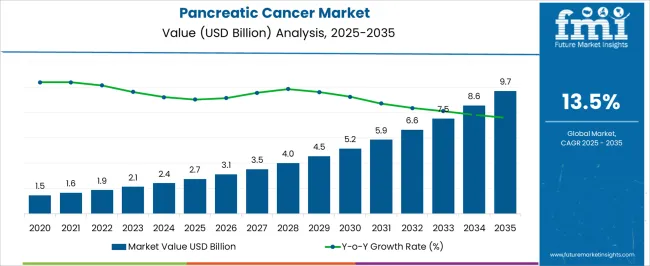

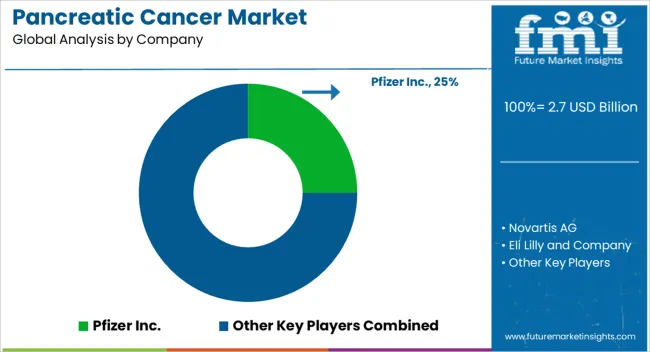

The Pancreatic Cancer Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 13.5% over the forecast period.

| Metric | Value |

|---|---|

| Pancreatic Cancer Market Estimated Value in (2025 E) | USD 2.7 billion |

| Pancreatic Cancer Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 13.5% |

The pancreatic cancer market is witnessing steady growth as advancements in treatment modalities, improved diagnostic capabilities, and rising awareness converge to drive demand for effective care solutions. Increasing incidence of pancreatic cancer, coupled with the aggressive nature of the disease, has intensified the need for early intervention and innovative therapies.

Developments in precision medicine and combination treatments are enhancing survival outcomes and broadening the therapeutic landscape. Hospitals and specialized cancer centers are investing in advanced technologies and multidisciplinary approaches, supporting improved patient management and fostering market expansion.

Future growth is expected to be fueled by ongoing clinical research, regulatory approvals of targeted therapies, and increasing collaboration between pharmaceutical companies and research institutions. These factors are collectively shaping a market characterized by innovation, improved accessibility, and greater emphasis on personalized care.

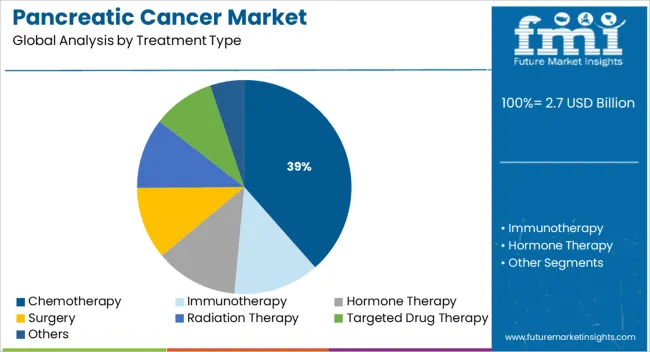

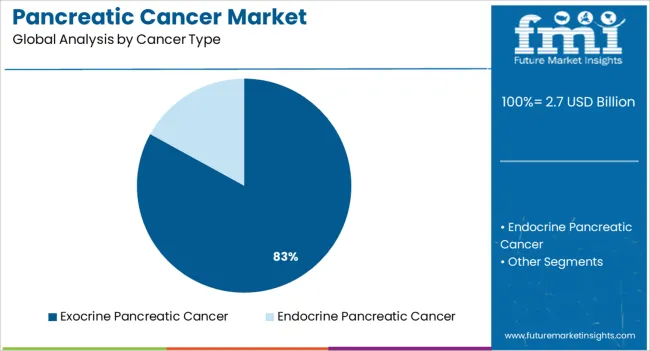

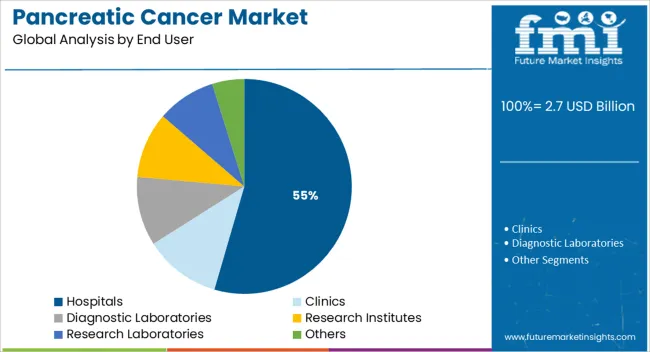

The market is segmented by Treatment Type, Cancer Type, and End User and region. By Treatment Type, the market is divided into Chemotherapy, Immunotherapy, Hormone Therapy, Surgery, Radiation Therapy, Targeted Drug Therapy, and Others. In terms of Cancer Type, the market is classified into Exocrine Pancreatic Cancer and Endocrine Pancreatic Cancer. Based on End User, the market is segmented into Hospitals, Clinics, Diagnostic Laboratories, Research Institutes, Research Laboratories, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by treatment type, chemotherapy is anticipated to account for 38∙5 % of the market revenue in 2025, maintaining its position as the leading treatment approach. This dominance is being sustained by its established role as the standard of care, particularly in advanced stages of the disease where surgical options are limited.

The ability of chemotherapy to target rapidly dividing cancer cells and provide systemic treatment has ensured its widespread use despite emerging alternatives. Hospitals and oncologists continue to prioritize chemotherapy protocols due to their proven efficacy, accessibility, and integration within existing treatment guidelines.

Additionally, combination regimens incorporating chemotherapy agents with newer targeted therapies and immunotherapies are being explored to enhance outcomes, further solidifying its relevance. The persistence of high unmet clinical needs and the incremental benefits of optimized chemotherapy schedules are reinforcing its leadership in the treatment landscape.

Segmented by cancer type, exocrine pancreatic cancer is projected to represent 83∙0 % of the overall market revenue in 2025, retaining its status as the most prevalent form. This predominance is attributed to the significantly higher incidence of exocrine malignancies compared to endocrine tumors within the pancreas.

The aggressive biology of exocrine pancreatic cancer, combined with its tendency to be diagnosed at advanced stages, has concentrated clinical and research efforts on this subtype. Therapeutic advancements, such as novel chemotherapeutic combinations and targeted therapies specifically designed for exocrine histologies, are further supporting the segment’s growth.

Multidisciplinary approaches, enhanced imaging techniques, and molecular profiling are also contributing to better management of this cancer type. The focus on addressing the substantial burden of exocrine disease has ensured its continued priority in clinical practice and therapeutic development.

When analyzed by end user, hospitals are expected to capture 54∙5 % of the market revenue in 2025, establishing themselves as the primary care setting. This leadership is being driven by the comprehensive resources, specialized expertise, and multidisciplinary care models available in hospital environments.

Patients diagnosed with pancreatic cancer typically require complex treatment plans involving surgery, chemotherapy, radiotherapy, and supportive care, all of which are coordinated within hospital settings. Hospitals also offer access to advanced diagnostic equipment, clinical trials, and specialized oncology teams, enabling more effective and timely interventions.

Centralized care delivery, coupled with the ability to manage severe side effects and provide intensive monitoring, has reinforced hospitals as the preferred choice for both patients and practitioners. Continued investment in oncology infrastructure and adoption of innovative treatment technologies are sustaining the hospital segment’s dominance in the market.

Despite advances in surgical technique, chemotherapy treatments, and the emergence of neoadjuvant chemoradiotherapy, five-year survivorship from this ailment is as low as 2.5% in certain countries. The total number of reported cases of pancreatic cancer in the 7MM nations was around 175,770 in 2024, and this was predicted to increase market growth during the historical period.

The upsurge of an unhealthy lifestyle and poor diet has heightened the number of individuals suffering from pancreatic diseases/conditions. The high incidence of diabetes patients has been mainly ascribed to the rising demand for packaged foods and beverages with elevated amounts of sugar, which also significantly contributes to the growing cases of pancreatic cancer patients. Thus, these factors will drive the market growth during the forecast period with a CAGR of 13.5%.

Owing to the lack of therapeutic procedures for early diagnosis, the pancreatic cancer market is expanding in developed nations

The American Society of Clinical Oncology predicts that 62,210 adults in the USA will be diagnosed with pancreatic cancer in 2025. The high prevalence of pancreatic cancer, which causes germline mutations, is also predicted to boost overall growth.

Besides that, the increasing adoption of therapeutic strategies is catapulting the pancreatic cancer market forward. Unlike traditional therapeutic methods such as chemotherapy, targeted therapy isolates receptor sites in cancer cells while causing no harm to the body's healthy peripheral cells. The industry is being influenced by the increasing prevalence of pancreatic cancer and the requirement for targeted therapy.

NCI-funded research projects to empower the market to grow

The National Cancer Institute has sponsored several research programs dedicated to developing treatments and medications for pancreatic cancer. The Pancreatic Cancer Cohort Consortium, Pancreatic Cancer Cancer Detection Consortium (PCDC), Pancreatic Ductal Adenocarcinoma (PDAC) Stromal Reprogramming Consortium (PSRC), Pancreatic Cancer Microenvironment Network (PaCMEN), RAS Initiative, Pancreatic Specialized Programs of Research Excellence (Pancreatic SPOREs), and others are instances of financed projects.

These programs each have their mission and targets, and they each seek to find novel solutions to the ailment. The Pancreatic Specialized Programs of Research Excellence (Pancreatic SPOREs), for instance, is an intervention designed to quickly implement principal scientific discoveries into medical settings. The Pancreatic SPORE grants promote novel and diverse methods of prevention and treatment.

rising costs of drug development and treatment, along with strict regulatory guidelines to constrain market growth

The elevated cost of drug advancement and treatment may stifle future growth. During the projected timeframe, the market will also face obstacles from stringent government laws and regulations. Inventions and comprehensive authorization methods can assist in overcoming these challenges and propelling the global pancreatic cancer market forward.

In 2024, the North American pancreatic cancer market dominated the global market. This is because pancreatic cancer is more prevalent in North American countries, with the USA having the most cancer victims globally. As a consequence, North America possessed the leading revenue proportion in the pancreatic cancer treatment market in 2024. It is primarily owing to the upgraded healthcare system, widespread utilization of pancreatic treatment procedures, and a huge target citizenry. Furthermore, the increasing prevalence of pancreatic cancer is driving up requirements for treatment options.

The Asia-Pacific pancreatic cancer market is expected to be the most rapidly sprouting in the globe. Asia Pacific, as a result, hand, is projected to expand the fastest during the projected timeline. The existence of well-established clinics and critical care centers, as well as a massive population suffering from pancreatic cancer, would help the industry develop in the Asia Pacific region. Furthermore, with the increasing number of pancreatic cancer cases in Asia Pacific, pancreatic cancer diagnosis and treatment must abide by the same protocol as in Western nations.

The rapid rise of pancreatic cancer patients and, increased investment in healthcare infrastructure propel the market

In North America, the USA of America leads the pancreatic cancer market. Based on the American Cancer Society's National Survey, approximately 3% of cancers in the USA were pancreatic by 2024. Moreover, pancreatic cancers account for 9% of all cancer deaths. The rising number of pancreatic cancer patients is accompanied by higher investment in medical infrastructure.

The simplification of regulatory approval processes has resulted in the safe and prompt approval of clinical drugs and treatments in the USA, contributing to the rising demand for pancreatic cancer treatment options in the country.

Surging tobacco consumption levels will propel the market forward

Germany had the highest number of cases reported of pancreatic cancer in Europe in 2024, with 21,859 cases. Rising tobacco consumption rates and a boost in cigarette smokers are expected to boost the expansion of the pancreatic cancer market.

Rising cancer prevalence, increased alcohol consumption, rising obesity rates, and increasing acceptance of various treatment options available are all forecasting overall growth in this country.

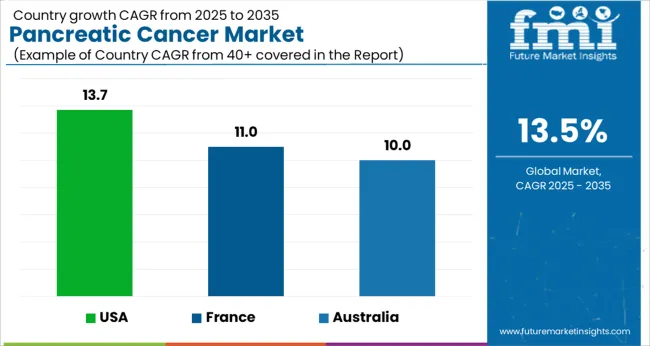

Country-wise Forecast CAGRs for the Pancreatic Cancer Industry

| China | 12% |

|---|---|

| USA | 13.7% |

| Australia | 10% |

| France | 11% |

The hospital's segment is dominant owing to the modern infrastructure

Based on end-user, the Hospital segment is the largest profit segment in the global pancreatic cancer therapeutics market, and this trend is expected to persist in the forecast years. The hospital segment is dominant owing to the quick influx of patients admitted to hospitals due to competent medical practitioners and the accessibility of multiple systems. In addition, hospitals have the decent infrastructure and a wide network, which is cruising market growth. The hospital segment accounted for a 48% share of the market in 2025.

Surgery and radiology segments are expected to lead the industry

Because of the incidence of these methodologies, treatment-type segments such as surgery and radiology are likely to dominate the market throughout the forecast period.

The prominence of targeted drugs and unique biologic therapeutics can also be credited to this segment's supremacy. Furthermore, personalized treatment systems are assisting in the segment's advancement.

Biosense was established in 2008. Biosense is a medical engineering and development company that produces ground-breaking diagnostics. Rexahn announced a contract with BioSense in April 2020 to commercialize its pancreatic cancer treatment in Greater China.

ElmediX was established in 2020 as a spin-off of the University of Antwerp with a single objective in mind: to produce a disruptive solution for (pancreatic) cancer and other life-threatening ailments. They produce oncothermia-based treatments for pancreatic cancer that minimize the likelihood of toxicity to healthy tissue.

Key players in the pancreatic cancer market are AstraZeneca, Merck Sharp & Dohme LLC, Bayer, Roche, Celgene, Bristol Myers Squibb, BioLineRx, Alligator Bioscience, Bellicum Pharmaceuticals, OSE Immunotherapeutics, Actuate Therapeutics, FibroGen, NeoImmuneTech, NOXXON Pharma, Silenseed Ltd., Amgen, NGM Biopharmaceuticals, Merus, Mirati Therapeutics.

| Report Attribute | Details |

|---|---|

| Expected Market Value (2025) | USD 2.7 billion |

| Projected Forecast Value (2035) | USD 9.7 billion |

| Global Growth Rate (2025 to 2035) | 13.5% CAGR |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Treatment Type, Cancer Type, End Use, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Pfizer Inc.; Novartis AG; Eli Lily and Company; Bristol Myers Squibb Company; Zydus Cadila; Myriad Genetics Inc.; F-Hoffmann-La Roche Ltd.; PharmaCyte Biotech Inc.; Teva Pharmaceutical Industries Ltd. |

| Customization | Available Upon Request |

The global pancreatic cancer market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the pancreatic cancer market is projected to reach USD 9.7 billion by 2035.

The pancreatic cancer market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in pancreatic cancer market are chemotherapy, immunotherapy, hormone therapy, surgery, radiation therapy, targeted drug therapy and others.

In terms of cancer type, exocrine pancreatic cancer segment to command 83.0% share in the pancreatic cancer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pancreatic Elastase Testing Market Analysis – Growth & Trends 2025 to 2035

Pancreatic Stone Protein Testing Market Growth - Trends & Forecast 2024 to 2034

Pancreatic Cyst Diagnostics Market

Fecal Pancreatic Elastase Testing Market Growth - Trends & Forecast 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Cancer Antigens Market

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA