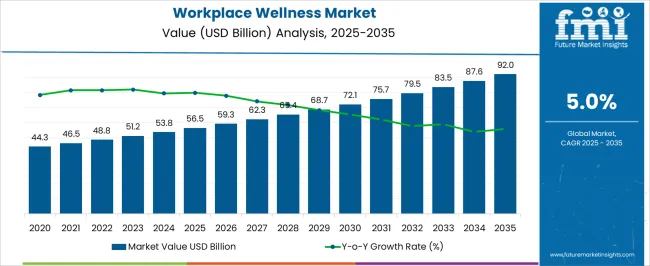

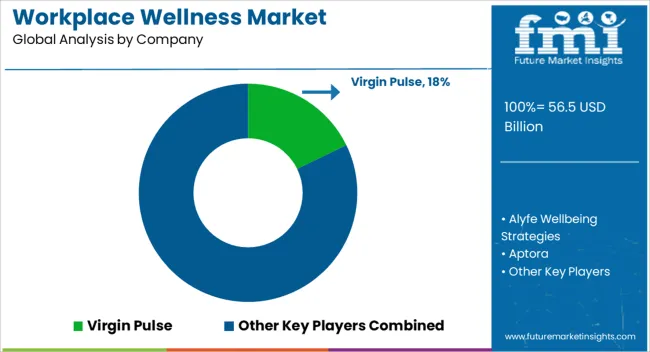

The workplace wellness market is projected to grow from USD 56.5 billion in 2025 to USD 92.0 billion by 2035, representing a CAGR of 5.0%. This growth corresponds to an absolute dollar opportunity of USD 35.5 billion over the decade. Expansion is driven by increasing investments in employee health programs, wellness services, and preventive care initiatives across corporate environments. Companies can capitalize on this growth by broadening service offerings, strengthening distribution and partnership networks, and enhancing program accessibility.

Over the next ten years, the USD 35.5 billion opportunity highlights a consistent and attractive growth trajectory for the workplace wellness market. By 2035, revenue will be supported by both new program adoption and expansion of existing wellness services across multiple industries. The CAGR of 5.0% indicates steady and reliable expansion, enabling companies to scale operations efficiently and strengthen regional and sectoral reach. Businesses can align sales, service, and delivery strategies with corporate demand to maximize returns. The absolute growth potential provides strong incentives for firms to maintain operational efficiency while capturing incremental revenue throughout the forecast period.

| Metric | Value |

|---|---|

| Workplace Wellness Market Estimated Value in (2025 E) | USD 56.5 billion |

| Workplace Wellness Market Forecast Value in (2035 F) | USD 92.0 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

In the early growth phase of the workplace wellness market, revenue expands steadily from USD 56.5 billion in 2025, reflecting a CAGR of 5.0%. Growth during this period is primarily driven by initial adoption of wellness programs and preventive health services among corporate clients. Companies focus on building service networks, establishing partnerships, and developing tailored wellness solutions to meet emerging demand. The absolute dollar opportunity in this phase is moderate, allowing firms to refine operations, test program offerings, and respond to client feedback. Early growth lays the foundation for scaling while maintaining manageable risk and steady revenue capture. In the late growth phase, approaching 2035 and a market size of USD 92.0 billion, the workplace wellness market experiences accelerated revenue capture due to broader adoption and expansion of existing programs.

Market strategies shift toward scaling services, increasing regional and industry penetration, and leveraging established client relationships. The absolute dollar opportunity in this stage is substantial, representing most of the USD 35.5 billion growth over the decade. Companies benefit from operational efficiencies and stronger brand recognition, ensuring the 5.0% CAGR translates into consistent and profitable growth. Late growth reflects a mature stage where market share optimization and program quality are critical for sustained success.

The workplace wellness market is witnessing notable growth as organizations increasingly recognize the direct correlation between employee well-being and productivity. Rising healthcare costs, increased stress levels, and a growing focus on preventive care have driven employers to adopt holistic wellness programs.

Government support through tax incentives and occupational health mandates is further encouraging corporate investment in wellness solutions. Additionally, the proliferation of digital health platforms and data analytics tools is enabling personalized interventions, scalable delivery, and measurable outcomes, making wellness strategies more accessible and outcome-driven.

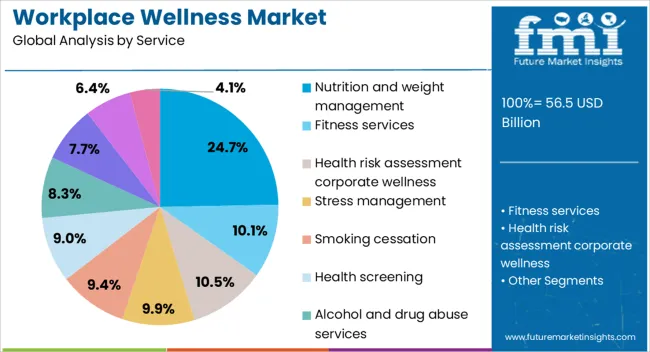

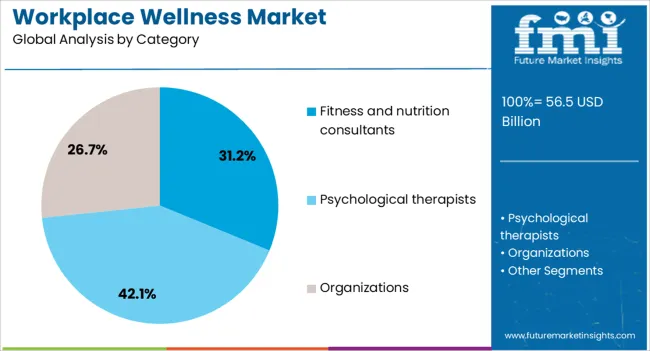

The workplace wellness market is segmented by service, category, end-user, delivery mode, and geographic regions. By service, the workplace wellness market is divided into Nutrition and weight management, Fitness services, Health risk assessment, corporate wellness, Stress management, Smoking cessation, Health screening, Alcohol and drug abuse services, Health education services, Biometric screening, and Others. In terms of category, the workplace wellness market is classified into Fitness and nutrition consultants, Psychological therapists, and Organizations.

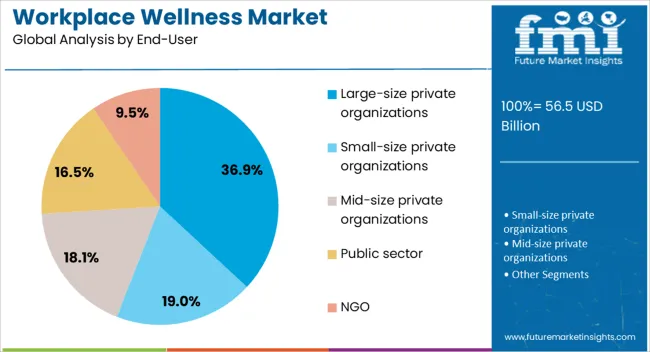

Based on end-user, the workplace wellness market is segmented into large-sized private organizations, small-sized private organizations, mid-sized private organizations, the Public sector, and NGO. By delivery mode, the workplace wellness market is segmented into Onsite and Offsite. Regionally, the workplace wellness industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Nutrition and weight management are projected to lead the services category with a 24.70% share in 2025. The increasing prevalence of obesity, lifestyle-related diseases, and sedentary work habits has prompted employers to implement structured nutrition plans and dietary coaching for their workforce.

Customized meal programs, on-site dietician consultations, and digital tracking apps are making these services highly scalable and measurable. This segment benefits from its preventive health orientation, aligning with broader corporate goals of reducing absenteeism, improving morale, and lowering insurance premiums.

The rising awareness around metabolic health and long-term productivity has further established its strategic importance in workplace wellness portfolios.

Fitness and nutrition consultants are expected to dominate the category segment with a 31.20% market share by 2025. Their prominence stems from the increasing corporate demand for specialized, personalized wellness solutions delivered both virtually and on-site.

These consultants offer hybrid wellness models that combine fitness training, ergonomic advice, stress management, and nutritional planning, catering to diverse workforce needs. As companies shift toward performance-based health outcomes, consultant-led programs offer flexibility, customization, and accountability.

The ability to scale across geographies and adapt to hybrid work structures makes this segment a critical enabler of holistic employee wellness.

Large-size private organizations are projected to lead the end-user segment with a 36.90% share in 2025. These organizations possess both the financial resources and scale to implement comprehensive wellness programs across multiple locations.

With workforce productivity and retention as top priorities, large firms are increasingly integrating wellness into corporate culture and HR strategies. Initiatives such as wellness platforms, biometric screenings, fitness reimbursements, and on-site medical support are commonly deployed.

The segment is further driven by shareholder expectations around ESG performance, workforce sustainability, and talent acquisition, reinforcing the role of large organizations in mainstreaming workplace wellness.

The workplace wellness market is expanding as organizations increasingly prioritize employee health, productivity, and engagement. Programs include mental health support, fitness initiatives, nutrition counseling, ergonomic assessments, and stress management solutions. Rising awareness of the link between employee well-being and organizational performance, coupled with the adoption of corporate social responsibility initiatives, is driving growth. Employers are investing in digital wellness platforms, on-site gyms, wearable devices, and personalized wellness plans. Providers offering integrated solutions, measurable outcomes, and easy program deployment are well-positioned to capture market opportunities. Additionally, remote work trends and hybrid workplace models have increased demand for virtual wellness programs, enhancing adoption globally across corporate, government, and educational institutions.

Market growth is constrained by high program implementation costs and challenges in employee engagement. Small and medium-sized enterprises may find investments in wellness platforms, fitness programs, or on-site facilities financially burdensome. Additionally, low participation rates, lack of motivation, or resistance to change can limit program effectiveness. Employers must balance cost with impact and provide engaging, accessible, and inclusive initiatives. Providers are addressing these challenges by offering scalable, modular solutions, virtual programs, incentive-based participation, and data-driven tracking of employee outcomes. Building awareness, demonstrating measurable ROI, and creating culturally sensitive programs are critical to increase adoption and sustain workplace wellness initiatives across organizations of varying sizes globally.

Market trends are shaped by digital platforms, wearable technology, and AI-driven analytics in workplace wellness programs. Employers are increasingly leveraging mobile apps, virtual coaching, and wearable fitness devices to monitor employee activity, stress, and health metrics. Artificial intelligence enables personalized wellness recommendations, predictive health insights, and automated reporting on program effectiveness. Virtual and hybrid delivery models provide flexibility for remote or distributed teams. These trends highlight the growing focus on technology-driven, data-informed wellness solutions that enhance employee engagement, improve health outcomes, and allow organizations to measure program impact accurately across diverse workplace environments globally.

Opportunities in the workplace wellness market are driven by increasing recognition of employee well-being, productivity, and retention benefits. Organizations are adopting wellness programs to reduce absenteeism, lower healthcare costs, and improve morale. Corporate wellness initiatives are also supported by health and labor regulations in certain regions, encouraging preventive care and mental health support. Emerging markets with rising corporate adoption and multinational companies implementing standardized wellness programs further expand potential. Providers offering customizable, measurable, and technology-enabled wellness solutions, including mental health services, physical fitness programs, and nutrition guidance, are positioned to benefit from growing corporate and institutional demand globally.

Budget limitations restrain market growth, challenges in measuring return on investment, and fragmented program offerings. Employers may struggle to justify expenditure on wellness programs without clear, quantifiable benefits. Diverse employee needs and preferences can result in inconsistent engagement, reducing program effectiveness. Fragmentation of wellness solutions across multiple vendors can complicate implementation and monitoring. Additionally, cultural and regional differences in health practices may affect adoption. Providers focusing on integrated, scalable, and measurable wellness solutions that demonstrate clear ROI, encourage participation, and cater to diverse workforces are critical to overcoming these restraints and driving broader adoption of workplace wellness initiatives globally.

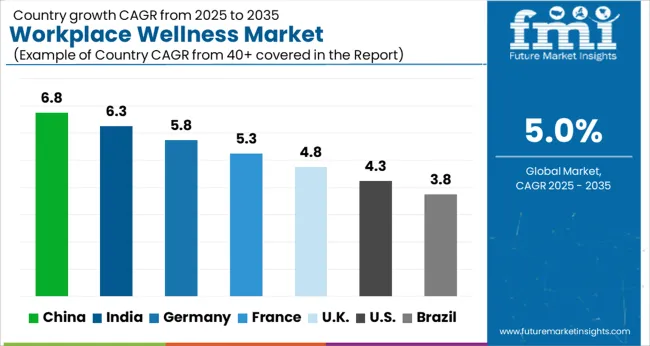

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global workplace wellness market is projected to grow at a CAGR of 5.0% through 2035, driven by demand across corporate offices, industrial facilities, and employee wellness programs. Among BRICS nations, China has been recorded with 6.8% growth, where production and deployment of health monitoring devices, ergonomic furniture, and wellness program solutions have been extensively carried out by companies such as Mindray, Xiaomi Health, and Huawei Health. India has been observed at 6.3%, supported by rising adoption in IT parks, corporate offices, and manufacturing units. In the OECD region, Germany has been measured at 5.8%, where production for employee wellness programs, workplace fitness solutions, and occupational health management has been steadily maintained. The United Kingdom has been noted at 4.8%, reflecting consistent use in corporate wellness initiatives, while the USA has been recorded at 4.3%, with deployment in corporate offices, industrial facilities, and health benefit programs being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The market for workplace wellness in China is expanding at a CAGR of 6.8%, driven by increasing corporate focus on employee health, productivity, and occupational well-being. Service providers and technology companies are offering wellness programs, mental health solutions, fitness initiatives, and ergonomic workplace solutions for corporate offices, industrial facilities, and government organizations. Government initiatives promoting occupational health, labor safety, and employee welfare encourage adoption. Pilot programs in large enterprises demonstrate benefits including improved employee engagement, reduced absenteeism, and enhanced productivity. Collaborations between wellness solution providers, corporate HR departments, and health technology companies are advancing digital wellness platforms, health monitoring tools, and ergonomic solutions. Growing awareness of employee well-being and corporate responsibility continues to drive the Chinese workplace wellness market.

The market for workplace wellness in India is growing at a CAGR of 6.3%, supported by rising corporate awareness of employee health, stress management, and productivity. Service providers supply wellness programs, mental health support, fitness initiatives, and ergonomic workplace solutions for offices, IT parks, and industrial facilities. Government initiatives promoting occupational health, labor welfare, and employee productivity foster adoption. Pilot deployments in corporate offices demonstrate operational benefits including improved employee engagement, reduced absenteeism, and better workplace morale. Collaborations between wellness service providers, corporate HR teams, and technology companies enhance wellness program effectiveness, monitoring tools, and health education. Increasing focus on employee well-being continues to drive growth in the Indian market.

The market for workplace wellness in Germany is recording a CAGR of 5.8%, driven by corporate employee health programs, occupational safety regulations, and ergonomic workplace adoption. Service providers supply mental health programs, fitness initiatives, wellness platforms, and ergonomic solutions for offices, industrial facilities, and public organizations. Government initiatives promoting employee well-being, occupational health, and labor safety support adoption. Pilot implementations in corporate offices and industrial facilities demonstrate benefits including reduced absenteeism, enhanced productivity, and improved employee satisfaction. Collaborations between wellness service providers, corporate HR departments, and health technology companies are enhancing program efficiency, digital platforms, and monitoring systems. Germany’s strong focus on workplace safety and employee health supports sustained growth in the market.

The market for workplace wellness in the United Kingdom is growing at a CAGR of 4.8%, supported by corporate wellness programs, occupational health awareness, and employee productivity initiatives. Service providers supply mental health support, fitness initiatives, ergonomic solutions, and digital wellness platforms for offices, healthcare facilities, and corporate campuses. Government initiatives promoting occupational health, labor welfare, and employee safety encourage adoption. Pilot programs in corporate offices demonstrate operational benefits including higher employee engagement, reduced absenteeism, and better workplace morale. Collaborations between wellness providers, corporate HR teams, and technology companies enhance program delivery, monitoring tools, and ergonomics. Increasing corporate focus on employee well-being continues to drive the UK market.

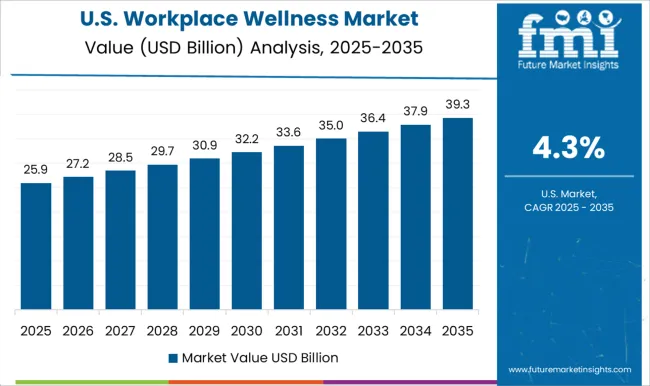

The market for workplace wellness in the United States is expanding at a CAGR of 4.3%, driven by corporate focus on employee health, mental well-being, and productivity optimization. Service providers supply fitness programs, wellness platforms, mental health initiatives, and ergonomic workplace solutions for offices, industrial facilities, and healthcare organizations. Government initiatives promoting occupational health, employee safety, and public health support adoption. Pilot deployments in corporate offices demonstrate operational benefits including improved productivity, reduced absenteeism, and enhanced employee engagement. Collaborations between wellness solution providers, HR departments, and technology companies enhance program effectiveness, digital monitoring, and ergonomic solutions. Growing awareness of employee well-being and corporate responsibility continues to support growth in the USA market.

Virgin Pulse, Alyfe Wellbeing Strategies, and Aptora provide workplace wellness solutions, including employee engagement platforms, fitness tracking, and wellness analytics, with brochures highlighting program modules, data dashboards, and integration with HR systems. BSDI and Burner Fitness supply corporate fitness and wellness programs, with technical literature detailing activity tracking, scheduling features, and personalized recommendations. Ceridian Lifeworks and Cerner Wellness offer digital wellness platforms, with brochures emphasizing mental health modules, biometric data integration, and reporting capabilities. CoreHealth Technologies and HealthifyMe Wellness provide holistic wellness software, with datasheets presenting health risk assessments, nutrition tracking, and engagement analytics. Infinite Wellness Solutions and Limeade deliver cloud-based solutions for employee well-being, with brochures highlighting mobile accessibility, gamification, and participation metrics. MediKeeper, Namaste New York, and NC State Human Resources supply tailored wellness programs, with literature detailing program flexibility, reporting dashboards, and intervention tracking.

Sprout, Wellness Layers, and Wellsource provide comprehensive employee wellness services, with brochures presenting wellness challenges, preventive care modules, and ROI measurement tools. Other regional players compete through specialized programs, cost-effective platforms, and integration with local HR systems, with brochures focused on usability, scalability, and measurable health outcomes. Market strategies focus on employee engagement, data-driven outcomes, and platform integration. Product development emphasizes mobile-friendly interfaces, personalized wellness plans, and analytic reporting capabilities. Partnerships with HR departments, corporate wellness consultants, and health service providers are leveraged to expand adoption and optimize program implementation. Observed industry patterns indicate attention to behavior tracking, participation incentives, and multi-channel delivery for physical, mental, and nutritional wellness. Product roadmaps frequently include AI-driven health recommendations, multi-language support, and expanded wearable device compatibility.

Differentiation is achieved through verified engagement metrics, data privacy compliance, and detailed technical guidance provided in brochures. Brochures and datasheets are used to communicate program modules, tracking features, reporting capabilities, and integration requirements. Virgin Pulse, Alyfe, and Aptora literature emphasize engagement dashboards, fitness tracking, and analytics. Ceridian Lifeworks, Cerner Wellness, and CoreHealth Technologies brochures provide mental health modules, biometric integration, and reporting templates. HealthifyMe, Infinite Wellness Solutions, and Limeade materials highlight nutrition tracking, gamification, and mobile accessibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 56.5 Billion |

| Service | Nutrition and weight management, Fitness services, Health risk assessment corporate wellness, Stress management, Smoking cessation, Health screening, Alcohol and drug abuse services, Health education services, Biometric screening, and Others |

| Category | Fitness and nutrition consultants, Psychological therapists, and Organizations |

| End-User | Large-size private organizations, Small-size private organizations, Mid-size private organizations, Public sector, and NGO |

| Delivery Mode | Onsite and Offsite |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Virgin Pulse, Alyfe Wellbeing Strategies, Aptora, BSDI, Burner Fitness, Ceridian Lifeworks, Cerner Wellness, CoreHealth Technologies, HealthifyMe Wellness, Infinite Wellness Solutions, Limeade, MediKeeper, Namaste New York, NC State Human Resources, Sprout, Wellness Layers, and Wellsource |

| Additional Attributes | Dollar sales by type including mental health programs, fitness and physical activity initiatives, nutrition and dietary services, and stress management solutions, application across corporate offices, manufacturing facilities, and healthcare organizations, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising employee health awareness, corporate investment in productivity, and increasing focus on occupational well-being. |

The global workplace wellness market is estimated to be valued at USD 56.5 billion in 2025.

The market size for the workplace wellness market is projected to reach USD 92.0 billion by 2035.

The workplace wellness market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in workplace wellness market are nutrition and weight management, fitness services, health risk assessment corporate wellness, stress management, smoking cessation, health screening, alcohol and drug abuse services, health education services, biometric screening and others.

In terms of category, fitness and nutrition consultants segment to command 31.2% share in the workplace wellness market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Workplace Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Smart Workplace Market Size and Share Forecast Outlook 2025 to 2035

Managed Workplace Services Market Analysis – Growth & Forecast through 2035

USA Managed Workplace Services Market Insights – Trends, Demand & Growth 2025-2035

Employer and Workplace Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Japan Managed Workplace Services Market Growth – Trends, Demand & Innovations 2025-2035

Industrial and Workplace Safety Market Growth – Trends & Forecast 2025 to 2035

Germany Managed Workplace Services Market Analysis – Demand, Growth & Forecast 2025-2035

UK Countries Managed Workplace Services Market Report – Demand, Trends & Industry Forecast 2025-2035

GCC Countries Managed Workplace Services Market Report – Growth, Demand & Forecast 2025-2035

Wellness Tourism Market Report – Growth & Demand 2025 to 2035

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

Global Pet Wellness Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Sexual Wellness Market Size and Share Forecast Outlook 2025 to 2035

Corporate Wellness Solution Market Size and Share Forecast Outlook 2025 to 2035

Corporate Wellness Software Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

UK Sexual Wellness Market Trends – Size, Share & Innovations 2025-2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Health and Wellness Product Market Analysis – Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA