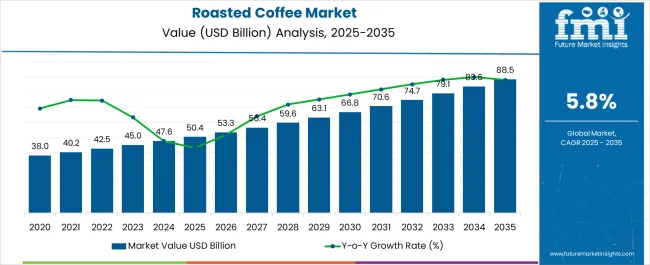

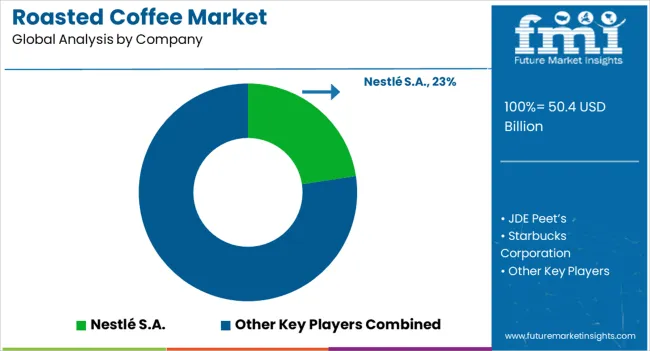

The roasted coffee market is estimated to be valued at USD 50.4 billion in 2025 and is projected to reach USD 88.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. Between 2020 and 2024, the market advanced from USD 38.0 billion to 47.6 billion, representing the early adoption stage. Growth during this period was gradual, as consumer habits evolved with shifting preferences toward premium offerings and differentiated experiences.

Early adopters, including specialty cafés and select retail chains, set the tone by highlighting variety and quality, influencing broader consumption trends. This stage focused on building brand loyalty, shaping awareness, and preparing the market for more rapid expansion. From 2025 to 2030, the roasted coffee market transitions into its scaling phase, climbing from USD 50.4 billion to nearly 66.8 billion. Adoption becomes more widespread as consumption patterns stabilize across both retail and out-of-home channels. Expansion of product formats and deeper penetration into emerging regions support volume growth, while established players strengthen supply chains and distribution. By 2030, with the market at approximately USD 66.8 billion, roasted coffee begins to shift into consolidation. From 2030 to 2035, growth steadies, reaching USD 88.5 billion, where major brands reinforce market dominance and consumption reflects a mature, consistent demand base.

| Metric | Value |

|---|---|

| Roasted Coffee Market Estimated Value in (2025 E) | USD 50.4 billion |

| Roasted Coffee Market Forecast Value in (2035 F) | USD 88.5 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The roasted coffee market is experiencing robust growth, driven by increasing global coffee consumption and evolving consumer preferences for premium and specialty blends. Demand has been steadily rising in both mature and emerging economies, as observed in industry publications, company earnings calls, and trade news. Urbanization, the expansion of café culture, and growing interest in artisanal coffee have been influencing consumption patterns.

Additionally, innovations in roasting techniques and flavor customization have allowed brands to differentiate their offerings in a competitive landscape. Press releases from major coffee producers highlight sustainability, traceability, and ethical sourcing as key value drivers shaping the market’s direction. The future outlook appears promising, supported by higher disposable incomes, expanding retail networks, and digital direct-to-consumer models.

These trends are expected to strengthen market penetration across all regions, particularly in Asia Pacific and North America As reported in company investor briefings, premiumization and consumer engagement strategies are also contributing to brand loyalty and repeat purchases, setting the stage for sustained growth in the years ahead.

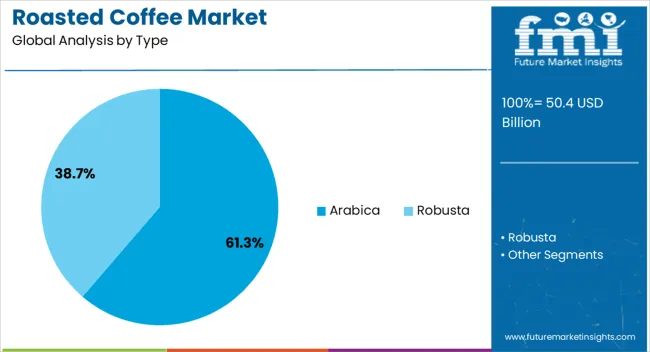

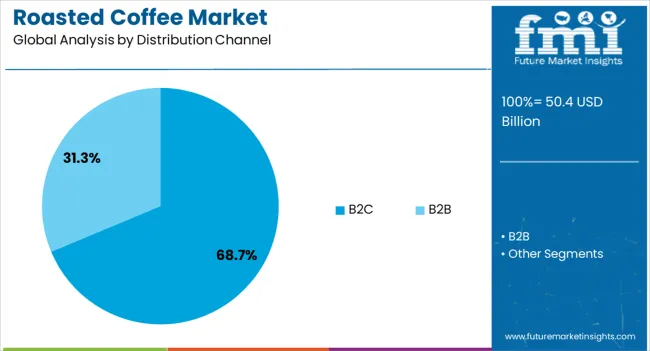

The roasted coffee market is segmented by type, distribution channel, and geographic regions. By type, the roasted coffee market is divided into Arabica and Robusta. In terms of distribution channels, the roasted coffee market is classified into B2C and B2B. Regionally, the roasted coffee industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Arabica type is projected to account for 61.3% of the roasted coffee market revenue share in 2025, positioning it as the leading segment within the market. This dominance is being driven by consumer preference for its mild flavor profile, balanced acidity, and aromatic qualities, as widely noted in trade publications and product press statements. Arabica beans are being cultivated at higher altitudes, contributing to their perceived quality and premium image among coffee consumers.

Roasters and retailers have increasingly promoted Arabica-based blends due to their favorable reception in specialty coffee markets. Furthermore, procurement strategies by major brands have placed emphasis on sustainably sourced Arabica, reinforcing its value proposition.

The segment’s growth has also been supported by rising health awareness, as Arabica is associated with lower caffeine content compared to its counterparts. These factors, combined with growing consumption among millennials and health-conscious demographics, have solidified its leadership in the roasted coffee category.

The B2C distribution channel is expected to contribute 68.7% of the roasted coffee market revenue share in 2025, making it the most dominant segment by channel. Its leading position is being reinforced by the widespread availability of roasted coffee products through supermarkets, hypermarkets, specialty stores, and online platforms. As detailed in corporate strategy updates and investor presentations, consumers are increasingly engaging with coffee brands directly via digital channels, subscription models, and home delivery services.

The shift in consumer behavior toward at-home consumption, accelerated by global lifestyle changes, has played a key role in this channel’s expansion. Moreover, branded retail stores and eCommerce platforms have been enhancing the B2C experience with personalized offerings, loyalty programs, and curated selections.

Industry news has also emphasized the importance of packaging innovations and convenience formats that appeal to individual buyers. These combined factors have elevated the B2C segment to a leadership position within the roasted coffee distribution landscape.

The roasted coffee market continues to grow as global demand for premium, specialty, and sustainably sourced coffee expands across retail, hospitality, and e-commerce channels. Rising coffee culture, café lifestyles, and the popularity of single-origin and artisanal blends are shaping consumer preferences. Europe and North America dominate due to established consumption habits, while Asia-Pacific is witnessing rapid growth driven by urbanization, younger demographics, and expanding coffee shop chains. Innovation in roasting methods, traceability, and sustainable sourcing is driving differentiation. Market expansion focuses on flavor diversity, ethical practices, and multi-channel distribution.

Maintaining consistent quality in roasted coffee remains a challenge due to variability in bean origin, climate impact, and roasting precision. Green coffee sourcing is affected by seasonal harvest cycles, geopolitical factors, and climate change risks, influencing bean availability and flavor stability. Roasting profiles require exacting standards to achieve desired taste, aroma, and texture, yet batch-to-batch consistency can be difficult for smaller roasters. Complex supply chains spanning multiple regions heighten risks of delays and quality degradation. Companies investing in direct trade, vertically integrated sourcing, and advanced roasting technologies gain credibility. Until global supply and climate resilience improve, consistency and supply chain volatility will remain key barriers.

Technology is reshaping the roasted coffee market through advanced roasting systems, automation, and data-driven precision. Smart roasters equipped with digital controls, sensors, and AI-based algorithms allow precise temperature and time management, ensuring optimal flavor profiles. Packaging innovations extend freshness and shelf life, while e-commerce platforms enhance consumer access to specialty coffee. Traceability technologies such as blockchain and QR codes provide transparency from farm to cup, appealing to ethically conscious buyers. Automation in roasting and distribution reduces costs while supporting scalability for specialty roasters. As technological innovation advances, producers delivering consistency, traceability, and efficiency gain stronger appeal among both consumers and institutional buyers.

The roasted coffee market is influenced by diverse regulations across production, labeling, and trade. Food safety standards, labeling requirements, and import/export regulations differ by region, creating complexity for global brands. Claims related to organic, fair trade, or specialty certifications must comply with recognized frameworks, requiring third-party validation. Mislabeling or unverifiable sustainability claims can lead to consumer mistrust and regulatory penalties. In addition, tariffs and international trade restrictions may influence sourcing strategies. Until greater harmonization of standards and certifications is achieved, regulatory differences and labeling constraints will continue to shape brand positioning and market accessibility.

The roasted coffee market is intensely competitive, with global multinationals, specialty roasters, and local brands all vying for market share. Larger players leverage strong distribution networks and brand recognition, while niche roasters differentiate through unique blends, single-origin sourcing, and artisanal quality. Sustainability is becoming a defining factor, with growing demand for eco-friendly packaging, carbon-neutral roasting, and ethically sourced beans. Supply chain disruptions and rising input costs further pressure pricing strategies. Companies investing in direct farmer partnerships, sustainability certifications, and innovative customer engagement through cafés and e-commerce gain an edge. Until supply stability and sustainability adoption improve, rivalry and ethical positioning will remain central to competition.

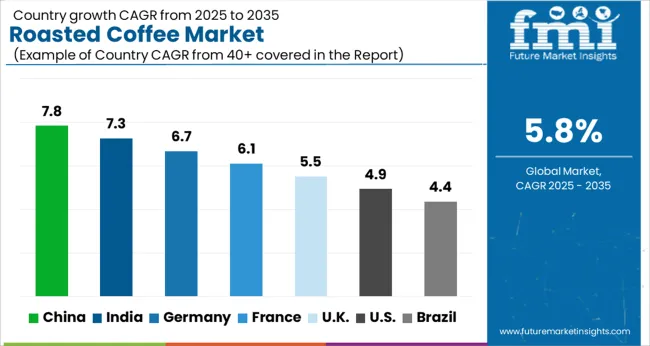

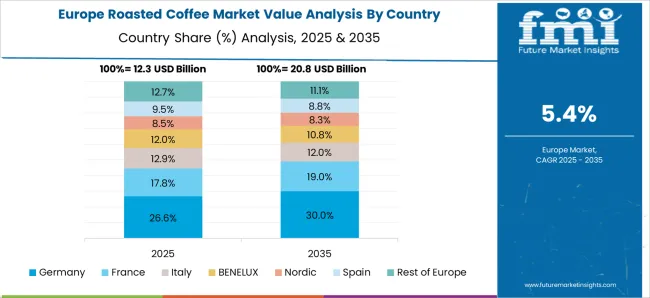

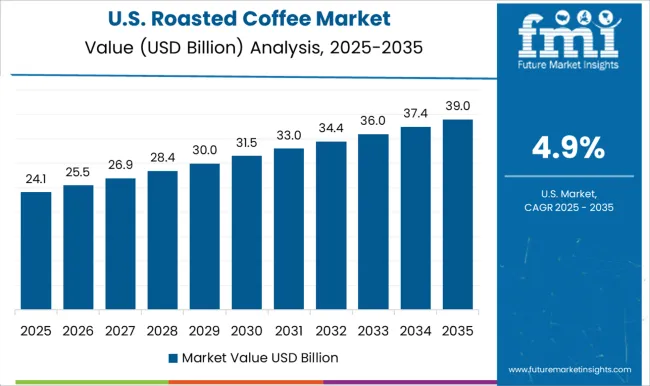

The global Roasted Coffee Market is projected to grow at a CAGR of 5.8% through 2035, supported by increasing consumption across households, cafés, and specialty outlets. Among BRICS nations, China has been recorded with 7.8% growth, driven by expanding café culture and rising demand in urban centers, while India has been observed at 7.3%, supported by stronger consumption in both domestic households and retail chains. In the OECD region, Germany has been measured at 6.7%, where established coffee-processing industries and premium product demand have been steadily maintained. The United Kingdom has been noted at 5.5%, with growth attributed to wider café networks and changing consumption preferences, while the USA has been recorded at 4.9%, reflecting steady demand in specialty blends and premium retail products. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The roasted coffee market in China is expanding rapidly, growing at a CAGR of 7.8%, driven by rising urbanization and increasing consumer preference for Western-style beverages. Coffee culture is becoming a significant lifestyle trend among younger demographics, with cafés and specialty coffee shops spreading across major cities. Domestic roasters are increasingly focusing on premium blends and single-origin varieties to meet evolving tastes. The market also benefits from the popularity of online platforms, which make high-quality roasted coffee more accessible to consumers in smaller cities. Multinational coffee chains are expanding their footprint, further promoting coffee consumption beyond traditional tea-drinking habits. In addition, rising disposable income levels are encouraging consumers to shift toward specialty and premium roasted coffee products. With China’s rapidly expanding middle class and the evolution of consumer preferences toward café-style experiences, the roasted coffee market in China is set for continued growth in the foreseeable future.

The roasted coffee market in Germany is advancing at a CAGR of 6.7%, reflecting the nation’s established reputation as one of Europe’s largest coffee consumers. German consumers show a strong preference for roasted coffee, with a growing shift toward specialty blends, organic options, and sustainable sourcing. Demand is being shaped by increasing awareness of ethical coffee consumption, with fair-trade and environmentally friendly products gaining popularity. Both retail and foodservice sectors are witnessing a rise in premium roasted coffee consumption. Home brewing equipment sales are also expanding, further boosting demand for quality roasted coffee products. Germany’s robust café culture continues to thrive, supported by innovation in flavors and roasting techniques. With consumers increasingly valuing traceability and authenticity, roasted coffee demand in Germany is expected to expand steadily. The combination of established consumption habits and growing focus on premium and sustainable products ensures long-term market stability.

The roasted coffee market in the United Kingdom is growing at a CAGR of 5.5%, supported by rising consumer interest in high-quality coffee experiences. Coffee consumption has become a daily ritual for many, with demand rising for freshly roasted, specialty, and premium blends. Growth in independent coffee shops and specialty cafés is shaping consumer preferences toward artisanal coffee. Online retail channels have also expanded significantly, allowing consumers to access a variety of roasted coffee products with ease. Sustainability is an increasingly important factor, with eco-conscious consumers driving demand for ethically sourced and environmentally friendly coffee. The UK market is also seeing an increase in at-home brewing trends, as consumers invest in coffee machines and grinders to replicate café-style experiences at home. With evolving consumer tastes and rising demand for premium coffee, the roasted coffee market in the UK is expected to maintain steady growth.

The roasted coffee market in India is projected to grow at a CAGR of 7.3%, supported by a rising shift in consumer beverage preferences. Traditionally dominated by tea consumption, India is witnessing a steady rise in coffee culture, particularly among younger urban professionals. Growth is being driven by café chains, specialty coffee shops, and local roasters offering unique and premium blends. Increasing awareness of global coffee trends and the rising popularity of artisanal beverages are reshaping demand patterns. E-commerce platforms are also playing a significant role by making premium roasted coffee available to consumers nationwide. Domestic roasters are focusing on sourcing quality beans from southern states, while international brands are gaining visibility through collaborations and marketing campaigns. As disposable incomes rise and urban lifestyles evolve, demand for roasted coffee in India is expected to remain strong, positioning it as one of the fastest-growing markets in Asia.

The roasted coffee market in the United States is expanding at a CAGR of 4.9%, supported by the country’s deep-rooted coffee culture and growing demand for specialty products. Consumers are increasingly favoring premium, organic, and ethically sourced roasted coffee, reflecting heightened awareness of quality and sustainability. Coffee chains, independent roasters, and artisanal cafés continue to shape consumption patterns, with millennials and Gen Z leading the demand for innovative blends and flavors. The rise of subscription-based coffee services and e-commerce platforms is improving accessibility and convenience for consumers. At-home brewing has become a prominent trend, with consumers investing in advanced coffee machines and grinders. Functional and health-focused roasted coffee products, such as low-acid and antioxidant-rich varieties, are also driving demand. With the USA remaining one of the world’s largest coffee markets, roasted coffee demand is expected to remain strong with steady long-term growth prospects.

The roasted coffee market continues to expand globally, driven by increasing consumer demand for premium, specialty, and sustainably sourced coffee. The shift toward café culture, rising consumption in emerging economies, and growing interest in ethically produced and organic coffee varieties are shaping the industry. Additionally, innovations in roasting techniques, packaging, and distribution channels are boosting the market’s growth while meeting evolving consumer preferences.

Nestlé S.A., through its Nescafé and Nespresso brands, is a global leader in the roasted coffee segment, offering a wide portfolio from instant blends to premium single-origin varieties. JDE Peet’s is another major player, with an extensive range of well-known coffee brands catering to both retail and out-of-home channels. Starbucks Corporation dominates the specialty coffee sector with its strong retail presence, global cafés, and packaged coffee offerings. The J.M. Smucker Company, through its Folgers and Dunkin’ brands, has a significant footprint in the North American roasted coffee market. Luigi Lavazza S.p.A. and Strauss Coffee B.V. (Strauss Group) are recognized leaders in Europe, offering a blend of tradition and innovation with their premium roasted coffee products. Melitta Group and Tchibo also maintain strong positions in the European market, focusing on quality and consumer-centric innovation.

Massimo Zanetti Beverage Group provides a global presence with its Segafredo brand, catering to both retail and foodservice markets. Farmer Bros. Co. specializes in supplying roasted coffee to restaurants, convenience stores, and institutional clients in the United States. With increasing consumer focus on flavor diversity, sustainability, and premium experiences, the roasted coffee market is expected to see sustained growth across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 50.4 Billion |

| Type | Arabica and Robusta |

| Distribution Channel | B2C and B2B |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé S.A., JDE Peet’s, Starbucks Corporation, The J.M. Smucker Company, Luigi Lavazza SPA, STRAUSS Coffee B.V. (Straus Group), Melitta Group, Tchibo, Massimo Zanetti Beverage Group, and Farmer Bros. Co. |

| Additional Attributes | Dollar sales by type including Arabica, Robusta, and blended coffee, form such as whole bean and ground, application across household, foodservice, and specialty outlets, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising coffee consumption, demand for premium blends, and expansion of café culture. |

The global roasted coffee market is estimated to be valued at USD 50.4 billion in 2025.

The market size for the roasted coffee market is projected to reach USD 88.5 billion by 2035.

The roasted coffee market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in roasted coffee market are arabica and robusta.

In terms of distribution channel, b2c segment to command 68.7% share in the roasted coffee market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Roasted Malt Market Size and Share Forecast Outlook 2025 to 2035

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Coffee Grounds Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Concentrate Market - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Grounds for Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Bottles Market Insights & Industry Trends 2025 to 2035

Coffee Pouch Market Growth - Demand & Forecast 2025 to 2035

Coffee Bags Market Demand & Forecast Analysis 2025 to 2035

Coffee Gummy Market Analysis by sales channel, application and region Through 2025 to 2035

Coffee Syrup Market Analysis by Product type, Application, End User and Packaging Through 2025 to 2035

Coffee Bean Grind Machine Market Trends - Growth & Forecast 2025 to 2035

Coffee Capsules Market Analysis - Growth & Forecast 2025 to 2035

Coffee Extract Market Analysis by Nature, Product, End Use, Formulation, and Region through 2025 to 2035

Market Share Distribution Among Coffee Filter Paper Manufacturers

Coffee Capsules and Pods Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA