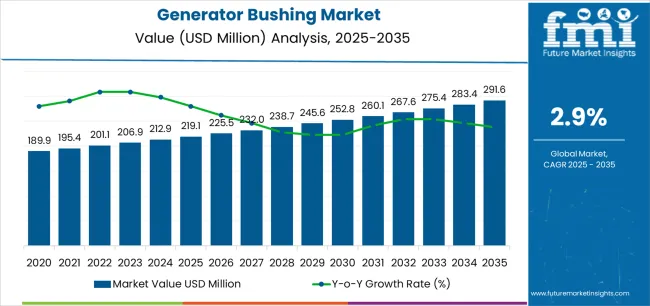

The generator bushing market is valued at USD 219.1 million in 2025 and is projected to reach USD 291.6 million by 2035, growing at a CAGR of 2.9%. Market growth is supported by the modernization of power generation infrastructure, expansion of renewable energy installations, and the need for reliable electrical insulation systems in high-voltage applications. The ongoing replacement of aging grid assets and continued investment in utility-scale generation facilities sustain steady demand across both industrialized and emerging economies.

Low-voltage bushings represent the leading product segment, widely used in power plants, substations, and auxiliary electrical systems where compact design and operational efficiency are essential. Their performance advantages include reduced partial discharge, higher dielectric strength, and longer service life under thermal and electrical stress. Technological advancements in epoxy-resin and oil-impregnated paper (OIP) insulation materials continue to improve mechanical durability and thermal endurance in demanding environments.

Asia Pacific remains the dominant regional market due to rapid capacity additions in China and India. Europe and North America maintain stable demand through grid refurbishment and compliance with safety and reliability standards. Key market participants include Nanjing Electric, Hitachi Energy, Trench Group, GE, and HSP Hochspannungsgeräte, focusing on material innovation, insulation performance, and integration with next-generation power systems.

Growth momentum analysis indicates a steady but moderate expansion rate, supported by consistent demand from the power generation and industrial sectors. Between 2025 and 2029, market momentum will remain moderate as replacement demand for high-voltage insulation components drives incremental gains. Upgrades in conventional power plants and rising maintenance activities for aging grid infrastructure will contribute to early growth.

From 2030 to 2035, the market’s growth momentum will stabilize as renewable energy installations expand and generator manufacturing activities shift toward efficiency-focused designs. Demand will be sustained by modernization of existing equipment rather than new installations, reflecting a mature industry cycle. Advancements in composite and epoxy resin insulation materials will help maintain competitive performance and durability standards. While growth acceleration will remain limited, steady procurement from utilities and industrial users will ensure a consistent market flow. The momentum trend suggests long-term resilience supported by ongoing power infrastructure maintenance and gradual integration of advanced bushing materials in generator systems worldwide.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 219.1 million |

| Market Forecast Value (2035) | USD 291.6 million |

| Forecast CAGR (2025 to 2035) | 2.9% |

The generator bushing market is expanding in response to increased global deployment of large-scale power generation facilities, including thermal plants, hydroelectric installations and renewables such as pumped-storage systems. Generator bushings, which provide insulated electrical passage through generator housing and connect internal windings to external circuits, must meet rising performance and reliability expectations in high-current, high-voltage environments.

Advances in insulation technologies (e.g., resin-impregnated paper, composite materials), along with heightened focus on maintenance, lifecycle costs and reliability, drive greater specification and replacement activity. Demand is further supported by grid modernisation efforts, refurbishment of ageing generator fleets and stricter electrical-safety/regulatory standards across utility end-users. However, growth is constrained by significant upfront investment for high-performance bushings, long asset lifecycles (which slow replacement cycles), and limited standardisation across generator types and regions, which can limit rapid global uptake.

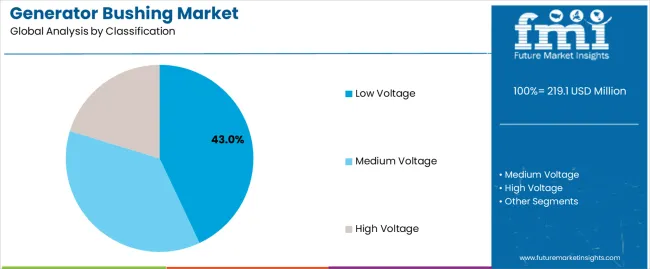

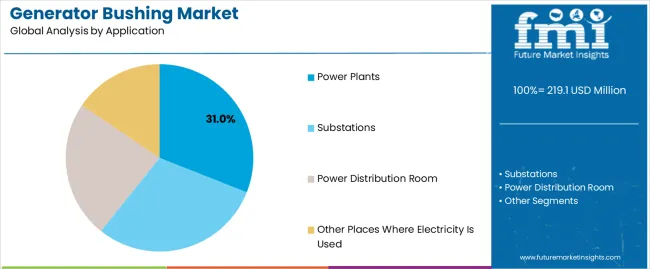

The generator bushing market is segmented by classification and application. By classification, the market is divided into low voltage, medium voltage, and high voltage generator bushings. Based on application, it is categorized into power plants, substations, power distribution rooms, and other locations where electricity is used. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The low voltage segment holds the leading position in the generator bushing market, representing approximately 43.0% of total market share in 2025. Low-voltage bushings are extensively used in compact generators, industrial machinery, and distributed power systems due to their simpler insulation design, ease of installation, and cost efficiency. These bushings provide electrical isolation between the current-carrying conductor and grounded enclosure components while maintaining mechanical support and dielectric integrity.

The segment’s prominence is supported by the growing deployment of low- and medium-capacity power systems in commercial buildings, industrial plants, and distributed renewable installations. Additionally, advancements in epoxy resin and polymeric insulation materials have improved reliability and heat resistance in low-voltage bushings. The medium voltage and high voltage categories collectively account for the remainder of the market, primarily serving large power generation units and grid infrastructure. Demand in these segments is driven by modernization projects and the replacement of aging equipment in power transmission networks.

Key factors supporting the low voltage segment include:

The power plants segment accounts for approximately 31.0% of the generator bushing market in 2025. This leadership is attributed to the essential role bushings play in power generation systems, ensuring safe current transfer from generators to transformers and switchgear assemblies. These components are critical for maintaining insulation strength, mechanical stability, and operational continuity in high-load environments such as thermal, hydroelectric, and renewable energy plants.

Power plant applications demand high reliability due to continuous operation and exposure to elevated temperatures, electrical stresses, and environmental contaminants. The substations segment follows, driven by the need for durable, high-dielectric bushings used in grid interconnections and power conversion systems. Power distribution rooms and other electrical installations constitute additional demand sources in commercial and industrial sectors.

Primary dynamics driving demand from the power plants segment include:

Expansion of power generation capacity, renewable energy integration, and grid upgrade initiatives are fuelling demand.

The generator bushing market is driven by increasing global electricity demand and corresponding growth in power-plant build-outs, which require high-performance bushings for reliable generator connection and insulation. Integration of renewable-energy plants (such as wind and solar farms) into existing grids creates additional demand for bushings that connect high-voltage generator output to substations and transformers. Many regions are upgrading aging grid infrastructure and expanding transmission networks, thereby boosting demand for modern bushing solutions with improved insulation, durability and compatibility with high-voltage equipment.

High material and manufacturing costs, supply-chain constraints and competitive alternative technologies restrict broader growth.

Production of advanced generator bushings involves expensive insulating materials, precision engineering and rigorous testing, all of which raise unit cost and limit adoption, especially in cost-sensitive markets. Raw-material price volatility and global supply-chain disruptions can delay delivery and increase lead-times, reducing attractiveness for fast-track power-projects. The availability of alternative insulation technologies and retrofitting of existing equipment may reduce demand for new bushing installations, constraining overall growth of dedicated generator bushing segments.

Shift toward polymeric and silicone bushings, growth in Asia-Pacific markets, and digital monitoring integration are shaping the outlook.

Manufacturers are increasingly adopting polymeric, resin-impregnated and silicone-rubber insulation materials in bushings to enhance mechanical strength, reduce maintenance and improve performance under harsh environments. Regionally, the Asia-Pacific region is witnessing significant growth in generator bushing demand, driven by large-scale power-plant construction, expansion of renewable-energy capacity and grid-modernisation programs in countries such as China, India and Southeast Asia. A further trend is the adoption of condition-monitoring features (such as embedded sensors and smart diagnostics) in bushings to enable real-time status tracking, predictive maintenance and reduced risk of failure in critical generator systems.

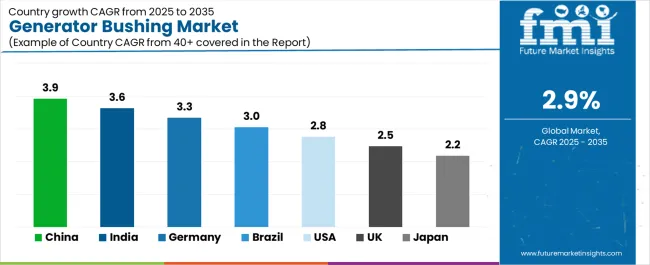

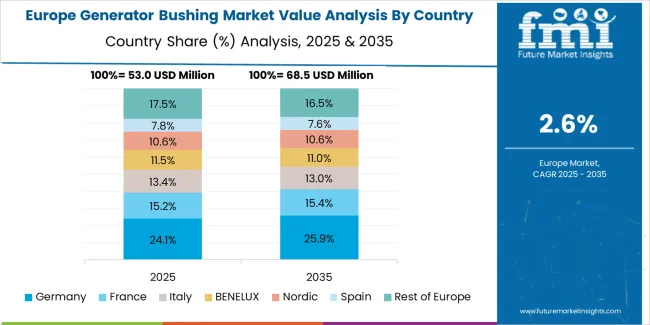

The global generator bushing market is expanding steadily through 2035, supported by the modernization of power generation infrastructure, demand for renewable energy integration, and advancements in insulation technologies. China leads with a 3.9% CAGR, followed by India at 3.6%, driven by continuous grid expansion and investment in power reliability. Germany grows at 3.3%, reflecting strong industrial modernization and smart grid deployment. Brazil’s 3.0% growth stems from hydropower and industrial electricity upgrades. The United States grows at 2.8%, supported by refurbishment of legacy power plants, while the United Kingdom (2.5%) and Japan (2.2%) maintain stable demand through ongoing electrical equipment standardization and technology upgrades.

| Country | CAGR (%) |

|---|---|

| China | 3.9 |

| India | 3.6 |

| Germany | 3.3 |

| Brazil | 3.0 |

| USA | 2.8 |

| UK | 2.5 |

| Japan | 2.2 |

China’s generator bushing market grows at 3.9% CAGR, driven by extensive power plant construction, renewable integration, and industrial electrification. The government’s grid modernization programs under the Energy Development Plan 2030 are increasing demand for high-voltage bushings with advanced insulation systems. Domestic manufacturers are expanding production of epoxy-resin and porcelain bushings designed for turbine generators and switchgear systems. Collaborations between state-owned utilities and local component suppliers are improving reliability standards and material testing processes. The market benefits from accelerated deployment of wind and solar energy projects that require high-performance generator insulation components.

Key Market Factors:

India’s market grows at 3.6% CAGR, supported by infrastructure investment, industrial electrification, and renewable capacity expansion. The National Electricity Plan emphasizes modernization of power generation assets, driving adoption of high-performance insulation components. Domestic electrical equipment manufacturers are producing silicone and composite bushings suited for high-temperature and humid operating conditions. Collaborations between public utilities and engineering firms are improving testing and reliability certification standards. The growing number of hydropower and thermal plant refurbishments also strengthens replacement demand. India’s emphasis on indigenization of power components supports cost-efficient production and export of generator bushings.

Market Development Factors:

Germany’s market grows at 3.3% CAGR, supported by industrial automation, renewable energy development, and high-performance insulation system innovation. German manufacturers are focusing on dry-type and gas-insulated bushings for wind and hydroelectric power plants. Continuous R&D in dielectric materials and epoxy composites enhances reliability and reduces maintenance costs. The country’s transition toward renewable energy under the Energiewende policy sustains steady demand for generator bushings in hybrid generation systems. Collaboration between engineering universities and component suppliers supports the design of compact, thermally optimized insulation components for advanced power generation systems.

Key Market Characteristics:

Brazil’s market grows at 3.0% CAGR, driven by grid reinforcement, hydropower modernization, and industrial electricity expansion. The country’s investment in power reliability under the Ten-Year Energy Expansion Plan supports upgrades to existing generator equipment. Local manufacturers are producing medium-voltage bushings tailored for tropical operating conditions. Partnerships with international suppliers are transferring expertise in epoxy resin and oil-impregnated paper (OIP) insulation systems. Growing energy consumption in mining, steel, and manufacturing industries supports consistent market demand. Brazil’s transition toward renewable and hybrid energy projects creates opportunities for modern bushing applications in power conversion systems.

Market Development Factors:

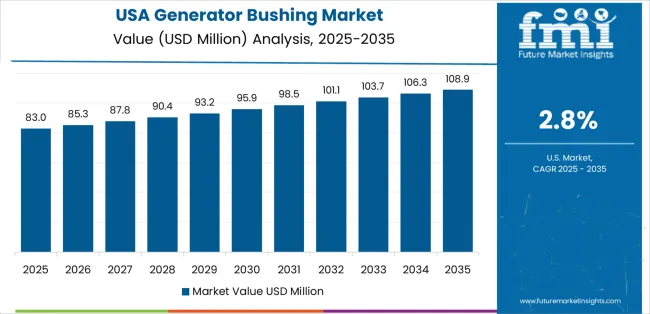

The United States grows at 2.8% CAGR, driven by modernization of legacy power plants and integration of advanced electrical components. Power utilities are upgrading aging generator insulation systems to improve reliability and operational safety. Manufacturers are developing polymeric and gas-insulated bushings to meet high-voltage and environmental performance standards. The transition toward renewable and distributed power generation is stimulating demand for flexible insulation technologies. The market benefits from federal investment in grid resilience and infrastructure reliability under national energy modernization programs. Continuous product testing under IEEE and ANSI standards ensures consistent quality across applications.

Key Market Factors:

The United Kingdom’s market grows at 2.5% CAGR, supported by ongoing grid modernization and renewable energy expansion. The transition to low-carbon power generation is increasing demand for reliable insulation components in offshore wind and combined-cycle power plants. Local manufacturers are focusing on compact, low-leakage bushing designs compliant with European electrical safety standards. Collaboration with European suppliers enhances innovation in epoxy resin formulations and testing methods. The country’s emphasis on extending the operational lifespan of existing power assets through preventive maintenance also sustains replacement demand.

Market Development Factors:

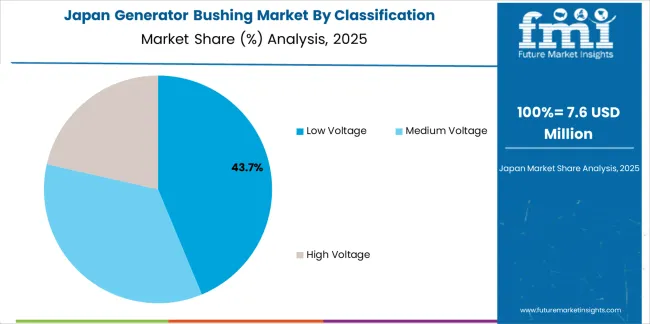

Japan’s market grows at 2.2% CAGR, reflecting its focus on high-quality manufacturing, electrical reliability, and export-oriented engineering. Domestic firms are producing precision-engineered bushings using advanced epoxy resin and high-temperature insulation materials. The aging power infrastructure is driving moderate replacement demand, particularly in thermal and hydroelectric plants. Research in compact bushing design supports integration within small and high-output generators. The Green Innovation Fund supports renewable and hydrogen energy projects, creating new applications for lightweight, thermally stable bushings. Japan’s emphasis on process reliability and material innovation maintains its position in the high-performance segment.

Key Market Characteristics:

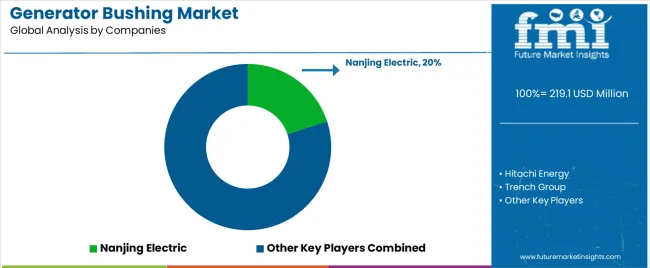

The generator bushing market is moderately concentrated, with around a dozen global manufacturers supplying equipment for power generation and high-voltage applications. Nanjing Electric leads the market with an estimated 20.0% global share, supported by its strong product portfolio in high-voltage bushings, advanced insulation systems, and consistent supply to thermal, hydro, and renewable energy sectors. The company’s advantage stems from material innovation and long-term collaboration with power utilities and OEMs across Asia and Europe.

Hitachi Energy, Trench Group, and GE follow as major international competitors, leveraging decades of engineering expertise and large-scale production capacity. Their competitiveness is reinforced by standardized product platforms, advanced resin-impregnated paper (RIP) technologies, and extensive aftersales service networks. HSP Hochspannungsgeräte and Pfiffner specialize in precision-engineered high-voltage bushings with strong European presence, emphasizing reliability, dielectric strength, and lifecycle performance.

Mid-tier and regional firms such as SERD, AGTServices, and Suzhou Yunteng Electric focus on refurbishment, component replacement, and cost-effective production tailored to regional power infrastructure needs. Mitsubishi Electric Power Products, Reinhausen Power Composites, and Toshiba Energy Systems & Solutions integrate bushing manufacturing within broader electrical system portfolios, ensuring compatibility with generators, transformers, and switchgear assemblies.

Competition in this market revolves around electrical performance, insulation technology, and reliability under high thermal stress. Growth is driven by modernization of aging power assets, expansion of renewable generation, and increasing demand for high-voltage components with enhanced safety and maintenance efficiency.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Classification | Low Voltage, Medium Voltage, High Voltage |

| Application | Power Plants, Substations, Power Distribution Room, Other Places Where Electricity Is Used |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Nanjing Electric, Hitachi Energy, Trench Group, GE, HSP Hochspannungsgeräte, SERD, AGTServices, Pfiffner, Mitsubishi Electric Power Products, Reinhausen Power Composites, Toshiba Energy Systems & Solutions, Suzhou Yunteng Electric, ChinSun Bushing |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of power equipment and insulation component manufacturers; advancements in high-voltage bushing technologies; integration with modern power generation and grid transmission systems. |

The global generator bushing market is estimated to be valued at USD 219.1 million in 2025.

The market size for the generator bushing market is projected to reach USD 291.6 million by 2035.

The generator bushing market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in generator bushing market are low voltage, medium voltage and high voltage.

In terms of application, power plants segment to command 31.0% share in the generator bushing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gas Generator Sets Market Growth - Trends & Forecast 2025 to 2035

Hydrogenerators Market

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Pulse Generator Market

Ozone Generators Market

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Signal Generator Market Analysis by Product, Technology, Application, End-use, and Region through 2035

Silent Generator Market Analysis by Sound Level, Type, Phase, Power Rating, Fuel, Application, End User, and Region through 2035

Standby Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Surgical Generators Market – Trends & Forecast 2025 to 2035

Aircraft Generators Market Trends and Forecast 2025 to 2035

Gasoline Generator Market - Growth & Demand 2025 to 2035

PLL Clock Generator Market Size and Share Forecast Outlook 2025 to 2035

RF Plasma Generators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA