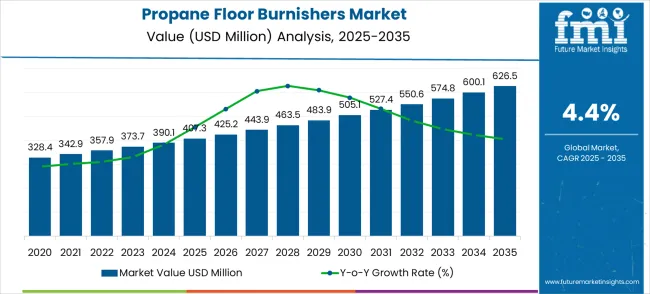

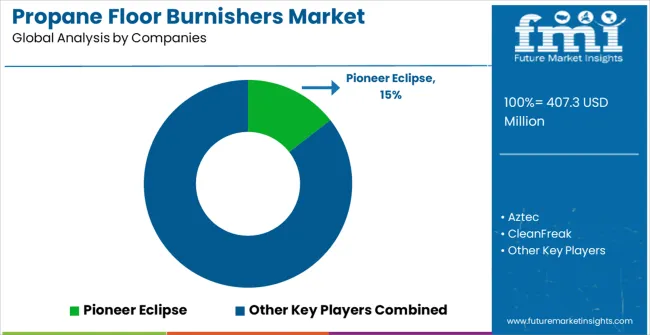

The global propane floor burnishers market is projected to grow from USD 407.3 million in 2025 to approximately USD 626.5 million by 2035, recording an absolute increase of USD 219.2 million over the forecast period. This translates into a total growth of 53.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.54X during the same period, supported by the rising adoption of propane-powered floor care equipment and increasing demand for efficient commercial cleaning solutions.

| Propane Floor Burnishers Market | Value |

|---|---|

| Market Value (2025) | USD 407.3 million |

| Market Forecast Value (2035) | USD 626.5 million |

| Market Forecast CAGR | 4.4% |

Between 2025 and 2030, the propane floor burnishers market is projected to rise from USD 407.3 million to USD 511.2 million, contributing USD 103.9 million, or 47.4% of the decade’s total growth. This phase will be driven by increased adoption of propane-powered cleaning equipment across commercial facilities, heightened demand for high-performance floor maintenance solutions, and growing focus on environmentally friendly cleaning technologies. Manufacturers are expanding product capabilities to meet the complexity of modern facility maintenance needs, including larger floor areas and diverse surface types. Demand clusters are forming in regions with high commercial development and in sectors emphasizing efficiency, mobility, and reliable performance, which positions propane burnishers as a preferred solution over traditional electric alternatives.

From 2030 to 2035, the market is forecast to expand from USD 511.2 million to USD 626.5 million, adding USD 115.3 million, representing 52.6% of total ten-year growth. Growth during this period will be shaped by the introduction of advanced propane engine technologies, improved productivity features, and enhanced emission control systems. Adoption is expected to rise in large commercial and industrial cleaning applications, where demand for more sophisticated and specialized burnisher solutions is increasing. Manufacturers are focusing on innovation to deliver higher efficiency, operational flexibility, and low-emission performance, reinforcing propane burnishers as essential tools for modern facility management operations.

The Propane Floor Burnishers market is entering a new phase of growth, driven by demand for efficient cleaning, commercial facility expansion, and evolving safety and sustainability standards. By 2035, these pathways together can unlock USD 200–250 million in incremental revenue opportunities beyond baseline growth.

Pathway A – Mid-Size Equipment Leadership (21-Inch Burnishers) The 21-inch segment already holds the largest share due to its balance of coverage and maneuverability. Expanding product innovation, ergonomics, and accessory bundles can consolidate leadership. Opportunity pool: USD 60–80 million.

Pathway B – High-Demand Retail Applications (Supermarkets & Malls) Supermarkets account for the majority of demand. Growing retail footprints, especially in emerging economies, will drive higher adoption of propane burnishers for floor appearance management. Opportunity pool: USD 50–70 million.

Pathway C – Facility Management & Outsourced Cleaning Growth Professional cleaning contractors and facility management firms are expanding, especially in urban centers. Burnishers tailored for outsourced cleaning firms (low-maintenance, durable, operator-friendly) can capture significant growth. Opportunity pool: USD 25–40 million.

Pathway D – Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present growing demand due to rising commercial infrastructure. Targeting distribution networks and affordable product lines will accelerate adoption. Opportunity pool: USD 20–30 million.

Pathway E – Eco & Low-Emission Compliance With stricter emission and workplace safety regulations, there is an opportunity to promote low-emission propane engines and hybrid propane-electric innovations. Opportunity pool: USD 15–20 million.

Pathway F – Premium Productivity Features Burnishers with dust-control, noise-reduction, and quick pad-change systems offer premium positioning for healthcare, airports, and 24/7 facilities. Opportunity pool: USD 10–15 million.

Pathway G – Service, Parts & Lifecycle Value Recurring revenue from accessories, propane refueling systems, and aftermarket service contracts creates a long-term revenue stream. Opportunity pool: USD 10–12 million.

Pathway H – Branding & Digital Transparency Digital dashboards, IoT integration, and operator tracking can elevate propane burnishers into “smart cleaning” equipment while strengthening customer trust. Opportunity pool: USD 5–8 million.

Why is the Propane Floor Burnishers Market Growing?

Market expansion is being supported by the rapid increase in commercial facility construction worldwide and the corresponding need for efficient floor maintenance equipment that provides superior cleaning performance and operational mobility. Modern commercial facilities rely on consistent floor appearance and maintenance quality to ensure optimal customer experience including retail environments, office buildings, and industrial facilities. Even minor maintenance inefficiencies can require comprehensive cleaning protocol adjustments to maintain optimal facility standards and operational performance.

The growing complexity of commercial cleaning requirements and increasing demand for high-productivity maintenance solutions are driving demand for propane burnisher equipment from certified manufacturers with appropriate performance capabilities and technical expertise. Facility management companies are increasingly requiring documented evidence of cleaning efficiency and equipment reliability to maintain service quality and cost-effectiveness. Industry specifications and performance standards are establishing standardized floor maintenance procedures that require specialized equipment, technologies, and trained operators.

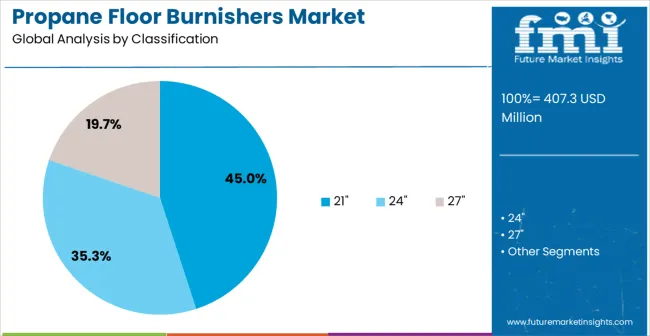

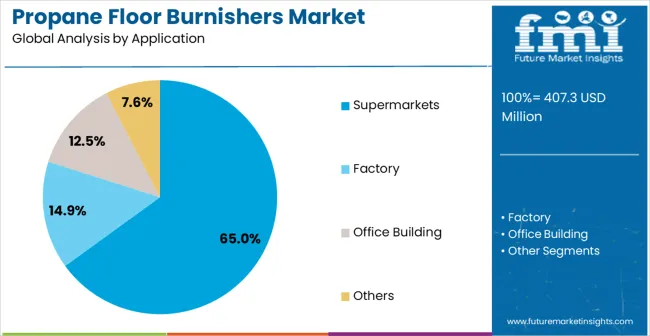

The market is segmented by product size, application, and region. By product size, the market is divided into 21-inch, 24-inch, 27-inch, and others. Based on application, the market is categorized into supermarkets, factory, office building, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

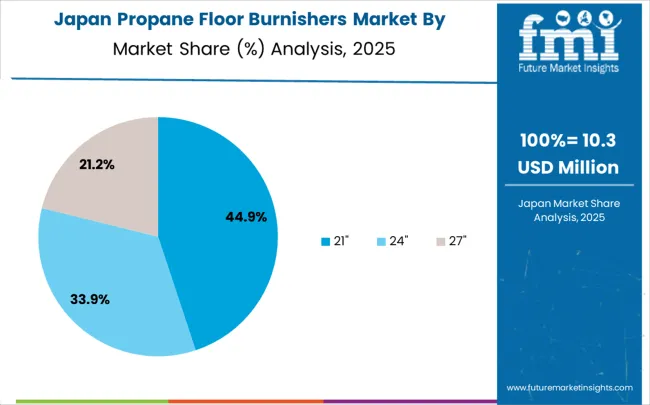

In 2025, 21-inch propane floor burnishers are expected to capture approximately 45% of the market, establishing this size as the leading segment. The dominance is driven by the optimal balance between floor coverage and maneuverability, which suits a wide range of commercial cleaning applications. Mid-size burnishers are particularly favored for their ability to clean efficiently in both expansive open areas and tighter spaces, providing operational flexibility. Facilities such as retail stores, office complexes, educational institutions, and healthcare centers increasingly rely on 21-inch models for routine floor maintenance. Established product lines, comprehensive accessory offerings, and robust aftersales support from manufacturers further strengthen this segment’s market position. The size also benefits from broad regional demand, as it is widely regarded as a practical, versatile solution for varying facility layouts. Its combination of cleaning efficiency, reliability, and user-friendliness ensures continued adoption across commercial cleaning environments.

The supermarket segment is projected to represent 65% of propane floor burnisher demand in 2025, reflecting its leading role in commercial applications. Supermarkets require consistent floor maintenance to ensure both hygiene and visual appeal, as large floor areas are subjected to heavy, continuous foot traffic. Propane burnishers provide high-gloss finishes quickly and reliably, even during active store hours, meeting stringent cleanliness and aesthetic standards. Market expansion and growing focus on store presentation further fuel demand, while competition among retailers incentivizes investment in efficient cleaning equipment. The segment benefits from organized retail growth, where operational efficiency and customer experience are prioritized. By delivering consistent performance, speed, and ease of use, propane floor burnishers become essential tools in supermarket maintenance strategies. Ongoing technological improvements and ergonomically designed equipment continue to reinforce this segment’s dominant position.

The Propane Floor Burnishers market is advancing steadily due to increasing commercial facility development and growing recognition of propane-powered equipment advantages over electric alternatives. However, the market faces challenges including higher initial equipment costs compared to electric models, need for proper ventilation systems in indoor applications, and varying emissions regulations across different geographic regions. Performance optimization efforts and technology advancement programs continue to influence equipment development and market adoption patterns.

The growing development of advanced propane engine systems is enabling higher performance output with improved fuel efficiency and reduced emissions characteristics. Enhanced engine technologies and optimized combustion systems provide superior cleaning performance while maintaining environmental compliance requirements. These technologies are particularly valuable for large facility operators who require reliable equipment performance that can support extensive cleaning operations with consistent results.

Modern propane floor burnisher manufacturers are incorporating advanced performance features and ergonomic design improvements that enhance operator efficiency and equipment effectiveness. Integration of advanced pad pressure systems and optimized weight distribution enables superior cleaning results and comprehensive floor maintenance capabilities. Advanced equipment features support operation in diverse facility environments while meeting various performance requirements and operational specifications.

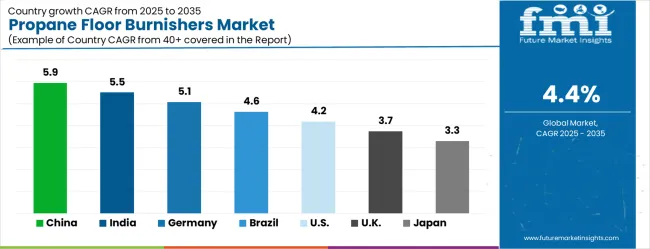

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| Brazil | 4.6% |

| United States | 4.2% |

| United Kingdom | 3.7% |

| Japan | 3.3% |

The propane floor burnishers market is growing rapidly, with China leading at a 5.9% CAGR through 2035, driven by strong commercial facility development and increasing adoption of professional cleaning equipment. India follows at 5.5%, supported by rising retail infrastructure development and growing awareness of advanced floor maintenance solutions. Germany grows steadily at 5.1%, integrating propane technology into its established commercial cleaning infrastructure. Brazil records a 4.6% increase, emphasizing facility management modernization and equipment upgrade initiatives. The United States is showing solid growth at 4.2%, with a focus on performance enhancement and operational efficiency. The United Kingdom demonstrates steady progress at 3.7%, maintaining established commercial cleaning applications. Japan records 3.3% growth, concentrating on technology advancement and quality optimization.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from propane floor burnishers in China is projected to exhibit the highest growth rate with a CAGR of 5.9% through 2035, driven by rapid expansion of commercial retail infrastructure and increasing demand for professional-grade cleaning equipment. The country’s growing retail sector and expanding commercial facility construction are creating significant demand for efficient floor maintenance solutions. Major equipment manufacturers are establishing comprehensive distribution networks to support the increasing requirements of retail operators and facility management companies across urban markets. Government infrastructure development initiatives are promoting modern retail facilities and commercial complexes, facilitating adoption of propane-powered maintenance equipment that enhances operational efficiency and cleaning quality standards throughout major metropolitan areas.

Revenue from propane floor burnishers in India is expanding at a CAGR of 5.5%, supported by increasing retail sector development and growing awareness of professional cleaning equipment benefits. The country’s expanding commercial infrastructure and rising facility management standards are driving demand for advanced floor maintenance solutions. Shopping centers and commercial facilities are gradually implementing professional-grade cleaning equipment to maintain appearance standards and operational efficiency. Commercial sector growth and retail infrastructure development are creating opportunities for equipment suppliers that can support diverse facility requirements and operational specifications. Professional training and service programs are building technical expertise among facility operators, enabling effective utilization of propane burnisher technology that meets commercial cleaning standards.

Demand for propane floor burnishers in Germany is projected to grow at a CAGR of 5.1%, supported by the country’s emphasis on commercial facility quality standards and professional cleaning technology adoption. German facility management companies are implementing advanced propane burnisher systems that meet stringent performance requirements and operational specifications. The market is characterized by focus on equipment reliability, operational efficiency, and compliance with comprehensive facility maintenance standards. Commercial cleaning industry investments prioritize advanced propane technology demonstrating superior performance while meeting German quality and operational standards. Professional certification programs ensure comprehensive technical expertise among equipment operators, enabling specialized floor maintenance capabilities that support diverse commercial applications and facility requirements.

Revenue from propane floor burnishers in Brazil is growing at a CAGR of 4.6%, driven by increasing commercial facility development and growing recognition of advanced cleaning equipment advantages. The country’s expanding retail sector is gradually integrating professional-grade floor maintenance equipment to enhance facility appearance and operational efficiency. Commercial facilities and shopping centers are investing in propane burnisher technology to address evolving customer expectations and maintenance standards. Facility management modernization facilitates adoption of advanced cleaning technologies supporting comprehensive floor maintenance capabilities across commercial and retail regions. Professional development programs enhance technical capabilities among facility operators, enabling effective propane burnisher utilization that meets evolving commercial standards and operational requirements.

Demand for propane floor burnishers in the USA is expanding at a CAGR of 4.2%, driven by established commercial cleaning industries and growing emphasis on operational efficiency enhancement. Large facility management companies and cleaning service providers are implementing comprehensive propane burnisher capabilities to serve diverse commercial requirements. The market benefits from established equipment distribution networks and professional training programs supporting various commercial cleaning applications. Commercial cleaning industry leadership enables standardized equipment utilization across multiple facility types, providing consistent maintenance quality and comprehensive operational coverage. Professional development and certification programs build specialized technical expertise among equipment operators, ensuring effective propane burnisher utilization that supports evolving commercial facility requirements.

Demand for propane floor burnishers in the UK is projected to grow at a CAGR of 3.7%, supported by established commercial sectors and growing emphasis on professional cleaning capabilities. British facility management companies and cleaning service providers are implementing propane burnisher equipment that meets industry quality standards and operational requirements. The market benefits from established commercial infrastructure and comprehensive training programs for cleaning professionals. Commercial facility investments prioritize advanced cleaning equipment supporting diverse maintenance applications while maintaining quality and operational standards. Professional development programs are building technical expertise among cleaning personnel, enabling specialized propane burnisher operation capabilities that meet evolving facility requirements and performance expectations.

Revenue from propane floor burnishers in Japan is growing at a CAGR of 3.3%, driven by the country’s focus on cleaning technology innovation and quality enhancement applications. Japanese facility management companies are implementing advanced propane burnisher systems demonstrating superior performance, reliability, and operational efficiency. The market is characterized by emphasis on technological excellence, quality assurance, and integration with established facility maintenance workflows. Technology investments prioritize innovative cleaning solutions combining advanced propane technology with precision engineering while maintaining Japanese quality and reliability standards. Professional development programs ensure comprehensive technical expertise among equipment operators, enabling specialized floor maintenance capabilities that support diverse commercial applications and facility requirements.

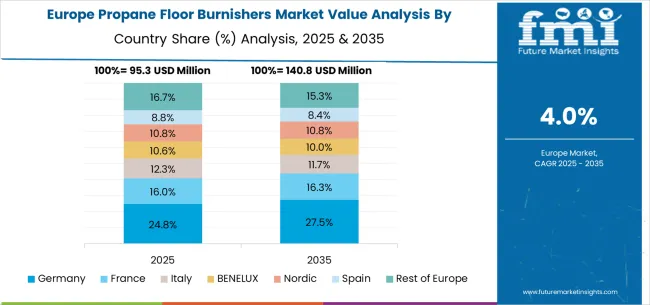

The propane floor burnishers market in Europe is forecast to expand from USD 112.5 million in 2025 to USD 172.3 million by 2035, registering a CAGR of 4.3%. Germany will remain the largest market, holding 23.0% share in 2025, easing to 22.5% by 2035, supported by strong retail infrastructure and advanced facility management. The United Kingdom follows, rising from 18.5% in 2025 to 19.0% by 2035, driven by supermarkets and outsourced cleaning firms. France is expected to decline slightly from 15.0% to 14.6%, reflecting environmental compliance pressures. Italy maintains stability at around 12.0%, supported by supermarkets and shopping centers, while Spain grows from 10.5% to 11.0% with expanding retail and industrial cleaning demand. BENELUX markets ease from 6.0% to 5.9%, while the remainder of Europe hovers near 15.0%–15.2%, balancing emerging Eastern European growth against mature Nordic markets.

The propane floor burnishers market is defined by competition among specialized equipment manufacturers, commercial cleaning companies, and facility maintenance solution providers. Companies are investing in advanced propane engine development, equipment performance optimization, ergonomic design improvements, and comprehensive service capabilities to deliver reliable, efficient, and cost-effective floor maintenance solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

Pioneer Eclipse offers comprehensive propane burnisher solutions with established manufacturing expertise and professional-grade equipment capabilities. Aztec provides specialized floor maintenance equipment with focus on performance reliability and operational efficiency. CleanFreak delivers cost-effective cleaning solutions with emphasis on accessibility and user-friendly operation. IPC Eagle specializes in commercial cleaning equipment with advanced propane technology integration.

Onyx offers professional-grade burnisher equipment with comprehensive service support capabilities. Tennant delivers established commercial cleaning solutions with advanced propane engine technologies. Tornado provides specialized floor maintenance equipment with focus on performance optimization. Nilfisk, Kärcher, Jon-Don, CPS, Betco, HAWK, DiamaPro, and Saturn offer specialized manufacturing expertise, equipment reliability, and comprehensive product development across global and regional market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 407.3 million |

| Product Size | 21-inch, 24-inch, and 27-inch |

| Application | Supermarkets, Factory, Office Building, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Pioneer Eclipse, Aztec, CleanFreak, IPC Eagle, Onyx, Tennant, Tornado, Nilfisk, Kärcher, Jon-Don, CPS, Betco, HAWK, DiamaPro, Saturn |

| Additional Attributes | Dollar sales by product size and application segment, regional demand trends across major markets, competitive landscape with established equipment manufacturers and emerging technology providers, customer preferences for different burnisher sizes and power options, integration with commercial facility management systems and cleaning protocols, innovations in propane engine efficiency and emission control technologies, and adoption of ergonomic design features with enhanced performance capabilities for improved operational workflows. |

The global propane floor burnishers market is estimated to be valued at USD 407.3 million in 2025.

The market size for the propane floor burnishers market is projected to reach USD 626.5 million by 2035.

The propane floor burnishers market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in propane floor burnishers market are 21", 24" and 27".

In terms of application, supermarkets segment to command 65.0% share in the propane floor burnishers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Propane-1,2-Diol Esters of Fatty Acid Market Analysis by Toppings, Processed Meat, Confectionery, Soft and Fizzy Drinks and others Through 2035

Octofluoropropane Market

Floor Screed Market Size and Share Forecast Outlook 2025 to 2035

Floor Standing Filtered Bottle Filling Stations Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Floor Transition Strips Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Floor Scales Market Size and Share Forecast Outlook 2025 to 2035

Floor Lamp Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Floor Marking Tape Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Flooring Market Size and Share Forecast Outlook 2025 to 2035

Floor Displays Market Growth from 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Floor Grinding Machine Market

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Gas Floor Fryers Market

Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Air Distribution Systems Market

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA