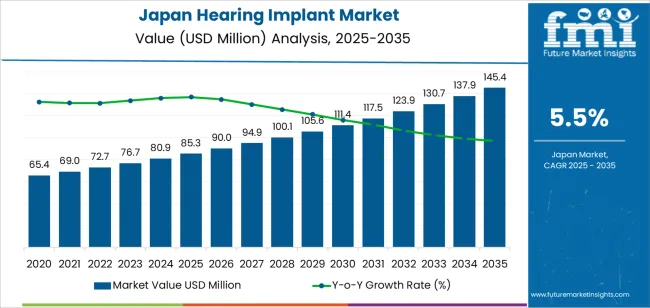

The Japan hearing implant demand is valued at USD 85.3 million in 2025 and is expected to reach USD 145.4 million by 2035, recording a CAGR of 5.5%. Demand is shaped by increased diagnosis of hearing loss, broader access to implantable hearing technologies, and continued expansion of audiology services across hospitals and specialist clinics. Ageing demographics, early-intervention programs, and improvements in post-implant rehabilitation support sustained device use in cases where conventional hearing aids provide limited benefit. Growth also reflects continued refinement of implant design, signal-processing capabilities, and minimally invasive surgical techniques.

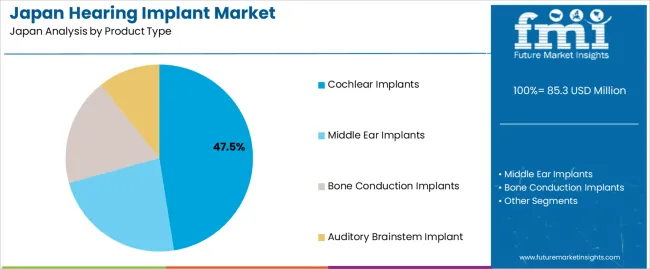

Cochlear implants represent the leading product type due to their suitability for severe-to-profound sensorineural hearing loss and their established clinical outcomes. These systems use external sound processors and implanted electrode arrays to deliver electrical stimulation to the auditory nerve. Advances in speech-coding strategies, microphone directionality, and electrode configurations continue to improve sound clarity and user comfort. Broader availability of paediatric and adult programming frameworks also supports increased adoption.

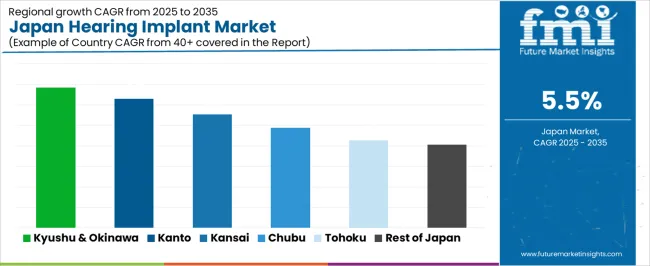

Demand is concentrated in Kyushu & Okinawa, Kanto, and Kinki, where specialist ENT centres, university hospitals, and regional audiology networks drive implantation volumes. Key suppliers include Cochlear Limited, Sonova (Advanced Bionics), MED-EL, Oticon Medical (Demant), and WS Audiology (Signia/Widex), providing implantable hearing systems supported by clinical-training programs and post-fitting services.

The acceleration and deceleration pattern shows a clear early-period rise from 2025 to 2029, supported by stable clinical demand, improved screening programs, and broader referral pathways for cochlear and middle-ear implant candidates. Hospitals and ENT centres will adopt upgraded processor units and refined electrode arrays, contributing to a steady acceleration phase. Increased awareness of implant eligibility among older adults will further support early momentum.

From 2030 to 2035, the segment moves into a controlled deceleration phase as adoption becomes more uniform across Japan’s healthcare system. Growth remains positive but moderates as procurement aligns with predictable replacement intervals and incremental upgrades rather than widespread new installations. Advances in sound-processing software, battery performance, and device miniaturisation will maintain steady demand without producing rapid surges. The long-term pattern reflects a shift from early acceleration driven by technology adoption and expanding patient pathways to a mature, stable phase shaped by lifecycle management and consistent therapeutic utilisation across Japan’s hearing-restoration landscape.

| Metric | Value |

|---|---|

| Japan Hearing Implant Sales Value (2025) | USD 85.3 million |

| Japan Hearing Implant Forecast Value (2035) | USD 145.4 million |

| Japan Hearing Implant Forecast CAGR (2025-2035) | 5.5% |

The demand for hearing implants in Japan is growing as the population ages and the incidence of sensorineural hearing loss rises. Advanced implantable solutions such as cochlear and bone-anchored devices offer improved outcomes for patients who derive limited benefit from conventional hearing aids. Technological progress in signal processing, smaller implantable components and enhanced connectivity features increase clinical appeal. Government-led initiatives to improve early intervention in children and subsidise hearing care also support uptake.

Growth is further encouraged by rising awareness of hearing rehabilitation benefits, and by hospitals and audiology centres expanding their services and outreach programmes. Constraints include historically low adoption rates relative to peer countries, due in part to strict eligibility criteria for subsidies and delays in diagnosis. High cost of implants, complex surgical requirements and post-implant rehabilitation demand specialised infrastructure and trained personnel. In rural and remote regions these service gaps may slow access and reduce the speed of industry growth.

Demand for hearing implants in Japan reflects clinical needs associated with congenital hearing loss, age-related impairment, and patients who do not benefit adequately from conventional hearing aids. Product-type preferences are shaped by the degree of hearing impairment, anatomical suitability, and surgical recommendations. End-user distribution reflects Japan’s treatment pathways, where implant evaluation, programming, and post-operative therapy occur across hospitals, ENT clinics, and ambulatory surgical facilities.

Cochlear implants hold 47.5% of national demand and represent the leading product category in Japan. They support individuals with severe to profound sensorineural hearing loss by directly stimulating the auditory nerve. These systems are widely used among children with early-diagnosed hearing impairment and adults with progressive loss who gain limited benefit from acoustic amplification. Middle-ear implants account for 23.2%, serving patients requiring mechanical vibration support rather than direct cochlear stimulation. Bone-conduction implants hold 18.6%, supporting conductive or mixed hearing-loss cases. Auditory brainstem implants represent 10.7%, used when cochlear structures are absent or non-functional. Product-type distribution reflects clinical suitability, patient anatomy, and long-term rehabilitation pathways.

Key drivers and attributes:

Hospitals hold 51.2% of national demand and form the largest end-user segment for hearing-implant procedures in Japan. Hospitals conduct diagnostic assessment, imaging, surgical placement, and initial device activation, making them central to the treatment pathway. ENT clinics represent 32.5%, supporting pre-operative evaluation, routine follow-up, mapping adjustments, and long-term therapy. Ambulatory surgical centres account for 16.3%, performing selected implant procedures suited to controlled outpatient environments. End-user distribution reflects Japan’s integrated care system, where hospitals manage complex surgeries and ENT clinics support continued device optimisation throughout the patient’s rehabilitation cycle.

Key drivers and attributes:

Japan’s large elderly population and the high prevalence of age-related hearing loss generate a substantial base of individuals who may benefit from implantable hearing devices such as cochlear implants and bone-anchored systems. Improved screening programmes, greater recognition of the link between untreated hearing loss and cognitive decline, and growing clinical comfort with implant technologies drive interest and referrals. Government and hospital initiatives targeting paediatric and adult hearing impairment encourage earlier implant consideration, which supports demand growth.

Despite the strong need, Japan historically shows relatively low adoption rates of hearing implants compared with other developed countries. Stringent subsidy eligibility (age thresholds, hearing-loss criteria) and complex reimbursement processes may delay or limit device access. Surgical centres and specialised audiology services required for implants may be less accessible in rural or smaller settings, which restricts diffusion into some regions. Cultural stigma around hearing loss and reluctance to undergo surgery may also reduce uptake among potential candidates.

Japan is seeing increased focus on paediatric implantation programmes to enable earlier treatment, which promotes long-term demand. Clinical guidelines are gradually broadening for adult candidates, including individuals with single-sided or moderate loss, which opens up new patient segments. Implant manufacturers are introducing devices with wireless connectivity, AI-enhanced signal processing and compatibility with hearing-aid accessories, increasing appeal and functionality. These developments are helping to address unmet need and support growth in the hearing-implant industry in Japan.

Demand for hearing implants in Japan is rising through 2035 as hospitals, audiology clinics, and rehabilitation centers expand the use of cochlear implants, middle-ear implants, and bone-conduction systems for patients with severe or progressive hearing loss. Adoption is shaped by Japan’s aging population, rising detection of age-related hearing conditions, and broader clinical use of implantable devices supported by diagnostic imaging, audiology testing, and postoperative therapy. Regional demand reflects healthcare-facility density, access to implant specialists, and availability of rehabilitation programs. Kyushu & Okinawa leads with a 6.8% CAGR, followed by Kanto (6.3%), Kinki (5.5%), Chubu (4.9%), Tohoku (4.3%), and the Rest of Japan (4.1%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.8% |

| Kanto | 6.3% |

| Kinki | 5.5% |

| Chubu | 4.9% |

| Tohoku | 4.3% |

| Rest of Japan | 4.1% |

Kyushu & Okinawa grows at 6.8% CAGR, supported by strong ENT services, active audiology networks, and consistent treatment volumes in Fukuoka, Kumamoto, Kagoshima, and surrounding areas. Hospitals increasingly recommend cochlear implants for adults experiencing progressive sensorineural loss, while bone-conduction systems support patients with conductive or mixed hearing conditions. Rehabilitation facilities offer structured auditory training programs that encourage implant adoption. Clinics rely on imaging tools, speech-processing assessments, and real-ear measurements to evaluate candidacy and guide device selection. Okinawa’s distributed population depends on implant solutions with reliable postoperative support and remote monitoring. Stable case volumes and increased screening reinforce long-term uptake across the region.

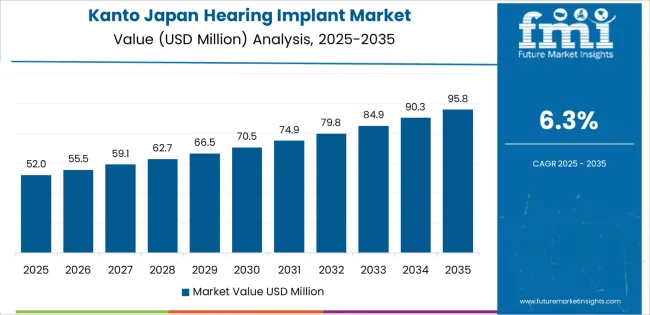

Kanto grows at 6.3% CAGR, driven by Japan’s highest concentration of tertiary hospitals, university medical centers, and ENT specialists. Facilities in Tokyo, Kanagawa, and Chiba perform high numbers of cochlear and middle-ear implant procedures supported by advanced diagnostics, imaging systems, and intraoperative monitoring tools. Postoperative rehabilitation centers provide structured auditory-training protocols for adults and children. Large patient populations with age-related or chronic hearing loss sustain consistent demand. Clinics integrate digital assessment tools to evaluate speech discrimination, auditory thresholds, and device-mapping requirements. Broader awareness of implant options reinforces adoption across metropolitan regions.

Kinki grows at 5.5% CAGR, supported by ENT departments and rehabilitation centers across Osaka, Kyoto, and Hyogo that manage chronic and age-related hearing conditions. Hospitals perform cochlear-implant procedures for adults and children with severe loss, while bone-anchored devices support conductive-hearing cases. Rehabilitation clinics provide speech-perception training and auditory-processing programs that strengthen implant outcomes. Diagnostic centers rely on real-ear measurements, auditory brainstem response testing, and advanced imaging to determine suitability. Although surgical volumes are moderate compared with Kanto, stable treatment patterns and aging demographics sustain consistent demand.

Chubu grows at 4.9% CAGR, supported by balanced hospital networks and ENT services across Aichi, Shizuoka, and Mie. Hospitals offer cochlear implants for severe sensorineural hearing loss, while bone-conduction implants support patients with conductive deficits. Clinics use audiology tools including otoacoustic emission testing, speech-recognition measurement, and device-mapping software to optimize patient outcomes. Rehabilitation providers guide adaptation through structured hearing-improvement programs. Industrial-region populations with long-term sound-exposure risks contribute additional clinical demand. Although adoption is moderate, essential hearing-care services support recurring implant use.

Tohoku grows at 4.3% CAGR, supported by regional hospitals and audiology centers across Miyagi, Fukushima, and Iwate that treat chronic and progressive hearing conditions. Facilities adopt cochlear implants for severe bilateral loss and bone-anchored systems for patients with conductive impairment. Diagnostic centers rely on automated audiometry and electrophysiological testing to determine suitability. Rehabilitation clinics support adaptation through structured therapy sessions. Geographic dispersion increases reliance on clinics offering stable long-term follow-up. Although the population is smaller, essential hearing-care needs sustain demand for implantable devices.

The Rest of Japan grows at 4.1% CAGR, supported by distributed hospitals, ENT clinics, and regional rehabilitation centers in rural and semi-rural prefectures. Facilities perform cochlear-implant procedures for severe sensorineural loss and use bone-conduction devices for conductive conditions. Clinics rely on audiologic screening, speech-testing tools, and real-ear device calibration to guide patient care. Rehabilitation providers offer structured auditory-learning programs despite limited facility density. Lower population levels moderate overall volumes, but essential hearing-care needs ensure steady demand.

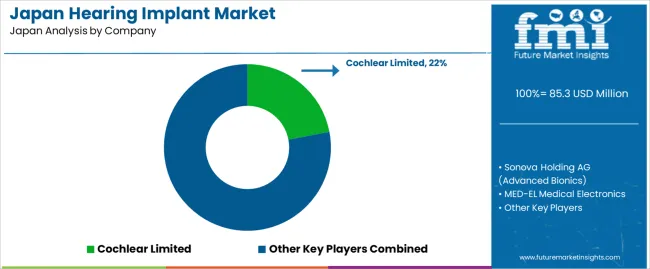

Demand for hearing implants in Japan is shaped by a concentrated group of global auditory-technology developers supporting cochlear, middle-ear, bone-conduction, and auditory-brainstem systems. Cochlear Limited holds the leading position with an estimated 22.0% share, supported by consistent implant reliability, stable speech-processing performance, and long-term clinical adoption across Japan’s ENT and audiology centres. Its position is reinforced by dependable electrode-array design and predictable post-implant rehabilitation outcomes.

Sonova Holding AG (Advanced Bionics) and MED-EL Medical Electronics follow as major participants, offering cochlear and middle-ear solutions characterized by robust signal processing, flexible electrode configurations, and reliable compatibility with varied anatomical and hearing-loss profiles. Their strengths include documented performance in quiet and noisy environments, established processor platforms, and broad clinician training networks.

Oticon Medical (Demant A/S) maintains a notable presence through bone-anchored and implantable systems designed for conductive and mixed hearing loss, emphasizing stable coupling efficiency and controlled vibration transmission. WS Audiology (Signia, Widex) contributes additional capability with implant-adjacent technologies and processor expertise that support consistent user outcomes in bone-conduction and hybrid approaches.

Competition across this segment centers on signal-processing accuracy, implant durability, electrode-array flexibility, surgical compatibility, rehabilitation support, and long-term device reliability. Demand remains steady due to Japan’s aging population, ongoing diagnostic coverage, and continued adoption of implantable hearing solutions that deliver predictable auditory performance across diverse hearing-loss categories.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Cochlear Implants, Middle Ear Implants, Bone Conduction Implants, Auditory Brainstem Implant |

| End User | Hospitals, ENT Clinics, Ambulatory Surgical Centres |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Cochlear Limited, Sonova Holding AG (Advanced Bionics), MED-EL Medical Electronics, Oticon Medical (Demant A/S), WS Audiology (Signia, Widex) |

| Additional Attributes | Dollar sales by product type and end-user categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of hearing implant manufacturers; advancements in implant miniaturisation, speech processor technology, and wireless connectivity; integration with ENT clinical workflows, paediatric and adult implant programs, and Japan’s hearing rehabilitation systems. |

The global demand for hearing implant in Japan is estimated to be valued at USD 85.3 million in 2025.

The demand for hearing implant in Japan is projected to reach USD 145.4 million by 2035.

The demand for hearing implant in Japan is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in demand for hearing implant in Japan are cochlear implants, middle ear implants, bone conduction implants and auditory brainstem implants.

In terms of end user, hospitals segment is expected to command 51.2% share in the demand for hearing implant in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA