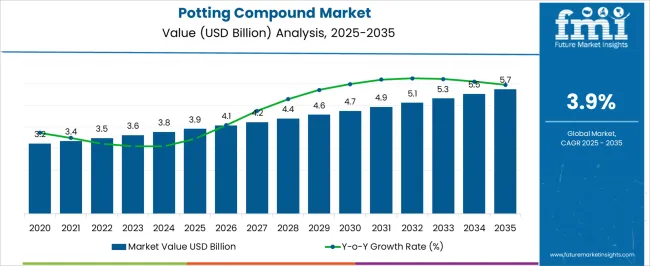

The potting compound market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The potting compound market is valued at USD 3.9 billion in 2025 and is expected to grow to USD 5.7 billion by 2035, with a CAGR of 3.9%. From 2021 to 2025, the market grows gradually from USD 3.2 billion to USD 3.9 billion, with values passing through USD 3.4 billion, 3.5 billion, 3.6 billion, and 3.8 billion. This steady progression reflects an increasing demand for potting compounds in the electronics, automotive, and renewable energy sectors, driven by the need for better protection and insulation of components.

Between 2026 and 2030, the market strengthens further, advancing from USD 3.9 billion to USD 5.1 billion. The values progress from USD 4.1 billion to USD 4.2 billion, 4.4 billion, 4.6 billion, and 4.7 billion, fueled by innovations in potting materials that improve thermal conductivity, dielectric properties, and environmental resistance. The period also sees greater adoption in electric vehicles (EVs) and renewable energy applications.

From 2031 to 2035, the market reaches USD 5.7 billion, with intermediate values of USD 4.9 billion, 5.1 billion, 5.3 billion, and 5.5 billion. The market continues its growth with stable demand, supported by the expanding use of potting compounds in advanced technologies. Despite steady growth, the market is characterized by a gradual peak-to-trough cycle, reflecting moderate fluctuations influenced by technological innovations and market dynamics.

| Metric | Value |

|---|---|

| Potting Compound Market Estimated Value in (2025 E) | USD 3.9 billion |

| Potting Compound Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The electronics and electrical equipment market is a major contributor, accounting for around 25-30%, as potting compounds are essential for protecting sensitive circuits and ensuring the reliability and longevity of electronic devices. The semiconductor market also plays a significant role, contributing approximately 20-25%, as potting compounds are used to encapsulate semiconductor devices, shielding them from moisture, dust, and mechanical stress to maintain their functionality. The automotive industry market is a key driver, contributing around 15-20%, with potting compounds being used to protect electrical components in vehicles, such as sensors, motors, and wiring systems, ensuring the durability and reliability of automotive electronics.

The industrial equipment market contributes approximately 10-15%, as potting compounds are used in machinery, motors, and control systems to safeguard electrical components in harsh environments with high vibration, moisture, or temperature fluctuations. The renewable energy market, accounting for around 8-10%, is an emerging driver, as potting compounds are used to protect electrical components in renewable energy systems like wind turbines, solar panels, and energy storage devices, ensuring their performance and durability in outdoor and exposed environments. These parent markets highlight the growing demand for potting compounds, driven by the need for protection and reliability in electronics, automotive, industrial, and renewable energy applications.

The potting compound market is gaining steady traction globally due to the growing need for enhanced protection and durability of electronic assemblies and sensitive electrical components. The increasing complexity and miniaturization of electronic devices have elevated the demand for materials that offer superior insulation, environmental resistance, and thermal stability. Rising adoption across automotive electronics, industrial controls, consumer electronics, and renewable energy systems is contributing to consistent demand.

Advancements in formulation technologies are allowing potting compounds to meet diverse performance criteria such as resistance to moisture, heat, vibration, and chemical exposure. The market is also benefiting from expanding investments in electric vehicles, solar inverters, and 5G infrastructure, where potting is critical for reliability and operational life.

Regulatory emphasis on product safety and long-term performance is prompting manufacturers to adopt potting compounds with proven dielectric strength and low shrinkage properties As electronics become more compact and integrated into harsh environments, the market for potting compounds is projected to grow, with innovation in curing technologies and resin systems shaping its long-term outlook.

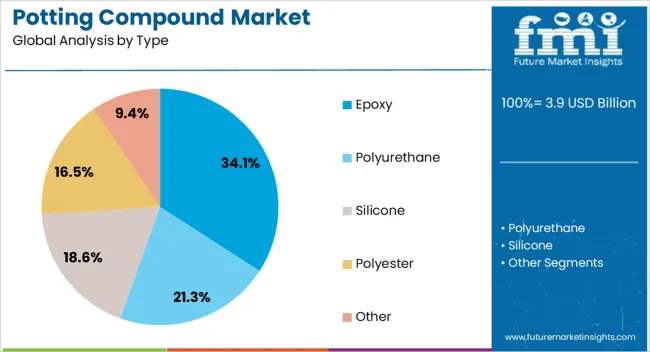

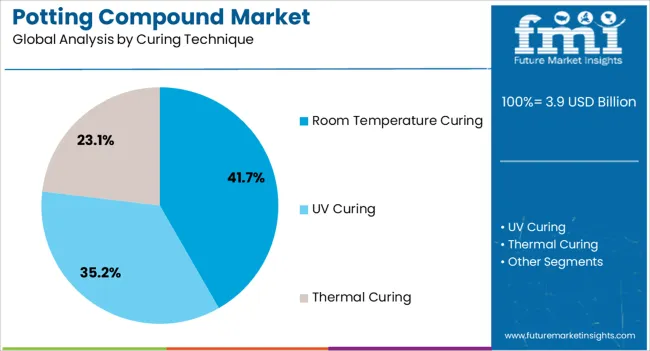

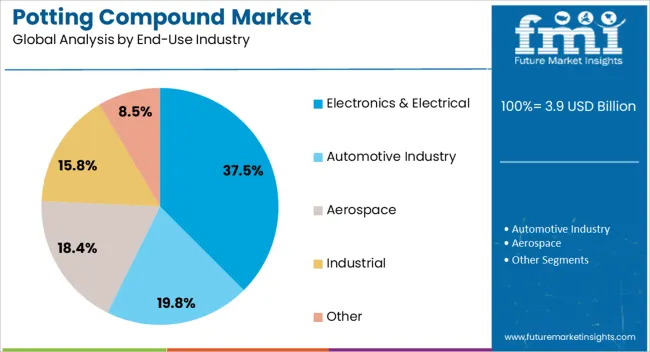

The potting compound market is segmented by type, curing technique, end-use industry, and geographic regions. By type, potting compound market is divided into epoxy, polyurethane, silicone, polyester, and other. In terms of curing technique, potting compound market is classified into room temperature curing, UV curing, and thermal curing. Based on end-use industry, potting compound market is segmented into electronics & electrical, automotive industry, aerospace, industrial, and other. Regionally, the potting compound industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The epoxy segment is anticipated to hold 34.1% of the potting compound market revenue share in 2025, making it the leading product type. This leadership is being driven by the material’s high mechanical strength, excellent adhesion properties, and superior chemical and moisture resistance, which make it ideal for protecting sensitive electronic and electrical components. Epoxy-based potting compounds are widely preferred in applications requiring dimensional stability, thermal conductivity, and long-term reliability.

Their ability to form a rigid encapsulation structure helps prevent damage caused by environmental stress, vibration, and thermal cycling. The segment is also benefiting from compatibility with a wide range of substrates including metals, plastics, and ceramics, allowing broad application across end-use industries.

The increasing use of epoxy compounds in automotive electronics, consumer devices, LED lighting, and industrial power systems is contributing to sustained growth Furthermore, advancements in low-viscosity and fast-curing epoxy formulations are improving process efficiency for manufacturers, enhancing their position as the most favored type in high-performance potting applications.

The room temperature curing segment is projected to account for 41.7% of the potting compound market revenue share in 2025, positioning it as the leading curing technique. This dominance is being supported by the method’s ease of use, energy efficiency, and compatibility with a wide variety of potting materials, particularly epoxy and polyurethane systems. The ability to cure at ambient conditions without requiring specialized equipment or elevated temperatures reduces production costs and simplifies the manufacturing process.

Room temperature curing is especially advantageous for temperature-sensitive components where thermal exposure must be minimized. Its flexibility in processing allows for use in both automated and manual applications, which supports high-volume production and prototyping environments alike.

The segment is experiencing increasing adoption across electronics, automotive, and telecommunications industries where rapid deployment, material stability, and cost control are essential Continuous improvements in formulation chemistry are enhancing curing speed and post-cure performance, further reinforcing the preference for room temperature curing as the most practical and scalable method in the global market.

The electronics and electrical segment is expected to capture 37.5% of the potting compound market revenue share in 2025, making it the most significant end-use industry. Its leadership is being attributed to the growing demand for component protection in complex circuits, high-density boards, and compact electronic devices. Potting compounds are being extensively used to safeguard printed circuit boards, sensors, power supplies, and control units from moisture, dust, thermal stress, and mechanical shock.

The widespread integration of electronics in automotive systems, industrial automation, consumer devices, and renewable energy platforms is reinforcing demand for reliable potting solutions. Additionally, the push for miniaturized and lightweight designs necessitates materials that provide superior dielectric strength and dimensional stability without compromising size or weight constraints.

Regulatory standards for electrical safety and device longevity are prompting manufacturers to adopt high-performance potting compounds As the electronics landscape evolves with trends such as IoT, 5G, and smart devices, the need for effective protection materials is expected to intensify, positioning this segment as a long-term growth engine within the potting compound market.

Potting compounds are widely used to encapsulate electronic components, providing protection against environmental factors such as moisture, dust, and chemicals. As industries such as automotive, consumer electronics, and renewable energy expand, the need for reliable, durable, and temperature-resistant potting compounds is rising. Challenges include fluctuating raw material prices, the complexity of material compatibility with different substrates, and the need for continuous innovation to meet diverse application requirements. Opportunities lie in the development of eco-friendly, lightweight, and high-performance potting materials, as well as increasing demand for custom formulations tailored to specific needs. Trends include growing adoption in electric vehicle (EV) applications, IoT devices, and the integration of potting compounds with smart technologies. Suppliers offering versatile, cost-effective, and environmentally friendly potting solutions are well-positioned for growth.

The potting compound market is driven by the rising demand for protection of electronic and electrical components. Potting compounds provide essential protection against environmental hazards such as moisture, vibration, and temperature extremes, which can significantly affect the performance and longevity of electronic devices. With the growth of the consumer electronics market, particularly mobile devices, wearables, and automotive electronics, the need for high-quality potting compounds is increasing. These materials are vital for enhancing the reliability of components in harsh environments, particularly in automotive, aerospace, telecommunications, and renewable energy sectors. As the demand for more advanced and miniaturized electronic devices continues to grow, the potting compound market is expected to expand further, with an emphasis on materials that offer superior protection, durability, and performance.

The potting compound market faces several challenges, particularly in terms of raw material costs, which can fluctuate based on global supply chain disruptions. The complexity of formulating potting compounds that are compatible with a wide range of substrates adds technical challenges. Manufacturers must ensure that compounds maintain their integrity and performance across various materials, such as metals, plastics, and ceramics. Regulatory constraints, including compliance with safety standards, particularly in industries such as automotive and medical electronics, require potting compounds to meet stringent requirements for toxicity, fire resistance, and environmental impact. Additionally, the demand for eco-friendly and low-VOC (volatile organic compound) potting materials adds to the development complexity. Balancing cost-effectiveness with performance and regulatory compliance remains a key challenge for suppliers in this market.

Opportunities in the potting compound market are growing in the electric vehicle (EV) and smart technology sectors. As the adoption of EVs continues to rise, there is an increasing need for potting compounds to protect and insulate electronic components such as sensors, batteries, and charging systems. Potting materials are essential in ensuring the reliability and durability of these components, particularly in harsh operating conditions. Additionally, the integration of IoT devices and smart technologies into everyday products, such as wearables, appliances, and industrial equipment, is driving the demand for potting compounds that offer enhanced protection, heat resistance, and flexibility. Suppliers that focus on developing specialized potting solutions for these high-growth sectors are positioned to capture significant market share in the coming years.

The potting compound market is trending toward the development of eco-friendly, lightweight, and high-performance materials. As environmental concerns grow, there is increasing pressure on manufacturers to develop potting compounds that are low in toxicity, made from renewable resources, and compliant with green standards. Furthermore, the demand for lighter, more efficient materials is driving the development of potting compounds that are both durable and less dense, offering weight savings for applications in the automotive and aerospace sectors. Innovations in thermal management and electrical insulation are also emerging, as potting compounds are being designed to withstand higher temperatures and provide better electrical conductivity. The trend toward customizable formulations, where potting compounds are tailored to specific application needs, is also gaining traction, allowing suppliers to offer more specialized and cost-effective solutions.

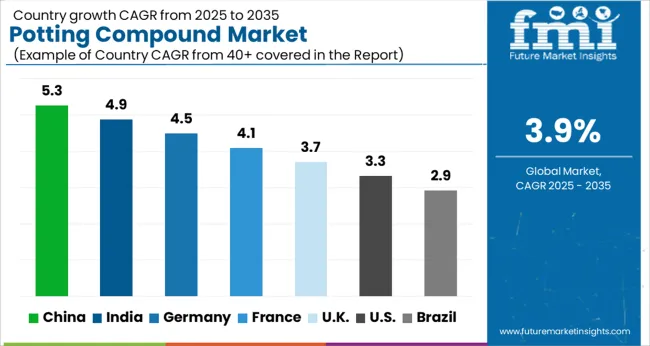

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The global potting compound market is projected to grow at a CAGR of 3.9% from 2025 to 2035. China leads with a growth rate of 5.3%, followed by India at 4.9% and France at 4.1%. The UK and USA show more moderate growth rates of 3.7% and 3.3%, respectively. The market is driven by the growing demand for protective coatings in industries like electronics, automotive, and renewable energy. As industries increasingly adopt energy-efficient technologies and electric vehicles, the need for potting compounds to protect and insulate electrical components continues to rise globally. The analysis spans over 40+ countries, with the leading markets shown below.

The potting compound market in China is expected to grow at a CAGR of 5.3% from 2025 to 2035. As one of the largest manufacturing hubs in the world, China’s demand for potting compounds is closely tied to the growth of the electronics, automotive, and renewable energy sectors. Potting compounds are essential for protecting electrical components from moisture, dust, and environmental stressors, which is crucial for the performance and longevity of devices. With China’s strong push towards automation and industrialization, the demand for potting compounds in applications like electrical circuits, LED lighting, and electric vehicle components is on the rise. The expansion of the country’s renewable energy sector and the increasing adoption of electric vehicles (EVs) are further driving the demand for protective coatings, including potting compounds.

The potting compound market in India is projected to grow at a CAGR of 4.9% from 2025 to 2035. The country’s increasing industrialization and growth in sectors like electronics, automotive, and renewable energy are contributing to the rising demand for potting compounds. As the Indian manufacturing sector modernizes, the need for protective coatings for electrical and electronic components has surged. Potting compounds, which offer protection against moisture, heat, and vibration, are essential in the production of devices like sensors, circuit boards, and LED lighting. The government’s focus on infrastructure development and the adoption of electric vehicles is further driving the need for potting compounds. India’s expanding renewable energy market, particularly solar energy, is contributing to the demand for potting compounds used in the protection of electrical components.

The potting compound market in France is projected to grow at a CAGR of 4.1% from 2025 to 2035. France’s demand for potting compounds is driven by the growing need for protection and insulation in electronic and electrical devices. The country’s strong aerospace, automotive, and renewable energy sectors require high-performance potting compounds to ensure the longevity and functionality of their products. With increasing government support for the expansion of the renewable energy market, particularly in wind and solar power, the demand for potting compounds used to protect electrical components in these systems is on the rise. France’s focus on sustainability and reducing carbon emissions is driving the adoption of energy-efficient technologies, which in turn boosts the need for protective coatings in various industrial applications.

The UK potting compound market is expected to grow at a CAGR of 3.7% from 2025 to 2035. The demand for potting compounds in the UK is primarily driven by the growth of the electronics and automotive sectors. As the country invests in energy-efficient and electric vehicles, potting compounds are being increasingly used to protect vital components in automotive systems, such as sensors, motors, and circuit boards. The UK government’s commitment to sustainability and reducing carbon emissions is fueling the adoption of renewable energy solutions, creating a rising demand for potting compounds in the wind and solar power industries. The market is also driven by the demand for LED lighting and other energy-efficient electronic products, where potting compounds play a crucial role in ensuring the protection and durability of components.

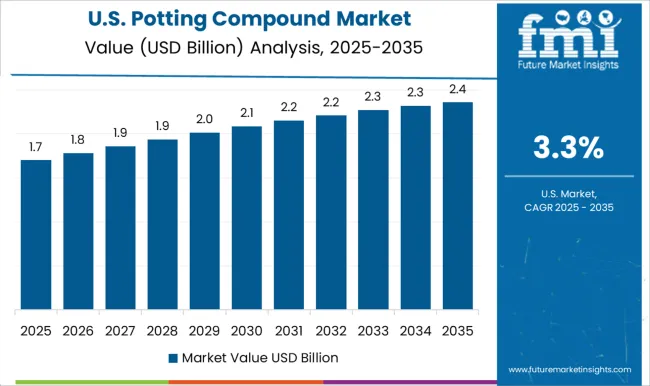

The USA potting compound market is projected to grow at a CAGR of 3.3% from 2025 to 2035. The demand for potting compounds in the USA is mainly driven by the expanding electronics, automotive, and renewable energy sectors. As the USA continues to invest in electric vehicle infrastructure and renewable energy solutions, the need for high-performance potting compounds in electrical components has increased. Potting compounds are essential in protecting sensitive electronic components, such as circuit boards and sensors, from environmental damage, particularly in harsh conditions. The growing adoption of energy-efficient technologies and the need for long-lasting electrical components further contribute to the market growth. The USA market is also supported by strong manufacturing capabilities and a well-established supply chain for potting compounds, ensuring widespread availability and competitive pricing.

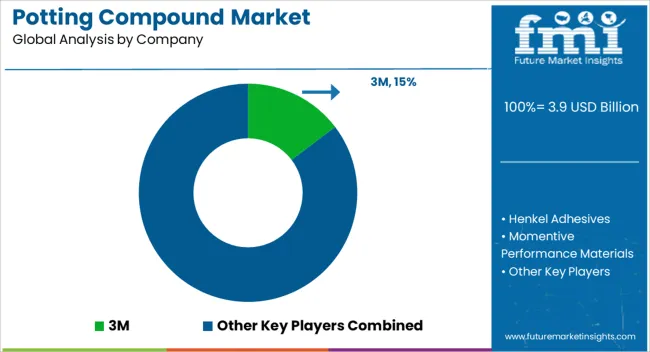

The potting compound market is driven by the increasing demand for protective coatings in the electronics, automotive, and industrial sectors. 3M is a leading player, offering a wide range of potting compounds designed for superior protection against moisture, temperature fluctuations, and mechanical stress. The company emphasizes high-performance products that meet the needs of automotive, aerospace, and electronics industries, with a focus on improving product durability and reliability. Henkel Adhesives competes strongly with its advanced epoxy and silicone-based potting compounds, known for their high thermal stability and resistance to chemicals. Henkel's offerings are tailored to meet the growing demands for automotive and consumer electronics applications.

Momentive Performance Materials is another key player, offering silicone-based potting compounds that provide excellent electrical insulation and protection. Their products are widely used in electronic components, offering improved performance and longevity. ELANTAS provides specialized potting materials that are suitable for a wide range of applications, from automotive to renewable energy, emphasizing electrical insulation and moisture protection. Electrolube offers a variety of potting compounds designed for harsh environments, particularly in automotive, industrial, and electronic applications, with an emphasis on ease of application and robust performance. Dymax focuses on fast-curing potting compounds, particularly for electronics manufacturers, where rapid production times are critical.

Epic Resins specializes in high-performance potting compounds that cater to industries such as aerospace, automotive, and defense, offering products that meet stringent industry standards. CHT Silicones provides silicone-based potting compounds with a focus on temperature stability and flexibility, ideal for high-performance applications. MasterBond and MG Chemicals focus on offering custom solutions for both high-temperature and low-temperature environments, providing a range of formulations for demanding applications.

Smaller companies like AeroMarine Products, Intertronics, RS Components India, XJY Silicones, and EFI Polymers offer niche solutions, catering to regional needs and specialized markets. Product brochures highlight key features such as excellent electrical insulation, chemical resistance, temperature stability, and easy application methods. Competitive strategies focus on providing customizable solutions that meet the specific requirements of diverse industries, improving the reliability and longevity of electronic and industrial components.

| Items | Values |

|---|---|

| Quantitative Units | USD 3.9 billion |

| Type | Epoxy, Polyurethane, Silicone, Polyester, and Other |

| Curing Technique | Room Temperature Curing, UV Curing, and Thermal Curing |

| End-Use Industry | Electronics & Electrical, Automotive Industry, Aerospace, Industrial, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Henkel Adhesives, Momentive Performance Materials, ELANTAS, Electrolube, Dymax, Epic Resins, CHT Silicones, MasterBond, MG Chemicals, AeroMarine Products, Intertronics, RS Components India, XJY Silicones, and EFI Polymers |

| Additional Attributes | Dollar sales by compound type (epoxy, silicone, polyurethane), application (electronics, automotive, medical devices, renewable energy), and curing method (UV-cured, thermal-cured, dual-cured). Demand is driven by the increasing need for protective solutions in high-performance electronics, the growth of the electric vehicle market, and the demand for sustainable, efficient potting solutions. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with increasing industrial automation, electronics manufacturing, and renewable energy projects driving adoption. |

The global potting compound market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the potting compound market is projected to reach USD 5.7 billion by 2035.

The potting compound market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in potting compound market are epoxy, polyurethane, silicone, polyester and other.

In terms of curing technique, room temperature curing segment to command 41.7% share in the potting compound market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compound Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Semiconductor Hall Elements Market Size and Share Forecast Outlook 2025 to 2035

Compounds Market Size and Share Forecast Outlook 2025 to 2035

Compound Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Semiconductor Materials Market Growth - Trends & Forecast 2025 to 2035

Compound Horse Feedstuff Market Analysis by Feed Type, Horse Activity, and Ingredient Composition Through 2035

Compound Feed Market Analysis by Ingredients, Form, Livestock and Region through 2035

Compounded Topical Drugs Market Analysis – Size, Share & Forecast 2024-2034

Compound Semiconductor Market Analysis – Growth & Forecast 2024-2034

Compounding Systems Market

Compounded Bioidentical Hormone Therapy Market

Wire Compounds and Cable Compounds Market Growth - Trends & Forecast 2025 to 2035

Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Lemon Compound Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Orange Compound Market Size and Share Forecast Outlook 2025 to 2035

Lithium Compound Market Forecast Outlook 2025 to 2035

Plastic Compounding Market Size, Growth, and Forecast 2025 to 2035

Purging Compounds Market

Platinum Compounds Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA