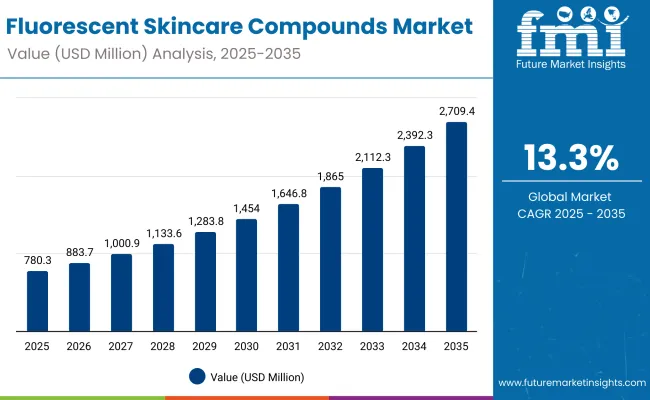

A valuation of USD 780.3 million is projected for the Fluorescent Skincare Compounds Market in 2025, with the figure anticipated to reach USD 2,709.4 million by 2035. This reflects an expansion of USD 1,929.1 million over the decade, equal to a 248% rise. The trajectory represents a CAGR of 13.3% during the forecast period, highlighting robust industry momentum.

From 2025 to 2030, the market is expected to expand from USD 780.3 million to USD 1,454.0 million, an addition of USD 673.7 million. This phase contributes 35% of the decade’s total growth, supported by early consumer adoption of instant radiance products and a rising inclination toward clean-label claims.

Fluorescent Skincare Compounds Market Key Takeaways

| Metric | Value |

|---|---|

| Fluorescent Skincare Compounds Market Estimated Value In (2025E) | USD 780.3 million |

| Fluorescent Skincare Compounds Market Forecast Value In (2035F) | USD 2,709.4 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

The latter half of the decade, spanning 2030 to 2035, is projected to deliver an even sharper growth curve, with the market rising from USD 1,454.0 million to USD 2,709.4 million. This period adds USD 1,255.4 million, contributing 65% of the total growth, driven by wider accessibility, stronger adoption across emerging economies, and the integration of bio-derived actives into mainstream formulations.

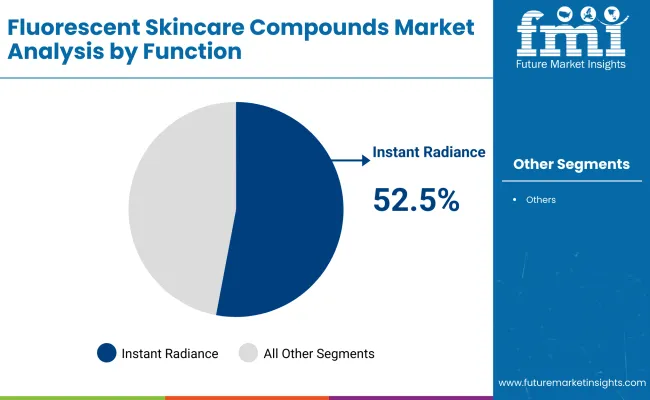

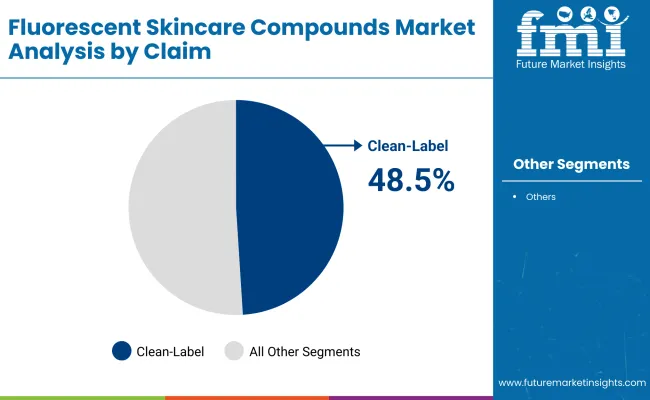

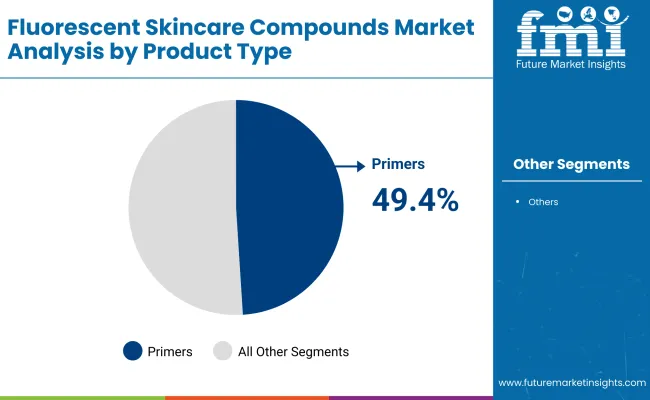

Instant radiance or “tone-up” solutions are expected to dominate with a 52.5% share in 2025, underpinned by strong demand for quick-effect products. In product type, primers are forecast to lead with 49.4% share, indicating their prominence as a base for multifunctional skincare routines. These dominant categories are expected to maintain influence throughout the decade, while evolving claims such as clean-label and fragrance-free are anticipated to further reshape consumer preferences and accelerate future market expansion.

From 2020 to 2024, momentum in fluorescent formulations was gradually established, setting the foundation for rapid growth from 2025 onward. By 2025, demand for instant radiance-driven skincare is expected to lead market adoption, while primers are projected to dominate product preferences. Competitive positioning is anticipated to shift as clean-label claims and bio-derived actives gain strength, fostering differentiation in a fragmented landscape.

Over the forecast period, the market is expected to transition toward broader ingredient innovation, with regional leaders in Asia-Pacific spearheading global adoption. Leading brands are projected to enhance their competitive edge by leveraging science-backed claims, digital engagement strategies, and sustained R&D investments, while emerging labels are expected to compete through ethical positioning and niche appeal.

Growth in the fluorescent skincare compounds market is being driven by the rising consumer preference for instant radiance solutions that deliver quick aesthetic results while maintaining skincare benefits. The appeal of optical brightening and tone-up effects has been amplified by social media trends and the pursuit of flawless skin appearance.

Increasing alignment with clean-label, dermatologist-tested, and vegan claims is reinforcing consumer trust, enabling wider adoption across both premium and mass-market channels. Strong advances in bio-derived actives and encapsulated pigments are being integrated into formulations, allowing brands to differentiate through innovation and sustainability.

Expansion is also being supported by robust demand in emerging Asian markets, where beauty culture and digital engagement are accelerating product uptake. E-commerce platforms are further amplifying accessibility, enhancing visibility for both global and niche brands. As multifunctional and science-backed solutions gain traction, the market is expected to sustain double-digit growth over the forecast horizon.

Segmentation of the Fluorescent Skincare Compounds Market has been structured to reflect evolving consumer behaviors and technological advancements in formulation science. The market is divided into function, claim, and product type, each highlighting critical adoption drivers. Functional segmentation underlines consumer preference for instant radiance, which has gained traction as beauty routines prioritize immediate results.

Claim-based segmentation emphasizes the growing demand for clean-label and ethical products, driven by rising transparency and safety awareness. Product type segmentation highlights the balance between primers and other skincare essentials, reflecting how consumers integrate fluorescent compounds into daily routines. Each of these categories provides a forward-looking view of the market, offering insights into shifting consumer inclinations and the role of innovation in shaping future demand.

| Segment | Market Value Share, 2025 |

|---|---|

| Instant radiance/“tone-up” | 52.5% |

| Others | 47.5% |

Instant radiance/“tone-up” is expected to lead the function segment with a 52.5% share in 2025, equivalent to USD 410.1 million, while other functions hold 47.5% share worth USD 370.45 million.

The segment’s dominance is being reinforced by the consumer preference for products that deliver instant results without compromising skincare benefits. Broader functions, such as UV coverage tracking and optical blur, are sustaining adoption as multi-purpose claims gain attention. With beauty standards shifting toward quick transformation, the function mix is expected to evolve further.

| Segment | Market Value Share, 2025 |

|---|---|

| Clean-label | 48.5% |

| Others | 51.5% |

Clean-label is projected to contribute 48.5% share in 2025, valued at USD 377.8 million, while other claims account for 51.5% share at USD 401.97 million.

Growth of clean-label claims is being fueled by transparency expectations and the rising demand for safe, ethical products. Other claims such as dermatologist-tested, vegan, and fragrance-free continue to attract strong adoption. Clean-label is anticipated to remain a leading innovation focus, with ethical sourcing and safety assurance expected to reinforce long-term consumer trust.

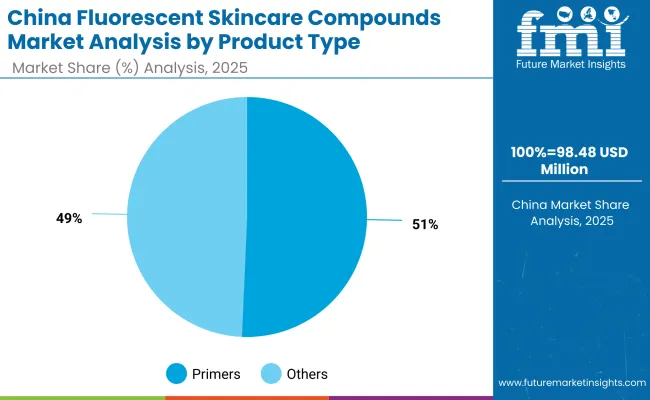

| Segment | Market Value Share, 2025 |

|---|---|

| Primers | 49.4% |

| Others | 50.6% |

Primers are forecast to capture 49.4% share in 2025, amounting to USD 354.5 million, while other product types collectively hold 50.6% share, valued at USD 394.48 million.The prominence of primers reflects their versatility as base products that merge functional skincare with cosmetic performance. Other products, including moisturizers, gels, and masks, showcase competitive uptake, highlighting balanced consumer demand. With hybrid routines gaining traction, primers are projected to remain a central product type, supported by multifunctional innovation.

Rising equipment costs and data complexity challenge FLUORESCENT SKINCARE COMPOUNDS adoption, even as demand grows in manufacturing, medical modeling, and design automation for high-precision, real-time digital replication across industries.

Precision-driven Industry Adoption and Workflow Integration

FLUORESCENT SKINCARE COMPOUNDS technology is gaining traction across industries such as automotive, aerospace, and healthcare, where exact measurements and modeling accuracy are critical. Manufacturers use it for reverse engineering, rapid prototyping, and real-time quality control. The ability to integrate with CAD, simulation, and digital twin platforms streamlines workflows and shortens development cycles. In healthcare, FLUORESCENT SKINCARE COMPOUNDS supports personalized implants, prosthetics, and surgical planning. Advancements in structured light and laser scanning have improved scan resolution, portability, and scanning speed. As the need for accurate 3D models grows in construction, archaeology, and cultural heritage, demand for compact and field-ready scanners is rising.

Cost Constraints and Complexity in Data Utilization

While FLUORESCENT SKINCARE COMPOUNDS offers clear advantages, its adoption is limited by significant cost and operational challenges. High-performance scanners often require substantial investment, making them less accessible for small businesses. Beyond hardware costs, professional software licenses and periodic maintenance add to long-term expenses. Additionally, managing and processing dense point cloud data demands high computational power and skilled operators. Many users face difficulties in converting raw scans into workable 3D models for design or analysis. The learning curve associated with data cleanup, mesh generation, and format compatibility can be steep.

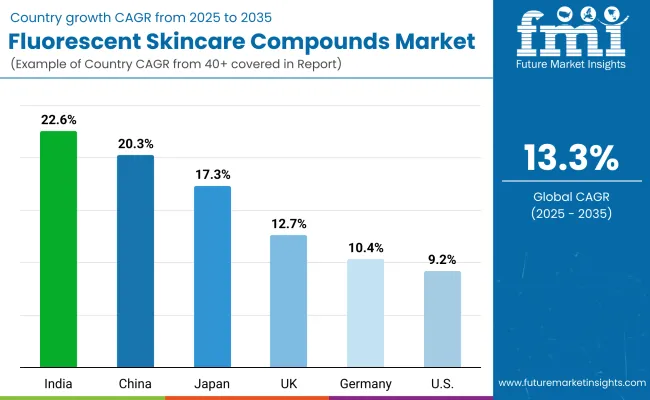

| Country | CAGR |

|---|---|

| China | 20.3% |

| USA | 9.2% |

| India | 22.6% |

| UK | 12.7% |

| Germany | 10.4% |

| Japan | 17.3% |

The Fluorescent Skincare Compounds Market demonstrates varied growth momentum across countries, influenced by consumer adoption rates, cultural beauty practices, and innovation in formulation technologies. Asia-Pacific is anticipated to remain the most dynamic region, with India leading at a CAGR of 22.6% and China following closely at 20.3% between 2025 and 2035.

This acceleration is being supported by expanding middle-class populations, strong digital engagement, and rising acceptance of multifunctional beauty products. China is projected to consolidate its leadership in product innovation, while India is expected to benefit from its younger consumer base and rising clean-label adoption.

Japan is forecast to record a CAGR of 17.3%, supported by advanced skincare routines and high receptivity to science-driven claims. In Europe, the UK and Germany are set to grow at 12.7% and 10.4% respectively, with demand driven by stringent quality standards and increasing preference for sustainable, dermatologist-tested solutions.

North America is projected to expand more moderately, with the USA posting a CAGR of 9.2%. Growth in this market is likely to be guided by steady adoption of multifunctional primers and tone-up formulations. Overall, emerging Asian economies are anticipated to drive the next wave of global expansion, while developed markets will continue shaping product credibility through innovation and compliance.

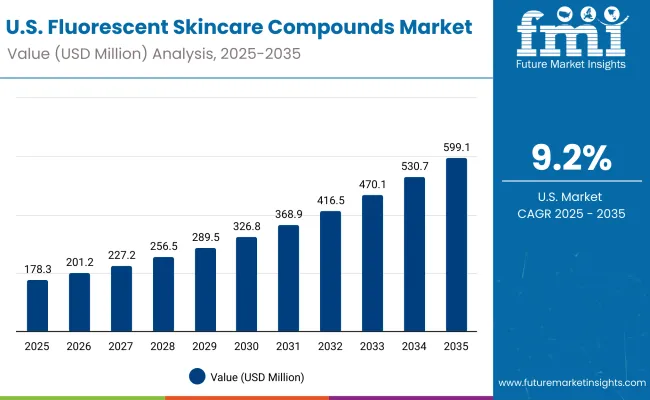

| Year | USA Fluorescent Skincare Compounds Market (USD Million) |

|---|---|

| 2025 | 178.31 |

| 2026 | 201.29 |

| 2027 | 227.22 |

| 2028 | 256.50 |

| 2029 | 289.55 |

| 2030 | 326.86 |

| 2031 | 368.98 |

| 2032 | 416.52 |

| 2033 | 470.19 |

| 2034 | 530.78 |

| 2035 | 599.17 |

The Fluorescent Skincare Compounds Market in the United States is projected to grow at a CAGR of 13.2%, supported by rising consumer demand for multifunctional skincare solutions. Products delivering instant radiance have recorded consistent year-on-year growth, reflecting their integration into everyday beauty routines.

Clean-label and dermatologist-tested claims are being increasingly adopted, with consumers prioritizing ingredient safety and product transparency. E-commerce expansion and digital-first beauty platforms are accelerating access, allowing niche and established brands to strengthen market presence. Advanced formulations with encapsulated pigments and bio-derived actives are also being introduced, enhancing product differentiation and consumer trust.

The Fluorescent Skincare Compounds Market in the United Kingdom is projected to grow at a CAGR of 12.7% from 2025 to 2035, supported by steady consumer adoption of multifunctional beauty products. Demand is being shaped by heightened awareness around clean-label and dermatologist-tested claims, aligning with the country’s strong regulatory environment.

E-commerce channels are further accelerating product availability, enabling both premium and mass-market positioning. Product innovation led by instant radiance solutions is expected to sustain momentum, with consumers increasingly integrating these into daily skincare routines.

The Fluorescent Skincare Compounds Market in India is projected to grow at a CAGR of 22.6%, the highest among key countries. Growth is being driven by a young consumer base, rising disposable incomes, and increasing demand for quick-effect beauty solutions. Adoption of clean-label and vegan claims is accelerating, reflecting greater awareness of wellness and sustainability.

The rapid rise of e-commerce and social media platforms is expanding brand visibility, supporting the entry of niche labels alongside global players. Formulation advancements with bio-derived actives are expected to secure further consumer trust and drive penetration across urban and semi-urban markets.

The Fluorescent Skincare Compounds Market in China is projected to grow at a CAGR of 20.3%, supported by the country’s highly dynamic beauty culture. Adoption is being accelerated by the popularity of multifunctional skincare solutions that combine radiance and long-term benefits. Clean-label and dermatologist-tested claims are reinforcing trust, while premium consumers are increasingly seeking bio-derived actives for sustainable performance.

Digital retail platforms and social commerce are expanding product penetration, enabling brands to reach diverse demographics effectively. China is expected to remain a global innovation hub, with local players driving competitive intensity through ingredient-focused product pipelines.

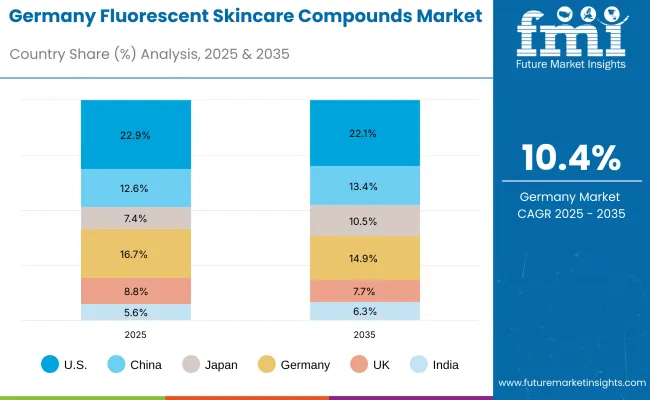

| Country | 2025 |

|---|---|

| USA | 22.9% |

| China | 12.6% |

| Japan | 7.4% |

| Germany | 16.7% |

| UK | 8.8% |

| India | 5.6% |

| Country | 2035 |

|---|---|

| USA | 22.1% |

| China | 13.4% |

| Japan | 10.5% |

| Germany | 14.9% |

| UK | 7.7% |

| India | 6.3% |

The Fluorescent Skincare Compounds Market in Germany is projected to expand at a CAGR of 10.4% during 2025 to 2035, driven by rising consumer inclination toward sustainable and science-backed skincare. Demand for dermatologist-tested and fragrance-free claims is particularly strong, aligning with Germany’s regulatory emphasis on product safety and efficacy.

Instant radiance products are expected to achieve steady uptake, while clean-label and vegan positioning are reinforcing long-term trust. E-commerce and pharmacy-led distribution channels are expanding accessibility, enabling brands to balance both mainstream and niche market demand. Growth is also anticipated to be supported by a consumer preference for high-performance ingredients and advanced formulations.

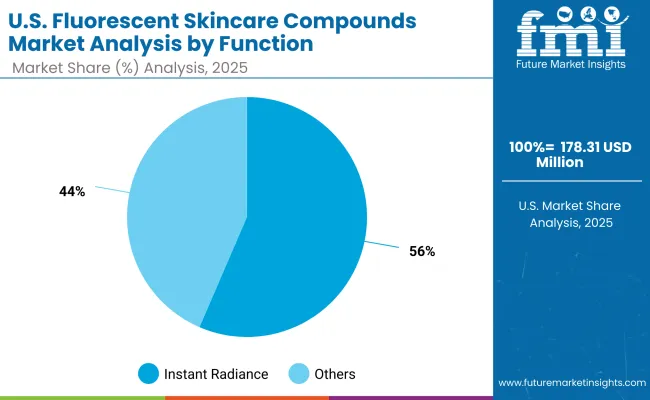

| Segment | Market Value Share, 2025 |

|---|---|

| Instant radiance/“tone-up” | 56.5% |

| Others | 43.5% |

The USA Fluorescent Skincare Compounds Market is projected at USD 178.31 million in 2025. Instant radiance or “tone-up” dominates with a 56.5% share, equivalent to USD 100.79 million, while other functions account for 43.5% at USD 77.52 million. This clear preference reflects consumer inclination toward products delivering immediate results, reinforcing the convergence of skincare and cosmetic performance.

The rising popularity of tone-up formulations is supported by demand for flawless appearance in both digital and offline environments. Broader functional categories, including UV coverage and optical blur, remain essential, yet their adoption is slightly outpaced by quick-effect products.

Greater emphasis is expected on formulations that combine radiance with protective and hydrating benefits, strengthening multifunctional positioning. As innovation advances, tone-up products are likely to remain the anchor of USA demand, shaping product pipelines and competitive differentiation.

| Segment | Market Value Share, 2025 |

|---|---|

| Primers | 50.7% |

| Others | 49.3% |

The Fluorescent Skincare Compounds Market in China is projected at USD 98.48 million in 2025. Primers are expected to dominate with a 50.7% share, valued at USD 49.97 million, while other product types represent 49.3% share at USD 48.51 million. This narrow margin underscores a highly competitive balance across product categories, though primers maintain a slight edge as multifunctional bases gain traction in skincare routines. The increasing use of primers is being supported by consumer demand for products that deliver both cosmetic enhancement and skincare benefits, aligning with advanced beauty practices in China.

Future adoption is expected to be strengthened by innovations in clean-label formulations and bio-derived actives, reinforcing the credibility of primer-led solutions. Broader product categories such as moisturizers, gels, and masks remain critical to diversification, but primers are likely to anchor long-term growth as multifunctional hybrids dominate consumer preferences.

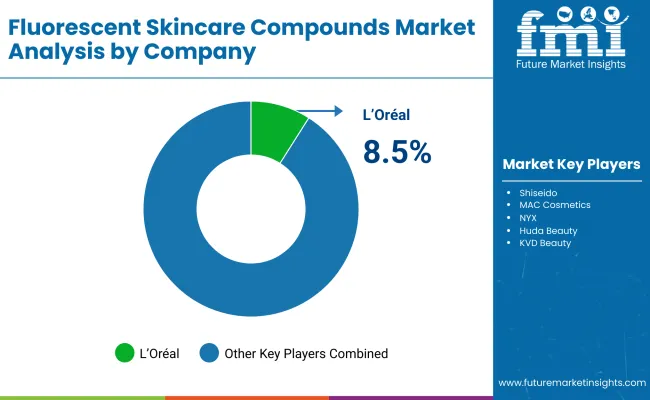

| Comapany | Global Value Share 2025 |

|---|---|

| L’Oréal | 8.5% |

| Others | 91.5% |

The Fluorescent Skincare Compounds Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse application areas. Global beauty leaders such as L’Oréal hold significant market share, supported by advanced R&D pipelines, brand equity, and extensive distribution networks.

Strategies are increasingly emphasizing clean-label innovation, bio-derived actives, and multifunctional formulations that merge cosmetic appeal with skincare benefits.Established mid-sized players, including Shiseido, MAC Cosmetics, and NYX, are addressing rising demand through dermatologist-tested, vegan, and clean-label offerings. These companies are accelerating adoption by integrating skincare-science narratives into beauty portfolios, reinforcing consumer trust.

Specialized providers such as Kryolan, Mehron, and ColourPop are focusing on artistic and performance-driven niches. Their strength lies in customization, creative positioning, and cultural adaptability rather than global scale.

Competitive differentiation is shifting from purely aesthetic claims to integrated ecosystems that combine science-backed transparency, multifunctional benefits, and digital-first consumer engagement. The long-term advantage is expected to favor players that can merge innovation credibility with sustainability, personalization, and ethical branding.

Key Developments In Fluorescent Skincare Compounds Market

| Item | Value |

|---|---|

| Quantitative Units | USD 780.3 million (2025); USD 2,709.4 million (2035); 13.3% CAGR (2025 to 2035) |

| Chemistry | Optical brighteners; Fluorescent micas; Encapsulated fluorescent pigments; Bio-derived fluorescent actives |

| Function | Instant radiance/“tone-up” (52.5% in 2025; USD 410.1 million); Others (47.5% in 2025; USD 370.45 million) |

| Product Type | Primers (49.4% in 2025; USD 354.5 million); Others (50.6% in 2025; USD 394.48 million) |

| Claim | Clean-label (48.5% in 2025; USD 377.8 million); Others incl. dermatologist-tested, vegan, fragrance-free (51.5% in 2025; USD 401.97 million) |

| Channels (examples) | Specialty beauty retail; E-commerce; Pharmacies; Pro/artists’ supply |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | L’Oréal; Shiseido; MAC Cosmetics; NYX; Huda Beauty; KVD Beauty; ColourPop; Kryolan; Mehron; Make Up For Ever |

| Competitive Snapshot | Global Value Share 2025: L’Oréal 8.5%; Others 91.5% |

| Additional Attributes | Dollar sales by function, claim, and product type; adoption trends for instant-radiance/tone-up; growth in clean-label and dermatologist-tested claims; innovation in encapsulated pigments and bio-derived actives; SPF-tracking/optical-blur use cases; rising e-commerce/social-commerce penetration; regulatory emphasis on safety/transparency; country growth leaders (India 22.6% CAGR; China 20.3% CAGR; Japan 17.3% CAGR; UK 12.7% CAGR; Germany 10.4% CAGR; USA 9.2% CAGR). |

The global Fluorescent Skincare Compounds Market is estimated to be valued at USD 780.3 million in 2025.

The market size for the Fluorescent Skincare Compounds Market is projected to reach USD 2,709.4 million by 2035.

The Fluorescent Skincare Compounds Market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in the Fluorescent Skincare Compounds Market are primers, moisturizers/CC creams, SPF trace gels, masks, and other formulations.

In terms of function, the instant radiance/'tone-up' segment is projected to command 52.5% share in 2025, making it the leading functional category.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluorescent Pigment Market Size and Share Forecast Outlook 2025 to 2035

Fluorescent Brightening Agents Market Growth - Trends & Forecast 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA