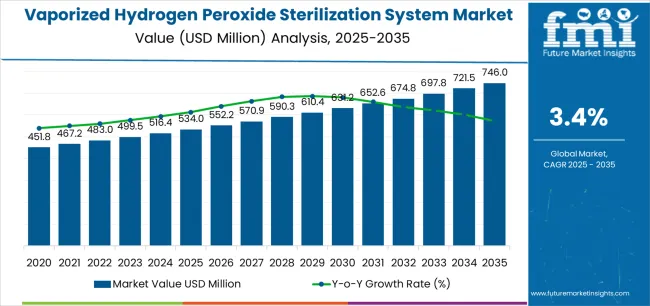

The global vaporized hydrogen peroxide sterilization system market is projected to reach USD 746 million by 2035, recording an absolute increase of USD 212.0 million over the forecast period. The market is valued at USD 534 million in 2025 and is set to rise at a CAGR of 3.4% during the assessment period. The overall market size is expected to grow by nearly 1.4 times during the same period, supported by increasing demand for advanced sterilization technologies in healthcare and life sciences sectors worldwide, driving demand for efficient bio-decontamination systems and increasing investments in pharmaceutical manufacturing facility upgrades and cleanroom validation programs globally.

Between 2025 and 2030, the vaporized hydrogen peroxide sterilization system market is projected to expand from USD 534 million to USD 631.1 million, resulting in a value increase of USD 97.1 million, which represents 45.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for sterile processing capabilities and contamination control solutions, product innovation in automated validation systems and integrated monitoring platforms, as well as expanding integration with pharmaceutical manufacturing operations and healthcare facility sterilization protocols. Companies are establishing competitive positions through investment in advanced vapor generation technologies, cycle optimization algorithms, and strategic market expansion across pharmaceutical production, medical device manufacturing, and hospital sterilization applications.

From 2030 to 2035, the market is forecast to grow from USD 631.1 million to USD 746 million, adding another USD 114.9 million, which constitutes 54.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized sterilization systems, including isolator-integrated solutions and mobile decontamination units tailored for specific facility requirements, strategic collaborations between equipment manufacturers and end-user industries, and an enhanced focus on validation efficiency and environmental sustainability. The growing emphasis on aseptic processing standards and regulatory compliance will drive demand for advanced, reliable vaporized hydrogen peroxide sterilization system solutions across diverse pharmaceutical and healthcare applications. However, high capital investment requirements and alternative sterilization technology competition may pose challenges to market expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 534 million |

| Market Forecast Value (2035) | USD 746 million |

| Forecast CAGR (2025-2035) | 3.4% |

The vaporized hydrogen peroxide sterilization system market grows by enabling pharmaceutical manufacturers and healthcare facilities to achieve comprehensive bio-decontamination while protecting sensitive equipment and materials from thermal damage. Life sciences organizations face mounting pressure to maintain sterile manufacturing environments and prevent contamination events, with vaporized hydrogen peroxide systems typically providing 6-log reduction in bacterial spores through low-temperature processing suitable for heat-sensitive materials, making these technologies essential for aseptic manufacturing and sterile processing operations. The pharmaceutical industry's need for validated sterilization processes creates demand for automated systems that provide consistent decontamination performance, comprehensive cycle documentation, and compatibility with regulatory validation requirements.

Government initiatives promoting pharmaceutical quality standards and healthcare infection control regulations drive adoption in drug manufacturing facilities, medical device production, and hospital sterile processing departments, where contamination prevention has direct impacts on patient safety and product quality. The global shift toward biologics manufacturing and cell therapy production accelerates vaporized hydrogen peroxide system demand as producers require gentle sterilization methods compatible with sophisticated cleanroom environments and barrier isolation systems. Biopharmaceutical facility expansion and contract manufacturing organization growth create sustained infrastructure investment supporting advanced sterilization technology deployment.

Healthcare-associated infection prevention drives hospital adoption of room decontamination systems, with vaporized hydrogen peroxide achieving 99.9% pathogen reduction for environmental disinfection addressing antibiotic-resistant organisms including C. difficile and MRSA. Medical device reprocessing requirements for heat-sensitive instruments create demand for alternative sterilization technologies providing material compatibility advantages over traditional steam autoclaves. However, high capital costs ranging from USD 50,000 to USD 500,000 per system and operational expertise requirements may limit adoption rates among smaller facilities and emerging market healthcare providers with constrained capital budgets and limited technical staffing.

| Driver | Catalyst | Impact |

|---|---|---|

| Rising Anemia Screening | Growing global anemia prevalence & routine testing in women and children | Boosts diagnostic kit demand in hospitals & labs |

| Clinical Automation | Shift to automated immunoassay analyzers | Increases testing throughput and accuracy |

| Regulatory Standardization | Stricter diagnostic validation norms (FDA, CE) | Favors high-quality, approved kit manufacturers |

| Point-of-Care Expansion | Portable & rapid transferrin detection systems | Drives adoption in low-resource and remote areas |

| Geriatric Population Growth | Higher incidence of nutritional deficiencies | Expands long-term testing volume globally |

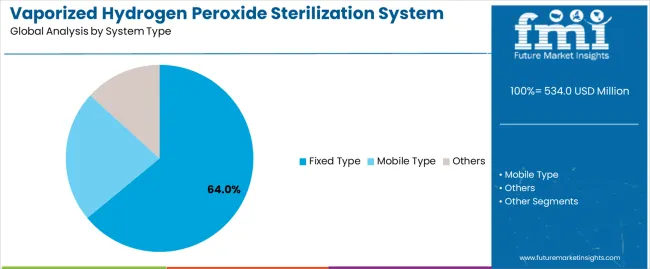

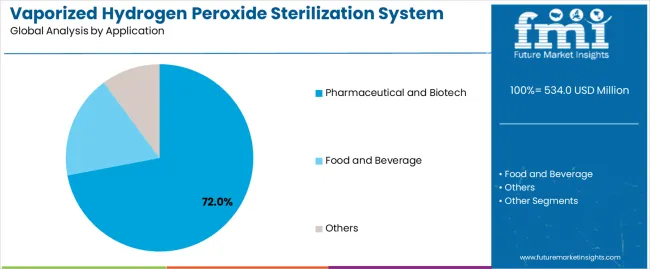

The market is segmented by system type, application, and region. By system type, the market is divided into fixed type, mobile type, and others. Based on application, the market is categorized into pharmaceutical and biotech, food and beverage, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

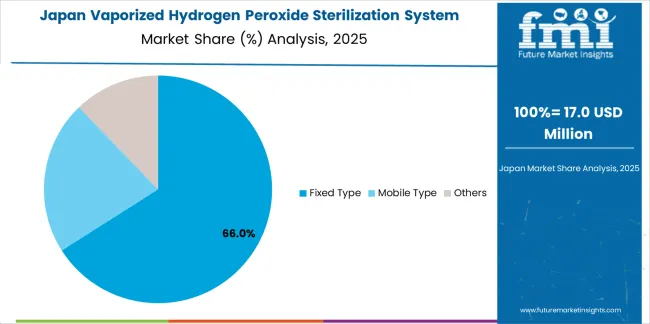

The fixed type segment represents the dominant force in the vaporized hydrogen peroxide sterilization system market, capturing approximately 64% of total market share in 2025. This established category encompasses permanently installed systems featuring integrated vapor generators, facility HVAC connections, and automated control platforms, delivering comprehensive room-scale decontamination with validated performance. The fixed type segment's market leadership stems from its superior cycle consistency, complete facility integration capabilities, and suitability for high-throughput pharmaceutical manufacturing requiring routine scheduled decontamination.

The mobile type segment maintains a substantial 28.0% market share, serving facilities requiring flexible deployment through portable units enabling multi-room decontamination with single equipment investment and supporting emergency response applications during outbreak situations. The others segment accounts for 8.0% market share, featuring specialized configurations including isolator-integrated systems, pass-through chamber units, and custom-engineered solutions for unique facility requirements. Key advantages driving the fixed type segment include installation permanence enabling optimized vapor distribution through facility-specific duct integration, automation capabilities supporting scheduled decontamination with minimal operator intervention, validation efficiency through consistent performance eliminating equipment variability between cycles, and throughput optimization enabling continuous manufacturing support through predictable cycle timing and rapid room turnaround supporting production schedules.

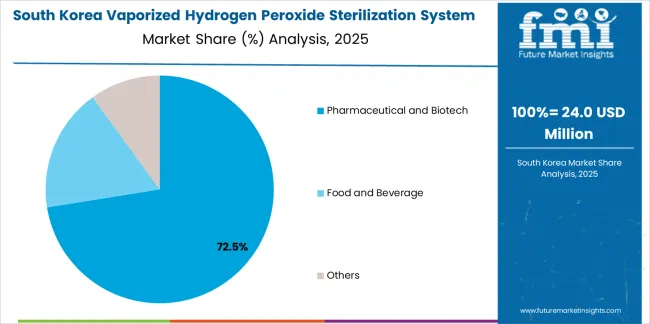

Pharmaceutical and biotech applications dominate the vaporized hydrogen peroxide sterilization system market with approximately 72% market share in 2025, reflecting the critical importance of sterile manufacturing environments in drug production and the stringent regulatory validation requirements governing pharmaceutical facilities. The segment's market leadership is reinforced by widespread adoption across aseptic filling operations, isolator decontamination, cleanroom bio-decontamination, and material transfer applications requiring validated low-temperature sterilization compatible with sophisticated pharmaceutical manufacturing infrastructure.

The food and beverage segment represents 18.0% market share through specialized applications including aseptic packaging line sterilization, cleanroom decontamination, and production equipment bio-decontamination supporting extended shelf-life product manufacturing. Others account for 10.0% market share, encompassing medical device manufacturing, hospital environmental disinfection, research laboratory decontamination, and biosafety cabinet sterilization applications. Key market dynamics supporting application preferences include pharmaceutical emphasis on regulatory compliance driving validated sterilization process requirements, biotech focus on contamination prevention in cell culture and biologics production requiring gentle material-compatible decontamination, food and beverage adoption for aseptic processing enabling ambient-temperature product storage without preservatives, and growing biosafety concerns in research facilities supporting comprehensive laboratory decontamination protocols.

The market is driven by three concrete demand factors tied to quality assurance and regulatory compliance. First, pharmaceutical manufacturing growth creates increasing requirements for sterile production capacity, with global biologics market expanding at 8-10% annually and requiring specialized cleanroom facilities where vaporized hydrogen peroxide provides validated bio-decontamination supporting aseptic processing standards. Second, healthcare infection control mandates drive hospital adoption of environmental disinfection technologies, with healthcare-associated infections affecting 5-10% of hospitalized patients globally and creating demand for proven pathogen elimination methods reducing transmission risks. Third, regulatory validation requirements accelerate adoption of automated sterilization systems, with FDA guidance emphasizing contamination control and requiring documented sterilization processes where vaporized hydrogen peroxide systems provide comprehensive cycle documentation and consistent performance supporting validation protocols.

Market restraints include high capital investment requirements affecting adoption decisions, particularly for fixed installation systems requiring facility modifications, HVAC integration, and validation studies where total project costs range from USD 200,000 to USD 1 million for comprehensive implementations creating budget challenges for smaller facilities. Operational complexity poses utilization barriers, as effective system operation requires trained personnel understanding vapor generation parameters, cycle development methodologies, and validation requirements creating staffing challenges for facilities without dedicated sterile processing expertise. Material compatibility limitations affect application scope, as certain plastics, electronics, and cellulosic materials experience degradation from repeated hydrogen peroxide exposure requiring material testing and potentially limiting system applicability for diverse equipment sterilization needs.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where pharmaceutical manufacturing expansion and biosafety laboratory development drive demand for advanced sterilization infrastructure supporting quality standards and export certifications. Technology advancement trends toward integrated monitoring systems with real-time chemical indicator verification, automated cycle optimization through AI-enhanced parameter adjustment, and wireless connectivity enabling remote system supervision are transforming sterilization workflows. Sustainability emphasis drives hydrogen peroxide adoption as environmentally-preferable alternative to ethylene oxide sterilization, with hydrogen peroxide decomposing into water and oxygen eliminating toxic emissions and residue concerns. However, the market thesis could face disruption if emerging sterilization technologies including nitrogen dioxide gas or supercritical carbon dioxide systems demonstrate superior material compatibility or cost-effectiveness, potentially fragmenting market share across multiple low-temperature sterilization modalities.

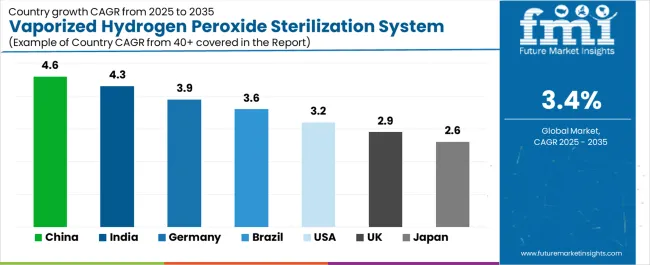

| Country | CAGR (2025-2035) |

|---|---|

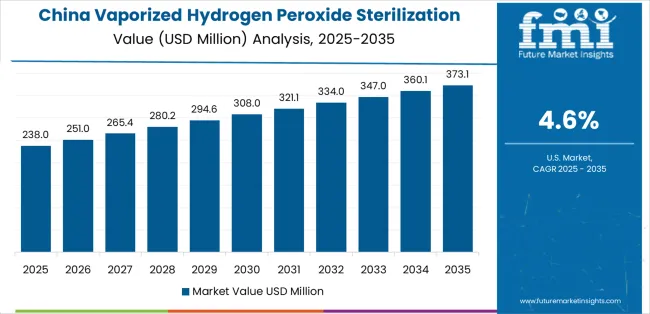

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| Brazil | 3.6% |

| USA | 3.2% |

| UK | 2.9% |

| Japan | 2.6% |

The vaporized hydrogen peroxide sterilization system market is gaining momentum worldwide, with China taking the lead thanks to aggressive pharmaceutical manufacturing expansion and biosafety laboratory infrastructure development. Close behind, India benefits from contract manufacturing growth and increasing regulatory alignment with international pharmaceutical standards, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where pharmaceutical industry excellence and stringent quality standards strengthen its role in European life sciences manufacturing.

Brazil demonstrates robust growth through pharmaceutical industry modernization and healthcare facility expansion, signaling continued investment in sterilization infrastructure. The USA maintains solid expansion through biologics manufacturing growth and hospital infection prevention programs, while the UK records consistent progress driven by pharmaceutical research capabilities and healthcare quality initiatives. Meanwhile, Japan stands out for its precision manufacturing culture and comprehensive pharmaceutical quality systems. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

China demonstrates the strongest growth potential in the Vaporized Hydrogen Peroxide Sterilization System Market with a CAGR of 4.6% through 2035. The country's leadership position stems from comprehensive pharmaceutical manufacturing capacity expansion, intensive biopharmaceutical industry development programs, and aggressive quality standard implementation driving adoption of advanced sterilization technologies.

Growth is concentrated in major pharmaceutical clusters, including Jiangsu, Shandong, Zhejiang, and Guangdong provinces, where drug manufacturers and contract production organizations are implementing vaporized hydrogen peroxide systems for aseptic manufacturing validation and cleanroom bio-decontamination. Distribution channels through medical equipment suppliers, pharmaceutical engineering companies, and direct manufacturer relationships expand deployment across pharmaceutical production facilities and biosafety laboratories. The country's pharmaceutical industry upgrade initiatives provide policy support for advanced manufacturing technology adoption, including incentives for GMP compliance and quality system implementation.

Key market factors include pharmaceutical production intensity with comprehensive capacity expansion in biologics manufacturing and sterile injectable production creating extensive sterilization infrastructure requirements, regulatory alignment with international standards driving technology adoption for export-oriented manufacturing facilities, comprehensive ecosystem including established pharmaceutical engineering firms and validation service providers with proven implementation capabilities, and government support through Made in China 2025 initiatives and pharmaceutical industry development programs providing favorable conditions for advanced equipment adoption.

In Hyderabad, Ahmedabad, Mumbai, and Bangalore regions, the adoption of vaporized hydrogen peroxide sterilization systems is accelerating across pharmaceutical manufacturing facilities, contract research organizations, and hospital sterile processing departments, driven by pharmaceutical industry growth and increasing quality standard implementation. The market demonstrates strong growth momentum with a CAGR of 4.3% through 2035, linked to comprehensive pharmaceutical manufacturing expansion and increasing focus on international regulatory compliance.

Indian pharmaceutical manufacturers are implementing advanced sterilization systems and validation protocols to support export market requirements while meeting domestic quality standards for critical drug manufacturing operations. The country's position as global generic drug supplier creates sustained demand for validated sterilization infrastructure, while growing biologics and biosimilar production capabilities drive adoption of sophisticated contamination control technologies.

Leading pharmaceutical development regions, including Telangana, Gujarat, Maharashtra, and Karnataka, driving vaporized hydrogen peroxide system adoption with facility modernization programs and regulatory compliance initiatives. Technology partnerships with international equipment manufacturers accelerate deployment with knowledge transfer and validation support addressing regulatory requirements. Market development through contract manufacturing organization expansion creates demand for flexible sterilization capabilities supporting diverse client requirements, while hospital infection control initiatives in major medical centers drive healthcare segment adoption.

Germany's advanced pharmaceutical sector demonstrates sophisticated implementation of vaporized hydrogen peroxide sterilization systems, with documented integration achieving comprehensive contamination control in aseptic manufacturing facilities producing injectable drugs and biologics. The country's pharmaceutical infrastructure in major regions, including Bavaria, North Rhine-Westphalia, Hesse, and Baden-Württemberg, showcases deployment of advanced sterilization technologies supporting pharmaceutical manufacturing excellence and regulatory compliance leadership. German pharmaceutical manufacturers emphasize quality assurance and process validation, creating demand for reliable sterilization solutions that support GMP compliance and facilitate regulatory inspections. The market maintains strong growth through focus on biologics manufacturing expansion and pharmaceutical innovation, with a CAGR of 3.9% through 2035.

Key development areas include pharmaceutical manufacturing excellence supporting comprehensive validation programs and systematic contamination control strategies, technical expertise among facility engineers and quality assurance professionals enabling sophisticated system implementation and optimization, strategic partnerships between pharmaceutical companies and equipment manufacturers supporting custom solution development for specialized applications, and integration of Industry 4.0 concepts including predictive maintenance and data analytics enhancing sterilization process monitoring and optimization.

Brazil's developing pharmaceutical sector demonstrates increasing implementation of vaporized hydrogen peroxide sterilization systems, with industry modernization and quality standard enhancement driving demand for advanced contamination control technologies. The market shows solid potential with a CAGR of 3.6% through 2035, driven by pharmaceutical manufacturing growth and healthcare infrastructure improvement across major industrial regions, including São Paulo, Rio de Janeiro, Minas Gerais, and Paraná. Brazilian pharmaceutical manufacturers are adopting advanced sterilization systems for compliance with ANVISA regulatory requirements, particularly in sterile injectable manufacturing requiring validated bio-decontamination processes. Technology deployment channels through pharmaceutical equipment distributors and engineering service providers expand coverage across pharmaceutical production and healthcare facility applications.

Leading market segments include pharmaceutical manufacturing facilities implementing GMP-compliant sterile production capabilities, hospital sterile processing departments upgrading infection control infrastructure, and contract manufacturing organizations serving international clients requiring validated sterilization processes. Technology partnerships with international equipment manufacturers provide access to proven systems and technical support for installation and validation programs, while growing domestic pharmaceutical R&D capabilities create demand for laboratory-scale sterilization supporting development activities.

The USA market demonstrates comprehensive implementation of vaporized hydrogen peroxide sterilization systems based on extensive biologics manufacturing infrastructure and advanced hospital infection prevention programs. The country shows solid potential with a CAGR of 3.2% through 2035, driven by biopharmaceutical industry expansion, cell and gene therapy development, and healthcare quality improvement initiatives across major pharmaceutical centers, including Boston, San Francisco, Research Triangle, and Philadelphia. American pharmaceutical manufacturers are adopting integrated sterilization solutions for isolator decontamination, cleanroom bio-decontamination, and material transfer applications supporting aseptic processing requirements. Technology deployment channels through specialized pharmaceutical equipment suppliers and sterile processing consultants provide comprehensive implementation support.

Leading market segments include biologics manufacturing facilities requiring sophisticated contamination control for cell culture operations, hospital sterile processing departments implementing environmental disinfection protocols for operating rooms and patient care areas, and pharmaceutical contract manufacturing organizations serving diverse clients with validated sterilization capabilities. Technology innovation through domestic equipment manufacturers advances system automation, cycle optimization, and integration capabilities, while regulatory guidance from FDA supporting vaporized hydrogen peroxide validation establishes clear implementation pathways for pharmaceutical applications.

The United Kingdom's vaporized hydrogen peroxide sterilization system market demonstrates focused implementation across pharmaceutical research facilities, contract development organizations, and National Health Service hospitals, with documented adoption supporting drug development and healthcare infection control. The country maintains steady growth momentum with a CAGR of 2.9% through 2035, driven by pharmaceutical industry innovation focus and healthcare quality improvement programs. Major pharmaceutical centers, including Cambridge, Oxford, London, and Manchester, showcase deployment of advanced sterilization systems supporting research operations and clinical manufacturing activities.

Key market characteristics include pharmaceutical research leadership creating demand for laboratory-scale sterilization supporting early-stage development, contract manufacturing presence requiring flexible sterilization capabilities serving diverse client projects, NHS infection control initiatives driving hospital adoption of environmental disinfection technologies, and regulatory expertise through MHRA guidance supporting clear validation pathways for pharmaceutical and healthcare applications.

Japan's vaporized hydrogen peroxide sterilization system market demonstrates mature implementation focused on pharmaceutical manufacturing quality and hospital infection prevention, with documented integration achieving superior contamination control through systematic validation and meticulous operational protocols. The country maintains steady growth through commitment to pharmaceutical excellence and patient safety, with a CAGR of 2.6% through 2035, driven by comprehensive quality culture and precision manufacturing expertise. Major pharmaceutical regions, including Tokyo, Osaka, Aichi, and Fukuoka, showcase sophisticated sterilization system deployment integrated with comprehensive manufacturing quality systems.

Key market characteristics include pharmaceutical manufacturing precision supporting thorough validation and systematic contamination control across sterile production facilities, hospital quality emphasis driving comprehensive infection prevention programs including environmental disinfection, technology partnerships between pharmaceutical companies and domestic equipment manufacturers ensuring system reliability and technical support, and regulatory compliance excellence through PMDA guidance and industry quality standards supporting validated sterilization implementation.

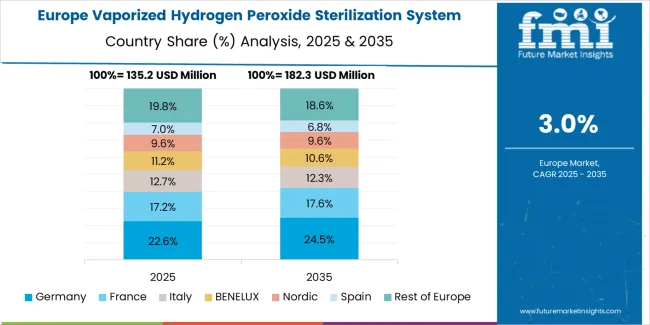

The vaporized hydrogen peroxide sterilization system market in Europe is projected to grow from USD 185.5 million in 2025 to USD 253.7 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 28.2% by 2035, supported by its pharmaceutical manufacturing excellence and major production centers, including Bavaria, North Rhine-Westphalia, and Hesse regions.

The United Kingdom follows with a 19.8% share in 2025, projected to reach 19.5% by 2035, driven by pharmaceutical research capabilities and NHS infection control programs. France holds a 16.5% share in 2025, expected to reach 16.7% by 2035, backed by pharmaceutical industry presence and healthcare quality initiatives. Italy commands a 12.8% share in both 2025 and 2035, driven by pharmaceutical manufacturing and medical device production. Switzerland accounts for 9.2% in 2025, rising to 9.4% by 2035 on pharmaceutical industry concentration and quality standards. The Netherlands maintains 6.4% in 2025, reaching 6.6% by 2035 on life sciences sector presence. The Rest of Europe region is anticipated to hold 6.8% in 2025, expanding to 9.4% by 2035, attributed to increasing vaporized hydrogen peroxide sterilization system adoption in Nordic countries and emerging Central & Eastern European pharmaceutical manufacturing development.

The Japanese vaporized hydrogen peroxide sterilization system market demonstrates a mature and precision-focused landscape, characterized by sophisticated integration of fixed-type systems with existing pharmaceutical manufacturing infrastructure across aseptic filling facilities, isolator operations, and cleanroom validation programs. Japan's emphasis on pharmaceutical quality and contamination control drives demand for reliable sterilization solutions that support comprehensive validation protocols and maintain consistent performance through systematic maintenance programs.

The market benefits from strong partnerships between pharmaceutical manufacturers and equipment suppliers including domestic technology companies, creating comprehensive service ecosystems that prioritize system reliability and technical support programs. Pharmaceutical centers in Tokyo Metropolitan Area, Kansai region, Chubu region, and other major production areas showcase advanced sterilization implementations where systems achieve validated bio-decontamination through precise parameter control and thorough cycle development.

The South Korean vaporized hydrogen peroxide sterilization system market is characterized by growing pharmaceutical manufacturing sector, with companies maintaining increasing system deployments through comprehensive facility modernization and quality standard enhancement supporting biosimilar production and export manufacturing. The market demonstrates increasing focus on flexible sterilization capabilities and multi-purpose system utilization, as Korean pharmaceutical manufacturers increasingly demand mobile-type systems enabling cost-effective decontamination across multiple production areas with single equipment investment.

Domestic pharmaceutical companies are expanding manufacturing capabilities through technology partnerships with international equipment manufacturers, implementing validated sterilization systems supporting regulatory compliance for domestic and export markets. The competitive landscape shows increasing collaboration between pharmaceutical engineering firms and sterilization equipment suppliers, creating integrated implementation approaches combining facility design with sterilization system installation supporting comprehensive contamination control strategies.

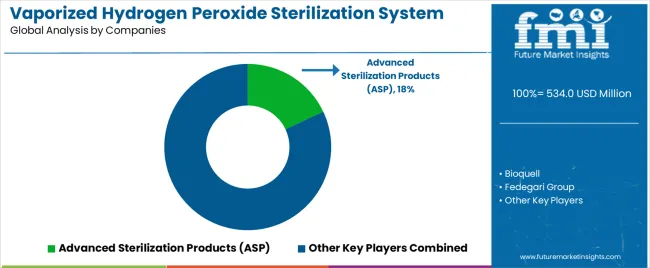

The vaporized hydrogen peroxide sterilization system market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 45-50% of global market share through established technology portfolios and comprehensive validation support capabilities. Competition centers on system reliability, validation documentation quality, and technical support responsiveness rather than price competition alone. Advanced Sterilization Products (ASP) leads with approximately 18% market share through its comprehensive bio-decontamination system portfolio serving pharmaceutical and healthcare applications.

Market leaders include Advanced Sterilization Products (ASP), Bioquell, and STERIS Life Sciences, which maintain competitive advantages through extensive validation databases, proven regulatory compliance track records, and comprehensive technical support networks spanning pharmaceutical manufacturing and healthcare sterilization applications, creating reliability and confidence advantages with quality-focused customers. These companies leverage research and development capabilities in vapor generation optimization, cycle parameter refinement, and ongoing regulatory affairs expertise to defend market positions while expanding into emerging applications including cell therapy manufacturing and biosafety laboratory decontamination.

Challengers encompass Fedegari Group and Getinge, which compete through integrated sterilization portfolios and strong pharmaceutical industry relationships supporting comprehensive contamination control solutions. Equipment specialists, including Steelco S.p.A., Shinva, and Van der Stahl Scientific, focus on specific market segments or geographic regions, offering differentiated capabilities in custom engineering, cost-competitive systems, and specialized application expertise.

Regional players including STERIS AST and Stryker create competitive pressure through healthcare segment focus and established hospital relationships, particularly in infection prevention applications where portable decontamination capabilities address outbreak response and terminal cleaning requirements. Market dynamics favor companies that combine proven sterilization efficacy with comprehensive validation support, responsive technical service, and ongoing system performance monitoring capabilities addressing the complete implementation lifecycle from initial specification through routine operational support and revalidation programs ensuring sustained regulatory compliance.

Vaporized hydrogen peroxide sterilization systems represent critical contamination control technologies that enable pharmaceutical manufacturers to achieve 6-log bacterial spore reduction through validated low-temperature processing, delivering comprehensive bio-decontamination with material compatibility advantages and environmental sustainability benefits in demanding life sciences applications. With the market projected to grow from USD 534 million in 2025 to USD 746 million by 2035 at a 3.4% CAGR, these sterilization systems offer compelling advantages - regulatory compliance assurance, contamination prevention, and operational efficiency - making them essential for pharmaceutical and biotech manufacturing, healthcare infection control, and facilities requiring validated bio-decontamination supporting quality assurance programs and patient safety objectives. Scaling market adoption and technology advancement requires coordinated action across regulatory frameworks, validation standards, equipment manufacturers, end-user industries, and pharmaceutical engineering expertise.

Pharmaceutical Quality Standards should establish clear guidance on sterilization validation requirements, harmonize international regulatory expectations reducing redundant validation efforts, and develop standardized test methods for bio-decontamination efficacy verification. Research & Innovation Funding must support development of next-generation sterilization technologies with improved material compatibility, fund validation studies establishing efficacy against emerging pathogens, and invest in automation research reducing operational complexity and staffing requirements. Healthcare Infrastructure should include sterilization equipment in hospital modernization funding programs, provide grants for infection prevention technology adoption in resource-limited facilities, and establish shared sterilization service centers enabling small hospitals to access advanced technologies.

Regulatory Harmonization needs to create mutual recognition agreements for sterilization validation between regulatory authorities, establish common guidance documents reducing facility compliance burden, and develop digital validation protocols enabling remote regulatory assessment. Biosafety Enhancement should mandate validated decontamination for high-containment laboratories, provide funding for biosafety laboratory sterilization infrastructure, and establish emergency response sterilization capabilities supporting outbreak containment and biodefense preparedness.

Validation Standards should define standardized biological indicator protocols for hydrogen peroxide sterilization efficacy verification, establish performance qualification methodologies ensuring consistent system validation across facilities, and create documentation templates supporting regulatory submission requirements. Technical Training must develop comprehensive education programs for sterile processing professionals on vaporized hydrogen peroxide system operation and validation, establish certification programs validating operator competencies, and create troubleshooting resources supporting effective system utilization and maintenance.

Application Guidelines need to develop best practices for cycle development addressing diverse facility configurations and material loads, establish safety protocols for hydrogen peroxide handling and exposure monitoring, and create material compatibility databases helping users select appropriate sterilization parameters. Performance Benchmarking should establish industry metrics for system reliability and cycle success rates, develop reporting frameworks documenting sterilization program effectiveness, and create peer learning networks enabling knowledge sharing across facilities implementing similar technologies.

Advanced System Design should develop next-generation vapor generators with improved distribution uniformity and reduced cycle times, create integrated monitoring systems providing real-time validation parameter tracking, and implement predictive maintenance capabilities using sensor data analytics to prevent system failures. Validation Support must provide comprehensive documentation packages supporting regulatory submissions, offer on-site validation assistance ensuring successful system qualification, and develop validation protocols for emerging applications including cell therapy manufacturing and continuous production systems.

User-Friendly Operation needs to implement intuitive control interfaces reducing training requirements for system operation, develop automated cycle selection based on room volume and configuration parameters, and create mobile applications enabling remote system monitoring and performance tracking. Service Excellence should establish rapid-response technical support networks minimizing system downtime, provide comprehensive preventative maintenance programs ensuring sustained performance, and offer validation renewal services supporting periodic requalification requirements maintaining regulatory compliance.

Application-Focused Solutions should develop specialized systems for pharmaceutical and biotech applications emphasizing validation documentation and GMP compliance, create healthcare-focused configurations for hospital environmental disinfection with simplified operation, and offer food and beverage solutions addressing aseptic processing requirements with formulations optimized for each application's specific regulatory and operational needs. Geographic Expansion must establish service networks in high-growth markets like China and India ensuring local technical support availability, while maintaining comprehensive validation support capabilities in established markets like USA and Europe through experienced technical teams.

Technology Differentiation should invest in proprietary vapor generation technologies providing superior distribution uniformity and cycle consistency, develop advanced monitoring systems enabling real-time validation with continuous chemical indicator verification, and create modular system designs allowing capacity scaling and feature upgrades without complete system replacement. Customer Partnership Models need to develop long-term relationships with pharmaceutical manufacturers through validation co-development programs, establish equipment leasing programs reducing capital barriers for facility adoption, and create performance guarantee agreements demonstrating confidence in system reliability while building customer loyalty.

Sterilization Equipment Manufacturing should finance established system manufacturers for capacity expansion, technology development programs, and regulatory affairs resources supporting growing demand in pharmaceutical and healthcare markets. Validation & Consulting Services must provide capital for establishing technical service organizations supporting system implementation and validation, enabling comprehensive customer success programs ensuring effective technology adoption.

Innovation & Biotechnology should back startups developing next-generation sterilization technologies including advanced monitoring systems, AI-enhanced cycle optimization platforms, and novel sterilant chemistries providing enhanced material compatibility while addressing environmental sustainability objectives. Market Integration should support strategic partnerships between sterilization equipment manufacturers and pharmaceutical engineering firms creating turnkey contamination control solutions, finance acquisitions consolidating complementary technologies and geographic capabilities, and enable vertical integration combining equipment manufacturing with validation services creating comprehensive solution providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 534 million |

| System Type | Fixed Type, Mobile Type, Others |

| Application | Pharmaceutical and Biotech, Food and Beverage, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Advanced Sterilization Products (ASP), Bioquell, Fedegari Group, Getinge, Steelco S.p.A., STERIS Life Sciences, Shinva, Van der Stahl Scientific, STERIS AST, Stryker |

| Additional Attributes | Dollar sales by system type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with sterilization equipment manufacturers and validation service providers, system specifications and validation parameters, integration with pharmaceutical manufacturing operations and healthcare facility protocols, innovations in vapor generation technology and monitoring systems, and development of specialized solutions with enhanced material compatibility and cycle efficiency. |

The global vaporized hydrogen peroxide sterilization system market is estimated to be valued at USD 534.0 million in 2025.

The market size for the vaporized hydrogen peroxide sterilization system market is projected to reach USD 746.0 million by 2035.

The vaporized hydrogen peroxide sterilization system market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in vaporized hydrogen peroxide sterilization system market are fixed type, mobile type and others.

In terms of application, pharmaceutical and biotech segment to command 72.0% share in the vaporized hydrogen peroxide sterilization system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA