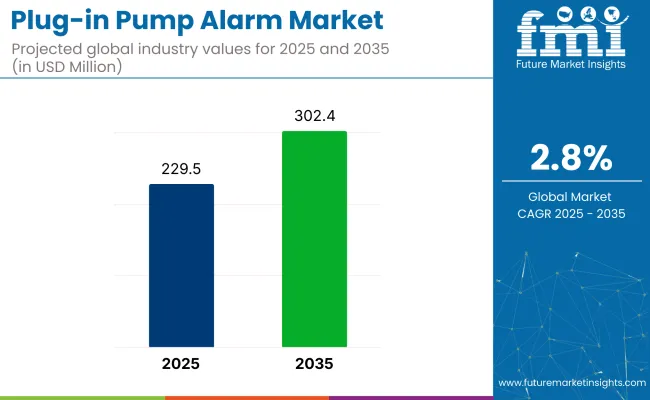

The plug-in pump alarm market is forecast to expand from USD 229.5 million in 2025 to USD 302.4 million by 2035, registering a CAGR of 2.8% over the assessment period. The steady growth is being supported by rising demand in residential, commercial, and light industrial settings, where real-time water level monitoring and early leak detection are becoming increasingly critical.

| Metric | Value |

|---|---|

| Market Size 2025 | USD 229.5 million |

| Market Size 2035 | USD 302.4 million |

| CAGR (2025 to 2035) | 2.8% |

As of 2025, the plug-in pump alarm market holds a niche yet functionally important share across several broader parent markets. Within the global water pump market, it contributes around 2-3%, serving as an essential accessory for pump failure detection and protection. In the smart home devices market, its share is smaller, at about 0.5-1%, as it represents a specialized utility within the broader home automation ecosystem.

Within the industrial monitoring equipment market, the contribution stands at 1-2%, particularly in facilities using sump or utility pumps. In the home safety and security market, it makes up around 1-1.5%, helping to prevent water damage. In the building automation systems market, plug-in pump alarms contribute roughly 1-2%, supporting integrated water management systems.

The market operates within a tightly integrated supply chain, beginning with raw material suppliers providing sensors, enclosures, circuit boards, and wiring components. OEMs then manufacture and assemble plug-in alarm systems tailored for sump pumps, sewage ejectors, and utility pumps. These alarms are integrated with float switches and audio-visual alert systems to signal pump failure or water level rise.

Distributors and wholesalers play a key role in supplying the finished products to hardware stores, online platforms, and plumbing suppliers. Contractors, plumbers, and DIY homeowners form the end-user base, often relying on plug-and-play models for ease of installation.

Growing concerns over basement flooding, smart home integration, and real-time monitoring drive demand. The supply chain is increasingly influenced by IoT adoption, quality certifications, and regulatory standards for residential water management.

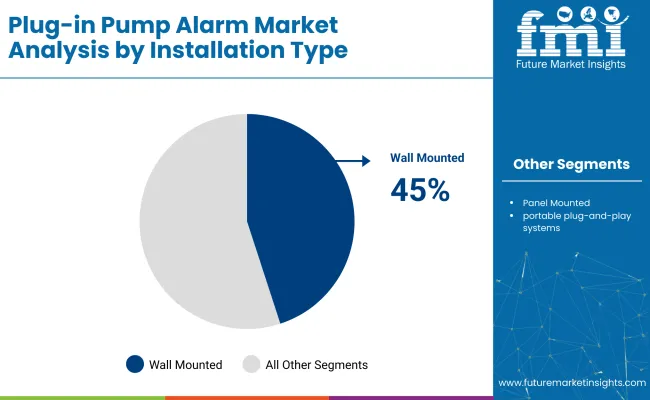

Wall-mounted plug-in pump alarms are expected to dominate the installation type segment with a 45% share by 2025, while float switch mechanisms are projected to lead the sensing mechanism segment at 40%.

Wall-mounted plug-in pump alarms are projected to lead the installation type segment, capturing 45% of the global market share by 2025. Their fixed positioning ensures reliable performance in water control systems.

Float switch sensing mechanisms are expected to dominate the sensing mechanism segment with a 40% share in 2025. These mechanisms have been favored for their simplicity, reliability, and cost-effectiveness.

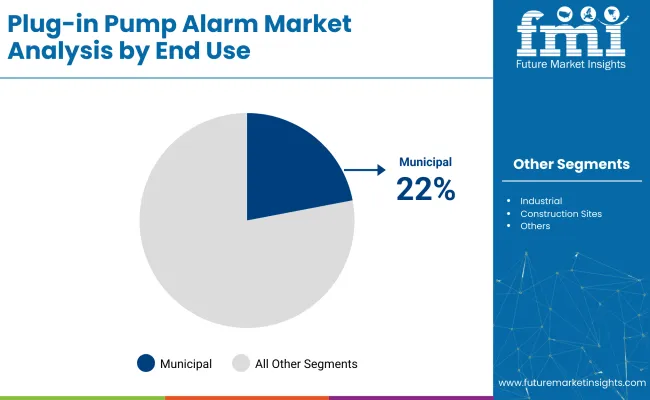

The municipal sector is expected to dominate the end-use segment with a 22% share by 2025. Plug-in pump alarms have been integrated into public water systems to prevent failures and improve overall infrastructure reliability.

The market is growing steadily as water damage prevention becomes a priority across residential, commercial, and industrial settings. These alarms are used to detect sump pump failures, rising water levels, and backup situations. With increasing awareness of flood risks and plumbing failures, demand is rising for easy-to-install, reliable, and battery-backed alarm systems.

Growing Use in Commercial and Light Industrial Water Management

In commercial buildings, restaurants, data centers, and light manufacturing facilities, plug-in pump alarms are used to prevent water damage around utility pumps and wastewater systems. Facilities management teams rely on these devices to ensure uninterrupted pump operation and timely maintenance. Alarms with visual indicators, remote alerts, and backup power are in high demand.

Product Innovation Focused on Connectivity and Long-Term Reliability

Manufacturers are integrating advanced features such as app-based notifications, moisture sensors, and extended battery life into modern plug-in pump alarms. There is also growing interest in models with self-testing capabilities and corrosion-resistant housing to support long-term reliability in damp environments. Compact designs and multi-zone monitoring options are gaining popularity.

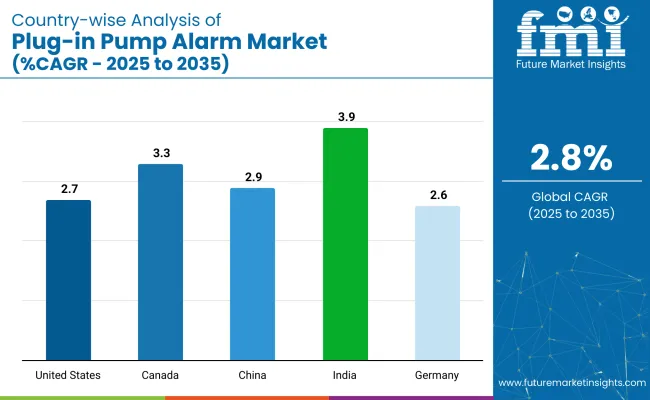

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 3.9% |

| Canada | 3.3% |

| China | 2.9% |

| United States | 2.7% |

| Germany | 2.6% |

India’s momentum is being driven by monsoon-related flooding, widespread urban construction, and public sector investments in drainage systems. Canada is advancing the use of plug-in alarms in flood-prone basements and is promoting integration through home insurance incentives and provincial mandates. In contrast, mature economies such as China (2.9%), the United States (2.7%), and Germany (2.6%) are expanding steadily at 0.92-1.03x rates.

China focuses on integrating alarms into bundled water monitoring kits within large-scale housing projects. The USA emphasizes smart-home applications and retrofitting solutions for flood-prone regions. Germany supports growth through compliance-based upgrades in municipal infrastructure and energy-efficient building basements. As the market grows steadily through 2035, both volume-driven and regulation-led countries are shaping its evolution.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is projected to grow at a CAGR of 3.9% through 2035. Rising urban flooding, weak drainage systems, and the construction of underground facilities are contributing to demand. Plug-in alarms are being installed in apartment complexes, metro stations, and public sector utility chambers. Affordable, dual-sensor models are being produced locally to support wide deployment. Smart city programs in states such as Maharashtra and Tamil Nadu are including sump monitoring units in their planning.

Canada is expected to grow at a CAGR of 3.3% through 2035. Basement water intrusion caused by snowmelt and groundwater has made alarm installation common in residential properties. Several provinces are promoting alarm use through building code updates and home insurance rebate programs.

Off-grid communities in Alberta and British Columbia are adopting alarms with battery backup for reliability during blackouts. Demand is concentrated in single-family suburban housing, with growing adoption in multi-unit residential basements.

China’s market is projected to expand at a CAGR of 2.9% from 2025 to 2035. Growth is supported by rapid urbanization, residential tower construction, and increased drainage load in industrial zones. Tier 1 and Tier 2 cities are embedding alarms in basement utility shafts and wastewater pump rooms. Local OEMs are bundling alarms with smart building control kits to meet evolving regulations. Plug-in alarms are also being deployed in temporary construction housing and mobile infrastructure.

The USA market is forecast to grow at a CAGR of 2.7% through 2035. Retrofits in older homes, smart home integration, and increased flood risks are sustaining demand. Homeowners in flood-prone regions such as the Midwest and Northeast are using sump alarms to prevent basement damage. Product sales are dominated by models with app-based alerts, battery backup, and Wi-Fi compatibility. Builders are incorporating alarms into new construction packages in FEMA-designated flood zones.

Germany is expected to grow at a CAGR of 2.6% during the forecast period. Energy-efficient commercial buildings and public garages are integrating plug-in alarms into automated drainage systems. The market is influenced by environmental compliance rules under the EU Floods Directive. German OEMs are developing silent, low-energy alarm models compatible with centralized building management systems. Retrofit installations are also occurring in schools, hospitals, and logistics facilities.

The market is moderately fragmented, with key players such as Sulzer, Xylem, and Grundfos driving innovation through smart sensor integration and user-friendly interfaces. Sulzer offers high-reliability alarm systems tailored for critical wastewater and dewatering applications. Xylem emphasizes intelligent monitoring and remote alert technologies through its brands like Flygt and Goulds Water Technology.

Grundfos supports plug-and-play alarms with advanced diagnostics to prevent basement flooding and pump failures in residential and commercial settings. Other manufacturers include Zoeller Pump Company and Liberty Pumps, known for rugged, easy-install alarms suitable for sump and sewage pump applications. Tsurumi Pump continues to strengthen its presence in the industrial segment with weatherproof, high-decibel alert solutions.

Recent Plug-in Pump Alarm Industry News

In January 2025, Dura Pump technical director John Calder stated that remote monitoring and smart, sensor-enabled pumps will become widespread in the pump sector this year. He emphasized the importance of early fault detection, including reduced flow, blockages, and temperature fluctuations, to minimize downtime and maintenance costs.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 229.5 million |

| Projected Market Size (2035) | USD 302.4 million |

| CAGR (2025 to 2035) | 2.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Installation Types Analyzed (Segment 1) | Wall Mounted, Panel Mounted, Portable Plug-and-Play Systems |

| End Uses Analyzed (Segment 2) | Residential, Municipal, Industrial, Construction Sites, Agriculture & Irrigation |

| Sensing Mechanisms Analyzed (Segment 3) | Float Switch, Probes, Sensors, Other Detection Technologies |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Sulzer, Xylem, Grundfos, Zoeller Pump Company, Tsurumi Pump, Liberty Pumps |

| Additional Attributes | Dollar sales by installation and sensing type, steady demand in water control systems, growing use in flood-prone areas, and product innovation in plug-and-play alarm technologies. |

The market is segmented by installation type into wall-mounted, panel-mounted, and portable plug-and-play systems.

Based on end use, the market serves residential, municipal, industrial, construction sites, and agriculture & irrigation applications.

By sensing mechanism, the market includes float switches, probes, sensors, and other detection technologies.

Regionally, the market is distributed across North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is valued at USD 229.5 million in 2025.

It is projected to reach USD 302.4 million by 2035.

The market is anticipated to grow at a CAGR of 2.8% during the forecast period.

Wall-mounted plug-in pump alarms are expected to lead with a 45% market share in 2025.

Float switch mechanisms are projected to dominate with a 40% market share in 2025.

The municipal sector is forecasted to hold the largest share at 22% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Alarm Management System Market Analysis by Component, Industry and Region - Trends, Growth & Forecast 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Pump and Dispenser Market Report – Demand, Trends & Industry Forecast 2025-2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

WiFi Alarm System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA