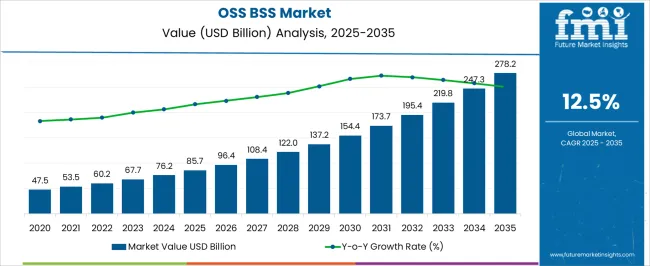

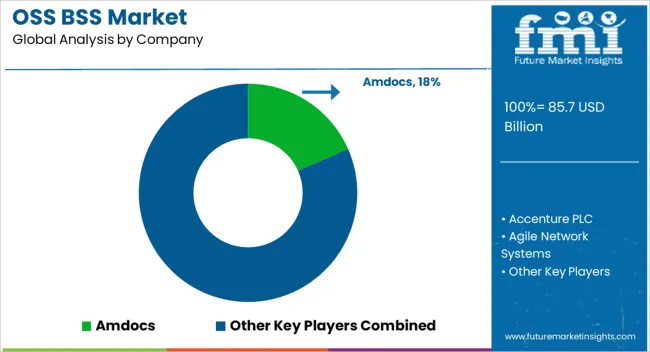

The OSS BSS Market is estimated to be valued at USD 85.7 billion in 2025 and is projected to reach USD 278.2 billion by 2035, registering a compound annual growth rate (CAGR) of 12.5% over the forecast period. The year-on-year (YoY) growth analysis indicates consistent and strong annual increases throughout this period, reflecting the steady adoption and integration of operational and business support systems across industries. In 2026, the market grows to USD 96.4 billion, marking a YoY increase of approximately 12.5% from 2025. This strong growth trend continues as the market reaches USD 108.4 billion in 2027 and USD 122.0 billion in 2028, demonstrating steady annual gains between 11% and 13%.

The mid-decade years see further acceleration, with the market advancing to USD 154.4 billion by 2030, representing a sustained upward trajectory. From 2031 to 2035, the YoY growth remains robust, as the market expands from USD 173.7 billion to USD 278.2 billion. This phase highlights increasing demand for OSS BSS solutions driven by digital transformation, enhanced customer experience needs, and evolving telecommunications infrastructure. The average YoY growth rate remains near the CAGR, with no significant volatility or downturns, signaling a mature, high-growth phase. The OSS BSS Market demonstrates a steady and reliable year-on-year growth pattern, making it an attractive sector for investors focusing on long-term value and sustained expansion.

| Metric | Value |

|---|---|

| OSS BSS Market Estimated Value in (2025 E) | USD 85.7 billion |

| OSS BSS Market Forecast Value in (2035 F) | USD 278.2 billion |

| Forecast CAGR (2025 to 2035) | 12.5% |

The OSS BSS market is undergoing a strategic transformation, fueled by the rapid digitalization of telecom infrastructure, the transition to 5G networks, and the growing integration of AI-driven service management platforms. Service providers are prioritizing business agility, network intelligence, and customer experience optimization, which is accelerating the adoption of cloud-native OSS and BSS systems.

Regulatory mandates around billing transparency, customer data protection, and service assurance are further reinforcing modernization across communication ecosystems. Investments in open architecture frameworks and microservices-based designs are enabling scalable deployment, improved interoperability, and faster time-to-market for new services.

As digital-first strategies become central to telecom business models, demand for unified and flexible OSS BSS platforms is expected to intensify across both mature and emerging markets.

The OSS BSS market is segmented by solution, deployment model, enterprise size, application, and geographic regions. By solution, the OSS BSS market is divided into BSS, OSS, Service assurance, Network management, Inventory management, Billing and revenue management, Service fulfillment, and Customer and product management. In terms of the deployment model, the OSS BSS market is classified into Cloud and On-Premise. Based on the enterprise size, the OSS BSS market is segmented into Large Enterprises and SME. By application, the OSS BSS market is segmented into IT & Telecom, BFSI, Media & Entertainment, and Others. Regionally, the OSS BSS industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

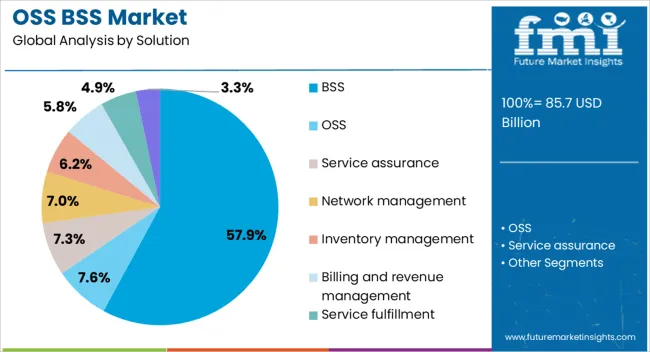

BSS is anticipated to hold 57.90% of the overall OSS BSS market share in 2025, making it the dominant solution segment. Its lead is being driven by the growing need for real-time billing, revenue management, customer experience platforms, and partner management tools in increasingly complex telecom environments.

As service providers expand into IoT, 5G, and content monetization models, BSS platforms are being prioritized to manage diverse pricing structures, subscriber lifecycle operations, and omni-channel engagement. The push toward digital self-care, seamless onboarding, and AI-enabled support tools has further enhanced the relevance of BSS offerings.

Additionally, the modularization of BSS components through APIs and containerized services is enabling faster service deployment and operational flexibility.

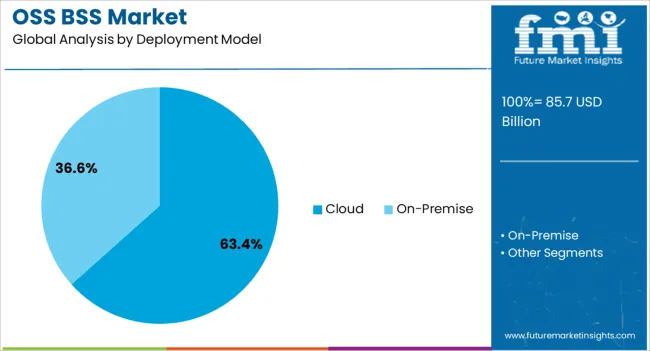

Cloud deployment is expected to account for 63.40% of the OSS BSS market revenue in 2025, positioning it as the leading model. This leadership is being driven by the need for scalable, cost-efficient infrastructure that can support agile service rollout and dynamic workload demands.

Cloud-native OSS BSS platforms offer enhanced uptime, automatic updates, and real-time analytics capabilities, making them ideal for telecom operators aiming to reduce capital expenditures while improving service velocity. The growing emphasis on edge computing, API management, and remote network monitoring has increased reliance on cloud-based delivery models.

Furthermore, strategic alliances between telecom companies and hyperscalers are enabling faster transitions to virtualized, service-driven network operations.

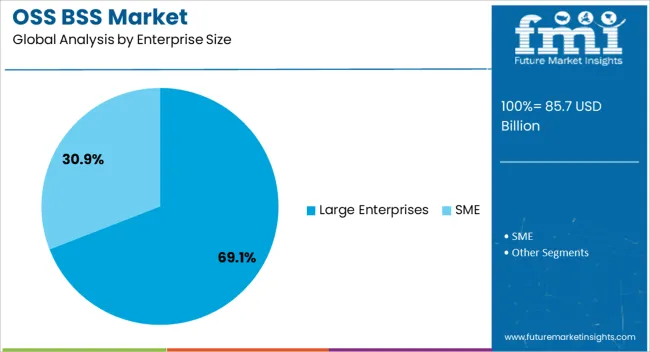

Large enterprises are projected to contribute 69.10% of the market revenue in 2025, marking them as the primary adopters of OSS BSS platforms. Their dominance stems from the complexity of managing large subscriber bases, multiregional network operations, and diversified service portfolios.

These organizations are prioritizing unified platforms to ensure interoperability between legacy systems and next-generation technologies, particularly in preparation for 5G, private networks, and AI-driven customer support. Enhanced budgetary capabilities, internal IT resources, and strategic transformation roadmaps are enabling large enterprises to lead OSS BSS modernization efforts.

Additionally, regulatory compliance pressures, demand for seamless integration across CRM and billing systems, and the need for network transparency continue to reinforce their high investment levels in this space.

The market has experienced significant growth driven by the evolving telecommunications landscape and the need for efficient operational and business support systems. OSS (Operations Support Systems) manage network operations, including fault, configuration, and performance management, while BSS (Business Support Systems) handle customer-facing activities such as billing, order management, and customer relationship management. The rapid adoption of 5G networks, IoT proliferation, and digital transformation initiatives have accelerated demand for integrated OSS BSS solutions. Innovations in cloud computing, AI, and automation have enhanced system capabilities, improving agility and reducing operational costs.

The deployment of 5G networks and the exponential growth of Internet of Things (IoT) devices have significantly increased the need for robust OSS BSS solutions. 5G’s complex network architecture requires advanced OSS for efficient network slicing, fault management, and resource optimization. Simultaneously, BSS must support dynamic billing, customer experience management, and service orchestration for a vast number of connected devices. The massive data volume generated by IoT necessitates scalable, real-time analytics and automation capabilities within OSS BSS platforms. Operators are investing heavily in modernizing their support systems to handle these requirements, driving market growth and innovation.

Cloud-native OSS BSS solutions are gaining traction due to their scalability, cost-effectiveness, and rapid deployment capabilities. The migration to cloud platforms allows operators to reduce capital expenditure and achieve operational agility. Artificial intelligence and machine learning integration facilitate predictive maintenance, anomaly detection, and automated customer service through chatbots and virtual assistants. These technologies improve decision-making, reduce manual interventions, and enhance customer experience. Open APIs and modular architectures promote interoperability and ease integration with third-party applications. The continuous evolution of cloud and AI technologies strengthens the OSS BSS market’s ability to adapt to rapidly changing telecom environments.

Telecommunications providers are increasingly focusing on delivering personalized customer experiences and innovative monetization models, fueling OSS BSS adoption. BSS platforms enable flexible pricing, real-time charging, and multi-service bundling, catering to diverse consumer and enterprise segments. Enhanced customer analytics and engagement tools support targeted marketing and loyalty programs. OSS systems ensure network reliability and quality of service, directly impacting user satisfaction. The convergence of telecom, media, and digital services requires integrated OSS BSS frameworks that facilitate seamless service delivery and billing across multiple platforms. This focus on customer-centric operations is a key market growth driver.

Despite the advantages, the OSS BSS market faces challenges related to integrating new solutions with existing legacy infrastructure. Many operators rely on outdated systems that lack interoperability and flexibility, making migration complex and costly. Data silos and inconsistent processes impede seamless information flow and real-time analytics. Security and compliance concerns also require robust solutions and continuous updates. Additionally, the customization and configuration needed for diverse operator requirements can prolong deployment timelines. Vendors are addressing these issues by offering modular, cloud-native platforms with standardized APIs and professional services to simplify integration and accelerate digital transformation initiatives.

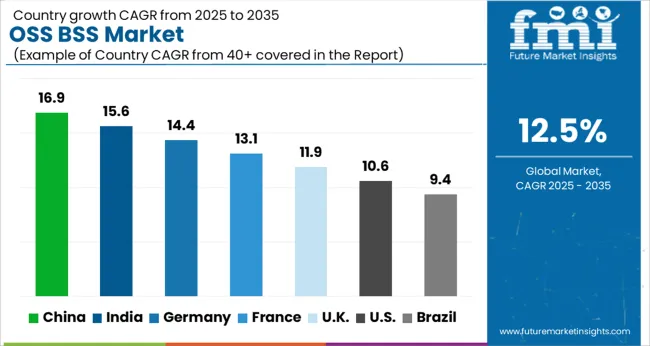

The market is forecasted to grow at a CAGR of 12.5% between 2025 and 2035, driven by increasing digital transformation in telecom networks, adoption of 5G technologies, and demand for enhanced customer experience management. China leads with a 16.9% CAGR, supported by rapid telecom infrastructure expansion and cloud-based OSS/BSS deployments. India follows at 15.6%, fueled by growing telecom subscriber base and service diversification. Germany, growing at 14.4%, benefits from strong enterprise adoption and network modernization efforts. The UK, at 11.9%, experiences steady growth due to telecom upgrades and digital services expansion. The USA, with a 10.6% CAGR, reflects innovation in software-defined networking and operational automation. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 16.9% from 2025 to 2035, driven by rapid digital transformation in telecommunications and 5G network rollouts. Domestic telecom providers such as China Mobile and Huawei are advancing integrated operational and business support systems to enhance service delivery and customer experience. Investments in AI-enabled automation and cloud-native OSS BSS platforms have increased efficiency in network management and billing processes. The government’s focus on smart city initiatives and expanding broadband connectivity further boosts demand for advanced OSS BSS solutions in both urban and rural regions.

India’s industry is expected to grow at a CAGR of 15.6%, supported by rising mobile subscriber base and expansion of digital services. Leading players like Tata Communications and Infosys are developing scalable OSS BSS platforms optimized for high-volume transaction processing and customer analytics. Telecom operators focus on upgrading legacy systems to support 5G, IoT, and converged services. Government digital initiatives such as Digital India accelerate deployment of advanced OSS BSS solutions, enhancing operational agility and revenue management across telecom providers.

Germany’s market is forecast to advance at a CAGR of 14.4%, driven by digital transformation efforts within telecom operators such as Deutsche Telekom and Vodafone. Emphasis on cloud-based OSS BSS platforms is rising to improve network automation, fault management, and customer billing. The demand for personalized telecom services and real-time data analytics is also encouraging adoption. Collaboration with technology providers for AI and machine learning integration enhances system performance and reduces operational costs. Regulatory frameworks supporting data privacy and security influence system design and deployment.

The United Kingdom is projected to grow at a CAGR of 11.9%, supported by the expansion of 5G networks and evolving customer expectations. Telecom companies including BT Group and Vodafone UK invest in automation and digitalization of OSS BSS to streamline operations and improve customer experience. Growing demand for omnichannel service delivery and predictive maintenance systems further stimulates market growth. Initiatives aimed at enhancing network resilience and reducing downtime through AI-powered OSS solutions are gaining traction among operators.

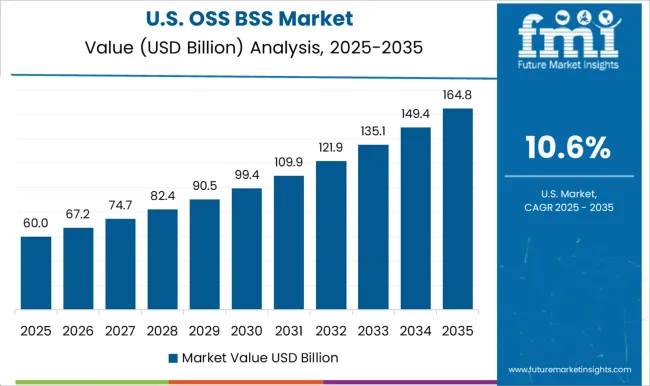

The market in the United States is expected to grow at a CAGR of 10.6% between 2025 and 2035, driven by telecommunications modernization and cloud migration efforts. Leading firms like Cisco and Oracle are advancing cloud-native OSS BSS architectures to support 5G, IoT, and digital service monetization. Increasing enterprise adoption of AI for network management and customer analytics further expands the market. Federal investments in broadband infrastructure and cybersecurity initiatives contribute to enhanced OSS BSS capabilities across telecom providers.

The market is characterized by a mix of established IT service providers and specialized software companies delivering operational and business support systems critical for telecommunications and digital service providers. Amdocs leads with comprehensive OSS BSS platforms that streamline network management and customer experience. Accenture PLC and Infosys Limited offer consulting and integration services, enabling digital transformation across telecom operations. Agile Network Systems and BMC Software Inc. focus on flexible, cloud-native solutions tailored to evolving network environments. Broadcom Inc. and Cisco Systems Inc. provide integrated software suites combining network automation with billing and customer management. Comarch SA and CSG Systems International, Inc. deliver scalable OSS BSS solutions for billing, revenue management, and service assurance. HP Enterprise Company and IBM Corporation contribute robust infrastructure and analytics platforms to enhance operational efficiency. Huawei Technologies Co., Ltd. and Nokia Corporation offer end-to-end OSS BSS ecosystems supporting 5G and next-generation networks. Netcracker Technology Corporation specializes in customizable software for network orchestration and customer engagement. Market growth is propelled by increasing demand for automation, real-time analytics, and customer-centric services in telecom networks. Entry barriers include technological complexity, high investment costs, and integration challenges. Leading providers sustain their positions through innovation, strategic partnerships, and global service delivery capabilities.

CX is a core driver in the evolution of OSS/BSS solutions. Telecom companies are investing in end-to-end customer journey management platforms that integrate billing, support systems, and service activation into a seamless experience. The goal is to improve customer satisfaction by providing faster issue resolution, personalized offers, and self-service capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 85.7 Billion |

| Solution | BSS, OSS, Service assurance, Network management, Inventory management, Billing and revenue management, Service fulfillment, and Customer and product management |

| Deployment Model | Cloud and On-Premise |

| Enterprise Size | Large Enterprises and SME |

| Application | IT & Telecom, BFSI, Media & Entertainment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amdocs, Accenture PLC, Agile Network Systems, BMC Software Inc., Broadcom Inc., Cisco Systems Inc., Comarch SA, CSG Systems International, Inc., HP Enterprise Company, Huawei Technologies Co., Ltd., IBM Corporation, Infosys Limited, Netcracker Technology Corporation, and Nokia Corporation |

| Additional Attributes | Dollar sales by solution type and deployment model, demand dynamics across telecom operators, cloud service providers, and enterprise networks, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in cloud-native architectures, AI-driven automation, and real-time analytics, environmental impact of data center energy use, hardware lifecycle, and software efficiency, and emerging use cases in 5G network monetization, IoT service management, and digital customer experience platforms. |

The global OSS BSS market is estimated to be valued at USD 85.7 billion in 2025.

The market size for the OSS BSS market is projected to reach USD 278.2 billion by 2035.

The OSS BSS market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in OSS BSS market are bss, oss, service assurance, network management, inventory management, billing and revenue management, service fulfillment and customer and product management.

In terms of deployment model, cloud segment to command 63.4% share in the OSS BSS market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud OSS BSS Market Size and Share Forecast Outlook 2025 to 2035

Fossil Fuel New Energy Generation Market Size and Share Forecast Outlook 2025 to 2035

Cross-chain NFT Market Size and Share Forecast Outlook 2025 to 2035

Cross-species Organ Transplantation Market Forecast and Outlook 2025 to 2035

Cross Interconnection Protection Box Market Size and Share Forecast Outlook 2025 to 2035

Cross Corner Industrial Bags Market Size and Share Forecast Outlook 2025 to 2035

Cross-Linked Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Cross-Border Road Transport Market Size and Share Forecast Outlook 2025 to 2035

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Cross Point Switch Market Size and Share Forecast Outlook 2025 to 2035

Cross Pein Hammer Market Size and Share Forecast Outlook 2025 to 2035

Cross Training Shoes Market Size and Share Forecast Outlook 2025 to 2035

Crossover Market Size and Share Forecast Outlook 2025 to 2035

Cross-Cloud Analytics Market Insights - Growth & Forecast 2025 to 2035

Understanding Market Share Trends in Gloss Control Agents

Cross-Belt Sorters Market

Gloss Meters Market

Cross-linked Shrink Films Market

Cross-Platform & Mobile Advertising Market Report – Growth 2018-2028

Cross Laminated Timber Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA