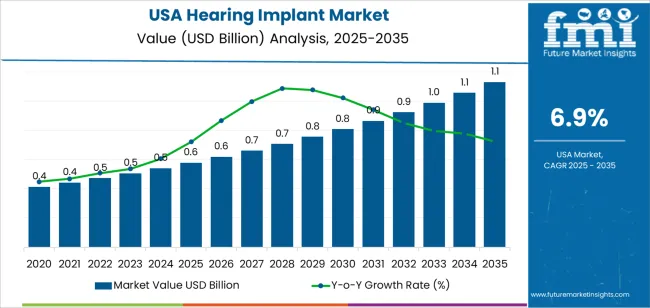

The demand for hearing implants in the USA is expected to grow from USD 0.6 billion in 2025 to USD 1.1 billion by 2035, reflecting a CAGR of 6.9%. Hearing implants, such as cochlear implants and bone-anchored hearing systems, are vital solutions for individuals suffering from severe hearing loss or deafness. The growth of this market is driven by several factors, including the aging population, which increases the prevalence of sensorineural hearing loss, and the rapid technological advancements in hearing implant devices that offer enhanced sound quality, comfort, and greater usability. As the population ages, the number of people experiencing age-related hearing loss increases, driving greater demand for effective hearing solutions.

In addition to the aging population, there is increasing consumer awareness regarding the availability of hearing implants. With more people recognizing the benefits of early intervention and the positive impact hearing implants have on overall quality of life, the market is expected to expand. Furthermore, as technological innovation continues to make hearing implants more affordable, effective, and less invasive, more individuals will opt for these devices. The growing acceptance and normalization of hearing devices will further drive the market’s growth, positioning hearing implants as a common solution to severe hearing impairments across all age groups.

The CAGR of 6.9% for hearing implants in the USA reflects a steady and strong growth trajectory over the 2025–2035 period. From 2025 to 2030, the market will likely experience strong initial growth, driven by the increasing adoption of advanced hearing implant technologies. The aging population, combined with greater awareness of hearing loss treatments, will drive demand for these solutions. Additionally, improvements in implant design, such as better sound fidelity and smaller, more comfortable devices, will make hearing implants more appealing to a broader consumer base. The early growth will also be fueled by early diagnosis and improvements in healthcare coverage, making implants more accessible.

From 2030 to 2035, the growth rate is expected to moderate slightly but remain steady, reflecting a maturation of the market. Even with the slower pace of growth, the demand for hearing implants will continue to rise due to advancements in surgical techniques, increased patient access to healthcare, and greater insurance coverage. The continued integration of hearing implant technology with smart devices and wearables will make these products more mainstream. As awareness about prevention and the long-term benefits of hearing implants increases, the market will see sustained adoption over the forecast period, with the CAGR of 6.9% indicating consistent expansion driven by technological advances and growing consumer acceptance.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 0.6 billion |

| Industry Forecast Value (2035) | USD 1.1 billion |

| Industry Forecast CAGR (2025-2035) | 6.9% |

The demand for hearing implants in the USA is being driven by the aging population and increasing awareness of hearing loss treatment options. As the number of adults aged 65 and older rises significantly, the prevalence of moderate to severe hearing loss increases accordingly, boosting demand for devices like cochlear implants and bone anchored hearing systems. Advances in implant technology have improved outcomes, making these solutions viable for a larger candidate pool. At the same time, reimbursement policies and Medicare/insurance coverage help to make implantation accessible to more patients.

Another factor is the growing recognition of the broader impacts of untreated hearing loss on cognitive health, social isolation, and quality of life. That recognition is prompting both physicians and patients to consider implants earlier in the treatment pathway instead of relying solely on conventional hearing aids. Technological improvements such as less invasive surgical methods, extended wear processors, wireless connectivity, and improved sound processing are enhancing device appeal. However, challenges remain — including cost of the implant and surgery, patient eligibility criteria, and the need for long term follow up care. Yet, given the demographic trends and enhanced technology, demand for hearing implants in the USA is expected to grow steadily.

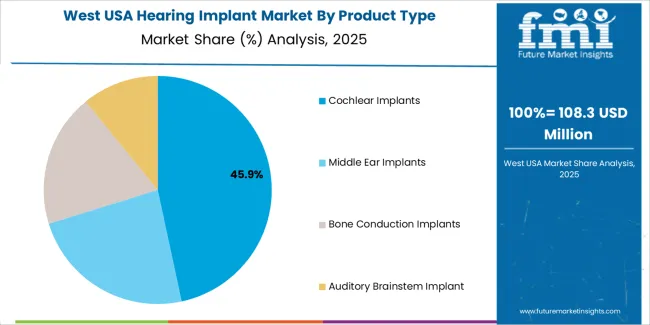

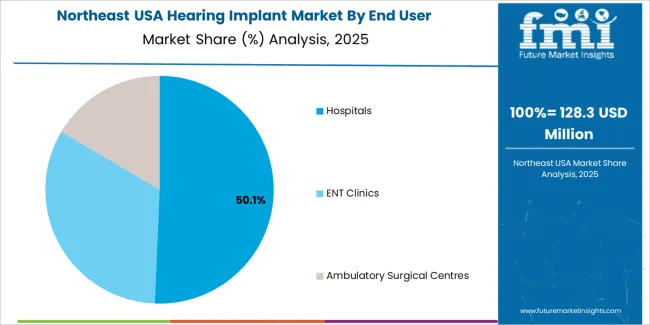

The demand for hearing implants in the USA is primarily driven by product type and end-user segment. The leading product type is cochlear implants, which hold 48% of the market share, while hospitals are the dominant end-user segment, accounting for 51.2% of the demand. Hearing implants, including cochlear, middle ear, and bone conduction implants, are essential for individuals with severe hearing loss or those who are not candidates for conventional hearing aids. The increasing prevalence of hearing impairment and advancements in implant technology continue to drive growth in the hearing implant market, particularly in medical settings where comprehensive care is provided.

Cochlear implants are the leading product type in the hearing implant market in the USA, capturing 48% of the demand. Cochlear implants are advanced medical devices designed to provide a sense of sound to individuals with severe to profound sensorineural hearing loss, especially those who do not benefit from traditional hearing aids. These implants are surgically placed in the inner ear, bypassing damaged portions of the ear and directly stimulating the auditory nerve.

The demand for cochlear implants is driven by their ability to significantly improve the quality of life for people with hearing loss, allowing them to better communicate and engage in everyday activities. As hearing loss continues to affect a large portion of the aging population in the USA, the need for cochlear implants remains high. Additionally, ongoing advancements in implant technology, including improvements in sound quality, miniaturization, and battery life, are expected to sustain the growth of the cochlear implant segment, ensuring its continued dominance in the hearing implant market.

Hospitals are the largest end-user segment for hearing implants in the USA, accounting for 51.2% of the demand. Hospitals play a critical role in the treatment of severe hearing loss, providing a comprehensive range of services, including pre-surgical evaluations, implantations, and post-surgical care. Hearing implants, particularly cochlear implants, are often implanted in a hospital setting, where medical professionals can monitor the patient's overall health and ensure proper recovery following surgery.

The demand from hospitals is driven by the need for specialized care for patients with complex hearing loss cases, including children, elderly individuals, and those with multiple health conditions. Hospitals are equipped with the necessary infrastructure, trained professionals, and technology to perform the surgical implantation of hearing devices and offer rehabilitation services to ensure the success of the implants. As awareness of hearing loss and the benefits of implants continues to grow, hospitals will remain the primary point of care for individuals requiring hearing implants in the USA.

Demand for hearing implants in the USA is propelled by a growing population with severe hearing loss, rising awareness of implant based hearing solutions, and strong healthcare infrastructure that supports complex surgical procedures. Technological advances in implant devices and sound processors further boost adoption. At the same time, constraints such as high device and surgery costs, reimbursement variability, and the need for specialised clinicians limit broader uptake. These forces together shape the current and future demand for hearing implant devices in the country.

What Are the Primary Growth Drivers for Hearing Implant Demand in the United States?

Several drivers support growth in the USA hearing implant segment. First, the increasing prevalence of profound or severe sensorineural hearing loss among adults and children creates a larger eligible patient pool for cochlear and other implantable hearing systems. Second, expanding clinical indications- such as single sided deafness and younger age of implantation- enable more patients to access implants. Third, technological improvements in device miniaturisation, connectivity with smartphones/streaming and better sound processing algorithms enhance patient outcomes and appeal. Fourth, favourable insurance coverage in many cases, along with greater awareness among ENT specialists and hearing health professionals, help drive adoption.

What Are the Key Restraints Affecting Hearing Implant Demand in the United States?

Despite positive drivers, demand faces several restraints. The high upfront cost of implant devices plus the surgical, rehabilitation and follow up care expenses present a barrier for some patients and healthcare providers. Reimbursement and insurance approval hurdles- including variability between insurers and requirements for candidacy- can delay or limit access. Access to specialised surgical centres and audiological rehabilitation may be uneven across regions, restricting patient access. Moreover, the pool of undiagnosed individuals or those unwilling to undergo surgery limits potential volume growth.

What Are the Key Trends Shaping Hearing Implant Demand in the United States?

Key trends include increased adoption of bilateral implantation (both ears) as evidence of improved outcomes grows, expanding the addressable market. There is also a growing use of hybrid and implantable systems that combine cochlear implants with hearing aid technology for residual hearing preservation. Direct to consumer awareness campaigns and broader screening of hearing loss are improving referrals for implant evaluation. Additionally, integration of implants with wireless streaming devices, mobile apps for sound adjustment and remote monitoring is enhancing user experience and driving demand.

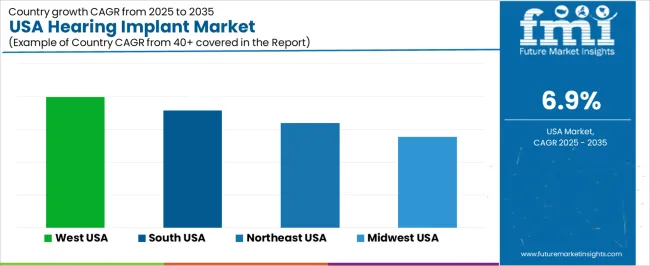

The demand for hearing implants in the USA is primarily driven by factors such as an aging population, the increasing prevalence of hearing loss, and advancements in medical technology. Hearing implants, including cochlear implants and bone-anchored hearing aids, provide life-changing solutions for individuals with moderate to severe hearing loss. The rising awareness of hearing health, coupled with the improved accessibility of these devices, is further fueling the market’s growth. Additionally, the growth of the healthcare sector, a focus on improving quality of life for the elderly, and advances in implant technology are important contributors. Regional variations in demand are influenced by factors such as population demographics, healthcare infrastructure, and the availability of specialized treatments. Below is a breakdown of the demand for hearing implants across different regions of the USA.

| Region | CAGR (2025-2035) |

|---|---|

| West | 8% |

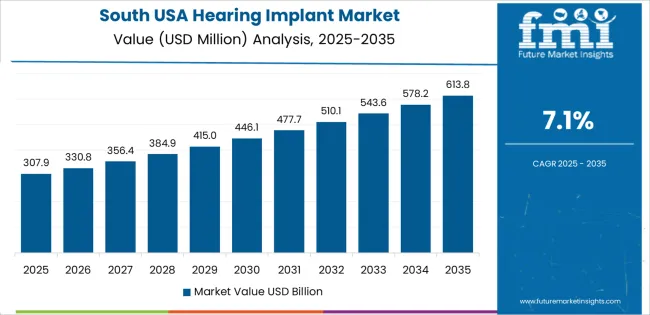

| South | 7.1% |

| Northeast | 6.4% |

| Midwest | 5.5% |

The West leads the demand for hearing implants in the USA with a CAGR of 8.0%. The region’s large and diverse population, coupled with a strong focus on healthcare innovation and accessibility, makes it a key market for hearing implant adoption. States like California, Washington, and Oregon have large elderly populations, which increases the demand for hearing solutions as age-related hearing loss becomes more prevalent.

The West’s emphasis on cutting-edge medical technology and the availability of top-tier healthcare facilities further supports the demand for hearing implants. Furthermore, the region's focus on improving quality of life through medical interventions and its high levels of awareness about hearing health contribute to the strong market growth. As the demand for hearing implants rises, the West continues to lead in both innovation and adoption of advanced hearing technologies.

The South shows strong demand for hearing implants with a CAGR of 7.1%. The region has a rapidly growing elderly population, with states like Florida, Texas, and Georgia experiencing significant demographic shifts. This increase in the aging population contributes to a higher prevalence of age-related hearing loss, driving demand for hearing implants.

The South's growing healthcare infrastructure and expanding access to advanced medical treatments, such as cochlear implants and bone-anchored hearing aids, also play a significant role in market growth. Additionally, the region's emphasis on improving the quality of life for seniors and the growing awareness about hearing loss management support the continued adoption of hearing implants. As healthcare facilities continue to offer more advanced hearing solutions, the South will remain a key region for hearing implant demand.

The Northeast demonstrates steady demand for hearing implants with a CAGR of 6.4%. The region has a large, aging population, particularly in cities like New York and Boston, where hearing loss rates are increasing due to the aging demographic. As the elderly population in the Northeast grows, so does the demand for hearing implants to address age-related hearing loss.

The Northeast's highly developed healthcare infrastructure, along with a strong emphasis on research and innovation in medical technology, supports the market for hearing implants. While growth is slower compared to the West and South, the region's advanced healthcare system ensures that those seeking hearing solutions have access to the latest technology and treatments. As awareness about hearing health continues to increase, the demand for hearing implants in the Northeast will remain strong.

The Midwest shows moderate growth in the demand for hearing implants with a CAGR of 5.5%. While the region’s growth rate is slower compared to the West and South, there is still a significant demand for hearing implants driven by the aging population and the increasing prevalence of hearing loss. States like Illinois, Michigan, and Ohio have large numbers of elderly residents, contributing to the demand for hearing solutions.

However, the Midwest has a relatively lower adoption rate of advanced hearing technology compared to more urbanized regions. This slower adoption may be attributed to factors such as fewer specialized healthcare centers in rural areas and a more traditional approach to healthcare. Nonetheless, as awareness of hearing loss increases and access to medical care improves, the demand for hearing implants in the Midwest is expected to grow steadily.

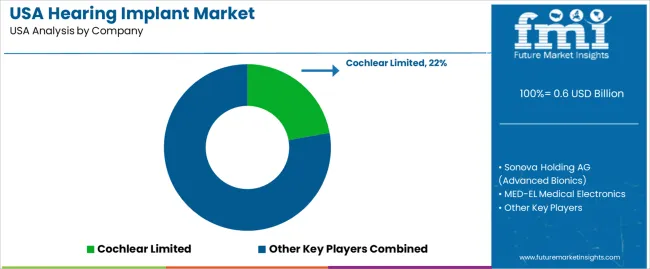

The demand for hearing implants in the United States is growing as the aging population, along with increasing awareness about hearing loss and treatment options, drives the need for advanced hearing solutions. Companies like Cochlear Limited (holding approximately 22% market share), Sonova Holding AG (Advanced Bionics), MED-EL Medical Electronics, Oticon Medical (Demant A/S), and WS Audiology (Signia, Widex) are key players in this market. The rise in hearing impairment diagnoses, combined with technological advancements in cochlear implants and other hearing devices, is fueling growth in the hearing implant sector.

Competition in the hearing implant industry is focused on innovation, device performance, and patient outcomes. Companies are investing heavily in developing more advanced implants with features such as better sound quality, wireless connectivity, and longer battery life. Another key factor is the personalization of hearing devices, with manufacturers offering a variety of implant options to cater to the specific needs of patients, including custom programming and compatibility with mobile apps for enhanced user experience. Companies also compete by focusing on ease of surgery, patient support services, and post-implant care to ensure long-term success and satisfaction. Marketing materials typically highlight features like sound clarity, ease of use, comfort, and aftercare programs. By aligning their products with the growing demand for effective, user-friendly, and technologically advanced hearing implants, these companies aim to strengthen their position in the USA hearing implant industry.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Product Type | Cochlear Implants, Middle Ear Implants, Bone Conduction Implants, Auditory Brainstem Implant |

| End User | Hospitals, ENT Clinics, Ambulatory Surgical Centres |

| Key Companies Profiled | Cochlear Limited, Sonova Holding AG (Advanced Bionics), MED-EL Medical Electronics, Oticon Medical (Demant A/S), WS Audiology (Signia, Widex) |

| Additional Attributes | The market analysis includes dollar sales by product type and end-user categories. It also covers regional demand trends in the USA, driven by the growing need for hearing implants in patients with severe hearing loss. The competitive landscape highlights major players focusing on innovations in cochlear and bone conduction implants. Trends in the increasing adoption of advanced hearing implants and improvements in implant technologies are explored, along with advancements in surgical techniques and post-implant care solutions. |

The global demand for hearing implant in USA is estimated to be valued at USD 0.6 billion in 2025.

The market size for the demand for hearing implant in USA is projected to reach USD 1.1 billion by 2035.

The demand for hearing implant in USA is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in demand for hearing implant in USA are cochlear implants, middle ear implants, bone conduction implants and auditory brainstem implant.

In terms of end user, hospitals segment to command 51.2% share in the demand for hearing implant in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hearing Aids Market Forecast and Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Hearing Amplifiers Market

Hearing Aid Dehumidifier Market

Hearing Implant Market Analysis - Trends & Forecast 2025 to 2035

Sheep Shearing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Custom Hearing Aids Market Growth - Trends & Forecast 2025 to 2035

Bluetooth Hearing Aids Market Trends – Growth & Forecast 2025 to 2035

Demand for Hearing Implant in Japan Size and Share Forecast Outlook 2025 to 2035

Bone Conduction Hearing Devices Market

Smart Behind-The-Ear Hearing Aid Market Size and Share Forecast Outlook 2025 to 2035

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Implantable Tibial Neuromodulation Market Forecast and Outlook 2025 to 2035

Implant-Borne Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Implantable Collamer Lens Market Size and Share Forecast Outlook 2025 to 2035

Implantable Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Implantable Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Implantable Drug Eluting Devices Market Size and Share Forecast Outlook 2025 to 2035

Implantable Drug Infusion Pumps Market

Preimplantation Genetic Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA