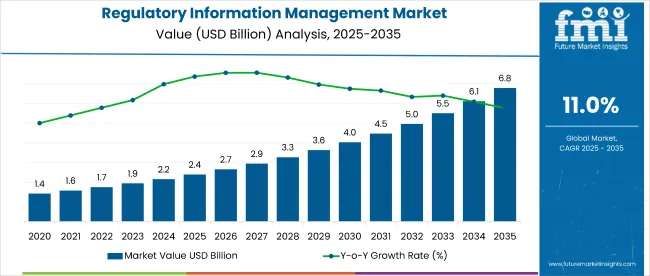

The regulatory information management market is projected to grow from USD 2.39 billion in 2025 to USD 6.79 billion by 2035, at a CAGR of 11%. Among the countries driving the market, the United States is expected to be the largest market, while China is poised to emerge as the fastest-growing market between 2025 and 2035.

The growth of the regulatory information management market is primarily being driven by expanding pharmaceutical and biotechnology pipelines, an increase in regulatory submission volumes, and stricter international compliance mandates. Furthermore, significant regulatory reforms, such as the 2024 eCTD v4.0 rollout by the European Medicines Agency and Health Canada, are accelerating the adoption of digital solutions in the industry.

However, challenges like the complexity of integrating various regulatory frameworks across regions and the high costs of implementing regulatory technology solutions could restrain market growth. Key trends include the increasing shift toward automation, AI, and machine learning for regulatory compliance, along with enhanced focus on improving operational efficiency and reducing time-to-market for pharmaceutical products. Additionally, increased emphasis on data security and privacy regulations is also influencing market dynamics, as companies seek solutions to ensure compliance while protecting sensitive information.

Looking ahead to 2025-2035, the regulatory information management market is expected to experience continued robust growth. The rising demand for regulatory compliance solutions across emerging markets and the ongoing digitalization of regulatory processes are anticipated to offer significant opportunities.

The market will also likely benefit from the adoption of new technologies and the increasing need for regulatory solutions to manage the expanding global pharmaceutical pipeline and submission requirements. It is anticipated that ongoing innovations in regulatory technologies and increased government investments will further propel market growth in the coming years.

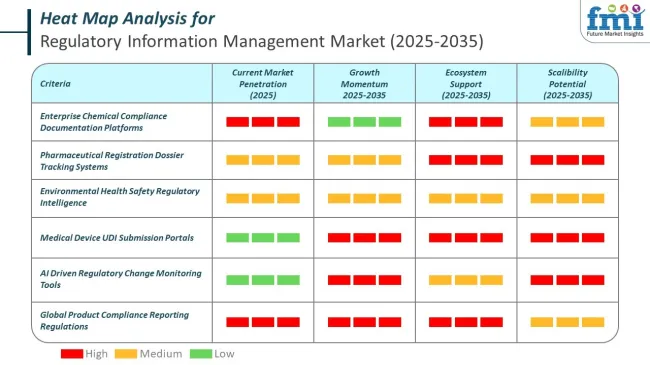

Master-data accuracy in UDI submissions is a critical compliance driver within the regulatory information management market. Both US and EU regulators are reinforcing structured device data reporting to enhance visibility, traceability, and safety across healthcare systems.

Companies in the Regulatory Information Management (RIM) market are implementing advanced digital platforms and compliance-focused strategies to meet evolving global regulatory frameworks. Many organizations have moved toward integrated systems that streamline data submission, version control, and regulatory reporting. These solutions reduce compliance risk and enhance transparency across the product lifecycle.

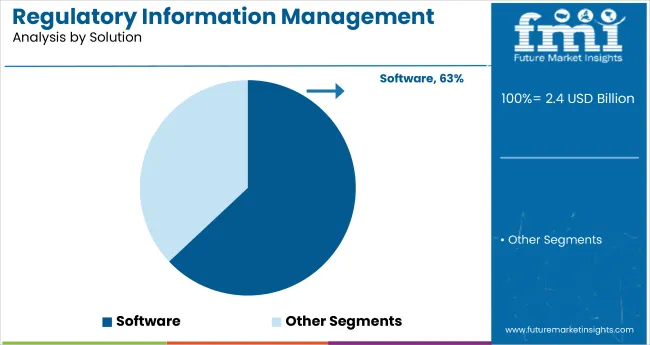

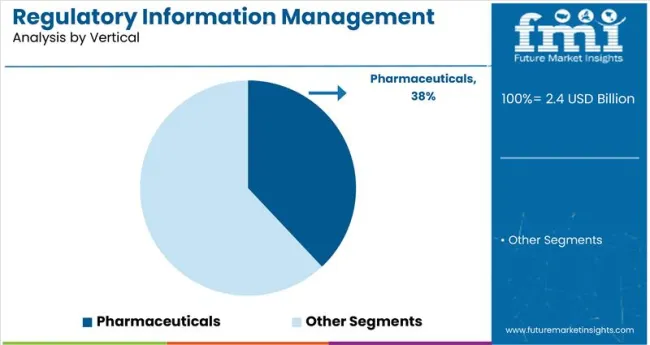

The market is segmented into various sub-segments. By solution, the industry is segmented into software (further categorized into cloud and on-premise) and services (including training & support and consulting). Analysis by company size includes small & medium enterprises (SMEs) and large enterprises. The vertical segmentation covers pharmaceuticals, cosmetics, medical devices, biologics, and nutraceuticals. Geographically, the industry is assessed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Software segment is projected to retain dominance in the industry, contributing the largest share by value over the forecast period. Estimated to account for USD 1.91 billion in 2025, software is forecasted to reach USD 6.37 billion by 2035, growing at a CAGR of 12.8%. This segment’s sustained expansion is supported by rising adoption of digital compliance solutions, AI-driven regulatory workflows, and increasing demand for centralized submission tracking. Life sciences companies are prioritizing software investment to meet evolving global regulatory standards, reduce manual errors, and accelerate product approvals.

Cloud-based software, offering scalable and cost-efficient deployment, is expected to grow from USD 1.08 billion in 2025 to USD 4.12 billion by 2035, registering a CAGR of 14.2%. Demand is driven by mid-sized and global pharma firms seeking secure remote access, minimal IT overheads, and easier system updates. In contrast, on-premise solutions are projected to expand from USD 0.83 billion in 2025 to USD 2.25 billion by 2035, growing at a CAGR of 9.5%. While favored by organizations with strict data sovereignty requirements and established legacy infrastructure, their growth remains comparatively moderate.

The services segment, including training & support and consulting, is expected to expand steadily. Training & support services are forecasted to grow from USD 240 million in 2025 to USD 640 million by 2035, reflecting a CAGR of 10.1%. This growth is tied to increasing system complexity and the need for ongoing technical assistance. Consulting services are projected to increase from USD 240 million to USD 620 million during the same period, at a CAGR of 9.7%, as firms seek guidance on strategic RIM planning, implementation, and regulatory optimization.

Large enterprises are expected to dominate the industry throughout the forecast period, driven by expansive global operations, multi-region regulatory compliance needs, and higher IT spending capacity. This segment is projected to grow from USD 1.61 billion in 2025 to USD 4.55 billion by 2035, reflecting a CAGR of 11.0%. Growth is underpinned by the adoption of enterprise-grade RIM platforms designed to manage complex product portfolios, integrate cross-border regulatory workflows, and support lifecycle data visibility. Global pharmaceutical giants and biologics manufacturers remain the primary adopters due to elevated risk exposure and strategic investments in digital compliance.

Small & medium enterprises (SMEs), while accounting for a smaller revenue share, are emerging as a high-growth segment. The SME segment is projected to increase from USD 780 million in 2025 to USD 2.24 billion by 2035, growing at a CAGR of 11.2%. This growth is driven by the adoption of cloud-based RIM solutions that lower upfront infrastructure costs and offer rapid deployment capabilities. Increasing participation of CROs and local biotech firms in global clinical trials and export-oriented manufacturing has further supported SME demand. Although absolute value remains lower than large enterprises, SMEs represent an agile, innovation-driven customer base responding rapidly to regulatory digitization trends.

As regulatory regimes tighten globally and digital-first compliance becomes a default requirement, both segments will experience sustained demand. However, value growth will remain skewed toward large enterprises, while SMEs will drive volume-based expansion and cloud-based platform penetration.

Pharmaceuticals are expected to retain the leading share in the industry throughout the forecast period, driven by intensive global regulatory oversight, complex product registration cycles, and a rising volume of new drug submissions. The pharmaceutical segment is projected to expand from USD 1.15 billion in 2025 to USD 3.32 billion by 2035, reflecting a CAGR of 11.2%. High-value pipelines, continuous filing requirements with agencies like the USFDA and EMA, and the adoption of structured product labeling formats are reinforcing digital RIM adoption across branded and generic pharma players globally.

Biologics represent the fastest-growing vertical, projected to scale from USD 440 million in 2025 to USD 1.38 billion by 2035, registering a CAGR of 12.2%. Demand is driven by the increased complexity of biologic and biosimilar approval processes, which necessitate lifecycle tracking, frequent dossier updates, and version-controlled submissions. The biologics segment benefits from robust growth in oncology, immunotherapy, and cell/gene therapies, where regulatory environments are highly dynamic and data-intensive.

The medical devices segment is forecasted to grow from USD 360 million in 2025 to USD 970 million by 2035, at a CAGR of 10.3%. The implementation of MDR and IVDR in the European Union and expanded premarket review in Asia are catalyzing digital RIM adoption for labeling, device classification, and registration workflows. Nutraceuticals, growing from USD 240 million to USD 670 million during the same period at a CAGR of 10.6%, are seeing increased compliance needs due to rising cross-border trade and stricter regional health claim regulations.

Cosmetics, while smaller in value, are forecasted to expand from USD 190 million in 2025 to USD 520 million by 2035, reflecting a CAGR of 10.4%. Product traceability, ingredient disclosure mandates, and region-specific formulation compliance are key drivers for RIM solution uptake in this vertical.

The United States is projected to grow from USD 0.73 billion in 2025 to USD 1.92 billion by 2035, registering a CAGR of 10.3%. With a well-established pharmaceutical and biotech ecosystem, the country benefits from advanced digital infrastructure, frequent regulatory filings, and complex product lifecycle management needs. The USA Food and Drug Administration (FDA) mandates structured product labeling (SPL), eCTD submissions, and periodic safety updates requirements that push for sophisticated RIM systems among pharmaceutical and biologics manufacturers.

Additionally, the rise of specialty drugs, biosimilars, and digital therapeutics is driving an expanded need for lifecycle regulatory compliance. Enterprise-grade RIM platforms that support real-time dossier management and multi-agency coordination are being prioritized. Furthermore, USA-based CROs and CDMOs are increasingly deploying cloud-based RIM tools to service global clients. Large enterprises account for a significant share, yet cloud solutions have democratized access for SMEs. Key trends such as decentralized clinical trials and AI-led document processing are expected to reinforce software demand. Regulatory tech partnerships and investments are accelerating, particularly across Boston, San Diego, and the Research Triangle.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 10.3% |

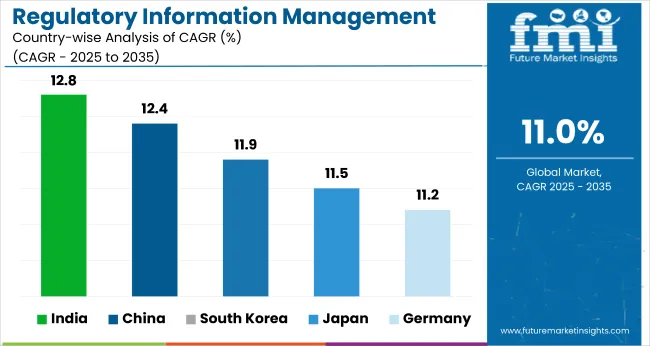

Germany is projected to grow from USD 0.29 billion in 2025 to USD 0.84 billion by 2035, registering a CAGR of 11.2%. The presence of pharmaceutical leaders, strict EU regulations, and early digitization initiatives fuel robust software demand. The implementation of the European Union’s eCTD v4.0, combined with the new IDMP standards, has necessitated upgrades across the R&D and regulatory landscape.

Germany’s push for digital healthcare through the “Digital Health Act” has also indirectly boosted RIM investments, particularly among companies that must integrate regulatory data into health-tech ecosystems. Germany’s biotech sector, which continues to expand post-COVID, is another high-growth contributor.

Furthermore, academic-industry collaborations with regulatory focus (e.g., BfArM initiatives) are facilitating smoother platform adoption. German firms show high preference for on-premise and hybrid cloud deployments due to GDPR compliance and data sovereignty concerns. However, SaaS-based tools are gaining traction among CROs and medical device startups. Regulatory intelligence modules integrated with AI are being piloted, especially among mid-sized firms.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 11.2% |

The United Kingdom is projected to grow from USD 0.23 billion in 2025 to USD 0.63 billion by 2035, registering a CAGR of 10.8%. Post-Brexit regulatory realignment has been a primary catalyst for new system deployments, particularly as firms operating in both EU and UK jurisdictions must now maintain parallel compliance workflows.

The UK Medicines and Healthcare Products Regulatory Agency (MHRA) has accelerated its digital transformation strategy, encouraging firms to modernize their regulatory operations. The RIM landscape in the UK is further supported by a strong contract research ecosystem and early-stage biotech sector. London and Cambridge-based firms are adopting RIM tools to manage the dual complexity of clinical and marketing authorization submissions. Investments in AI-based regulatory automation have gained traction in clusters such as Oxford and Manchester.

Furthermore, mid-sized pharmaceutical companies are focusing on centralized data repositories to track global registrations and renewals, increasing reliance on end-to-end platforms. The shift to electronic patient information leaflets and structured digital labeling formats also supports this evolution.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.8% |

Japan is projected to grow from USD 0.21 billion in 2025 to USD 0.62 billion by 2035, registering a CAGR of 11.5%. The Pharmaceuticals and Medical Devices Agency (PMDA) has mandated eCTD-based filings for most therapeutic products and is increasingly adopting international harmonization protocols in collaboration with ICH and USFDA.

Japanese pharmaceutical firms, traditionally slow to adopt cloud technologies, are now transitioning toward hybrid RIM deployments to manage growing global compliance needs. The aging population and rise of advanced therapies such as cell and gene therapies have introduced additional complexity in regulatory workflows, which drives demand for configurable RIM software with multi-language and region-specific modules. Japan’s medtech sector also contributes significantly to RIM adoption due to rigorous premarket and postmarket surveillance processes.

Several multinationals based in Tokyo and Osaka are integrating their local regulatory operations with global systems, fueling cross-border platform standardization. Localization, language compliance, and structured submission templates tailored to PMDA expectations are key competitive differentiators among RIM vendors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.5% |

China is projected to grow from USD 0.27 billion in 2025 to USD 0.88 billion by 2035, registering a CAGR of 12.4%. The National Medical Products Administration (NMPA) continues to streamline its review process, aligning with international standards such as ICH M4. These reforms have intensified the need for structured data, electronic submission protocols, and robust regulatory lifecycle management systems.

Chinese pharmaceutical companies are increasingly launching products for industries, requiring multi-country registration capabilities and bilingual compliance tools. Domestic CROs are rapidly digitizing operations to cater to multinational clinical sponsors, driving cloud-based RIM demand. Additionally, the country’s growing footprint in biosimilars and traditional Chinese medicine (TCM) exports introduces documentation complexity, necessitating scalable regulatory platforms.

National policy frameworks such as the "Healthy China 2030" plan promote digital health infrastructure, indirectly supporting RIM ecosystem growth. Local vendors are emerging with cost-effective solutions for mid-sized firms, while large players are integrating AI modules for submission validation and impact analysis.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 12.4% |

Canada is projected to grow from USD 0.14 billion in 2025 to USD 0.37 billion by 2035, registering a CAGR of 10.1%. The mandatory adoption of eCTD for prescription drugs and alignment with ICH standards has accelerated system upgrades across large and mid-sized firms.

Canada’s increasing involvement in multinational clinical trials and its role as a secondary regulatory node for USA-based drug developers further elevate the need for compliant, real-time RIM platforms. Firms are investing in RIM tools that ensure seamless coordination with Health Canada’s regulatory gateway, especially in therapeutic areas such as oncology, rare diseases, and specialty biologics. Bilingual labeling, electronic adverse event reporting, and ongoing lifecycle maintenance of registration data are critical drivers of software complexity.

The country’s favorable data privacy framework and high cloud readiness make it an attractive environment for SaaS-based deployments. Growth is supported by clusters in Ontario and British Columbia, where government incentives for regulatory tech adoption exist.

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 10.1% |

France is projected to grow from USD 0.18 billion in 2025 to USD 0.50 billion by 2035, registering a CAGR of 10.7%. France plays a critical role in EU compliance workflows post-Brexit, attracting regulatory consolidation across multinationals. Strong uptake of eCTD v4.0, integration with pharmacovigilance tools, and AI-powered translation modules are shaping next-gen platforms.

Local vendors in Paris and Lyon are driving customized deployments for ANSM compliance, particularly among firms managing centralized and decentralized registration pathways. Generics and branded pharma are the highest adopters, followed by medtech and emerging biotech. Regulatory lifecycle convergence across functions quality, labeling, and clinical is creating demand for unified, configurable platforms that enable cross-functional visibility and collaboration.

The industry is also benefitting from the EU’s digital product information initiatives and growing demand for IDMP-compliant infrastructure. SaaS growth is expanding among mid-sized players seeking structured product information capabilities, cost-efficient upgrades, and lower system maintenance burdens. France is expected to remain a vital EU anchor for scalable RIM across both regional and global operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 10.7% |

South Korea is projected to grow from USD 0.12 billion in 2025 to USD 0.37 billion by 2035, registering a CAGR of 11.9%. With increasing regulatory complexity enforced by the Ministry of Food and Drug Safety (MFDS), particularly around electronic documentation and registration of biosimilars, South Korean firms are upgrading their systems to enhance compliance.

South Korea’s growing influence in the global biologics, vaccines, and CDMO industries necessitates cross-border regulatory synchronization and lifecycle data centralization. Korean pharma and medtech firms have started transitioning from manual tracking to automated RIM platforms that support bilingual submissions, global compliance updates, and digital labeling. Tech-savvy companies in Seoul and Incheon are pioneering hybrid RIM deployments, integrating regulatory intelligence and impact assessment modules.

The government’s investment in digital health infrastructure and its ambition to become a global bio-innovation hub further reinforce demand for scalable RIM solutions. Notably, small and mid-sized biotech players are showing rising demand for low-latency cloud-based tools.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.9% |

Australia is projected to grow from USD 0.11 billion in 2025 to USD 0.33 billion by 2035, registering a CAGR of 11.6%. Australia’s industry is supported by an expanding pharmaceutical and clinical trial ecosystem under the Therapeutic Goods Administration (TGA). Regulatory data standardization efforts have intensified across both pharma and nutraceutical verticals, prompting higher RIM solution uptake.

The country’s alignment with ICH guidelines and TGA’s push for electronic submissions and e-labeling has forced firms to reassess legacy compliance workflows. Australian companies are responding by integrating cloud-based RIM systems that enable remote document access, real-time status tracking, and simplified variation management. Notably, CROs and regulatory consultants in Sydney and Melbourne are partnering with software providers to offer bundled RIM platforms to emerging biotech clients.

Australia also serves as a preferred location for early-phase trials, necessitating fast, accurate, and region-specific regulatory reporting. AI-powered document pre-validation tools and submission planning dashboards are increasingly being adopted. Limited regulatory workforce availability has made automation a necessity rather than an option.

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 11.6% |

India is projected to grow from USD 0.11 billion in 2025 to USD 0.37 billion by 2035, registering a CAGR of 12.8%. With increasing exports of generics, biosimilars, and active pharmaceutical ingredients (APIs), the need for multi-jurisdictional regulatory documentation has intensified.

The Central Drugs Standard Control Organization (CDSCO) has accelerated digitization mandates through initiatives like SUGAM, driving pharmaceutical companies to implement RIM systems that align with global eCTD and IDMP formats. Indian firms, particularly in Hyderabad, Mumbai, and Ahmedabad, are scaling cloud-based RIM platforms to streamline submission tracking and global registration management. Large contract manufacturers and CDMOs are adopting enterprise-level systems to ensure audit readiness and client-specific documentation compliance.

Meanwhile, mid-sized exporters are favoring modular, cost-optimized platforms. Integration with quality management systems and supply chain compliance modules is becoming more common. Regulatory staff shortages and growing demand from ROW (rest of world) industries further amplify the need for centralized digital solutions. India is expected to emerge as a pivotal RIM technology consumer and partner in the coming decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 12.8% |

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.39 billion |

| Projected Market Size (2035) | USD 6.79 billion |

| CAGR (2025 to 2035) | 11% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Solution | Software and Services |

| By Company Size | Small & Medium Enterprises (SMEs) and Large Enterprises |

| By Vertical | Pharmaceuticals, Cosmetics, Medical Devices, Biologics, and Nutraceuticals |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China, Canada, France, South Korea, Australia, India |

| Key Players | Veeva Systems, Kalypso , DDI, Körber AG, ArisGlobal , PhlexGlobal , AmpleLogic , Calyx, Amplexor Life Sciences, Ennov , MasterControl |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The regulatory information management market is projected to reach USD 6.79 billion by 2035, growing at a CAGR of 11% from USD 2.39 billion in 2025.

Cloud-based RIM software is expected to outpace on-premise deployments, driven by global submissions, cost efficiency, and real-time access.

Pharmaceuticals and biologics remain the top industries adopting RIM platforms due to complex regulatory workflows and global lifecycle tracking needs.

North America leads in RIM adoption, while Asia Pacific is the fastest-growing region with increasing pharmaceutical exports and compliance digitization.

Veeva Systems, ArisGlobal, and PhlexGlobal are among the top companies shaping the industry through integrated platforms and AI-driven automation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Latin America Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Western Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 15: Western Europe Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 28: East Asia Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Solution, 2019 to 2034

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Company Size, 2019 to 2034

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Vertical , 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Solution, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 17: Global Market Attractiveness by Solution, 2024 to 2034

Figure 18: Global Market Attractiveness by Company Size, 2024 to 2034

Figure 19: Global Market Attractiveness by Vertical , 2024 to 2034

Figure 20: Global Market Attractiveness by Region, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 22: North America Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 23: North America Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 24: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 28: North America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 29: North America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 30: North America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 37: North America Market Attractiveness by Solution, 2024 to 2034

Figure 38: North America Market Attractiveness by Company Size, 2024 to 2034

Figure 39: North America Market Attractiveness by Vertical , 2024 to 2034

Figure 40: North America Market Attractiveness by Country, 2024 to 2034

Figure 41: Latin America Market Value (US$ Million) by Solution, 2024 to 2034

Figure 42: Latin America Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 43: Latin America Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 57: Latin America Market Attractiveness by Solution, 2024 to 2034

Figure 58: Latin America Market Attractiveness by Company Size, 2024 to 2034

Figure 59: Latin America Market Attractiveness by Vertical , 2024 to 2034

Figure 60: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 61: Western Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 63: Western Europe Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 64: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 68: Western Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 71: Western Europe Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 77: Western Europe Market Attractiveness by Solution, 2024 to 2034

Figure 78: Western Europe Market Attractiveness by Company Size, 2024 to 2034

Figure 79: Western Europe Market Attractiveness by Vertical , 2024 to 2034

Figure 80: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 81: Eastern Europe Market Value (US$ Million) by Solution, 2024 to 2034

Figure 82: Eastern Europe Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 83: Eastern Europe Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 97: Eastern Europe Market Attractiveness by Solution, 2024 to 2034

Figure 98: Eastern Europe Market Attractiveness by Company Size, 2024 to 2034

Figure 99: Eastern Europe Market Attractiveness by Vertical , 2024 to 2034

Figure 100: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: South Asia and Pacific Market Value (US$ Million) by Solution, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 103: South Asia and Pacific Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 117: South Asia and Pacific Market Attractiveness by Solution, 2024 to 2034

Figure 118: South Asia and Pacific Market Attractiveness by Company Size, 2024 to 2034

Figure 119: South Asia and Pacific Market Attractiveness by Vertical , 2024 to 2034

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 121: East Asia Market Value (US$ Million) by Solution, 2024 to 2034

Figure 122: East Asia Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 123: East Asia Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 124: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 128: East Asia Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 131: East Asia Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 134: East Asia Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 137: East Asia Market Attractiveness by Solution, 2024 to 2034

Figure 138: East Asia Market Attractiveness by Company Size, 2024 to 2034

Figure 139: East Asia Market Attractiveness by Vertical , 2024 to 2034

Figure 140: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 141: Middle East and Africa Market Value (US$ Million) by Solution, 2024 to 2034

Figure 142: Middle East and Africa Market Value (US$ Million) by Company Size, 2024 to 2034

Figure 143: Middle East and Africa Market Value (US$ Million) by Vertical , 2024 to 2034

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Solution, 2019 to 2034

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Solution, 2024 to 2034

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Solution, 2024 to 2034

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Company Size, 2019 to 2034

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Company Size, 2024 to 2034

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Company Size, 2024 to 2034

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Vertical , 2019 to 2034

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Vertical , 2024 to 2034

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vertical , 2024 to 2034

Figure 157: Middle East and Africa Market Attractiveness by Solution, 2024 to 2034

Figure 158: Middle East and Africa Market Attractiveness by Company Size, 2024 to 2034

Figure 159: Middle East and Africa Market Attractiveness by Vertical , 2024 to 2034

Figure 160: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Product Information Management Market Growth – Trends & Forecast 2024-2034

Building Information Management (BIM) Market Analysis – Trends & Forecast 2024-2034

Security Information and Event Management Software Market

Physical Security Information Management (PSIM) Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Regulatory Reporting Solution Market Growth – Trends & Forecast 2025 to 2035

Regulatory Reporting Solution Market Growth – Trends & Forecast 2023-2033

Regulatory Reporting Solution Market Growth – Trends & Forecast 2023-2033

Regulatory Reporting Solutions Market

Information Security Consulting Market

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Bank Regulatory & Governance Consulting Market Size and Share Forecast Outlook 2025 to 2035

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA