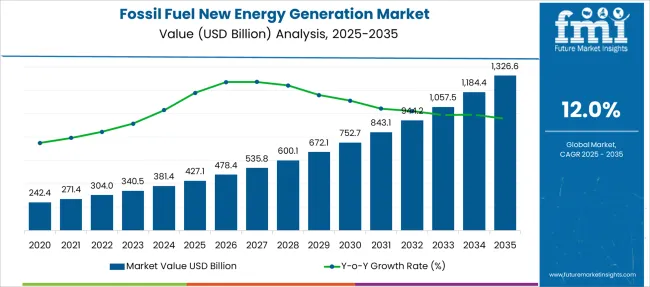

The Fossil Fuel New Energy Generation Market is estimated to be valued at USD 427.1 billion in 2025 and is projected to reach USD 1326.6 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

| Metric | Value |

|---|---|

| Fossil Fuel New Energy Generation Market Estimated Value in (2025 E) | USD 427.1 billion |

| Fossil Fuel New Energy Generation Market Forecast Value in (2035 F) | USD 1326.6 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The Fossil Fuel New Energy Generation market is evolving as global energy priorities shift toward hybrid approaches that balance legacy energy infrastructure with emerging clean technologies. Investments are increasingly being directed toward transitional solutions that optimize fossil fuel resources while incorporating carbon mitigation and energy efficiency strategies.

This shift is driven by rising global energy demand, particularly in regions undergoing industrial expansion, and by regulatory frameworks aiming to reduce emissions without abruptly eliminating fossil fuel dependence. Energy producers are adapting by retrofitting existing systems, integrating carbon capture mechanisms, and leveraging digital monitoring to improve output while managing environmental impact.

The market outlook remains favorable as energy security concerns and economic constraints fuel demand for dependable baseload power, which fossil fuels continue to provide. Simultaneously, technology innovation is enabling cleaner fossil fuel use, positioning this segment as a critical bridge in the global shift toward a lower carbon energy mix..

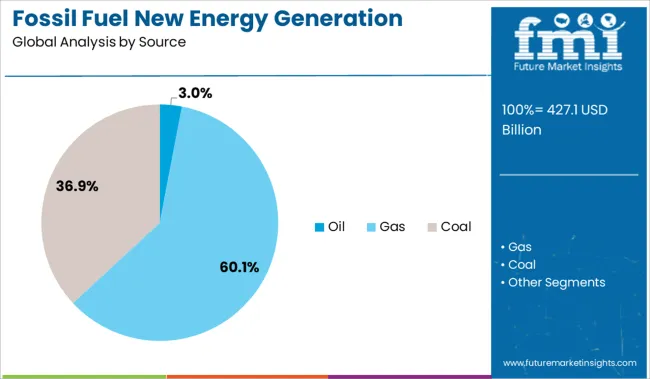

The market is segmented by Source and region. By Source, the market is divided into Oil, Gas, and Coal. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil segment is expected to account for 3% of the Fossil Fuel New Energy Generation market revenue share in 2025. Growth in this segment has been influenced by its strategic role in regions where energy diversification is in progress but full transition to renewables remains economically or technologically unfeasible. Oil has continued to serve as a backup and peaking source in hybrid grids, where reliability and dispatch flexibility are essential.

Advanced combustion technologies and improved refining processes have allowed for more efficient energy conversion, reducing waste and emissions in energy generation. Furthermore, energy operators have favored oil-based solutions for their logistical advantages in remote and off-grid installations.

Strategic reserves, existing infrastructure, and rising geopolitical emphasis on energy self-reliance have sustained interest in maintaining oil as a component of the evolving energy mix. These factors have contributed to the continued relevance of the oil segment, despite its relatively smaller market share compared to other sources..

The cattle management software market has gained traction through mobile-first solutions that enhance on-field usability and data reliability. From 2023 to 2025, offline functionality, real-time syncing, and role-based access have enabled broader adoption among ranchers, veterinarians, and advisors. These developments demonstrate that mobility and ease of use are no longer optional-they are foundational to software relevance and long-term engagement within livestock operations.

The imposition of stricter emissions limits has been increasingly recognized as a primary catalyst for growth in fossil fuel-powered energy generation systems with emissions controls. In 2023, power plants were retrofitted with carbon capture modules and low-NOx combustion burners to comply with newly enacted regional air-quality restrictions. By 2024, operators were compelled to invest in upgraded flue-gas desulfurization and advanced monitoring systems to avoid penalties and maintain grid access. Into 2025, these technologies have been paired with efficiency upgrades-such as high-efficiency turbines-to reduce operational costs amid compliance demands. These developments indicate that regulatory scrutiny is being transformed into an operational advantage, as operators preemptively adopt controlled combustion and emissions mitigation methods.

In 2023, applications designed for offline field entry were introduced to enable cattle managers to record health events, breeding data, and feed metrics directly via smartphones while on pasture. By 2024, these mobile solutions were updated to synchronize with central farm management systems once connectivity became available, reducing data delays and improving accuracy. Into 2025, role-based dashboards were being deployed to provide veterinarians, supply chain partners, and farm advisors with tailored access, fostering collaborative decision-making. These developments show that mobile-first design is not just a convenience enhancement but a strategic driver that improves data fidelity and user adoption. Vendors who prioritize intuitive, accessible platforms will likely secure deeper integration into livestock operations.

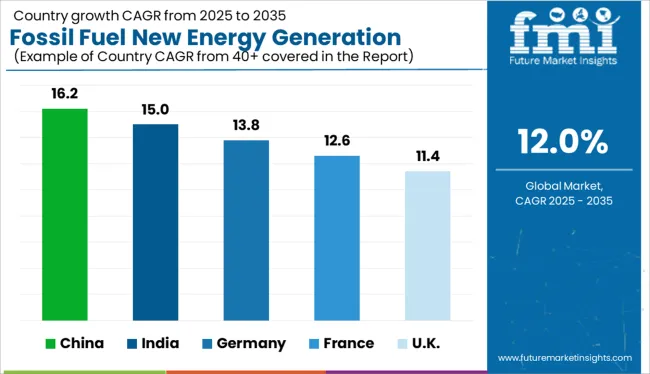

| Country | CAGR |

|---|---|

| China | 16.2% |

| India | 15.0% |

| Germany | 13.8% |

| France | 12.6% |

| UK | 11.4% |

| USA | 7.8% |

| Brazil | 6.9% |

The fossil fuel new energy generation market is forecast to grow globally at a CAGR of 12% between 2025 and 2035. China leads with a 16.2% CAGR, followed by India at 15.0% and Germany at 13.8%. France aligns just above the global average at 12.6%, while the United Kingdom trails slightly at 11.4%. China and India are pushing hybrid systems such as gas-CCS and coal co-firing with hydrogen and biomass. Germany is leading in repurposing fossil plants for flexible load support via power-to-gas integration. France emphasizes combined heat and power (CHP) retrofits, while the UK pivots toward blue hydrogen and carbon capture pilots.

China is projected to lead the fossil fuel new energy generation market with a 16.2% CAGR, supported by massive public-private investment in coal-to-hydrogen, natural gas hybrid systems, and carbon capture retrofits. Provincial authorities are rolling out flexible power generation schemes, particularly in regions reliant on legacy coal plants. High-efficiency gas turbines are being paired with ammonia-ready co-firing units. Chinese OEMs are also scaling exports of low-carbon fossil technologies.

India is forecast to grow its fossil fuel new energy market at a 15.0% CAGR, driven by flexible grid demand, power dispatch balancing, and emission-cutting mandates. State-run utilities are co-firing biomass pellets with coal across thermal plants. Pilot CCS initiatives and hydrogen-ready boilers are gaining traction in Gujarat and Maharashtra. Local manufacturers are producing oxy-combustion components to reduce flue gas volumes and retrofit cost.

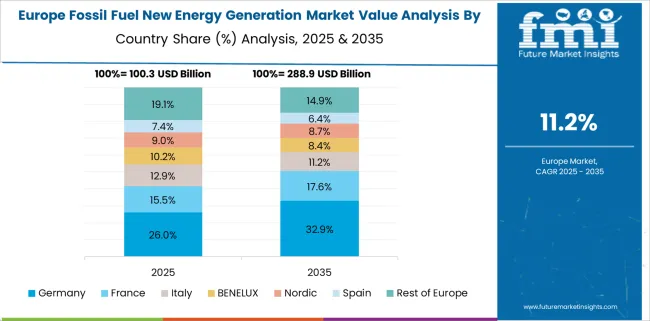

Germany is expected to grow at a 13.8% CAGR in this sector, driven by flexible fossil assets used as grid stabilizers under the Energiewende policy. Brownfield power stations are being converted for synthetic methane and hydrogen co-firing. EU funding supports retrofitting for carbon capture, while utilities like Uniper and RWE are trialing carbon mineralization alongside traditional gas generation. Municipal utilities deploy CHP systems integrated with thermal storage.

France is projected to grow its fossil fuel new energy generation market at 12.6% CAGR, led by investments in gas-based CHP, hydrogen blending, and small-scale carbon capture solutions. Natural gas plants are being upgraded with dry low-emission burners and pre-combustion carbon filters. State-backed projects encourage hybridization of fossil systems with solar thermal and industrial waste heat. Strategic demand arises in manufacturing and urban heating zones.

The United Kingdom is projected to expand at an 11.4% CAGR, driven by early-stage deployment of blue hydrogen, BECCS (Bioenergy with Carbon Capture and Storage), and gas-to-power innovations. Transitioning fossil assets are key to the UK's carbon budget targets, with Drax and SSE launching hybrid generation facilities. CCS retrofits for CCGT (Combined Cycle Gas Turbine) plants are being piloted in the North Sea basin. Flexible capacity auctions support investments in dispatchable fossil-based hybrid systems.

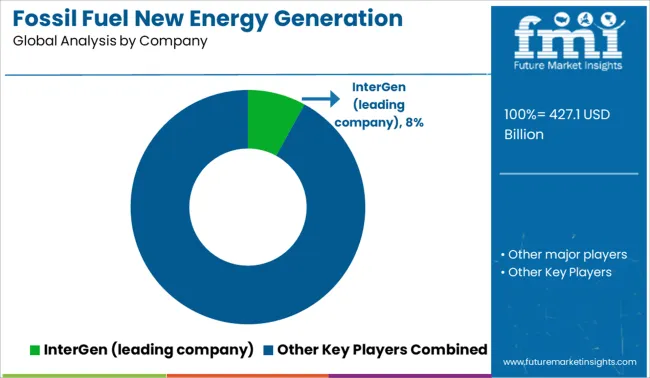

The fossil fuel new energy generation market is moderately consolidated, led by InterGen. The company holds a dominant position through its high-efficiency gas-fired power plants, grid-stabilizing assets, and experience in transitioning conventional generation portfolios toward lower-emission operations.

Dominant player status is held exclusively by InterGen. Key players include other major generation companies operating large-scale combined-cycle facilities, advanced thermal units, and integrated energy infrastructure designed to complement renewable intermittency and support energy security.

Emerging players are limited in this segment due to capital-intensive entry barriers and heavy regulatory oversight in power generation markets. Market demand is driven by increasing reliance on flexible thermal generation, modernization of aging plants, and the push for cleaner-burning fossil fuel alternatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 427.1 Billion |

| Source | Oil, Gas, and Coal |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | InterGen (leading company) and Other major players |

| Additional Attributes | The Cattle Management Software market is undergoing accelerated growth as digitization becomes increasingly critical in optimizing livestock operations. Advancements in cloud computing, real-time analytics, and mobile integration have enabled cattle owners to track animal health, breeding cycles, feeding behavior, and environmental conditions with precision. Rising global demand for dairy and beef products has prompted farms to increase productivity and operational efficiency, further fueling the adoption of intelligent management platforms. Governments and agricultural bodies are also supporting digital transformation through funding programs, training initiatives, and regulatory modernization. In emerging markets, improved internet connectivity and smartphone penetration are facilitating access to sophisticated farm management tools. In developed regions, focus is being placed on automation, traceability, and sustainable farming practices, which are expected to drive long-term software investment. The convergence of IoT devices with cattle management software is shaping the future of livestock technology, empowering producers with real-time insights that improve decision-making and profitability across the value chain. |

The global fossil fuel new energy generation market is estimated to be valued at USD 427.1 billion in 2025.

The market size for the fossil fuel new energy generation market is projected to reach USD 1,326.6 billion by 2035.

The fossil fuel new energy generation market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in fossil fuel new energy generation market are oil, gas and coal.

In terms of , segment to command 0.0% share in the fossil fuel new energy generation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fuel rail for CNG Systems Market Size and Share Forecast Outlook 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Fuel Capacitance Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fuel Gas Heater Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell UAV Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Stack Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Electric Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Cell Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Fuel Injection System Market Growth - Trends & Forecast 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Fuel Cell Market Growth – Trends & Forecast 2025 to 2035

Fuel Cell for Data Center Market - Trends & Forecast 2025 to 2035

Fuel Cell for Stationary Power Market Growth - Trends & Forecast 2025 to 2035

Fuel Analyzer Market

Fuel Vending Machines Market

Fuel Operated Heaters Market

Fuel Resistant Sealant Market

Fuel Feed Pumps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA