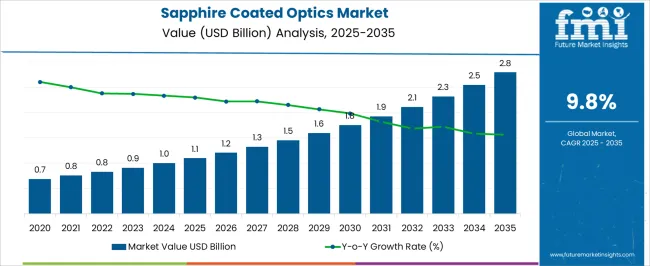

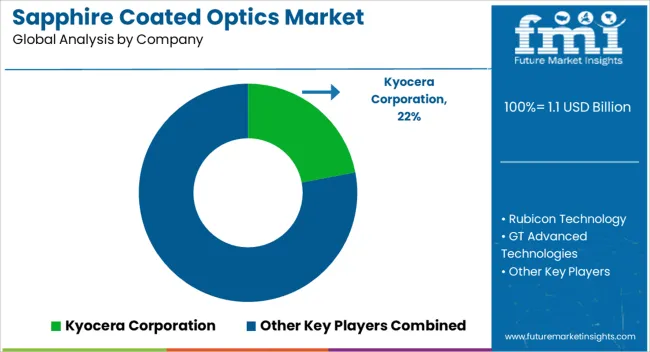

The sapphire coated optics market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

The market is progressing along a steady technology adoption curve, fueled by rising demand across aerospace, defense, semiconductor, and advanced photonics industries, where attributes such as durability, scratch resistance, and superior optical clarity play a critical role. From 2020–2024, the industry expanded from USD 0.7–1.0 billion, representing the early adoption stage. During this phase, growth remained moderate, with YoY increases fluctuating between 0–14%, largely supported by conventional sapphire windows, domes, and substrates that offered reliable, cost-effective solutions for demanding operational environments. Advanced coated optics, incorporating multilayer protective films and high laser-damage thresholds, remained at experimental stages with limited market penetration.

Between 2025–2030, the industry transitions into a scaling phase, growing from USD 1.1 to 1.8 billion, with YoY growth varying between 6–15% and peaking at 15.4% in 2028, largely due to capacity expansions and rising demand from semiconductor lithography, IR imaging, and aerospace sensor systems. Products with enhanced spectral selectivity see broader adoption, while ultra-precision adaptive coatings remain concentrated in premium and defense-specific applications. From 2030–2035, the market advances toward consolidation, expanding from USD 1.8 to 2.8 billion, with growth stabilizing at 8–12% YoY as sapphire-coated optics become standardized across multiple industries and economies of scale drive cost efficiencies.

| Metric | Value |

|---|---|

| Sapphire Coated Optics Market Estimated Value in (2025 E) | USD 1.1 billion |

| Sapphire Coated Optics Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The sapphire coated optics market holds a defined role within the broader optical components ecosystem, representing nearly 6–8% of the global optics industry where uncoated lenses and glass-based substrates maintain a stronger foothold. Within the precision engineering and photonics sector, sapphire coated optics command around 4–5%, while metal-coated and polymer-coated optics continue to cover larger ground. In the high-performance optical coatings category, which includes anti-reflective, dichroic, and beam-splitting coatings, sapphire-coated formats contribute close to 10–12%, given their superior hardness, thermal stability, and scratch resistance. Across aerospace and defense optical applications, sapphire-coated products account for approximately 14–16%, aided by their durability in harsh environments and ability to withstand extreme temperature variations.

Within the semiconductor inspection and metrology equipment segment, these coatings hold about 7–9% share, supported by their integration into wafer inspection systems and high-precision imaging platforms. In medical and biomedical imaging optics, the share approaches 6–7%, driven by demand for higher clarity and longer service life in diagnostic instruments. While sapphire-coated optics remain a niche compared to glass-coated alternatives, their identity as a premium optical solution continues to strengthen across industries where performance, resilience, and extended lifecycle are non-negotiable. The share is being reinforced by greater adoption in defense surveillance, industrial laser systems, and advanced R&D laboratories, making it an influential segment with scope for higher penetration as specialized optical requirements intensify across sectors.

The market is experiencing strong growth due to the increasing adoption of high-performance optical components across industrial, defense, medical, and research applications. The exceptional mechanical strength, scratch resistance, and thermal stability of sapphire have positioned it as a preferred material for demanding environments. Advances in thin-film deposition and coating technologies are enabling enhanced optical performance, which is essential for precision equipment operating across a wide spectral range.

Growing investments in laser-based manufacturing, semiconductor inspection, and defense-grade optical systems are further supporting market expansion. Additionally, the shift toward miniaturized and high-durability optical assemblies in aerospace and biomedical devices is boosting demand.

The ability of sapphire to withstand harsh chemical and thermal conditions without compromising optical clarity is making it a critical choice in applications where reliability is paramount With continuous innovation in coating materials and processes, the market is expected to benefit from higher adoption rates in next-generation imaging, sensing, and high-power laser systems.

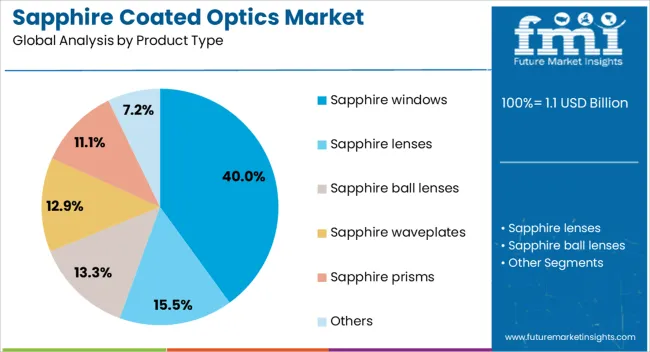

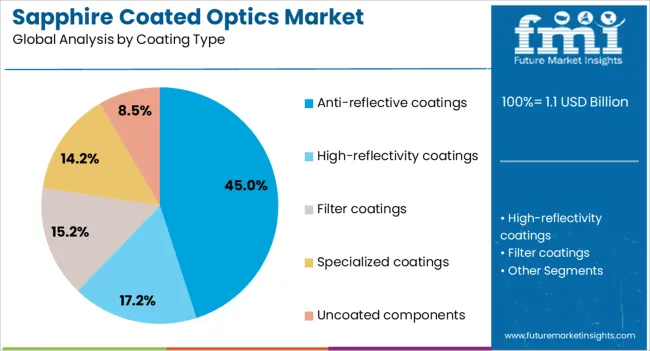

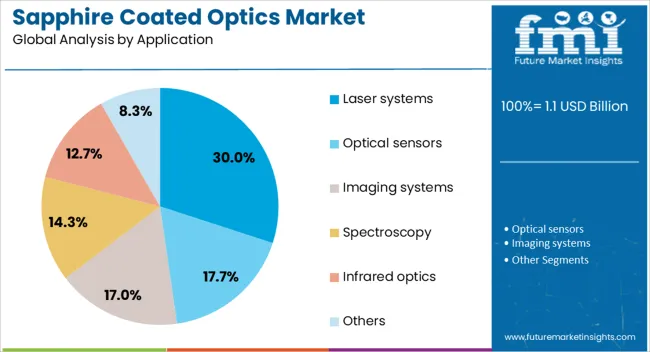

The sapphire coated optics market is segmented by product type, coating type, application, end use, and geographic regions. By product type, sapphire coated optics market is divided into sapphire windows, sapphire lenses, sapphire ball lenses, sapphire waveplates, sapphire prisms, and others. In terms of coating type, sapphire coated optics market is classified into anti-reflective coatings, high-reflectivity coatings, filter coatings, specialized coatings, and uncoated components. Based on application, sapphire coated optics market is segmented into laser systems, optical sensors, imaging systems, spectroscopy, infrared optics, and others. By end use, sapphire coated optics market is segmented into defense and aerospace, military optics, surveillance systems, aircraft and spacecraft components, medical and healthcare, industrial manufacturing, semiconductor and electronics, consumer electronics, oil and gas, research and development, and others. Regionally, the sapphire coated optics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sapphire windows segment is projected to hold 40% of the sapphire coated optics market revenue share in 2025, making it the leading product type. Growth in this segment has been driven by the exceptional optical transparency, hardness, and resistance to abrasion that sapphire windows provide. Their ability to transmit across a broad wavelength range, including ultraviolet and infrared, makes them highly suitable for advanced optical systems. These windows have been preferred in environments where extreme durability and consistent optical performance are required, such as in aerospace, defense, and industrial laser applications. The capacity of sapphire windows to endure high pressures and temperatures without degradation has reinforced their demand in precision instruments. Additionally, advancements in coating technologies have further enhanced their performance by reducing surface reflections and improving light transmission The combination of material resilience, optical clarity, and compatibility with complex coatings has positioned sapphire windows as the dominant choice within the product type category.

The anti-reflective coatings segment is anticipated to command 45% of the market revenue share in 2025, establishing it as the leading coating type. This dominance has been supported by the critical role anti-reflective coatings play in maximizing light transmission and minimizing optical losses across a range of wavelengths. Their application on sapphire substrates enhances imaging clarity and overall system efficiency, which is essential in high-precision environments such as medical imaging, defense optics, and laser systems. The ability of these coatings to reduce glare and improve signal-to-noise ratios has driven their integration into mission-critical optical assemblies. The compatibility of sapphire with advanced thin-film processes has allowed manufacturers to produce highly durable, long-lasting coatings capable of withstanding mechanical wear and environmental exposure As industries continue to demand higher optical performance with minimal energy loss, anti-reflective coatings on sapphire optics are expected to maintain their strong market position.

The laser systems segment is expected to account for 30% of the market revenue share in 2025, making it the leading application. This growth has been supported by the increasing reliance on sapphire-coated optical components in high-power and precision laser systems used in manufacturing, defense, and research. Sapphire’s exceptional thermal conductivity and mechanical strength allow it to withstand intense laser energy without distortion or damage, ensuring consistent beam quality. The use of specialized coatings, such as anti-reflective layers, further enhances system efficiency by optimizing light transmission and reducing reflection-induced losses. In industrial settings, sapphire-coated optics have been deployed to improve cutting, welding, and engraving processes, where reliability and precision are crucial. The demand for laser-based medical treatments and scientific instrumentation has also contributed to this segment’s prominence As laser technologies advance toward higher power and greater precision, the integration of sapphire-coated optics is expected to expand, reinforcing the segment’s market leadership.

Sapphire coated optics are gaining recognition as a premium solution across defense, semiconductor, and biomedical sectors. Their durability and performance advantages strengthen long-term growth despite cost-related challenges.

The expansion of sapphire coated optics is being driven by their superior hardness, thermal resistance, and clarity, which make them ideal for use in aerospace, defense, semiconductor, and biomedical imaging sectors. The growing need for durable and scratch-resistant materials in precision instruments has created a favorable setting for their adoption. Sapphire-coated components are gaining preference over conventional glass lenses due to their longevity, especially in extreme operational environments. Defense surveillance systems, industrial lasers, and semiconductor inspection tools have integrated these optics at a faster pace, making them a premium alternative. Rising investment in photonics and precision engineering has also reinforced their relevance, ensuring consistent demand across multiple specialized industries and research domains.

Opportunities for sapphire coated optics are being supported by their integration into emerging sectors such as advanced biomedical imaging, semiconductor wafer inspection, and aerospace equipment. Their compatibility with high-performance instruments provides opportunities for deeper penetration across niche applications. Industrial R&D and government-funded defense programs are expected to scale up their procurement of sapphire optics, reinforcing market presence. In addition, opportunities exist in expanding medical diagnostics and metrology where accuracy and reliability are non-negotiable. Growth is further supported by rising adoption of high-power laser systems where the material’s resilience proves critical. Expanding global investments in aerospace and photonics have further positioned sapphire coatings as a differentiated solution compared to conventional alternatives.

The competitive dynamics of sapphire coated optics revolve around quality differentiation, production scalability, and ability to meet stringent industry standards. Established players focus on precision polishing, advanced coating methods, and integration into high-value applications. Companies with wider manufacturing capabilities maintain stronger positions, while niche producers target customized offerings for specific requirements. Pricing competition is less significant compared to value differentiation, as industries requiring sapphire optics prioritize reliability over cost. Partnerships between manufacturers and defense contractors, semiconductor tool makers, and medical device developers reinforce competitive positioning. Differentiation is also achieved through extended product life cycles, higher resistance to wear, and capacity to perform under extreme thermal and mechanical stress conditions.

Despite growth potential, sapphire coated optics face challenges including high production costs, complex fabrication processes, and limited scalability compared to glass-based counterparts. Precision engineering requirements increase overall manufacturing expenses, which restricts their adoption in mid-tier applications. Industries with cost-sensitive procurement models often prefer alternatives such as polymer or standard coated glass, limiting broader commercial use. Supply chain constraints, particularly for high-purity sapphire substrates, present another challenge that can slow adoption in rapidly growing industries. Longer lead times and specialized equipment requirements add further barriers for manufacturers. Although demand in premium markets remains strong, commercial diffusion beyond specialized applications has been hindered, creating an imbalance between potential demand and accessible supply.

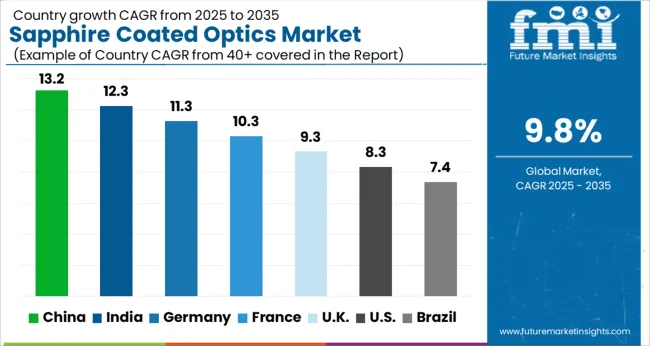

| Country | CAGR |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| France | 10.3% |

| UK | 9.3% |

| USA | 8.3% |

| Brazil | 7.4% |

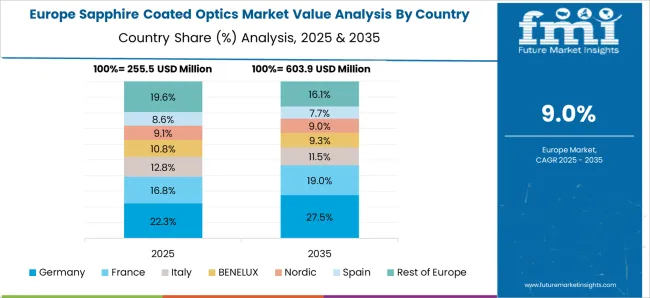

The sapphire coated optics market is projected to expand globally at a CAGR of 9.8% from 2025 to 2035. China leads at 13.2%, driven by large-scale semiconductor manufacturing, defense applications, and rapid adoption in laser-based systems. India follows at 12.3% as government-backed aerospace and biomedical sectors integrate sapphire optics into precision equipment. Germany records 11.3%, supported by strong industrial laser adoption and expansion in metrology applications. France posts 10.3% growth, where demand is tied to defense surveillance optics and high-value photonics research. The UK shows 9.3%, benefiting from investment in advanced medical diagnostics and aerospace innovation. The USA remains moderate at 8.3%, where adoption is centered on defense procurement and selective semiconductor inspection systems. Asia is at the forefront of momentum, with China and India steering the strongest expansion compared to developed economies.

The CAGR for the sapphire coated optics market in the United Kingdom stood at 7.2% during 2020–2024 and then improved to 9.3% in the 2025–2035 period. This upward trend was influenced by expanding adoption in aerospace surveillance systems and stronger demand for advanced medical imaging devices. The earlier period showed steady yet moderate growth as applications remained limited to defense optics and selective photonics projects. As government-backed defense programs scaled, adoption levels increased significantly in the later phase. The integration of sapphire-coated optics into industrial laser systems also supported the improvement in CAGR. With higher demand for durability, precision, and extended product lifecycles, the United Kingdom has established stronger relevance within the global sapphire optics landscape.

The CAGR for the sapphire coated optics market in China was tracked at 11.4% during 2020–2024 and surged further to 13.2% in the 2025–2035 period. This sharp progression was anchored by China’s massive semiconductor industry and broader photonics applications. Early growth was supported by wafer inspection systems and industrial lasers, which created a foundation for future acceleration. Strong defense procurement and large-scale aerospace programs provided further impetus for expansion in the later phase. The availability of high-purity sapphire substrates at competitive prices also allowed Chinese manufacturers to supply global markets, giving the country a leadership position. With rising investment in research and broader optical integration, China continues to dominate sapphire optics growth worldwide.

The CAGR for the sapphire coated optics market in the United States was calculated at 6.5% during 2020–2024 and improved to 8.3% in the 2025–2035 period. Earlier adoption remained limited due to high production costs and selective usage in defense and semiconductor inspection systems. Later growth was more visible as biomedical imaging, defense procurement, and aerospace programs widened application scope. Rising demand for high-durability optics in extreme environments encouraged stronger utilization during the 2025–2035 phase. While growth remained below China and India, the United States established steady expansion supported by defense-driven procurement and niche industrial applications. This rise in CAGR illustrates the strengthening role of sapphire optics in premium markets.

The CAGR for the sapphire coated optics market in India was reported at 10.2% during 2020–2024 and expanded further to 12.3% in the 2025–2035 period. This improvement was shaped by government-funded aerospace projects, expansion of biomedical imaging, and broader industrial adoption. Early growth remained steady as applications were still concentrated in medical instruments and research-based optics. The acceleration in the later period was a result of semiconductor investments and stronger integration of sapphire-coated optics into defense projects. India’s optical ecosystem also gained traction with rising collaborations between global suppliers and domestic manufacturers. These factors together supported an above-average CAGR and positioned India as one of the fastest-expanding contributors to sapphire optics globally.

The CAGR for the sapphire coated optics market in France stood at 8.7% during 2020–2024 and advanced to 10.3% in the 2025–2035 period. The early phase of adoption was led by defense surveillance optics and select industrial laser applications. In the later period, a more pronounced expansion occurred due to government investments in aerospace programs, research in photonics, and rising adoption in medical diagnostics. French companies emphasized advanced R&D in optics, which elevated their role in premium applications. With photonics and aerospace acting as strong pillars, France recorded a clear upward shift in CAGR, positioning it among the leading European contributors in sapphire-coated optics.

The sapphire coated optics market is shaped by a combination of multinational corporations and specialized optical technology firms that emphasize material purity, fabrication expertise, and advanced coating techniques. Kyocera Corporation maintains a strong leadership position with its wide sapphire solutions portfolio catering to electronics, defense, and precision optics. Rubicon Technology and GT Advanced Technologies remain key producers of high-purity sapphire substrates, supplying to semiconductor, aerospace, and photonics industries. Monocrystal is recognized for large-diameter sapphire crystals with applications in high-power lasers and semiconductor inspection systems. Saint-Gobain and Schott AG strengthen the competitive landscape with advanced glass and sapphire optics integration across industrial and aerospace domains.

Edmund Optics and Thorlabs focus on distributing specialized sapphire-coated lenses and components tailored to R&D laboratories and industrial laser users. Precision Sapphire Technologies and Rayotek Scientific offer custom-engineered sapphire optics for demanding environments, while Crystalwise Technology supports large-scale production for photonics and semiconductor applications. Competitive differentiation in this market is being defined by substrate quality, coating uniformity, and the ability to scale production for high-performance applications across aerospace, defense, medical imaging, and semiconductors, making sapphire-coated optics a critical niche in the global photonics ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 billion |

| Product Type | Sapphire windows, Sapphire lenses, Sapphire ball lenses, Sapphire waveplates, Sapphire prisms, and Others |

| Coating Type | Anti-reflective coatings, High-reflectivity coatings, Filter coatings, Specialized coatings, and Uncoated components |

| Application | Laser systems, Optical sensors, Imaging systems, Spectroscopy, Infrared optics, and Others |

| End Use | Defense and aerospace, Military optics, Surveillance systems, Aircraft and spacecraft components, Medical and healthcare, Industrial manufacturing, Semiconductor and electronics, Consumer electronics, Oil and gas, Research and development, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kyocera Corporation, Rubicon Technology, GT Advanced Technologies, Monocrystal, Saint-Gobain, Schott AG, Edmund Optics, Thorlabs, Precision Sapphire Technologies, Rayotek Scientific, and Crystalwise Technology |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive landscape, end-use industry adoption, pricing benchmarks, supply chain constraints, growth drivers, and future opportunities. |

The global sapphire coated optics market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the sapphire coated optics market is projected to reach USD 2.8 billion by 2035.

The sapphire coated optics market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in sapphire coated optics market are sapphire windows, sapphire lenses, sapphire ball lenses, sapphire waveplates, sapphire prisms and others.

In terms of coating type, anti-reflective coatings segment to command 45.0% share in the sapphire coated optics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sapphire Technology Market Trends – Growth & Forecast 2025 to 2035

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Casing Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

Market Share Breakdown of Coated Recycled Boxboard Manufacturers

Competitive Landscape of Coated Recycled Paperboard Providers

Coated White Board Paper Market

Coated Sack Kraft Paper Market

Coated Duplex Board Market

Uncoated Fine Papers Market Size and Share Forecast Outlook 2025 to 2035

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Paper Market Trends- Growth & Industry Outlook 2025 to 2035

AR Coated Film Glass Market Size and Share Forecast Outlook 2025 to 2035

PE Coated Sack Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of PE Coated Sack Kraft Paper Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA