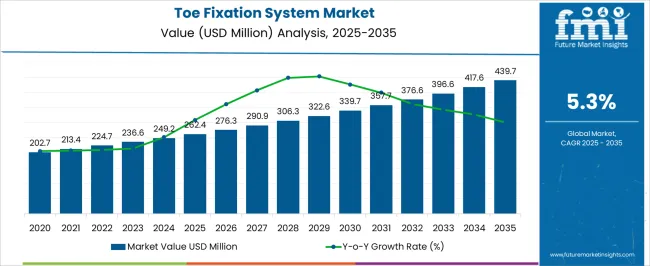

The Toe Fixation System Market is estimated to be valued at USD 262.4 million in 2025 and is projected to reach USD 439.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Toe Fixation System Market Estimated Value in (2025 E) | USD 262.4 million |

| Toe Fixation System Market Forecast Value in (2035 F) | USD 439.7 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The toe fixation system market is advancing steadily as the prevalence of forefoot deformities rises globally, particularly among aging populations and individuals with lifestyle-related conditions such as diabetes and arthritis. The shift toward minimally invasive surgical procedures has driven adoption of specialized fixation systems that offer enhanced stability, reduced recovery times, and improved patient outcomes. Technological innovations in bioabsorbable materials, cannulated screws, and anatomically contoured implants are enhancing surgical precision and long-term durability.

Healthcare providers are increasingly prioritizing devices that allow intraoperative flexibility and reduce post-operative complications. Hospital networks and ambulatory surgical centers are investing in integrated fixation platforms compatible with advanced imaging and navigation systems.

Market growth is further supported by early intervention trends and improved access to podiatric care, particularly in developed regions. As reimbursement frameworks become more favorable and physician awareness improves, demand for targeted, condition-specific fixation systems is expected to expand consistently over the coming years.

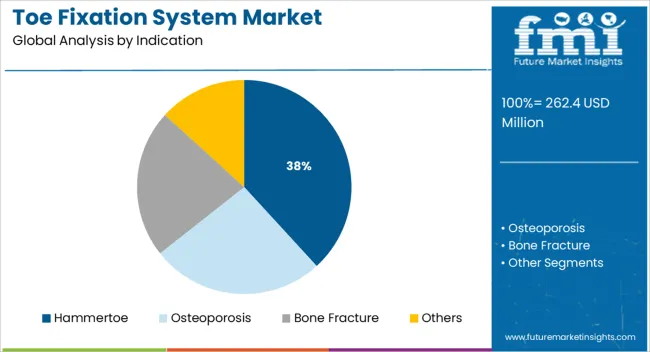

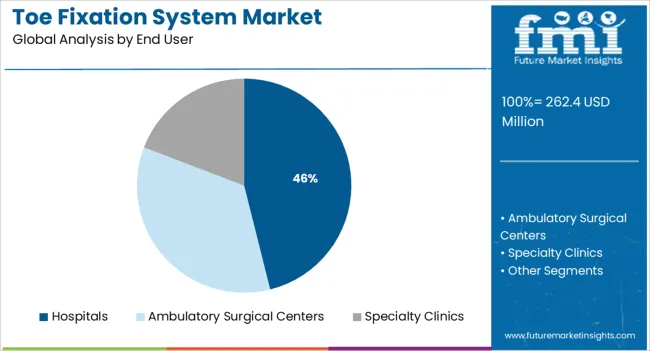

The market is segmented by Indication and End User and region. By Indication, the market is divided into Hammertoe, Osteoporosis, Bone Fracture, and Others. In terms of End User, the market is classified into Hospitals, Ambulatory Surgical Centers, and Specialty Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hammertoe indication segment is expected to account for 38.2% of total revenue in the toe fixation system market in 2025, making it the leading clinical use case. This dominance is driven by the high prevalence of hammertoe deformities, particularly among older adults and patients with diabetic foot complications.

Increasing awareness of surgical correction options and earlier intervention by orthopedic specialists have accelerated demand for indication-specific fixation devices. Surgical advancements have enabled stable, low-profile implants that accommodate flexible and rigid hammertoe corrections, supporting clinical decision-making and improving functional outcomes.

Furthermore, minimally invasive approaches and absorbable implant options are being adopted to reduce the need for hardware removal. The segment's leading share is reinforced by its association with reduced recurrence rates and positive post-operative mobility outcomes, positioning hammertoe as the primary surgical focus within the toe fixation system landscape.

Hospitals are projected to contribute 46.1% of total market revenue in 2025 within the end user category, making them the primary channel for toe fixation system procedures. This is due to their comprehensive surgical infrastructure, access to skilled orthopedic and podiatric surgeons, and ability to manage complex comorbidities in patients.

Hospitals serve as key settings for both elective and trauma-related foot surgeries, enabling the widespread adoption of standardized fixation systems. Institutional procurement strategies favor vendors offering customizable, procedure-specific kits and post-operative support, contributing to increased device utilization in hospital environments.

Additionally, hospitals often act as centers of excellence for foot and ankle care, where advanced diagnostic and imaging tools guide pre-operative planning and implant selection. The concentration of surgical volumes, combined with established reimbursement workflows and infection control protocols, has solidified hospitals as the dominant end user segment in the toe fixation system market.

The market for toe fixation systems is expanding primarily due to the rising incidence of hammertoe and osteoporosis. The market for toe fixation systems will expand as more surgical implants for the treatment of hammertoe are developed. Additionally, the manufacturers of the toe fixation systems are concentrating on innovative product launches which will help to boost the revenue growth of the toe fixation systems market.

Moreover, the toe fixation systems manufacturers are collaborating with a top hospital, which will help the market for these devices grow financially. For instance, Stryker, the top medical technology firm, unveiled an immersive campaign to encourage consumers to research novel bunion treatment alternatives and raise awareness of the advantages of bunion surgery. The interactive campaign used visually appealing chalk patterns in four major cities - New York City, Los Angeles, Chicago, and Miami - to pique the curiosity of passers-by and encourage them to discover more.

The toe fixation systems market is majorly dominated by North America owing to a rise in orthopedic procedures in the USA and Canada. Following, North America, Europe and East Asia are anticipated to show gradual growth in the toe fixation systems market due to the rising prevalence of hammertoe. Due to the rising incidence of osteoporosis, India is a major market for toe fixation systems in the South Asian region.

Latin America and the Middle East and Africa are anticipated to show comparatively low adoption of the toe fixation systems due to the low availability of the skilled professionals and orthopedic surgeons in these regions.

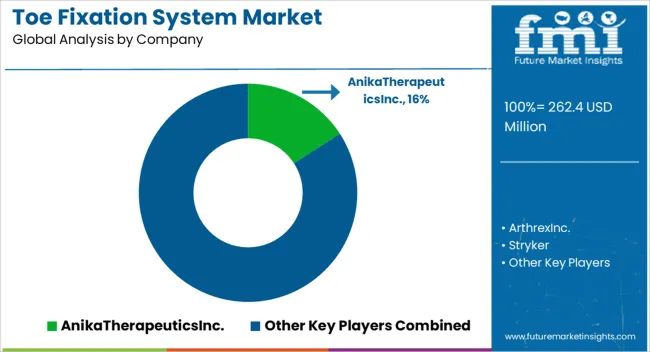

Some of the key manufacturers operating in the toe fixation systems industry are Anika Therapeutics, Inc., Arthrex, Inc., Stryker, Zimmer Biomet., Novastep Inc., CENTRIC MEDICAL, LLC., Osteotec Limited, VILEX, LLC, Wright Medical Group N.V., DJO, LLC, and Aleda Makina.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 5.3% 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2012 to 2024 |

| Forecast Period | 2025 to 2035 |

| Qualitative Units | Revenue in USD Million, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segment Covered | Indication, End User, Region |

| Region Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Players | Anika Therapeutics, Inc.; Arthrex, Inc.; Stryker; Zimmer Biomet.; Novastep Inc.; CENTRIC MEDICAL, LLC.; Osteotec Limited; VILEX, LLC; Wright Medical Group N.V.; DJO, LLC; Aleda Makina |

| Customization | Available Upon Request |

The global toe fixation system market is estimated to be valued at USD 262.4 million in 2025.

The market size for the toe fixation system market is projected to reach USD 439.7 million by 2035.

The toe fixation system market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in toe fixation system market are hammertoe, osteoporosis, bone fracture and others.

In terms of end user, hospitals segment to command 46.1% share in the toe fixation system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optoelectronic Transducers Market Growth – Trends & Forecast 2025 to 2035

Optoelectronic Development Tools Market

Photoelectric Sensors Market

Magnetoencephalography Market - Growth & Technological Advancements 2025 to 2035

X-ray Photoelectron Spectroscopy Market Insights - Growth & Forecast 2024 to 2034

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Automotive Optoelectronics Market Trends - Growth & Forecast 2025 to 2035

Angle-Resolved Photoemission Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Bone Fixation Plates Market Trends - Growth, Demand & Forecast 2025 to 2035

Elbow Fixation Systems Market

Bone Graft Fixation System Market – Growth & Demand 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Cranial Closure And Fixation Devices Market Size and Share Forecast Outlook 2025 to 2035

Non- Resorbable Cranial Fixation System Market

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA