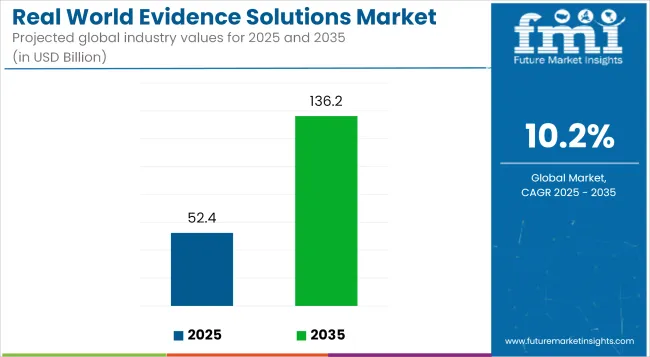

The global real world evidence (RWE) solutions market is projected to grow from USD 52.4 billion in 2025 to USD 136.2 billion by 2035, advancing at a solid compound annual growth rate (CAGR) of 10.2% over the forecast period. This growth is being driven by increasing demand for data-backed decision-making in healthcare, accelerated drug development, value-based care models, and evolving regulatory expectations across pharmaceutical, biotechnology, and medical device sectors.

| Attributes | Details |

|---|---|

| Real World Evidence Solutions Market Size (2025) | USD 52.4 billion |

| Real World Evidence Solutions Market Size (2035) | USD 136.2 billion |

| Real World Evidence Solutions Market CAGR (2025 to 2035) | 10.2% |

RWE solutions involve the use of real-world data (RWD) such as electronic health records (EHRs), insurance claims, patient registries, and mobile health data to generate actionable insights on the safety, effectiveness, and value of treatments outside of clinical trials. With growing pressure to demonstrate cost-effectiveness and patient outcomes, life sciences companies are turning to RWE to guide research and commercialization strategies. Governments and payers are also relying on RWE to inform coverage, reimbursement, and policy decisions.

The pharmaceutical industry is one of the biggest beneficiaries of RWE, using it to support regulatory submissions, post-marketing surveillance, label expansions, and comparative effectiveness studies. RWE also plays a pivotal role in rare disease research, oncology, and chronic disease management-areas where traditional randomized controlled trials may be limited or impractical.

The expansion of AI and machine learning tools is enhancing the capabilities of RWE platforms by enabling more sophisticated data analysis, patient stratification, and predictive modeling. Integration of wearable technology and patient-reported outcomes is also making RWE more dynamic and patient-centric.

In an interview with Fierce Biotech in March 2023, Amitabh Chandra, Director of Health Policy Research at Harvard Kennedy School, noted, “Real world evidence is no longer a secondary tool-it’s becoming foundational to how we design and evaluate health interventions.

The shift is not just scientific, it's strategic.” This quote underscores the central role RWE is playing in transforming how health systems, regulators, and drug developers approach innovation and accountability. As data infrastructure improves and global healthcare systems pivot toward outcomes-based models, RWE solutions are poised to become indispensable tools for future-ready healthcare.

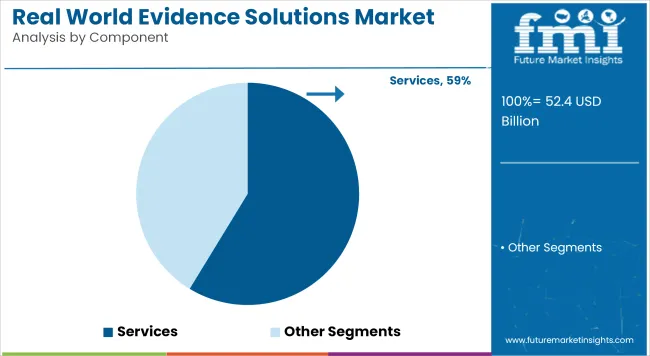

The Real World Evidence (RWE) solutions market is projected to grow from USD 52.4 billion in 2025 to USD 136.2 billion by 2035, at a CAGR of 10.2%. Services dominate with a 58.7% market share, while clinical data contributes 46.3%, and drug development & approvals make up 49.5%, driven by data-driven healthcare strategies.

Services in the Real World Evidence (RWE) solutions market will account for a dominant 58.7% share by 2025. This segment includes services that analyze data from real-world settings, such as healthcare data from hospitals, clinics, patient registries, and insurance claims. These services play a critical role in understanding the effectiveness and safety of drugs and treatments outside of clinical trials, which is crucial for market access, reimbursement decisions, and regulatory approvals.

The rise of data-driven healthcare and personalized medicine is a significant driver of the services segment's growth. Real world evidence helps pharmaceutical companies, medical device manufacturers, and healthcare providers make informed decisions by offering insights into treatment patterns, outcomes, and patient experiences.

Additionally, healthcare providers are increasingly relying on these services to improve patient care, streamline processes, and reduce costs. The integration of advanced technologies like AI, machine learning, and data analytics has further enhanced the services offered in this market, making it an essential component for healthcare organizations looking to optimize operations and enhance patient outcomes.

Clinical data holds a substantial 46.3% share in the Real World Evidence solutions market, playing a pivotal role in providing insights into patient outcomes and healthcare practices. This data is gathered from various real-world settings, including electronic health records (EHR), patient registries, insurance claims, and more, offering an in-depth understanding of treatment effectiveness and the patient journey. Pharmaceutical and biopharmaceutical companies rely on clinical data to assess the post-market safety and efficacy of their products, as well as for conducting comparative effectiveness research.

As healthcare evolves toward more personalized treatments, clinical data becomes essential in identifying the optimal therapies for individual patients, monitoring drug effectiveness, and evaluating the safety of newly approved drugs. The increasing demand for data transparency, real-time health data, and outcomes-driven insights has propelled the growth of clinical data in the RWE space.

Companies in the pharmaceutical and medical device industries are focusing more on leveraging this data to make strategic decisions related to product development, regulatory approvals, and marketing strategies. Additionally, the push for value-based healthcare and outcomes-based reimbursement models further strengthens the need for robust, real-world clinical data.

The rise in chronic illness incidence, the switch from volume to value-based care, the expanding focus on personalized healthcare and the growing geriatric population are projected to drive the growth of the Real World Evidence Solutions Market. Regulatory bodies' encouragement for the use of Real-world evidence (RWE) solutions is expected to drive industry growth. The RWE data has been pooled by the major health organizations to improve clinical trial efficiency and maintain risk-benefit data. As a result, market growth is projected to be aided by favorable government initiatives.

RWE can often provide a complete perspective that can’t be provided in traditional clinical trials. Observational research that is well-designed can reveal hidden characteristics of diseases, benefiting researchers and policymakers in improving care delivery systems and raising public awareness regarding the disease. The Patient centric medication was promoted with the adoption of RWE based developments with more enhanced design and clinical studies. Adoption of real-world evidence makes information more accessible and reduces barriers, while also allowing for a greater knowledge of how medicine is utilized in practice.

Many firms are experimenting with novel techniques to cut clinical trial expenses and avoid drug development barriers to speed up the drug development process. Furthermore, drug development delays are projected to stimulate market expansion in terms of switching from clinical trials to less time-consuming RWE Solutions.

The United States accounts for the largest revenue share of nearly 30% in the Global Real World Evidence Solutions Market. The USA market is anticipated to grow at a CAGR of 11.2% during the forecasted period owing to the growing dominance of RWE service providers in the region and favourable government policies. Furthermore, the region's growth is fuelled by a favourable regulatory environment, a well-established pharmaceutical industry, increased demand for clinical research activities, and expanding research and development spending.

In terms of CAGR, the USA and South Korea grow significantly at a CAGR of 10.7%. This happens because of an increase in government initiatives to implement RWE studies and the presence of numerous contract research organisations (CROs) & manufacturing enterprises. Also, the market is expected to rise due to rising demand for better and affordable healthcare services, increased government efforts to apply RWE research, rising chronic illness burdens, and an increasing geriatric population. Furthermore, China and Japan are expected to grow at a CAGR of 10.5% and 8.8% respectively between 2025 and 2035.

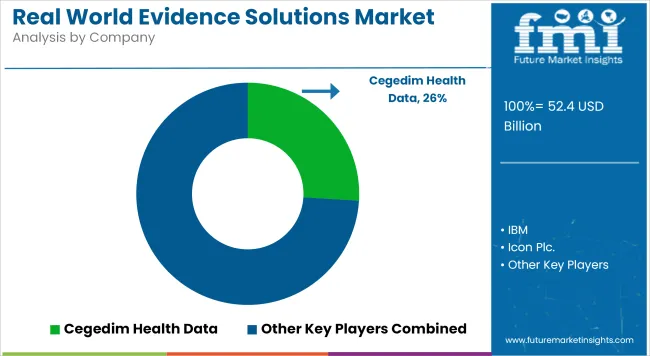

The major corporations in the Global Real World Evidence Solutions market are boosting their research and development expenditure to finance the development of strategically advanced products. Furthermore, government financing, technological developments, regulatory approvals, mergers and acquisitions and diversifying product portfolio has been significantly contributing to the healthy competitive environment. The top players are expected to gain from new product releases and the growth of current operations to maintain their dominance in the global market for Real World Evidence Solutions.

The key competitors in the Real World Evidence Solutions Market are Cegedim Health Data, IBM, Icon Plc., IQVIA, Medpace, Oracle, Parexel International Corp., PerkinElmer, Inc., PPD, Inc., and Syneos Health.

The recent developments in the Global Real World Evidence Solutions Market which were being channelized by market players are as follows:

Similarly, recent developments related to companies offering Real World Evidence Solutions have been tracked by the team at Future Market Insights, which are available in the full report.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 52.4 billion |

| Projected Market Size (2035) | USD 136.2 billion |

| CAGR (2025 to 2035) | 10.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million data points for volume |

| Components Analyzed (Segment 1) | Services, Data Sets, Clinical Settings Data, Claims Data, Pharmacy Data, Patient-powered Data |

| Applications Analyzed (Segment 2) | Reimbursement/Coverage & Regulatory Decision Making, Drug Development & Approvals, Medical Device Development & Approvals, Post Market Safety & Adverse Events Monitoring |

| End Users Analyzed (Segment 3) | Healthcare Payers, Pharmaceutical & Medical Device Companies, Healthcare Providers, Other End-users |

| Regions Covered | North America; Latin America; Europe; Asia-Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, India, China, Japan, South Korea, Australia, South Africa, Saudi Arabia, UAE, Israel |

| Key Players Influencing the Market | Cegedim Health Data, IBM, Icon Plc., IQVIA, Medpace, Oracle, Parexel International Corp., PerkinElmer Inc., PPD Inc., Syneos Health |

| Additional Attributes | Manufacturers seek insights on dollar sales, share, CAGR, top applications like drug development, leading data types, buyer trends, pricing models, regional adoption, tech shifts (AI, EHR), and competitor moves to guide strategy. |

The Global Real World Evidence Solutions Market is estimated to reach USD 52.4 billion by the end of 2025.

The Real World Evidence Solutions Market is expected to grow at a CAGR of 10.2% during the forecasted period of 2025 to 2035. It will be valued at USD 136.2 billion by the end of 2035.

The Real World Evidence Solutions Market provides an absolute dollar opportunity of USD 83.8 Billion during the period between 2025 and 2035.

The Services component is expected to dominate the market with an expected compound annual growth rate of 10.4% during the forecasted.

The key players operating in the Real World Evidence Solutions market are Cegedim Health Data, IBM, Icon Plc., IQVIA, Medpace, Oracle, Parexel International Corp., PerkinElmer, Inc., PPD, Inc., and Syneos Health.

The USA dominates the Global Market for Real World Evidence Solutions with a majority share of around 30%.

Table 1: Global Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Market Value (US$ Mn) Forecast by Component, 2017-2032

Table 3: Global Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 4: Global Market Value (US$ Mn) Forecast by End-user, 2017-2032

Table 5: North America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 6: North America Market Value (US$ Mn) Forecast by Component, 2017-2032

Table 7: North America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 8: North America Market Value (US$ Mn) Forecast by End-user, 2017-2032

Table 9: Latin America Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 10: Latin America Market Value (US$ Mn) Forecast by Component, 2017-2032

Table 11: Latin America Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 12: Latin America Market Value (US$ Mn) Forecast by End-user, 2017-2032

Table 13: Europe Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 14: Europe Market Value (US$ Mn) Forecast by Component, 2017-2032

Table 15: Europe Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 16: Europe Market Value (US$ Mn) Forecast by End-user, 2017-2032

Table 17: Asia Pacific Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 18: Asia Pacific Market Value (US$ Mn) Forecast by Component, 2017-2032

Table 19: Asia Pacific Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 20: Asia Pacific Market Value (US$ Mn) Forecast by End-user, 2017-2032

Table 21: MEA Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 22: MEA Market Value (US$ Mn) Forecast by Component, 2017-2032

Table 23: MEA Market Value (US$ Mn) Forecast by Application, 2017-2032

Table 24: MEA Market Value (US$ Mn) Forecast by End-user, 2017-2032

Figure 1: Global Market Value (US$ Mn) by Component, 2022-2032

Figure 2: Global Market Value (US$ Mn) by Application, 2022-2032

Figure 3: Global Market Value (US$ Mn) by End-user, 2022-2032

Figure 4: Global Market Value (US$ Mn) by Region, 2022-2032

Figure 5: Global Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 8: Global Market Value (US$ Mn) Analysis by Component, 2017-2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2022-2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2022-2032

Figure 11: Global Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 14: Global Market Value (US$ Mn) Analysis by End-user, 2017-2032

Figure 15: Global Market Value Share (%) and BPS Analysis by End-user, 2022-2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 17: Global Market Attractiveness by Component, 2022-2032

Figure 18: Global Market Attractiveness by Application, 2022-2032

Figure 19: Global Market Attractiveness by End-user, 2022-2032

Figure 20: Global Market Attractiveness by Region, 2022-2032

Figure 21: North America Market Value (US$ Mn) by Component, 2022-2032

Figure 22: North America Market Value (US$ Mn) by Application, 2022-2032

Figure 23: North America Market Value (US$ Mn) by End-user, 2022-2032

Figure 24: North America Market Value (US$ Mn) by Country, 2022-2032

Figure 25: North America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 28: North America Market Value (US$ Mn) Analysis by Component, 2017-2032

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2022-2032

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2022-2032

Figure 31: North America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 34: North America Market Value (US$ Mn) Analysis by End-user, 2017-2032

Figure 35: North America Market Value Share (%) and BPS Analysis by End-user, 2022-2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 37: North America Market Attractiveness by Component, 2022-2032

Figure 38: North America Market Attractiveness by Application, 2022-2032

Figure 39: North America Market Attractiveness by End-user, 2022-2032

Figure 40: North America Market Attractiveness by Country, 2022-2032

Figure 41: Latin America Market Value (US$ Mn) by Component, 2022-2032

Figure 42: Latin America Market Value (US$ Mn) by Application, 2022-2032

Figure 43: Latin America Market Value (US$ Mn) by End-user, 2022-2032

Figure 44: Latin America Market Value (US$ Mn) by Country, 2022-2032

Figure 45: Latin America Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 48: Latin America Market Value (US$ Mn) Analysis by Component, 2017-2032

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2022-2032

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2022-2032

Figure 51: Latin America Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 54: Latin America Market Value (US$ Mn) Analysis by End-user, 2017-2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-user, 2022-2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 57: Latin America Market Attractiveness by Component, 2022-2032

Figure 58: Latin America Market Attractiveness by Application, 2022-2032

Figure 59: Latin America Market Attractiveness by End-user, 2022-2032

Figure 60: Latin America Market Attractiveness by Country, 2022-2032

Figure 61: Europe Market Value (US$ Mn) by Component, 2022-2032

Figure 62: Europe Market Value (US$ Mn) by Application, 2022-2032

Figure 63: Europe Market Value (US$ Mn) by End-user, 2022-2032

Figure 64: Europe Market Value (US$ Mn) by Country, 2022-2032

Figure 65: Europe Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 68: Europe Market Value (US$ Mn) Analysis by Component, 2017-2032

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2022-2032

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2022-2032

Figure 71: Europe Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 74: Europe Market Value (US$ Mn) Analysis by End-user, 2017-2032

Figure 75: Europe Market Value Share (%) and BPS Analysis by End-user, 2022-2032

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 77: Europe Market Attractiveness by Component, 2022-2032

Figure 78: Europe Market Attractiveness by Application, 2022-2032

Figure 79: Europe Market Attractiveness by End-user, 2022-2032

Figure 80: Europe Market Attractiveness by Country, 2022-2032

Figure 81: Asia Pacific Market Value (US$ Mn) by Component, 2022-2032

Figure 82: Asia Pacific Market Value (US$ Mn) by Application, 2022-2032

Figure 83: Asia Pacific Market Value (US$ Mn) by End-user, 2022-2032

Figure 84: Asia Pacific Market Value (US$ Mn) by Country, 2022-2032

Figure 85: Asia Pacific Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 88: Asia Pacific Market Value (US$ Mn) Analysis by Component, 2017-2032

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Component, 2022-2032

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Component, 2022-2032

Figure 91: Asia Pacific Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 94: Asia Pacific Market Value (US$ Mn) Analysis by End-user, 2017-2032

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by End-user, 2022-2032

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 97: Asia Pacific Market Attractiveness by Component, 2022-2032

Figure 98: Asia Pacific Market Attractiveness by Application, 2022-2032

Figure 99: Asia Pacific Market Attractiveness by End-user, 2022-2032

Figure 100: Asia Pacific Market Attractiveness by Country, 2022-2032

Figure 101: MEA Market Value (US$ Mn) by Component, 2022-2032

Figure 102: MEA Market Value (US$ Mn) by Application, 2022-2032

Figure 103: MEA Market Value (US$ Mn) by End-user, 2022-2032

Figure 104: MEA Market Value (US$ Mn) by Country, 2022-2032

Figure 105: MEA Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 106: MEA Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 107: MEA Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 108: MEA Market Value (US$ Mn) Analysis by Component, 2017-2032

Figure 109: MEA Market Value Share (%) and BPS Analysis by Component, 2022-2032

Figure 110: MEA Market Y-o-Y Growth (%) Projections by Component, 2022-2032

Figure 111: MEA Market Value (US$ Mn) Analysis by Application, 2017-2032

Figure 112: MEA Market Value Share (%) and BPS Analysis by Application, 2022-2032

Figure 113: MEA Market Y-o-Y Growth (%) Projections by Application, 2022-2032

Figure 114: MEA Market Value (US$ Mn) Analysis by End-user, 2017-2032

Figure 115: MEA Market Value Share (%) and BPS Analysis by End-user, 2022-2032

Figure 116: MEA Market Y-o-Y Growth (%) Projections by End-user, 2022-2032

Figure 117: MEA Market Attractiveness by Component, 2022-2032

Figure 118: MEA Market Attractiveness by Application, 2022-2032

Figure 119: MEA Market Attractiveness by End-user, 2022-2032

Figure 120: MEA Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Real-time Bioprocess Raman Analyzer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Real Time Parking System Market Growth - Trends & Forecast 2025 to 2035

Real-Time Store Monitoring Platform Market Outlook - Demand, Trends & Forecast 2025 to 2035

Real-Time PCR Systems Market Growth – Trends & Forecast 2025 to 2035

Real Estate InsurTech Market Growth - Trends & Forecast 2025 to 2035

Real-Time E-Healthcare System Market Analysis - Trends & Forecast 2025 to 2035

Real-time Bidding Market Insights – Growth & Forecast through 2034

RTLS Market – IoT & Asset Tracking Innovations

Real Time Continuous Microbiological Monitoring Systems Market

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Cereal and Dry Food Dispensers Market – Fresh & Convenient Dispensing 2025-2035

Cereal Rolling Machine Market – Growth & Market Trends 2025-2035

Cereal Bars Market Growth - Health & Convenience Food Trends 2025 to 2035

Cereal Flake Market

Web Real-Time Communication (WebRTC) Solution Market Analysis - Size, Share, and Forecast 2025 to 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Extended Reality (XR) Market Trends – Growth & Forecast 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Augmented Reality Glasses Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA