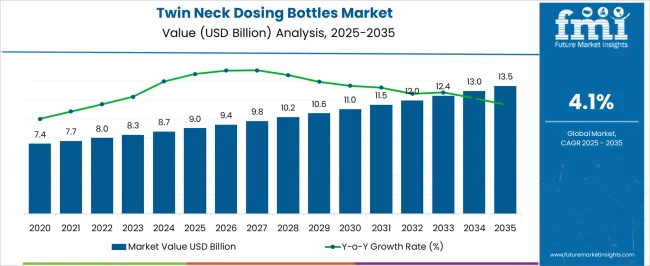

The Twin Neck Dosing Bottles Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 13.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Twin Neck Dosing Bottles Market Estimated Value in (2025E) | USD 9.0 billion |

| Twin Neck Dosing Bottles Market Forecast Value in (2035F) | USD 13.5 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The Twin Neck Dosing Bottles market is experiencing steady growth, primarily fueled by increasing demand for precision in liquid measurement and contamination-free dispensing across pharmaceutical, nutraceutical, and agrochemical applications. The design efficiency of these bottles, which allows accurate dosing without additional measuring tools, is gaining traction among manufacturers and end-users prioritizing user convenience and regulatory compliance.

Growth in regulated packaging standards and a surge in demand for accurate single-use liquid dispensing in clinical and consumer health settings have further supported adoption. The material flexibility and tamper-evident features embedded in these bottles are enhancing their appeal across sensitive applications.

The rising usage of child-resistant and calibrated packaging has accelerated innovation in twin neck bottle designs, with manufacturers offering scalable capacity options for various formulations As the market moves toward patient-centric, portable, and hygienic dosing solutions, twin neck dosing bottles are expected to maintain strong relevance, especially in regions with expanding pharmaceutical infrastructure and over-the-counter product demand.

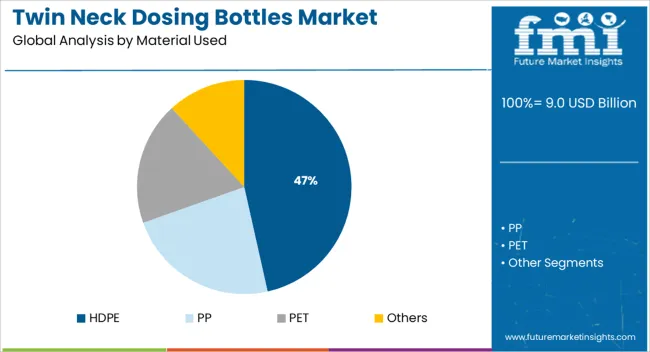

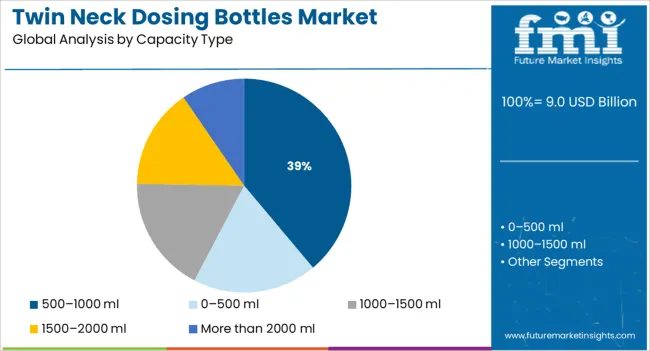

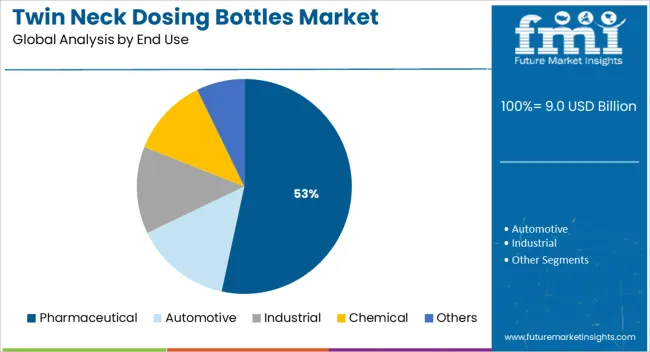

The market is segmented by Material Used, Capacity Type, and End Use and region. By Material Used, the market is divided into HDPE, PP, PET, and Others. In terms of Capacity Type, the market is classified into 500–1000 ml, 0–500 ml, 1000–1500 ml, 1500–2000 ml, and More than 2000 ml. Based on End Use, the market is segmented into Pharmaceutical, Automotive, Industrial, Chemical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

HDPE is expected to account for 46.5% of the revenue share in the Twin Neck Dosing Bottles market in 2025, positioning it as the dominant material used. The growth of this segment has been influenced by HDPE’s excellent chemical resistance, lightweight properties, and suitability for pharmaceutical-grade packaging. Its robustness under varying temperature and storage conditions has made it a preferred material for storing liquid medications, agrochemicals, and cleaning agents.

HDPE offers ease of molding, allowing precise bottle structures with dual-chamber configurations, which are essential for accurate dosing. The material’s compatibility with high-speed production lines and recyclability has further supported its usage across industries aiming for sustainable and efficient packaging solutions.

Regulatory acceptability for pharmaceutical and food-contact applications, combined with cost-effectiveness and consistent mechanical performance, has reinforced HDPE’s dominance in the material segment As global compliance and packaging integrity remain critical in liquid product markets, HDPE’s position as the primary material in twin neck dosing bottles is projected to remain strong.

The 500 to 1000 ml capacity range is projected to contribute 38.9% of the total revenue share in the Twin Neck Dosing Bottles market in 2025, emerging as the leading capacity type. This segment’s leadership is driven by its versatility in accommodating medium-volume liquid formulations, which are common in pharmaceuticals, veterinary medicines, and industrial solutions. Bottles within this range offer a practical balance between storage convenience and portability, making them suitable for both institutional and household use.

Their size supports extended usage without frequent replacement, which is particularly valued in healthcare and agricultural applications. The growing demand for bulk dosing options in clinical settings and increased consumer reliance on refillable containers have further strengthened the segment’s position.

Additionally, the ability to incorporate accurate measuring features while maintaining ergonomic handling has made this capacity range ideal for both professional and consumer markets With increasing preference for calibrated and resealable liquid packaging, the 500 to 1000 ml segment is expected to continue its growth trajectory.

The pharmaceutical segment is forecasted to hold 53.4% of the revenue share in the Twin Neck Dosing Bottles market in 2025, positioning it as the leading end use category. This dominance has been supported by the critical need for accurate, hygienic, and user-friendly liquid medication delivery systems. Twin neck bottles offer integrated measuring chambers, which eliminate the need for external tools and minimize dosing errors, a key requirement in pharmaceutical administration.

The segment’s growth has been influenced by the increasing prevalence of chronic diseases requiring liquid therapies, along with the rising trend of self-medication and home-based healthcare. Pharmaceutical companies have adopted these bottles for their compliance with stringent regulatory standards, tamper-evident sealing, and child-resistant features.

Moreover, their ability to be manufactured in sterile environments and customized for pediatric, geriatric, or specialty drug formulations has expanded their applicability As personalized medicine and precision dosing continue to evolve, twin neck dosing bottles are expected to remain a core packaging solution in the pharmaceutical sector.

Convenient packaging solution such as twin neck dosing bottles, also known as Bettix twin neck bottles or Double neck bottles, are widely used in different industries such as pharmaceuticals, chemical, automotive, etc. The design of twin neck dosing bottle is what makes it a unique packaging solution.

The bottle is equipped with a storage and dispenser chambers along with a neck mounted on each chamber which allows dual control dispensing. The dispenser chamber eliminates the traditional two-hand filling of the liquids in a separate measuring cup.

The twin neck dosing bottles are designed to dispense a measured amount of liquid by single-hand operation more safely and accurately without any spillage or loss of the product. The twin neck dosing bottles possess high tensile strength, good impact resistance, high rigidity, and chemical resistance.

These bottles are primarily made up of high-density polyethylene, an FDA approved material, which offers good protection for low freezing point liquids. The twin neck dosing bottles also have an easy-to-read gradient measurement as an added feature.

In recent years, there has been a noticeable rise in the usage of twin neck dosing bottles in different markets. This is because of the exclusive design of twin neck dosing bottles which provides accurate filling of the liquids without any loss or spillage.

The twin neck dosing bottles are widely used in pharmaceutical industry which offer unusual convenience to end consumers to ease unit dosing of various drugs. With numerous features such as metered dosing and ability to protect liquids from surrounding air and gases, makes twin neck dosing bottles a perfect packaging solution for the chemical industry.

The latest technological changes and innovation in the design of twin neck bottles offers opportunities for the growth of twin neck bottles market. The latest trends observed in twin neck dosing bottles market is the increased usage of these bottles in fertilizers and automotive market.

The major restraining factor in the twin neck dosing bottles market is the enforcement of stringent rules and regulations on the use of plastics all over the world. This will diminish the growth of twin neck bottles market in the near future.

Geographically, the global twin neck dosing bottles market is segmented across following regions- Asia-Pacific, Eastern Europe, Western Europe, North America, Latin America, Middle East and Africa. The twin neck dosing bottles market is increasing at a good annual growth rate in emerging economies such as Asia Pacific and MEA region due to extraordinary growth in the pharmaceutical industry.

The mature markets such as North America and Europe will grow at a rate lower than that of developing countries including India, China, and Brazil. The regions such as Latin America and Japan also offer untapped growth potential in the twin neck dosing bottles market.

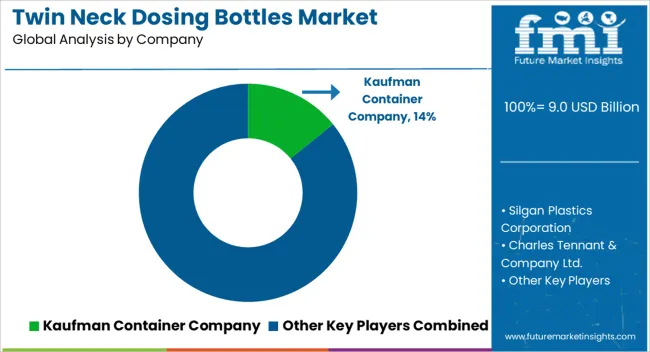

Some of the key players in the global twin neck dosing bottles market are Kaufman Container Company, Silgan Plastics Corporation, Charles Tennant & Company Ltd., Richmond Containers CTP Ltd., Richards Packaging, Inc., IGH Holdings, Inc., Hangzhou Glory Industry Co., Ltd., Bharat Propack Private Limited, Silverlock & Co. Pty Ltd., Hebei ShengXiang Package Materials Co.,Ltd., O.Berk Company, LLC.

The global twin neck dosing bottles market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the twin neck dosing bottles market is projected to reach USD 13.5 billion by 2035.

The twin neck dosing bottles market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in twin neck dosing bottles market are hdpe, pp, pet and others.

In terms of capacity type, 500–1000 ml segment to command 38.9% share in the twin neck dosing bottles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Twin Screw Extruders Market Size and Share Forecast Outlook 2025 to 2035

Twin Seal Bags Market Size and Share Forecast Outlook 2025 to 2035

Twin Pouch Packaging Market

Twin Neck Bottles Market Size and Share Forecast Outlook 2025 to 2035

Digital Twins Technologies Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin In Logistics Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin Technology Market Size and Share Forecast Outlook 2025 to 2035

Digital Twin Packaging Line Market Size and Share Forecast Outlook 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Neck Pillows Market Analysis - Trends, Growth & Forecast 2025 to 2035

Crimp Neck Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Head and Neck Cancer (HNC) Therapeutics Market - Growth & Drug Developments 2025 to 2035

Head and Neck Squamous Cell Carcinoma Market

Cordless Long Neck Grinder Market Size and Share Forecast Outlook 2025 to 2035

PD1 Resistant Head and Neck Cancer Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Beer Bottles Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA