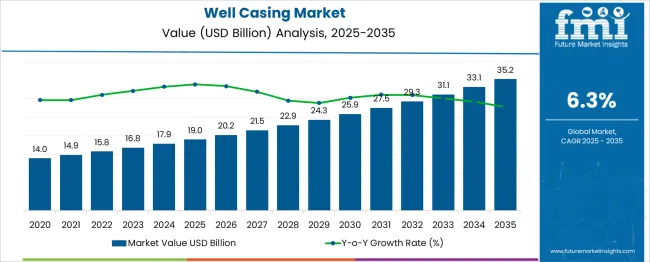

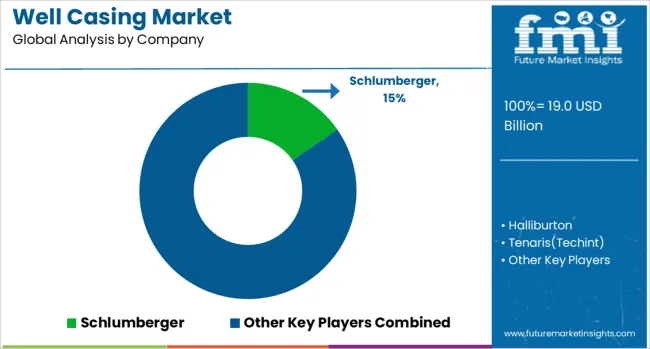

The Well Casing Market is estimated to be valued at USD 19.0 billion in 2025 and is projected to reach USD 35.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

The market is expected to grow at an absolute dollar gain of USD 16.2 billion. From 2025 to 2030, the market rises to USD 25.9 billion, reflecting a gain of USD 6.9 billion in the first half of the forecast period. Year-over-year growth rates are consistent: 2026 at USD 20.2 billion (+6.3%), 2027 at USD 21.5 billion (+6.4%), 2028 at USD 22.9 billion (+6.5%), 2029 at USD 24.3 billion (+6.1%), and 2030 at USD 25.9 billion (+6.6%).

The steady global drilling activity in both conventional and unconventional reservoirs drives this growth. Well casing remains a critical component of drilling infrastructure, providing structural integrity and zonal isolation. According to SPE publications and IADC guidelines, demand for casing is closely linked to rig count, lateral length, and well complexity.

In regions like the USA Permian Basin, longer laterals and multi-stage completions increase casing footage per well. Meanwhile, international deepwater and high-pressure wells require more advanced casing grades. The market’s expansion through 2030 reflects operational demand, particularly in areas focused on reservoir lifecycle optimization and production continuity.

| Metric | Value |

|---|---|

| Well Casing Market Estimated Value in (2025 E) | USD 19.0 billion |

| Well Casing Market Forecast Value in (2035 F) | USD 35.2 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The well casing market is primarily driven by the oil and gas sector, with onshore exploration and production accounting for approximately 70% of global demand. Onshore wells dominate due to easier access, lower drilling costs, and established infrastructure in major oil-producing regions. Casing is essential in these wells for maintaining borehole integrity, isolating groundwater layers, and withstanding pressure during extraction. Offshore oil and gas operations contribute around 30% of the market.

Although smaller in volume, offshore drilling requires advanced casing solutions due to the extreme environmental and pressure conditions in deepwater and ultra-deepwater reserves. This segment is steadily growing with increased offshore exploration activity. Beyond oil and gas, geothermal energy wells represent a small but rising share. These wells demand high-temperature, corrosion-resistant casing, particularly as governments support cleaner energy sources.

Water well drilling, used for municipal, industrial, and agricultural water supply, accounts for a modest portion of the market but provides consistent demand, especially in developing regions. Mining and mineral exploration applications use well casing in dewatering and exploration boreholes, though this remains a niche use case. While oil and gas remain dominant, diversification into geothermal, water, and mining sectors is gradually shaping the future outlook of the well casing market.

The well casing market is experiencing sustained growth as global exploration and production activities intensify across both conventional and unconventional reserves. Increasing complexity in well architecture and rising depth of drilling operations have necessitated the use of durable, high-pressure resistant casing solutions. The need to isolate different subsurface zones, prevent fluid migration, and maintain well integrity under high thermal and mechanical stress has pushed oilfield operators to adopt advanced casing materials and configurations.

Shale development in North America, deepwater projects in South America and Africa, and enhanced oil recovery initiatives in the Middle East are collectively fueling demand. Technological innovations in casing centralizers, expandable tubular systems, and cementing hardware are also enabling operators to reduce non-productive time and improve operational efficiency.

Environmental regulations and safety standards are further supporting the adoption of high-performance casing systems that ensure structural stability and zonal isolation. Looking ahead, the market is expected to benefit from the integration of digital well planning tools and data-driven casing design optimization, paving the way for smart and cost-efficient drilling solutions.

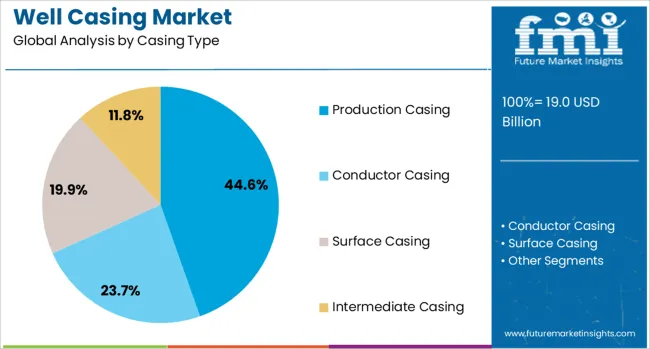

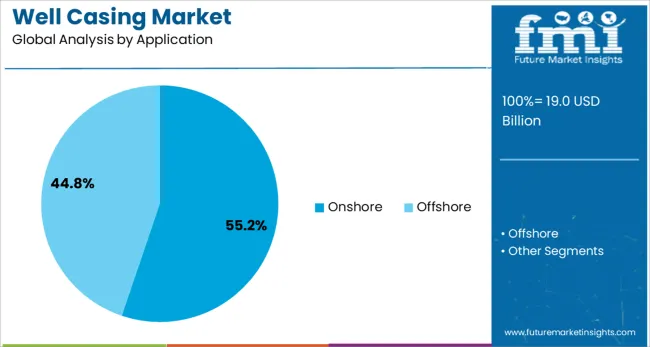

The well casing market is segmented by casing type, application, and geographic regions. The well casing market is divided by casing type into Production Casing, Conductor Casing, Surface Casing, and Intermediate Casing. In terms of application, the well casing market is classified into Onshore and Offshore. Regionally, the well casing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The production casing segment is anticipated to contribute 44.6% of the total revenue share in the well casing market in 2025, establishing it as the dominant casing type. This segment’s leading position is being reinforced by its critical role in maintaining long-term well integrity and facilitating controlled production flow. Production casing is installed after drilling is completed and is essential for isolating production zones, providing structural support, and preventing contamination between different reservoir layers.

Its usage has become increasingly prevalent due to rising exploration depths and more challenging pressure and temperature environments. Operators have favored production casing for its ability to accommodate artificial lift systems, downhole sensors, and advanced completion tools that enhance reservoir performance.

Improvements in metallurgy and premium connections have enhanced its durability, corrosion resistance, and sealing efficiency under high-pressure environments. The growing adoption of horizontal and multilateral drilling techniques has further elevated the need for reliable casing infrastructure, making production casing indispensable for sustainable and high-yield extraction operations.

The onshore application segment is projected to account for 55.2% of the total revenue share in the well casing market in 2025, positioning it as the leading deployment environment. This dominance is being driven by the extensive number of land-based drilling projects across regions such as North America, the Middle East, and parts of the Asia Pacific, where shale, tight oil, and heavy oil reservoirs are being actively developed.

Onshore fields are generally more accessible, allowing faster project turnaround times and cost-effective casing installation compared to offshore environments. The segment’s growth is further supported by technological advancements in land rig mobility, directional drilling, and wellbore stability management, all of which have reduced downtime and improved casing efficiency.

Higher frequency of workovers and re-entries in mature onshore fields has increased the demand for casing replacement and reinforcement. National energy programs, favorable licensing policies, and increasing private sector participation in land drilling activities have reinforced the onshore segment’s role as a high-volume consumer of casing solutions.

Demand is increasing for robust well casing solutions that ensure structural integrity and safety across oil, gas, geothermal, and water drilling operations. Key opportunities are emerging through alloy innovations, local fabrication hubs, and bundled inspection services that support long-term well performance.

Drilling contractors and energy operators are specifying high strength steel and corrosion resistant alloys for well casing installations to withstand pressure fluctuations, chemical exposure, and prolonged subsurface conditions. Casing must support borehole stability during drilling, cementing and production phases. Environments with high salinity, acidic gas or hydrogen sulfide exposure require premium grades such as stainless or nickel alloy casing to prevent failure. Operators demand consistent dimensional tolerance, welding seam quality and resistance to downhole erosion. Because downtime is costly in deep or offshore wells, reliability and long service life are essential. Regulatory safety standards for well blowout prevention and groundwater protection further reinforce need for certified casing materials and traceable supply chains.

Growth opportunities exist in providing preconfigured casing kits that include coupled strings, centralizers and end connectors tailored to specific well designs. Suppliers can collaborate with drilling service providers and engineering firms to deliver kits ready for deployment and testing, shortening rig preparation time. Offering casing inspection as a service covering ultrasonic testing, thread torque verification and surface coating evaluation adds value by ensuring installation quality. Establishing regional fabrication and threading centers near drilling hubs reduces lead time, shipping costs and import complexity. Offering rental or lease plans for casing spools along with local support for casing retrieval and recycling helps operators manage capital and environmental considerations. Technical assistance and training programs for rig staff further improve casing performance and integration into well operations.

Well casing producers must continuously meet stringent casing grade and corrosion standards, especially for deepwater and high-temperature reservoirs. Variability in well conditions—such as high CO₂, H₂S content, or fluctuating geomechanical profiles requires casing materials with exact chemical resistance and tensile strength profiles. Consistently sourcing grade L80 or P110 casing with controlled alloy composition presents manufacturing challenges. Corrosion-resistant liners or premium connections add cost and require qualification testing. Without consistent metallurgical control and performance testing, casing failures can lead to major well integrity risks. Field failures increase maintenance and can reduce production uptime. Manufacturers lacking quality traceability or repeatable material analysis protocols struggle to secure contracts in mature fields or offshore environments where failure tolerance is extremely low.

Unconventional drilling operations in shale and deep offshore installations offer strong expansion potential for casing suppliers. These wells demand high-strength and specially-tubed casings capable of withstanding high bottom-hole pressure and thermal cycling. Rising activity in regions with shale development or deep offshore expansion translates into increasing casing demand. Suppliers that provide premium quenched-and-tempered pipe or nickel-alloyed liners gain preference. Operational efficiency becomes a differentiator: premium casing that supports expandable liners or slim-hole profiles reduces installation cost and enhances recovery. As new wells target deeper targets or expanded lateral lengths, material volumes per well increase. Providers supporting these requirements and offering regional warehousing or logistics support capture stronger share among E&P companies seeking reliability under challenging downhole conditions.

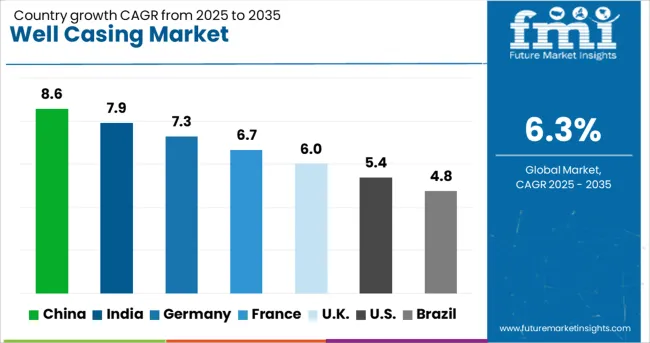

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 7.9% |

| Germany | 7.3% |

| France | 6.7% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.8% |

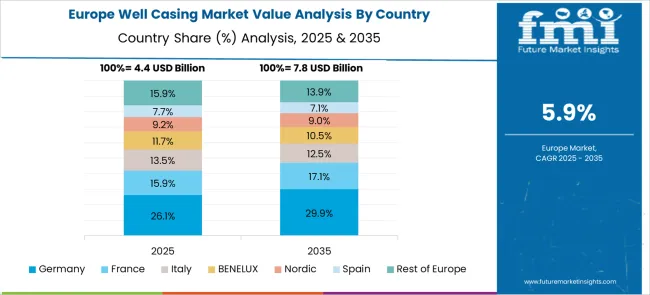

China, part of the BRICS group, is projected to grow at an 8.6% CAGR from 2025 to 2035, supported by continued upstream drilling activities across shale basins and rising domestic steel casing output. India follows at 7.9%, where enhanced oil recovery programs and expanding geothermal exploration are increasing demand for cemented and non-cemented casing installations. Within the OECD, Germany is growing at 7.3%, with steady consumption across mature oilfields, groundwater extraction projects, and structural reinforcements in legacy well systems.

France, with a 6.7% CAGR, is witnessing demand from deep well monitoring infrastructure and specialized casing applications in environmental geotechnics. The United Kingdom, at 6.0%, maintains volume through offshore casing installations and refurbishment work in existing subsea wells and coastal exploration sites. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is leading the well casing market with a CAGR of 8.6%, supported by robust domestic oil and gas drilling activities and infrastructure expansion. Government-backed exploration projects and energy independence goals are driving the use of durable casing materials. Chinese manufacturers are producing advanced steel grades and threaded designs to support both onshore and offshore applications. Seamless casings are gaining popularity for their corrosion resistance and load-bearing capacity. Automation in casing pipe production is improving consistency and reducing costs. Growing demand in coal bed methane and geothermal drilling is adding further momentum. With increasing investments in domestic energy extraction and tight timelines for exploration blocks, prefabricated and ready-to-deploy casing solutions are in high demand. Export growth is also significant, especially to energy-intensive countries in Asia and Africa that rely on cost-efficient Chinese casing technologies.

India is witnessing a CAGR of 7.9% in the well casing market, driven by rising oil and gas exploration, as well as increasing interest in geothermal and coal bed methane drilling. Public sector energy firms are investing in domestic exploration to reduce import dependence, spurring demand for well casing solutions. Indian manufacturers are enhancing production of welded and seamless casing pipes that comply with API standards. The country is also importing specialized casing for deep and ultra-deep drilling from global suppliers. Casing deployment is expanding in the eastern and western sedimentary basins. Adoption of high-collapse and anti-corrosion casing is growing, especially in challenging drilling environments. Cost sensitivity remains high, encouraging innovations in material efficiency and pipe lifecycle extension. Training and certification programs are improving casing installation and maintenance practices across oilfields.

Germanys well casing market is growing at a CAGR of 7.3% due to increased geothermal exploration, carbon capture projects, and underground energy storage needs. Emphasis on sustainability and clean energy transition is shifting focus toward long-life, corrosion-resistant casing materials. German engineering firms are producing precision-made casing pipes for high-pressure and high-temperature wells. Advanced welding techniques and material testing protocols are ensuring quality compliance. The country is developing pilot projects for hydrogen storage in underground formations, further driving casing demand. Environmental regulations require tight sealing and durability, prompting the use of multilayer composite casing in some locations. Customized casing solutions are being adopted in shallow and deep well setups across Germany. Import substitution strategies are supporting local production expansion.

France is experiencing a 6.7% CAGR in the well casing market, supported by its focus on geothermal energy, environmental safety, and carbon capture initiatives. French energy firms are adopting well casing solutions that align with EU standards for emissions and groundwater protection. Modular and corrosion-resistant casing types are in demand for use in thermal and pilot storage wells. Domestic manufacturers are working with research institutions to develop new casing materials suited for long-term deployment. Regional drilling programs in the south and west of France are driving demand for anti-corrosion and easy-to-install casing products. Cross-border projects with neighboring countries are also influencing design standards. Import reliance is being reduced through incentives for local casing pipe production. Greater digital monitoring and real-time stress testing are improving casing reliability in field conditions.

The United Kingdom well casing market is growing at a CAGR of 6.0 percent, supported by offshore oilfield maintenance, geothermal energy trials, and regulatory upgrades in well integrity. British operators are deploying casing systems in both mature fields and new offshore zones to ensure environmental compliance. Casing design is being optimized for easier installation and reduced risk of wellbore collapse. Domestic suppliers are offering quick-turnaround casing pipe fabrication with digital quality control. The UK is also participating in carbon capture and hydrogen storage initiatives, where sealed casing systems are critical. Legacy oilfields in the North Sea are undergoing casing upgrades to extend operational life. Emphasis is placed on pressure integrity, corrosion resistance, and regulatory traceability. Partnerships with academic labs are fostering material testing for next-generation well casing products.

The well stimulation materials market is moderately consolidated and segmented into Tier 1 and Tier 2 suppliers, comprising global chemical corporations and specialized mining companies that support enhanced oil and gas recovery operations. Tier 1 suppliers are typically large-scale chemical manufacturers offering comprehensive portfolios of specialty materials essential to hydraulic fracturing (fracking), acidizing, and other well stimulation techniques.

These companies provide surfactants, friction reducers, scale inhibitors, biocides, and crosslinkers designed to improve reservoir permeability, minimize formation damage, and maximize hydrocarbon flowback. Their formulations are engineered for complex geological environments, enabling higher extraction efficiency while maintaining compatibility with formation chemistry and produced fluids.

These suppliers often operate globally, backed by integrated research and development capabilities, on-site technical services, and long-term relationships with major oilfield service providers and E&P operators. Tier 2 suppliers play a crucial role in the supply of granular materials, fluid enhancers, and gelling systems. These include companies focused on the production and refinement of high-purity proppants such as silica sand, resin-coated sand, and ceramic particles used to keep fractures open during stimulation.

Additionally, they offer gelling agents, clay stabilizers, and rheology modifiers that enhance fluid transport and control during downhole deployment. Tier 2 suppliers are vital for regional shale and tight oil plays, where consistent material quality and logistical efficiency are critical to operational success.

On June 4, 2025, Tenaris officially announced that Brava Energia had completed its first-ever casing drilling operation in production wells at the Alto do Rodrigues Field, within Brazil’s Potiguar Basin. Two vertical wells, approximately 380 meters deep, were drilled using Tenaris’s Rig Direct® casing drilling solution.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.0 Billion |

| Casing Type | Production Casing, Conductor Casing, Surface Casing, and Intermediate Casing |

| Application | Onshore and Offshore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger, Halliburton, Tenaris(Techint), Vallourec, PAOTMK(TrubnayaMetallurgicheskayaKompaniyaOAO), WeatherfordInternational, NOVInc.(NationalOilwellVarcoInc.), ForumEnergyTechnologies, TricanWellService, InnovexDownholeSolutions, and NeOzEnergy |

| Additional Attributes | Dollar sales by casing type such as conductor, surface, intermediate, and production casing, by connection thread type and by application segmented into on‑shore and offshore usage; demand driven by oil & gas exploration, deep‑water drilling, and geothermal projects; innovation in expandable tubular systems, IoT-enabled monitoring, and eco‑friendly materials; cost shaped by steel sourcing and manufacturing complexity. |

The global well casing market is estimated to be valued at USD 19.0 billion in 2025.

The market size for the well casing market is projected to reach USD 35.2 billion by 2035.

The well casing market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in well casing market are production casing, conductor casing, surface casing and intermediate casing.

In terms of application, onshore segment to command 55.2% share in the well casing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Well Stimulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Wellness Tourism Market Report – Growth & Demand 2025 to 2035

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

Wellbore Cleaning Tool Market Size, Share, Trend & Forecast 2024-2034

Wellhead System Market

Swellable Packers Market Growth - Trends & Forecast 2025 to 2035

Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Jewellery Box Market

Oilwell Completion Tools Market Analysis - Size, Share & Forecast 2025 to 2035

Global Pet Wellness Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Sexual Wellness Market Size and Share Forecast Outlook 2025 to 2035

Dipper Wells and Accessories Market - Sanitary Utensil Rinsing 2025 to 2035

Corporate Wellness Solution Market Size and Share Forecast Outlook 2025 to 2035

Corporate Wellness Software Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Workplace Wellness Market Size and Share Forecast Outlook 2025 to 2035

Leather Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

UK Sexual Wellness Market Trends – Size, Share & Innovations 2025-2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Health and Wellness Product Market Analysis – Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA