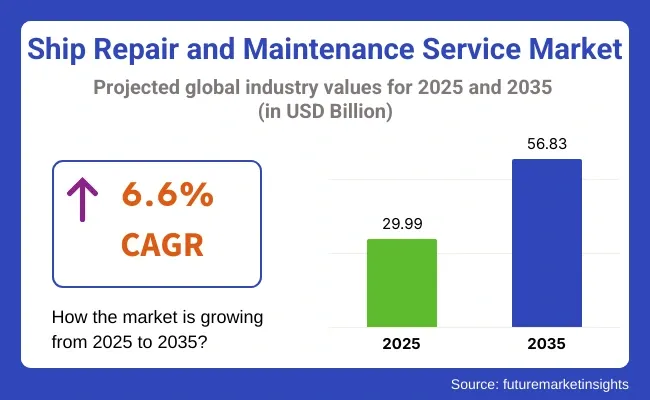

The ship repair and maintenance service market is valued at USD 29.99 billion in 2025 and is poised to witness a notable increase to USD 56.83 billion by 2035, which shows a CAGR of 6.6%. Among the leading markets, Asia-Pacific is anticipated to be the most lucrative region, driven by significant growth in maritime trade.

However, the fastest-growing country in this market is expected to be India, where the expansion of commercial fleets and maritime logistics is particularly strong. This trend is expected to boost demand for maintenance and repair services, as both new and aging vessels require regular upkeep and updates to meet evolving regulations.

The market growth is primarily fueled by the rising demand for maritime trade and the need to maintain aging fleets. As global trade continues to expand, the demand for ship repairs and maintenance services becomes increasingly critical. The push toward stricter environmental regulations further accelerate the need for fleet upgrades to reduce emissions and increase efficiency.

However, there are challenges such as rising labor costs, high repair service prices, and the growing pressure for compliance with environmental standards that could restrain growth in some regions. Key trends shaping the market include the implementation of digital technologies for efficient repair management, a stronger focus on energy-efficient and eco-friendly maintenance solutions, and the rise of remote monitoring and diagnostics for ship systems.

Looking ahead to 2025 to 2035, the ship repair and maintenance service market is set for robust expansion. The continued growth in global trade and the increasing number of vessels in service will drive demand for repair and maintenance services. Additionally, technological advancements in repair processes and a sustained focus on sustainability will likely lead to more innovative service offerings. As environmental regulations tighten, more shipping companies will invest in maintenance solutions that not only extend the lifespan of their vessels but also help meet sustainability goals, further propelling market growth.

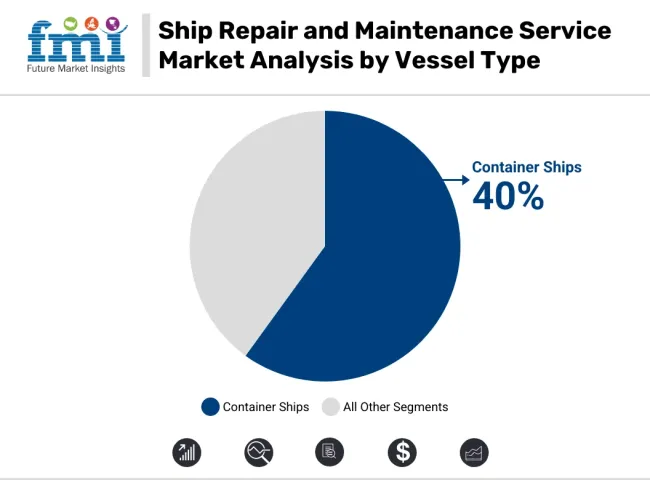

The market is segmented based on vessel type, service, and region. By vessel type, the market is divided into oil and chemical tankers, bulk carriers, general cargo, container ships, gas carriers, offshore vessels, passenger ships and ferries, and mega yachts and other vessels. In terms of service, it is categorized into general services, dockage, hull part, engine parts, electric works, and auxiliary services. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Container ships are projected to be the fastest-growing segment in the ship repair and maintenance service market, with an anticipated CAGR of 7.2% from 2025 to 2035. In 2025, container ships account for a significant 40% market share, a testament to their central role in the global logistics chain. With the consistent expansion of global trade, container ships are essential for transporting goods worldwide, ensuring their critical position in the maritime industry. The rapid growth of e-commerce further accelerates the demand for containerized shipping, which requires modernized repair services.

This demand is reflected in the need for specialized repair services such as hull maintenance, engine parts, and electrical works. The increasing focus on environmental regulations and technological advancements necessitates frequent updates to container vessels, driving the growth of maintenance services.

Compared to other vessel types like oil and chemical tankers, bulk carriers, and general cargo ships, container ships experience a higher demand for repairs due to the greater operational complexity and regulatory pressure. Although these other vessels continue to see steady demand, container ships require more frequent technological updates, which fuels a higher demand for specialized repair services during the forecast period.

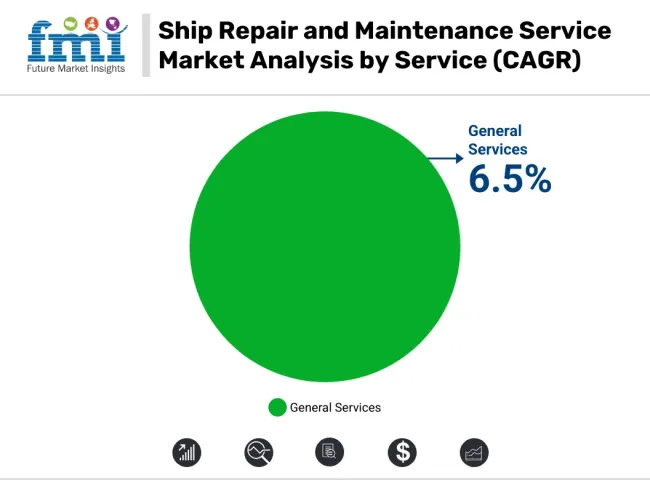

The general services segment is set to remain the dominant growth driver in the ship repair and maintenance service market, with a forecasted CAGR of 6.5% from 2025 to 2035. This segment, which includes routine maintenance, inspections, and minor repairs, ensures the continued operational efficiency of vessels, contributing significantly to the market's steady expansion.

With the increasing number of vessels operating globally, the demand for regular maintenance services is on the rise, supporting consistent growth in this segment. As vessels become more technologically advanced, the need for specialized repairs, such as engine parts and electrical works, is growing. General services are essential for keeping these vessels operational, and their importance is magnified as the maritime industry faces increasing pressure for energy efficiency and adherence to environmental standards.

While other service categories, such as dockage and auxiliary services, are growing at a slower pace due to their more specialized nature, the general services sector is benefitting from the broader demand across a wide range of vessels. Despite higher costs and longer maintenance cycles associated with hull part maintenance, it is expected to grow gradually, driven by technological advancements and stricter regulatory requirements in the ship repair and maintenance services market.

Between 2020 and 2024, the ship repair and maintenance service market demonstrated a CAGR of 5.50%. This growth was primarily fueled by several factors, including increasing maritime trade activities, aging fleets necessitating more frequent repairs, and stringent regulations mandating regular maintenance to ensure safety and compliance.

Advancements in technology during this period, such as adopting automation and data-driven solutions, contributed to improved efficiency and effectiveness in repair processes, further driving market expansion.

Looking ahead to the forecasted period from 2025 to 2035, the market is projected to experience an even higher CAGR of 6.60%. This accelerated growth rate is anticipated due to continued global economic development and increased maritime traffic, particularly in emerging markets.

With a growing emphasis on sustainability and environmental regulations, there will be a greater demand for eco-friendly repair solutions and upgrades, further stimulating market growth.

Integrating advanced technologies such as artificial intelligence and predictive analytics is expected to optimize maintenance operations, reduce downtime, and enhance overall efficiency in the coming years.

| Historical CAGR from 2020 to 2024 | Forecast CAGR from 2025 to 2035 |

|---|---|

| 5.50% | 6.60% |

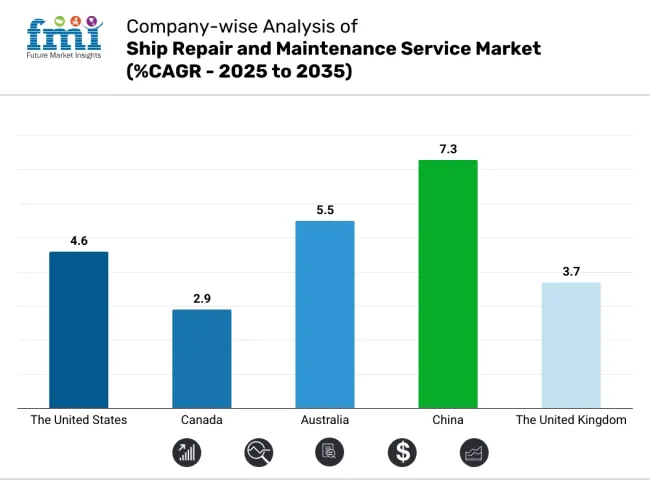

The provided table illustrates the top five countries in terms of revenue, with China leading the list. One major reason China leads the ship repair and maintenance service market is its strategic geographical location, which positions it as a hub for maritime trade and shipping activities.

As one of the largest maritime nations, China boasts an extensive coastline and ports, facilitating a high volume of vessel traffic. This results in a strong demand for ship repair and maintenance services to support the upkeep of commercial fleets, including cargo ships, tankers, and container vessels.

In the United States, the market is utilized primarily to support the extensive maritime industry, which includes commercial shipping, naval operations, offshore energy exploration, and cruise tourism. Major seaports along the East, West, and Gulf coasts require regular maintenance and repair services to keep vessels operational and ensure safety and environmental regulations compliance.

The United States Navy, one of the largest naval fleets globally, relies on ship repair services for maintenance, modernization, and upgrades of its ships and submarines. The United States commercial shipping sector, encompassing container shipping, bulk carriers, and oil tankers, requires ongoing repair and maintenance to sustain efficient operations and ensure vessel safety.

In Canada, the market is crucial in supporting maritime transportation, including shipping, fishing, offshore oil and gas, and naval operations. The shipyards and repair facilities provide services for various vessels, including commercial, fishing, research, and naval vessels.

The ship repair market in Canada is essential for ensuring the safety, reliability, and longevity of the maritime fleet operating in the waters of Canada, including the Great Lakes, St. Lawrence Seaway, and coastal regions. With the increasing focus on Arctic shipping due to melting ice caps, the demand for specialized repair and maintenance services for icebreakers and Arctic vessels is expected to grow in Canada.

The market serves the needs of its vibrant maritime industry, which encompasses shipping, offshore oil and gas exploration, fisheries, and naval operations. The shipyards and repair facilities cater to a diverse fleet of vessels, including bulk carriers, container ships, cruise liners, offshore support vessels, and naval vessels.

The strategic location of Australia in the Asia-Pacific region makes it a key hub for maritime trade and logistics, driving the demand for repair and maintenance services.

The extensive coastline and vast exclusive economic zone (EEZ) require a robust ship repair and maintenance infrastructure to support maritime activities along the coast and in remote offshore areas.

In China, the market is integral to the maritime industry, which includes shipbuilding, shipping, offshore engineering, and naval construction. The ship repair facilities provide services for various vessels, including bulk carriers, container ships, oil tankers, LNG carriers, and naval vessels.

The rapid expansion of the shipping fleet, driven by international trade and domestic economic growth, fuels the demand for repair and maintenance services.

The strategic investments in maritime infrastructure, such as ports, shipyards, and repair facilities along its coastline and major waterways, support the development of the ship repair market and contribute to the position as a leading maritime nation.

In the United Kingdom, the market supports various segments of the maritime industry, including commercial shipping, offshore energy, fishing, and naval operations. British shipyards and repair facilities provide services for a diverse fleet of vessels, including container ships, ferries, offshore support vessels, fishing boats, and naval vessels.

The strategic location of the United Kingdom in the North Sea and the English Channel makes it a key hub for maritime trade, offshore operations, and naval activities. The ship repair market is driven by the need to ensure vessel safety, compliance with regulations, and operational efficiency in supporting maritime activities in both domestic and international waters.

The ship repair and maintenance service market features a competitive landscape with several key players offering a wide range of services. Major companies in the market include shipyards, repair facilities, and service providers with significant expertise and capabilities in vessel repair and maintenance.

Competition is driven by technological innovation, service quality, geographic reach, and pricing strategies. Collaboration and partnerships between industry players are common, particularly for large-scale projects and specialized services.

Market dynamics are influenced by regulatory requirements, technological advancements, and evolving customer needs, shaping the competitive environment within the industry.

Some of the key developments

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 29.99 billion |

| Projected Market Size (2035) | USD 56.83 billion |

| Overall Market CAGR (2025 to 2035) | 6.60% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Analysis Parameter | Revenue in USD billion |

| By Vessel Type | Oil and Chemical Tankers, Bulk Carriers, General Cargo, Container Ships, Gas Carriers, Offshore Vessels, Passenger Ships and Ferries, and Mega Yachts and Other Vessels |

| By Service | General Services, Dockage, Hull Part, Engine Parts, Electric Works, and Auxiliary Services |

| By Regions | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Damen Shipyards Group, Sembcorp Industries Ltd., Cochin Shipyard Limited, China Shipbuilding Industry Corporation, Fincantieri S.p.A., Dae Sun Shipbuilding & Engineering Co. Ltd., Hyundai Mipo Dockyards Co. Ltd., Arab Shipbuilding and Repair Yard Company, Dormac Ship Repairs, and Alexandria Shipyard. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Vessel Type, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 13: Global Market Attractiveness by Vessel Type, 2024 to 2034

Figure 14: Global Market Attractiveness by Service Type, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 28: North America Market Attractiveness by Vessel Type, 2024 to 2034

Figure 29: North America Market Attractiveness by Service Type, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Vessel Type, 2024 to 2034

Figure 44: Latin America Market Attractiveness by Service Type, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Vessel Type, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by Service Type, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Vessel Type, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by Service Type, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Vessel Type, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by Service Type, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Vessel Type, 2024 to 2034

Figure 104: East Asia Market Attractiveness by Service Type, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Vessel Type, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by Service Type, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Vessel Type, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Vessel Type, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vessel Type, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Vessel Type, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by Service Type, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

The global ship repair and maintenance service market is projected to be valued at USD 29.99 billion in 2025.

By 2035, the market value of the ship repair and maintenance service market is expected to reach USD 56.83 billion.

From 2025 to 2035, the ship repair and maintenance service market is expected to grow at a CAGR of 6.6%.

Container ships are expected to dominate the market, with a share of 40% in 2025. They will also register the fastest growth with a CAGR of 7.2%.

China is expected to be the fastest-growing country, with a CAGR of 7.3% during the forecast period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.