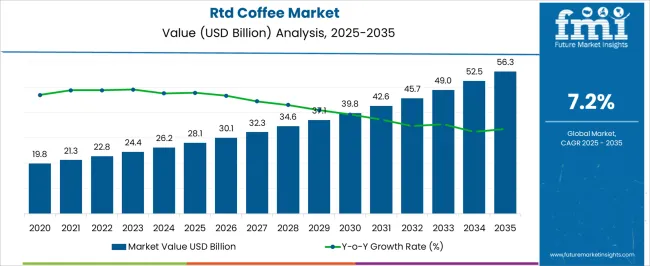

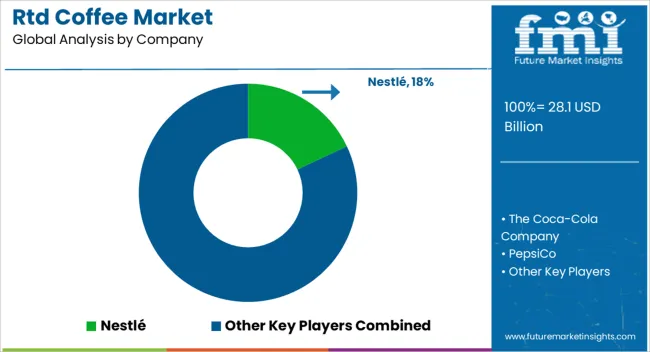

The RTD coffee market is estimated to be valued at USD 28.1 billion in 2025 and is projected to reach USD 56.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

Over this period, the market is expected to nearly double in value, supported by the rising consumer preference for convenient, on-the-go beverage formats. Growing demand among younger demographics, coupled with the appeal of cold-brew and specialty coffee options, is driving sales. Manufacturers are investing in product variety, flavor innovation, and packaging formats that enhance accessibility, which is further boosting the adoption of RTD coffee globally.

This growth trajectory highlights strong opportunities for market participants as RTD coffee becomes increasingly integrated into daily routines across both developed and emerging economies. The steady rise in premium offerings, sugar-free formulations, and functional coffee blends with added ingredients like protein or vitamins is reshaping consumer expectations. Expansion in retail channels, particularly supermarkets, convenience stores, and online platforms, is enhancing availability and supporting broader penetration. As the RTD coffee segment continues to gain momentum, companies that can balance affordability with high-quality taste profiles are expected to capture significant opportunities, ensuring the market maintains its upward trajectory throughout the forecast period.

| Metric | Value |

|---|---|

| RTD Coffee Market Estimated Value in (2025 E) | USD 28.1 billion |

| RTD Coffee Market Forecast Value in (2035 F) | USD 56.3 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

Within the global coffee market, RTD coffee commands only a small fraction, representing just a few percent of all coffee consumption, underscoring its niche role in a massive industry. When examined within the broader RTD coffee & tea combined market, RTD coffee accounts for approximately 25% of that category, indicating its significance among ready to drink beverages. In the context of the broader RTD beverages market, RTD coffee contributes around 10%, signifying that it remains a specialty offering next to other RTD drink types such as teas and functional beverages. Within the non carbonated RTD coffee segment, RTD coffee dominates heavily, with nearly 95% share, demonstrating its strong presence in conventional formats. Conversely, in the much smaller carbonated RTD coffee segment, RTD coffee constitutes the remaining approximate 5%, reflecting limited penetration in fizzy formats.

Together, these shares reveal that while RTD coffee holds modest share in massive parent markets like global coffee and RTD beverages overall, it is the centerpiece of certain sub segments, especially in non carbonated formats, highlighting both its specialty status in mainstream contexts and its dominance within its own segment.

The market is experiencing strong expansion, driven by rising consumer demand for convenient, ready-to-drink beverages that combine taste, functionality, and portability. Growing urbanization and busy lifestyles have led to increased consumption of coffee products that can be enjoyed on the go, while premiumization trends are supporting higher-value offerings. The incorporation of innovative brewing methods, sustainable sourcing practices, and functional additives has enhanced consumer appeal across demographics.

Advancements in packaging technology and the shift toward recyclable materials are further encouraging product adoption among environmentally conscious consumers. In addition, strong penetration in retail, e-commerce, and foodservice channels is broadening market reach and boosting brand visibility.

The market is projected to continue benefiting from product innovation, flavor diversification, and targeted marketing strategies that align with health, wellness, and lifestyle trends As global coffee culture evolves and demand for specialty beverages rises, the RTD Coffee segment is expected to maintain a dynamic growth trajectory in both developed and emerging economies.

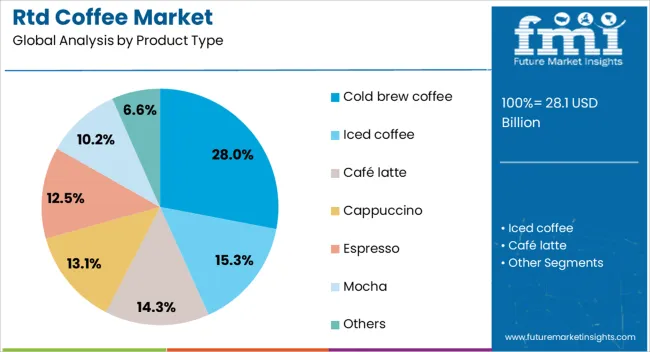

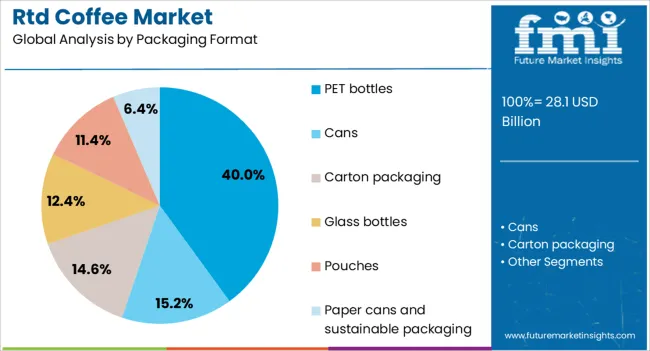

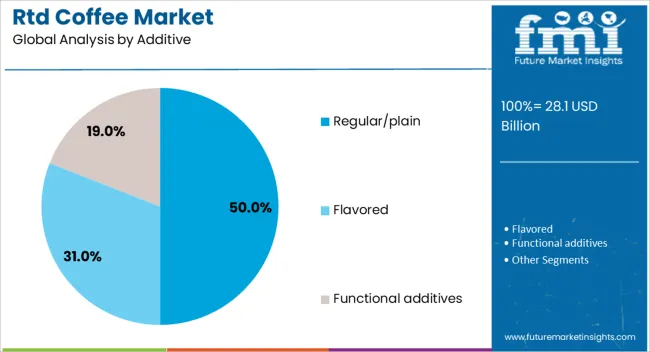

The RTD coffee market is segmented by product type, packaging format, additive, sweetener type, milk type, price segment, distribution channel, and geographic regions. By product type, RTD coffee market is divided into cold brew coffee, iced coffee, café latte, cappuccino, espresso, mocha, and others. In terms of packaging format, RTD coffee market is classified into PET bottles, cans, carton packaging, glass bottles, pouches, and paper cans and sustainable packaging. Based on additive, RTD coffee market is segmented into regular/plain, flavored, and functional additives. By sweetener type, RTD coffee market is segmented into regular sugar, reduced sugar, sugar-free, naturally sweetened, and artificially sweetened. By milk type, RTD coffee market is segmented into dairy milk, plant-based alternatives, and black/no milk. By price segment, RTD coffee market is segmented into mid-range, economy/mass market, premium, and super-premium/craft. By distribution channel, RTD coffee market is segmented into off-trade (supermarkets/hypermarkets) and on-trade. Regionally, the RTD coffee industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cold brew coffee subsegment within the product type category is projected to hold 28% of the market revenue share in 2025, making it the leading product type. Growth in this segment has been driven by its smooth flavor profile, lower acidity, and perceived health benefits compared to traditional coffee. Consumers have shown increasing preference for cold brew due to its premium positioning and compatibility with various flavor infusions.

The segment has also benefited from rising availability in retail and foodservice channels, supported by extended shelf life and portability. Brands have leveraged cold brew’s artisanal image to attract younger consumers seeking innovative beverage experiences.

The ability to integrate functional ingredients such as protein or vitamins without compromising taste has further enhanced its market appeal As health-conscious and trend-aware consumers continue to explore alternative coffee formats, cold brew is expected to retain its competitive advantage in the product type category.

The PET bottles subsegment within the packaging format category is expected to account for 40% of the market revenue share in 2025, making it the dominant packaging choice. This leadership position has been supported by the lightweight, durable, and shatter-resistant nature of PET bottles, which makes them highly suitable for on-the-go consumption. Their compatibility with various beverage volumes and ability to preserve product freshness have made them a preferred option among manufacturers.

PET bottles also offer excellent design flexibility, enabling attractive branding and labeling that enhance shelf appeal. Advances in recyclable and sustainable PET materials have strengthened their acceptance among environmentally conscious consumers.

The widespread use of PET bottles across both retail and convenience channels has ensured consistent product availability Their favorable cost structure, combined with manufacturing efficiency and distribution convenience, has reinforced PET bottles as the packaging format of choice in the RTD Coffee market.

The regular or plain subsegment within the additive category is anticipated to hold 50% of the market revenue share in 2025, marking it as the leading additive preference. Its dominance has been reinforced by consumer demand for authentic coffee flavor without added sugars, artificial sweeteners, or flavorings. The clean-label movement and heightened awareness of ingredient transparency have driven greater interest in plain coffee options.

This segment has also benefited from its appeal to both traditional coffee drinkers and health-conscious consumers who prioritize minimal processing. The simplicity of regular coffee formulations allows manufacturers to emphasize coffee bean quality, origin, and brewing method as key differentiators.

Furthermore, the absence of additives supports versatility in consumption, as it can be customized with milk or flavorings by the consumer The regular or plain additive profile aligns strongly with ongoing wellness trends, ensuring its sustained relevance and leadership in the RTD Coffee market.

The RTD coffee market is gaining momentum as convenient, flavorful, and functional beverage options attract a wide consumer base across retail and e-commerce channels. Opportunities are expanding within premium and health-focused variants, while flavor innovation and packaging creativity are shaping brand differentiation. Challenges remain in cost management, sourcing stability, and competition from adjacent beverage categories. In my opinion, the most competitive players will be those capable of delivering distinctive taste profiles and efficient supply models, allowing them to balance profitability with consumer expectations in a rapidly evolving global drinks landscape.

Demand for RTD coffee has been stimulated by the shift toward convenient beverage options that save time and deliver consistent quality. Consumers are drawn to ready-to-drink formats as alternatives to brewing, with preferences shaped by flavor variety, packaging convenience, and functional benefits like added protein or energy. Expansion of retail distribution, including supermarkets, vending machines, and e-commerce platforms, has improved accessibility, further strengthening volume growth. In my opinion, demand will continue to intensify as lifestyle habits evolve toward portability, with RTD coffee maintaining a competitive edge over traditional hot coffee and energy drinks in many global markets.

Opportunities have been created within premium and functional categories of RTD coffee. Formulations with plant-based milk, reduced sugar, and fortified nutrients are targeting health-conscious buyers, while indulgent variants appeal to consumers seeking rich taste experiences. Collaborations between coffee brands and dairy or plant-based beverage producers have opened new product lines, expanding portfolio diversity. Growth potential is particularly strong in Asia and Latin America, where coffee culture is blending with modern convenience. I believe opportunities will be maximized by players who innovate in flavor customization and functional ingredients while aligning product placement with consumer wellness and lifestyle expectations.

Trends in RTD coffee highlight a surge in flavor experimentation and packaging innovation. Brands are launching variants infused with exotic flavors, cold brew styles, and limited seasonal editions to capture consumer attention. Packaging is evolving toward recyclable cans, resealable bottles, and compact designs suited for on-the-go consumption. Another trend is the rising penetration of RTD coffee in convenience stores and online subscription services, which are reshaping purchase behaviors. In my opinion, these trends suggest that consumer engagement will increasingly be driven by creativity in flavor design and practical packaging solutions, making differentiation critical in a crowded beverage category.

Challenges persist in balancing pricing and profitability in the RTD coffee market. High production costs associated with cold brew extraction, specialty coffee beans, and premium packaging raise product prices, limiting adoption in price-sensitive regions. Supply chain disruptions for coffee beans due to climatic conditions and geopolitical issues pose further risks. Intense competition from soft drinks, tea, and energy beverages adds another layer of complexity. In my assessment, companies that establish resilient sourcing networks and optimize production efficiency will be better positioned to manage cost pressures and maintain consumer loyalty in an increasingly competitive beverage environment.

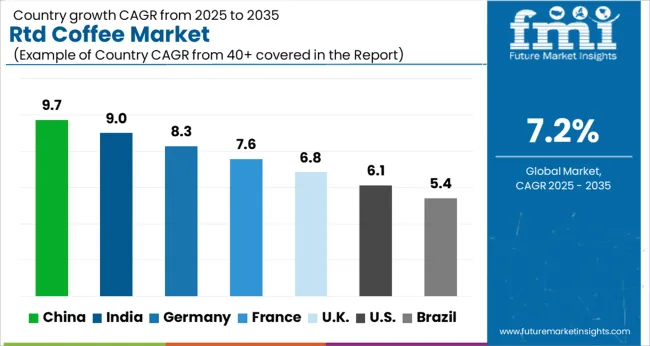

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global RTD coffee market is projected to grow at a CAGR of 7.2% from 2025 to 2035. China leads with a growth rate of 9.7%, followed by India at 9%, and Germany at 8.3%. The United Kingdom records a growth rate of 6.8%, while the United States shows the slowest growth at 6.1%. Expansion in emerging markets is fueled by increasing urban population, evolving consumer preferences for convenient and ready-to-drink beverages, and rising coffee culture. Mature markets such as the UK and USA experience steady growth driven by premiumization trends, product innovation, and growing demand for functional and flavored coffee drinks. Insights span over 40+ countries, with leading markets highlighted below.

The RTD coffee market in China is projected to grow at a CAGR of 9.7%. Rising urbanization, increasing disposable incomes, and shifting consumer preferences toward convenient beverage formats drive growth. The expanding café culture, coupled with rising demand for premium and flavored coffee, accelerates adoption of RTD coffee products. E-commerce and modern retail channels have enhanced product accessibility, while local and international brands continue to innovate in ready-to-drink coffee variants. Increasing awareness of coffee benefits and lifestyle-driven consumption patterns further contribute to market expansion, making China a leading growth hub for RTD coffee.

The RTD coffee market in India is expected to grow at a CAGR of 9%. Rising coffee consumption in urban areas, growing preference for convenient beverages, and exposure to global coffee trends are key drivers. The increasing presence of international and domestic RTD coffee brands in modern trade and online channels is improving accessibility. Functional coffee variants, including energy-boosting and flavored options, are gaining popularity among young consumers and working professionals. Rapidly expanding urban population and evolving lifestyle patterns support continued demand, while marketing campaigns and collaborations with café chains further reinforce RTD coffee adoption.

The RTD coffee market in Germany is projected to grow at a CAGR of 8.3%. Demand is driven by consumer preference for convenience, ready-to-drink beverages, and specialty coffee variants. The growing trend of on-the-go consumption, coupled with increased awareness of sustainable and premium coffee products, supports market growth. Retail expansion, including supermarkets, convenience stores, and online platforms, enhances product availability. Brand innovations in flavor, packaging, and functional benefits continue to attract health-conscious and young consumers. The strong coffee culture and rising adoption of innovative beverage formats ensure continued market expansion in Germany.

The RTD coffee market in the United Kingdom is expected to grow at a CAGR of 6.8%. Growing on-the-go lifestyles, demand for premium and specialty coffee products, and rising consumer awareness of coffee trends drive adoption. Functional and flavored RTD coffee products are becoming increasingly popular among young adults and working professionals. Expansion of modern retail, online channels, and café collaborations improves market reach. Additionally, brand marketing emphasizing quality, taste, and convenience reinforces consumer preference for RTD coffee, providing further opportunities for market growth in the UK

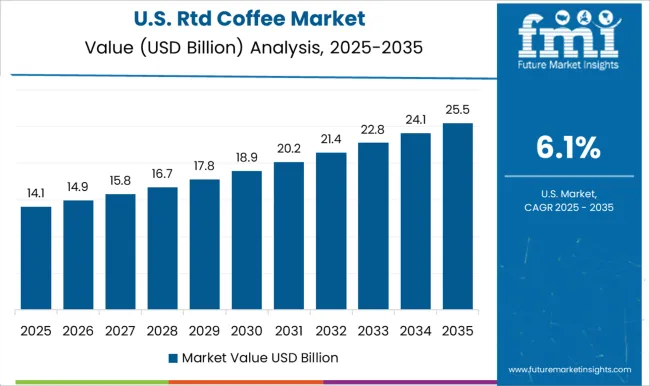

The RTD coffee market in the United States is projected to grow at a CAGR of 6.1%. Growth is fueled by increasing demand for convenient beverage formats, flavored and functional coffee, and premium ready-to-drink options. Consumer preference for on-the-go consumption and healthier alternatives supports market expansion. Retail and e-commerce penetration enhances product accessibility, while brand innovation in flavors, packaging, and formulation continues to attract young and working consumers. Although growth is slower compared to emerging markets, stable demand for RTD coffee products ensures steady expansion in the USA market.

Competition in the RTD coffee market has been directed by leading global beverage companies, each applying distinct strategies to strengthen their foothold. Nestlé has been expanding its dominance through ready-to-drink milk-based coffee, cold brews, and flavored variants, supported by strong retail presence and brand trust. The Coca-Cola Company has been securing visibility with its diversified beverage portfolio, embedding coffee products into existing distribution channels to maximize reach. PepsiCo has been using partnerships and co-branding approaches to expand on-the-go coffee options, leveraging strength in convenience retail and supermarkets. Suntory has been highly influential in Asia with an emphasis on tailoring RTD coffee to regional taste preferences, supported by extensive vending and convenience store networks. Asahi Group has been innovating with unique blends and packaging, ensuring its presence resonates with younger consumers seeking novelty. JAB through JDE Peet’s has been consolidating premium coffee assets and deploying them across bottled and canned offerings, combining scale with brand sophistication.

Starbucks has been extending its café experience into packaged formats, creating premium shelf appeal that resonates with loyal customers. Danone has been focusing on lighter and health-oriented RTD coffee variations, strengthening its position with consumers looking for functional beverage attributes. Strategies have been differentiated through format diversity, regional targeting, and branding power. Nestlé and Starbucks have been emphasizing café-inspired quality and consumer loyalty, while Coca-Cola and PepsiCo have been focusing on volume scale and global distribution strength. Suntory and Asahi have been advancing through cultural awareness and flavor customization, turning regional expertise into market strength. JAB / JDE Peet’s has been consolidating presence by combining premium and mainstream positioning, gaining leverage across multiple consumption occasions. Danone has been competing through wellness-driven branding, capturing a niche within the expanding RTD coffee landscape. This competitive environment has been defined by brand authority, rapid shelf availability, and product differentiation, with each company evaluated on its ability to balance consumer preference with broad distribution efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.1 Billion |

| Product Type | Cold brew coffee, Iced coffee, Café latte, Cappuccino, Espresso, Mocha, and Others |

| Packaging Format | PET bottles, Cans, Carton packaging, Glass bottles, Pouches, and Paper cans and sustainable packaging |

| Additive | Regular/plain, Flavored, and Functional additives |

| Sweetener Type | Regular sugar, Reduced sugar, Sugar-free, Naturally sweetened, and Artificially sweetened |

| Milk Type | Dairy milk, Plant-based alternatives, and Black/no milk |

| Price Segment | Mid-range, Economy/mass market, Premium, and Super-premium/craft |

| Distribution Channel | Off-Trade (Supermarkets/Hypermarkets) and On-Trade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé, The Coca-Cola Company, PepsiCo, Suntory, Asahi / Asahi Group, JAB / JDE Peet’s, Starbucks, Danone, and Other regional players |

| Additional Attributes | Dollar sales by product type (dairy-based vs plant-based), Dollar sales by format (bottled, canned, cartons), Trends in reduced sugar and clean-label offerings, Use of functional ingredients like protein and adaptogens, Growth of on-the-go consumption and café-style flavors, Regional preferences shaping premiumization in Asia-Pacific, North America, and Europe. |

The global RTD coffee market is estimated to be valued at USD 28.1 billion in 2025.

The market size for the RTD coffee market is projected to reach USD 56.3 billion by 2035.

The RTD coffee market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in RTD coffee market are cold brew coffee, iced coffee, café latte, cappuccino, espresso, mocha and others.

In terms of packaging format, pet bottles segment to command 40.0% share in the RTD coffee market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy-Free RTD Coffee Products Market

RTD Cocktail Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

RTD Canned Cocktail Market Growth - Convenience & Mixology Trends 2025 to 2035

RTD Temperature Sensors Market Growth - Trends & Forecast 2025 to 2035

RTD Cocktail Shots Market Analysis by Type, Packaging Type, and Distribution Channel Through 2035

Pre-mixed/RTD Alcoholic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for RTD Whey Deployments for Shelf-stable Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Low-calorie RTD Beverages Market Analysis by Product Type, Flavor, Distribution Channel and Region through 2035

Non Alcoholic RTD Beverages Market Size and Share Forecast Outlook 2025 to 2035

Ready To Drink (RTD) Tea Market Trends - Functional & Refreshing Beverage Growth 2025 to 2035

RTD Packaging Market Trends & Industry Growth Forecast 2024-2034

Demand of Heat Stable Whey for RTD Performance Drinks in EU Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Whey-plus-Prebiotic Stacks for RTD Shakes in CIS Analysis Size and Share Forecast Outlook 2025 to 2035

Coffee Cherry Market Forecast and Outlook 2025 to 2035

Coffee Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Coffee Roaster Machine Market Analysis - Size, Share, and Forecast 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Coffee Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA