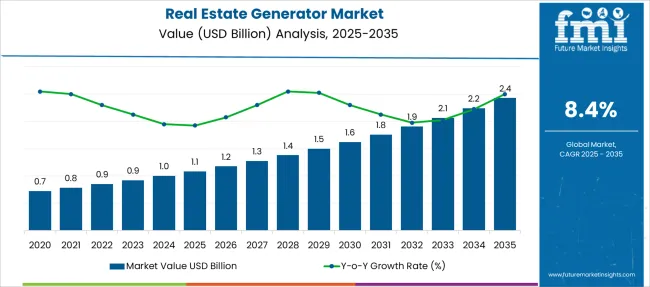

The Real Estate Generator Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Real Estate Generator Market Estimated Value in (2025 E) | USD 1.1 billion |

| Real Estate Generator Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The real estate generator market is experiencing steady momentum driven by the rising need for uninterrupted power supply across residential and commercial infrastructure. Frequent grid instability, urban construction activity, and growing energy demands have increased reliance on backup power systems, particularly in developing regions.

Generator adoption in real estate is being propelled by stricter building codes, a heightened focus on safety, and the integration of backup solutions as value-added features in high-end properties. Additionally, real estate developers are investing in generator systems to ensure business continuity, tenant satisfaction, and regulatory compliance during power outages.

The long-term outlook remains positive, supported by ongoing real estate expansion, infrastructure modernization, and the increasing severity of weather-related disruptions. With technological advancements improving efficiency and emissions compliance, generator systems are expected to remain a critical component of real estate development and facility management strategies.

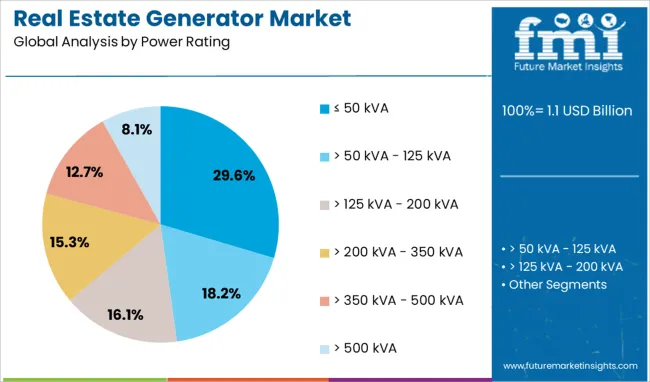

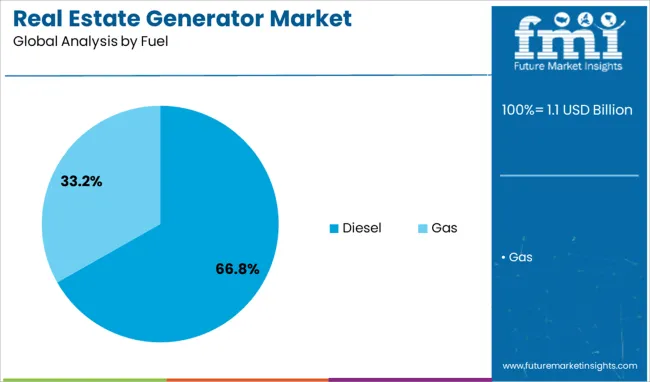

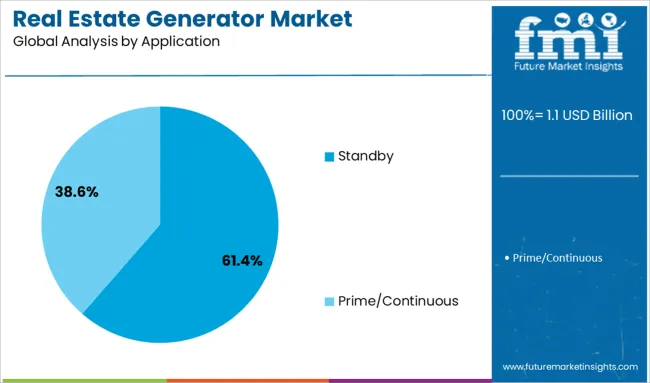

The real estate generator market is segmented by power rating, fuel, application and geographic regions. The real estate generator market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 350 kVA, > 350 kVA - 500 kVA, and > 500 kVA. In terms of fuel, the real estate generator market is classified into Diesel and Gas. Based on the application of the real estate generator market, it is segmented into Standby and Prime/Continuous. Regionally, the real estate generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA segment represents 29.6% of the real estate generator market, reflecting its suitability for low to mid-scale residential and light commercial power backup needs. This power range is particularly popular among standalone homes, small office spaces, and boutique properties that require limited but reliable emergency power during grid failures.

The segment has seen increased adoption due to the compact size, fuel efficiency, and lower upfront investment of small-capacity generators. Urban developments in emerging economies, where infrastructure inconsistencies persist, continue to drive demand in this category.

Manufacturers are increasingly introducing silent and portable variants within this range to address noise and space constraints in urban settings. As distributed real estate models grow and smart home integration expands, demand for small-capacity generator solutions is expected to remain stable and resilient over the forecast period.

Diesel generators dominate the fuel category with a commanding 66.8% market share, owing to their robust performance, high efficiency, and established supply chain infrastructure. Diesel-powered units are preferred across a wide spectrum of real estate applications due to their ability to provide reliable power output during prolonged outages.

The segment has benefited from technological enhancements in emission control, noise reduction, and fuel optimization, which have helped mitigate regulatory and environmental concerns. Despite the growing focus on sustainable alternatives, the cost-effectiveness and widespread availability of diesel fuel continue to underpin its stronghold in the market.

Real estate developers favor diesel units for large-scale properties, mixed-use buildings, and commercial assets where uninterrupted operations are critical. While gradual transition to hybrid and cleaner fuels is underway, diesel generators are expected to retain dominance in the medium term due to performance consistency and maturity of supporting infrastructure.

The standby generator segment leads the application category with 61.4% market share, driven by its essential role in maintaining power continuity in residential and commercial real estate during grid outages. These systems are designed for automatic activation, offering seamless power transfer and safeguarding occupants, operations, and critical systems from unexpected disruptions.

The segment’s growth is supported by increasing awareness of power reliability as a core real estate value proposition and rising demand for uninterrupted building services such as HVAC, lighting, and security systems. Urban infrastructure projects, high-rise apartments, and smart buildings increasingly integrate standby generators into initial construction planning to comply with regulatory standards and meet tenant expectations.

The integration of remote monitoring and automation features has further enhanced the operational appeal of standby systems. As power grid challenges persist globally, the standby application segment is expected to maintain its leadership in the real estate generator market.

Emission targets, large‑scale CCS investments, and demand for enhanced connectivity are impacting the market. Rural broadband deployments and industrial IoT use in upstream operations drive growth. Opportunities are found in hybrid fixed‑mobile WiMAX expansion and government spectrum licensing. Emerging trends highlight integration with LTE and the development of WiMAX‑enabled hubs. Restraints include infrastructure costs, regulatory uncertainty, and competition from LTE/5G. Stakeholders investing in versatile WiMAX platforms and multi‑use deployments are viewed as better positioned through 2025.

Increasing power interruption risks are driving market growth due to aging electrical infrastructure and climate‑related outages. In 2024, many residential and commercial real estate projects in North America and the Asia-Pacific adopted diesel and gas backup sets as essential amenities. Developers installed generators rated above 200 kVA for standby use in new housing and office complexes. It is widely believed that rising consumer expectations for uninterrupted power and safety protocols in multi-unit properties will sustain high adoption of property-grade generator systems globally.

Opportunities are arising from preference toward gas-fired generators and hybrid fuel options offering cleaner standby power for urban real estate installations. The gas-fired segment was valued at over USD 290 million in 2024 and is forecast to grow at about 9% CAGR through 2034. In 2025, gas gensets became favored in mixed-use developments and high-end residential towers, demanding lower emissions and quieter operation. It is considered that suppliers offering gas-powered units with smart load-sharing and integration into microgrid systems will capture the most value amid evolving regulatory expectations.

A notable trend is the deployment of modular generator configurations combined with maintenance and monitoring service contracts tailored to real estate clients. In 2025, packaged standby solutions with remote diagnostics and preventative servicing were introduced for property portfolios and multi-site developments. Plug-and-play installations and flexible fuel setups reduced commissioning complexity. It is strongly believed that providers offering turnkey solutions—generator, control systems, and service bundled into a single offering—will dominate demand from developers and building operators seeking reliable uptime without infrastructure burden.

Major restraints include high initial investment, fuel availability uncertainty, and permitting complexity in residential zones. In 2024, several developers in Asia reported delays in generator deployment due to zoning restrictions and compliance with noise regulations. Smaller landlords and residential operators resisted adoption due to upfront cost concerns and servicing requirements. It is believed that without financing or leasing schemes, or adherence to streamlined permitting processes, many real estate projects may continue to rely on rental power or grid-only backup rather than investing in dedicated generator systems.

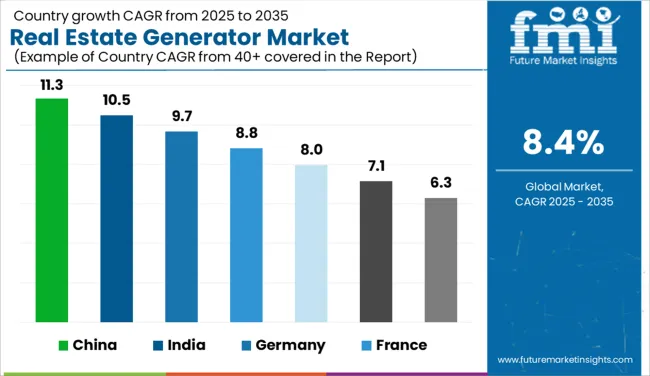

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

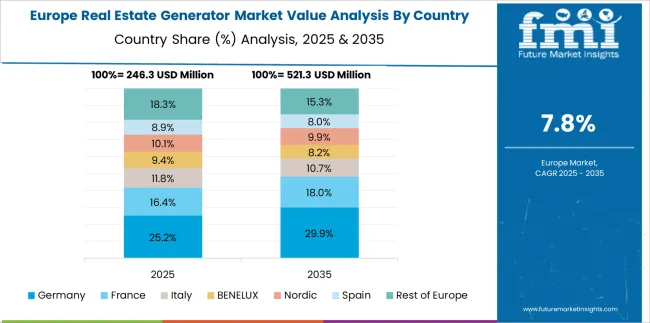

The global real estate generator market is expected to grow at an 8.4% CAGR from 2025 to 2035. Among the leading regions, China tops the list at 11.3% CAGR, supported by rapid construction activity and commercial property expansions. India follows at 10.5%, driven by residential high-rise developments and infrastructural upgrades. Germany posts 9.7%, reflecting advanced adoption in commercial and industrial complexes. Meanwhile, the United Kingdom records 8.0% and the United States stands at 7.1%, with growth largely driven by retrofitting projects and compliance with grid reliability standards. Market dynamics are shaped by power backup needs in urban real estate, heightened demand from mixed-use properties, and increasingly stringent energy continuity regulations across developed and emerging markets.

China leads the global real estate generator market, growing at a 11.3% CAGR through 2035. The surge is underpinned by the rapid expansion of commercial office complexes, retail spaces, and smart residential projects in urban regions. Frequent grid load fluctuations, combined with government-backed infrastructure modernization programs, drive sustained generator demand. High-rise developments in megacities, coupled with hospitality sector expansion, require uninterrupted power for elevators, HVAC systems, and safety operations. Local manufacturers offer cost-effective diesel and hybrid generators, while global players penetrate the premium market through partnerships. Strong construction activity, particularly in Tier-1 and Tier-2 cities, creates an ongoing requirement for high-capacity standby power solutions.

India’s real estate generator market is forecast to achieve a 10.5% CAGR during 2025–2035, propelled by rapid real estate development across metro and Tier-2 cities. Large-scale residential townships, commercial complexes, and data centers have significantly contributed to backup power demand. National energy policies encourage deployment of reliable generator systems, especially in regions prone to grid instability. Diesel generators remain dominant, but gas-based and hybrid models are increasingly preferred for compliance with emission norms. Leading domestic manufacturers and global brands are investing in distribution networks to cater to the rising demand from housing societies, malls, and corporate office parks.

Germany posts a 9.7% CAGR between 2025 and 2035, driven by high energy reliability standards in industrial, commercial, and mixed-use developments. The growing prominence of green-certified buildings has spurred demand for energy-efficient generator systems integrated with load optimization technology. Real estate developers are increasingly prioritizing standby solutions to meet building codes and minimize operational downtime. Urban property redevelopment and modernization projects in Berlin, Hamburg, and Munich account for significant generator adoption. Global brands dominate the premium market segment, offering advanced automation, remote monitoring capabilities, and hybridized power systems.

The United Kingdom records an 8.0% CAGR during the forecast period, supported by moderate demand from commercial real estate, retail chains, and high-value residential complexes. Market growth is heavily influenced by compliance with building energy continuity standards and integration of smart monitoring technologies. Hybrid generator systems are gaining momentum as developers aim for sustainable building certifications. Large-scale retrofitting projects in London and other urban centers also contribute to market expansion. Manufacturers are focusing on modular, low-noise generator units that align with local regulations for urban installations.

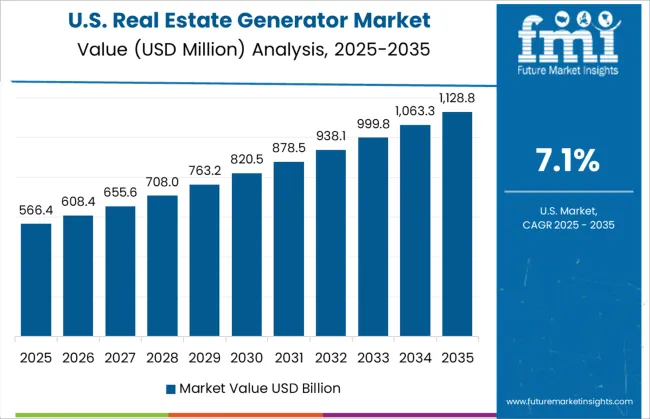

The United States is projected to grow at a 7.1% CAGR, with adoption largely influenced by retrofitting initiatives in older buildings and modernization of office spaces. Demand is rising in data centers, healthcare facilities, and luxury residential complexes that require uninterrupted power backup. Energy codes and resilience mandates have prompted property developers to include advanced generator systems in large-scale projects. Hybrid and gas-based units are replacing conventional diesel sets in response to stringent emission regulations. Technological innovations such as telematics-enabled control and predictive maintenance features have become critical differentiators in this mature market.

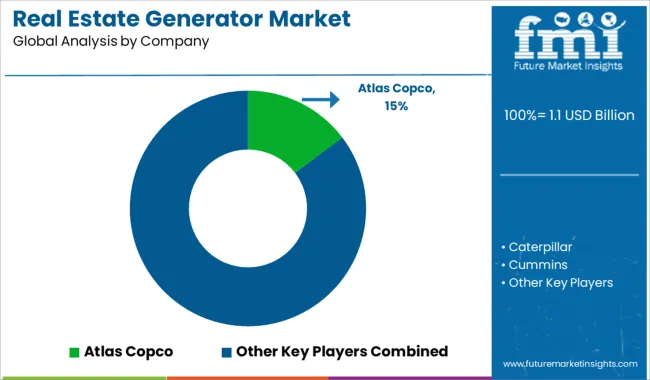

The real estate generator market is moderately consolidated, with Atlas Copco recognized as a leading player due to its advanced generator technologies, global service network, and emphasis on fuel efficiency and reliability. The company provides a broad range of portable and stationary generators tailored for residential and commercial real estate projects, ensuring uninterrupted power supply during grid outages or peak demand.

Key players include Caterpillar, Cummins, DEUTZ Power Center, Doosan Portable Power, FG Wilson, Generac Power Systems, HIMOINSA, HIPOWER, Mitsubishi Heavy Industries, PR INDUSTRIAL, Rolls-Royce, SDEC Power, Wacker Neuson SE, and YANMAR HOLDINGS. These companies offer diesel and gas-powered generators designed for diverse applications in high-rise buildings, gated communities, shopping complexes, and mixed-use developments, prioritizing performance, compliance with emission regulations, and low maintenance requirements.

Market growth is driven by the increasing demand for backup power in urban infrastructure, rising real estate investments, and growing reliance on uninterrupted electricity for critical building operations. Leading manufacturers are focusing on hybrid power solutions, integration with energy storage systems, and IoT-enabled remote monitoring for predictive maintenance.

Emerging trends include the development of low-noise, fuel-efficient models for urban environments and the adoption of generators compatible with renewable energy sources to reduce environmental impact. Asia-Pacific remains the fastest-growing market due to rapid construction activity, while North America and Europe maintain steady demand for high-capacity backup systems in commercial real estate.

Rising investments in reliable power infrastructure are fueling demand for real estate generators, particularly in regions experiencing frequent outages or unstable grids. Growth in data centers, remote work adoption, and high-rise residential developments further accelerates the need for continuous power backup solutions across urban and commercial environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 350 kVA, > 350 kVA - 500 kVA, and > 500 kVA |

| Fuel | Diesel and Gas |

| Application | Standby and Prime/Continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco, Caterpillar, Cummins, DEUTZ Power Center, Doosan Portable Power, FG Wilson, Generac Power Systems, HIMOINSA, HIPOWER, MITSUBISHI HEAVY INDUSTRIES, PR INDUSTRIAL, Rolls-Royce, SDEC Power, Wacker Neuson SE, and YANMAR HOLDINGS |

| Additional Attributes | Dollar sales segmented by generator type (standby vs prime), fuel type (diesel vs gas), and power rating (≤50 kVA, 50–125 kVA, >125 kVA). Regional demand trends indicate strong adoption in North America and rapid growth in Asia-Pacific. Buyers prioritize emissions compliance, smart monitoring integration, and modular gensets. Innovations include IoT-based diagnostics and hybrid-ready systems. |

The global real estate generator market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the real estate generator market is projected to reach USD 2.4 billion by 2035.

The real estate generator market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in real estate generator market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 350 kva, > 350 kva - 500 kva and > 500 kva.

In terms of fuel, diesel segment to command 66.8% share in the real estate generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel Powered Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Real Estate InsurTech Market Growth - Trends & Forecast 2025 to 2035

AI-Driven CRE Compliance Tools – Navigating Regulatory Challenges

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Real-time Lithium Sensor Market Size and Share Forecast Outlook 2025 to 2035

Real Time Location System (RTLS) Market Size and Share Forecast Outlook 2025 to 2035

Real-time Bioprocess Raman Analyzer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Real Time Parking System Market Growth - Trends & Forecast 2025 to 2035

Real World Evidence Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Real-Time Store Monitoring Platform Market Outlook - Demand, Trends & Forecast 2025 to 2035

Real-Time PCR Systems Market Growth – Trends & Forecast 2025 to 2035

Real-Time E-Healthcare System Market Analysis - Trends & Forecast 2025 to 2035

Real-time Bidding Market Insights – Growth & Forecast through 2034

Real Time Continuous Microbiological Monitoring Systems Market

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Cereal and Dry Food Dispensers Market – Fresh & Convenient Dispensing 2025-2035

Cereal Rolling Machine Market – Growth & Market Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA