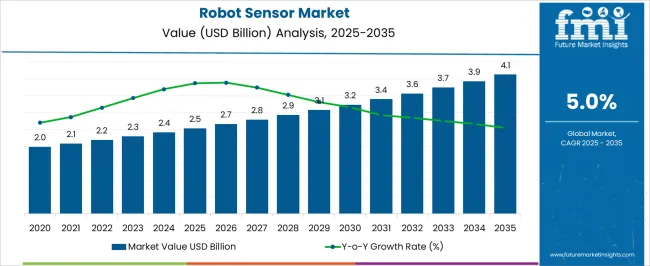

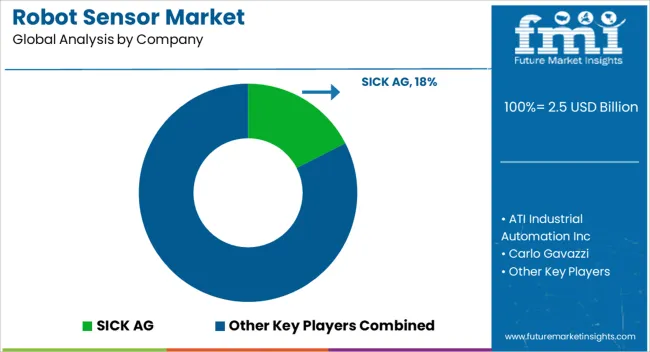

The robot sensor market is estimated at USD 2.5 billion in 2025 and is expected to reach USD 3.2 billion by 2030. From 2025 to 2027, the market will rise from USD 2.5 billion to USD 2.8 billion, delivering an incremental USD 0.3 billion. This phase is supported by strong adoption of navigation, vision, and tactile sensors across industrial automation and healthcare robotics.

Demand for precision-driven automation in logistics and assembly lines, combined with advances in miniaturized sensing devices, continues to elevate adoption. Enhanced compatibility with modern robotic platforms further boosts integration in both traditional and emerging application segments. Between 2028 and 2030, the market will grow from USD 2.9 billion to USD 3.2 billion, adding another USD 0.3 billion in incremental value.

This expansion is driven by increasing penetration of AI-enhanced sensing capabilities, improved efficiency of collaborative robots, and a growing preference for predictive maintenance solutions in automated environments. Emerging demand in agriculture, retail, and autonomous service robots adds to the pace of adoption. The total incremental growth for 2025–2030 will be USD 0.7 billion, underscoring steady yet substantial expansion.

| Metric | Value |

|---|---|

| Robot Sensor Market Estimated Value in (2025 E) | USD 2.5 billion |

| Robot Sensor Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The robot sensor market is witnessing significant advancement due to the accelerated deployment of automation across manufacturing, logistics, healthcare, and service sectors. The integration of advanced sensors has become essential in improving robot perception, autonomy, and human-machine collaboration.

Increased investment in smart factories and Industry 4.0 initiatives is reshaping the demand landscape for sensory components that support object recognition, environmental mapping, and safety assurance. Regulatory emphasis on worker safety, along with the rise of collaborative robots, has amplified the need for responsive and adaptive sensing technologies.

Additionally, the convergence of robotics with AI and edge computing is facilitating real-time data processing, driving innovation in sensor design and functionality. The market is expected to expand further through sensor miniaturization, energy efficiency improvements, and growing demand for intelligent sensing systems that enable predictive maintenance and adaptive control in complex operational environments.

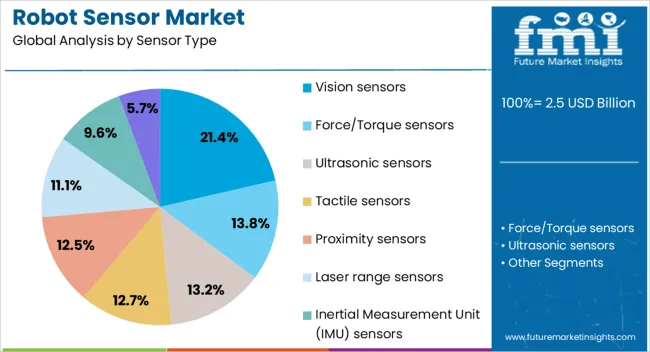

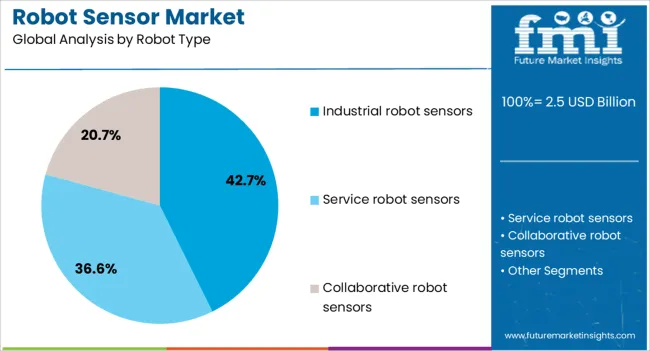

The robot sensor market is segmented by sensor type, robot type, technology, connectivityend use industry, and geographic regions. By sensor type, the market is divided into Vision sensors, Force/Torque sensors, Ultrasonic sensors, Tactile sensors, Proximity sensors, Laser range sensors, Inertial Measurement Unit (IMU) sensors, and Other sensors. In terms of robot type, the market is classified into Industrial robot sensors, Service robot sensors, and Collaborative robot sensors.

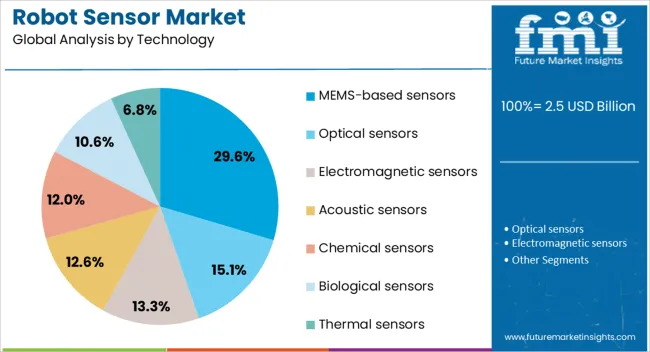

Based on technology, the market is segmented into MEMS-based sensors, Optical sensors, Electromagnetic sensors, Acoustic sensors, Chemical sensors, Biological sensors, and Thermal sensors. By connectivity, the market is segmented into Wireless sensors, Wired sensors, and Hybrid sensors.

By end use industry, the market is segmented into Manufacturing, Logistics and Warehousing, Healthcare and Medical, Agriculture and Farming, Defense and Security, Domestic and Personal Use, Entertainment and Hospitality, Construction and Mining, and Other applications.

Regionally, the robot sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vision sensors are projected to account for 21.4% of the total revenue in the robot sensor market in 2025, making them the leading sensor type segment. Their dominance is being driven by the increasing reliance on vision-based systems for object detection, quality inspection, and real-time decision-making in autonomous robotics.

The demand for high-resolution imaging and depth perception has encouraged the adoption of 2D and 3D vision sensors across industrial and service robots. Their ability to function in dynamic environments and support machine learning algorithms enhances the performance and flexibility of robotic systems.

Moreover, the evolution of compact vision modules with built-in lighting and communication interfaces has improved ease of integration into robotic platforms. As automation becomes more decentralized and collaborative, vision sensors are expected to remain central to enabling spatial awareness and contextual understanding in robotics.

Industrial robot sensors are expected to contribute 42.7% of total market revenue in 2025, establishing them as the top robot type segment. Their leadership stems from widespread integration in automotive, electronics, and heavy machinery sectors, where precision, repeatability, and safety are paramount.

The growing complexity of tasks performed by industrial robots including welding, assembly, and material handling requires an extensive array of sensors to monitor force, proximity, position, and environmental conditions. Increased adoption of smart robotics in manufacturing, driven by productivity optimization and labor cost reduction, has amplified the need for sensor-equipped systems that can operate with minimal supervision.

Additionally, investments in upgrading legacy automation systems and the global push toward digital manufacturing are expected to sustain the demand for industrial robot sensors in the coming years.

MEMS-based sensors are forecast to hold 29.6% of the total revenue share in 2025, making them the most widely adopted technology segment in the robot sensor market. Their compact size, low power consumption, and high sensitivity make them suitable for integration in space-constrained robotic applications.

MEMS technology enables the development of accelerometers, gyroscopes, and pressure sensors that are crucial for motion control, stability monitoring, and spatial orientation in autonomous systems. These sensors support real-time responsiveness in dynamic environments, particularly in drones, medical robots, and mobile service robots.

Their cost-efficiency and scalability in production have allowed broader adoption across both industrial and consumer robotics. As demand rises for lightweight and multifunctional robots, MEMS-based sensing solutions are positioned to remain at the forefront of next-generation robotic innovation.

The robot sensor market is expanding, driven by increasing automation in industries such as manufacturing, logistics, and healthcare. Growth in 2024 and 2025 was fueled by the rising demand for precise and efficient robotic systems. Opportunities exist in the integration of sensors with artificial intelligence for enhanced capabilities. Emerging trends include the use of advanced sensors for collaborative robots (cobots). However, market growth is hindered by high costs and the complexity of integrating sensors with existing robotic systems.

The major growth driver in the robot sensor market is the growing adoption of automation across various industries. In 2024 and 2025, manufacturing, logistics, and healthcare sectors increasingly relied on robotics to improve productivity, accuracy, and safety. Sensors integrated into robotic systems play a key role in providing real-time data, improving functionality, and enabling autonomous decision-making. The need for precision in these applications has accelerated the demand for advanced robotic sensors, which is driving market growth in both industrial and commercial sectors.

Opportunities in the market lie in the integration of sensors with artificial intelligence (AI) to enable smarter robots. In 2025, robotics manufacturers incorporated AI-enabled sensors to allow robots to learn, adapt, and interact with their environments in real time. This integration not only improved operational efficiency but also opened up new applications, such as in healthcare robots, where sensor data is used for diagnostics and monitoring. AI integration is expected to expand the range of robotic capabilities, creating significant growth opportunities.

Emerging trends in the robot sensor market include the increasing use of collaborative robots (cobots) equipped with advanced sensors. In 2024, industries began adopting cobots to work alongside humans in more complex tasks, requiring precise and safe interaction. These robots rely heavily on advanced sensors, including proximity, vision, and force sensors, to ensure safe collaboration with workers. This trend towards safer and more adaptable robotic systems is expected to drive demand for highly accurate and specialized sensors in various sectors.

Key restraints in the robot sensor market include the high costs of advanced sensors and the complexity of integrating them into existing robotic systems. In 2024 and 2025, small and medium-sized enterprises (SMEs) struggled with the high initial investment required for advanced sensor systems, limiting their adoption. Additionally, integrating sensors into diverse robotic platforms, especially in legacy systems, presented technical challenges. These factors hindered the widespread adoption of advanced robotics in industries where cost and system compatibility are major concerns.

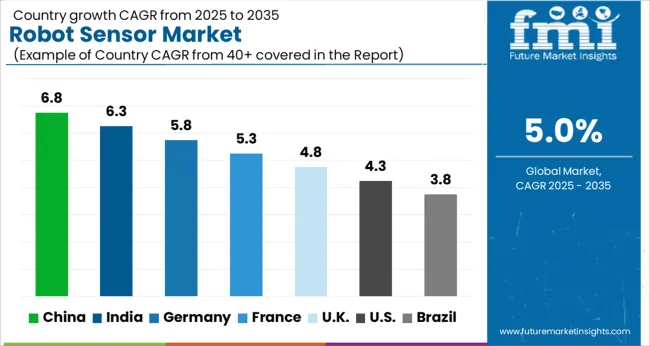

The global robot sensor market is projected to grow at 5% CAGR from 2025 to 2035. China leads with 6.8% CAGR, driven by the country's expanding robotics industry, increasing industrial automation, and growing demand for advanced sensor technologies. India follows at 6.3%, fueled by the rising demand for automation solutions across manufacturing, logistics, and healthcare sectors.

France records 5.3% CAGR, supported by a strong focus on industrial robotics, precision sensors, and smart automation technologies. The United Kingdom grows at 4.8%, while the United States posts 4.3%, reflecting steady demand in mature markets with a focus on improving operational efficiency, safety, and productivity in robotic applications.

Asia-Pacific leads the market growth, while Europe and North America focus on innovation and integration with Industry 4.0 technologies.

The robot sensor market in China is forecasted to grow at 6.8% CAGR, driven by the country's rapid industrial growth and adoption of automation in manufacturing, logistics, and service industries. As China continues to strengthen its position as a global leader in robotics, the demand for advanced robot sensors for precise movement, detection, and control in robots increases. Government initiatives to support industrial automation and AI integration further contribute to the growth of robot sensors across various applications.

The robot sensor market in India is projected to grow at 6.3% CAGR, supported by the increasing demand for automation solutions in industries such as manufacturing, healthcare, and logistics. As India adopts Industry 4.0 technologies and robotics, the need for efficient, reliable sensors in robotic applications continues to rise. Additionally, the growing focus on labor-saving technologies and precision control systems further fuels market growth, particularly in the automotive and electronics sectors.

The robot sensor market in France is expected to grow at 5.3% CAGR, driven by increasing demand for industrial robots equipped with advanced sensors for precise control, navigation, and feedback systems. France’s strong robotics and automation sector, particularly in automotive and electronics manufacturing, creates significant demand for robot sensors. Furthermore, the growing trend toward smart factories and the integration of IoT and AI technologies in manufacturing processes further accelerates the market growth.

The robot sensor market in the United Kingdom is projected to grow at 4.8% CAGR, driven by steady demand for sensors used in robotic applications across industrial automation, logistics, and defense sectors. The UK’s focus on enhancing manufacturing efficiency and safety through robotics and automation technologies supports the growing need for robot sensors. Furthermore, the trend towards smart manufacturing and the use of robotics in healthcare and service industries strengthens the demand for advanced sensing solutions.

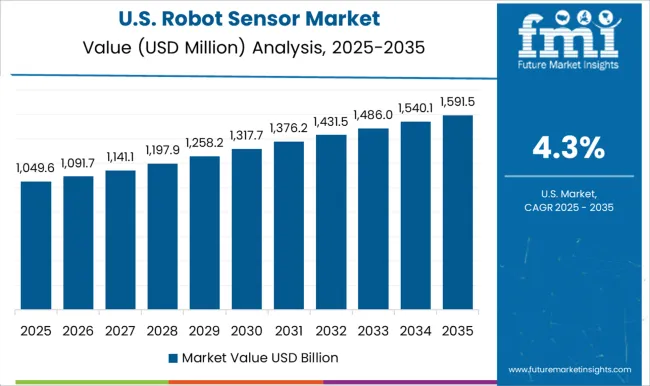

The robot sensor market in the United States is projected to grow at 4.3% CAGR, reflecting steady demand in a mature robotics market. The USA continues to be a leader in robotics, with significant investments in automation for manufacturing, defense, and logistics applications. As AI, IoT, and machine learning technologies integrate into robotics, the demand for advanced sensor systems to provide precise control, detection, and feedback continues to rise. The increasing adoption of collaborative robots (cobots) in the workplace further accelerates market growth.

Competition in robot sensing has been shaped by global automation incumbents with broad catalogs and tight OEM relationships. Advantage is pursued through certified safety, integrated vision, and software-upgradeable sensing suites tuned for collaborative and mobile robots.

Within SICK’s portfolio, hazardous zones are policed with microScan3 safety laser scanners that establish programmable protective fields for stationary cells and automated guided vehicles, while time-of-flight 3D cameras such as Visionary-T Mini are specified for navigation, pallet detection, and object avoidance in ambient light, and 2D vision sensors like PLOC2D are configured for part localization and robot guidance with direct controller connectivity and IP-rated housings, enabling fast commissioning on the line. Ecosystems are emphasized.

Sensors are provided with engineering tools, standard M12 connectors, and prebuilt function blocks for robot PLCs. Safety controllers and motion monitoring modules are used to implement speed and separation monitoring, safe brake control, and drive supervision across electric and pneumatic axes. Service packages and application guides are presented to shorten commissioning and validation. Distribution is executed through direct industry vertical teams and integrator channels (observed industry pattern).

The strategy has been articulated as a migration from application-specific hardware to software-defined sensors feeding integrated solutions, with business fields split between sensor level offerings and solution integration so that value is captured beyond the device. Prioritization is given to higher compute on-edge, improved algorithms for perception under glare, dust, and vibration, and easier web-based configuration to reduce total cost of ownership.

Target segments are defined as logistics automation, industrial vehicles, airports, ports, discrete manufacturing, and building safety, where safety certification and uptime are purchasing criteria. Scalability is sought through modular platforms that reuse optics, firmware, and configuration environments across 2D, 3D, LiDAR, and safety families, enabling cross-sell from detection to measurement to protection. Sustainability and compliance are framed through machine safety standards support, reduction of machine footprint via compact sensors, and tools that cut commissioning travel (observed industry pattern).

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Sensor Type | Vision sensors, Force/Torque sensors, Ultrasonic sensors, Tactile sensors, Proximity sensors, Laser range sensors, Inertial Measurement Unit (IMU) sensors, and Other sensors |

| Robot Type | Industrial robot sensors, Service robot sensors, and Collaborative robot sensors |

| Technology | MEMS-based sensors, Optical sensors, Electromagnetic sensors, Acoustic sensors, Chemical sensors, Biological sensors, and Thermal sensors |

| Connectivity | Wireless sensors, Wired sensors, and Hybrid sensors |

| End Use Industry | Manufacturing, Logistics and Warehousing, Healthcare and Medical, Agriculture and Farming, Defense and Security, Domestic and Personal Use, Entertainment and Hospitality, Construction and Mining, and Other applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SICK AG, ATI Industrial Automation Inc, Carlo Gavazzi, Cognex Corporation, Fanuc Corporation, Honeywell International Inc, Infineon Technologies, and KEYENCE CORPORATION |

| Additional Attributes | Dollar sales by sensor type and application, demand dynamics across industrial automation, healthcare, and consumer electronics, regional trends in robot sensor adoption, innovation in AI-driven sensing technologies, impact of regulatory standards on safety and performance, and emerging use cases in autonomous robots and smart manufacturing systems. |

The global robot sensor market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the robot sensor market is projected to reach USD 4.1 billion by 2035.

The robot sensor market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in robot sensor market are vision sensors, force/torque sensors, ultrasonic sensors, tactile sensors, proximity sensors, laser range sensors, inertial measurement unit (imu) sensors and other sensors.

In terms of robot type, industrial robot sensors segment to command 42.7% share in the robot sensor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anthropomorphic Robot Inertial Sensor Market Size and Share Forecast Outlook 2025 to 2035

Demand for Anthropomorphic Robot Inertial Sensor in USA Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Robot Controller, Integrator and Software Market Size and Share Forecast Outlook 2025 to 2035

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robot Assisted Surgical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA