The packer bottle packaging sector is evolving fast as firms address their durability, sustainability, and the consumers' convenience. With increasing demands across pharmaceuticals, nutraceuticals, personal care, and food industries, manufacturers are enhancing bottle designs with more tamper-proof seals, lightweight materials, or ecofriendly alternatives. They have also combined smart packaging features, high-barrier coatings, and recyclable polymers to improve safety and functionality.

It is developing the automatic molding processes, AI-driven defect detection, and precision sealing technologies involved in packer bottle production to optimize efficiency and integrity in products. The industry trends include packages made of PCR plastics, biodegradable bottles, and reusable glass substitutes, matching international trends for sustainability.

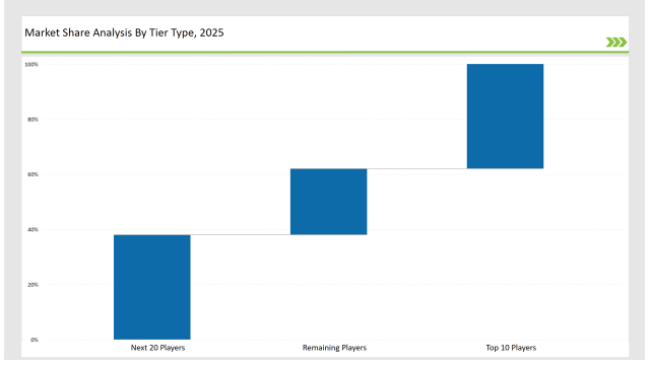

Tier 1 players such as Berry Global, Gerresheimer, and Alpha Packaging constitute 37% of the market as a result of their presence in innovation in material, precision molding, and global supply chain capabilities.

The tier 2 companis includes Amcor, Comar, and Alpla Group, which dominate 39% of the market by providing economical, customized, and specialty packer bottles specifically designed for pharmaceuticals, supplements, and personal care products.

Tier 3 players includes regional and niche players focused on refillable, high-barrier, and lightweight packer bottles which represent about 24% of the market. These businesses invest in localized production and sustainable innovations, all the while targeting premium bottle designs.

| Category | Market Share (%) |

|---|---|

| Top 3 (Berry Global, Gerresheimer, Alpha Packaging) | 19% |

| Rest of Top 5 (Amcor, Comar) | 10% |

| Next 5 of Top 10 (Alpla Group, Silgan Plastics, Pretium Packaging, Weener Plastics, United Caps) | 8% |

Packer bottles have uses in various industries where product safety, strength, and environment-friendliness are important. Business groups are turning innovative to develop more trusted packages, minimize wastage, and adhere to evolving regulatory requirements. They are developing multi-layer barrier technology to enhance product preservation. Producers are incorporating smart tamper-evident markers to enhance customer confidence and safeguarding.

Producers are developing packer bottles with new sealing technologies, light-weight designs, and smart tracking functionality. They are using high-impact resistant materials to improve strength without increasing weight. Firms are also fortifying UV-resistant coatings to keep sensitive contents safe from degradation. Firms are also incorporating ergonomic designs to maximize consumer convenience and handling.

Sustainability and product protection are driving the packer bottle market revolution. Companies are integrating AI-based defect detection, light-weight resin chemistry, and advanced sealing technology to enhance packaging integrity. Companies are investing in reusable and recyclable packs to minimize environmental impact. Manufacturers are launching child-resistant caps and smart caps for tamper-evident packs. In addition, companies are adding NFC-enabled technology to upgrade product traceability and customer engagement.

Technology suppliers should focus on automation, advanced material innovations, and smart packaging features to support the evolving packer bottle market. Partnering with pharmaceutical, nutraceutical, and personal care brands will drive innovation and market growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Berry Global, Gerresheimer, Alpha Packaging |

| Tier 2 | Amcor, Comar, Alpla Group |

| Tier 3 | Silgan Plastics, Pretium Packaging, Weener Plastics, United Caps |

Front-running producers are pushing packer bottle tech through AI-based quality control, eco-friendly material breakthroughs, and intelligent packaging solutions. Corporations are creating ultra-lightweight bottles to minimize plastic usage while ensuring strength. Marketers are also incorporating antimicrobial coatings to improve cleanliness and increase product shelf life. Companies are implementing energy-efficient production methods to minimize carbon footprints.

| Manufacturer | Latest Developments |

|---|---|

| Berry Global | Launched fully recyclable packer bottles in March 2024. |

| Gerresheimer | Developed tamper-evident pharmaceutical bottles in April 2024. |

| Alpha Packaging | Expanded child-resistant PCR bottle production in May 2024. |

| Amcor | Released refillable packer bottles for personal care in June 2024. |

| Comar | Strengthened airtight supplement bottle designs in July 2024. |

| Alpla Group | Introduced energy-efficient molding technology in August 2024. |

| Silgan Plastics | Pioneered smart caps with RFID tracking in September 2024. |

The packer bottle market is evolving as companies invest in sustainable materials, AI-driven defect detection, and smart packaging innovations. They are incorporating lightweight yet durable materials to enhance bottle resilience while minimizing plastic use. Additionally, manufacturers are optimizing production efficiency through high-speed molding technologies. Businesses are also integrating tamper-evident closures to improve security and regulatory compliance.

Manufacturers will continue refining AI-driven defect detection, lightweight bottle designs, and high-barrier packaging solutions. Companies will expand refillable and biodegradable bottle production to meet sustainability goals. Smart packer bottles with authentication and tracking features will gain traction in pharmaceuticals and nutraceuticals. Additionally, predictive analytics and automated quality control will improve production efficiency, reduce waste, and enhance customization. Businesses will integrate nanotechnology-based barrier coatings to extend product shelf life. Firms will also adopt AI-powered material optimization to improve recyclability and minimize raw material use.

Leading players include Berry Global, Gerresheimer, Alpha Packaging, Amcor, Comar, Alpla Group, and Silgan Plastics.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, AI-driven quality control, smart packaging, and tamper-proof solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packer Bottle Market Analysis by Shape & Size Through 2034

Market Share Distribution Among Bottle Dividers Suppliers

Market Positioning & Share in the Skep Bottle Industry

Market Share Insights for Beer Bottles Providers

Competitive Overview of Glass Bottles Market Share

Market Positioning & Share in the Serum Bottles Market

Industry Share & Competitive Positioning in Carton Bottle Market

Competitive Overview of Plasma Bottle Industry Share

Market Share Breakdown of Foamer Bottle Manufacturers

Competitive Overview of Dosing Bottles Providers

Breaking Down the Aluminum bottles market: Key Players and Innovations

Competitive Breakdown of Security Bottles Manufacturers

Market Share Insights for Aluminium Bottle Providers

Examining Market Share Trends in the PET Syrup Bottle Industry

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Fluorinated Bottle Market Share

Competitive Landscape of Prescription Bottles Suppliers

Industry Share & Competitive Positioning in Indonesia Baby Bottle Market

Industry Share & Competitive Positioning in Glass Cosmetic Bottles

Key Companies & Market Share in the Acrylic Airless Bottle Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA