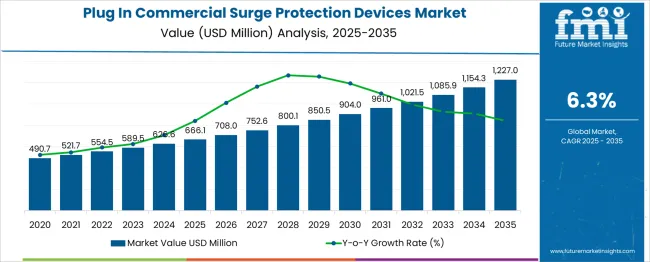

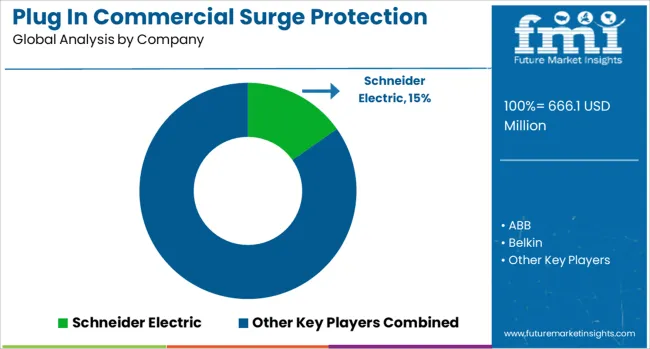

The Plug In Commercial Surge Protection Devices Market is estimated to be valued at USD 666.1 million in 2025 and is projected to reach USD 1227.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Plug In Commercial Surge Protection Devices Market Estimated Value in (2025 E) | USD 666.1 million |

| Plug In Commercial Surge Protection Devices Market Forecast Value in (2035 F) | USD 1227.0 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

With the rise in electronic equipment and automation systems in commercial buildings, the need for reliable surge protection solutions has become critical. Industry discussions highlight growing concerns about power quality and the potential damage caused by voltage spikes to sensitive devices.

Technological advancements have improved the efficiency and durability of surge protection devices, making them more adaptable to complex electrical systems. Regulatory standards and building codes emphasizing electrical safety have also boosted adoption rates.

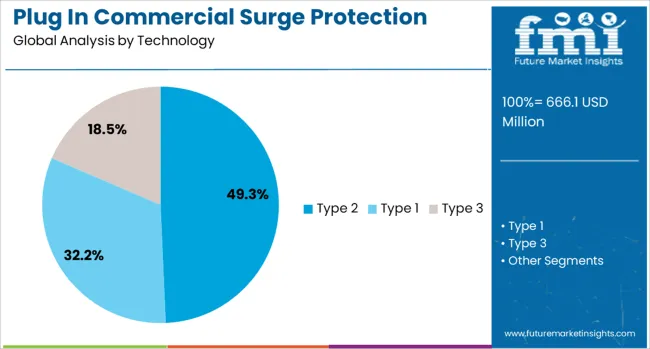

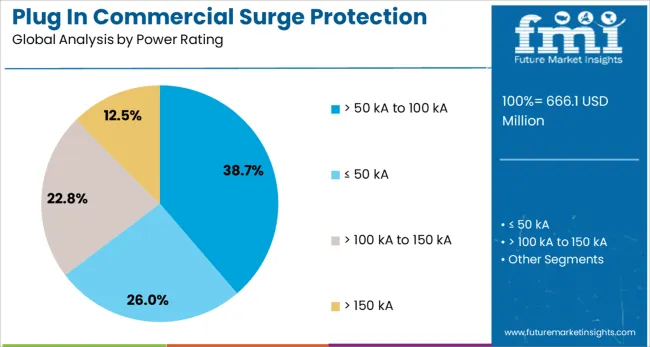

Increasing investments in commercial infrastructure, especially in urban centers, support the market’s growth. The market is expected to expand with innovations in smart surge protection and growing awareness about energy management. Segment growth is likely to be led by Type 2 surge protection technology and devices with power ratings greater than 50 kA up to 100 kA.

The plug-in commercial surge protection devices market is segmented by technology and power rating, and geographic regions. The plug-in commercial surge protection devices market is divided into Type 2, Type 1, and Type 3. In terms of power rating of the plug-in commercial surge protection devices, the market is classified into > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA. Regionally, the plug-in commercial surge protection devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Type 2 technology segment is projected to hold 49.3% of the market revenue in 2025, establishing it as the leading technology category. This segment has been favored due to its role in providing secondary protection downstream from the main distribution board. Type 2 devices effectively protect against residual surges caused by indirect lightning strikes and switching operations.

Their compatibility with a wide range of electrical systems has supported their widespread deployment in commercial settings. Moreover, improvements in component durability and response time have enhanced the reliability of Type 2 devices.

As commercial electrical infrastructures become more complex, the need for dependable secondary surge protection will continue to drive the adoption of Type 2 technology.

The power rating segment ranging from greater than 50 kA to 100 kA is expected to contribute 38.7% of the market revenue in 2025, making it the dominant category. This power rating provides an optimal balance between protection capacity and cost effectiveness for commercial installations. Devices within this range can handle high surge currents typical of large commercial facilities while maintaining manageable installation requirements.

Increased awareness of the financial impact of power surges on critical commercial equipment has encouraged investment in higher capacity protection devices. Furthermore, advancements in material technology have improved device longevity and surge handling capability within this power rating.

With commercial electrical loads increasing and power quality concerns rising, this segment is poised for sustained growth.

Plug in surge protection devices (SPDs) are being adopted in commercial electrical installations to guard sensitive equipment from transient voltage spikes. Applications include retail stores, data centers, office buildings and medical facilities where uninterrupted power quality and equipment protection matter. SPD installation has been driven by upgrading existing electrical systems, equipment warranty requirements and compliance with updated electrical codes. Manufacturers have responded with compact plug in form factors compatible with power strips, UPS units and wall receptacles to enable field upgrades for facility managers and electricians.

Growth in SPD installation has been driven by updated electrical codes mandating overvoltage protection in commercial and mixed-use facilities. Facility managers have selected plug in devices to protect point-of-use electronics such as point-of-sale systems, networking gear and security cameras. These devices have offered fast response times and audible or LED-based status indicators to alert maintenance staff of protection status. Warranty clauses from IT equipment vendors have promoted SPD use on building outlets to avoid damage from power surges. Plug in SPDs have been featured in retrofit kits targeting leased spaces, simplifying compliance without full outlet replacement. As threats from lightning strikes and switching surge events have been increasingly recognized, SPD deployment has grown in mid-rise and high-tech commercial properties.

Adoption of plug-in SPDs has been limited by variations in certification requirements across jurisdictions, resulting in inconsistent product labeling and testing standards. Misunderstanding of device clamping voltage, joule rating, and protection modes has led to incorrect product selection and reduced effectiveness during transient events. Outlet load configurations and upstream panel conditions have affected SPD performance but are often not assessed before installation. Maintenance teams have been reluctant to inspect and replace aging SPDs due to a lack of clear replacement guidelines. Compact form factors have presented compatibility issues with tamper-resistant outlets and shallow receptacle enclosures. As electrical code updates proceed asynchronously between regions, building owners have deferred upgrades until full code alignment occurs across their portfolios.

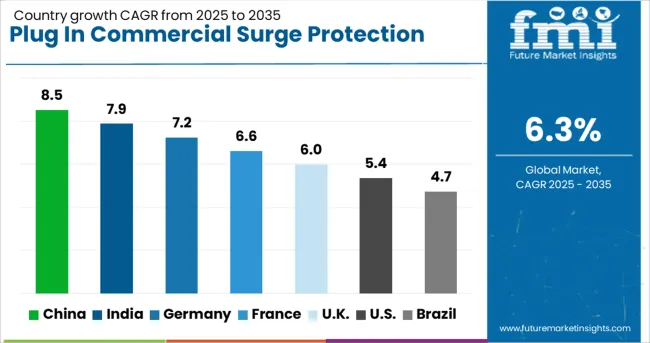

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

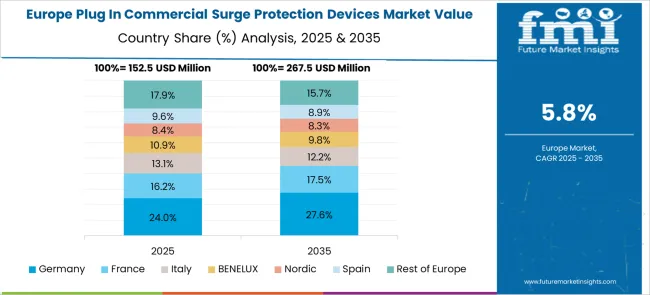

The global plug in commercial surge protection devices market is projected to grow at a 6.3% CAGR from 2025 to 2035. Of the 40 countries analyzed, China leads at 8.5%, followed by India at 7.9% and Germany at 7.2%, while France posts 6.6% and the United Kingdom records 6.0%. These growth premiums represent +35% for China, +25% for India, and +14% for Germany, while France and the UK are near the global average. Divergence reflects regional catalysts: China’s commercial infrastructure expansion, India’s rapid digitalization in Tier II cities, Germany’s advanced industrial automation, France’s demand for smart building systems, and the UK’s modernization of office spaces and data centers. The report includes analysis of over 40 countries, with five profiled below for reference.

China is expected to grow at a 8.5% CAGR, driven by the rapid deployment of smart commercial buildings and large-scale data centers. Surge protection adoption is being accelerated by government directives for electrical safety compliance in critical sectors such as healthcare, banking, and telecom. Local manufacturers are expanding their product portfolios with high-joule-rated devices and advanced diagnostics features. Integration of IoT-based monitoring systems in surge protectors enhances real-time fault detection. E-commerce distribution channels support accessibility for small and mid-size businesses seeking plug-in solutions.

India is projected to grow at a 7.9% CAGR, supported by rapid digital infrastructure development and electrification in Tier II and III cities. Rising demand for protection of sensitive equipment in retail outlets, IT hubs, and hospitality spaces is driving adoption. Domestic manufacturers are introducing cost-effective plug-in devices with multi-port configurations to cater to small businesses. Partnerships between surge protection suppliers and real estate developers are expanding integration in commercial projects. Government initiatives for smart cities and uninterrupted power supply systems further enhance market penetration.

Germany is forecast to grow at a 7.2% CAGR, driven by increased adoption of automation and IoT in commercial spaces. Surge protection is critical for preventing downtime in industries like banking, retail, and industrial logistics that rely on sensitive electronics. OEMs are introducing compact, modular surge devices compatible with advanced energy management systems. Integration with smart grids and renewable energy networks is influencing demand for surge protectors capable of handling variable loads. Compliance with stringent EU electrical safety regulations ensures steady replacement cycles.

France is projected to grow at a 6.6% CAGR, driven by modernization of commercial infrastructure and adoption of connected energy systems. Surge protection demand is increasing in hospitality, healthcare, and co-working spaces due to equipment-sensitive operations. Manufacturers are developing aesthetically designed plug-in devices with smart control features for contemporary office spaces. Emphasis on building automation systems is driving installations of surge protectors integrated with energy monitoring and load-balancing tools. Partnerships with property management firms are creating bundled safety and energy efficiency packages.

The United Kingdom is expected to grow at a 6.0% CAGR, supported by commercial retrofitting projects and expansion of data center facilities. Plug-in surge protectors with energy analytics capabilities are gaining traction among enterprises focused on operational continuity. Manufacturers are introducing compact surge devices suitable for constrained office layouts and modular workstations. Increasing prevalence of telecommunication hubs and cloud service infrastructure accelerates demand for advanced surge protection systems. Regulatory emphasis on energy efficiency is promoting products that combine surge protection with energy monitoring functions.

The plug-in commercial surge protection devices market is led by global players such as ABB, Eaton, Schneider Electric, Emerson Electric, Siemens, Legrand, and Hubbell, alongside regional brands like Havells India, JMV, and WenZhou-based manufacturers. These companies compete by offering advanced surge protection solutions across Type 1, Type 2, and Type 3 devices. Competitive strategies focus on enhancing surge current handling capacity, reducing response times, and integrating IoT-enabled diagnostic features. Adoption of smart building technologies and increased reliance on data centers drive the need for compact, high-performance surge protection units. Leading manufacturers are also investing in modular designs and predictive maintenance capabilities to align with evolving safety standards and improve reliability across critical infrastructure and commercial applications.

In August 2024, ABB finalized its acquisition of SEAM Group, integrating the company into its Electrification Service division and more than doubling its USA field technician workforce, enhancing predictive maintenance and electrical safety capabilities

| Item | Value |

|---|---|

| Quantitative Units | USD 666.1 Million |

| Technology | Type 2, Type 1, and Type 3 |

| Power Rating | > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Belkin, Eaton, Emerson Electric, Havells India, Hubbell, Infineon Technologies, JMV, Legrand, Leviton Manufacturing, Maxivolt, Phoenix Contact, Signify Holding, Socomec, Weidmuller Electronics India, WenZhou Chuangjie Lightning Protection Electrical, and Wenzhou Wanlai Electric |

| Additional Attributes | Dollar sales by device category (Type 1, Type 2, Type 3) and application (data centers, commercial facilities, smart buildings), driven by the growing need to safeguard critical electrical infrastructure from surges. Regional trends are led by North America, while Asia-Pacific shows rapid growth. Key players focus on IoT-enabled diagnostics, modular architectures, and enhanced surge current ratings for improved reliability and performance |

The global plug in commercial surge protection devices market is estimated to be valued at USD 666.1 million in 2025.

The market size for the plug in commercial surge protection devices market is projected to reach USD 1,227.0 million by 2035.

The plug in commercial surge protection devices market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in plug in commercial surge protection devices market are type 2, type 1 and type 3.

In terms of power rating, > 50 ka to 100 ka segment to command 38.7% share in the plug in commercial surge protection devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plug-in Hybrid Electric Vehicle (PHEV) Market Forecast and Outlook 2025 to 2035

Plug-In Aluminum Electrolytic Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Plug-in Pump Alarm Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plug In Power Meter Market

Earplugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Luer Plug Market Size and Share Forecast Outlook 2025 to 2035

Drum Plugs Market

Spark Plug Market Growth – Trends & Forecast 2024 to 2034

Spark Plug Accessories Market

Push-in Plug Vials Market Size and Share Forecast Outlook 2025 to 2035

Industrial Plugs And Sockets Market

Embolization Plugs Market

Iridium Spark Plug Market Size and Share Forecast Outlook 2025 to 2035

Automotive Spark Plug Market Size and Share Forecast Outlook 2025 to 2035

Humidity Indicator Plugs Market

Electric Vehicle Charging Cable and Plug Market Size and Share Forecast Outlook 2025 to 2035

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Support Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA