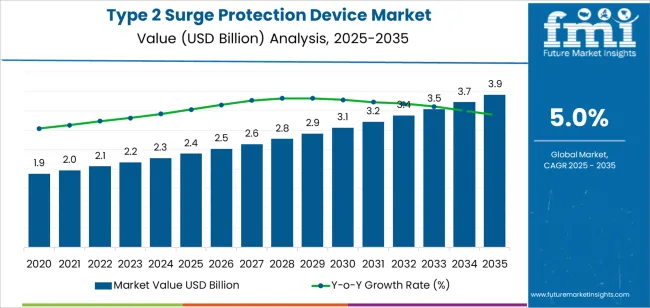

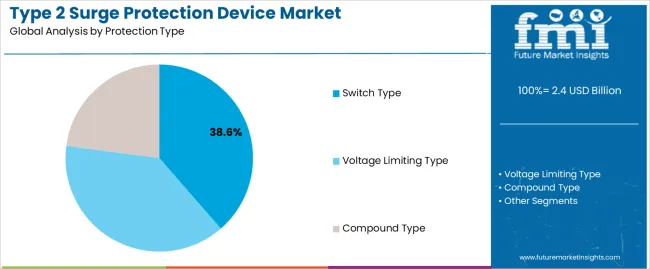

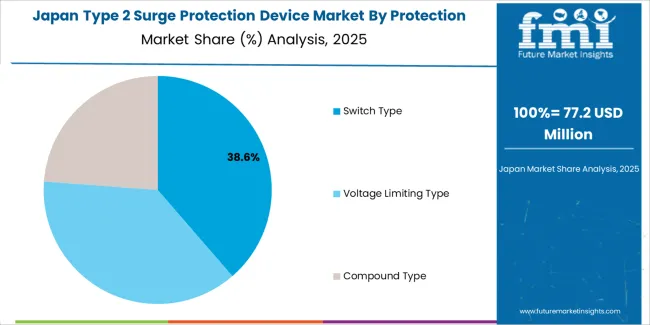

The global Type 2 surge protection device market is set to grow from USD 2.4 billion in 2025 to USD 3.9 billion by 2035, adding USD 1.5 billion in new revenue and advancing at a CAGR of 5.0%. Growth is driven by rising risk exposure from switching surges, distributed energy resources connected to grids, and expanding automation footprints in industrial and commercial facilities. Type 2 devices are increasingly mandated at distribution panels as part of layered protection architectures to prevent equipment downtime, warranty disputes, and insurance liabilities. Switch type SPDs hold a 38.6% share in 2025, favored in heavy-load environments for their defined disconnection behavior and compliance traceability. Voltage limiting types represent 33.2% and remain essential in data centers, communication systems, and electronic equipment where fast clamping and compact panel integration are priorities. Compound (hybrid) types at 28.2% are accelerating fastest as facilities seek both endurance and coordinated response profiles in mixed-load environments.

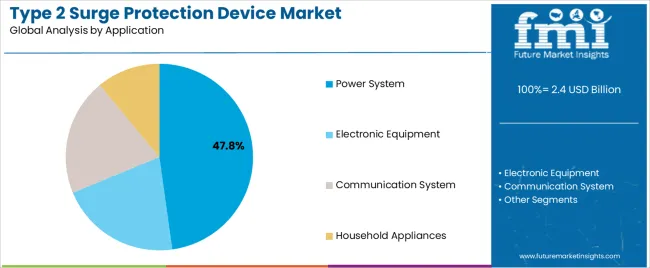

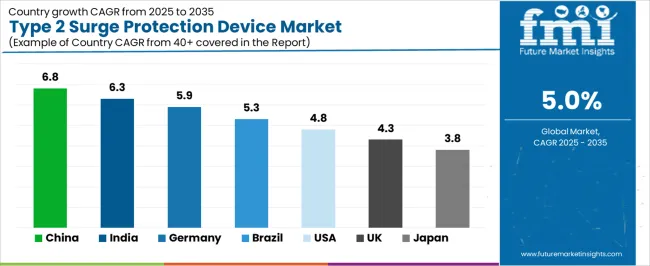

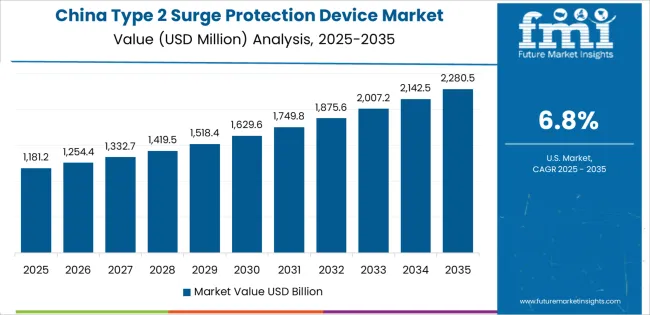

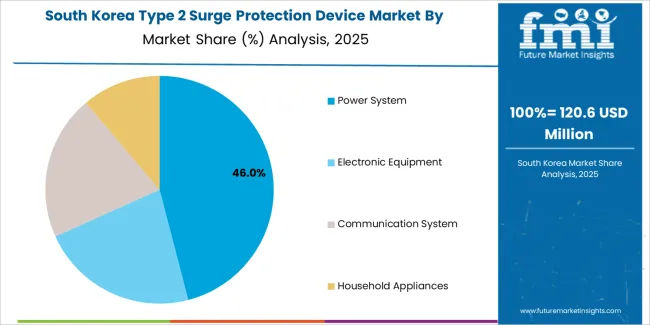

Power systems remain the dominant application at 47.8%, reflecting the need for protection in MCCs, switchboards, and building distribution layers. Electronic equipment protection at 27.3% expands as PLCs, drives, servers, and medical electronics become more surge-sensitive. Asia Pacific leads growth, with China at 6.8% and India at 6.3% CAGR, supported by grid upgrades and manufacturing capacity expansion. Germany, the United States, and Japan prioritize technical standards compliance and reliability assurance. Competitive advantage is consolidating around lifecycle engineering, protection coordination studies, remote fault diagnostics, and multi-site maintenance support rather than device hardware.

Technology advancement in voltage limiting materials, thermal disconnect mechanisms, and failure indication systems is enhancing device reliability while reducing maintenance complexity for facility operators managing distributed protection networks. Manufacturers are developing application-specific configurations optimized for power system panelboards, electronic equipment installations, and communication infrastructure protection, creating segmented product portfolios addressing diverse voltage ratings, discharge capacities, and coordination requirements. The competitive landscape features established electrical equipment manufacturers expanding protection device offerings alongside specialized surge protection suppliers capturing market share through technical service capabilities and installation support programs that reduce implementation barriers for electrical contractors and facility management operations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.4 billion |

| Market Forecast Value (2035) | USD 3.9 billion |

| Forecast CAGR (2025-2035) | 5.0% |

| INFRASTRUCTURE MODERNIZATION | EQUIPMENT PROTECTION REQUIREMENTS | REGULATORY & SAFETY STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Protection Type | Switch Type, Voltage Limiting Type, Compound Type |

| By Application | Power System, Electronic Equipment, Communication System, Household Appliances |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Switch Type |

|

| Voltage Limiting Type |

|

| Compound Type |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Power System |

|

| Electronic Equipment |

|

| Communication System |

|

| Household Appliances |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

China is projected to exhibit strong growth with a market value of USD 919.4 million by 2035, driven by expanding industrial manufacturing infrastructure and comprehensive electrical modernization initiatives creating substantial opportunities for protection device suppliers across power distribution operations, data center facilities, and communication network installations. The country's massive industrial base and expanding renewable energy integration capabilities are creating significant demand for both conventional and intelligent surge protection solutions. Major electrical equipment manufacturers including Shanghai Chenzhu Instrument, Yuelong Electric, and SUNTREE are establishing comprehensive local production facilities to support large-scale installation operations and meet growing demand for cost-effective protection solutions.

Industrial automation programs are supporting widespread adoption of advanced surge protection across manufacturing operations, driving demand for reliable devices capable of protecting programmable logic controllers, variable frequency drives, and distributed control systems. Smart grid development initiatives and renewable energy integration programs are creating substantial opportunities for protection suppliers requiring coordinated device architectures and performance monitoring capabilities. Manufacturing sector growth and communication infrastructure expansion are facilitating adoption of specialized protection devices throughout major industrial regions.

India is expanding to reach USD 657.3 million by 2035, supported by extensive rural electrification programs and comprehensive industrial development initiatives creating sustained demand for reliable electrical protection across diverse power quality environments and cost-sensitive market segments. The country's expanding manufacturing sector and growing data center capabilities are driving demand for protection solutions that provide consistent performance while supporting competitive installation requirements. Equipment manufacturers and electrical contractors are investing in local distribution facilities to support growing project volumes and customer service demands.

Government electrification initiatives and smart city development programs are creating opportunities for protection devices across diverse installation categories requiring reliable performance and accessible price points. Infrastructure modernization and industrial facility construction are driving investments in protection systems supporting operational requirements throughout major metropolitan areas. Commercial building growth and telecommunications expansion programs are enhancing demand for application-specific protection devices throughout emerging market regions.

Demand for Type 2 Surge Protection Devices in Germany is projected to reach USD 724.8 million by 2035, supported by the country's leadership in electrical engineering standards and advanced industrial automation technologies requiring sophisticated protection systems for Industry 4.0 manufacturing facilities and renewable energy installations. German manufacturers including Siemens, Phoenix Contact, and DEHN maintain premium market positioning through technical innovation, comprehensive testing protocols, and extensive application support services. The market is characterized by focus on operational reliability, system integration capabilities, and compliance with stringent safety and performance standards.

Industrial equipment manufacturers are prioritizing intelligent protection technologies that demonstrate remote monitoring capabilities and predictive maintenance features while meeting German electrical codes and insurance requirements. Renewable energy leadership programs and distributed generation integration initiatives are driving adoption of coordinated protection systems that support photovoltaic installations, wind farms, and energy storage facilities. Research and development programs for smart grid technologies are facilitating adoption of networked protection devices throughout major industrial centers.

The United States is growing to reach USD 692.1 million by 2035, driven by National Electrical Code updates mandating surge protection and increasing data center construction creating sustained opportunities for device suppliers serving both commercial construction projects and industrial facility contractors. The country's extensive electrical infrastructure base and expanding code compliance awareness are creating demand for protection devices that support diverse installation requirements while maintaining competitive pricing standards. Manufacturers and distribution partners are developing market strategies to support contractor education and specification assistance programs.

Building code modernization programs and insurance industry protection requirements are facilitating adoption of surge protection devices capable of supporting whole-building protection architectures and equipment-specific applications. Data center growth and communication infrastructure expansion programs are enhancing demand for high-performance devices that support operational uptime requirements and sensitive equipment protection. Industrial facility modernization and commercial construction activity are creating opportunities for coordinated protection capabilities across American electrical distribution systems.

Demand for Type 2 Surge Protection Devices in United Kingdom is projected to reach USD 448.2 million by 2035, expanding at a CAGR of 4.3%, driven by BS 7671 wiring regulations requiring surge protection assessment and commercial facility modernization supporting advanced electrical safety capabilities. The country's established electrical contracting industry and growing renewable energy installations are creating demand for protection devices that support regulatory compliance and operational performance standards. Equipment distributors and installation contractors are maintaining comprehensive product portfolios to support diverse project requirements.

Commercial building modernization and industrial facility upgrade programs are supporting demand for protection devices that meet contemporary performance and reliability standards. Data center development and telecommunications infrastructure programs are creating opportunities for specialized protection systems that provide comprehensive equipment protection. Construction sector recovery and infrastructure investment programs are facilitating adoption of certified protection capabilities throughout major commercial regions.

Japan is projected to reach USD 521.7 million by 2035, expanding at a CAGR of 3.8%, driven by premium equipment protection requirements and comprehensive electrical safety standards supporting advanced manufacturing operations and critical facility protection. The country's established quality culture and sophisticated building systems are creating demand for high-performance protection devices that support operational reliability and equipment longevity requirements. Manufacturers including Mitsubishi Electric, Fuji Electric, and Panasonic maintain comprehensive product development capabilities to support diverse installation requirements.

Industrial manufacturing excellence and precision equipment operations are supporting demand for protection devices that meet stringent performance and reliability standards. Urban infrastructure modernization and commercial facility development programs are creating opportunities for intelligent protection systems that provide comprehensive monitoring capabilities. Renewable energy integration and distributed generation programs are facilitating adoption of coordinated protection architectures throughout major industrial regions.

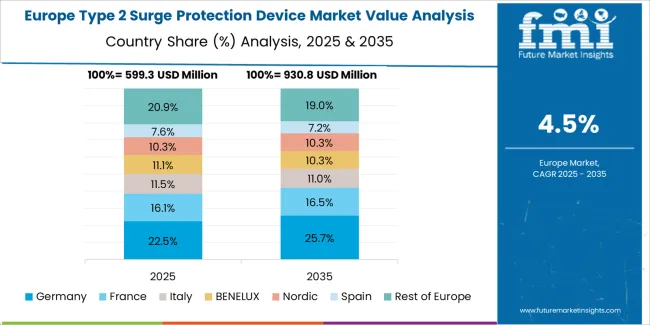

The Type 2 surge protection device market in Europe is projected to grow from USD 831.6 million in 2025 to USD 1,354.2 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, declining slightly to 27.6% by 2035, supported by its advanced industrial infrastructure and stringent electrical safety standards requiring comprehensive surge protection across manufacturing facilities, commercial installations, and residential construction.

France follows with a 19.3% share in 2025, projected to reach 19.8% by 2035, driven by nuclear power infrastructure protection requirements and comprehensive building code mandates for electrical safety systems. The United Kingdom holds a 16.7% share in 2025, expected to stabilize at 16.5% by 2035 as post-Brexit regulatory alignment maintains equivalence with European standards. Italy commands a 14.9% share, while Spain accounts for 12.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 8.5% to 9.2% by 2035, attributed to increasing protection device adoption in Nordic countries implementing smart grid technologies and Eastern European markets modernizing electrical infrastructure to meet European Union safety directives.

Japanese Type 2 surge protection device operations reflect the country's emphasis on electrical safety and equipment reliability across industrial, commercial, and residential applications. Major electrical equipment manufacturers including Mitsubishi Electric, Fuji Electric, and Panasonic maintain rigorous product development processes emphasizing high-temperature performance, compact dimensions for space-constrained panelboards, and extended service life meeting Japan's demanding quality expectations. The domestic market demonstrates preference for compound-type protection devices combining multiple technologies to address diverse transient threats in facilities with sensitive electronic equipment and critical production systems.

Regulatory oversight through the Ministry of Economy, Trade and Industry establishes comprehensive testing requirements and certification standards that often exceed international benchmarks, creating barriers for foreign suppliers while ensuring consistent protection performance. Japanese Industrial Standards specify installation requirements, coordination methodologies, and maintenance protocols that shape product development priorities for manufacturers serving domestic and export markets. The building code framework mandates surge protection for commercial facilities, medical installations, and high-rise residential buildings, creating stable demand for certified devices meeting Japanese specifications.

Supply chain management emphasizes long-term relationships between equipment manufacturers and electrical contractors, with technical support and training programs maintaining installation quality across distributed project networks. Companies invest in application engineering resources providing specification assistance and coordination studies for complex facilities requiring integrated protection architectures. The market structure rewards manufacturers demonstrating consistent product quality and responsive technical service rather than purely price-competitive positioning.

South Korean Type 2 surge protection device operations benefit from the country's advanced industrial base and export-oriented manufacturing sector requiring comprehensive electrical protection systems. Major industrial conglomerates including Samsung, LG, and Hyundai drive sophisticated protection requirements through their manufacturing facilities, semiconductor fabrication plants, and electronics production operations demanding precise transient overvoltage control to prevent equipment damage and production disruptions.

The Korean market demonstrates particular strength in applying surge protection to semiconductor manufacturing equipment, automated production lines, and cleanroom facilities where electrical disturbances can result in significant yield losses and quality control failures. Companies require specific coordination studies and protection architectures that integrate with existing power distribution systems while meeting stringent electromagnetic compatibility requirements for sensitive process equipment.

Regulatory frameworks emphasize electrical safety and equipment protection, with Korean Electrical Code requirements establishing minimum protection standards for industrial facilities, commercial buildings, and critical infrastructure installations. The certification environment requires comprehensive testing documentation and third-party verification that creates barriers for uncertified suppliers while ensuring consistent protection performance across installed base.

Supply chain efficiency remains critical for timely project completion in Korea's fast-paced construction environment. Manufacturers maintain local inventory and technical support capabilities to meet short lead times demanded by general contractors and electrical engineering firms managing concurrent projects across industrial and commercial sectors. The market increasingly pursues digital integration capabilities with building management systems and remote monitoring platforms supporting proactive maintenance strategies.

Profit pools are consolidating upstream in component manufacturing for metal oxide varistors and gas discharge tubes while downstream value concentrates in application engineering services and coordinated protection system design where technical expertise and installation support command premiums over commodity device sales. Value is migrating from standalone product transactions to integrated protection architectures where certification, coordination studies, and lifecycle support differentiate market leaders from volume-oriented suppliers. Several archetypes define competitive dynamics: global electrical equipment manufacturers leveraging brand recognition and distribution networks to maintain market share across industrial and commercial segments; specialized surge protection suppliers capturing premium applications through technical service capabilities and custom solutions; regional manufacturers competing on price in cost-sensitive markets; and component suppliers pursuing vertical integration to capture system-level margins.

Switching costs for end users remain moderate due to standardized mounting configurations and electrical specifications, but technical risk from improper device coordination creates barriers favoring established suppliers with proven track records and engineering support capabilities. Supply chain disruptions affecting semiconductor components and raw materials periodically reshape competitive dynamics as manufacturers with diversified sourcing networks gain advantage over single-source operations. Market consolidation continues through acquisitions of regional suppliers by multinational corporations seeking geographic expansion and technology portfolios, while digital transformation initiatives enable new service models combining hardware sales with remote monitoring and predictive maintenance offerings.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global electrical equipment manufacturers | Brand recognition, distribution scale, product breadth | Multi-product bundling, contractor relationships, technical training programs |

| Specialized protection suppliers | Technical expertise, custom solutions, application engineering | Coordination studies, custom specifications, premium positioning |

| Regional manufacturers | Cost structure, local relationships, market knowledge | Price competition, regional codes, distributor networks |

| Component suppliers | Material science, manufacturing efficiency, vertical integration | Technology licensing, OEM relationships, capacity investment |

| Distribution networks | Contractor access, inventory management, logistics | Stock programs, counter sales, project quotations |

| Items | Values |

|---|---|

| Quantitative Units | USD 2.4 billion |

| Protection Type | Switch Type, Voltage Limiting Type, Compound Type |

| Application | Power System, Electronic Equipment, Communication System, Household Appliances |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, China, India, Japan, Brazil, and other 40+ countries |

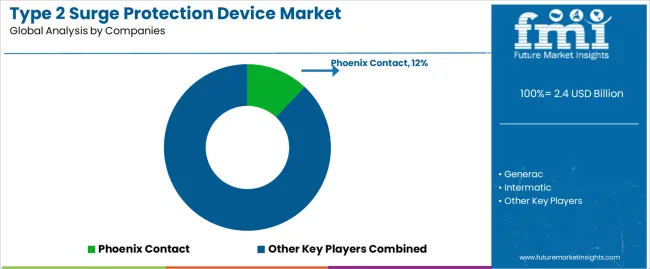

| Key Companies Profiled | Phoenix Contact, Generac, Intermatic, Leviton, Mersen, Siemens, Onccy, PD Devices, Shanghai Chenzhu Instrument, LSP, SUNTREE, Anhui Jinli Electric Tech, Yuelong Electric, Schneider Electric, Eaton, Littelfuse, ABB, CITEL, FATECH ELECTRONIC (FOSHAN) |

| Additional Attributes | Dollar sales by protection type/application, regional demand (NA, EU, APAC), competitive landscape, technology adoption trends, industrial/commercial installation dynamics, and smart monitoring innovations driving electrical safety, equipment protection, and operational reliability |

The global type 2 surge protection device market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the type 2 surge protection device market is projected to reach USD 3.9 billion by 2035.

The type 2 surge protection device market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in type 2 surge protection device market are switch type, voltage limiting type and compound type.

In terms of application, power system segment to command 47.8% share in the type 2 surge protection device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

Type 1 Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

V-type Classifiers Market Size and Share Forecast Outlook 2025 to 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

USB Type C Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of the USB Type-C Industry

Stud Type Track Roller Market Size and Share Forecast Outlook 2025 to 2035

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Roll Type Thermal Paper Market Forecast and Outlook 2025 to 2035

Brush-Type Belt Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Blade-type Belt Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA