the future, the sector will mostly rely on artificial intelligence-driven imaging tools, automation, and hybrid imaging platforms that provide multispectral diagnostic studies such as MRI-CT and PET-CT for comprehensive diagnosis. AI-powered platforms are set to accelerate the image interpretation process while reducing diagnosis errors and further enable personalized treatment planning.

Innovations, such as low-dose radiation techniques and 3D imaging, are thus bound to go hand in glove with patient safety and accuracy of diagnosis. Additionally, this would include an increasing rate of sport injuries, road mishaps, and elderly people globally to continuously propel the need for novel orthopaedic imaging solutions.

Future investments will likely be next-generation point-of-care imaging, automated diagnostic software, and extended diagnostic capabilities in emerging markets, continuing to reshape the sector. This further technological evolution will strive for better patient outcomes, quicker recovery times, and a reduced overall burden on healthcare systems.

Tier 1 companies are the major companies as they hold a 41.2% share worldwide. Tier 1 Companies are industry leaders with significant market influence, substantial revenue, and extensive global operations. They have a diverse product portfolio covering multiple imaging modalities, including X-ray systems, MRI, CT scanners, and nuclear imaging.

They often lead in acquisitions, strategic collaborations, and regulatory approvals, enabling them to set industry standards. Prominent tier 1 players include General Electric Healthcare Limited, Siemens AG, Esaote SPA, Koninklijke Philips N.V

The tier 2 companies hold a share of 26.5% worldwide. Tier 2 Companies have a smaller market share but maintain a strong presence in specific segments or regions. These companies focus on specialized or cost-effective imaging solutions. They target mid-sized hospitals and outpatient care centers, often emphasizing portable and niche imaging technologies such as ultrasound and point-of-care systems. Key Companies under this category include Hitachi Ltd, Planmed OY, EOS imaging, Canon Medical Systems Corporation.

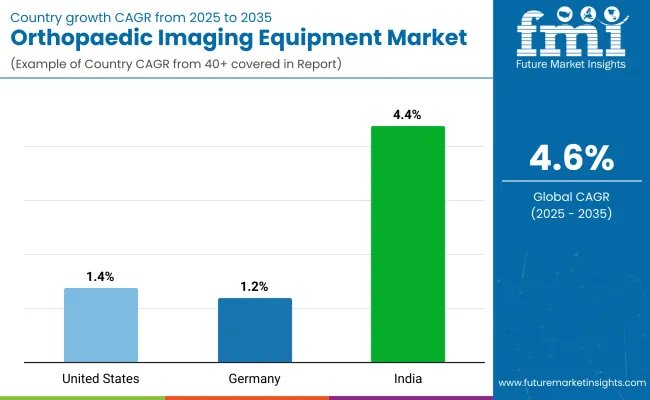

The section below covers the industry analysis for orthopaedic imaging equipment sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 1.4% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 4.4% by 2035.

The United States dominates the global market with a high share in 2024. The United States is expected to exhibit a CAGR of 1.4% throughout the forecast period (2025-2035).

Pediatric orthopaedic conditions and trauma-related injuries are the major drivers for the orthopaedic imaging market in the United States. Injuries are the leading cause of death for children and teens, accounting for about 20,000 deaths per year, with more than 70 percent of these deaths being due to unintentional causes, including falls, motor vehicle accidents, and sports injuries.

The alarming rise in this health challenge has raised the bar of demand for advanced pediatric imaging technologies that include low-radiation digital X-ray systems, portable ultrasound, and MRI systems solely intended for pediatric use. Community outreach through health awareness programs and in-school safety campaigns has heightened this need for diagnostics.

Besides trauma centers, children's hospitals are fast adapting to the adoption of AI-driven imaging systems, ensuring early, swift, and highly accurate diagnosis of fractures and injury conditions. Government funding for child injury prevention, and advancement in radiation-free imaging technologies are, therefore further solidifying the presence of the sector within the United States.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 1.2%.

Germany has established comprehensive national strategies for osteoporosis management, significantly driving demand for orthopaedic imaging equipment. With the approval of the Disease Management Program for Osteoporosis (DMP) in 2023, patients requiring anti-osteoporosis medications now receive care under a structured framework, ensuring consistent diagnosis and treatment.

The presence of a national hip fracture registry and the universal adoption of osteoporosis management guidelines have further streamlined diagnostic practices while promoting the routine use of advanced imaging technologies like DEXA scans and digital radiography for early detection.

Reimbursement policies by public health insurers have also facilitated broader access to diagnostic services, particularly among the aging population. Germany’s focus on preventive healthcare and chronic disease management, along with continuous advancements in imaging technology, has led to increased investments in AI-driven diagnostics and portable imaging solutions, making osteoporosis care more effective and widely accessible.

India occupies a leading value share in South Asia & Pacific market in 2024 and is expected to grow with a CAGR of 4.4% during the forecasted period.

Osteoporosis has now become a big burden in India, especially in postmenopausal women. Six crore people in India suffer from this problem, 80% of whom are women. According to the World Health Organization, the peak incidence of osteoporosis in India is seen 10-20 years earlier compared to the Western countries, thus again highlighting the need for early diagnostic tools.

The rising burden of this health concern has raised the demand for sophisticated orthopaedic imaging modalities that can facilitate early diagnosis and better management of bone-related health disorders.

Further, lack of awareness and limited access to diagnostic facilities in rural areas increase the demand for portable imaging solutions along with screening camps organized by governmental authorities. This, combined with expanding healthcare infrastructure and initiatives such as Ayushman Bharat for increasing diagnostic coverage, has been driving this market.

Besides, the partnerships between public and private entities facilitate wider availability of diagnostic tools, making early detection of osteoporosis more accessible and effective.

Key players in the orthopaedic imaging equipment market are focused on regular product innovations and launches to meet the evolving demands of healthcare providers. These companies are introducing advanced and versatile imaging systems, expanding their portfolios to offer more comprehensive solutions across various segments. This constant development ensures they stay competitive and address the diverse needs of medical professionals and patients.

Recent Industry Developments in Orthopaedic Imaging Equipment Market

In terms of product, the industry is divided into X-Ray systems, CT-scanner, MRI systems, EOS imaging systems, ultrasound, and nuclear imaging systems.

In terms of indication, the industry is divided into acute injuries, chronic disorders, and others.

In terms of end user, the industry is segregated into hospitals, radiology centers, emergency care facility and ambulatory surgical centers.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global orthopaedic imaging equipment industry is projected to witness CAGR of 3.8% between 2025 and 2035.

The global orthopaedic imaging equipment industry stood at USD 9,409.1 million in 2020.

The global orthopaedic imaging equipment industry is anticipated to reach USD 18,718.3 million by 2035 end.

China is expected to show a CAGR of 4.6% in the assessment period.

The key players operating in the global orthopaedic imaging equipment industry include General Electric Healthcare Limited, Siemens AG, Esaote SPA, Hitachi Ltd, Koninklijke Philips N.V, Planmed OY, EOS imaging, Canon Medical Systems Corporation, Neusoft Corporation and Carestream Health

Table 01: Global Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 02: Global Market Volume (Units) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 03: Global Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 04: Global Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End User

Table 05: Global Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Region

Table 06: Global Market Volume (Units) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Region

Table 07: North America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Country

Table 08: North America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 09: North America Market Volume (Units) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 10: North America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 11: North America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End User

Table 12: Latin America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Country

Table 13: Latin America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 14: Latin America Market Volume (Units) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 15: Latin America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 16: Latin America Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End User

Table 17: Europe Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Country

Table 18: Europe Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 19: Europe Market Volume (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 20: Europe Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 21: Europe Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End User

Table 22: South Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Country

Table 23: South Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 24: South Asia Market Volume (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 25: South Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 26: South Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End User

Table 27: East Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Country

Table 28: East Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 29: East Asia Market Volume (Units) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 30: East Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 31: East Asia Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End User

Table 32: Oceania Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Country

Table 33: Oceania Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 34: Oceania Market Volume (Units) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 35: Oceania Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 36: Oceania Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End User

Table 37: MEA Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Country

Table 38: MEA Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 39: MEA Market Volume (Units) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Product

Table 40: MEA Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By Indication

Table 41: MEA Market Value (US$ Million) Analysis 2016 to 2020 and Forecast 2021 to 2031, By End Use

Figure 01: Global Market Revenue Share, By Product (2021E)

Figure 02: Global Market Revenue Share, By Indication (2021E)

Figure 03: Global Market Revenue Share, By End User (2021E)

Figure 04: Global Average Pricing Analysis Benchmark USD (2020)

Figure 05: Global Market: X-ray System, CT scanner, MRI system, EOS Imaging Systems, Ultrasound and Nuclear Imaging Systems Price Difference (US$) By Region, 2031

Figure 06: Global Historical Volume (Units) Analysis, 2016 to 2020

Figure 07: Global Market Volume (Units) & Y-o-Y Growth (%), 2021 to 2031

Figure 08: Global Historical Market (US$ Million) Analysis, 2016 to 2020

Figure 09: Global Market Value (US$) & Y-o-Y Growth (%), 2021 to 2031

Figure 10: Global Market Absolute $ Opportunity, 2020 to 2031

Figure 11: Global Market Share Analysis (%) By Product, 2021 to 2031

Figure 12: Global Market Y-o-Y Growth (%) By Product, 2021 to 2031

Figure 13: Global Market Attractiveness Analysis by Product

Figure 14: Global Market Share Analysis (%) By Indication, 2021 to 2031

Figure 15: Global Market Y-o-Y Growth (%) By Indication, 2021 to 2031

Figure 16: Global Market Attractiveness Analysis by Indication

Figure 17: Global Market Share Analysis (%) By End User, 2021 to 2031

Figure 18: Global Market Y-o-Y Growth (%) By End User, 2021 to 2031

Figure 19: Global Market Attractiveness Analysis by End User

Figure 20: Global Market Share Analysis (%) By Region, 2021 to 2031

Figure 21: Global Market Y-o-Y Growth (%) By Region, 2021 to 2031

Figure 22: Global Market Attractiveness Analysis by Region

Figure 23: North America Market Value Share, By Product (2021 E)

Figure 24: North America Market Value Share, By Indication (2021 E)

Figure 25: North America Market Value Share, By End User (2021 E)

Figure 26: North America Market Value Share, By Country (2021 E)

Figure 27: North America Market Value (US$ Million) Analysis, 2016 to 2020

Figure 28: North America Market Size (US$ Million) & Y-o-Y Growth (%), 2021 to 2031

Figure 29: North America Market Attractiveness Analysis, By Country

Figure 30: North America Market Attractiveness Analysis, By Product

Figure 31: North America Market Attractiveness Analysis, By Indication

Figure 32: North America Market Attractiveness Analysis, By End User

Figure 33: Latin America Market Value Share, By Product (2021 E)

Figure 34: Latin America Market Value Share, By Indication (2021 E)

Figure 35: Latin America Market Value Share, By End User (2021 E)

Figure 36: Latin America Market Value Share, By Country (2021 E)

Figure 37: Latin America Market Value (US$ Million) Analysis, 2016 to 2020

Figure 38: Latin America Market Size (US$ Million) & Y-o-Y Growth (%), 2021 to 2031

Figure 39: Latin America Market Attractiveness Analysis, By Country

Figure 40: Latin America Market Attractiveness Analysis, By Product

Figure 41: Latin America Market Attractiveness Analysis, By Indication

Figure 42: Latin America Market Attractiveness Analysis, By End User

Figure 43: Europe Market Value Share, By Product (2021 E)

Figure 44: Europe Market Value Share, By Indication (2021 E)

Figure 45: Europe Market Value Share, By End User (2021 E)

Figure 46: Europe Market Value Share, By Country (2021 E)

Figure 47: Europe Market Value (US$ Million) Analysis, 2016 to 2020

Figure 48: Europe Market Size (US$ Million) & Y-o-Y Growth (%), 2021 to 2031

Figure 49: Europe Market Attractiveness Analysis, By Country

Figure 50: Europe Market Attractiveness Analysis, By Product

Figure 51: Europe Market Attractiveness Analysis, By Indication

Figure 52: Europe Market Attractiveness Analysis, By End User

Figure 53: South Asia Market Value Share, By Product (2021 E)

Figure 54: South Asia Market Value Share, By Indication (2021 E)

Figure 55: South Asia Market Value Share, By End User (2021 E)

Figure 56: South Asia Market Value Share, By Country (2021 E)

Figure 57: South Asia Market Value (US$ Million) Analysis, 2016 to 2020

Figure 58: South Asia Market Size (US$ Million) & Y-o-Y Growth (%), 2021 to 2031

Figure 59: South Asia Market Attractiveness Analysis, By Country

Figure 60: South Asia Market Attractiveness Analysis, By Product

Figure 61: South Asia Market Attractiveness Analysis, By Indication

Figure 62: South Asia Market Attractiveness Analysis, By End User

Figure 63: East Asia Market Value Share, By Product (2021 E)

Figure 64: East Asia Market Value Share, By Indication (2021 E)

Figure 65: East Asia Market Value Share, By End User (2021 E)

Figure 66: East Asia Market Value Share, By Country (2021 E)

Figure 67: East Asia Market Value (US$ Million) Analysis, 2016 to 2020

Figure 68: East Asia Market Size (US$ Million) & Y-o-Y Growth (%), 2021 to 2031

Figure 69: East Asia Market Attractiveness Analysis, By Country

Figure 70: East Asia Market Attractiveness Analysis, By Product

Figure 71: East Asia Market Attractiveness Analysis, By Indication

Figure 72: East Asia Market Attractiveness Analysis, By End User

Figure 73: Oceania Market Value Share, By Product (2021 E)

Figure 74: Oceania Market Value Share, By Indication (2021 E)

Figure 75: Oceania Market Value Share, By End User (2021 E)

Figure 76: Oceania Market Value Share, By Country (2021 E)

Figure 77: Oceania Market Value (US$ Million) Analysis, 2016 to 2020

Figure 78: Oceania Market Size (US$ Million) & Y-o-Y Growth (%), 2021 to 2031

Figure 79: Oceania Market Attractiveness Analysis, By Country

Figure 80: Oceania Market Attractiveness Analysis, By Product

Figure 81: Oceania Market Attractiveness Analysis, By Indication

Figure 82: Oceania Market Attractiveness Analysis, By End User

Figure 83: MEA Market Value Share, By Product (2021 E)

Figure 84: MEA Market Value Share, By Indication (2021 E)

Figure 85: MEA Market Value Share, By End User (2021 E)

Figure 86: MEA Market Value Share, By Country (2021 E)

Figure 87: MEA Market Value (US$ Million) Analysis, 2016 to 2020

Figure 88: MEA Market Size (US$ Million) & Y-o-Y Growth (%), 2021 to 2031

Figure 89: MEA Market Attractiveness Analysis, By Country

Figure 90: MEA Market Attractiveness Analysis, By Product

Figure 91: MEA Market Attractiveness Analysis, By Indication

Figure 92: MEA Market Attractiveness Analysis, By End User

Figure 93: The USA Market Value Proportion Analysis

Figure 94: Global Vs The USA Growth Comparison

Figure 95: The USA Market Share Analysis (%) By Product, 2021 to 2031

Figure 96: The USA Market Share Analysis (%) By Indication, 2021 to 2031

Figure 97: The USA Market Share Analysis (%) By End User, 2021 to 2031

Figure 98: Canada Market Value Proportion Analysis

Figure 99: Global Vs Canada Growth Comparison

Figure 100: Canada Market Share Analysis (%) By Product, 2021 to 2031

Figure 101: Canada Market Share Analysis (%) By Indication, 2021 to 2031

Figure 102: Canada Market Share Analysis (%) By End User, 2021 to 2031

Figure 103: Mexico Market Value Proportion Analysis

Figure 104: Global Vs Mexico Growth Comparison

Figure 105: Mexico Market Share Analysis (%) By Product, 2021 to 2031

Figure 106: Mexico Market Share Analysis (%) By Indication, 2021 to 2031

Figure 107: Mexico Market Share Analysis (%) By End User, 2021 to 2031

Figure 108: Brazil Market Value Proportion Analysis

Figure 109: Global Vs Brazil Growth Comparison

Figure 110: Brazil Market Share Analysis (%) By Product, 2021 to 2031

Figure 111: Brazil Market Share Analysis (%) By Indication, 2021 to 2031

Figure 112: Brazil Market Share Analysis (%) By End User, 2021 to 2031

Figure 113: The UK Market Value Proportion Analysis

Figure 114: Global Vs The UK Growth Comparison

Figure 115: The UK Market Share Analysis (%) By Product, 2021 to 2031

Figure 116: The UK Market Share Analysis (%) By Indication, 2021 to 2031

Figure 117: The UK Market Share Analysis (%) By End User, 2021 to 2031

Figure 118: Germany Market Value Proportion Analysis

Figure 119: Global Vs Germany Growth Comparison

Figure 120: Germany Market Share Analysis (%) By Product, 2021 to 2031

Figure 121: Germany Market Share Analysis (%) By Indication, 2021 to 2031

Figure 122: Germany Market Share Analysis (%) By End User, 2021 to 2031

Figure 123: France Market Value Proportion Analysis

Figure 124: Global Vs France Growth Comparison

Figure 125: France Market Share Analysis (%) By Product, 2021 to 2031

Figure 126: France Market Share Analysis (%) By Indication, 2021 to 2031

Figure 127: France Market Share Analysis (%) By End User, 2021 to 2031

Figure 128: Italy Market Value Proportion Analysis

Figure 129: Global Vs Italy Growth Comparison

Figure 130: Italy Market Share Analysis (%) By Product, 2021 to 2031

Figure 131: Italy Market Share Analysis (%) By Indication, 2021 to 2031

Figure 132: Italy Market Share Analysis (%) By End User, 2021 to 2031

Figure 133: Spain Market Value Proportion Analysis

Figure 134: Global Vs Spain Growth Comparison

Figure 135: Spain Market Share Analysis (%) By Product, 2021 to 2031

Figure 136: Spain Market Share Analysis (%) By Indication, 2021 to 2031

Figure 137: Spain Market Share Analysis (%) By End User, 2021 to 2031

Figure 138: BENELUX Market Value Proportion Analysis

Figure 139: Global Vs BENELUX Growth Comparison

Figure 140: BENELUX Market Share Analysis (%) By Product, 2021 to 2031

Figure 141: BENELUX Market Share Analysis (%) By Indication, 2021 to 2031

Figure 142: BENELUX Market Share Analysis (%) By End User, 2021 to 2031

Figure 143: Russia Market Value Proportion Analysis

Figure 144: Global Vs Russia Growth Comparison

Figure 145: Russia Market Share Analysis (%) By Product, 2021 to 2031

Figure 146: Russia Market Share Analysis (%) By Indication, 2021 to 2031

Figure 147: Russia Market Share Analysis (%) By End User, 2021 to 2031

Figure 148: China Market Value Proportion Analysis

Figure 149: Global Vs China Growth Comparison

Figure 150: China Market Share Analysis (%) By Product, 2021 to 2031

Figure 151: China Market Share Analysis (%) By Indication, 2021 to 2031

Figure 152: China Market Share Analysis (%) By End User, 2021 to 2031

Figure 153: Japan Market Value Proportion Analysis

Figure 154: Global Vs Japan Growth Comparison

Figure 155: Japan Market Share Analysis (%) By Product, 2021 to 2031

Figure 156: Japan Market Share Analysis (%) By Indication, 2021 to 2031

Figure 157: Japan Market Share Analysis (%) By End User, 2021 to 2031

Figure 158: South Korea Market Value Proportion Analysis

Figure 159: Global Vs South Korea Growth Comparison

Figure 160: South Korea Market Share Analysis (%) By Product, 2021 to 2031

Figure 161: South Korea Market Share Analysis (%) By Indication, 2021 to 2031

Figure 162: South Korea Market Share Analysis (%) By End User, 2021 to 2031

Figure 163: India Market Value Proportion Analysis

Figure 164: Global Vs India Growth Comparison

Figure 165: India Market Share Analysis (%) By Product, 2021 to 2031

Figure 166: India Market Share Analysis (%) By Indication, 2021 to 2031

Figure 167: India Market Share Analysis (%) By End User, 2021 to 2031

Figure 168: Thailand Market Value Proportion Analysis

Figure 169: Global Vs Thailand Growth Comparison

Figure 170: Thailand Market Share Analysis (%) By Product, 2021 to 2031

Figure 171: Thailand Market Share Analysis (%) By Indication, 2021 to 2031

Figure 172: Thailand Market Share Analysis (%) By End User, 2021 to 2031

Figure 173: Indonesia Market Value Proportion Analysis

Figure 174: Global Vs Indonesia Growth Comparison

Figure 175: Indonesia Market Share Analysis (%) By Product, 2021 to 2031

Figure 176: Indonesia Market Share Analysis (%) By Indication, 2021 to 2031

Figure 177: Indonesia Market Share Analysis (%) By End User, 2021 to 2031

Figure 178: Malaysia Market Value Proportion Analysis

Figure 179: Global Vs Malaysia Growth Comparison

Figure 180: Malaysia Market Share Analysis (%) By Product, 2021 to 2031

Figure 181: Malaysia Market Share Analysis (%) By Indication, 2021 to 2031

Figure 182: Malaysia Market Share Analysis (%) By End User, 2021 to 2031

Figure 183: Australia Market Value Proportion Analysis

Figure 184: Global Vs Australian Growth Comparison

Figure 185: Australia Market Share Analysis (%) By Product, 2021 to 2031

Figure 186: Australia Market Share Analysis (%) By Indication, 2021 to 2031

Figure 187: Australia Market Share Analysis (%) By End User, 2021 to 2031

Figure 188: New Zealand Market Value Proportion Analysis

Figure 189: Global Vs New Zealand Growth Comparison

Figure 190: New Zealand Market Share Analysis (%) By Product, 2021 to 2031

Figure 191: New Zealand Market Share Analysis (%) By Indication, 2021 to 2031

Figure 192: New Zealand Market Share Analysis (%) By End User, 2021 to 2031

Figure 193: GCC Countries Market Value Proportion Analysis

Figure 194: Global Vs GCC Countries Growth Comparison

Figure 195: GCC Countries Market Share Analysis (%) By Product, 2021 to 2031

Figure 196: GCC Countries Market Share Analysis (%) By Indication, 2021 to 2031

Figure 197: GCC Countries Market Share Analysis (%) By End User, 2021 to 2031

Figure 198: Turkey Market Value Proportion Analysis

Figure 199: Global Vs Turkey Growth Comparison

Figure 200: Turkey Market Share Analysis (%) By Product, 2021 to 2031

Figure 201: Turkey Market Share Analysis (%) By Indication, 2021 to 2031

Figure 202: Turkey Market Share Analysis (%) By End User, 2021 to 2031

Figure 203: South Africa Market Value Proportion Analysis

Figure 204: Global Vs South Africa Growth Comparison

Figure 205: South Africa Market Share Analysis (%) By Product, 2021 to 2031

Figure 206: South Africa Market Share Analysis (%) By Indication, 2021 to 2031

Figure 207: South Africa Market Share Analysis (%) By End User, 2021 to 2031

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopaedic Bone Cement and Casting Material Market Growth – Trends & Forecast 2025 to 2035

Orthopaedic Cushions Market

Keyhole Orthopaedic Surgery Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Orthopaedic Insert Market

Personalized Orthopaedic Implant Market

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Hybrid Imaging System Market

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Optical Imaging Market Size and Share Forecast Outlook 2025 to 2035

Quantum Imaging Devices Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medical Imaging Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA