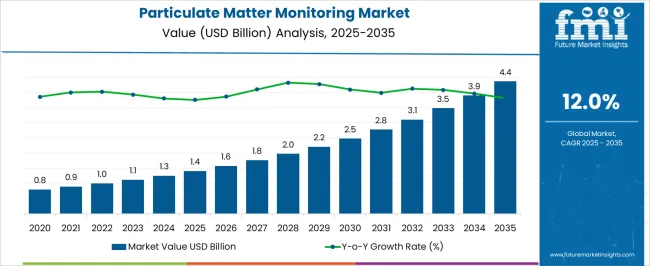

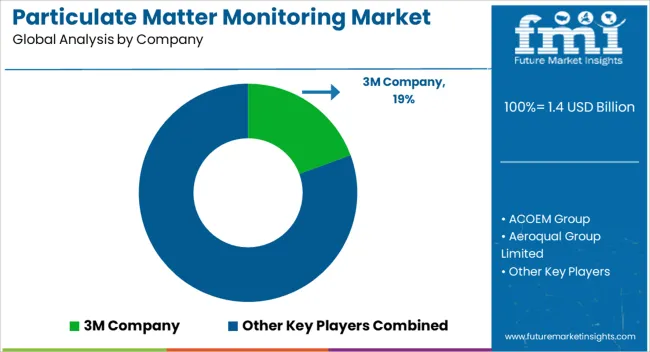

The particulate matter monitoring market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 4.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

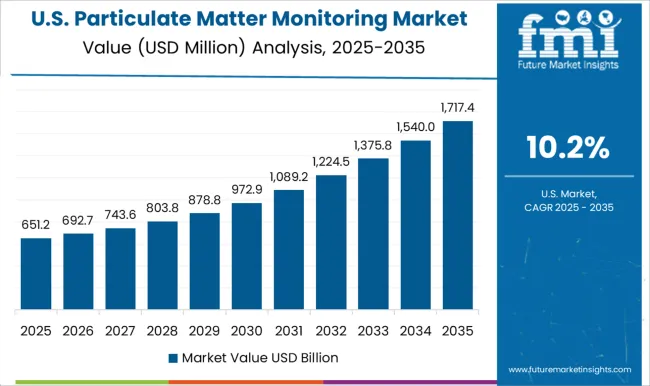

The particulate matter monitoring market, valued at USD 1.4 billion in 2025 and expected to reach USD 4.4 billion by 2035 at a CAGR of 12.0%, reflects a strong upward trajectory along the market maturity curve. The data trend demonstrates rapid year-on-year growth, indicating that the industry is currently moving from the introduction stage toward an early growth phase within the adoption lifecycle. Rising awareness of air quality standards, stringent environmental regulations, and technological advancements in sensor miniaturization are accelerating adoption across industrial, commercial, and governmental applications. During the early phase, adoption is being driven by industries under compliance pressure, along with urban administrations deploying smart city solutions. The growth between 2025 and 2030, from USD 1.4 billion to nearly USD 2.5 billion, shows strong penetration among early adopters such as manufacturing, energy, and automotive sectors.

The acceleration post-2030, reaching USD 4.4 billion by 2035, reflects a transition into the maturity stage, where broader adoption across residential, commercial, and public health monitoring is expected. The adoption lifecycle indicates innovators and early adopters have established the foundation, while the early majority is entering, driven by declining costs and improved reliability of devices. By 2035, the market will approach late growth, with adoption becoming mainstream across global regions, though opportunities will remain in emerging economies with weaker monitoring infrastructure.

| Metric | Value |

|---|---|

| Particulate Matter Monitoring Market Estimated Value in (2025 E) | USD 1.4 billion |

| Particulate Matter Monitoring Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The particulate matter monitoring market represents a critical segment within the global environmental monitoring and air quality management industry, emphasizing public health, regulatory compliance, and industrial safety. Within the broader air quality monitoring systems sector, it accounts for about 6.1%, driven by stricter regulations and rising awareness of air pollution impacts. In the environmental testing and measurement equipment segment, it holds nearly 5.3%, reflecting demand from governments, research institutions, and industrial facilities. Across the emission control and pollution management market, the share is 4.7%, supporting integration into pollution source tracking and compliance monitoring. Within the smart city and urban environmental monitoring category, it represents 4.2%, highlighting adoption of IoT-based air quality sensors.

In the healthcare and occupational safety monitoring sector, it secures 3.8%, emphasizing workplace air quality assessments and exposure tracking. Recent developments in this market have focused on sensor miniaturization, digital connectivity, and real-time data analytics. Innovations include low-cost portable PM2.5 and PM10 sensors, AI-driven predictive monitoring platforms, and satellite-assisted air quality mapping. Key players are collaborating with smart city planners, environmental agencies, and industrial operators to deploy large-scale monitoring networks. Adoption of cloud-based data platforms, remote calibration, and mobile app integration is gaining traction to improve accessibility and decision-making. The hybrid monitoring systems combining optical, gravimetric, and laser-based detection technologies are being developed to enhance accuracy and coverage. These trends demonstrate how technology, regulation, and health priorities are shaping the market.

The particulate matter monitoring market is experiencing notable growth driven by increasing public awareness of air pollution’s impact on health, stricter environmental regulations, and the rising need for real time air quality assessment. Advancements in sensor technology, miniaturization, and data integration capabilities have enhanced the accuracy and accessibility of particulate monitoring systems.

Government initiatives and corporate sustainability goals are further accelerating deployment in both urban and industrial environments. The growing adoption of air quality monitoring in smart city infrastructure and commercial buildings is expanding the market’s scope.

With heightened concern over respiratory illnesses linked to fine particulate matter exposure, the outlook for the market remains strong, supported by sustained demand from regulatory bodies, research institutions, and private enterprises seeking continuous environmental compliance and public health protection.

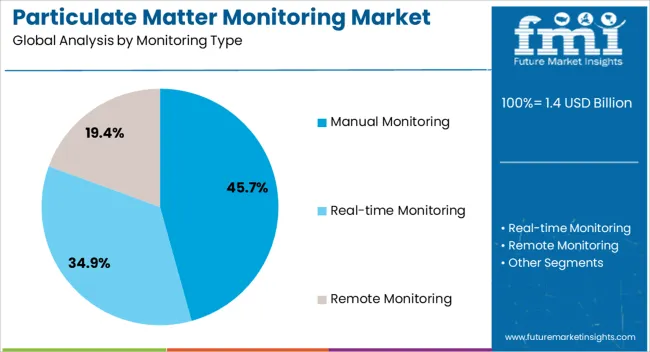

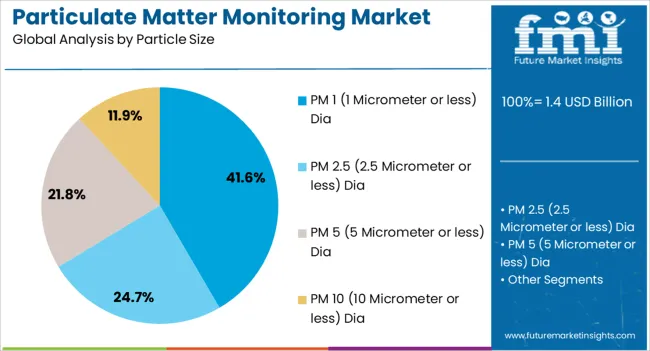

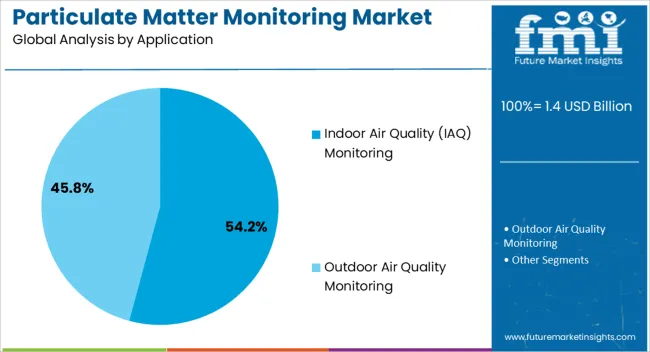

The particulate matter monitoring market is segmented by monitoring type, particle size, application, end-use industry, and geographic regions. By monitoring type, particulate matter monitoring market is divided into manual monitoring, real-time monitoring, and remote monitoring. In terms of particle size, particulate matter monitoring market is classified into PM 1 (1 Micrometer or less) Dia, PM 2.5 (2.5 Micrometer or less) Dia, PM 5 (5 Micrometer or less) Dia, and PM 10 (10 Micrometer or less) Dia. Based on application, particulate matter monitoring market is segmented into indoor air quality (IAQ) monitoring and outdoor air quality monitoring.

By end-use industry, particulate matter monitoring market is segmented into power generation, oil & gas, chemical & petrochemical, transportation & logistics, healthcare, research institutions, and others. Regionally, the particulate matter monitoring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual monitoring segment is expected to hold 45.7% of the total market revenue by 2025 within the monitoring type category, making it a leading segment. Its prominence is driven by the reliability, cost effectiveness, and ease of deployment in diverse environmental conditions.

Manual methods remain preferred in regions with limited access to automated monitoring infrastructure and where periodic sampling is sufficient to meet regulatory requirements. Additionally, the lower maintenance costs and simpler calibration processes contribute to its sustained use.

The flexibility to operate without continuous power supply further enhances its suitability for field studies and remote locations, ensuring continued adoption across developing and developed markets.

The PM 1 particle size category is projected to account for 41.6% of the total market share by 2025, representing a significant focus area. This trend is influenced by growing evidence linking ultrafine particles to severe health effects due to their ability to penetrate deep into the respiratory system and enter the bloodstream.

Increased demand for precision monitoring of PM 1 has been supported by advances in sensor sensitivity and calibration technologies. Regulatory frameworks and indoor air quality standards are increasingly recognizing the importance of PM 1 data, particularly in healthcare facilities, schools, and sensitive industrial environments.

These factors have positioned PM 1 monitoring as a priority in both environmental research and public health protection.

The indoor air quality monitoring application segment is forecasted to contribute 54.2% of the total market revenue by 2025, making it the most dominant application. This growth is being propelled by rising awareness of indoor pollution sources such as dust, combustion particles, and chemical emissions from furnishings and equipment.

Corporate wellness programs, building certifications, and post pandemic concerns about ventilation quality have also accelerated adoption. Real time monitoring systems for indoor spaces are increasingly integrated into smart building management systems, enabling continuous optimization of air filtration and ventilation.

As indoor environments are closely tied to occupant health, productivity, and comfort, the demand for robust indoor air quality monitoring solutions is expected to remain strong, reinforcing its leadership in the application category.

The market has emerged as a critical sector due to increasing environmental awareness and public health concerns associated with fine particle exposure. Rising pollution levels across industrial, residential, and transportation sectors have resulted in heightened monitoring demand. Advanced technologies such as laser scattering and IoT-enabled sensors have enhanced the ability to detect particles like PM2.5 and PM10 with improved accuracy. Regulatory requirements have accelerated installations across regions, while community initiatives and smart infrastructure programs are also creating significant opportunities for growth within this segment.

Stringent environmental regulations have been implemented across several regions to reduce the harmful effects of airborne pollutants. Regulatory authorities including the United States Environmental Protection Agency and the European Environment Agency have mandated continuous emissions monitoring. Industrial sectors such as power generation, cement manufacturing, oil refining, and mining have been required to integrate monitoring solutions to ensure compliance with permissible emission limits. Government funded projects in developing economies have also focused on deploying particulate matter monitoring devices to control rising pollution. The inclusion of such systems within smart city initiatives and environmental health monitoring programs has amplified demand globally.

Technological innovation has significantly strengthened the capabilities of particulate matter monitoring systems. Modern solutions have been designed with features such as laser diffraction, gravimetric methods, and optical particle counters that ensure high precision. Integration of IoT has enabled continuous data collection and real time analysis across remote and industrial locations. Cloud based platforms have enhanced predictive monitoring while supporting regulatory reporting requirements. Portable and low power consumption devices have expanded accessibility for research institutions and community driven monitoring programs. Manufacturers have been focusing on compact designs and improved durability, making the systems more reliable for long term environmental and occupational applications.

Health concerns associated with particulate matter have been driving market expansion across diverse regions. Scientific studies have linked prolonged exposure to fine particles with asthma, lung disease, and cardiovascular complications. As a result, hospitals, schools, and public spaces have witnessed installations of monitoring devices to ensure safer environments. Growing involvement of non-governmental organizations, research institutions, and local communities in air quality projects has supported widespread adoption. Publicly accessible air quality data has encouraged informed decision making by individuals and policy makers. This increasing awareness has created a favorable environment for sustained investments in particulate matter monitoring solutions across industrial and residential landscapes.

Despite strong growth potential, cost remains a significant challenge within the particulate matter monitoring market. Advanced systems require high capital investment along with recurring maintenance costs for calibration, spare parts, and data management. Small and medium sized industries in emerging economies face difficulties in adopting such solutions. In addition, environmental conditions including temperature and humidity variations can affect monitoring accuracy, creating operational concerns. Lack of standardization in measurement methods across global markets has also led to inconsistencies in data reporting. Addressing these barriers through affordable solutions, enhanced calibration techniques, and international cooperation on measurement standards has become crucial for long term adoption.

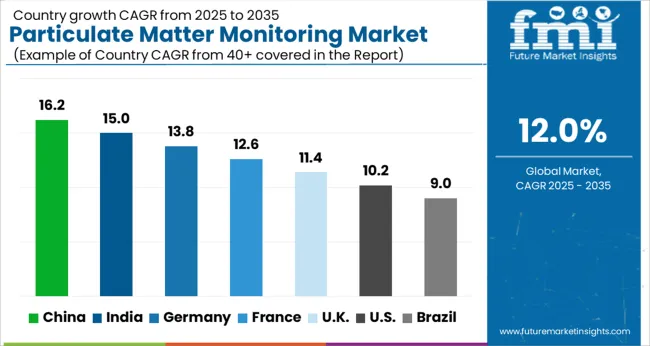

| Country | CAGR |

|---|---|

| China | 16.2% |

| India | 15.0% |

| Germany | 13.8% |

| France | 12.6% |

| UK | 11.4% |

| USA | 10.2% |

| Brazil | 9.0% |

The market is projected to expand at a CAGR of 12.0% between 2025 and 2035, fueled by stricter air quality regulations, technological innovation, and rising awareness of pollution control. India recorded 15.0%, supported by nationwide initiatives to strengthen air quality monitoring networks. Germany registered 13.8%, with growth influenced by stringent environmental standards and advanced industrial applications. China led the market with 16.2%, reflecting large-scale infrastructure deployment and regulatory enforcement. The United Kingdom posted 11.4%, shaped by growing adoption of smart monitoring technologies, while the United States reached 10.2%, driven by investments in pollution tracking and data-driven environmental management. The landscape illustrates how both developed and emerging markets are intensifying efforts to address air quality challenges. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to record a CAGR of 16.2%, supported by stringent air quality regulations, government initiatives on emission reduction, and increased deployment of monitoring systems in industrial hubs. Adoption has been reinforced by investments in smart city projects where continuous monitoring is a priority. Domestic manufacturers focus on cost effective sensor based systems, while international players provide advanced analyzers and real time monitoring solutions. Growing awareness among citizens regarding health impacts of air pollution has further boosted adoption across multiple sectors.

India is forecast to grow at a CAGR of 15.0%, driven by rapid increase in industrial monitoring requirements and expansion of ambient air quality stations in urban regions. Adoption has been reinforced by government led air quality improvement programs and integration of IoT enabled devices for real time reporting. Domestic producers collaborate with research institutes for calibration technologies, while imports of advanced analyzers from global suppliers remain vital. Awareness of respiratory health issues is also creating demand for low cost portable monitors among consumers.

Germany is anticipated to expand at a CAGR of 13.8%, supported by strict EU emission control laws and strong adoption of advanced environmental monitoring technologies. Adoption has been reinforced by the automotive sector, which relies on particulate matter testing for compliance with Euro 6 and upcoming Euro 7 standards. Domestic companies emphasize precision and integration with cloud based platforms for data reporting. Collaboration between government bodies and environmental agencies is further driving research into long term air quality impacts.

The United Kingdom market is projected to grow at a CAGR of 11.4%, supported by regulatory compliance needs and increasing deployment of community based monitoring networks. Adoption has been reinforced by local councils implementing real time pollution alert systems. Imports from European suppliers remain important, while domestic distributors focus on low maintenance solutions for local governments and industries. Growing public awareness of health impacts has also led to higher adoption of indoor air monitoring devices across residential and office spaces.

The United States is expected to advance at a CAGR of 10.2%, supported by industrial compliance requirements under EPA guidelines and an expanding network of local air monitoring stations. Adoption has been reinforced by strong participation of universities and research institutions in developing low cost sensor technologies. Domestic players invest in wireless and IoT enabled monitoring systems, while demand from healthcare and workplace safety segments continues to grow. The combination of regulatory enforcement and public interest ensures a steady market outlook.

The market is marked by the presence of global conglomerates, specialized sensor developers, and advanced analytical equipment providers. Thermo Fisher Scientific, Inc., 3M Company, Siemens AG, and Emerson Electric Co. lead the industry with comprehensive portfolios, large-scale distribution networks, and integration of real-time monitoring solutions for industrial and environmental applications. AMETEK, Beckman Coulter, Inc., and Teledyne API enhance competition by offering precision instruments and laboratory-grade analyzers that support compliance with strict air quality regulations.

Specialized companies such as Aeroqual Group Limited, GrayWolf Sensing Solutions, Kanomax, Inc., and Kaiterra focus on portable and IoT-enabled sensors catering to urban monitoring and indoor air quality management. Horiba, Ltd. and ACOEM Group strengthen their positions through innovation in continuous emission monitoring systems, while Rupprecht & Patashnick Co., Inc. (R&P) and TSI Incorporated are recognized for research-grade instruments trusted in regulatory and academic use. The market’s competition is shaped by technological advancements in low-cost sensors, integration with cloud platforms, and the shift toward predictive air quality monitoring. Companies that emphasize miniaturization, data analytics, and compliance with global emission standards are expected to maintain competitive advantage across industrial, governmental, and consumer-driven segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Monitoring Type | Manual Monitoring, Real-time Monitoring, and Remote Monitoring |

| Particle Size | PM 1 (1 Micrometer or less) Dia, PM 2.5 (2.5 Micrometer or less) Dia, PM 5 (5 Micrometer or less) Dia, and PM 10 (10 Micrometer or less) Dia |

| Application | Indoor Air Quality (IAQ) Monitoring and Outdoor Air Quality Monitoring |

| End-use Industry | Power Generation, Oil & Gas, Chemical & Petrochemical, Transportation & logistics, Healthcare, Research institutions, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, ACOEM Group, Aeroqual Group Limited, AMETEK, Beckman Coulter, Inc., ECOM America, Ltd., Emerson Electric Co., GrayWolf Sensing Solutions, Horiba, Ltd., Kaiterra, Kanomax, Inc., Rupprecht & Patashnick Co., Inc. (R&P), Siemens AG, Teledyne API, Thermo Fisher Scientific, Inc., and TSI Incorporated |

| Additional Attributes | Dollar sales by monitoring device type and application, demand dynamics across industrial, environmental, and residential sectors, regional trends in air quality monitoring adoption, innovation in sensor accuracy, IoT connectivity, and real-time analytics, environmental impact of emissions tracking and regulatory compliance, and emerging use cases in smart cities, workplace safety, and portable personal monitoring devices. |

The global particulate matter monitoring market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the particulate matter monitoring market is projected to reach USD 4.4 billion by 2035.

The particulate matter monitoring market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in particulate matter monitoring market are manual monitoring, real-time monitoring and remote monitoring.

In terms of particle size, pm 1 (1 micrometer or less) dia segment to command 41.6% share in the particulate matter monitoring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microparticulated Whey Protein Market Analysis by Application, Form & Region Through 2035

Diesel Particulate Filter Market Size and Share Forecast Outlook 2025 to 2035

Respirator Mask Particulate Market Size and Share Forecast Outlook 2025 to 2035

White Matter Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flare Monitoring Market

Yield Monitoring Systems Market

Driver Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA