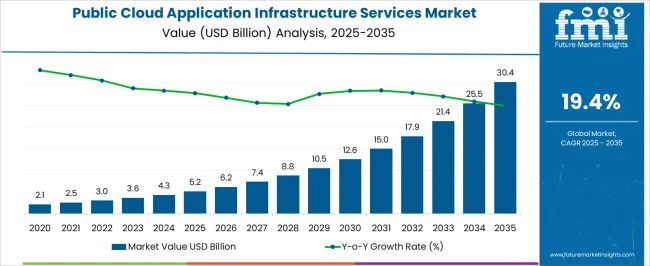

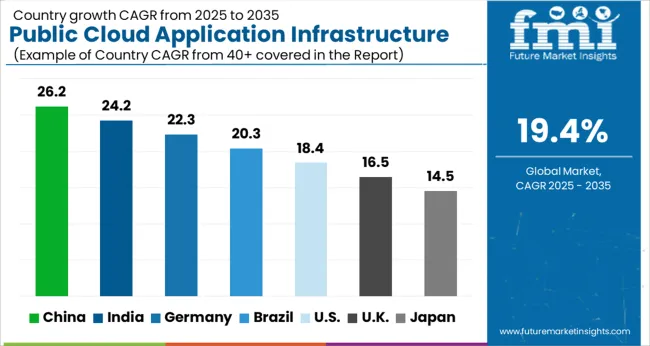

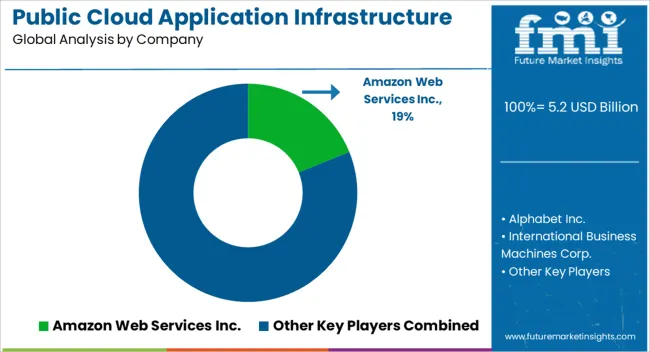

The Public Cloud Application Infrastructure Services Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 30.4 billion by 2035, registering a compound annual growth rate (CAGR) of 19.4% over the forecast period.

| Metric | Value |

|---|---|

| Public Cloud Application Infrastructure Services Market Estimated Value in (2025 E) | USD 5.2 billion |

| Public Cloud Application Infrastructure Services Market Forecast Value in (2035 F) | USD 30.4 billion |

| Forecast CAGR (2025 to 2035) | 19.4% |

The public cloud application infrastructure services market is advancing steadily, supported by widespread digital transformation, rising enterprise adoption of cloud-native architectures, and the need for scalable and cost-efficient IT infrastructure. Current dynamics are being shaped by accelerated demand for application modernization, microservices, and container-based environments, which are fueling reliance on cloud platforms for deployment and operations. Service providers are focusing on enhancing automation, integration, and security to meet enterprise-grade requirements.

The future outlook is reinforced by expanding use cases in artificial intelligence, big data, and real-time analytics, which require robust cloud application infrastructures. Growth rationale is further supported by regulatory shifts encouraging data localization, expansion of 5G networks, and the ongoing migration of mission-critical workloads to the cloud.

Competitive differentiation is being driven by innovation in multi-cloud and hybrid cloud frameworks, while strong enterprise adoption signals consistent revenue expansion Collectively, these factors ensure a stable trajectory of growth for the market across regions and verticals.

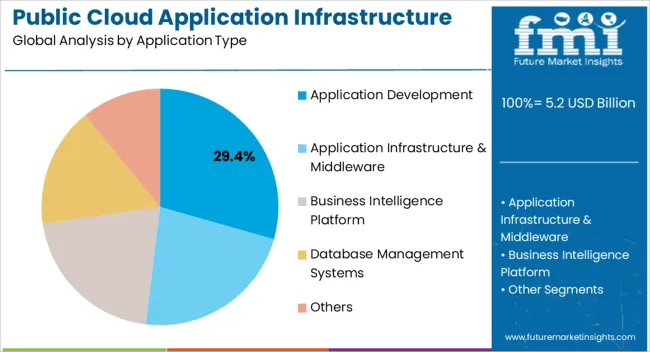

The application development segment, accounting for 29.4% of the application type category, is leading due to its central role in enabling enterprises to design, build, and deploy cloud-native applications efficiently. Adoption has been reinforced by demand for faster time-to-market, continuous integration and deployment, and agile methodologies.

The scalability and flexibility offered by public cloud infrastructure have ensured its sustained use across industries. Enhanced developer tools, pre-configured frameworks, and integrated security features are strengthening market confidence.

Growth is further supported by the increasing alignment of application development with digital business models and customer engagement strategies The segment’s market share is expected to remain strong as enterprises expand modernization initiatives and embrace low-code and no-code platforms to accelerate innovation and reduce development costs.

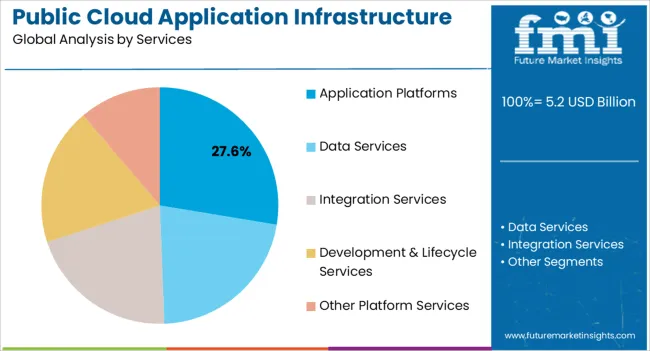

The application platforms segment, representing 27.6% of the services category, has been maintaining a leading position due to its ability to provide a comprehensive environment for running, managing, and scaling applications. Its share is being driven by the demand for middleware, runtime environments, and integration frameworks that streamline development processes.

Enterprise reliance on application platforms has increased with the growing complexity of hybrid and multi-cloud ecosystems. The segment’s growth is being reinforced by continuous enhancements in performance, availability, and security compliance.

As more enterprises migrate core business processes to cloud-native infrastructures, application platforms are serving as critical enablers of operational resilience and innovation This segment is expected to sustain its growth trajectory as advanced features such as AI-driven orchestration and cross-platform compatibility become more integral to enterprise IT strategies.

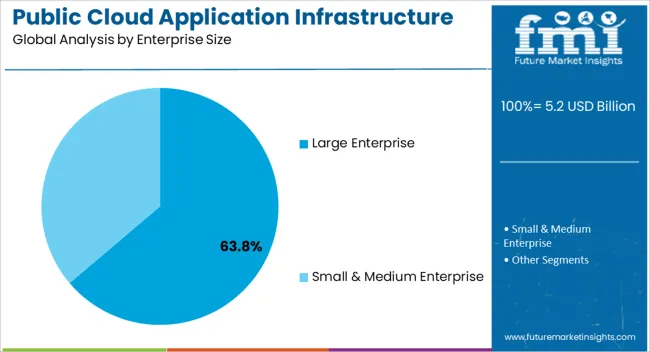

The large enterprise segment, holding 63.8% of the enterprise size category, dominates the market as these organizations are at the forefront of cloud adoption due to their scale, budget flexibility, and complex IT requirements. Market leadership is being reinforced by large-scale investments in cloud infrastructure to support digital transformation, data analytics, and global operations.

The segment’s growth is also supported by the need for robust governance, security, and compliance frameworks, which public cloud providers are increasingly able to deliver. Strategic partnerships between hyperscalers and large enterprises are enabling tailored solutions that enhance efficiency and agility.

With the rising importance of data-driven decision-making and customer-centric operations, large enterprises are expected to sustain their high share Continued focus on hybrid deployment models, cost optimization, and global scalability will ensure strong growth momentum within this segment.

From 2020 to 2025, the public cloud application infrastructure services market witnessed remarkable growth and transformation. The market experienced explosive growth, driven by increasing digitization, remote work trends, and the need for scalable, cost effective cloud solutions. Amazon Web Services, Microsoft Azure, Google Cloud, and IBM maintained their dominance, expanding services and global data center networks.

Data breaches and cybersecurity threats prompted heightened security investments, leading to the development of robust cloud native security solutions. Integrating AI and automation into cloud services gained traction, enabling businesses to optimize operations and gain valuable insights. Cloud providers adopted greener practices, investing in renewable energy sources and more energy efficient data centers.

The market is projected to maintain robust growth, surpassing the USD 22,527.80 million mark by 2035, as businesses rely more heavily on cloud infrastructure. Edge computing is expected to become a standard, as real time data processing becomes critical for applications like IoT and autonomous vehicles. With cloud services offering advanced AI and machine learning capabilities for diverse applications, AI will play an even more substantial role.

Cloud providers will develop tailor made solutions for various industries, offering specialized services and compliance features. Data center expansion will continue worldwide, focusing on emerging markets and regions with growing demand for cloud services. The future of the public cloud application infrastructure services market promises to be even more dynamic, transformative, and integral to global digital infrastructure.

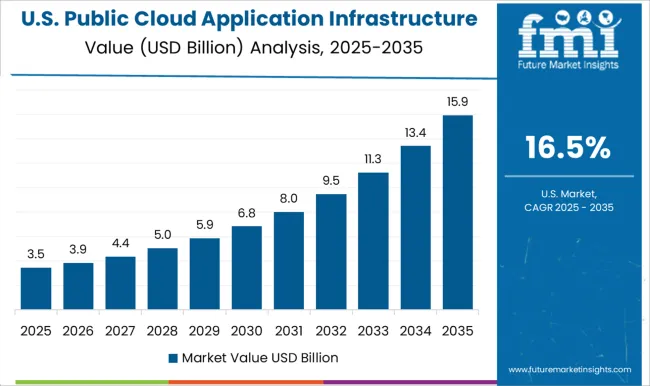

The United States public cloud application infrastructure services market stands at the forefront of global cloud technology adoption and innovation. As a digital economy powerhouse, the United States market is a dynamic, ever expanding ecosystem characterized by relentless innovation, wide scale adoption, and fierce competition among leading cloud service providers.

The key drivers of this market include the vast pool of enterprises across industries leveraging cloud services for scalability, agility, and cost efficiency. Prominent cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, continue to invest heavily in the United States, offering a vast array of services, from infrastructure as a service (IaaS) to platform as a service (PaaS) and software as a service (SaaS).

The United States market also drives technological advancements, with a strong focus on AI, IoT, and machine learning integrated into cloud offerings. Challenges like data security, compliance, and vendor lock in are addressed with constant innovation and a robust regulatory environment.

As the epicenter of cloud technology, the United States public cloud application infrastructure services market remains a global trailblazer, defining the future of cloud based business solutions and shaping the digital landscape for businesses worldwide.

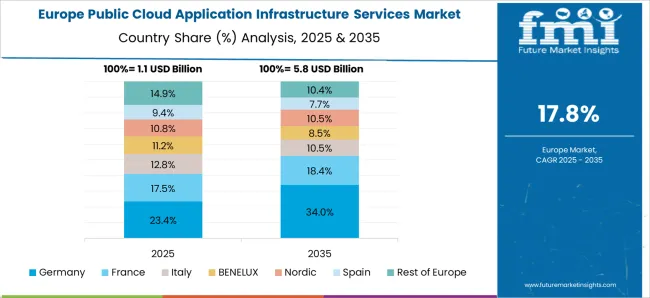

Germany public cloud application infrastructure services market is a robust and thriving ecosystem, deeply entrenched in the heart of Europe. Renowned for its strong industrial base and commitment to technology, Germany cloud services sector is a powerhouse, marked by innovation, security, and reliability.

A key driver for this market is the advanced industrial landscape of the country, which is increasingly relying on cloud solutions for digital transformation, data management, and automation. Leading global cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have established a significant presence, offering tailored solutions for diverse industries, including automotive, manufacturing, finance, and healthcare.

Germany stringent data privacy laws, epitomized by the GDPR (General Data Protection Regulation), have created a strong emphasis on data security and compliance. This, in turn, fuels the demand for secure and compliant cloud services. Germany public cloud application infrastructure services market represents a dynamic fusion of innovation, traditional craftsmanship, and digital excellence, making it a pivotal player in the European cloud landscape and a pivotal force in shaping the future of industry and technology.

China public cloud application infrastructure services market is a unique and rapidly evolving landscape that reflects burgeoning technological prowess of the country and its vast market potential. As the world most populous nation and a global economic giant, the cloud computing sector in China is experiencing explosive growth.

Numerous factors are propelling this market forward, including push from the government for digital transformation, the surge in ecommerce, and a flourishing startup ecosystem. Prominent cloud providers like Alibaba Cloud, Tencent Cloud, and Huawei Cloud are actively expanding their infrastructure and service offerings, while international players like AWS and Microsoft Azure are also tapping into this lucrative market.

With a focus on cost efficiency, scalability, and innovative applications, cloud services are transforming industries like ecommerce, finance, healthcare, and manufacturing in China. Data privacy and cybersecurity challenges drive the demand for secure and compliant cloud solutions.

China public cloud application infrastructure services market stands as a testament to China technological ambitions, offering both domestic and global players ample opportunities in this dynamic landscape. It continues to drive digital transformation in one of the world's most influential markets.

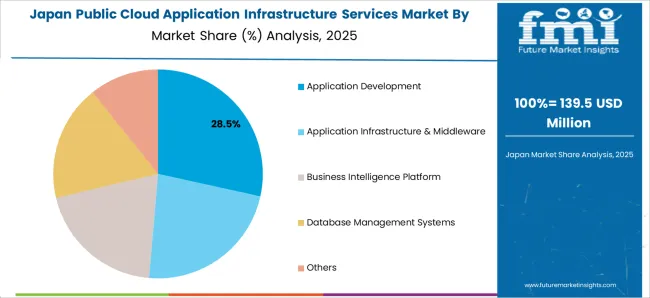

Japan public cloud application infrastructure services market presents a captivating landscape at the intersection of tradition and innovation. A culture of technological excellence and a growing embrace of cloud solutions drive this dynamic market across industries.

Japan large and diverse corporate sector, including manufacturing, finance, and healthcare, is increasingly migrating to the cloud. This transition fosters operational efficiency, scalability, and cost effectiveness, particularly in application development, data storage, and infrastructure management.

Leading global cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have established a significant presence in Japan, offering services tailored to the market in Japan. The commitment of Japan to data security and privacy is also a driving force. The government's efforts to establish robust regulatory frameworks ensure data protection and compliance, further accelerating cloud adoption.

While a mix of global and domestic providers marks the market, Japan public cloud application infrastructure services market is poised for continued growth, offering a blend of traditional values and cutting edge technology in a rapidly evolving landscape.

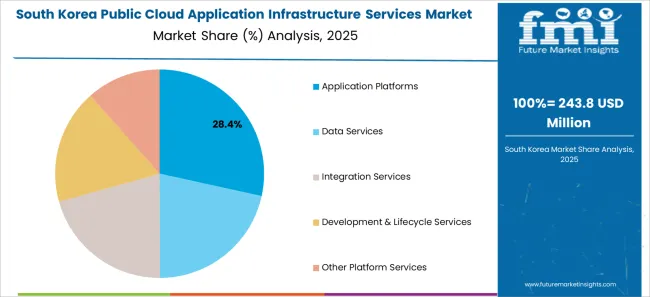

The South Korea public cloud application infrastructure services market is experiencing remarkable growth, reflecting the technological prowess of the country and its strong emphasis on digital transformation. South Korea strategic geographical location, robust internet infrastructure, and tech-savvy population position it as a vibrant market for cloud services.

Key factors driving this market expansion include the increasing adoption of cloud based solutions by various industries, including finance, healthcare, and manufacturing. These industries leverage cloud services for data storage, application development, and scalable infrastructure, driving operational efficiency and innovation.

Prominent players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are actively investing in South Korea, establishing data centers and expanding their services to meet the growing demand. Local providers like SK Telecom and KT Corporation vigorously compete, creating a dynamic marketplace.

Challenges, such as data privacy and compliance, are being addressed, and the government is fostering a conducive environment for cloud adoption through regulations and incentives. In a country known for its innovation and tech-savvy culture, the South Korea public cloud application infrastructure services market continues to flourish, promising a future marked by technological advancements and economic growth.

| Category | Market Share |

|---|---|

| Application Development | 34.3% |

| Data Services | 32.3% |

In the ever evolving public cloud application infrastructure services market, the application development segment emerges as the reigning champion. With digital transformation at the forefront, businesses worldwide are investing heavily in crafting innovative applications to cater to the evolving demands of their customers.

This surge in application development fuels the demand for cloud based services, providing developers with scalable and cost efficient infrastructure. Leading cloud providers like AWS, Azure, and Google Cloud continually enhance their developer tools and services, making the application development segment the epicenter of growth and transformation in the cloud ecosystem, ultimately propelling it to market dominance.

The data services segment is poised to dominate the public cloud application infrastructure services market. With the exponential data growth, businesses increasingly rely on cloud-based solutions for storage, processing, and analysis. This surge in demand for data centric services, including databases, data warehousing, and analytics tools, positions data services as the linchpin of cloud infrastructure.

Cloud providers continually enhance their data offerings, driving innovation in the sector. As data underpins critical decision making and insights, the data services segment is primed to play a pivotal role in shaping the future of cloud infrastructure, making it the frontrunner in the market.

The competitive landscape of the public cloud application infrastructure services market is dynamic and fiercely contested. Dominated by prominent players like Amazon Web Services AWS, Microsoft Azure, and Google Cloud, the market is marked by intense rivalry as these tech giants constantly expand their service offerings and geographic reach.

Niche players and emerging startups contribute to the competition by offering specialized solutions. The key drivers include innovation, performance, scalability, and customer service, with companies vying to meet the diverse needs of businesses across industries. As businesses increasingly migrate to the cloud, the competitive landscape is expected to evolve, creating further opportunities for innovation and growth.

Product Portfolio

Oracle’s portfolio comprises cloud infrastructure, database management, enterprise software, and industry-specific applications. With a strong emphasis on cloud based solutions and data management, Oracle assists organizations in driving digital transformation and efficiency.

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 5.2 billion |

| Projected Market Valuation in 2035 | USD 30.4 billion |

| Value-based CAGR 2025 to 2035 | 19.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Application Type, Services, Enterprise Size, Verticals, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Amazon Web Services Inc.; Alphabet Inc.; International Business Machines Corp.; Microsoft Corporation; Oracle Corp.; ServiceNow Inc.; Salesforce.com Inc.; VMware Inc.; NetSuite Inc.; Red Hat Inc. |

The global public cloud application infrastructure services market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the public cloud application infrastructure services market is projected to reach USD 30.4 billion by 2035.

The public cloud application infrastructure services market is expected to grow at a 19.4% CAGR between 2025 and 2035.

The key product types in public cloud application infrastructure services market are application development, application infrastructure & middleware, business intelligence platform, database management systems and others.

In terms of services, application platforms segment to command 27.6% share in the public cloud application infrastructure services market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA