The vented liner market is experiencing strong growth driven by rising demand for safe and efficient packaging solutions across various industries. Increasing awareness regarding product integrity, leakage prevention, and pressure equalization has accelerated adoption across food, pharmaceutical, and chemical sectors. The current scenario reflects steady advancements in liner materials, improved sealing technologies, and integration of venting mechanisms that enhance packaging reliability.

Manufacturers are focusing on developing liners with superior chemical resistance and compatibility with diverse container types. Future growth is expected to be supported by rising consumption of packaged goods, stricter safety standards, and innovations in venting membranes.

Market expansion is also being propelled by the increasing shift toward sustainable materials and high-performance packaging components Growth rationale is built on consistent product innovation, rising end-user awareness, and expanding applications in storage and transport of volatile or sensitive liquids, ensuring long-term demand stability and technological evolution across global markets.

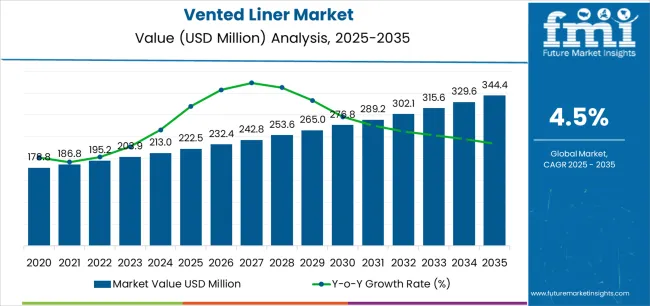

| Metric | Value |

|---|---|

| Vented Liner Market Estimated Value in (2025 E) | USD 222.5 million |

| Vented Liner Market Forecast Value in (2035 F) | USD 344.4 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

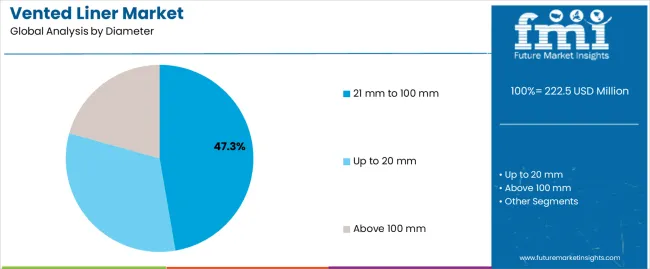

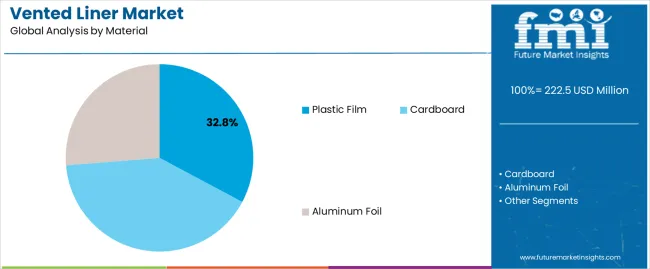

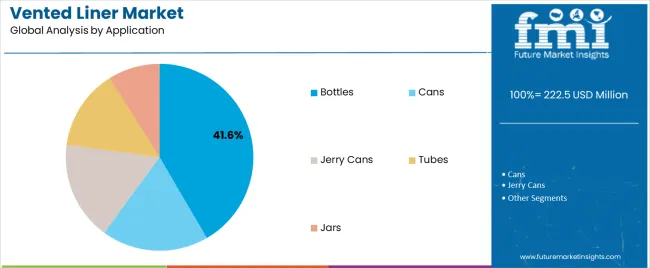

The market is segmented by Diameter, Material, Application, and End-Use and region. By Diameter, the market is divided into 21 mm to 100 mm, Up to 20 mm, and Above 100 mm. In terms of Material, the market is classified into Plastic Film, Cardboard, and Aluminum Foil. Based on Application, the market is segmented into Bottles, Cans, Jerry Cans, Tubes, and Jars. By End-Use, the market is divided into Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals, Pesticides, Chemicals, and Other Commodities. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 21 mm to 100 mm segment, accounting for 47.30% of the diameter category, has maintained its lead due to its suitability for a wide range of bottle and container types used in industrial, pharmaceutical, and consumer packaging. Its dominance is being reinforced by versatility in closure systems, ease of integration with automated filling lines, and cost-effectiveness in mass production.

The segment’s strong position is supported by increasing usage in mid-volume liquid containers that require effective venting to prevent leakage or deformation. Demand stability has been enhanced by adoption across multiple industries where controlled pressure balance is essential.

Technological enhancements in venting films and liner materials have improved durability and barrier performance Future growth will be sustained by continued demand for standard-sized closures in expanding sectors such as personal care, agrochemicals, and food packaging.

The plastic film segment, representing 32.80% of the material category, has emerged as the preferred choice owing to its lightweight nature, flexibility, and high compatibility with vented designs. Its widespread adoption has been driven by ease of processing, adaptability to varied container geometries, and strong resistance to chemical interaction.

Market performance has been supported by innovations in multilayer film construction that enhance permeability control and product protection. Plastic films also offer cost advantages compared to alternative materials while maintaining consistent venting performance.

Their recyclability and ongoing developments in biodegradable variants are contributing to sustainable growth prospects Expansion of end-use applications in pharmaceuticals, industrial chemicals, and household products is expected to reinforce the segment’s leading position throughout the forecast period.

The bottles segment, holding 41.60% of the application category, has remained dominant due to extensive utilization in packaging liquids that generate internal pressure or require air exchange. This segment’s growth has been supported by its widespread use across personal care, food and beverage, and chemical packaging sectors.

The integration of vented liners in bottles ensures product stability, prevents leakage, and extends shelf life, making it a preferred solution among manufacturers and consumers. Demand has been further strengthened by the increasing production of large-volume plastic bottles used for detergents, pesticides, and industrial liquids.

Continued innovations in liner design and compatibility with advanced bottle closure systems are expected to sustain its leading share and enhance reliability in high-performance packaging applications globally.

The vented liner market grew at a CAGR of 3.2% during the historical period, with a market value of USD 222.5 million in 2025 from USD 178.8 million in 2020.

The table presents the expected CAGR for vented liner market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the market is predicted to surge at a CAGR of 4.5%, followed by a slightly higher growth rate of 4.9% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease to 4.6% in the first half and remain moderate at 4.8% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 | 4.5% (2025 to 2035) |

| H2 | 4.9% (2025 to 2035) |

| H1 | 4.6% (2025 to 2035) |

| H2 | 4.8% (2025 to 2035) |

Rising Chemical Safety Concerns Spur Vented Liner Adoption

Agriculture Sector Adopts Vented Liners to Get Diverse Benefits

The table below shows the estimated growth rates of the leading countries. Japan, Mexico, and India are set to record high CAGRs of 7.4%, 6.7%, and 6.4%, respectively, through 2035.

| Countries | Value-based CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| Canada | 4.7% |

| Brazil | 3.0% |

| Mexico | 6.7% |

| Germany | 1.5% |

| France | 4.8% |

| United Kingdom | 3.9% |

| China | 5.1% |

| India | 6.4% |

| Japan | 7.4% |

| UAE | 5.4% |

| South Africa | 6.3% |

The United States is expected to rise at 2.9% CAGR by 2035. Some of the factors influencing growth of the market in the country are:

India's vented liner market is projected to surge at 6.4% CAGR through 2035. Some of the factors responsible for the growth of the market are:

The market is expected to progress at a CAGR of 6.7% in Mexico in the forecast period. This stable growth is fueled by the following factors:

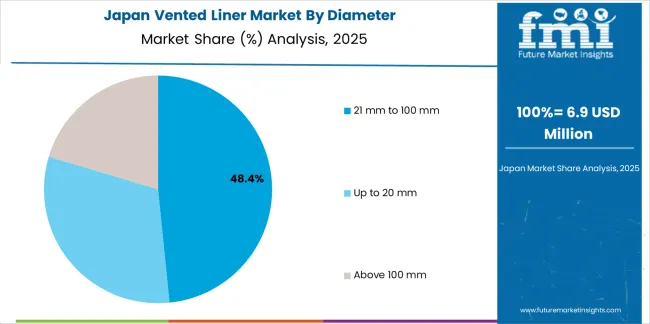

The vented liner industry in Japan is anticipated to rise at a CAGR of 7.4% through 2035. This steady rise is primarily driven by:

France's vented liner industry is projected to rise at a CAGR of 4.8% through 2035. This relatively sluggish growth can be attributed to:

The section below shows the up to 20 mm segment dominating by diameter. The segment is predicted to rise at 5.4% CAGR through 2035. Based on end-use, the pesticides segment is anticipated to generate a dominant share through 2025. It is set to rise at a CAGR of 4.6% through 2035.

| Segment | Value-based CAGR (2025 to 2035) |

|---|---|

| Up to 20 mm (Diameter) | 5.4% |

| Pesticides (End-use) | 4.6% |

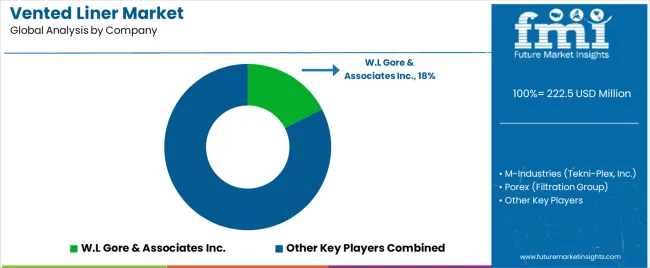

Vented liner manufacturers are primarily focused on improving venting efficiency and the integrity of packages that apply these liners. Key players are investing in research and development to innovate new products with better efficiency to expand their market reach.

Leading players in the market are W.L Gore & Associates Inc., M-Industries (Tekni-Plex, Inc), Porex (Filtration Group), Selig Group, Inc., Meyer Seals Group, Mold Rite Plastics, and Pano Cap. Tier 1 players in the market hold 25% to 30% of the overall vented liner market share.

A Few Key Companies in the Market include:

The global vented liner market is estimated to be valued at USD 222.5 million in 2025.

The market size for the vented liner market is projected to reach USD 344.4 million by 2035.

The vented liner market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in vented liner market are 21 mm to 100 mm, up to 20 mm and above 100 mm.

In terms of material, plastic film segment to command 32.8% share in the vented liner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vented Stretch Wrap Market Insights & Forecast 2025 to 2035

Vented Caps Market Analysis – Growth & Forecast 2024 to 2034

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Liner Bag Market Report – Key Trends & Forecast 2024-2034

Liner Hanger Market

Eyeliner and Kajal Sculpting Pencil Packaging Market Trends and Forecast 2025 to 2035

Evaluating Eyeliner and Kajal Sculpting Pencil Packaging Market Share & Provider Insights

Eyeliner Pen Market

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

IBC Liner Market Size and Share Forecast Outlook 2025 to 2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

EPE Liner Market Analysis – Size, Growth & Demand 2025 to 2035

Examining Market Share Trends in the Cap Liner Industry

IBC Liner Market Share Insights & Industry Leaders

Industry Share Analysis for Box Liners Companies

Cap Liner Market from 2024 to 2034

Cap Liner Films Market

Testliner Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA