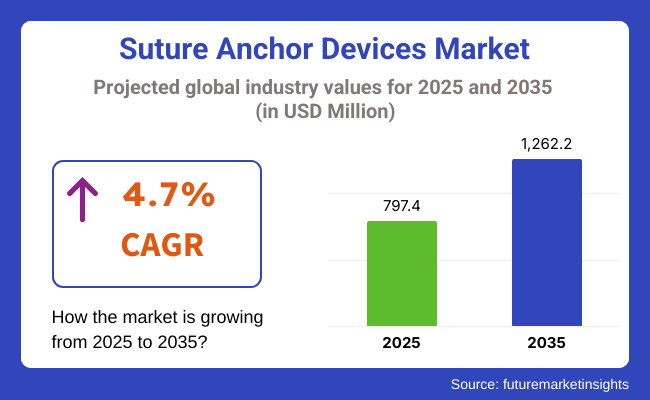

The global Suture Anchor Devices Market is projected to be valued at USD 797.4 million in 2025, reaching USD 1,262.2 million by 2035, with a compound annual growth rate (CAGR) of 4.7% during the forecast period. Growth is being supported by rising incidences of sports-related injuries, an aging population, and greater prevalence of musculoskeletal disorders.

The shift toward minimally invasive surgeries for rotator cuff repair, knee, and shoulder soft tissue reconnections is promoting usage of both absorbable and non-absorbable anchors Favorable reimbursement policies and enhanced procedural throughput in outpatient surgical centers are creating new demand channels. Advances in PEEK-based and biodegradable materials, along with innovative knotless anchor designs, are enhancing clinical outcomes and surgeon confidence.

Major market leaders include Smith & Nephew, Zimmer Biomet, Arthrex, Stryker, DePuy Synthes (J&J), and Medtronic. These Key players are pushing differentiation through enhanced materials, design innovation, and clinician training programs. In 2024, Paragon 28, Inc. announce the launch of the Grappler® Knotless Anchor System and Bridgeline™ Tape, enhancing the Company’s position in the fast-growing foot and ankle specific soft tissue market.

“We continue to believe soft tissue will play an increasingly important role in improving foot and ankle patient outcomes, and we could not be more excited to bring two new solutions to market to start the year.”- commented Albert DaCosta, CEO Paragon 28’s. Clinical adoption is further aided by hospital-anchor company initiatives providing soft tissue repair training.

These strategic moves, along with growing outpatient procedure volumes, are fueling continued market expansion. In 2024, bioabsorbable PEEK anchors with integrated growth factor coatings were introduced, facilitating controlled degradation and improved tissue integration . These novel anchors combine the mechanical strength of PEEK with the regenerative benefits of biomaterials, offering consistent fixation during ligament repairs and gradual resorption post-healing.

In North America, accounting for maximum global revenue share, growth is being driven by a high volume of sports- and trauma-related orthopedic procedures and widespread adoption of knotless anchors in rotator cuff and elbow repairs. A rise in outpatient surgery center use, coupled with favorable commercial insurance reimbursement, has supported faster adoption. Clinicians are also benefiting from intraoperative visualization using radiolucent PEEK anchors, which better integrate with imaging pathways.

Europe is experiencing steady expansion in the suture anchor market through adoption of bioabsorbable and PEEK-based anchors. The market growth is underpinned by public health initiatives focusing on sports injury rehabilitation and preventive orthopedic programs in aging populations. Local manufacturers are also investing in eco-friendly packaging to align with EU medical device directives. These regional dynamics are strengthening anchor adoption in both hospital and outpatient settings.

In 2025, absorbable suture anchors have been observed to dominate the global market with a commanding 79.0% revenue share. This growth has been attributed to their ability to degrade safely over time, eliminating the need for surgical removal and reducing postoperative complications.

Preference for absorbable anchors has been reinforced by advancements in bioresorbable materials such as polyglycolic acid (PGA), poly-L-lactic acid (PLLA), and newer biocomposites that provide strong initial fixation and predictable degradation timelines. Increasing procedural volumes in sports injuries and soft tissue reattachment surgeries have driven demand.

Surgeons have shown increased clinical confidence in absorbable variants due to reduced imaging artifacts and minimized long-term foreign body reactions. Additionally, regulatory approvals for absorbable anchors in key geographies have expanded market penetration. Cost-efficiency over the long term, combined with improvements in material strength and bio-integration, has further enhanced product preference. These factors collectively have contributed to the segment’s continued leadership position.

Biocomposite suture anchors are projected to hold a leading 50.4% revenue share in the global suture anchor devices market in 2025. The segment’s dominance has been driven by the unique clinical advantages offered by biocomposite materials, which combine synthetic polymers with bioactive ceramics such as β-tricalcium phosphate or hydroxyapatite.

These anchors have been adopted widely due to their superior osteoconductive properties, enabling enhanced bone integration and gradual bioresorption. Biocomposites have shown reduced inflammatory response compared to traditional materials, improving postoperative outcomes in ligament and tendon repair surgeries. Market demand has been influenced by increased surgeon preference for anchors that balance strength and biological performance.

Further, biocomposite anchors have been compatible with MRI imaging, eliminating radiological artifacts and supporting postoperative assessment. As orthopedic practices and ambulatory surgical centers continue to prioritize tissue-friendly, biodegradable materials, biocomposite anchors have gained traction as the gold standard in arthroscopic and open joint repairs, sustaining their leadership in material preference.

The Approval Process for New Suture Anchor Technologies Is Complex and Time-Consuming, Delaying Market Entry and Increasing Compliance Costs for Manufacturers.

Facing these hurdles are the overwhelming costs of next-generation fixation implants, risks of loosening or migration of the implants, and regulatory hurdles in obtaining approvals for innovative anchor materials. Barriers to the extrusion of the market include the calls for greater biocompatibility and longevity of implants; challenges in consistency in mechanical performance of bioabsorbable anchors; and discrepancies in reimbursement policy for orthopedic surgeries.

And, here, this injury brings challenges from several directions: integrating smart implant tracking technologies, high-level costs for training surgeons on robotic-assisted fixation procedures, and resistances to shifting from old traditions into bioengineered suture anchors.

The Development of Biocomposite and Bioabsorbable Suture Anchors Is Creating Opportunities for Improved Healing Outcomes, Reducing The Need for Implant Removal Surgeries.

Adoption of more AI-powered surgical planning tools, which will continue to grow; continued pervasiveness of biocomposite and biodegradable anchor technologies; and rising investment in patient-specific fixation solutions. Unfortunately, the needs in the hybrid fixation devices involve metallic and bioabsorbable combinations, and the greater concentration of interest in smart implant tracking systems for development are becoming major driving forces in the market.

Another major driver in the market is the growing interest in robotic-assisted suture anchor placement. Further, all these efforts in increasing research areas toward bioengineered tissue fixation materials and their application for the development of AI-assisted image-guided anchor placement are expected to provide opportunities with the emerging mergers and collaborations between the orthopedic research institutions and the medical device firms in optimizing anchor performance.

Add to that future advances in the next-generation biodegradable anchors and increasing consumer demand for minimally invasive yet long-lasting orthopedic implants, which would further enhance ease and long-term relevance in the market.

Growth of Biodegradable and Hybrid Suture Anchor Materials

The demand for bioabsorbable and hybrid-setting tools is changing the whole orthopedic fixation arena-the traumas, sports medicine, and reconstruction procedures. Bioabsorbable anchors, made of materials such as polylactic acid (PLA) and polyglycolic acid (PGA), provide a progressive biodegradation process, which avoids implant removal procedures and creates fewer long-term foreign body responses.

Hybrid anchors were developed from a combination of bio-absorbable and non-absorbable components. They provide higher strengths rendered by their components and allow the gradual attachment of bone. Such materials are what surgeons prefer for their biocompatibility, better healing, and less imaging interference.

Rapid improvements in technology may see this line advance into use or into even more progressive applications in the future, so the argument for biodegradable and hybrid suture anchors continues to grow in antennae-for patients benefiting from more advance and less invasive approaches to orthopedic applications.

Integration of AI and Robotic-Assisted Surgery in Suture Anchor Placement

In AI-based surgical navigation and robotic-assisted methods, the placement of suture anchors is undergoing transformation by enhancing accuracy, minimizing surgical errors, and maximizing patients' benefit. Imaging and navigation aids with AI provide real-time and very high-definition visualization of anatomical structures, thus enabling the surgeon to achieve his best accuracy in obtaining the anchor position.

Robotic-assisted surgery increases the reliability of the minimally invasive, controlled motion procedures to minimize the potential damage to the tissue or misalignment of the implant. This, therefore, a long-term benefit of improving implant stability, reducing reoperation rates, and hastening recovery for the patient.

Market Outlook

The United States market for suture anchor devices is expanding steadily, with increasing cases of sports injuries, orthopedic trauma, and degenerative joint disorders being the key factors driving the growth. Most companies are turning their attentions significantly toward suture anchor solutions in a push toward minimally invasive procedures like arthroscopic surgeries that demand enhanced fixation features and faster recoveries.

With a constant ongoing trend toward bioabsorbable materials, patient outcomes are improved with lesser complications and eliminating the need for implant removal ever since. A well-elaborated healthcare infrastructure in the country and friendly reimbursement policies shall facilitate the market's growth in terms of the acceptance of these devices across hospitals and ambulatory surgical centers into orthopedic care.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

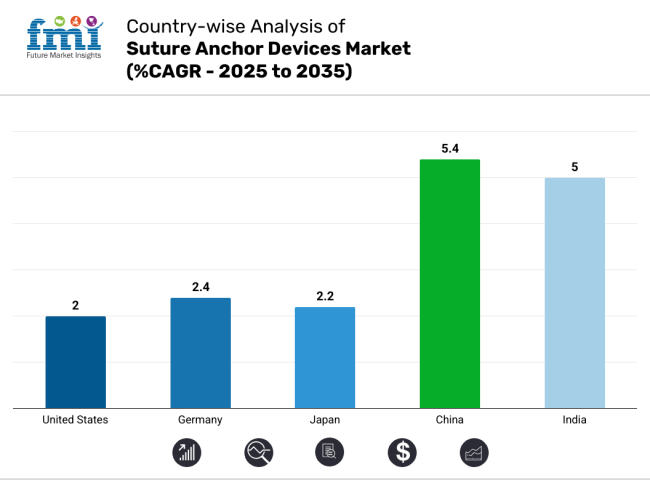

| United States | 2.0% |

Market Outlook

The market for suture anchor devices in Germany will take its impressive growth trajectory due to an ageing population, increasing sports-related injuries, and a spurious ascent in the demand for advanced orthopedic solutions. This growth is facilitated by an established healthcare system in the country compared with other countries, high adoption of minimally invasive surgeries, and strong backing from leading medical device manufacturers.

Advances in biocompatible and bioabsorbable materials will also make procedures more effective and improve patient outcomes. Moreover, reimbursement policies and government support will enable leveraging adoption. There are also a number of orthopedic and sports medicine clinics, and research is being conducted in the area of regenerative medicine, making Germany a formidable market for suture anchor devices in Europe.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.4% |

Market Outlook

The continuous growth of the suture anchor devices market in Japan has its roots in the rapidly aging population, increased osteoporosis-related fractures, and rising sports participation. Relying on a well-developed healthcare system with an emphasis on minimally invasive surgical technical approaches and a high demand for bioabsorbable suture anchors, the market presents huge opportunities for growth.

Investments and research and development policies by local manufacturers of medical devices also stimulate innovation in orthopedic repairs. Similarly, advances in surgical solutions are promoted by public healthcare policies and insurance coverages and encourage the use of advanced surgical techniques. Finally, robotics and precision-guided surgery in orthopedics improve Japan's position as a competitive player in the suture anchor devices market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.2% |

Market Outlook

The suture anchor devices market in China has tremendous potential and is experiencing rapid growth increasing sports injuries, rising orthopedic procedures, and the expansion of healthcare infrastructure. The population of elderly people has become a major factor affecting demand for high-performing suture anchors, as well as encouraging initiatives from the government for the advancement of surgical treatment.

The increase in urbanization along with rising income levels and better access to healthcare are all positive indications for the market. With a strong local manufacturing base investing in bioabsorbable and hybrid fixation technology to compete with global players, China also has a growing medical tourism industry that invests highly in high-quality orthopedic device localization, increasing market opportunity. It adopts innovative surgical procedures such as arthroscopy, thus making India an emerging player in the world of suture anchors.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.4% |

Market Outlook

India's suture anchor devices market is exhibiting a good growth spurt owing to an increasing incidence of sports injuries, trauma cases, and rising levels of awareness regarding advanced orthopedic treatments. Major demand drivers for the market expansion include the burgeoning healthcare sector of the country, a developing medical tourism industry, and increasing acceptability of minimally invasive procedures.

Improvements in access to high-quality orthopedic implants due to favorable government incentives and upsurge in investments in domestic manufacturing of medical devices further enhance the market scenario. Cost-effective therapies coupled with revolutionized reimbursement policies favor wider acceptance among medical care providers. The presence of skilled orthopedic surgeons, in addition to the trend toward bioabsorbables, spurs demand and positions India as one of the attractive markets for suture anchor devices.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.0% |

Suture anchor devices market has very great competition owing to the rising incidences of sports injuries, advances in minimally invasive orthopedic procedures, and growing acceptability of bioabsorbable and knotless suture anchor technology.

To maintain the competitive advantage in the market, companies are focusing on research in the area of high strength materials, improved fixation techniques, and innovations in arthroscopy. The market is being influenced by the position of solid orthopedic device manufacturers, sports medicine companies, and new bioengineering companies all playing a part in the evolving nature of suture anchor solutions.

Arthrex, Inc. (22-26%)

A dominant force in suture anchor devices, Arthrex pioneers advanced anchor designs that improve fixation strength, enhance tissue healing, and optimize surgical precision in orthopedic and sports medicine procedures.

Smith & Nephew plc (18-22%)

A leader in orthopedic innovations, Smith & Nephew develops high-strength, biocompatible suture anchors that provide secure fixation, improve procedural efficiency, and support minimally invasive arthroscopic repairs for ligament and tendon injuries.

Johnson & Johnson (DePuy Synthes) (10-14%)

A key player in sports medicine, DePuy Synthes offers precision-engineered suture anchors designed for arthroscopic and reconstructive surgeries, ensuring long-term stability, tissue integration, and enhanced post-surgical recovery.

Stryker Corporation (8-12%)

A strong competitor in orthopedic trauma, Stryker integrates advanced biomaterials, hybrid fixation methods, and innovative surgical techniques to improve suture anchor performance in complex ligament and tendon repair procedures.

Zimmer Biomet Holdings (5-9%)

A major provider of bioabsorbable suture anchors, Zimmer Biomet emphasizes enhanced healing, reduced post-surgical complications, and patient-friendly solutions, strengthening its position in the minimally invasive orthopedic repair market.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of suture anchor solutions, offering competitive pricing and cutting-edge innovations to meet diverse orthopedic and sports medicine needs.

Absorbable and Non-Absorbable

Metallic suture anchor, bio-absorbable suture anchor, PEEK suture ancho, bio-composite suture anchor and all suture anchor.

Knotless suture anchor and knotted suture anchor.

Hospitals, emergency medical services, clinics and ambulatory surgical centres.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Tying, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Tying, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tying, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Product, 2023 to 2033

Figure 27: Global Market Attractiveness by Material, 2023 to 2033

Figure 28: Global Market Attractiveness by Tying, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Tying, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Product, 2023 to 2033

Figure 57: North America Market Attractiveness by Material, 2023 to 2033

Figure 58: North America Market Attractiveness by Tying, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Tying, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Tying, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Tying, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Tying, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Tying, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Tying, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Tying, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Tying, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Tying, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Tying, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Tying, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Tying, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Tying, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Tying, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tying, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Tying, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The global suture anchor devices industry is projected to witness CAGR of 4.7% between 2025 and 2035.

The global suture anchor devices industry stood at USD 749.8 million in 2024.

The global suture anchor devices industry is anticipated to reach USD 1,262.2 million by 2035 end.

China is expected to show a CAGR of 5.4% in the assessment period.

The key players operating in the global suture anchor devices industry are Smith & Nephew plc., Zimmer Biomet Holdings, Inc., ConMed Corporation, Arthrex, Inc., Johnson and Johnson (DePuy Synthes, Inc.), Medtronic plc, Stryker Corporation, Parcus Medical, LLC., Wright Medical Group N.V., Teknimed SA and Others.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA