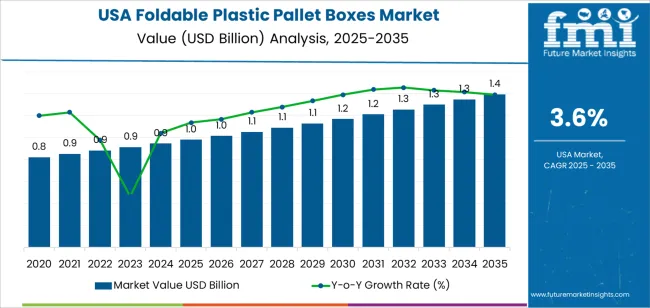

The demand for foldable plastic pallet boxes in the USA is projected to grow from USD 1.0 billion in 2025 to USD 1.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.60%. Foldable plastic pallet boxes are increasingly becoming a preferred solution for logistics and warehousing due to their lightweight, durable, and space-saving features. The growing need for efficient storage and transportation solutions in industries like retail, food and beverage, and automotive is driving the demand for these products. Their collapsible nature allows for better space utilization, reducing storage costs and improving operational efficiency.

The expansion of e-commerce, which requires fast and reliable logistics, is also contributing to the rise in demand for foldable plastic pallet boxes. These boxes provide optimal protection for products during shipping and handling, helping businesses meet the growing need for secure and cost-effective packaging. Furthermore, the adoption of sustainable practices in supply chains is promoting the use of reusable and recyclable packaging materials, like foldable plastic pallet boxes, over single-use alternatives.

Between 2025 and 2030, the demand for foldable plastic pallet boxes in the USA is expected to increase from USD 1.0 billion to USD 1.2 billion, adding USD 0.2 billion. During this phase, the expansion of e-commerce and the increasing demand for efficient and environmentally friendly packaging solutions will continue to drive steady growth. Companies in the retail and food sectors, in particular, are expected to adopt foldable plastic pallet boxes to improve their logistics operations and reduce costs.

From 2030 to 2035, the demand for foldable plastic pallet boxes is expected to grow from USD 1.2 billion to USD 1.4 billion, adding USD 0.2 billion. The latter phase will see continued growth, fueled by the maturation of the e-commerce sector and the ongoing trend of businesses seeking sustainable and reusable packaging solutions. As industries increasingly adopt automated and optimized supply chain systems, the demand for foldable plastic pallet boxes will rise, offering a convenient, cost-effective, and environmentally friendly alternative for transporting goods.

| Metric | Value |

|---|---|

| Demand for Foldable Plastic Pallet Boxes in USA Value (2025) | USD 1.0 billion |

| Demand for Foldable Plastic Pallet Boxes in USA Forecast Value (2035) | USD 1.4 billion |

| Demand for Foldable Plastic Pallet Boxes in USA Forecast CAGR (2025–2035) | 3.60% |

The demand for foldable plastic pallet boxes in the USA is rising as industrial, retail and logistics sectors seek more efficient, lightweight and reusable packaging and storage solutions. These collapsible units provide major advantages over traditional wooden crates and rigid bins by saving floor and transport space when empty and enabling easier return logistics. As warehousing and supply‑chain costs climb amid e‑commerce expansion and cross‑border trade, these space‐saving solutions are gaining traction.

Key demand drivers include the rise in e‑commerce fulfillment, frequent product turnover and increasing automation in distribution centres. Retailers and logistics operators need durable containers that integrate well with automated systems, reduce manual handling and optimise warehouse density. Foldable plastic pallet boxes, often made from HDPE or other engineered plastics, meet these needs by offering stackability, durability and versatility. Their usability across industries such as food & beverage, automotive parts, pharmaceuticals and consumer goods broadens adoption.

Total cost of ownership considerations is fueling growth in the USA. Companies are shifting from disposable packaging toward reusable containers to reduce waste, lower long‑haul return transportation costs and align with corporate environmental targets. The enhanced durability, washability and repeated‑use cycle of foldable plastic pallet boxes make them a preferred option in modern supply chains. Given these operational, space‑efficiency and sustainability benefits, the demand in the USA is anticipated to grow steadily through 2035.

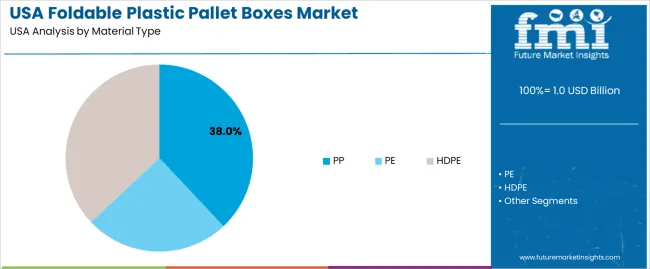

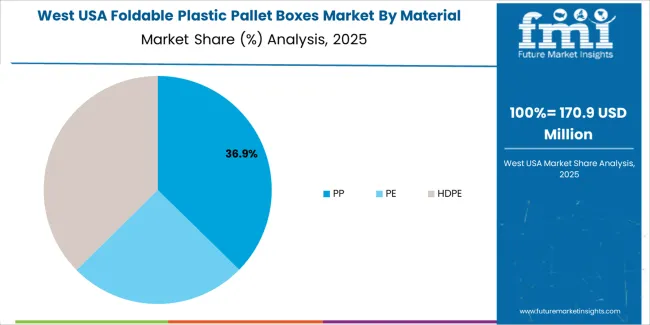

Demand for foldable plastic pallet boxes in the USA is segmented by material type and end-use type. By material type, demand is divided into PP (Polypropylene), PE (Polyethylene), and HDPE (High-Density Polyethylene), with PP holding the largest share. In terms of end-use type, the industry is categorized into automotive industry, food and beverage industry, logistics and shipping, pharmaceutical, consumer goods, and others, with the automotive industry leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest.

PP (Polypropylene) accounts for 38% of the demand for foldable plastic pallet boxes in the USA. Polypropylene is favored for its unique combination of lightweight, durability, and versatility, making it an ideal material for storage and transport packaging solutions. It offers excellent resistance to chemicals, moisture, and wear, making it especially suitable for industries where pallet boxes are exposed to various environmental conditions and need to endure repeated use.

In industries like automotive, logistics, and food and beverage, PP provides a cost-effective and long-lasting solution, helping to reduce packaging waste and the overall costs associated with shipping. The lightweight nature of PP also contributes to cost savings in transportation, as it reduces shipping weight. PP is highly resistant to impact, which is essential for ensuring the protection of goods during transit and storage. As sustainability concerns increase, PP is also a preferred option because it is recyclable, contributing to a greener supply chain.

The automotive industry accounts for 23% of the demand for foldable plastic pallet boxes in the USA. In this sector, these pallet boxes are used extensively for transporting and storing automotive parts, components, and assemblies. The automotive industry demands packaging solutions that are not only durable and able to withstand heavy loads but also flexible enough to optimize storage space. Foldable plastic pallet boxes meet all these needs, offering reusable, sturdy, and stackable storage options that help improve the efficiency of supply chain operations.

The automotive industry’s adoption of foldable plastic pallet boxes is driven by the need for cost-effective, space-saving packaging solutions that also enhance logistics processes. As the industry focuses on streamlining its production and transportation methods, the demand for packaging that reduces waste and transportation costs grows. As companies seek more sustainable practices, foldable plastic pallet boxes, which can be reused and recycled, are becoming a preferred choice. Given the growing complexity and scale of automotive production and the need for efficient logistics, the demand for foldable plastic pallet boxes in the automotive industry will continue to expand, reinforcing its dominant position in the industry.

The food and beverage industry represents a key demand segment for foldable plastic pallet boxes in the USA. The industry requires packaging solutions that are not only durable but also compliant with stringent hygiene and safety standards. Foldable plastic pallet boxes are ideal for this purpose, providing a hygienic and secure way to store, transport, and display products. These boxes are used extensively for bulk food items, beverages, and packaged products, ensuring that goods are safely stored and transported without contamination.

The demand for foldable plastic pallet boxes in the food and beverage industry is driven by the sector’s focus on efficiency, cost-effectiveness, and sustainability. These boxes can be easily folded and stacked when not in use, saving valuable space in warehouses and transportation. As the food and beverage industry grows increasingly concerned with reducing waste, foldable plastic pallet boxes offer a reusable and recyclable solution, making them an environmentally friendly choice. The ongoing trend toward sustainable packaging and the need to meet stringent health and safety regulations ensure that foldable plastic pallet boxes will continue to see rising demand in the food and beverage sector, playing a crucial role in modernizing logistics and improving operational efficiency.

Key drivers include: growing e‑commerce and omni‑channel fulfilment requiring flexible storage/transport solutions; rising emphasis on reusable packaging and reducing empty return‑leg costs; wood and steel alternatives facing sustainability and regulation pressure; and automation/warehouse redesign where stackable, standardized foldable plastics are preferred. Restraints include higher upfront cost compared to basic rigid containers or wooden crates, raw‑material price volatility (plastics, resin) which affects unit cost, load‑capacity limitations (some foldable cannot handle as heavy loads as rigid heavy‑duty steel crates), and inertia in replacing long‑standing rack systems or standard container types.

Why is Demand for Foldable Plastic Pallet Boxes Growing in USA?

In the USA, growth is driven by organizations seeking to reduce storage and transport inefficiencies and by the shift to reusable/returnable container systems. Many fulfilment‑centres and distribution hubs face high real‑estate costs and value any space‑saving measure foldable plastic pallet boxes allow empty containers to collapse, reducing the footprint of storage when not in use. The surge in e‑commerce shipping and returns also means more empty containers travelling back in supply‑chains. Foldable reduce empty‑leg cost and volume. Environmental factors matter too: companies are replacing single‑use or poorly recycled wooden crates with plastic that can be reused many times. Some sectors like automotive manufacturing, cold‑chain, and food & beverage demand hygienic, easy‑to-clean containers foldable plastic pallet boxes support those requirements while offering the collapse/stack benefit.

How are Technological & Product Innovations Driving Growth of Foldable Plastic Pallet Boxes in USA?

Innovation is helping accelerate uptake of foldable plastic pallet boxes in the USA by improving materials, design, and integration. For example: manufacturers are using high‑density polyethylene (HDPE) or polypropylene (PP) and composite materials for improved durability and load‑capacity; designs now enable dramatic volume reduction when collapsed (e.g., 1:2 or 1:3 fold ratios) making them highly space‑efficient. Some models integrate features like drop‑gates, hinged walls, ventilation for food/fresh produce, compatibility with automated storage/retrieval systems (ASRS) and racking systems. Customizations (size, lid/vented options, RFID tracking) adds value for logistic operators. These improvements reduce total cost of ownership (TCO), facilitate integration into modern logistics systems, and make the investment case stronger for USA operations.

What are the Key Challenges Limiting Adoption of Foldable Plastic Pallet Boxes in USA?

A major challenge is cost, foldable plastic pallet boxes often cost more upfront than standard one‑piece plastic or wooden crates, meaning smaller operators may delay upgrading. Load and durability limitations can be a barrier for heavy‑duty or industrial uses where extreme loads or rough handling occur some foldable models may not match the capacity of rigid steel/wood boxes. Raw‑material and resin price volatility (e.g., HDPE, PP) can affect pricing and ROI calculations. Also, in large enterprises the shift to reusable systems requires changes in logistics, tracking and reverse‑flow operations (collecting the collapsed units, managing returns) these operational changes slow adoption. Finally, some supply‑chains are still reliant on legacy container types and may resist switching until full cost/benefit is proven.

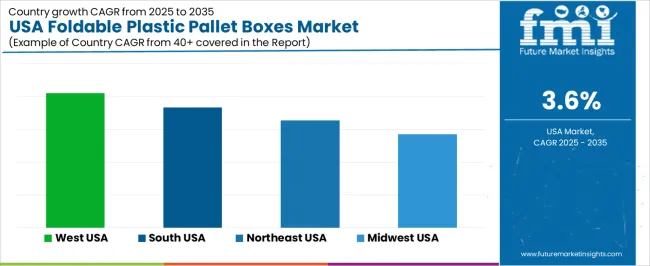

| Region | CAGR (%) |

|---|---|

| West | 4.1% |

| South | 3.7% |

| Northeast | 3.3% |

| Midwest | 2.9% |

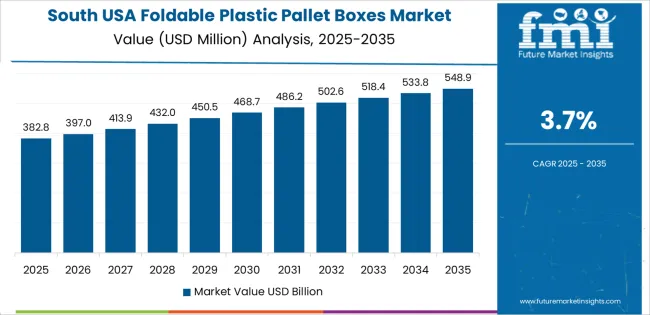

The demand for foldable plastic pallet boxes in the USA is growing across all regions, with the West leading at a 4.1% CAGR. This growth is driven by the increasing need for efficient, durable, and reusable packaging solutions in industries like retail, logistics, and manufacturing. The South follows with a 3.7% CAGR, fueled by its expanding logistics and distribution networks. The Northeast shows a 3.3% CAGR, supported by high consumer demand and strong industrial sectors. The Midwest experiences moderate growth at 2.9%, driven by a rising focus on cost-effective and space-efficient packaging in industries.

The West is experiencing the highest demand for foldable plastic pallet boxes in the USA, with a 4.1% CAGR. This growth is primarily attributed to the region’s large logistics and manufacturing industries, particularly in cities like Los Angeles and San Francisco, where distribution networks are extensive. The West has a significant focus on sustainability and space efficiency, making foldable plastic pallet boxes an attractive solution for businesses seeking to reduce waste, optimize storage, and improve overall supply chain efficiency.

Thee growing emphasis on reducing packaging waste and adopting reusable, long-lasting solutions is contributing to the demand for foldable plastic pallet boxes in the region. As industries such as retail and e-commerce continue to expand in the West, the need for durable, easy-to-store, and cost-effective packaging solutions like foldable plastic pallet boxes is expected to rise. With a strong logistical infrastructure and increasing environmental awareness, the West is set to maintain its leadership in the demand for these products.

The South is experiencing steady demand for foldable plastic pallet boxes, with a 3.7% CAGR. This growth is largely driven by the region's expanding manufacturing, retail, and logistics sectors, particularly in states like Texas, Georgia, and Florida. The rise of large distribution centers, warehouses, and e-commerce fulfillment hubs is contributing to the increasing adoption of foldable plastic pallet boxes, as businesses look for ways to optimize their storage and supply chain operations.

As industries in the South focus on reducing packaging costs, improving efficiency, and minimizing environmental impact, foldable plastic pallet boxes are becoming an attractive solution due to their durability, reusability, and space-saving features. The growing demand for sustainable and cost-effective packaging options in the South is supporting the growth of this product. With continued industrial expansion and a focus on better supply chain management, the South is expected to see continued growth in the use of foldable plastic pallet boxes.

The Northeast is seeing steady demand for foldable plastic pallet boxes, with a 3.3% CAGR. The region’s strong industrial base, particularly in retail, manufacturing, and food production, is contributing to this demand. Major cities like New York, Boston, and Philadelphia are home to large-scale warehouses and distribution centers, which rely on efficient packaging solutions for transporting goods. Foldable plastic pallet boxes, known for their ability to be reused and stored compactly, are becoming an increasingly popular choice in these sectors.

As businesses in the Northeast focus on optimizing supply chain efficiency and reducing packaging costs, the demand for foldable plastic pallet boxes is growing. There is an increasing focus on environmental sustainability, driving industries to move away from disposable packaging and adopt more durable and reusable options. With a combination of strong manufacturing and retail sectors, as well as rising environmental concerns, the Northeast is well-positioned for continued growth in the adoption of foldable plastic pallet boxes.

The Midwest is experiencing moderate growth in demand for foldable plastic pallet boxes, with a 2.9% CAGR. The region’s manufacturing and industrial sectors, particularly in cities like Chicago and Detroit, are driving this growth. As industries in the Midwest continue to focus on improving logistics, reducing operational costs, and enhancing supply chain efficiency, foldable plastic pallet boxes are becoming increasingly popular due to their space-saving and reusable design.

While growth in the Midwest is slower compared to other regions, the increasing awareness of the benefits of foldable plastic pallet boxes, such as their durability and environmental impact, is contributing to their adoption. The region’s strong manufacturing base, combined with a rising focus on sustainability and cost-effective solutions, supports the continued demand for these products. As more companies in the Midwest seek to improve packaging efficiency and reduce waste, the demand for foldable plastic pallet boxes is expected to grow at a moderate pace.

The demand for foldable plastic pallet boxes in the USA is on the rise, driven by logistics optimization, e‑commerce growth, and sustainability initiatives. These containers offer significant benefits in reducing return‑trip volume, saving warehouse space when collapsed, and improving the handling of bulk materials across industries, from automotive to food & beverage. The broader foldable and collapsible container industry is projected to grow steadily, reflecting the need for efficient storage and transport solutions.

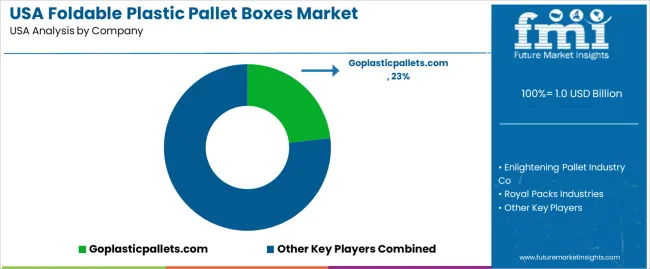

In the USA demand landscape, Goplasticpallets.com holds an estimated 23.2% share, underscoring its strong role in providing foldable plastic pallet box solutions tailored to American logistics and material‑handling needs. Other key suppliers include Enlightening Pallet Industry Co, Royal Packs Industries, Exporta, Transoplast, and CABKA Group, all of which contribute to the USA demand by offering container solutions suited for return logistics, storage efficiency, and space‑conscious operations.

Key drivers of demand include the surge in omnichannel retail and e‑commerce, which places a premium on collapsible and reusable bulk containers, growing awareness of circular‑economy practices, and increasing industrial focus on reducing container footprint and maximizing transport efficiency. While challenges such as higher upfront costs compared to traditional wooden crates and the need for standardization and durability in reuse loops may moderate uptake, the overall outlook for foldable plastic pallet boxes in the USA remains positive, driven by sustainable logistics and supply‑chain efficiency trends.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Material Type | PP, PE, HDPE |

| End-Use Type | Automotive Industry, Food and Beverage Industry, Logistics and Shipping, Pharmaceutical, Consumer Goods, Others |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Goplasticpallets.com, Enlightening Pallet Industry Co, Royal Packs Industries, Exporta, Transoplast, CABKA Group |

| Additional Attributes | Dollar sales by material type, end-use, and regional trends with a focus on automotive, logistics, and food industries. Growing demand driven by the shift to sustainable packaging solutions and the increasing need for efficient logistics and storage systems in multiple sectors. |

The global demand for foldable plastic pallet boxes in USA is estimated to be valued at USD 1.0 billion in 2025.

The market size for the demand for foldable plastic pallet boxes in USA is projected to reach USD 1.4 billion by 2035.

The demand for foldable plastic pallet boxes in USA is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in demand for foldable plastic pallet boxes in USA are pp, pe and hdpe.

In terms of end-use type, automotive industry segment to command 23.0% share in the demand for foldable plastic pallet boxes in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in Foldable Plastic Pallet Boxes

Foldable Plastic Pallet Boxes Market Trends & Forecast through 2035

Demand for Foldable Plastic Pallet Boxes in Japan Size and Share Forecast Outlook 2025 to 2035

Plastic Pallets Market Size and Share Forecast Outlook 2025 to 2035

USA Bio-Plasticizers Market Report – Size, Share & Forecast 2025-2035

USA Flexible Plastic Packaging Market Insights – Trends, Demand & Growth 2025-2035

Clear Plastic Boxes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Clear Plastic Boxes

Foldable And Collapsible Pallets Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Disposable Plastic Pallet Production

Demand for Bioplastics in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Interlocking Boxes in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Heavy Duty Pallet Rack in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Stand-Up Rider Pallet Truck in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Biodegradable Plastic in USA Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Pallet Displays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA