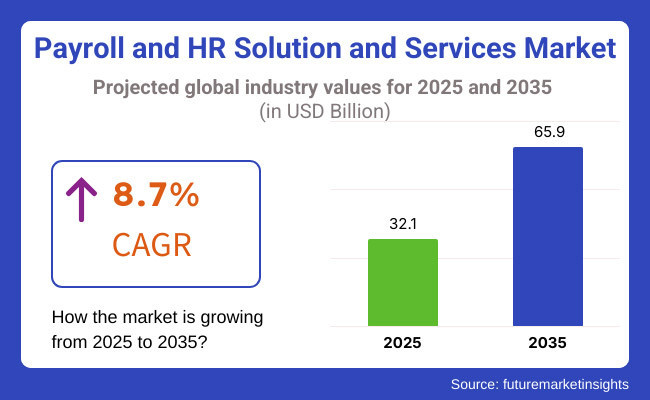

The global payroll and HR solution and services market is projected to grow from USD 32.1 billion in 2025 to approximately USD 65.9 billion by 2035, registering a CAGR of 8.7% over the forecast period.

In 2024, widespread adoption of cloud-based platforms was observed across enterprises aiming to streamline HR operations and improve compliance. The shift toward digital workforce management tools was accelerated by the growing prevalence of hybrid work models and the need to automate payroll, benefits processing, and employee engagement systems.

By 2025, integrated HR platforms will be increasingly used to unify key functions, including payroll, compliance, recruitment, time tracking, and analytics. SaaS-based solutions are being adopted by mid-size and global enterprises to enhance operational scalability and reduce overhead costs.

Multinational corporations are prioritizing multi-currency payroll management, global compliance alignment, and localization support to manage distributed teams. These capabilities are being viewed as critical to addressing regulatory complexity, maintaining accuracy in tax reporting, and avoiding administrative inefficiencies.

Innovations across the market are focusing on automation, personalization, and AI-led insights. AI-powered assistants, predictive analytics, and mobile-enabled employee self-service tools are being deployed to reduce workload and boost engagement. Onboarding, benefits administration, and performance tracking are being automated to minimize errors and ensure faster processing. According to Amin Venjara, Chief Data Officer at ADP, “It’s important not to get lost in the technology and to focus on outcomes instead.

What goals do you want to achieve, and how can generative AI help you achieve them? Remembering your desired outcomes will be crucial for success as this technology becomes further integrated into our everyday work.” This reflects the shift from transactional tools toward value-focused platforms.

In 2025, key developments have reshaped the competitive landscape. Global Payments divested its payroll unit, Heartland Payroll Solutions to Acrisure for USD 1.1 billion to sharpen strategic focus. Market leaders like Workday, SAP SuccessFactors, Oracle, Ceridian (Dayforce), and UKG have expanded AI features, regional coverage, and industry-specific solutions.

Workday’s AI capabilities for workforce optimization and SAP’s localized compliance modules are being enhanced. As HR roles grow more strategic and compliance demands intensify, the market is expected to remain on a strong growth trajectory driven by intelligent automation, flexible deployment, and outcome-oriented innovation through 2035.

Cloud-based deployment is projected to hold 54.3% of the payroll and HR solutions & services market in 2025, driven by the need for scalable, cost-effective, and remotely accessible platforms. Small and mid-sized enterprises are leading adopters due to minimal infrastructure demands and rapid implementation. Providers such as Workday, SAP SuccessFactors, and Ceridian Dayforce offer integrated platforms supporting payroll, HR compliance, and workforce analytics. These systems are widely used across retail, tech, education, and services industries.

Features such as self-service portals, automated updates, and mobile access make them ideal for modern, hybrid work environments. With increasing demand for compliance automation, data insights, and seamless global payroll, the cloud-based segment is at the core of digital HR transformation.

On-premise deployment is projected to capture 45.7% of the market in 2025, reflecting continued reliance by large organizations in highly regulated sectors. Industries like healthcare, banking, and public administration prefer on-premise systems to maintain full control over data security, configuration, and compliance.

Vendors such as Oracle, SAP, and ADP offer secure on-prem solutions tailored to complex payroll cycles and internal IT environments. In markets where data localization laws are stringent, on-premise models remain crucial. Organizations managing sensitive records or requiring deep customization maintain steady investments in on-premise platforms for long-term risk mitigation and operational control.

The BFSI sector is forecast to hold 23.6% of the global payroll and HR solutions market in 2025, underpinned by its stringent regulatory landscape and operational complexity. Banks, insurance firms, and financial services companies need systems that automate compliance tracking, payroll audit trails, and tax reporting.

Vendors like Zellis, Dayforce, and ADP offer BFSI-focused features such as secure payment workflows, multi-location employee management, and real-time analytics. As this sector navigates global expansions, remote operations, and workforce restructuring, robust and compliant HR systems have become mission-critical, securing BFSI's position as a top investment segment.

In 2025, the government sector is projected to account for 18.9% of the payroll and HR solutions market, driven by the need to manage large public workforces and ensure strict policy adherence. National and regional bodies are adopting digital HR tools from vendors like UKG, Dayforce, and Oracle to modernize leave management, pension processing, and compliance workflows.

These solutions reduce errors, support regulatory reporting, and improve transparency. Public agencies are investing in workforce modernization programs and leveraging cloud and hybrid systems to align HR operations with digital governance goals. The sector remains a stronghold for vendor growth through long-term government contracts.

The fast growth of the global payroll and HR solutions and services industry can primarily be attributed to the digital transformation and the automation in workforce management that is happening at a very fast rate. Frontline enterprises have been focusing on automation, compliance, and system integration to help them streamline the complex payroll processes. Cost-effective and easily scalable solutions are the priorities of small and medium-sized enterprises (SMEs) as they look to digitize the HR and payroll processes along with cutting down on administrative tasks.

HR and payroll service suppliers concentrate on integrated, compliance-driven platforms to meet the varied needs of their clients, thus ensuring adherence to regulations in different countries. Self-service portals are preventive measures that allow employees to not only get a boost in the availability of payroll information but also take care of benefits and HR support on their own. One of the main changes happening in the pay and HR market is the switch to cloud solutions, AI human resource analytics, and mobile workforce management systems, which leads to better accuracy, flexibility, and security.

Contracts & Deals Analysis

| Company | Contract/Development Details |

|---|---|

| Edison Partners | Acquired payroll and HR software company Fingercheck for USD 115 million, aiming to expand services for "deskless" employees. |

| Paychex | Announced plans to acquire competitor Paycor HCM in a transaction valued at approximately USD 4.1 billion, aiming to enhance upmarket capabilities and AI-driven HR technologies. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Greater payroll processing complexity from changing tax regulations and labor laws. | Payroll compliance engines powered by AI manage compliance with changing labor laws across geographies. |

| Cloud-based HR systems and AI-based recruitment software adoption. | AI and blockchain-based employee identity verification and compensation optimization tools become standard. |

| Surge in demand for remote workforce management tools and digital time tracking solutions. | Fully autonomous workforce management platforms powered by AI and IoT ensure seamless remote and hybrid work environments. |

| HR solutions integrated AI-driven employee engagement analytics and mental health support programs. | Personalized AI-driven career coaching and predictive workforce analytics drive employee well-being and retention strategies. |

| Growing adoption of multi-factor authentication and secure payroll processing tools. | Blockchain-enabled payroll systems eliminate fraud risks, ensuring fully auditable transactions. |

| Rising adoption of automated HR and payroll software, digital workforce trends, and gig economy expansion. | Expansion driven by decentralized HR ecosystems, AI-powered workforce analytics, and the emergence of global digital payroll services. |

| Greater payroll processing complexity driven by changing tax legislation and workforce regulations. | AI-powered payroll compliance engines enable automation of compliance with dynamic labor laws across geographies. |

| Cloud-based HR platforms and AI-fueled recruitment tools gain adoption. | AI and blockchain-based employee identity verification and compensation optimization solutions become mainstream. |

The biggest potential threat in the payroll and HR solution market accounts for compliance with regulations. Payroll and HR services are invariably subject to the unique labor laws, tax regulations, and data protection policies of jurisdictions around the world. Legal and reputational consequences await violators, whether it's GDPR in European countries, FLSA in the USA, or labor laws elsewhere, such as in Asia. Regular regulatory updates and local compliance knowledge are the key requirements.

Payroll and HR systems deal with highly sensitive data that includes employees' salaries, benefits, and other personal details, meaning the threat of data security and privacy issues can stand out as a major risk factor. Identity theft, fraud, and legal liabilities can lead to cyber-attacks, data breaches, and ransomware assaults.

The software package from the AI-powered payroll and HR solutions should have the worker's acceptance of mechanization as one of the prerequisites. Many businesses, particularly in traditional industries, are demographically quite resistant to disconnecting from manual processes to plug into automated HR platforms out of fears of being replaced and being deprived of learning opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.6% |

| Germany | 8.6% |

| United Kingdom | 9.2% |

| Japan | 3.8% |

| Unites States | 7.5% |

The payroll and HR solution and services market in China is a department that is growing rapidly owing to factors like digital transformation, evolving labor laws, and a growing workforce. While companies are looking at cloud-based HR solutions, they are also ensuring that the solutions signed up for will help increase efficiency and compliance with complex tax and social security regulations. There are increasing Remote and Hybrid work models, which is also contributing to the demand for automated payroll systems. Also, integrating AI and big data makes HR decision-making even better. Driving the market growth is the influx of SMEs, foreign investments, and multinationals flocking to set up operations in India, precipitating the need for scalable and compliant HR solutions to manage payroll, benefits, and employee engagement. FMI anticipates China's industry to grow at a 9.6% CAGR during the forecast period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Rapid Digital Transformation | Cloud-based and AI-powered HR solutions are being used more and more. |

| Government Regulations & Compliance | The need for automated payroll solutions is being driven by stringent tax and labor legislation. |

The demand for payroll and HR solutions and services in Germany is being driven by stringent labor laws, rising digital transformation, and a streamlined workforce management process. Businesses use automated payroll processing to ensure compliance with complicated tax regulations and employment laws. Cloud-based human resource platforms, According to Salary Intel, are gaining popularity due to the growing trend of remote work coupled with a demand for real-time payroll processing. Moreover, the rise of the gig economy, the integration of AI in HR solutions, and data security issues under GDPR are driving the adoption of modern HR and payroll services across sectors. The German industry will expand at an 8.6% CAGR during the forecast period, according to FMI.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Tight Labor Regulations & Adherence | Businesses use automated payroll solutions to ensure compliance with complex employment rules |

| Cloud-Based Payroll and HR Solution Adoption | Cloud-based solutions are being used by businesses in order to improve scalability, efficiency, and real-time data access. |

The payroll and HR solution and services market in the UK is considerably growing owing to increasing regulatory complexity, digital transformation, and growing remote working. Businesses are adopting automated payroll systems to comply with changing tax laws and employment regulations. As companies search for more efficiency and higher employee engagement, AI and cloud-based HR platforms are a growing trend. A growing economy, data security concerns, and government initiatives focusing on the digitalization of payroll solutions further contribute to the demand for advanced HR and payroll services in the UK. The UK industry will grow at a 9.2% CAGR during the forecast period, according to FMI.

Growth Factors in UK

| Key Drivers | Details |

|---|---|

| Compliance & Regulatory Complexity | The need for automated payroll systems is driven by frequent changes to employment and tax legislation. |

| Cloud-Based Payroll and HR Solution Adoption | Businesses are switching to SaaS-based HR systems in order to increase productivity, scalability, and accessibility. |

The rapid digital transformation, challenging labor laws, and growing automation of HR processes can be identified as the main driving forces in the Payroll and HR Solution and Services Market in Japan. That is why the companies are moving towards the AI-based payroll solution to bring operational efficiency, decrease mistakes, and comply with strict protocol of employment rule. The growth of remote and hybrid working has driven demand for cloud-based HR platforms. Also, Japan's aging workforce and growing emphasis on workforce optimization is compelling businesses to adopt advanced payroll and workforce management systems in order to improve productivity and employee satisfaction. FMI anticipates Japan's industry to grow at a 3.8% CAGR during the study period.

Growth Factor in Japan

| Key Drivers | Details |

|---|---|

| Quick Digital Change | Payroll management systems powered by AI and the cloud are being used by businesses for accuracy and efficiency |

| Complicated Labor Laws and Adherence | Automated solutions are necessary to guarantee compliance with stringent employment requirements. |

AI can also be used in payroll systems to help minimize error while keeping costs down due to the complicated tax regulations and labor laws many employers are subject to. Demand for mobile-friendly HR platforms is growing in tandem as remote and hybrid work models become more prevalent. Moreover, the bifurcated gig economy, growing emphasis on employee experience, and data security trends are expected to be some of the prominent drivers for refinancing to advanced payroll and HR solutions in the USA The USA market is expected to expand at a 7.5% CAGR during the forecast period, according to FMI.

Growth Factor in USA

| Key Drivers | Details |

|---|---|

| Cloud-Based Payroll System Adoption | SaaS-based payroll and HR systems are becoming more popular among businesses due to their increased scalability and effectiveness. |

| Changing Labor Laws and Requirements for Compliance | The need for automated payroll solutions is fueled by complicated tax and employment laws. |

The market for Payroll and HR Solutions & Services is fiercely competitive in nature, with forces at work encouraging massive cloud adoption, AI-powered automation, and rapidly changing regulatory compliance requirements. Businesses want solutions for payroll processing, workforce management and employee engagement that are scalable, secure, and integrated.

The market is dominated by big players offering end-to-end payroll automation, HR analytics, and global workforce management solutions. These big players are ADP, Workday, SAP SuccessFactors, Oracle HCM Cloud, and UKG (Ultimate Kronos Group). With an aim to gain enterprise-grade compliance automation, ADP and SAP SuccessFactors are on different tracks from those taken by workforce analytics and ERP integration via AI-fueled methods adopted by Workday and Oracle HCM Cloud.

The likes of Paychex, Ceridian, and Rippling are gaining space, focusing on cost-effective platforms that are cloud-native and suitable for small to mid-sized companies and mid-market players. The market continues to evolve with cross-border payroll solutions, predictive workforce analytics, and employee self-service platforms for hybrid and remote working models.

| Company Name | Key Offerings/Activities |

|---|---|

| ADP | Provides cloud-based payroll and HR solutions, integrating compliance management and workforce analytics. |

| Workday | Offers AI-driven Human Capital Management (HCM) solutions with real-time workforce insights and payroll processing. |

| SAP SuccessFactors | Delivers scalable HR and payroll solutions focusing on automation, compliance, and employee experience. |

| Oracle HCM Cloud | Provides comprehensive workforce solutions, including global payroll, AI-driven analytics, and talent management. |

| UKG (Ultimate Kronos Group) | Specializes in workforce management and payroll automation, prioritizing employee engagement and data security. |

Key Company Insights

ADP (18-22%)

A frontrunner in business with a powerful global focus, ADP is emphasizing the value of AI payroll automation and compliance solutions.

Workday (12-16%)

Proclaimed to be a unified HCM firm Workday also utilizes real-time data analytics to leverage its workforce planning and payroll operations.

SAP SuccessFactors (10-14%)

Cloud-based payroll integration is what they focus on, complemented with compliance and automation tools for businesses of all sizes.

Oracle HCM Cloud (9-12%)

Intense investment in predictive workforce analytics and worldwide payroll management using Artificial Intelligence and machine learning as a tool for the future.

UKG (Ultimate Kronos Group) (7-11%)

Workforce automation self-service remains as priority to ensure payroll and HR systems would work as seamless functionality.

Other Key Players (25-35% Combined)

In January 2025, Paychex announced that it intended to acquire competitor Paycor HCM in a transaction valued at around USD 4.1 billion. With this acquisition, Paychex expects to be better positioned to encompass an array of AI-enhanced HR technologies, thereby enhancing its longer-term growth prospects in the domain of payroll and HR solutions.

In December 2024, global HR platform Deel accomplished its fifth acquisition of the year by purchasing Assemble, a compensation management startup. This acquisition fosters Deel's product suite and proves the company's commitment to embedding new-age technologies into its solutions for the increasing appetite for holistic HR solutions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 32.1 billion |

| Projected Market Size (2035) | USD 65.9 billion |

| CAGR (2025 to 2035) | 8.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million licenses or active subscriptions for volume |

| Solutions Analyzed (Segment 1) | Integrated Payroll HR Platform, Standalone Software, Services |

| Enterprise Sizes Analyzed (Segment 2) | Small & Medium Enterprises (SMEs), Large Enterprises |

| Deployment Models Analyzed (Segment 3) | Cloud-based, On-premises |

| Industry Verticals Analyzed (Segment 4) | Banking Financial Services & Insurance (BFSI), IT & Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | ADP, Workday, SAP SuccessFactors, Oracle HCM Cloud, UKG (Ultimate Kronos Group), Paychex, Ceridian, Rippling, Deel, Zenefits |

| Additional Attributes | Rise in cloud-native HR solutions, Automation in payroll compliance, Increasing HR analytics and employee self-service adoption |

The market is projected to witness a CAGR of 8.7% between 2025 and 2035.

The market is anticipated to reach USD 65.9 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 10.8% in the assessment period.

The key players operating in the industry include Intuit, Inc., Automatic Data Processing, Inc. (ADP), Jobvite, Inc., Sage Group plc, Kronos, Inc., SAP SE, Oracle Corporation, TriNet Group, Inc., Paychex, Inc., Paycom, Paycor, Inc., Paylocity, TMF Group B.V., Ultimate Software Group, Inc., and Ramco Systems Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Enterprise Size, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Solution, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Industry, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 21: Global Market Attractiveness by Deployment, 2024 to 2034

Figure 22: Global Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 23: Global Market Attractiveness by Solution, 2024 to 2034

Figure 24: Global Market Attractiveness by Industry, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 29: North America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 46: North America Market Attractiveness by Deployment, 2024 to 2034

Figure 47: North America Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 48: North America Market Attractiveness by Solution, 2024 to 2034

Figure 49: North America Market Attractiveness by Industry, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Deployment, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Solution, 2024 to 2034

Figure 74: Latin America Market Attractiveness by Industry, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Solution, 2024 to 2034

Figure 99: Western Europe Market Attractiveness by Industry, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Solution, 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by Industry, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Solution, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by Industry, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Deployment, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Solution, 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by Industry, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Solution, 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by Industry, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Deployment, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Solution, 2024 to 2034

Figure 174: East Asia Market Attractiveness by Industry, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Enterprise Size, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Solution, 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by Industry, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Enterprise Size, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Enterprise Size, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Enterprise Size, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Deployment, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Enterprise Size, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Solution, 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by Industry, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Payroll & HR Solutions Market Trends – Growth & Forecast 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA