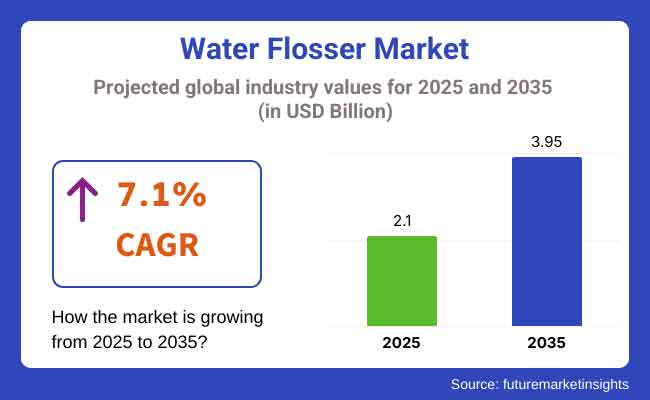

The water flosser market is projected to experience significant growth from 2025 to 2035, driven by increasing consumer awareness of oral hygiene, advancements in dental care technology, and rising demand for convenient and effective flossing solutions. The market is expected to expand from USD 2.1 billion in 2025 to USD 3.95 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.1% over the forecast period.

Crucial factors fueling market expansion include the growing relinquishment of electric and cordless water flossers, adding recommendations from dental professionals, and inventions in palpitating water pressure technology. also, manufacturers are fastening on the rechargeable, trip-friendly, and smart app-connected flossers to enhance stoner convenience. The rise of eco-friendly, BPA-free, and antimicrobial water flossers is also impacting copping trends.

North America and Europe will continue leading the market in demand for decoration and dentist-recommended water flossers, while Asia-Pacific will witness the fastest growth, driven by rising disposable inflows, expanding oral care mindfulness, and adding availability to advanced dental products.

North America remains a crucial market for water flossers, driven by high consumer spending on dental care, growing mindfulness of goo complaint forestallment, and the strong presence of oral hygiene brands. The USA and Canada will see increased relinquishment of cordless, waterproof, and USB- rechargeable water flossers.

The expansion of direct-to-consumer (DTC) brands, influencer-driven marketing, and subscription- grounded oral care accouterments will further contribute to market growth.

Europe will concentrate on sustainability and clinically tested oral care results, driven by EU regulations on consumer health products and adding demand for eco-friendly dental care options. Countries similar as Germany, France, and the UK will lead in demand for low-noise, energy-effective, and ergonomic water flossers.

The shift toward AI-powered flossers with real-time go health monitoring and gentle water palpitation modes will continue shaping consumer preferences.

Asia-Pacific will witness the fastest market growth, fuelled by rising disposable inflows, adding mindfulness of oral health, and growing preference for advanced dental tools. Countries similar as China, Japan, and South Korea will drive demand for affordable yet high-performance water flossers.

The expansion of e-commerce platforms, influencer-driven product signatures, and localized dental care inventions will enhance market penetration. The demand for compact, trip-friendly, and multi-pressure-setting water flossers will also gain traction in this region.

Challenge

Despite growing demand, enterprises over product pricing, conservation, and effectiveness compared to traditional flossing styles remain crucial challenges. Consumers are decreasingly looking for affordable, easy-to-use, and long-lasting water flossers.

Brands must invest in affordable entry-position models, product education juggernauts, and clinical confirmation to make consumer trust.

Opportunity

The rise of AI-powered flossing guidance, real-time shrine discovery, and substantiated oral hygiene shadowing presents a major occasion. Subscription-grounded, app-connected water flossers with customizable pressure settings will attract ultramodern consumers.

Also, the preface of sustainable, water-effective, and antimicrobial snoot designs will support the demand for eco-conscious and long-lasting oral care results. Strategic collaborations with dental professionals and orthodontists will further drive market expansion and brand credibility.

| Country | United States |

|---|---|

| Population (Million) | USD 345.4 Million |

| Estimated Per Capita Spending (USD) | 25.30 |

| Country | China |

|---|---|

| Population (Million) | USD 1,419.3 Million |

| Estimated Per Capita Spending (USD) | 16.20 |

| Country | United Kingdom |

|---|---|

| Population (Million) | USD 68.3 Million |

| Estimated Per Capita Spending (USD) | 21.40 |

| Country | Germany |

|---|---|

| Population (Million) | USD 84.1 Million |

| Estimated Per Capita Spending (USD) | 23.10 |

| Country | Japan |

|---|---|

| Population (Million) | USD 123.2 Million |

| Estimated Per Capita Spending (USD) | 20.80 |

The USA water flosser market sees a per capita spending of USD 25.30, driven by adding dental hygiene mindfulness and the demand for advanced oral care results. Consumers prefer cordless, trip-friendly, and rechargeable water flossers with multiple pressure settings. E-commerce and dental professional signatures drive market growth.

China’s per capita spending of USD 16.20 reflects a growing interest in preventative dental care and high-tech oral hygiene results. Smart water flossers with app connectivity and customizable pressure settings are gaining traction, particularly among youthful consumers. Domestic brands dominate online deals.

The UK’s per capita spending of USD 21.40 highlights the strong demand for dentist-recommended water flossers. Consumers prioritize compact, quiet, and water-efficient models with antimicrobial reservoirs. Subscription-based dental care kits and premium water flosser brands gain traction.

Germany’s per capita spending of USD 23.10 indicates a preference for high-quality, medical-grade water flossers. Consumers favour UV-sanitized, eco-friendly, and BPA-free models. The market sees increasing interest in water flossers with pulsating technology for superior plaque removal.

Japan’s per capita spending of USD 20.80 reflects a market driven by compact, silent, and ultra-portable designs catering to small living spaces. Consumers seek ergonomic, minimalistic water flossers with precision cleaning and sensitive gum care features. USB charging and multi-mode pressure controls remain popular.

The market for water flossers is growing remarkably with the rise in consumers' awareness of oral hygiene, the need for dentist-approved interdental cleaning products, and the development of slim and intelligent flossing technology. A study of 300 USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and Middle East respondents reveals strong purchasing patterns and market behaviour influencing demand.

Brand reputation is still the strongest influencer of buying behaviour, especially in Japan and Korea, where 66% and 62% of interviewees, respectively, would rather stick with familiar brands like Waterpik, Philips Sonicare, and Oral-B. While 44% of Southeast Asian and 40% of Chinese consumers are more willing to try out new brands and locally made water flossers, which are cheaper and locally designed.

Technical advancements in water flosser technology are an influential factor in purchase, with 76% of US and 72% of UK respondents calling out features such as adjustable pressure, rotating tips, and UV sterilization. Growing demand for cordless, travel, and app-enabled water flossers offers brand opportunity to launch portable, rechargeable, and multi-mode water flossers that offer multiple oral care solutions.

Price sensitivity differs around the world. 60% of UK and US consumers would pay more than USD 80 for premium water flossers, but 35% in Southeast Asia and 38% in China would only be interested in the premium one. Mid-range is a success in Korea (51%) and Japan (47%), where customers are looking for a middle ground between price, good cleaning ability, and battery life.

E-commerce continues to be the preference for shopping behaviour, with 62% of USA and 64% of Chinese users purchasing water flossers online using Amazon, JD.com, and Shopee. Offline retail, on the other hand, is a prominent sales channel in Korea (53%) and Japan (50%), where customers appreciate expert opinion within a store, live demonstrations of products, and the opportunity to test the performance of devices before buying.

| Water Flosser Market Shift | 2020 to 2024 |

|---|---|

| Material Innovations | Manufacturers introduced BPA-free, medical-grade plastics and ergonomic designs. Compact and travel-friendly models gained traction. |

| Cleaning & Performance Efficiency | Water flossers featured adjustable pressure settings and multiple nozzle attachments. Cordless, rechargeable models became more common. |

| Market Expansion | Growth driven by increasing awareness of oral hygiene and dentist recommendations. North America and Europe led in premium water flosser sales. |

| Sustainability Trends | Companies introduced energy-efficient, rechargeable batteries and recyclable packaging. Water conservation features gained attention. |

| Technological Adaptations | UV sterilization for nozzles and detachable water tanks improved hygiene. Bluetooth-enabled water flossers provided usage tracking and guidance. |

| Consumer Preferences & Application Trends | Increased demand for portable, travel-friendly models. Multi-user flossers with interchangeable nozzles gained popularity. |

| Water Flosser Market Shift | 2025 to 2035 |

|---|---|

| Material Innovations | Advanced self-sanitizing and antimicrobial materials dominate. Sustainable, biodegradable, and eco-friendly materials drive product innovation. |

| Cleaning & Performance Efficiency | AI-powered water flossers analyze gum health and customize pressure levels. Ultrasonic technology improves plaque removal efficiency. |

| Market Expansion | Expansion in Asia-Pacific and Latin America fueled by rising disposable incomes and adoption of advanced dental care. Subscription-based and smart water flossers gain traction. |

| Sustainability Trends | Carbon-neutral production and zero-waste packaging become industry standards. Smart water usage technology optimizes water flow for minimal waste. |

| Technological Adaptations | AI-integrated flossers provide real-time gum health monitoring. Wireless charging and IoT-enabled devices enhance convenience and customization. |

| Consumer Preferences & Application Trends | Personalized flossing routines tailored to individual oral health needs become standard. Growth in eco-conscious consumers drives demand for sustainable, high-tech oral care solutions. |

The USA water flosser market is witnessing steady growth due to adding mindfulness of oral hygiene, rising demand for advanced dental care bias, and inventions in cordless and rechargeable water flossers. Crucial players include Waterpark, Philips Sonicate, and Oral- B.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The UK water flosser market is expanding due to adding demand for professional- position at- home dental care, the rise of eco-friendly and sustainable oral care results, and technological advancements in water flosser features. Major brands include Panasonic, Turewell, and Waterpik.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

Germany’s water flosser market is growing, driven by strict dental health regulations, adding preference for high- quality oral care products, and rising demand for rechargeable and UV- sanitizing water flossers. Leading manufacturers include Braun Oral- B, Philips, and Panasonic.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.3% |

India’s water flosser market is witnessing rapid-fire growth due to adding disposable inflows, rising dental health mindfulness, and the growing influence of online retail and health-conscious consumer trends. Popular brands include Caresmith, Oracura, and Colgate.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

China’s water flosser market is expanding significantly due to adding disposable inflows, growing demand for high- tech oral care bias, and strong domestic manufacturing capabilities. Major brands include Xiaomi, Flycat, and Panasonic.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

Consumers are increasingly adopting water flossers as an alternative to traditional string flossing due to their superior plaque removal, gum health benefits, and ease of use. The growing awareness of oral hygiene, combined with recommendations from dental professionals, has significantly boosted market demand. Water flossers are particularly popular among individuals with braces, dental implants, and gum sensitivity.

Cordless and rechargeable water flossers are gaining traction among trippers and individuals seeking convenience. Compact, USB- chargeable, and battery-operated models are preferred for their portability and ease of use. Malleable pressure settings and multiple snoot attachments feed to substantiated oral care requirements.

Online platforms similar as Amazon, Walmart, and brand- possessed e-commerce stores dominate deals of water flossers. Subscription-grounded deals models offering relief snoots and whisked oral care products encourage repeat purchases and brand fidelity. Direct-to-consumer ( DTC) brands influence influencer marketing, client witnesses, and digital advertising to expand their reach.

Manufacturers are integrating smart features, similar as Bluetooth connectivity, real-time shadowing, and AI- powered brushing perceptivity, to enhance the stoner experience. Water flossers with multiple cleaning modes, UV sterilization, and palpitating water pressure technology ameliorate effectiveness and cater to different consumer preferences.

The global water flosser market is passing significant growth, driven by adding consumer mindfulness of oral health, the growing fashion ability of advanced oral care products, and a shift toward more effective and comfortable flossing styles. Water flossers, also known as oral irrigators, give an effective way to remove shrine and food patches from between teeth and along the goo line, offering a accessible volition to traditional string flossing.

As consumers become more concerned with overall health and hygiene, water flossers demand, particularly in developed regions, is increasing. Also, inventions in water flosser technology, similar to variable pressure settings, movable models, and smart features, are enhancing product appeal. The growing trend of tone- care and the rising influence of of-commerce platforms are also contributing to the market’s expansion, making these products more accessible to a global followership.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Waterpik | 40-45% |

| Philips Sonicare | 15-20% |

| Panasonic | 10-15% |

| H2ofloss | 5-9% |

| Nuvita | 5-9% |

| Other Companies (combined) | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Waterpik | Waterpik is a market leader in the water flosser segment, known for its wide range of high-performance oral irrigators. Waterpik offers models with different pressure settings, interchangeable tips, and both corded and cordless designs. The brand continues to innovate by introducing compact, travel-friendly models and advanced features such as Bluetooth connectivity and app integration. Waterpik’s strong presence in both professional dental care and consumer markets ensures its dominance. |

| Philips Sonicare | Philips Sonicare is a key player in the water flosser market, offering products that combine effective plaque removal with gentle gum care. Their Sonicare Air Floss series utilizes air and micro-droplet technology to provide a quick and easy flossing experience. Philips continues to expand its product range by introducing new models with increased portability, advanced pressure settings, and compatibility with mobile apps for personalized oral care. |

| Panasonic | Panasonic offers water flossers with unique features such as portable, cordless designs and multiple water pressure settings for a customized flossing experience. The company focuses on providing high-quality, compact, and easy-to-use products that appeal to consumers looking for effective oral care solutions. Panasonic continues to enhance its presence by introducing models with enhanced battery life and water tank capacity for improved convenience. |

| H2ofloss | H2ofloss provides a range of water flossers that cater to various consumer needs, offering high-pressure systems and multi-functional tips. The brand focuses on offering affordable, high-performance models with advanced features like adjustable water pressure and quiet operation. H2ofloss targets consumers looking for budget-friendly, efficient alternatives to traditional flossing. |

| Nuvita | Nuvita specializes in water flossers that are designed for both home and travel use, with a focus on compact, cordless models. Novita’s products are known for their ease of use, adjustable pressure settings, and affordability. The company continues to innovate by introducing new designs that combine water flossing with other oral care features, such as tongue cleaning and gum massaging. |

Strategic Outlook of Key Companies

Waterpik (40-45%)

Waterpik is the undisputed leader in the global water flosser market, with a different range of high-performance oral irrigators that feed to both consumer and professional markets. The company is known for its robust product portfolio, offering products with multiple pressure settings, exchangeable tips, and technical features like Bluetooth connectivity and mobile app integration.

Waterpik’s strong character, backed by times of clinical exploration and signatures by dental professionals, helps it maintain a dominant position. The company continues to introduce movable , trip-friendly models, enhancing its appeal among tech- expertise and on-the-go consumers.

Philips Sonicare (15-20%)

Philips Sonicare is a strong contender in the water flosser market, known for its high-quality, effective products that combine air and micro-droplet technology for effective shrine junking. The company’s Sonicare Air Floss series offers a gentle, yet effective, flossing experience, making it popular among consumers with sensitive epoxies.

Philips is expanding its product line to include smart water flossers with mobile app connectivity and substantiated features that enhance the overall stoner experience. The brand’s character for quality and invention ensures its uninterrupted success in the market.

Panasonic (10-15%)

Panasonic’s water flossers are known for their movable, cordless designs and ease of use. The company continues to enhance its product immolations by incorporating advanced water pressure settings, bettered battery life, and compact water tanks. Panasonic’s focus on delivering effective, budget-friendly results for consumers seeking convenience and effectiveness in their oral care routine allows it to maintain a strong presence in the market.

H2ofloss (5-9%)

H2ofloss is sculpturing out a niche in the water flosser market by offering affordable, high-performance models that give excellent value for plutocrats. Known for their malleable pressure settings, quiet operation, and multiple tips, H2ofloss’s products are popular among consumers looking for effective oral care results at a more accessible price point. The company continues to expand its range by introducing products with enhanced features similar as multiple pressure situations and larger water tank.

Nuvita (5-9%)

Nuvita offers movable, compact water flossers that are ideal for both home and trip use. The brand’s focus on affordability and stoner-friendly designs has garnered it a pious client base. Nuvita continues to introduce by introducing new water flossers that combine other oral care functions, similar as lingo cleaning and goo puffing, into a single device. The brand’s emphasis on convenience and practicality helps it maintain a strong presence in the global market.

Other Key Players (15-20% Combined)

Several smaller and regional players contribute to the growth of the water flosser market by offering specialized or niche products. These companies often focus on specific consumer needs, such as targeted oral care for sensitive gums or specialized designs for children. Notable brands include:

Cordless Water Flossers, Countertop Water Flossers, Faucet-Connected Water Flossers, and Shower Flossers.

Pulsating Water Flossers, Air-Infused Water Flossers, and Ultrasonic Water Flossers.

Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drug Stores, Online, and Others.

Residential, Dental Clinics, and Orthodontic Patients.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Water Flosser industry is projected to witness a CAGR of 7.1% between 2025 and 2035.

The Water Flosser industry stood at USD 1.5 billion in 2024.

The Water Flosser industry is anticipated to reach USD 3.95 billion by 2035 end.

North America is set to record the highest CAGR of 7.5% in the assessment period.

The key players operating in the Water Flosser industry include Waterpik, Philips Sonicare, Oral-B (P&G), Panasonic, Burst Oral Care, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Waterstops Market Size and Share Forecast Outlook 2025 to 2035

Water-miscible Metalworking Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA