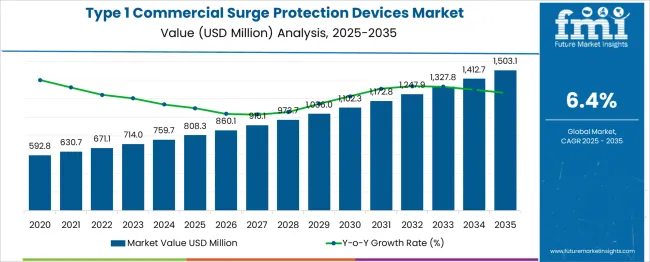

The Type 1 Commercial Surge Protection Devices Market is estimated to be valued at USD 808.3 million in 2025 and is projected to reach USD 1503.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. From 2025 to 2030, the market is expected to rise from USD 808.3 million to USD 1,102.3 million, driven by increasing investments in electrical infrastructure safety and the rising prevalence of transient voltage issues in commercial facilities.

Year-on-year growth shows steady gains, reaching USD 860.1 million in 2026 and USD 915.1 million in 2027, supported by growing compliance requirements and the need for enhanced power quality management. By 2028, the market is forecasted to hit USD 973.7 million, advancing to USD 1,036.0 million in 2029 and USD 1,102.3 million by 2030. Growth is anticipated to be further influenced by advancements in monitoring technologies and the integration of smart surge protection systems in commercial networks.

Expansion in sectors such as data centers, healthcare, and industrial facilities, where uninterrupted power supply is critical, will also fuel adoption. These dynamics position Type 1 surge protection devices as an essential component for electrical resilience, ensuring operational continuity and safeguarding high-value equipment in modern commercial environments.

| Metric | Value |

|---|---|

| Type 1 Commercial Surge Protection Devices Market Estimated Value in (2025 E) | USD 808.3 million |

| Type 1 Commercial Surge Protection Devices Market Forecast Value in (2035 F) | USD 1503.1 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The Type 1 commercial surge protection devices (SPD) market holds a crucial position within several electrical safety and power quality sectors. In the surge protection devices market, it represents approximately 30–35%, as Type 1 SPDs are essential for main service entrances in commercial facilities, protecting against external lightning-induced surges.

Within the electrical protection and safety equipment market, its share is around 8–10%, as this category also includes circuit breakers, fuses, and grounding systems. In the commercial electrical equipment market, Type 1 SPDs account for about 6–8%, given their specific application compared to broader electrical infrastructure.

For the power quality and energy management market, the share is approximately 4–5%, since this segment encompasses voltage regulation, harmonic filters, and monitoring solutions. In the building and infrastructure protection systems market, its share is nearly 5–6%, as surge protection forms one element of a larger safety framework. Market growth is driven by increased reliance on sensitive electronics, stricter safety regulations, and the rising incidence of power disturbances due to grid instability and lightning strikes.

Advancements such as smart monitoring, modular designs, and compliance with international standards are boosting adoption. As commercial infrastructure modernizes globally, Type 1 SPDs are expected to gain stronger presence within these parent markets.

The type 1 commercial surge protection devices market is witnessing notable growth as increasing awareness of electrical infrastructure resilience, stringent safety regulations, and rising energy demand converge to drive adoption. Businesses are actively seeking solutions to protect critical electrical assets from transient overvoltages, reducing downtime and maintenance costs while ensuring compliance with evolving standards.

The market is being shaped by technological advancements that enable higher performance, compact designs, and easier integration into existing systems. Future growth is expected to benefit from expanding commercial construction activities, heightened focus on operational continuity, and integration of smart grid technologies which demand more robust protection systems.

The confluence of regulatory enforcement, operational cost reduction, and growing emphasis on business continuity planning is paving the way for wider deployment of type 1 commercial surge protection devices in diverse commercial settings.

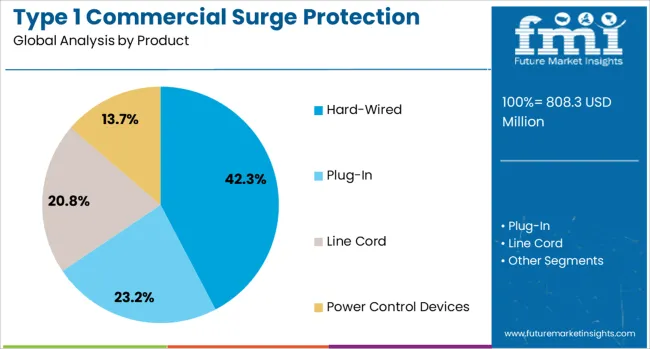

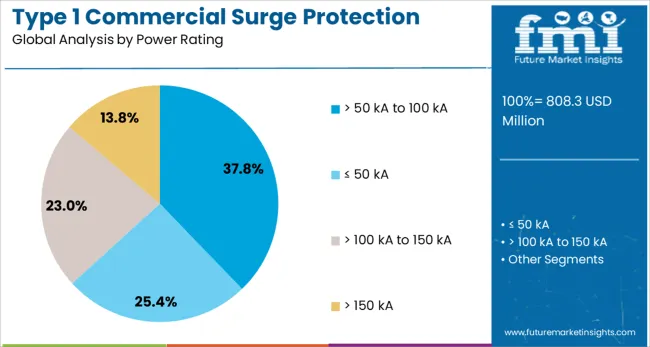

The type 1 commercial surge protection devices market is segmented by product and power rating and geographic regions. By product of the type 1 commercial surge protection devices market is divided into Hard-Wired, Plug-In, Line Cord, and Power Control Devices. In terms of power rating of the type 1 commercial surge protection devices market is classified into > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA.

Regionally, the type 1 commercial surge protection devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, the hard wired category is projected to hold 42.3 % of the total market revenue in 2025, positioning it as the leading product segment. This dominance is attributed to its ability to offer durable, permanent protection against high energy surges, particularly in environments with frequent transient events.

The hard wired configuration has been favored due to its reliable integration into electrical distribution panels, providing consistent protection without requiring manual intervention. Its widespread acceptance has been reinforced by the simplicity of maintenance, compatibility with a variety of commercial applications, and adherence to strict electrical codes.

These attributes have allowed businesses to ensure a higher level of safety, minimize risk of equipment failure, and maintain uninterrupted operations, supporting the segment’s continued leadership in the market.

Segmented by power rating, the greater than 50 kA to 100 kA segment is expected to account for 37.8 % of the market revenue in 2025, establishing itself as the dominant power rating category. This leadership has been driven by the growing need to safeguard commercial installations against medium to high intensity surges commonly experienced in urban electrical grids and industrial environments.

Devices in this power range have been selected for their ability to effectively dissipate substantial surge energy while maintaining the operational integrity of downstream equipment. The segment’s prominence has also been supported by its suitability for a broad spectrum of commercial buildings, balancing cost effectiveness with adequate protection levels.

Businesses have increasingly prioritized this range for its optimal performance in mitigating risk, aligning with safety standards, and providing peace of mind without over-investing in excessive capacity.

The Type 1 commercial surge protection devices market is expanding as businesses prioritize electrical safety and equipment reliability amid rising grid disturbances and lightning-related risks. Opportunities exist in modular surge protection units and integrated monitoring-enabled solutions for critical facilities. Key trends include the use of advanced thermal disconnects, remote status indication, and smart diagnostics integrated into power distribution systems.

However, high initial installation costs, complexity in retrofitting, and limited awareness in small enterprises remain critical restraints. Manufacturers focusing on customizable configurations and compliance with international safety standards are expected to maintain strong competitive advantage globally.

An increased focus on power quality and operational continuity across commercial spaces has driven the market growth. In 2024, frequent voltage surges linked to renewable energy grid integration prompted large-scale adoption of surge protection systems in data centers and manufacturing units. Retail and healthcare facilities implemented Type 1 devices at service entrances to safeguard sensitive equipment against transient overvoltages. It is considered that the strict enforcement of IEC 61643 standards and growing investment in modern power distribution systems have further strengthened demand. The preference for high-discharge capacity devices in lightning-prone regions remains a key growth factor.

Opportunities are expected to emerge from surge protection devices with embedded diagnostics and IoT-enabled communication for predictive maintenance. In 2025, global electrical solution providers introduced smart SPD modules capable of real-time status reporting and automatic alerts for component replacement. These features appeal to commercial buildings and industrial complexes aiming to minimize downtime. Multi-channel monitoring integrated into building energy management systems is gaining attention in smart infrastructure projects. It is strongly believed that suppliers offering connected surge protection solutions and modular units will capture significant market share as facilities transition to digitally managed power systems.

An emerging trend involves the introduction of modular SPDs designed for quick replacement and scalability in large commercial installations. In 2024, several manufacturers launched replaceable cartridge-based designs combined with visual indicators for maintenance efficiency. Adoption of compliance-certified devices tested for high fault current ratings is increasing due to stricter electrical safety audits. Hybrid SPDs integrating metal oxide varistors with spark gap technology have gained traction for improved durability under repeated surge events. It is widely believed that manufacturers focusing on compact form factors and multi-standard certification will dominate procurement pipelines for new commercial infrastructure projects.

One of the primary restraints for the Type 1 SPD market is the significant installation cost associated with service entrance protection in commercial properties. In 2024, retrofitting challenges were reported in aging infrastructure where panel capacity and wiring constraints increased deployment complexity. Limited awareness among small and mid-sized enterprises regarding surge protection benefits further slows penetration. Additionally, price-sensitive buyers often opt for lower-category devices, restricting Type 1 adoption in certain markets. It is considered that without incentive-driven programs or cost-optimized designs, this segment will continue to face challenges in achieving widespread implementation.

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

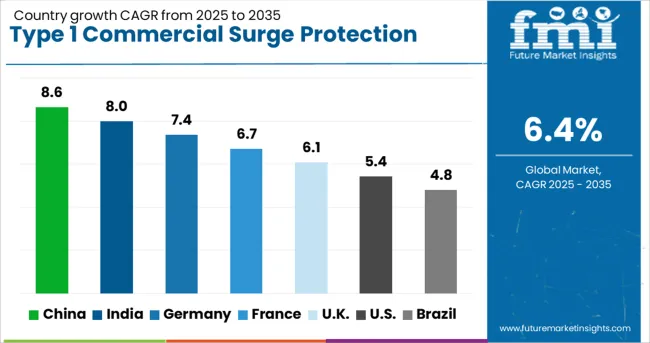

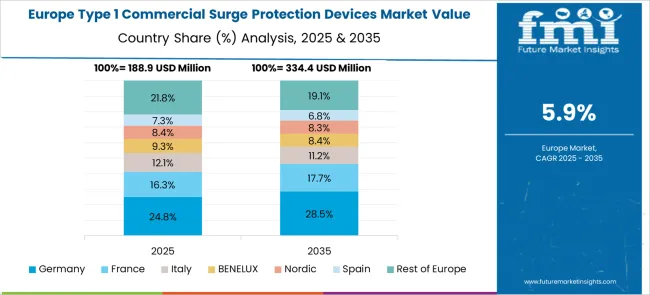

The global Type 1 commercial surge protection devices market is projected to grow at a CAGR of 6.4% from 2025 to 2035. China leads with 8.6%, followed by India at 8.0% and Germany at 7.4%. France records 6.7%, while the United Kingdom posts 6.1%. Growth is driven by increased installation in commercial facilities, demand for lightning protection in power systems, and integration with smart building infrastructure. China and India dominate adoption due to expanding industrial corridors and commercial real estate projects, while Germany focuses on advanced surge suppression systems. France and the UK prioritize regulatory compliance and energy-efficient designs.

The Type 1 commercial surge protection devices market in China is projected to grow at 8.6%, driven by rapid development of commercial infrastructure and industrial parks. DIN rail-mounted devices dominate installations in power distribution networks. Manufacturers integrate IoT-enabled monitoring for predictive fault detection. Strong government investments in grid modernization and smart city initiatives further enhance adoption.

The Type 1 commercial surge protection devices market in India is expected to grow at 8.0%, supported by rapid urbanization and increased focus on commercial building safety. Plug-in SPDs dominate small and medium commercial installations. Manufacturers develop compact, cost-effective solutions for local markets. Expansion of data centers and IT parks drives adoption of advanced surge protection systems.

The Type 1 commercial surge protection devices market in Germany is forecast to grow at 7.4%, driven by EU safety regulations and emphasis on energy efficiency. Modular SPDs dominate industrial and high-rise building applications. Manufacturers integrate thermal disconnection and status monitoring for enhanced safety. Strong focus on renewable energy integration supports SPD use in solar-connected commercial installations.

The Type 1 commercial surge protection devices market in France is projected to grow at 6.7%, supported by retrofitting of aging commercial structures and smart grid projects. Panel-mounted SPDs dominate installations in large office complexes. Manufacturers innovate with low-profile SPD designs for space optimization. Regulatory compliance for lightning protection under French building codes drives adoption.

The Type 1 commercial surge protection devices market in the UK is forecast to grow at 6.1%, driven by increased investments in commercial real estate and renewable energy systems. Compact SPDs dominate installations in modular building designs. Manufacturers integrate real-time diagnostics for smart building compatibility. Rising adoption of electric vehicle infrastructure further expands the need for surge protection.

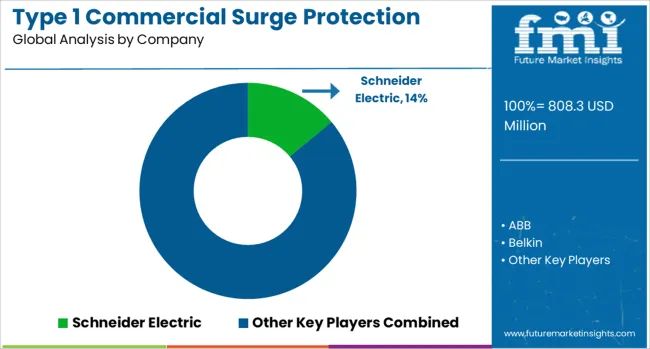

The Type 1 commercial surge protection devices market is moderately consolidated, with Schneider Electric recognized as a leading player for its extensive portfolio of surge protection solutions designed for critical commercial infrastructure. The company’s products offer advanced safety features, durability, and seamless integration with building management systems, reinforcing its strong position globally.

Key players include ABB, Belkin, Eaton, Emerson Electric, Hubbell, Intermatic, Legrand, Leviton Manufacturing, Littelfuse, LS Electric, Mersen, Raycap, Phoenix Contact, Siemens, and Socomec. These companies provide a range of high-performance surge protection devices engineered to safeguard electrical systems from voltage transients and lightning strikes, ensuring operational continuity for offices, industrial facilities, and data centers.

Market growth is driven by increasing adoption of sensitive electronic equipment in commercial spaces, stricter electrical safety regulations, and growing awareness of downtime costs associated with power surges. Leading manufacturers are investing in innovations such as compact modular designs, remote monitoring features, and enhanced thermal protection for improved reliability.

Additionally, the integration of surge protection devices with smart energy management systems is emerging as a key trend to support digital building infrastructure. North America and Europe dominate the market due to stringent safety standards, while Asia-Pacific is witnessing rapid expansion driven by industrialization and infrastructure development.

| Item | Value |

|---|---|

| Quantitative Units | USD 808.3 Million |

| Product | Hard-Wired, Plug-In, Line Cord, and Power Control Devices |

| Power Rating | > 50 kA to 100 kA, ≤ 50 kA, > 100 kA to 150 kA, and > 150 kA |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, ABB, Belkin, Eaton, Emerson Electric, Hubbell, Intermatic, Legrand, Leviton Manufacturing, Littelfuse, LS Electric, Mersen, Raycap, Phoenix Contact, Siemens, and Socomec |

| Additional Attributes | Dollar sales segmented by device type (Type 1 and Type 2/T3 combos) and voltage rating (480 V, 600 V). North America leads, while Asia-Pacific grows fastest. Key players include Eaton, Schneider Electric, Siemens, ABB. Buyers prefer UL‑1449 compliance, IoT-enabled monitoring, integration with power management, and innovations in smart grid-compatible SPDs with remote diagnostics. |

The global type 1 commercial surge protection devices market is estimated to be valued at USD 808.3 million in 2025.

The market size for the type 1 commercial surge protection devices market is projected to reach USD 1,503.1 million by 2035.

The type 1 commercial surge protection devices market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in type 1 commercial surge protection devices market are hard-wired, plug-in, line cord and power control devices.

In terms of power rating, > 50 ka to 100 ka segment to command 37.8% share in the type 1 commercial surge protection devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

Type 3 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 2 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Type 1 Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

V-type Classifiers Market Size and Share Forecast Outlook 2025 to 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Dry-type Air-core Smoothing Reactor Market Size and Share Forecast Outlook 2025 to 2035

USB Type C Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of the USB Type-C Industry

Stud Type Track Roller Market Size and Share Forecast Outlook 2025 to 2035

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Roll Type Thermal Paper Market Forecast and Outlook 2025 to 2035

Brush-Type Belt Cleaners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA