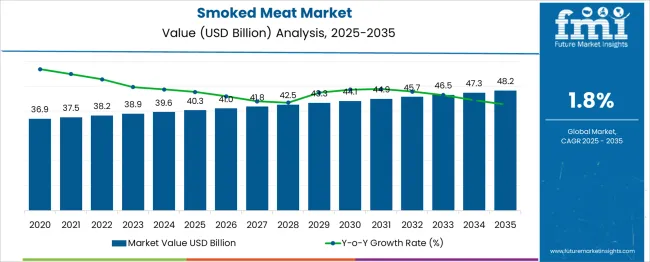

The Smoked Meat Market is estimated to be valued at USD 40.3 billion in 2025 and is projected to reach USD 48.2 billion by 2035, registering a compound annual growth rate (CAGR) of 1.8% over the forecast period. From 2025 to 2030, the market is expected to move from USD 40.3 billion to USD 44.1 billion, indicating slow yet stable growth. Year-on-year analysis shows incremental gains, with values reaching USD 41.0 billion in 2026 and USD 41.8 billion in 2027, supported by steady consumption in foodservice and retail channels.

This trend reflects the mature nature of the segment, where demand remains consistent due to traditional consumer preferences. By 2028, the market is projected to reach USD 42.5 billion, followed by USD 43.3 billion in 2029 and USD 44.1 billion by 2030. Growth is anticipated to be reinforced by product diversification, such as low-sodium and premium smoked varieties, along with the rising presence of ready-to-eat meat snacks in convenience retail.

Manufacturers are likely to focus on packaging innovation and distribution optimization to maintain competitiveness in this low-growth category. These dynamics position smoked meat as a stable segment within the processed meat industry, with innovation in flavors and value-added offerings serving as key differentiators for future expansion.

| Metric | Value |

|---|---|

| Smoked Meat Market Estimated Value in (2025E) | USD 40.3 billion |

| Smoked Meat Market Forecast Value in (2035F) | USD 48.2 billion |

| Forecast CAGR (2025 to 2035) | 1.8% |

The smoked meat market occupies a substantial yet distinct position across multiple food industry segments. In the processed meat market, its share is approximately 12–14%, as smoking remains a popular preservation and flavor-enhancement method. Within the meat and poultry products market, it accounts for about 6-8%, since fresh meat still dominates overall consumption.

In the convenience foods market, smoked meat holds nearly 7-9%, driven by demand for ready-to-eat and heat-and-serve options. The foodservice and HoReCa market sees a contribution of around 4-5%, as smoked meats feature prominently in premium dining menus, BBQ concepts, and quick-service offerings. Within the packaged and ready-to-eat foods market, its share stands at 5-6%, supported by strong retail presence in cold cuts, sausages, and smoked poultry products.

Rising consumer interest in artisanal flavors, extended shelf life, and high-protein snack options is accelerating market growth. Technological innovations in smoking techniques, such as liquid smoke and controlled smoking environments, enhance consistency while maintaining traditional taste profiles. Additionally, the increasing popularity of global cuisines and premium meat products is fostering demand in retail and foodservice channels. With growing preference for flavorful and convenience-oriented protein products, the smoked meat market is expected to strengthen its position across these parent markets.

The smoked meat market is witnessing sustained growth as consumer demand for authentic flavors, premium protein options, and artisanal food experiences continues to expand.

Increasing urbanization and higher disposable incomes have encouraged experimentation with diverse cuisines, positioning smoked meat as a desirable category in retail and foodservice.

Rising awareness of protein-rich diets and the influence of culinary tourism have further enhanced the appeal of smoked products across demographics. Future growth is expected to be driven by innovations in smoking techniques that improve shelf life and flavor consistency, as well as growing investments by manufacturers in branding and premiumization strategies.

Regulatory focus on food quality and safety, alongside a trend toward clean label offerings, is anticipated to open new avenues for differentiation and market expansion.

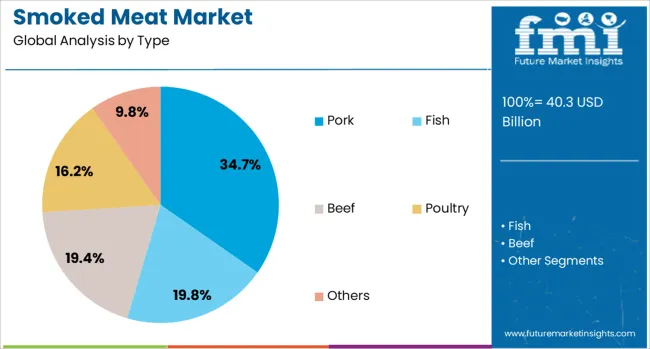

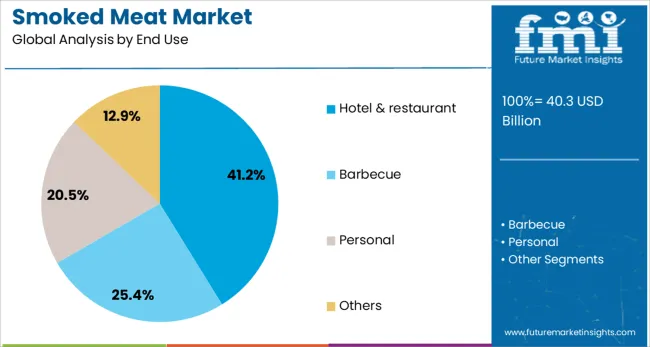

The smoked meat market is segmented by type, end use, and geographic regions. The smoked meat market is divided by type into Pork, Fish, Beef, Poultry, and Others. The end use of the smoked meat market is classified into Hotel & restaurant, Barbecue, Personal, and Others. Regionally, the smoked meat industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, pork is projected to hold 34.7% of the smoked meat market revenue in 2025, establishing itself as the leading type segment. This leadership has been supported by pork’s versatility, affordability, and widespread cultural acceptance in smoked preparations.

Advancements in curing and smoking processes have enhanced both the flavor profile and safety of pork products, increasing their appeal in retail and foodservice settings. Producers have optimized production efficiencies while meeting consumer expectations for tender texture and traditional taste, strengthening the position of pork within the category.

Additionally, the ability of pork to adapt to various regional flavorings and menu applications has reinforced its continued dominance as the preferred smoked meat type.

Segmenting by end use shows that the hotel and restaurant segment is forecast to command 41.2% of the smoked meat market revenue in 2025, making it the top end use segment. This prominence has been driven by the hospitality industry’s focus on delivering differentiated dining experiences and meeting the growing demand for premium, handcrafted menu items.

Smoked meat has been increasingly featured in upscale dining, casual restaurants, and catering services due to its rich sensory appeal and association with quality. The ability to serve smoked offerings as signature dishes has allowed hotels and restaurants to capture customer loyalty and justify higher price points.

Operational investments in in-house smoking facilities and partnerships with specialty suppliers have further strengthened the role of this segment in driving smoked meat consumption.

The smart home-based beverage machine market is growing as connected appliances become integral to modern living. In 2024, consumers increasingly adopted smart coffee, tea, and juice machines offering programmable and app-controlled features.

By 2025, integration with home automation systems accelerated demand for appliances that provide convenience, energy efficiency, and personalization. Manufacturers delivering machines with seamless smart-home compatibility, intuitive interfaces, and enhanced functionality are positioned to lead in this evolving segment.

Consumer interest in rich, smoky flavors has supported heightened demand for both shelf-stable and refrigerated smoked meats. In 2024, specialty retailers and delis expanded offerings such as smoked turkey, sausages, and salmon, emphasizing artisanal flavor profiles.

By 2025, mainstream brands adopted enhanced smoking techniques to deliver consistent flavor and aroma at scale. These shifts show that sensory appeal rather than price alone is directing product acceptance. Suppliers producing smoked meat products with traceable ingredients, flavor integrity, and uniform quality control are positioned to capture growth among both foodservice professionals and retail consumers.

The development of user-friendly packaging has unlocked opportunities for expanding smoked meat availability. In 2024, vacuum-sealed single-serve packs and resealable pouches began to gain traction for consumption on the go. By 2025, ultralight grab-and-go portion formats were rolled out in cafeterias, convenience stores, and airline catering, reinforcing the appeal of smoked meats as quick protein solutions.

These innovations illustrate that packaging convenience can elevate smoked meat into new usage occasions beyond conventional deli counters. Manufacturers offering shelf-stable, portion-controlled smoked meat packs compatible with modern retail environments are poised to capitalize on evolving consumption patterns.

In 2024 and 2025, regulatory scrutiny over smoked meat processing created compliance challenges for producers. Authorities mandated rigorous checks on smoke flavoring techniques and chemical usage to ensure product safety. Meeting these standards required investment in advanced smoking chambers, filtration systems, and quality testing protocols.

Smaller producers struggled to absorb these costs, leading to reduced profit margins and, in some cases, market exit. This operational burden particularly impacted artisanal brands and regional processors. Unless streamlined approval frameworks or cost-efficient compliance solutions emerge, regulatory rigidity will continue to restrain the expansion of smoked meat production in multiple regions.

In 2024 and 2025, the smoked meat market experienced rising demand for unique and bold flavor profiles. Brands introduced premium variants infused with herbs, spices, and exotic wood smokes such as applewood or cherrywood to differentiate offerings. Limited-edition seasonal collections were rolled out in North America and Europe, targeting consumers seeking distinctive dining experiences.

This movement positioned flavor innovation as a key brand strategy for driving repeat purchases and building customer loyalty. The ability to combine traditional smoking techniques with creative flavoring has created a clear opportunity for companies to capture attention in both retail and foodservice channels.

| Countries | CAGR |

|---|---|

| China | 2.4% |

| India | 2.3% |

| Germany | 2.1% |

| France | 1.9% |

| UK | 1.7% |

| USA | 1.5% |

| Brazil | 1.4% |

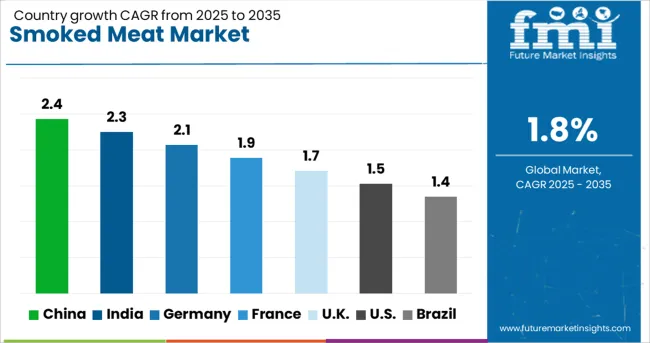

The global smoked meat market is expected to grow at a CAGR of 1.8% from 2025 to 2035. China leads with 2.4%, followed by India at 2.3% and Germany at 2.1%. France records 1.9%, while the United Kingdom posts 1.7%. Growth is influenced by increasing demand for ready-to-eat protein products, rising adoption of traditional flavor profiles, and product innovation in premium meat segments. China and India dominate due to population size and evolving packaged food trends. Germany emphasizes artisanal smoked meat for gourmet applications, while France and the UK see steady demand for convenience-oriented, flavor-enhanced offerings.

China is forecast to grow at 2.4%, driven by robust demand for ready-to-eat meals and premium smoked meat snacks. Pork-based smoked meat dominates urban consumption patterns. Manufacturers invest in vacuum-sealed packaging to extend shelf life and maintain product quality. Growth in online retail and specialty meat outlets further expands accessibility for consumers seeking traditional and modern smoked meat variants.

India is projected to grow at 2.3%, supported by rising acceptance of processed meat in urban households and hospitality sectors. Smoked chicken and fish dominate menus across quick-service restaurants and premium hotels. Manufacturers explore natural smoking techniques to meet clean-label preferences. Online meat delivery platforms accelerate availability of ready-to-cook smoked meat products in tier-one cities.

Germany is expected to grow at 2.1%, driven by the popularity of traditional smoked sausages and ham in retail and foodservice channels. Premium artisanal smoked meats dominate high-end dining and gourmet stores. Manufacturers adopt eco-friendly smoking methods and biodegradable packaging to align with sustainability goals. Increasing demand for high-protein convenience snacks supports steady market expansion.

France is projected to grow at 1.9%, supported by strong culinary traditions and rising demand for gourmet charcuterie products. Smoked ham and duck dominate festive and fine dining menus. Manufacturers introduce pre-sliced, vacuum-packed options for convenience-seeking consumers. Innovation in flavor infusion and seasoning blends enhances product appeal in premium retail chains.

The UK is forecast to grow at 1.7%, driven by the popularity of smoked bacon and fish in everyday diets. Premium smoked meat products dominate growth in retail and online grocery channels. Manufacturers focus on low-sodium and nitrate-free options to address health concerns. Partnerships with quick-service restaurants enhance visibility and increase product adoption among younger consumers.

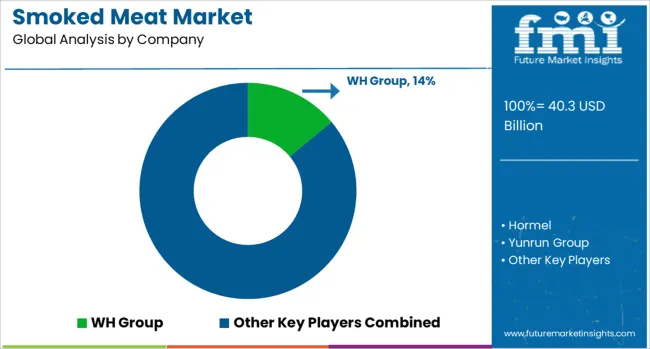

The smoked meat market is moderately consolidated, with WH Group holding a leading position due to its extensive global processing capabilities, strong distribution networks, and diversified smoked meat portfolio catering to retail and foodservice channels. The company leverages advanced curing and smoking technologies to deliver consistent quality and flavor across international markets.

Key players include Hormel, Yunrun Group, Fratelli Beretta SpA, Columbus Foods, Peer Foods Group, Inc., Kayem Foods, Inc., Schwartz, Falls Brand and Independent Meat Company, and Sunnyvalley Smoked Meats, Inc. These companies offer a wide range of smoked products, including ham, bacon, sausages, and specialty cuts, targeting both traditional and premium consumer segments. Market growth is driven by rising demand for ready-to-eat protein options, expanding product innovation in flavors and formats, and the popularity of artisanal and gourmet smoked meats.

Leading suppliers are focusing on premiumization strategies, introducing natural wood-smoking processes, and clean-label products to align with evolving consumer preferences. In addition, investments in automated processing facilities, cold-chain logistics, and e-commerce distribution channels are enhancing operational efficiency and market penetration. Emerging trends include the introduction of plant-infused smoke flavors and low-sodium formulations to cater to health-conscious consumers, along with regional taste innovations for diversified markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 40.3 Billion |

| Type | Pork, Fish, Beef, Poultry, and Others |

| End Use | Hotel & restaurant, Barbecue, Personal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | WH Group, Hormel, Yunrun Group, Fratelli Beretta SpA, Columbus Foods, Peer Foods Group, Inc., Kayem Foods, Inc., Schwartz, Falls Brand and Independent Meat Company, and Sunnyvalley Smoked Meats, Inc. |

| Additional Attributes | Dollar sales by meat type (pork, beef, poultry, fish), Dollar sales by preservation/smoking method (cold-smoked, hardwood smoked, liquid smoke), regional demand trends, competitive landscape, consumer preference for clean-label and nitrate-free products, integration with retail, foodservice, and meal-kit channels, innovations in plant-based smoked alternatives and flavor-infused processing. |

The global smoked meat market is estimated to be valued at USD 40.3 billion in 2025.

The market size for the smoked meat market is projected to reach USD 48.2 billion by 2035.

The smoked meat market is expected to grow at a 1.8% CAGR between 2025 and 2035.

The key product types in smoked meat market are pork, fish, beef, poultry and others.

In terms of end use, hotel & restaurant segment to command 41.2% share in the smoked meat market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA