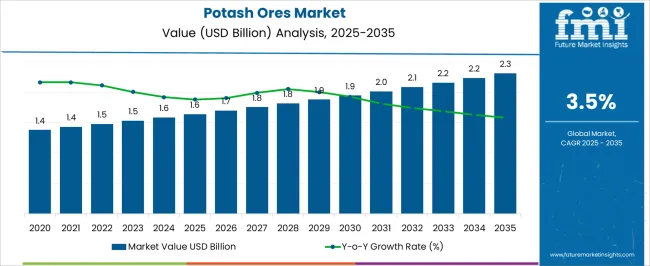

The Potash Ores Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Potash Ores Market Estimated Value in (2025 E) | USD 1.6 billion |

| Potash Ores Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The potash ores market is witnessing consistent growth as demand for potassium-based fertilizers continues to expand across the globe. Rising global population levels and the resulting pressure on agricultural productivity are driving the increasing use of potash ores in enhancing soil fertility and crop yield. Governments and international organizations are promoting sustainable agricultural practices and encouraging the adoption of fertilizers that improve efficiency and reduce environmental impact, which is further supporting demand.

Technological advancements in mining and ore processing have improved extraction efficiency, reducing production costs and making potash more widely available to end users. Global trade flows are also shaping the market, with potash playing a vital role in food security strategies of both developed and emerging economies.

Increasing investment in new mining projects and expansion of existing facilities are expected to support stable supply levels over the coming decade With agriculture remaining a priority sector worldwide, the potash ores market is positioned for steady long-term growth, driven by the dual factors of rising food demand and the need for sustainable crop management practices.

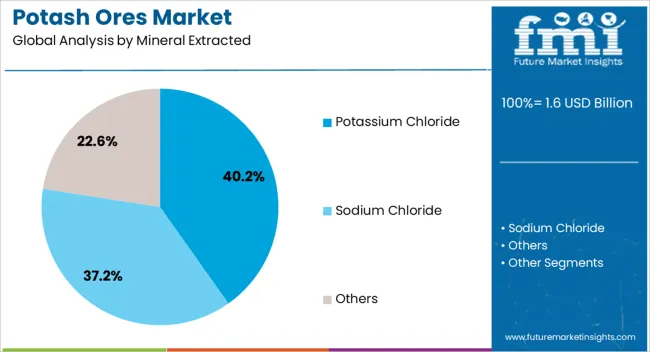

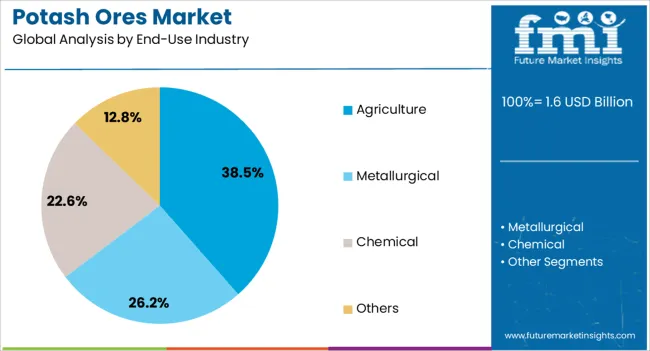

The potash ores market is segmented by mineral extracted, end-use industry, and geographic regions. By mineral extracted, potash ores market is divided into Potassium Chloride, Sodium Chloride, and Others. In terms of end-use industry, potash ores market is classified into Agriculture, Metallurgical, Chemical, and Others. Regionally, the potash ores industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The potassium chloride segment is projected to hold 40.2% of the potash ores market revenue share in 2025, establishing it as the leading mineral extracted. This dominance is being reinforced by the widespread use of potassium chloride as a primary fertilizer component to improve plant growth, strengthen root development, and enhance crop resilience against stress conditions. Its relatively high solubility and compatibility with various soil types make it a preferred choice in large-scale agricultural applications.

Cost efficiency compared to other potash derivatives has further supported its adoption, especially in regions with high fertilizer demand. The segment is also benefiting from consistent trade activity, as potassium chloride is one of the most globally traded potash forms.

Improved mining technologies and better logistics infrastructure are enabling steady supply to key agricultural markets With food production targets rising and agricultural practices evolving toward intensive cultivation methods, potassium chloride is expected to maintain its position as the most significant mineral extracted within the global potash ores market.

The agriculture segment is anticipated to account for 38.5% of the potash ores market revenue share in 2025, making it the dominant end-use industry. This leadership is being driven by the critical role potash plays in improving soil quality, enhancing nutrient absorption, and supporting higher crop yields to meet growing food demand. Farmers and agribusinesses are increasingly adopting potash-based fertilizers as part of integrated nutrient management practices that balance productivity with sustainability.

Government policies in multiple regions are encouraging fertilizer use to secure food supply and reduce yield gaps, further accelerating demand. The segment’s growth is also supported by advances in precision agriculture, which leverage data and technology to optimize fertilizer application and maximize efficiency.

Rising global consumption of staple crops such as rice, wheat, and corn is reinforcing the need for potash as a fundamental input in agricultural production As the agricultural sector continues to expand in both developed and developing markets, potash ores are expected to remain central to ensuring food security and maintaining soil fertility over the long term.

Potash ores are primarily used in the fertilizer industries, and a surging fertilizer sector represents a lot of scope for the potash ores market, and reflects potash fertilizer uses.

Apart from that, rising vegan population across the globe, coupled with an increased demand for organic food is expected to drive the demand for potash ores during the forecast period, which also displays potash use.

Furthermore, the ground water levels leading to alarmingly lower levels would mean that dependence on waste water, which can be consumed after processing. The potash ores are used in significant quantities during waste water treatment. This might surge the sales of potash ores during the forecast period.

Potash ores are used for manufacturing ceramics and detergents, as a result of which soaps and detergents markets have started investing in potash ores, which is expected to surge the adoption of potash ores during the forecast period.

Apart from that, there has been an increase in the demand for animal feed at a global level. The huge animal feed market represents a massive opportunity for the potash ores market during the forecast period.

Moreover, potash is also used in the glass industry. When the molten form is made harder, it is believed to be very robust. In order to enhance the robustness, the glass manufacturers are making use of stabilizers along with potash ores which makes the glass water resistant as well.

Introduction of bio-fertilizers, which are known to have almost no negative impact on human health, also shows that the market has a lot of prospects.

The consumption of potash may have some serious side effects on human health, and this may well weaken the potash ores adoption trends.

Apart from that, massive disruption in the supply chain management owing to Covid-19 pandemic followed by Russia-Ukraine war is expected to have a negative impact on the market of potash ores going ahead.

It has also been found that the operation of potash mining industry also causes pollution. The pollution is spread across land, water and air, which can be quite dangerous, as the process leads to emission of carbon dioxide, carbon monoxide, etc.

Based on the regional analysis, the Asia-Pacific market is expected to be the largest during the forecast period. An enormous animal feed market, coupled with huge population in the region is expected to be the major reason why Asia-Pacific could be the largest market.

On the basis of end use industry, the agriculture segment currently holds the highest market share. A huge demand for potassium chloride is driving the application of potash ores in the agricultural sector.

Global demand for potash ores is expected to rise significantly with the growth of the fertilizer industry over the next few years. In addition, rising consumption of organic food is expected to drive the demand for potash fertilizers, thereby boosting the potash ore market over the next few years.

North America and Europe are the largest consumers of organic foods. Significant growth is expected in the Asia-Pacific region over the next few years on account of rising disposable incomes of consumers and an inclining trend towards healthy food.

However, rising health concern from the consumption of potash fertilizers as well as fluctuating prices of potassium chloride is expected to slow down the growth of the market. Demand for food and animal feed has been on the rise since 2000 with growing disposable incomes in developing economies being a major factor in the growing potash and fertilizer use.

However, after years of showing an upward growth trajectory, fertilizer use experienced a significant decline in 2008. The global economic downturn has been the primary cause for decreased potash use as well as the declining prices, which caused instability in crop and raw material prices and fuelled uncertainty in the farming community.

Increasing use of potash as potash mobilizing biofertlizers is expected to provide new opportunities for the growth of the market.

Growth of the fertilizer industry has been one of the major factors driving the demand for potash ores. The global outlook for the fertilizer industry shows a positive growth, resulting from a progressive demand for phosphate and potassium demand in Asia Pacific.

Although agricultural prices have been under pressure, they are anticipated to remain attractive stimulating fertilizer applications leading to the growth of the industry. Demand for potash ores is expected to witness a noticeable increase in every region except North America, due to the expected drop in crop prices and residual effect of nutrient applications leading to a decline in consumption.

Future market growth is expected to be significant from emerging regions such as Asia Pacific as a result of improvements in fertilizer practices by Indian farmers. As per The International Fertilizer Industry Association, more than 25 potash expansion projects have been intended by manufacturers between from 2025 to 2025.

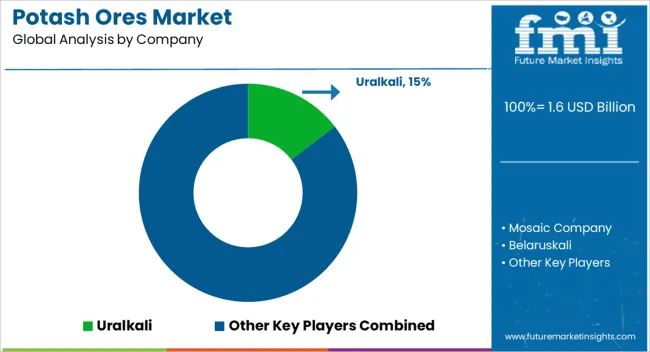

Elementals Minerals Limited, Agrium Inc., PotashCorp, JSC Belaruskali, Uralkali, K+S GmbH, and Israel Chemicals Ltd. are some of the key players present in the potash ore market.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to categories such as market segments, geographies, types and applications. The report covers exhaustive analysis on:

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

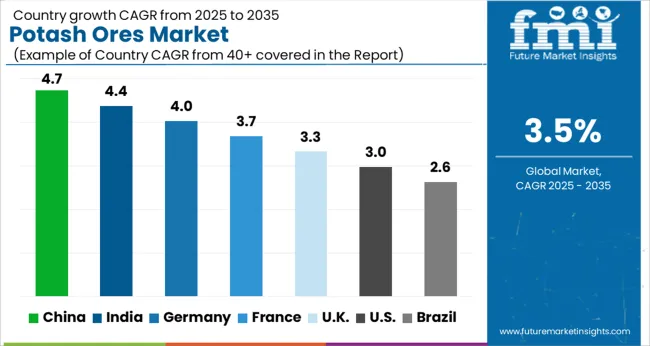

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The Potash Ores Market is expected to register a CAGR of 3.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.7%, followed by India at 4.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.6%, yet still underscores a broadly positive trajectory for the global Potash Ores Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.0%. The USA Potash Ores Market is estimated to be valued at USD 568.1 million in 2025 and is anticipated to reach a valuation of USD 761.6 million by 2035. Sales are projected to rise at a CAGR of 3.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 79.0 million and USD 50.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Mineral Extracted | Potassium Chloride, Sodium Chloride, and Others |

| End-Use Industry | Agriculture, Metallurgical, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Uralkali, Mosaic Company, Belaruskali, ICL Group Ltd., Intrepid Potash, Inc., Arab Potash Company, Sinofert Holdings Limited, Agrium Inc., EuroChem Group AG, JSC Acron, Yara International ASA, CF Industries Holdings, Inc., OCI Nitrogen, and Helm AG |

The global potash ores market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the potash ores market is projected to reach USD 2.3 billion by 2035.

The potash ores market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in potash ores market are potassium chloride, sodium chloride and others.

In terms of end-use industry, agriculture segment to command 38.5% share in the potash ores market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Borescope Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Forestry Lubricants Manufacturers

Borescope Inspection Camera Market

Bioresorbable Polymers Market Analysis – Size, Share & Forecast 2025 to 2035

Bioresorbable Coronary Scaffolds Market

Fluorescence Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Fluorescent Pigment Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence-Activated Cell Sorting Market Size and Share Forecast Outlook 2025 to 2035

Fluorescent Skincare Compounds Market Size and Share Forecast Outlook 2025 to 2035

Fluorescence Cell Market Analysis - Growth & Industry Trends 2025 to 2035

Fluorescent Brightening Agents Market Growth - Trends & Forecast 2025 to 2035

Global Fluorescence Guided Surgery System Market Analysis – Size, Share & Forecast 2024-2034

Fluorescence Immunoassay Analyzers Market

Photoresist Chemical Market Forecast and Outlook 2025 to 2035

Photoresist and Photoresist Ancillaries Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Electronic Chemical Market Size and Share Forecast Outlook 2025 to 2035

Photoresist Stripper Market Analysis - Size, Share, and Forecast 2025 to 2035

Phosphorescent Pigments Market Size and Share Forecast Outlook 2025 to 2035

Magnetoresistive Sensors Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA