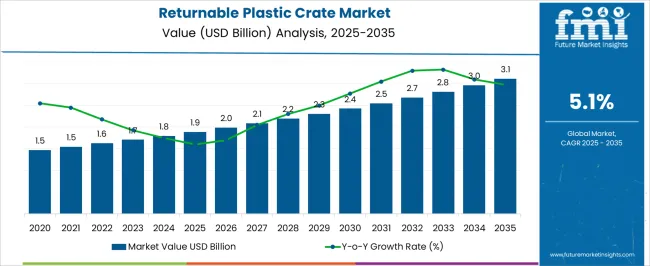

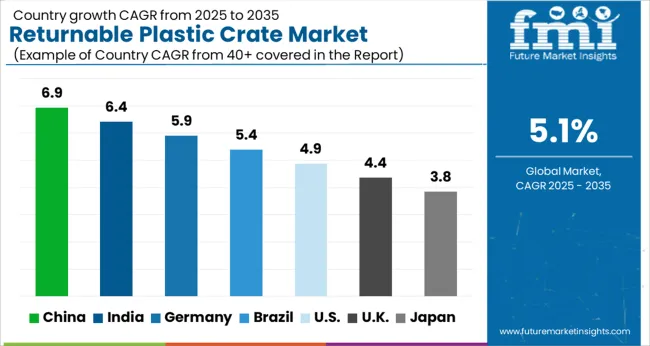

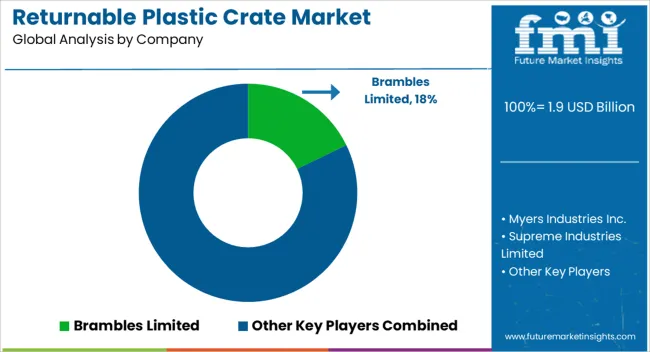

The Returnable Plastic Crate Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Returnable Plastic Crate Market Estimated Value in (2025 E) | USD 1.9 billion |

| Returnable Plastic Crate Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The returnable plastic crate market is experiencing robust growth driven by increasing adoption of sustainable packaging solutions, the need for efficient supply chain management, and rising demand across food, beverage, and retail sectors. Current market dynamics are influenced by the shift from single-use packaging to reusable systems, regulatory emphasis on environmental sustainability, and technological improvements in crate design and durability.

The future outlook is characterized by growing e-commerce penetration, expansion of cold chain logistics, and heightened focus on reducing packaging waste, which collectively are expected to drive increased utilization of returnable crates. Growth rationale is anchored on the operational cost savings, enhanced handling efficiency, and reduced environmental footprint associated with returnable systems, while innovations in material strength, stackability, and customization are supporting broader adoption.

Strategic initiatives by manufacturers to improve lifecycle management, distribution network integration, and compliance with industry standards are expected to further underpin market expansion and ensure sustained demand across diverse end-use industries.

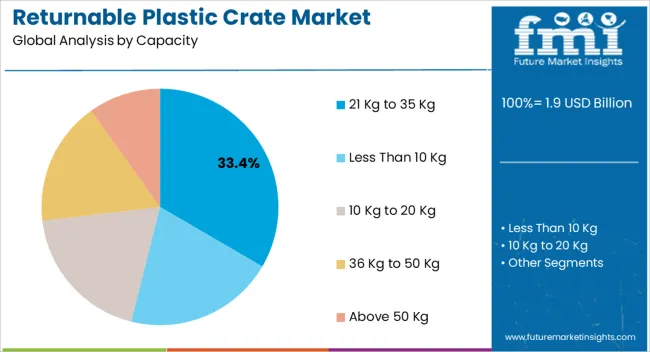

The 21 Kg to 35 Kg capacity segment, representing 33.4% of the capacity category, has been leading due to its optimal balance between load handling and ease of transport. This segment is preferred for diverse logistics and storage applications where moderate weight capacity ensures operational efficiency.

Adoption has been supported by standardized sizing that aligns with pallet and vehicle dimensions, facilitating stacking, transport, and storage. Product durability and resistance to wear have reinforced preference among distributors and end-users.

Continued improvements in molding techniques and material optimization are enhancing crate strength while reducing weight, sustaining market share The segment benefits from consistent demand across perishable goods, FMCG, and industrial supply chains, ensuring stable growth and reliable contribution to overall market expansion.

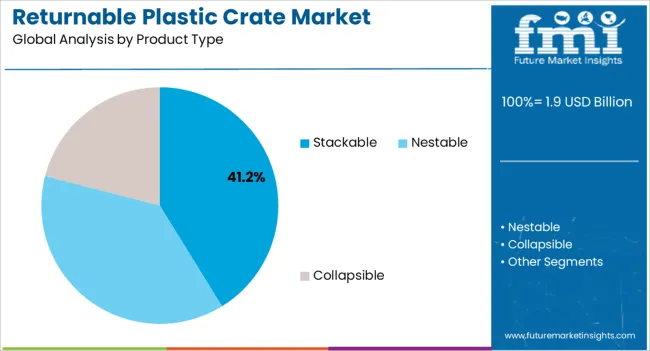

The stackable segment, holding 41.2% of the product type category, has maintained a leading position due to its ability to optimize storage space, improve handling efficiency, and facilitate cost-effective transportation. Adoption has been reinforced by integration into automated warehousing and logistics systems.

Stackable design ensures stability during transit and storage, reducing product damage and enhancing operational efficiency. The segment’s popularity is supported by compatibility with standardized pallets and containerized shipping, while design innovations continue to enhance load-bearing capacity and durability.

As supply chains increasingly demand efficient, scalable, and reusable packaging solutions, the stackable segment is expected to maintain its market share and contribute significantly to growth across industrial and retail applications.

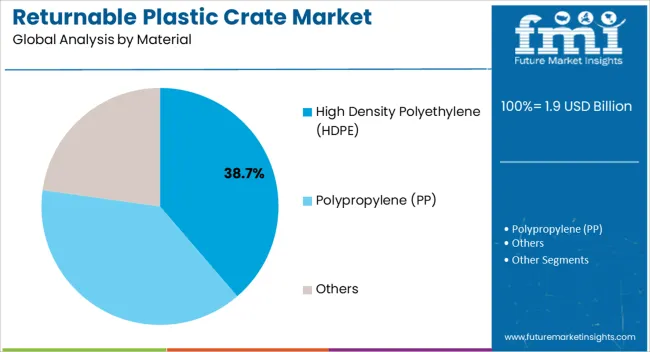

The high-density polyethylene (HDPE) segment, accounting for 38.7% of the material category, has emerged as the preferred material due to its superior strength, chemical resistance, and durability under repeated use. Adoption has been supported by the material’s lightweight properties, recyclability, and compliance with food-grade and industrial safety standards.

HDPE crates offer extended lifecycle performance, reducing replacement costs and environmental impact. Technological advancements in polymer processing and reinforcement have enhanced impact resistance and load-bearing capacity, maintaining product reliability.

The segment continues to be favored across sectors requiring robust, hygienic, and reusable packaging solutions, and ongoing focus on material innovation is expected to sustain market leadership and facilitate broader adoption of returnable plastic crates globally.

The scope for returnable plastic crate rose at a 5.0% CAGR between 2020 and 2025. The global market for returnable plastic crate is anticipated to grow at a moderate CAGR of 5.4% over the forecast period 2025 to 2035.

| Report Attributes | Details |

|---|---|

| Market Value in 2020 | USD 1.3 billion |

| Market Value in 2025 | USD 1.6 billion |

| CAGR from 2020 to 2025 | 5.0% |

During the historical period 2020 to 2025, the returnable plastic crate market experienced steady growth. The growth was driven by sustainability awareness, supply chain optimization, and government regulations on single use plastics.

Industries such as agriculture, automotive, and retail were prominent adopters due to cost reduction and sustainability benefits. Environmental regulations and sustainability drove adoption. Crate design improvements and IoT integration were notable.

Supply chain optimization became a top priority for businesses during this period. Returnable plastic crates, with their durability, reusability, and ease of handling, offered a solution for streamlining logistics and reducing costs throughout the supply chain.

Looking ahead to the period from 2025 to 2035, the returnable plastic crate market is expected to continue growing at an accelerated pace, owing to sustainability initiatives, eCommerce expansion, and ongoing technological advancements.

Pharmaceuticals, electronics, and healthcare sectors are expected to increase their usage of returnable plastic crates. Sustainability initiatives are expected to intensify, influencing further adoption. Continued innovation, including advanced tracking and lightweight yet durable materials, will enhance the appeal of the market.

Increased investments in research and development, with a focus on gaining a competitive edge through innovations and acquisitions. While established companies will continue to dominate, technology driven startups are expected to have an increased presence, leading to potential shifts in market share.

Market players are projected to increase investments in research and development. The focus will be on gaining a competitive edge through innovations and acquisitions. The emphasis on R&D will lead to the introduction of more advanced and efficient returnable plastic crate solutions.

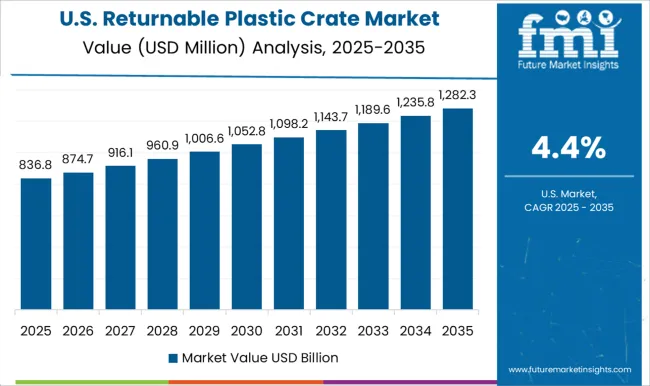

The returnable plastic crate market in the United States expected to expand at a CAGR of 2.8% through 2035.

The increasing emphasis on sustainability and environmental responsibility has driven the adoption of returnable plastic crates in the United States. Businesses are looking for eco friendly alternatives to single use packaging, and returnable plastic crates align with these objectives by reducing waste and promoting circular economy principles.

The country has various environmental regulations and policies at the federal, state, and local levels that encourage businesses to reduce their carbon footprint and promote sustainable practices. The regulations can drive companies to explore returnable plastic crate solutions.

Efficient logistics and supply chain management have become essential in the modern business landscape. Returnable plastic crates are designed to optimize transportation, reduce shipping costs, and minimize product damage, making them attractive for companies looking to enhance their supply chain operations.

The returnable plastic crate market in the United Kingdom is anticipated to expand at a CAGR of 4.4% through 2035.

The United Kingdom has been actively promoting sustainability and environmental responsibility. Returnable plastic crates are considered a more eco friendly option compared to single use packaging, which aligns with the efforts of the country to reduce waste and promote circular economy principles.

The government in the country has shown a commitment to creating a circular economy by encouraging the use of recyclable and reusable packaging. Returnable plastic crates support these initiatives by reducing the need for disposable packaging.

Stringent environmental regulations and policies in the country push companies to adopt more sustainable practices. Businesses are encouraged to explore packaging solutions like returnable plastic crates to meet these regulatory requirements.

The returnable plastic crate market in India is poised to expand at a CAGR of 6.5% through 2035.

The agriculture and horticulture industries in India have seen increased adoption of returnable plastic crates for the transportation of fruits, vegetables, and other produce. The crates help protect perishable goods and extend their shelf life.

The growth of organized retail and eCommerce in India has increased the demand for durable packaging solutions. Returnable plastic crates are well suited for product transport and storage in these sectors. While there may be an initial investment in acquiring returnable plastic crates, businesses can achieve long term cost savings by reducing packaging expenses and waste disposal costs.

The ability to customize returnable plastic crates to meet specific product requirements and branding needs is attractive to businesses looking to establish their identity and cater to specific market demands.

Returnable plastic crate trends in China are taking a turn for the better. A 5.9% CAGR is forecast for the country from 2025 to 2035.

Returnable plastic crates are designed to enhance supply chain efficiency. They are stackable, lightweight, and durable, reducing transportation costs and minimizing product damage.

While there may be an initial investment in acquiring returnable plastic crates, businesses in China can achieve long term cost savings by eliminating the need for single use packaging, reducing packaging costs, and waste disposal expenses.

Collaborative supply chain models, including crate pooling and sharing, have gained momentum in China. The models make it more convenient and cost effective for businesses to adopt returnable plastic crates.

The ability to customize returnable plastic crates to meet specific product requirements and branding needs appeals to businesses looking to establish their identity and cater to specific market demands.

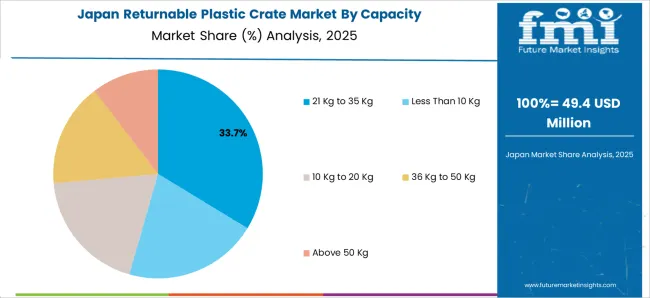

The returnable plastic crate market in the Japan is anticipated to expand at a CAGR of 3.2% through 2035.

Japan has a strong focus on environmental sustainability and reducing plastic waste. Returnable plastic crates are viewed as a more eco friendly option compared to single use packaging, aligning with the efforts to promote recycling and waste reduction in the country

The commitment to high quality standards, particularly in industries like pharmaceuticals, food processing, and electronics, in the country, makes returnable plastic crates an attractive choice for maintaining product integrity and compliance.

The need for temperature controlled logistics in Japan, especially for the transport of fresh and frozen food products, has increased the use of returnable plastic crates with insulation properties. Innovations in crate design and the integration of tracking technologies, such as RFID and IoT, have improved the management and traceability of returnable plastic crates in Japan.

The below table highlights how nestable segment is projected to lead the market in terms of product type, and is expected to account for a share of 49.5% in 2025.

Based on material, the HDPE segment is expected to account for a share of 67.1% in 2025.

| Category | Shares (in 2025) |

|---|---|

| Nestable | 49.5% |

| HDPE | 67.1% |

Based on product type, the nestable segment is expected to continue dominating the returnable plastic crate market. The segment is expected to account for a share of 49.5% in 2025.

Nestable crates are highly space efficient. When not in use, they can be nested or stacked inside one another, reducing the amount of storage space required, which is particularly advantageous in warehouses, distribution centers, and during return transit.

The space efficiency of nestable crates leads to cost savings in terms of storage and transportation. Reduced storage space requirements mean lower warehouse expenses, and the ability to stack more crates on a single pallet leads to reduced shipping costs.

Nestable crates optimize supply chain and logistics operations. The stackable design allows for efficient transportation and storage, which minimizes product damage and transportation costs.

Nestable plastic crates contribute to sustainability efforts. They are reusable, which reduces the need for single use packaging, and their space saving design means fewer resources are used for production and transportation.

Based on material, the HDPE segment is expected to continue dominating the returnable plastic crate market. The segment is expected to account for a share of 67.1% in 2025.

HDPE is known for its high durability, making it ideal for applications that require long lasting and robust packaging solutions. HDPE crates can withstand rough handling and provide protection to the transported goods.

HDPE is highly recyclable, making it an environmentally responsible choice. Businesses and industries are increasingly opting for packaging solutions made from recycled HDPE or that can be recycled after use. HDPE crates can be designed with insulating properties, making them suitable for temperature controlled logistics, such as the transport of pharmaceuticals and perishable goods.

HDPE crates can be branded with company logos and product information, serving as a marketing tool during transportation and in store displays. The use of HDPE in returnable plastic crates aligns with sustainability initiatives and efforts to reduce single use plastics and waste. It is considered more eco friendly compared to some other materials.

The key strategies chosen by large companies include several growth strategies such as technology development, expansion as well and mergers and acquisitions to surge market share, reach and revenue.

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.9 billion |

| Projected Market Valuation in 2035 | USD 3.1 billion |

| Value based CAGR 2025 to 2035 | 5.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered |

Capacity, Product Type, Material, Application, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled |

Brambles Limited; Myers Industries Inc.; Supreme Industries Limited; Schoeller Allibert Services B.V.; DS Smith PLC; Rehrig Pacific Company Inc.; TranPak Inc.; IPL Plastics Inc.; RPP Containers; Craemer UK Limited; Dynawest Limited; Dolav UK Limited; Ravensbourn Limited; Zhejiang Zhengji Plastic Industry Co. Ltd.; Stamford Products Limited |

The global returnable plastic crate market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the returnable plastic crate market is projected to reach USD 3.1 billion by 2035.

The returnable plastic crate market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in returnable plastic crate market are 21 kg to 35 kg, less than 10 kg, 10 kg to 20 kg, 36 kg to 50 kg and above 50 kg.

In terms of product type, stackable segment to command 41.2% share in the returnable plastic crate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Returnable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Returnable Circular Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Returnable Transport Packaging Market Analysis by Metal, Plastic, Paper, and Wood Through 2035

Returnable Glass Bottle Market Trends – Size & Forecast 2024-2034

North America Returnable Transport Packaging Market Trends – Forecast 2023-2033

WAN Connected Returnable Transport Asset Tracking Market Trend - Growth & Forecast 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Bottle Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Drum Industry Analysis in Malaysia Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Bottles Market Size and Share Forecast Outlook 2025 to 2035

Plastic Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA