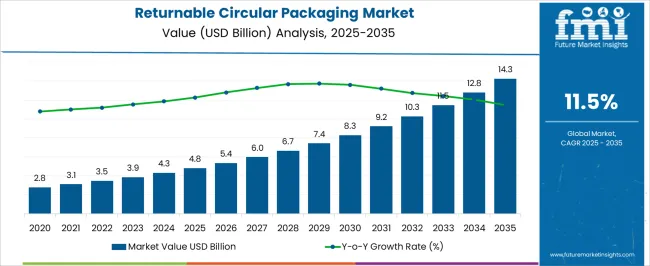

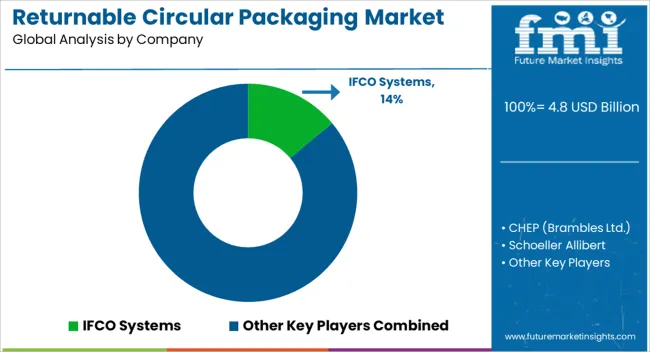

The returnable circular packaging market is valued at USD 4.8 billion in 2025 and is set to reach USD 13.9 billion by 2035, resulting in a total increase of USD 9.1 billion over the forecast decade. This represents a 189.6% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 11.5%. Over ten years, the market grows by a 2.9 multiple.

In the first five years (2025 to 2030), the market progresses from USD 4.8 billion to USD 8.4 billion, contributing USD 3.6 billion, or 39.6% of total decade growth. This phase is shaped by rising demand from food and beverage industries adopting circular packaging systems. Regulatory emphasis on waste reduction and deposit-return schemes in Europe accelerate early adoption.

In the second half (2030 to 2035), the market grows from USD 8.4 billion to USD 13.9 billion, adding USD 5.5 billion, or 60.4% of the total growth. This acceleration is supported by expanded applications across chemicals and industrial sectors, along with technological advances in tracking systems and standardized designs. Growing consumer acceptance of reusable packaging formats ensures sustained market expansion through this specialized packaging segment.

| Metric | Value |

| Returnable Circular Packaging Market Estimated Value in (2025E) | USD 4.8 Billion |

| Returnable Circular Packaging Market Forecast Value in (2035F) | USD 13.9 Billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

From 2020 to 2024, the returnable circular packaging market expanded from USD 1.5 billion to USD 4.1 billion, driven by strong adoption in food and beverage supply chains where reusable containers reduce waste and logistics costs. Nearly 60% of revenue was concentrated among major pooling companies providing standardized crates, pallets, and containers. Leading firms such as IFCO Systems, CHEP, and ORBIS Corporation emphasized durability, tracking technology, and closed-loop distribution networks. Competitive focus remained on container standardization, supply chain integration, and cost reduction per use cycle, while digital tracking and IoT-enabled monitoring stayed secondary. Service-led offerings such as container washing and logistics management contributed approximately 35% of revenues during this period.

By 2035, the returnable circular packaging market will reach USD 13.9 billion, growing at a CAGR of 11.50%, with smart tracking technologies and automated sorting systems representing over 45% of market value. Competition will intensify as solution providers offer RFID-enabled containers, blockchain-based tracking, and AI-driven logistics optimization. Established players are pivoting toward hybrid models combining traditional pooling services with digital supply chain platforms. Emerging companies such as RePack are gaining market share with innovative consumer-facing reusable packaging, modular designs, and sustainability-focused business models, meeting global demand for circular economy solutions and waste reduction targets.

The growing demand for sustainable packaging solutions and circular economy practices is driving growth in the returnable circular packaging market. These systems reduce single-use packaging waste, lower material costs over multiple use cycles, and support corporate sustainability targets. Expanding regulatory mandates for deposit-return schemes and extended producer responsibility accelerate adoption.

Packaging systems designed with durable materials, standardized dimensions, and integrated tracking capabilities are gaining traction for their ability to streamline supply chains while reducing environmental impact. Compatibility with automated handling equipment enhances operational efficiency, while reduced per-unit packaging costs over multiple cycles appeal to cost-conscious manufacturers. Consumer acceptance of reusable packaging formats in retail and e-commerce channels further strengthens market growth opportunities worldwide.

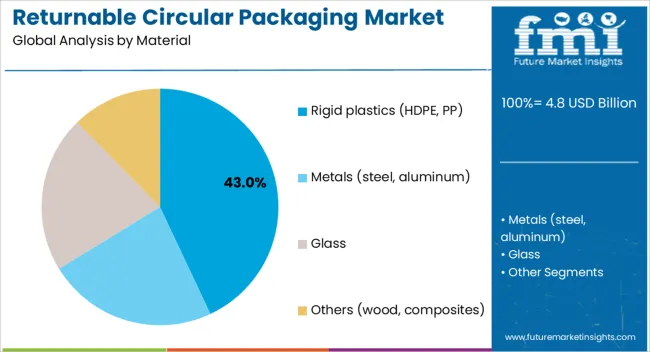

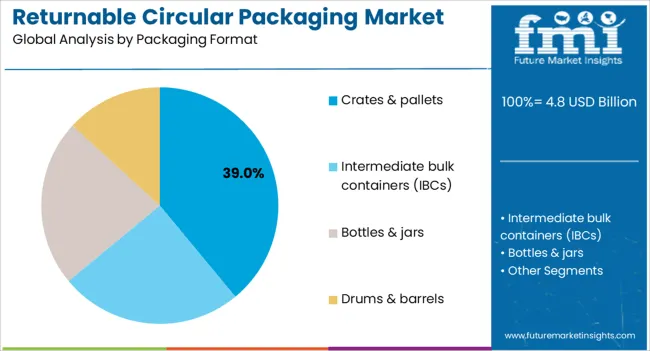

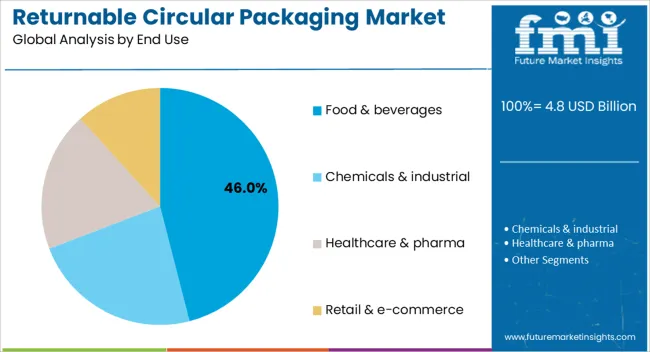

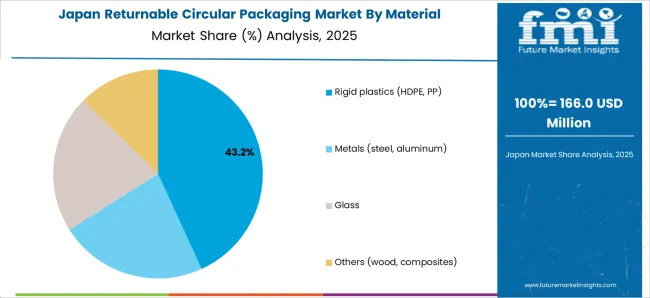

The market is segmented by material, packaging format, end-use, and region. Material segmentation includes rigid plastics such as HDPE and PP, metals including steel and aluminum, glass, and other materials like wood and composites, each offering durability and reusability benefits. Packaging format covers crates and pallets, intermediate bulk containers (IBCs), bottles and jars, and drums and barrels, supporting diverse product categories and supply chain requirements. End-use industry segmentation includes food and beverages, chemicals and industrial applications, healthcare and pharmaceuticals, and retail and e-commerce, reflecting broad adoption across sectors. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Rigid plastics (HDPE, PP) are forecast to account for 43.0% of the returnable circular packaging market in 2025, supported by their lightweight structure, impact resistance, and chemical compatibility. These materials withstand multiple use cycles while maintaining structural integrity, making them ideal for food-grade applications and industrial containers. Their moldability allows for optimized designs that stack efficiently and integrate with automated handling systems.

Rising demand for lightweight packaging that reduces transportation costs has accelerated adoption of plastic over traditional materials. Innovations in recycled content and improved polymer formulations enhance sustainability credentials while maintaining performance. The material's compatibility with tracking technologies such as embedded RFID tags reinforces its leadership in smart packaging applications.

Crates and pallets are projected to hold 39.0% of the market in 2025, driven by their fundamental role in supply chain logistics and material handling. Their standardized dimensions ensure compatibility with existing warehouse infrastructure, automated sorting systems, and transportation equipment. The format's proven track record in pooling operations makes it the preferred choice for established circular packaging programs.

Adoption is fueled by their dominance in fresh produce, beverage, and industrial goods distribution. Companies prefer these formats for their stackability, durability across temperature ranges, and ability to protect products during transit. Integration with tracking systems enables visibility throughout the supply chain, supporting efficient inventory management and loss prevention.

Food and beverage applications are expected to capture 46.0% of demand in 2025, as returnable packaging systems align with the industry's focus on freshness, cost efficiency, and sustainability. The sector's high-volume operations and established distribution networks make circular packaging economically viable. Fresh produce, dairy, and beverage companies particularly benefit from reusable crates and containers that protect products while reducing packaging waste.

The sector's adoption is reinforced by consumer acceptance of returnable bottles, crates, and containers in retail environments. Regulatory support for deposit-return schemes in beverage packaging creates additional momentum. Supply chain efficiencies from standardized containers and reduced packaging procurement costs further cement the food and beverage sector as the primary market driver.

The returnable circular packaging market is expanding as businesses adopt sustainable packaging solutions that reduce waste, lower costs, and meet regulatory requirements. Rising consumer environmental awareness and corporate sustainability commitments drive adoption across industries. However, high initial investments, logistics complexity, and consumer behavior challenges restrain growth. Innovations in smart tracking, standardized designs, and deposit-return systems are reshaping market opportunities.

Returnable circular packaging systems reduce material consumption and waste generation compared to single-use alternatives, supporting corporate environmental targets and regulatory compliance. These systems lower per-unit packaging costs over multiple use cycles, making them economically attractive for high-volume applications. Government regulations promoting extended producer responsibility and deposit-return schemes create favorable conditions for adoption. Consumer acceptance of reusable packaging in retail settings, particularly for beverages and fresh produce, supports market growth. The combination of environmental benefits, cost savings, and regulatory alignment positions returnable packaging as a strategic business solution.

Despite strong benefits, widespread adoption faces challenges from significant upfront investments in containers, tracking systems, and reverse logistics infrastructure. Complex supply chain management requirements for collection, cleaning, and redistribution add operational complexity. Consumer behavior patterns that favor convenience over sustainability can limit adoption in certain segments. Contamination risks and hygiene concerns in food applications require additional processing steps. Standardization challenges across different regions and industries complicate global implementation, slowing market penetration in cost-sensitive applications.

Key trends include the integration of RFID tags, QR codes, and IoT sensors for real-time container tracking and inventory management. Automated sorting and cleaning systems are improving operational efficiency while reducing labor costs. Blockchain technology is being explored for supply chain transparency and fraud prevention. Deposit-return schemes are expanding beyond traditional beverage applications to include food containers and e-commerce packaging. Standardization initiatives are driving industry-wide adoption of common dimensions and specifications, enabling greater supply chain efficiency and cross-industry compatibility.

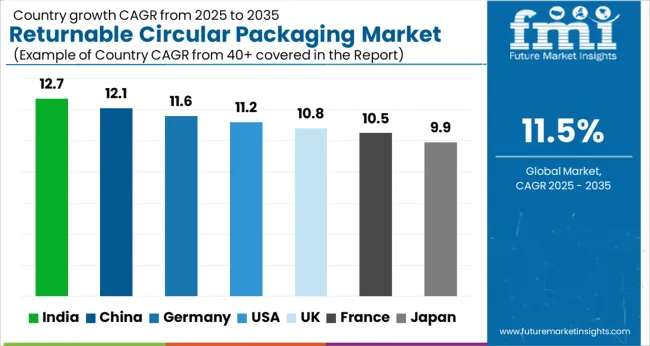

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 12.70% |

| China | 12.10% |

| Germany | 11.60% |

| USA | 11.20% |

| UK | 10.80% |

| France | 10.50% |

| Japan | 9.90% |

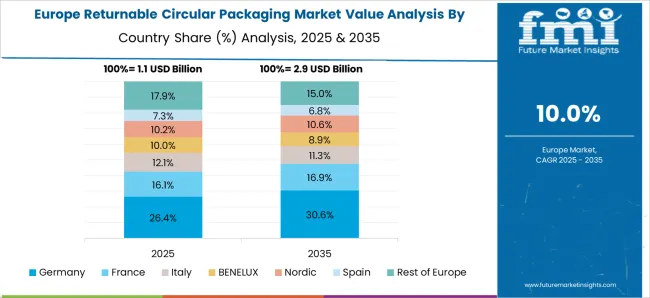

The global returnable circular packaging market is experiencing consistent growth, driven by regulatory support for circular economy practices, corporate sustainability initiatives, and cost reduction pressures. Asia-Pacific is emerging as the fastest-growing region, with India and China adopting returnable systems due to expanding industrial production and government waste reduction policies. Developed economies like the USA, Germany, and Japan emphasize advanced tracking technologies, standardized pooling systems, and deposit-return schemes to meet environmental regulations and supply chain efficiency goals.

The USA market for returnable circular packaging is projected to grow at a CAGR of 11.2% from 2025 to 2035, supported by expanding pilot programs for reusable e-commerce packaging and beverage deposit systems. Consumer goods companies are adopting circular packaging to meet sustainability targets while reducing material costs. Food and beverage manufacturers are investing in standardized crate and pallet systems for supply chain efficiency.

Germany's market for returnable circular packaging is expected to grow at a CAGR of 11.6%, supported by EU packaging directives and established deposit-return schemes. The country's advanced manufacturing sector drives demand for standardized industrial containers and pallets. Beverage and food companies utilize mature pooling systems for cost-effective circular packaging solutions.

The UK market for returnable circular packaging is forecast to grow at a CAGR of 10.8%, driven by grocery retailers scaling deposit-return systems for bottles and containers. Government waste reduction targets and plastic packaging taxes create favorable conditions for circular packaging adoption. Food and beverage companies invest in reusable container systems to reduce material costs and environmental impact.

China's market for returnable circular packaging is projected to grow at a CAGR of 12.1%, fueled by government-led waste reduction initiatives and expanding beverage industry adoption. Manufacturing companies implement circular packaging systems to comply with environmental regulations and reduce material costs. Food and chemical industries drive demand for standardized containers and intermediate bulk containers.

Indian returnable circular packaging market is forecast to record the fastest growth at a CAGR of 12.7%, supported by FMCG and dairy industries scaling returnable crate systems. Food and beverage companies invest in circular packaging to reduce costs and meet sustainability targets. Government initiatives promoting waste reduction and plastic alternatives create favorable market conditions.

France's market for returnable circular packaging is expected to grow at a CAGR of 10.5%, driven by circular economy laws and refillable format adoption. Food and beverage companies utilize established pooling systems for cost-effective packaging solutions. Retail sector adoption of deposit-return schemes supports market expansion.

Japan's market for returnable circular packaging is projected to grow at a CAGR of 9.9%, led by reusable packaging adoption in pharmaceutical and convenience retail sectors. Companies implement circular systems to meet waste reduction targets and improve supply chain efficiency. Advanced tracking technologies support sophisticated pooling operations.

The returnable circular packaging market is moderately concentrated, with established pooling companies, container manufacturers, and logistics providers competing across food and beverage, industrial, and retail sectors. Global leaders such as IFCO Systems, CHEP (Brambles Ltd.), and Schoeller Allibert hold significant market share, driven by standardized container designs, comprehensive logistics networks, and established customer relationships. Their strategies increasingly emphasize digital tracking integration, supply chain optimization, and sustainability reporting capabilities.

Established players including ORBIS Corporation, DS Smith Plc, and RPC Group (Berry Global) are supporting adoption of circular packaging systems featuring durable materials, modular designs, and compatibility with automated handling equipment. These companies are especially active in industrial applications and food service sectors, offering integrated solutions that combine container supply, logistics management, and cleaning services to optimize total cost of ownership.

Specialized providers such as Greif Inc., Tosca Services, Arca Systems, and RePack focus on niche market segments and innovative packaging formats. Their strengths lie in customized container designs, sector-specific solutions, and consumer-facing reusable packaging systems, enabling brands to implement circular packaging strategies that align with sustainability goals while maintaining operational efficiency and customer satisfaction.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 billion |

| By Material | Rigid Plastics (HDPE, PP), Metals (Steel, Aluminum), Glass, Others (Wood, Composites) |

| By Packaging Format | Crates & Pallets, Intermediate Bulk Containers (IBCs), Bottles & Jars, Drums & Barrels |

| By End-Use | Food & Beverages, Chemicals & Industrial, Healthcare & Pharma, Retail & E-commerce |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | IFCO Systems, CHEP (Brambles Ltd.), Schoeller Allibert, ORBIS Corporation, DS Smith Plc, RPC Group (Berry Global), Greif Inc., Tosca Services, Arca Systems, RePack |

| Additional Attributes | Dollar sales by material, packaging format, end use, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging startups, buyer preferences for sustainable versus conventional materials, integration with AI-driven design and digital manufacturing platforms, innovations in multi-material packaging capabilities and closed-loop recycling systems, and adoption of smart packaging solutions with embedded sensors, QR codes, and interactive features for enhanced consumer engagement. |

The global returnable circular packaging market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the returnable circular packaging market is projected to reach USD 14.3 billion by 2035.

The returnable circular packaging market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in returnable circular packaging market are rigid plastics (hdpe, pp), metals (steel, aluminum), glass and others (wood, composites).

In terms of packaging format, crates & pallets segment to command 39.0% share in the returnable circular packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Returnable Plastic Crate Market Size and Share Forecast Outlook 2025 to 2035

Returnable Glass Bottle Market Trends – Size & Forecast 2024-2034

Returnable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Returnable Transport Packaging Market Analysis by Metal, Plastic, Paper, and Wood Through 2035

North America Returnable Transport Packaging Market Trends – Forecast 2023-2033

WAN Connected Returnable Transport Asset Tracking Market Trend - Growth & Forecast 2025 to 2035

Circular Saw Blade Market Forecast and Outlook 2025 to 2035

Circular Industrial Bags Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA