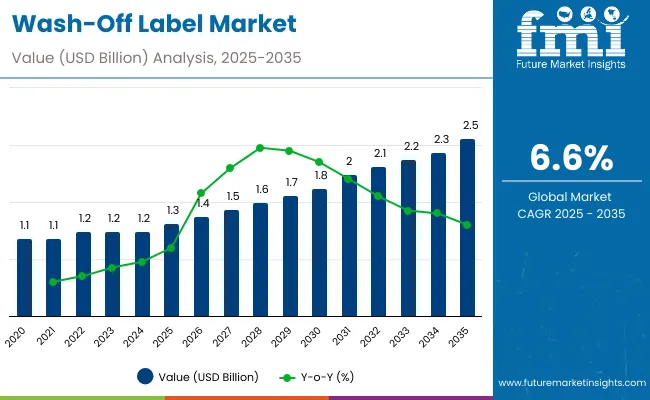

The wash-off label market will expand from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, reflecting a CAGR of 6.6%. This growth is supported by rising demand for recyclable packaging, strict sustainability regulations, and brand focus on clean-label packaging. Wash-off labels enable effective recycling and reuse of containers, reducing waste across food, beverage, personal care, and pharmaceutical sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.5 billion |

| CAGR (2025 to 2035) | 6.6% |

Between 2025 and 2030, the market will add USD 0.4 billion, largely driven by beverage and food packaging adoption. From 2030 to 2035, expansion of USD 0.8 billion will stem from healthcare, cosmetics, and e-commerce applications. Key growth drivers include polypropylene films, water-based adhesives, and flexographic printing technology, while automation-ready label production enhances scalability for global brands and retailers.

From 2020 to 2024, wash-off labels gained significant traction as recycling regulations strengthened across Europe and North America. Beverage companies introduced wash-off solutions to support container reuse systems, while food and personal care brands piloted paper-based and biodegradable materials. The technology enabled clean recycling of PET bottles, improving yield and compliance.

By 2035, the market will grow to USD 2.5 billion at a CAGR of 6.6%. Polypropylene films, combined with water-based adhesives, will dominate due to durability and recyclability. Flexographic printing will retain leadership, while digital adoption expands for short runs. Asia-Pacific will deliver the highest growth, led by Japan and South Korea, while Europe emphasizes circularity and North America drives scale with beverage packaging.

The wash-off label market is expanding as industries adopt recyclable packaging systems aligned with circular economy policies. Food and beverage companies are leading demand, using wash-off solutions to facilitate container reuse and meet Extended Producer Responsibility (EPR) targets. PET recycling efficiencies further reinforce adoption.

Healthcare and cosmetics also adopt wash-off labels for sterilizable, clean-label solutions. Consumer demand for eco-friendly products drives brand adoption, while advances in adhesives and printing extend performance. With global regulations tightening, wash-off labels are positioned as essential for sustainable packaging across food, beverage, healthcare, and personal care markets.

The wash-off label market is segmented by material type, adhesive type, printing technology, application, end-use industry, and region. Material types include PP, PET, PE, paper-based, and biodegradable labels. Adhesive types cover water-based, hot-melt, solvent-based, and acrylic. Printing technologies include flexographic, digital, offset, and gravure. Applications span beverage bottles, food jars, cosmetics, pharmaceuticals, and household packaging. End-use industries include food and beverages, pharmaceuticals, cosmetics, cleaning, and e-commerce across global regions.

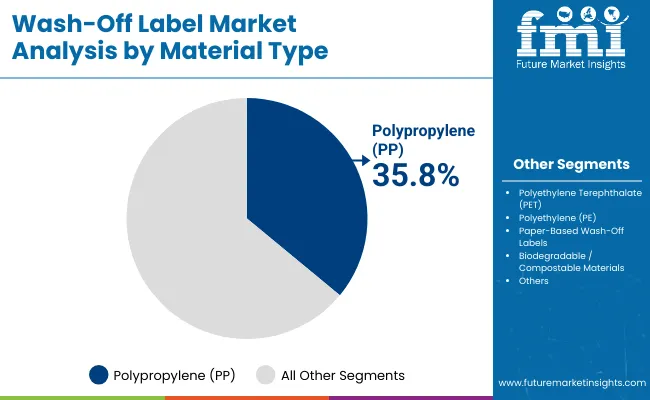

Polypropylene will hold 35.8% share in 2025, driven by its durability, print quality, and compatibility with recycling systems. Beverage and personal care sectors favor PP wash-off labels for clarity, branding, and clean removal during recycling. Adoption is reinforced by low cost and regulatory acceptance.

Growth is supported by integration with biodegradable coatings and compatibility with water-based adhesives. PP-based labels deliver high moisture resistance and adaptability across automated labeling lines. By 2035, polypropylene will remain dominant due to scalability and alignment with circular economy initiatives.

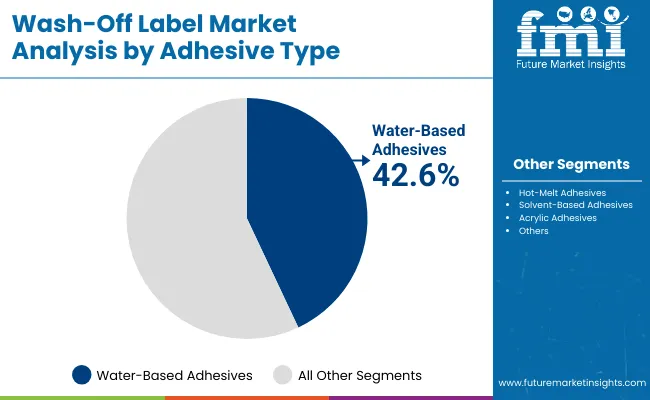

Water-based adhesives will capture 42.6% share in 2025, favored for recyclability, low VOC emissions, and safe processing. Beverage and food applications prefer water-based adhesives for reliable performance and compliance with food-contact regulations.

Advancements in wash-off technologies enhance adhesive removal, ensuring high PET recycling yields. Expansion into healthcare and cosmetics further supports adoption. As sustainability and regulatory standards tighten, water-based adhesives will remain the adhesive type of choice for wash-off labels.

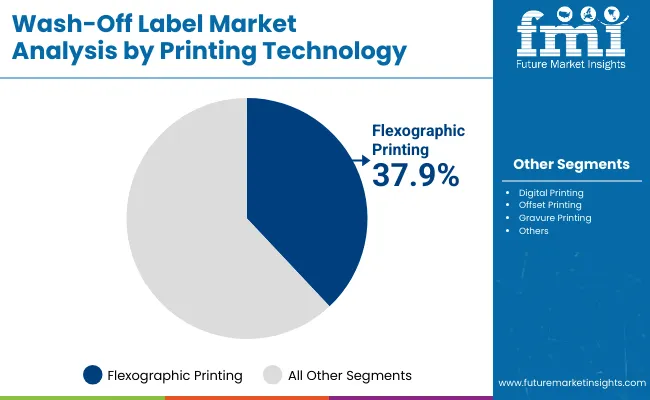

Flexographic printing will hold 37.9% share in 2025, offering high-quality output, efficiency, and versatility across substrates. Beverage and FMCG brands rely on flexo for mass-volume labeling due to cost efficiency and durability.

Growth continues as innovations in inks improve recyclability and compostability. Flexo remains critical for large-scale adoption, while short-run printing shifts to digital. By 2035, flexographic printing will anchor global production capacity for wash-off labels.

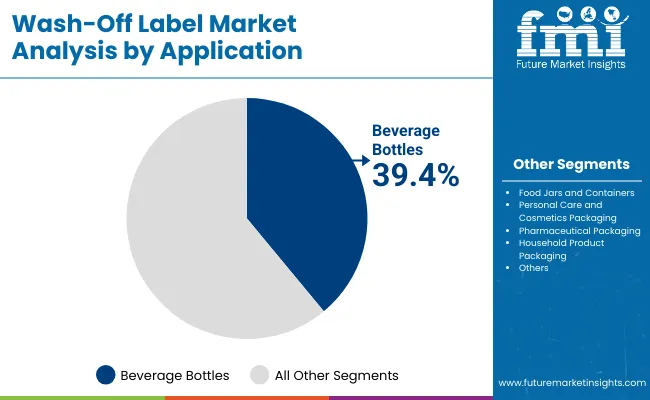

Beverage bottles will account for 39.4% share in 2025, making them the leading application segment. Wash-off labels are widely used by water, soda, and beer companies to support PET recycling and container reuse. Global beverage giants increasingly adopt wash-off solutions to align with EPR mandates and sustainability goals.

Future adoption extends into premium packaging and returnable bottle systems. Wash-off labels enhance branding while ensuring recyclability, positioning beverages as the largest driver of demand through 2035.

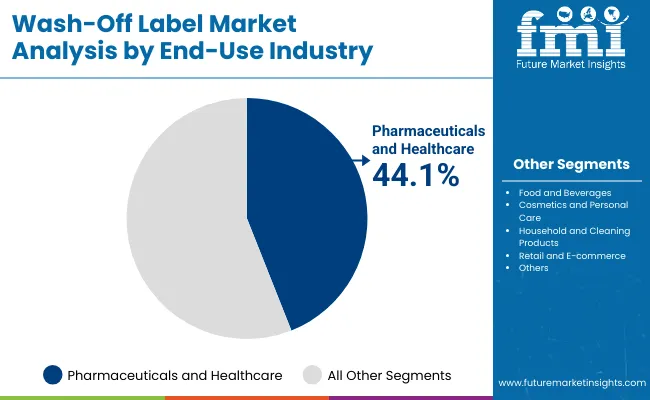

Food and beverages will represent 44.1% share in 2025, cementing their role as the largest end-use sector. Wash-off labels are used on bottles, jars, trays, and pouches to ensure recyclability and consumer appeal. Strict food safety and sustainability policies reinforce adoption.

Growth is supported by demand for reusable containers, meal kits, and eco-friendly grocery packaging. As consumer preference for recyclable packaging rises, food and beverages will anchor global demand through 2035.

Wash-off label demand is fueled by sustainability mandates, PET recycling systems, and EPR compliance. Beverage and FMCG companies lead adoption, while adhesives and printing innovations improve recyclability. Consumer demand for clean-label, eco-friendly packaging strengthens growth.Challenges include higher costs compared to conventional labels, limited recycling infrastructure in developing regions, and technical complexity in adhesive removal. Performance consistency under humidity and sterilization also limits applications.

Healthcare, cosmetics, and premium beverages present opportunities for expansion. Functional innovations such as antimicrobial coatings and smart tracking enhance value. Regional adoption in Latin America and Asia-Pacific grows with policy alignment.

Trends include rapid development of biodegradable label films, PFAS-free adhesives, and water-efficient recycling processes. Digital printing adoption grows for customization. Retailers emphasize circularity and recyclability claims, making wash-off labels key in sustainable packaging strategies.

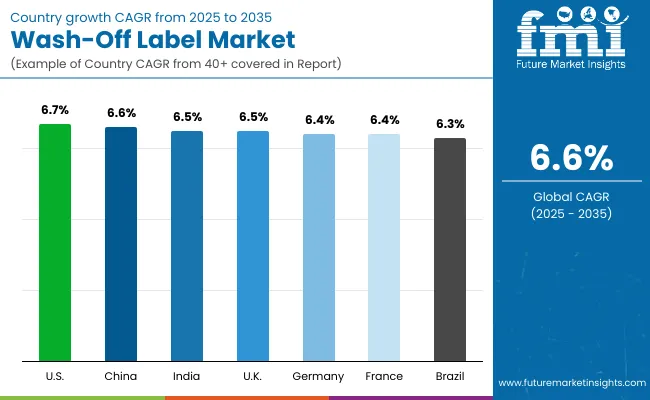

The wash-off label market is growing worldwide as sustainability mandates and consumer demand converge. Asia-Pacific is expected to lead growth, particularly in Japan and South Korea. Europe enforces strict EPR and recyclability standards, while North America drives adoption through large-scale beverage packaging programs. Latin America and the Middle East & Africa strengthen demand through agriculture and food exports.

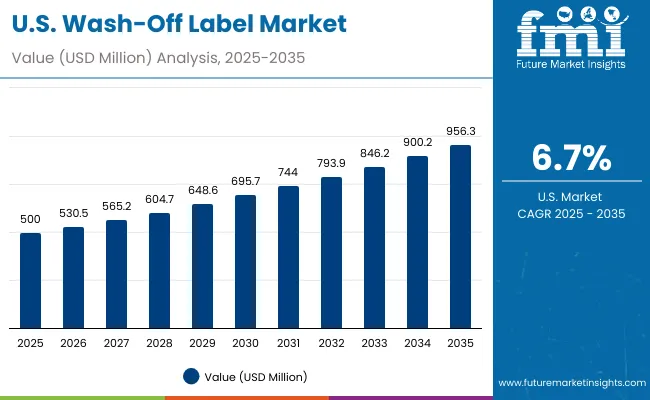

The USA market is forecast to grow at 6.7% CAGR, fueled by large beverage brands transitioning to sustainable adhesive formats and the rapid expansion of e-commerce packaging. FDA-approved water-based adhesives are increasingly adopted across cartons, labels, and pouches, enhancing consumer trust through safety and compliance. Recycling initiatives further reinforce PET label compliance, aligning with circular economy targets. The combination of beverage packaging dominance, FDA-backed safety, and recycling-driven adoption makes the USA a leader in sustainable adhesive uptake.

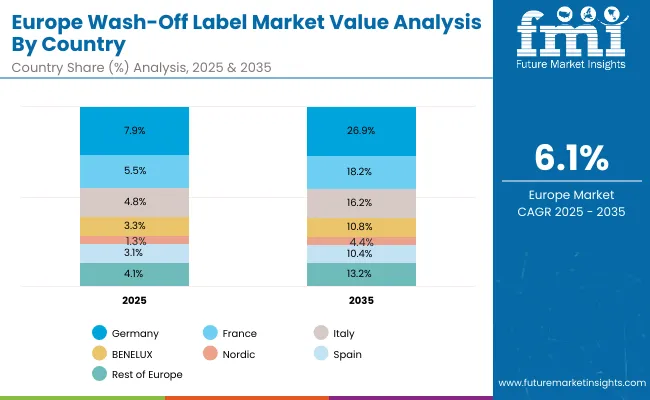

Germany will expand at 6.4% CAGR, supported by strict VerpackG laws that reinforce recyclability standards across all packaging formats. Food, beverage, and cosmetics companies are leading adopters, particularly as premium brands seek sustainable labeling options. Local recycling infrastructure offers a strong foundation, ensuring scalability and compliance with EU-wide directives. Industrial-scale usage is being supported by fiber-based adoption mandates, ensuring sustainability across key applications. As a result, Germany remains a central hub for eco-friendly adhesive packaging innovation and expansion.

The UK is projected to grow at 6.5% CAGR, with growth driven by Extended Producer Responsibility (EPR) and Plastic Tax schemes. Beverage bottles and food jars dominate demand, with grocers rapidly adopting recyclable labels to comply with stricter regulations. Healthcare pilots are also gaining traction, testing adhesives in sensitive medical packaging applications. The shift toward circular compliance has created opportunities for compostable and water-based adhesives. These drivers are reinforcing both mass retail usage and specialized adoption in healthcare packaging.

China is set to expand at 6.6% CAGR, supported by high demand from packaged food and beverages alongside robust export-driven packaging adoption. Large-scale production capacity ensures affordability, driving adoption across FMCG brands and industrial exporters. Compliance with EU and USA trade rules is boosting PLA-based adhesive demand, aligning local products with international market standards. Beverage exports and electronics packaging are strengthening applications. With its massive scale and manufacturing edge, China is becoming a pivotal global player in adhesive adoption.

India will grow at 6.5% CAGR, driven by agriculture, beverages, and the retail sector. Nationwide plastic bans are enforcing transitions to compostable adhesives, particularly in food and beverage packaging. Export alignment with EU and USA compliance standards has increased demand from manufacturers seeking international certifications. Rapid retail expansion, combined with quick-commerce and consumer-driven sustainability, reinforces large-scale adoption. Agriculture remains a vital driver, using bio-based adhesives for packaging fresh produce and supply chain operations, ensuring eco-friendly compliance nationwide.

Japan will lead global expansion with a 7.3% CAGR, driven by premium beverage, healthcare, and cosmetics packaging. Its advanced recycling systems reinforce adoption, enabling recovery and reuse of compostable adhesives effectively. Premium brands are opting for high-quality, water-based adhesives that align with consumer preference for safety and sustainability. Healthcare applications are increasing, with sterile medical packaging gaining traction. With an emphasis on both premium quality and environmental responsibility, Japan is shaping global benchmarks in adhesive packaging.

South Korea will grow at 7.2% CAGR, with expansion fueled by e-commerce packaging, personal care, and beverages. Export-driven adoption is rising as manufacturers emphasize recyclable solutions to meet global trade requirements. Bio-based adhesives are gaining popularity in cosmetics packaging, reflecting consumer preference for eco-friendly products. Electronics and online retail growth further strengthen market usage. By integrating innovation with export competitiveness, South Korea is emerging as a regional leader in sustainable adhesive packaging adoption.

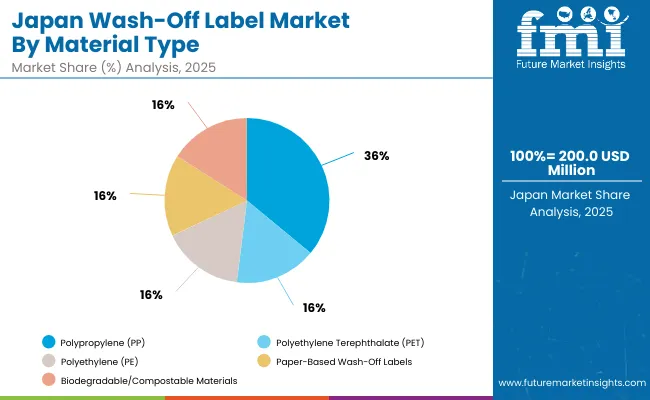

Japan’s wash-off label market, valued at USD 200 million in 2025, is led by polypropylene (PP), holding 37.4% share due to its durability, recyclability, and widespread use in beverage and personal care packaging. Polyethylene terephthalate (PET) follows with 20%, supported by premium branding needs in food and drinks. Polyethylene (PE) contributes 18.1%, favored for flexibility and cost-effectiveness. Paper-based wash-off labels, accounting for 15.8%, gain demand from eco-friendly packaging. Biodegradable and compostable materials, at 8.7%, reflect Japan’s gradual pivot toward sustainability. This segmentation underscores the balance between established plastic substrates and rising adoption of green alternatives, driven by circular economy policies.

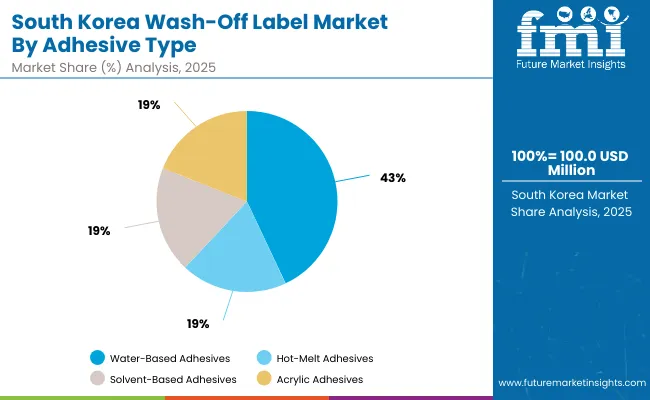

South Korea’s wash-off label market, valued at USD 100 million in 2025, is dominated by water-based adhesives, which capture 42.6% share, driven by their recyclability and ease of removal in glass and PET bottles. Hot-melt adhesives follow with 18.2%, offering strong adhesion for high-speed labeling processes. Solvent-based adhesives, at 16%, are still applied in heavy-duty packaging but face regulatory pressure. Acrylic adhesives account for 14.1%, supporting durable, weather-resistant labeling. This segmentation reflects South Korea’s strong emphasis on water-based formats aligned with global recycling initiatives, highlighting innovation in adhesive formulations to support sustainability goals and compliance with strict waste-management standards.

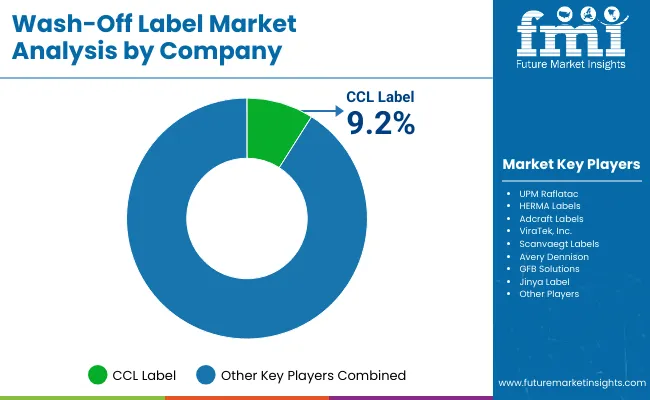

The market is moderately fragmented with leaders including CCL Label, UPM Raflatac, HERMA Labels, Adcraft Labels, ViraTek Inc., Scanvaegt Labels, Avery Dennison Corporation, GFB Solutions and Jinya Label. Global leaders like CCL Label, UPM Raflatac, Avery Dennison, and HERMA invest in recyclable label films, PFAS-free adhesives, and large-scale production. Partnerships with beverage and FMCG giants drive growth.

Regional players including Adcraft Labels, ViraTek Inc., and Jinya Label compete with customization and local supply advantages. Emerging companies like GFB Solutions and Labelprint.com focus on innovation and regional service. Competition centers on recyclability claims, certification compliance, and automation readiness, ensuring wash-off labels remain core to sustainable packaging strategies.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| By Material Type | PP, PET, PE, Paper-Based, Biodegradable |

| By Adhesive Type | Water-Based, Hot-Melt, Solvent-Based, Acrylic |

| By Printing Technology | Flexographic, Digital, Offset, Gravure |

| By Application | Beverage Bottles, Food Jars, Cosmetics, Pharmaceuticals, Household |

| By End-Use Industry | Food & Beverages, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, Household & Cleaning, Retail & E-commerce |

| Key Companies Profiled | CCL Label, UPM Raflatac, HERMA Labels, Adcraft Labels, ViraTek Inc., Scanvaegt Labels, Avery Dennison Corporation, GFB Solutions, Jinya Label |

| Additional Attributes | Growth driven by sustainability mandates, recyclability targets, and beverage packaging demand. |

The market will be valued at USD 1.3 billion in 2025.

The market will reach USD 2.5 billion by 2035.

The market will grow at a CAGR of 6.6% during 2025-2035.

Polypropylene will lead with a 35.8% share in 2025.

Water-based adhesives will dominate with a 42.6% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Labels Market Forecast and Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Labels, Tapes And Films Market Size and Share Forecast Outlook 2025 to 2035

Labeling Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Label Printers Market Size, Growth, and Forecast 2025 to 2035

Labelling Machine Market Growth & Industry Trends through 2035

Competitive Overview of Labels Companies

Key Players & Market Share in the Label Applicators Industry

Competitive Breakdown of Labeling Equipment Providers

Labeling Software Market Growth - Trends & Forecast through 2034

Label Printing Software Market – Smart Labeling & Automation

GHS Label Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

GMO Labelling Market Size and Share Forecast Outlook 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among USA Labels Providers

Leading Providers & Market Share in GHS Label Industry

Foam Labels Market Trends and Growth 2035

Market Share Breakdown of Foil Labels Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA