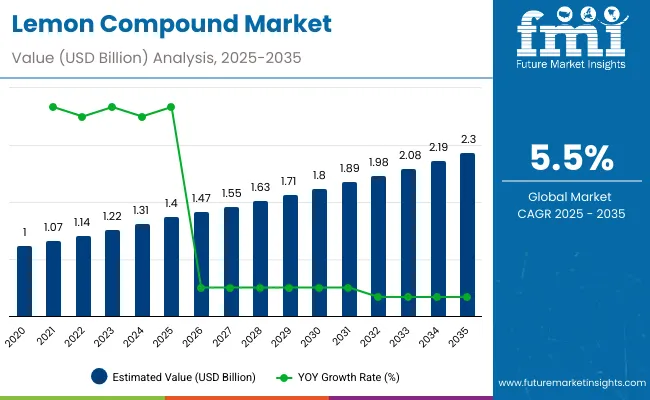

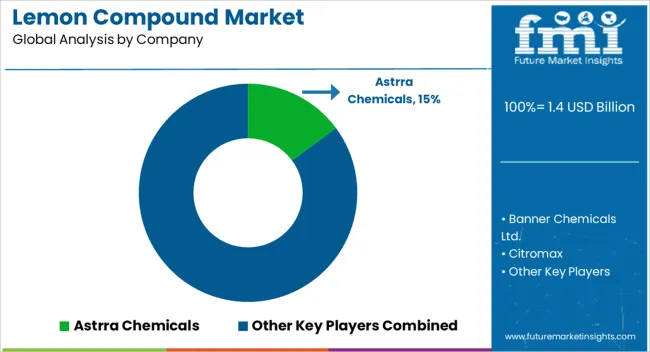

The lemon compound market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Observing the long-term value accumulation curve, the market shows gradual growth from USD 1.4 billion in 2026 to USD 2.2 billion in 2034, before reaching the forecasted value. This steady trajectory highlights the increasing reliance on lemon compounds in flavoring, fragrance, and chemical applications where consistency and performance are critical. In my view, the accumulation curve indicates that manufacturers are steadily expanding capacities and optimizing production processes to meet demand while maintaining quality standards, suggesting a predictable and stable growth environment for stakeholders across multiple sectors. The lemon compound market stood at USD 1.4 billion in 2025 and is anticipated to grow to USD 2.3 billion by 2035, maintaining a CAGR of 5.5%.

The year-on-year increments show a controlled and consistent expansion, with values rising from USD 1.5 billion in 2027 to USD 2.1 billion in 2033. The long-term value accumulation curve suggests that the market is being reinforced by steady adoption in end-use applications, where lemon compounds contribute to product differentiation and consumer appeal. From my perspective, the market’s stable growth emphasizes its strategic significance in flavor and fragrance industries, where predictable supply and consistent quality are prioritized. The trend also indicates that incremental investments in capacity and formulation are enabling the market to steadily strengthen its position over the forecast period.

| Metric | Value |

|---|---|

| Lemon Compound Market Estimated Value in (2025 E) | USD 1.4 billion |

| Lemon Compound Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The lemon compound market has been increasingly positioned as a key segment within several broad parent industries, each demonstrating measurable influence and adoption. Within the food flavors and additives market, lemon compounds account for approximately 6.1%, driven by their use in imparting citrus flavor and enhancing taste profiles across confectionery, bakery, dairy, and savory products. In the beverage ingredients market, the share is estimated at 5.5%, reflecting integration into juices, soft drinks, and functional beverages where consistent flavor delivery and aroma retention are critical.

The cosmetic ingredients market records a share of around 4.2%, with lemon compounds utilized for their fragrance and functional properties in personal care formulations, including skin care and hair care products. Within the fragrance compounds market, the market holds approximately 5.0%, as citrus notes remain highly valued for perfumes, household products, and aromatherapy blends. In the specialty chemicals market, the share stands at about 3.8%, where lemon compounds serve as intermediates in flavor, fragrance, and chemical synthesis processes. Collectively, these segments indicate that the lemon compound market accounts for nearly 24.6% across these parent industries, underlining its strategic relevance in flavor, fragrance, and chemical performance.

Market adoption has been influenced by the demand for natural, high-purity, and consistent compounds that enhance consumer experience and product differentiation. Its presence has been reshaping competitive approaches within parent markets, prompting manufacturers to optimize formulation efficiency, regulatory compliance, and product quality, while positioning lemon compounds as essential ingredients that elevate both functional and sensory performance across multiple applications.

The lemon compound market is gaining strategic relevance across multiple industries, primarily driven by the rising demand for natural ingredients and aromatic additives. Characterized by its bioactive properties and citrus aroma, lemon-derived compounds are widely adopted in flavoring, fragrance, and functional product formulations. Market dynamics are supported by the growing inclination toward clean-label products, especially in food, beverage, and personal care sectors.

With consumers increasingly favoring natural over synthetic ingredients, lemon compounds have become preferred inputs in both edible and non-edible applications. The current market outlook reflects a healthy trajectory, with innovation in extraction technologies enhancing purity and yield. Additionally, the sustainable sourcing of lemon derivatives is aligning well with circular economy goals in agribusiness.

Regulatory endorsements for GRAS (Generally Recognized As Safe) ingredients have further facilitated market penetration. Over the forecast period, the market is expected to register steady expansion, driven by heightened demand from flavor houses, nutraceutical brands, and green cleaning product manufacturers, thereby securing the lemon compound market’s role as a vital category within the global ingredients landscape.

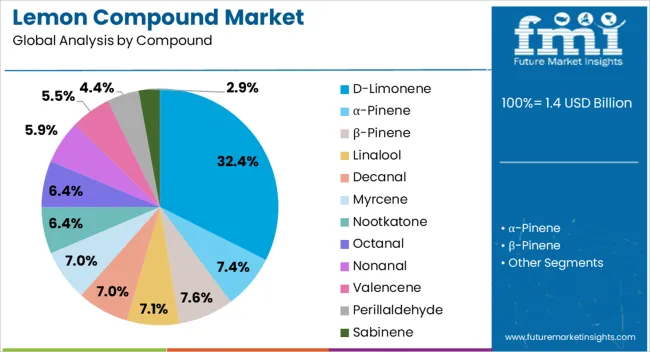

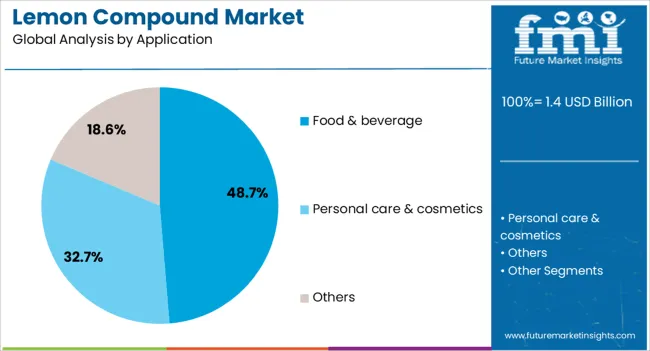

The lemon compound market is segmented by compound, application, and geographic regions. By compound, lemon compound market is divided into D-Limonene, α-Pinene, β-Pinene, Linalool, Decanal, Myrcene, Nootkatone, Octanal, Nonanal, Valencene, Perillaldehyde, and Sabinene. In terms of application, lemon compound market is classified into Food & beverage, Personal care & cosmetics, and Others. Regionally, the lemon compound industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The D-Limonene segment accounts for approximately 32.4% of the lemon compound market and has gained prominence due to its multi-functional characteristics. Widely extracted from citrus rinds, D-Limonene is favored for its solvent properties, distinctive lemon aroma, and compatibility across food, pharmaceutical, and industrial applications. Its segmental leadership is supported by its role as a flavoring agent in consumables and a degreasing component in eco-friendly cleaning solutions.

D-Limonene’s natural origin and bioactive profile align with consumer demand for plant-based, biodegradable ingredients. The segment's expansion is also linked to increased utilization in aromatherapy and personal care, where it serves as a fragrant and stabilizing agent.

Regulatory approval for its use in food and beverage applications has further amplified its uptake, reinforcing its market position. With scalability in production and a broad application range, D-Limonene is expected to maintain a strong share, supported by ongoing demand from both food-grade and technical-grade end users.

The food and beverage segment contributes the highest application share in the lemon compound market, commanding approximately 48.7% of total usage. This leadership stems from the growing reliance on citrus-based compounds as flavor enhancers and natural preservatives across beverage formulations, confectionery, and bakery goods. Lemon compounds are widely employed to deliver freshness, aroma, and acidity that align with consumer expectations for authentic sensory experiences.

The shift toward natural additives in processed and ready-to-eat foods has further accelerated the adoption of lemon-derived ingredients. Additionally, lemon compounds offer functional benefits such as antioxidative properties and digestive support, adding value to health-focused product development.

The segment's growth is further propelled by demand from clean-label and low-sugar beverage categories, where lemon profiles are used to enhance taste without artificial additives.With manufacturers prioritizing natural formulations and regulatory support for citrus compounds in food-grade applications, the food and beverage segment is positioned to maintain its dominant application share in the lemon compound market.

The lemon compound market has been shaped by increasing demand in flavoring, fragrance, and food additive applications. Adoption has been driven by growing consumption in beverages, confectionery, bakery, and personal care products. Opportunities are emerging in natural extracts, clean-label ingredients, and specialty formulations for premium products. Trends are being observed in functional blends, multi-industry applications, and concentrated or encapsulated lemon derivatives, while challenges persist in raw material price volatility, seasonal supply fluctuations, and regulatory compliance. The market outlook remains positive, supported by evolving consumer preferences for authentic and high-quality lemon flavors.

The demand for lemon compounds has been strongly influenced by their extensive use in beverages, bakery items, confectionery, and processed food products. Manufacturers in the food and beverage sector have been observed increasingly relying on lemon compounds to deliver consistent taste, aroma, and consumer-preferred sensory profiles. In opinion, this demand has been reinforced by growing consumer preference for citrus flavors in refreshing drinks, desserts, and ready-to-eat snacks, where authentic or high-quality lemon derivatives are prioritized. Flavor houses and ingredient suppliers have been focusing on solutions that provide stability, long shelf life, and compatibility across diverse matrices. Seasonal consumption patterns, regional taste preferences, and innovative product development have further shaped the demand trajectory. Overall, reliance on lemon compounds is being viewed as essential for maintaining product quality, enhancing sensory appeal, and meeting competitive market expectations.

Opportunities in the lemon compound market have been largely defined by the rising demand for natural extracts, clean-label ingredients, and specialty formulations for premium products. Flavor and fragrance manufacturers have been observed leveraging high-quality lemon derivatives to create distinctive beverages, confectionery, baked goods, and personal care items. In opinion, emerging markets present significant opportunities as disposable incomes rise and consumers increasingly seek authentic, high-intensity citrus flavors. Functional blends, combining lemon compounds with complementary botanical or fruit ingredients, are being explored to enhance sensory appeal and perceived health benefits. Opportunities have also been identified in aromatherapy, cosmetics, and oral care, where lemon derivatives are valued for their refreshing and cleansing properties. Collaborations between ingredient suppliers and product manufacturers are enabling tailored solutions for diverse applications. Overall, the market is expected to benefit from premiumization, evolving flavor trends, and multi-industry adoption.

The lemon compound market has been shaped by trends in functional blends, multi-industry applications, and innovative delivery formats. Manufacturers have been increasingly focusing on formulations that integrate lemon compounds with complementary flavors or active ingredients to enhance taste, aroma, and functional appeal. In opinion, these trends are redefining product development strategies across beverages, confectionery, bakery, and personal care sectors, as consumers seek authentic and versatile flavor experiences. Encapsulation, concentrated extracts, and controlled-release formats have been adopted to improve stability, shelf life, and consistent sensory performance. Additionally, cross-industry applications, including oral care, cosmetics, and aromatherapy, are contributing to growing demand for high-quality lemon compounds. Overall, these trends are expected to influence competitive positioning, product differentiation, and stakeholder investments, highlighting versatility, authenticity, and multi-sensory appeal as central to market growth.

The lemon compound market has faced persistent challenges related to raw material price volatility, seasonal availability, and strict regulatory requirements. Lemon oils and extracts are highly dependent on crop yields, climatic conditions, and regional production patterns, which can create supply inconsistencies and cost fluctuations. In opinion, these challenges have occasionally constrained manufacturers’ ability to maintain stable formulations and pricing. Compliance with flavor and fragrance safety regulations, labeling standards, and quality certifications varies across regions, adding complexity for global distribution. Supply chain dependencies, including transport, storage, and preservation of sensitive compounds, have also affected timely product availability. Addressing these challenges requires strategic sourcing, supplier partnerships, and careful inventory planning. Overcoming these barriers is critical to ensuring product quality, reliable supply, and sustained growth in the lemon compound market.

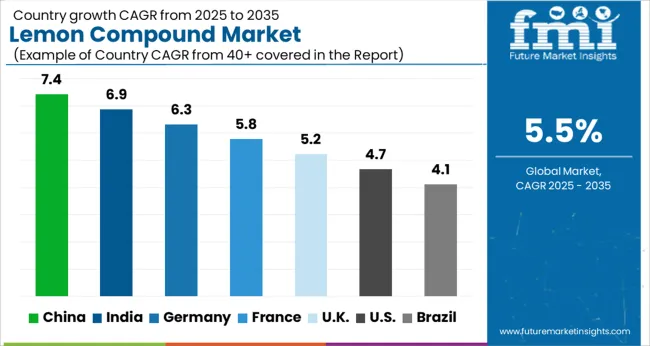

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

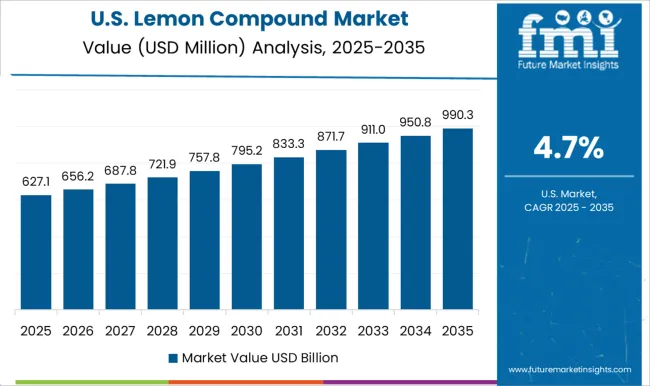

| USA | 4.7% |

| Brazil | 4.1% |

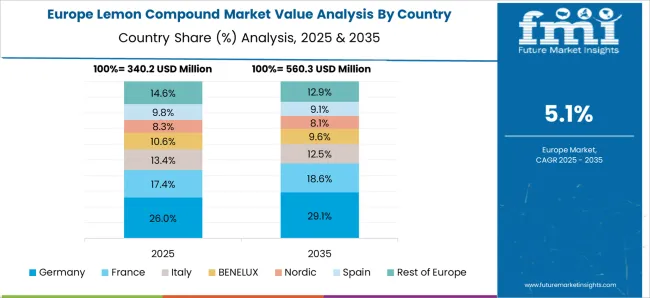

The global lemon compound market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads with 7.4% growth, followed by India at 6.9%, and Germany at 6.3%. The United Kingdom records 5.2%, while the United States shows 4.7% growth. Expansion is being driven by increasing demand for natural flavors in beverages, confectionery, bakery, and processed foods. Emerging markets like China and India witness higher growth due to rising consumption of flavored food and drink products, expanding processed food industries, and increasing retail penetration, while developed markets focus on premium product formulations, flavor innovation, and maintaining consistency and quality in industrial applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The lemon compound market in China is growing at a CAGR of 7.4%, supported by rising demand in beverages, confectionery, and processed food products. Manufacturers are adopting lemon compounds to deliver consistent taste, aroma, and color in various applications. Growth is reinforced by increasing domestic consumption, expanding retail channels, and investments in food processing and flavor manufacturing infrastructure. Adoption is further driven by the rising popularity of ready-to-drink beverages, flavored snacks, and bakery products where lemon compounds enhance sensory appeal and product differentiation.

The lemon compound market in India is advancing at a CAGR of 6.9%, driven by increasing processed food consumption, confectionery production, and beverage sector expansion. Indian manufacturers are integrating lemon compounds to improve flavor profiles, maintain product consistency, and meet rising consumer expectations. Growth is supported by modern retail expansion, packaged food trends, and investments in flavoring technology. Adoption is further fueled by demand for ready-to-eat foods, juices, and bakery items where lemon compounds provide refreshing taste and aroma.

The lemon compound market in Germany is projected to grow at a CAGR of 6.3%, supported by demand from premium confectionery, beverages, and bakery segments. German manufacturers focus on high-quality lemon compounds to meet stringent food safety standards and consumer preferences for natural flavors. Growth is reinforced by research and development initiatives, innovative product formulations, and adoption in industrial-scale production. Demand is particularly strong in beverage and confectionery applications where flavor consistency and aroma are critical.

The lemon compound market in the United Kingdom is expanding at a CAGR of 5.2%, fueled by increasing adoption in beverages, bakery, and confectionery products. Manufacturers are integrating lemon compounds to enhance taste, aroma, and product appeal. Growth is supported by investments in food processing, innovation in flavor blends, and consumer preference for naturally flavored products. Adoption is also driven by demand for flavored snacks, juices, and ready-to-eat bakery items, where lemon compounds provide consistent and appealing sensory experiences.

The lemon compound market in the United States is growing at a CAGR of 4.7%, driven by demand from beverages, confectionery, and bakery applications. USA manufacturers are adopting lemon compounds to deliver consistent flavor and aroma while meeting regulatory standards and consumer expectations. Growth is reinforced by innovation in flavored products, premium beverage launches, and the expansion of packaged foods. While growth is moderate compared to emerging markets, steady adoption is observed across industrial and consumer applications, particularly in bakery, juices, and confectionery segments.

The lemon compound market is being shaped by global flavor houses, specialty chemical producers, and citrus extract experts. Givaudan and Univar Solutions are being positioned as leaders through broad product portfolios, regulatory compliance, and supply chain reliability that ensure consistent availability for multiple applications. Their strategy is being centered on high-purity extracts, reproducible flavor profiles, and multi-industry adoption across beverages, confectionery, and personal care. Astrra Chemicals, Banner Chemicals Ltd., and Citromax are being directed toward cost-effective solutions with strong regional distribution and technical support. Citrus Oleo, DRT, and Ernesto Ventós are being recognized for premium, small-batch extraction processes that emphasize aroma fidelity, stability, and clean-label compliance.

FBC Chemical and Florida Chemical Company are being noted for industrial-scale production, bulk deliveries, and application flexibility. Competition is being defined by purity, consistency, and versatility, while market leadership is reinforced by traceable sourcing, certification adherence, and the ability to meet evolving consumer preferences. Product brochures are being curated as persuasive, compact references to communicate product value. Givaudan and Univar brochures are being structured with flavor maps, application guides, and stability charts to highlight consistent performance. Astrra, Banner Chemicals, and Citromax brochures focus on cost-effective solutions, availability, and technical documentation.

Citrus Oleo, DRT, and Ernesto Ventós brochures emphasize artisanal quality, concentrated aroma, and regulatory compliance. FBC Chemical and Florida Chemical brochures highlight industrial-scale capability, reproducibility, and application versatility. Each brochure is being designed to act as a standalone decision-making tool, combining visuals, concise specifications, and usage recommendations. The presentation ensures lemon compound offerings are communicated with clarity, credibility, and instant appeal for flavorists, formulators, and procurement teams in a competitive landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 billion |

| Compound | D-Limonene, α-Pinene, β-Pinene, Linalool, Decanal, Myrcene, Nootkatone, Octanal, Nonanal, Valencene, Perillaldehyde, and Sabinene |

| Application | Food & beverage, Personal care & cosmetics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Astrra Chemicals, Banner Chemicals Ltd., Citromax, Citrus Oleo, DRT, Ernesto Ventós, FBC Chemical, Florida Chemical Company, Givaudan, and Univar Solutions Inc. |

| Additional Attributes | Dollar sales by product type (liquid, powder, paste) and application (beverages, confectionery, bakery, dairy) are key metrics. Trends include rising demand for natural and flavorful ingredients, growth in processed and ready-to-drink foods, and increasing adoption in flavor and fragrance formulations. Regional adoption, consumer preferences, and technological advancements are driving market growth. |

The global lemon compound market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the lemon compound market is projected to reach USD 2.3 billion by 2035.

The lemon compound market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in lemon compound market are d-limonene, α-pinene, β-pinene, linalool, decanal, myrcene, nootkatone, octanal, nonanal, valencene, perillaldehyde and sabinene.

In terms of application, food & beverage segment to command 48.7% share in the lemon compound market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lemon Juice Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Lemonade Market Size and Share Forecast Outlook 2025 to 2035

Lemongrass Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lemon Balm Extract Market Analysis by Powder, Liquid, and Capsule Forms Through 2025 to 2035

Lemon Salt Market Trends - Citrus-Infused Seasoning Demand 2025 to 2035

Lemon Oil Market Analysis by Form, Application, End Use,Region through 2035

Market Share Breakdown of Lemongrass Oil Manufacturers

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Compound Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Semiconductor Hall Elements Market Size and Share Forecast Outlook 2025 to 2035

Compounds Market Size and Share Forecast Outlook 2025 to 2035

Compound Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Semiconductor Materials Market Growth - Trends & Forecast 2025 to 2035

Compound Horse Feedstuff Market Analysis by Feed Type, Horse Activity, and Ingredient Composition Through 2035

Compound Feed Market Analysis by Ingredients, Form, Livestock and Region through 2035

Compounded Topical Drugs Market Analysis – Size, Share & Forecast 2024-2034

Compound Semiconductor Market Analysis – Growth & Forecast 2024-2034

Compounding Systems Market

Compounded Bioidentical Hormone Therapy Market

Wire Compounds and Cable Compounds Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA