Emergence of new surgical modalities to drive demand New avenues of surgical procedures and preference towards less invasive interventions have due only with a long term impact on the surgical generators market.

The market is expected to grow from USD 567.2 million in 2025 to USD 815.5 million by 2035, at a CAGR of 3.8% during the forecast period. Integrated advanced generator systems for precise, safe, and efficient surgical treatment across various surgical disciplines are currently integrated in hospitals and ambulatory surgical centers.

Surgical generators are the backbone of electrosurgery, delivering controlled electric currents to achieve cutting, coagulation, and tissue ablation. They are commonly used in general surgery, gynaecology, urology, orthopedics, and oncology. Growing demand for outpatient surgeries, combined with enhanced reimbursement models and a surging geriatric population, continues to drive equipment adoption.

Advancements in technology like bipolar and ultrasonic modes, real-time feedback loops, and energy modality integration make surgical generators more complex, reliable, and customizable for tidal clinical needs. Small, portable generators are also becoming more popular in remote and low-resource settings, enabling more widespread access to surgical care.

Metric Overview

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 567.2 million |

| Market Value (2035F) | USD 815.5 million |

| CAGR (2025 to 2035) | 3.8% |

OEMs are collaborating with hospitals and surgical centers, providing bundled services such as generator maintenance, training, and procedure consumables kits designed for that institution (which promotes loyalty with the OEM and extends service agreements).

Surgeons increasingly use energy systems for cutting, coagulation and tissue dissection across specialties, driving the global surgical generators market. They assist surgeons, increasing accuracy, minimizing blood loss, and facilitating recovery after surgery. This augmented market has stepped the preference of hospitals, trauma centers, and ambulatory surgical facilities to opt for electrosurgical, and ultrasonic generators, which is accountable for doing minimally invasive procedures.

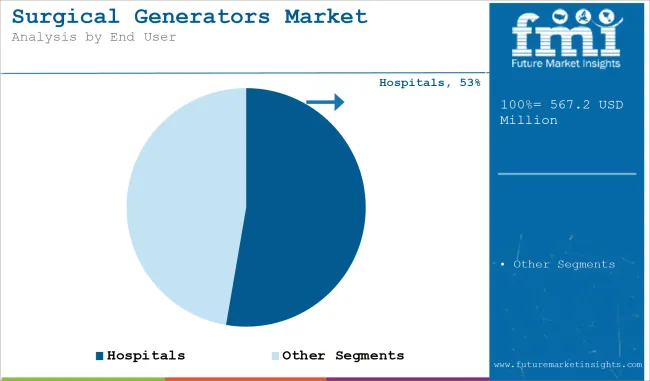

It covers by product-electrosurgical RF generators, electrocautery generators, ultrasonic generators and argon plasma coagulation generators, and end user-hospitals, ambulatory surgery centers, specialty clinics, and trauma centers. In 2025, electrosurgical RF generators and hospitals will be the largest segments due to the most utilization of energy-based surgical procedures and a preference for centralizing energy-based surgical infrastructure.

Electrosurgical RF Generators Lead as a Universal Energy Platform for High-Volume Surgical Specialties

| Product Segment | Market Share (2025) |

|---|---|

| Electrosurgical RF Generators | 39.2% |

Electrosurgical RF generators are anticipated to hold 39.2% of the total market share in 2025, delivering a greater degree of versatility than competing RF devices in cut and coagulation functions across several disciplines including general surgery, gynaecology, and cardiology. These systems are preferred for their cost-effectiveness, compatibility with new OR instruments, and decreased procedural time.

Impedance monitoring, digital displays with numerous operating modes have led to newer systems being increasingly preferred by large hospitals and mid-sized surgical centers. Further increasing the versatility, accessories like bipolar forceps and return electrode monitoring units are also available.

Hospitals Dominate the End User Segment with Centralized Energy Device Procurement and Diverse Surgical Caseloads

| End User Segment | Market Share (2025) |

|---|---|

| Hospitals | 52.7% |

Hospitals are expected to continue holding 52.7% of the surgical generators market in terms of revenue in 2025. Often these are high volume institutions treating a diverse patient population with a broad range of surgical energy devices needed for various modalities. Hospitals have central procurement systems, staff training infrastructure and high-volume surgeries with rigorous regulatory and sterilization channels.

Additionally, hospital demand has been solidified by the drive for integrated ORs, along with adoption of data-logging surgical generators for quality monitoring. Moreover, RF is being progressively integrated into hybrid combinatory models, introducing supportive advantages of the ultrasonic modality in the same surgical unit.

USA commands regional demand, backed by robust investments in operating room upgrades and the increasing number of outpatient facilities. In high-acuity environments, sophisticated generators integrated with energy control systems and safety monitoring are commonplace. Demand in Canada reflects upgrades to public hospitals and increased patient access to specialist care.

Europe is a key player in the market, with the largest economies in the region such as Germany, France, and the UK leading in technological integration and novel surgeries. Public healthcare investments, stringent medical device regulations, and high adoption rates of laparoscopic and endoscopic procedures play crucial part for the region.

This need for economical yet high-quality surgical generators as Eastern European countries are gradually modernizing their surgical infrastructure, feeding the Eastern European surgical generators market growth. Hospitals are placing higher and higher importance on sustainability and reusable devices when purchasing equipment.

Asia Pacific is anticipated to be the fastest developing regional market owing to growing surgical infrastructure, better access to healthcare, and increasing surgical procedures. Government hospitals in India and China are buying general surgery gear in massive quantities.

In contrast, Japan and South Korea hold top positions in technological sophistication and high acceptance of electrosurgical technologies. The region is also witnessing an increased demand for portable, stacked surgical generators to facilitate the rural surgical programs and mobile operating units.

Cost Sensitivity and Device Standardization

Despite strong demand, cost is a significant hurdle in emerging economies, where public hospitals often run on a shoestring budget. Moreover, variability in device interoperability, safety controls and instruction across health networks hinders best practices for the devices. These settings are still clinically dangerous when not properly set up by nominees.

Energy Modality Integration and Ambulatory Surgery Growth

The opportunity lies in combining, integrated, multiple energy modalities, including ultrasonic, RF, and bipolar technologies, into a single platform that yields greater precision and safety. The increase in ambulatory surgery centers and outpatient care models favours the use of smaller, more user-friendly generators.

As personalized surgery comes of age, the value of intelligent generators with software-enabled options and analytics will be hard to resist for surgical teams determined to optimize their performance and maximize patient safety.

However, between 2020 and 2024, there was a resurgence in demand for surgical generators following the pandemic, as hospitals resumed elective surgeries and the need for operating room (OR) equipment upgrades became paramount. Portable and energy-efficient generators gained a foothold, especially in emerging countries, while integrated smoke evacuation and safety monitoring features became table stakes. This led to regulatory bodies putting more focus on traceability of the device, operator safety, and performance monitoring.

Between 2025 and 2035, the market will move in the direction of an intelligent surgical generator system, with AI-enabled power control, user behaviour analytics and integrated into digital OR suites. Data for preventive maintenance systems, cloud-based diagnostics, and remote troubleshooting will be important value adds.

Moreover, there will be increased need for environmentally friendly systems in the market where these systems themselves would possess modular and upgradable components while designs would consume minimum energy.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Technology Focus | Monopolar /bipolar energy with basic control |

| Demographic Penetration | General surgery and gynaecology |

| Treatment Settings | Hospital operating rooms |

| Geographical Growth | North America and Western Europe |

| Application Preference | Cutting and coagulation in open surgeries |

| Cost Dynamics | Capital purchase models |

| Consumer Behaviour | Device-focused procurement |

| Service Model Evolution | On-demand technical support |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Technology Focus | Multi-energy platforms with smart feedback systems |

| Demographic Penetration | Expanded use in robotics, oncology, and outpatient surgery |

| Treatment Settings | Ambulatory surgical centers and rural OR facilities |

| Geographical Growth | Accelerated adoption in Asia Pacific and Latin America |

| Application Preference | Real-time energy modulation for minimally invasive procedures |

| Cost Dynamics | Subscription, lease, and maintenance bundle offerings |

| Consumer Behaviour | Preference for fully integrated systems and service support |

| Service Model Evolution | Predictive maintenance and remote equipment monitoring |

The global surgical generators market is split by region, with North America accounting for the largest share due to the presence of a strong healthcare infrastructure and a high number of surgical procedures performed in the United States across general surgery, orthopedics, and cardiovascular.

Use of combined electrosurgical and ultrasonic technologies is being increasingly adapted into both inpatient and outpatient environments. Hospitals and ambulatory surgery centers are investing in sophisticated systems that deliver a more judicious amount of energy, minimize thermal spread, and provide real-time feedback mechanisms.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

Demand for surgical generators in the UK market is steady, especially within NHS-affiliated facilities that are adopting minimally invasive energy-efficient tools. Electrocautery and argon plasma coagulation generators are used more and more in gastroenterology and ENT subspecialties. The growth is also aided by upgrades in operating room equipment and advanced surgical training programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.4% |

Germany, France and Italy are among the leading EU nations where hospitals are shifting to combination energy platforms for hybrid operating rooms. European Union regulations prioritize tools that increase surgical safety and tractability. Both public and private healthcare sectors are also adopting because of the growing number of trauma centres and outpatient surgeries.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.5% |

Japan's aging population is increasing incentives for surgical procedures, especially in gastroenterology, oncology, and urology. Key factors include the adoption of ultrasonic and RF-based generators for precision electrosurgery by hospitals and specialty centers. For example, local manufacturers are also designing small, multifunctional surgical generators targeted to outpatient and mobile surgical units.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The South Korean surgical generator market is propelled with rising investment in smart surgical suites and advanced ambulatory care facilities. Ultrasonic and electrosurgical devices became more widely adopted after time-motion studies demonstrated their ability to improve surgical outcomes and reduce hospital stay, as empowered by government incentives. Training centers in Seoul, Busan are upgrading to newer energy platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Custom surgical generators with technology compliance and defined features with high-voltage specialty surgical applications are gaining increasing traction in surgical generators market, albeit moderate consolidation in market with technology innovation associated with key manufacturers in relevant fields such as energy modulation, wireless connectivity, and hybrid power delivery systems.

The companies launch the devices with better ergonomics, safety feedback, and the use of AI-powered energy control. Partnerships with surgical education institutes and robotic-assisted system developers are also transforming the competitive ecosystem. The global and regional players are battling on pricing, contracts, and modularity upgrades with an aim to retain customers.

Market Share Analysis by Key Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 21-24% |

| Johnson & Johnson (Ethicon) | 17-20% |

| Olympus Corporation | 14-17% |

| CONMED Corporation | 10-13% |

| Others | 30-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | In 2025, launched the Valley lab FT10 energy platform with AI-driven tissue sensing for optimized delivery. |

| Johnson & Johnson (Ethicon) | In 2024, released the next-gen MEGADYNE Electrosurgical Generator with integrated smoke evacuation and real-time power control. |

| Olympus Corporation | In 2025, expanded its Thunder beat hybrid platform offering ultrasonic and bipolar energy in a single device for advanced laparoscopic procedures. |

| CONMED Corporation | In 2024,introduced System 5000+ RF generator with customizable settings and OR integration for orthopaedic and general surgery. |

Key Market Insights

Medtronic plc (21-24%)

Medtronic maintains a leading position with its comprehensive energy solutions portfolio and advanced RF systems. Its R&D investments in tissue-sensing technologies and system versatility continue to support dominance across general and specialist surgeries.

Johnson & Johnson (17-20%)

Ethicon, a J&J company, is gaining traction with highly modular electrosurgical platforms that integrate smoke management, safety tracking, and ergonomic designs. It remains a top choice for high-acuity hospitals and surgical education centers.

Olympus Corporation (14-17%)

Olympus excels in hybrid surgical energy devices, especially in laparoscopic and ENT applications. Its global distribution network and ongoing integration of AI control modules provide significant competitive leverage.

CONMED Corporation (10-13%)

CONMED focuses on mid-market hospitals and trauma centers with cost-effective and easy-to-maintain electrosurgical units. Its intuitive interfaces and OR-compatible generators are favored in fast-paced surgical environments.

Other Key Players (30-35% Combined)

The market size in 2025 was USD 567.2 million.

It is projected to reach USD 815.5 million by 2035.

Key growth drivers include increasing volume of surgical procedures, technological advancements in electrosurgery, and growing preference for minimally invasive surgeries across various specialties.

The top contributors are United States, China, Germany, Japan, and India.

The hospitals segment is anticipated to dominate due to higher patient inflow, adoption of advanced surgical systems, and expanded procedural capabilities in large healthcare facilities.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 16: APEJ Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 17: APEJ Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 18: APEJ Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 19: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 21: Japan Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 22: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 23: Middle East & Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 24: Middle East & Africa Market Value (US$ Million) Forecast by End User, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: APEJ Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: APEJ Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: APEJ Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: APEJ Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 80: APEJ Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: APEJ Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: APEJ Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 83: APEJ Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: APEJ Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: APEJ Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 86: APEJ Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: APEJ Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: APEJ Market Attractiveness by Product Type, 2023 to 2033

Figure 89: APEJ Market Attractiveness by End User, 2023 to 2033

Figure 90: APEJ Market Attractiveness by Country, 2023 to 2033

Figure 91: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Japan Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 98: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Japan Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 101: Japan Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Japan Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Japan Market Attractiveness by End User, 2023 to 2033

Figure 105: Japan Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East & Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East & Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 110: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East & Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 113: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East & Africa Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 116: Middle East & Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: Middle East & Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: Middle East & Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East & Africa Market Attractiveness by End User, 2023 to 2033

Figure 120: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surgical Tourniquet Market Size and Share Forecast Outlook 2025 to 2035

Surgical Operating Microscope Market Forecast and Outlook 2025 to 2035

Surgical Heart Valves Market Size and Share Forecast Outlook 2025 to 2035

Surgical Aspirators Market Size and Share Forecast Outlook 2025 to 2035

Surgical Robot Procedures Market Size and Share Forecast Outlook 2025 to 2035

Surgical Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Surgical Retractors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Drainage Devices Market Size and Share Forecast Outlook 2025 to 2035

Surgical Booms Market Insights - Size, Share & Industry Growth 2025 to 2035

Surgical Scissors Market Size and Share Forecast Outlook 2025 to 2035

Surgical Instruments Tracking System Market Growth - Trends & Forecast 2025 to 2035

Surgical Instruments Packaging Market Size, Share & Forecast 2025 to 2035

Surgical Monitors Market Analysis - Industry Insights & Forecast 2025 to 2035

Surgical Scalpels Market Trends – Growth & Forecast 2025-2035

Surgical Gloves Market Trends - Size, Demand & Forecast 2025 to 2035

Surgical Clips Market Analysis - Size, Share & Forecast 2025 to 2035

Surgical Mask Market Insights - Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Surgical Stapling Device Market is segmented by product, Usage Type, Stapling Type, Indication and End User from 2025 to 2035

Key Companies & Market Share in the Surgical Scrub Sector

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA