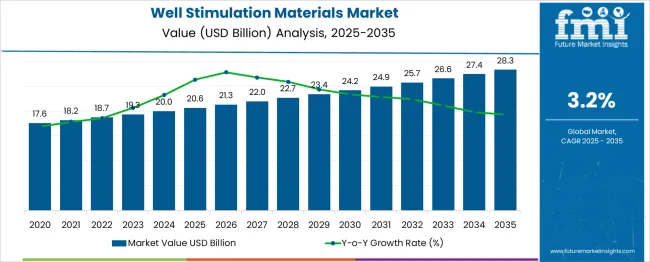

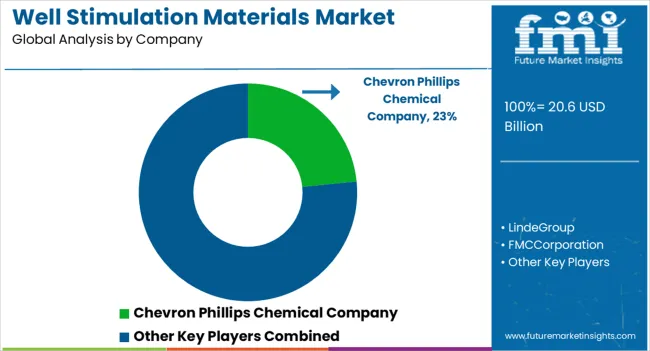

The Well Stimulation Materials Market is estimated to be valued at USD 20.6 billion in 2025 and is projected to reach USD 28.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

Between 2025 and 2030, the market rises to USD 24.2 billion, reflecting a five-year increase of USD 3.6 billion. YoY growth is gradual: USD 21.3 billion in 2026 (+3.4%), USD 22.0 billion in 2027 (+3.3%), USD 22.7 billion in 2028 (+3.2%), USD 23.4 billion in 2029 (+3.1%), and USD 24.2 billion in 2030 (+3.4%). This growth trend reflects steady activity in hydraulic fracturing and acidizing, particularly in mature and unconventional fields.

A validated trend in technical literature is the shift toward low-viscosity, high-performance materials, which improve well productivity while reducing water and chemical loads. These materials support better proppant suspension and flow characteristics during stimulation. The demand is consistent in regions with extensive tight formations, where stimulation remains essential for economic production. Market expansion is influenced by field requirements rather than speculative innovation, and the pace reflects operational needs across key producing regions. The overall trajectory remains stable through 2030, driven by the operational role of stimulation in maximizing reservoir output.

| Metric | Value |

|---|---|

| Well Stimulation Materials Market Estimated Value in (2025 E) | USD 20.6 billion |

| Well Stimulation Materials Market Forecast Value in (2035 F) | USD 28.3 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

In the well stimulation materials market, manufacturers compete by optimizing material performance, supply chain efficiency, and client-specific solutions. A key strategy is the development of high-purity proppants and chemical additives that enhance hydrocarbon recovery rates, often targeting stimulation efficiency gains of 15–25% per well. Manufacturers also focus on granule strength, sphericity, and conductivity, as operators demand materials that maintain fracture integrity under pressures exceeding 10,000 psi.

To meet these technical demands while controlling costs, companies invest in vertically integrated operations, managing everything from raw material extraction (e.g., frac sand or resin-coated proppants) to final processing. This integration can reduce material costs by 10–20%, improving bid competitiveness. Regional supply hubs near key basins such as the Permian or Marcellus are another priority, helping reduce lead times and transportation costs, which can otherwise comprise up to 50% of total delivery expenses.

Manufacturers also tailor chemical blends to local reservoir conditions, using field data to adjust surfactants, gelling agents, and crosslinkers for specific formations. Long-term supply agreements with oilfield service companies and E&P operators create stable demand pipelines. In a market influenced by drilling cycles, regulatory scrutiny, and environmental concerns, responsiveness to client needs and operational flexibility remain central to sustained market success.

As global energy demand continues to grow, exploration and production companies are increasingly investing in unconventional hydrocarbon reservoirs that require advanced stimulation methods. This transition has driven the need for materials that can endure extreme subsurface conditions while improving extraction efficiency.

Rising capital inflows into upstream operations, particularly across North America, the Middle East, and the Asia Pacific, have been complemented by favorable regulatory environments encouraging domestic production. Material science innovations have further improved the performance of stimulation agents by enhancing thermal resistance, minimizing formation damage, and optimizing proppant conductivity.

Lifecycle optimization and sustainability targets gain prominence, the demand for high-performance, environmentally conscious stimulation materials is expected to grow. In the coming years, the market will likely benefit from integration with digital monitoring systems and the development of next-generation fracturing fluids.

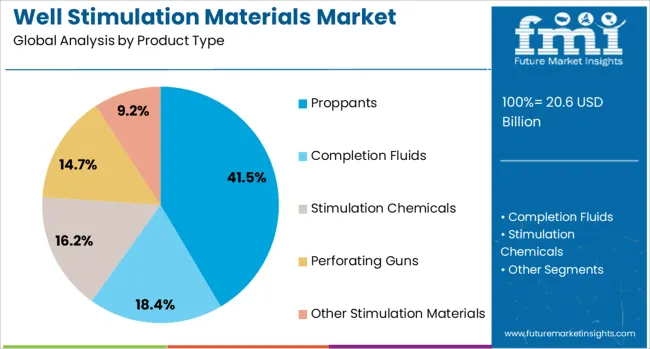

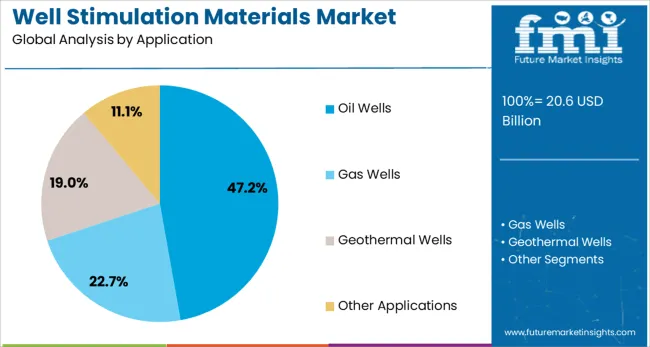

The well stimulation materials market is segmented by product type, application, extraction method, company size, and geographic regions. The well stimulation materials market is divided by product type into Proppants, Completion Fluids, Stimulation Chemicals, Perforating Guns, and Other Stimulation Materials. In terms of application, the well stimulation materials market is classified into Oil Wells, Gas Wells, Geothermal Wells, and Other Applications.

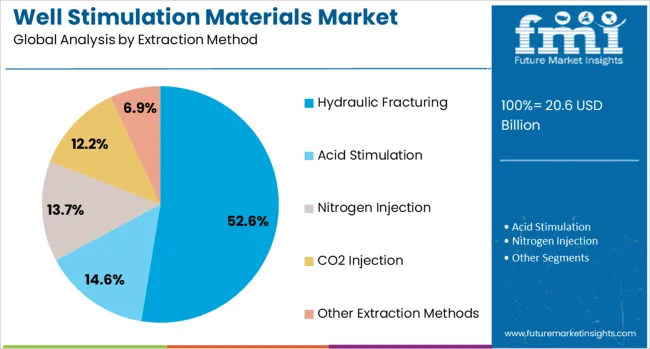

Based on the extraction method of the well stimulation materials, the market is segmented into Hydraulic Fracturing, Acid Stimulation, Nitrogen Injection, CO2 Injection, and Other Extraction Methods. The well stimulation materials market is segmented by company size into Large Companies, Medium-Sized Companies, and Small Companies. Regionally, the well stimulation materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Proppants are expected to hold 41.5% of the total revenue share in the well stimulation materials market in 2025, making them the dominant product type. This leadership is being driven by the critical role of proppants in maintaining fracture integrity and enhancing hydrocarbon flow post-stimulation. The segment has witnessed steady innovation in terms of material composition, with ceramic, resin-coated, and ultra-lightweight proppants gaining traction for their superior strength and conductivity.

The demand has also been supported by the growing prevalence of multi-stage hydraulic fracturing techniques in shale and tight reservoirs, which require high volumes of durable proppants to maximize reservoir contact. Enhanced compatibility with fracturing fluids and reduced flowback tendencies have further contributed to the rising preference for engineered proppants.

Moreover, advancements in logistics and regional sourcing have improved supply chain efficiency, enabling large-scale operations in active drilling basins. The adaptability of proppants across diverse geologies and their direct impact on well productivity have firmly established their significance in stimulation programs.

Oil wells are projected to account for 47.2% of the revenue share in the well stimulation materials market in 2025, marking their position as the leading application segment. This dominance is being shaped by the consistent demand for improved recovery from both mature and newly developed oil fields. The ongoing depletion of conventional reservoirs has led operators to deploy advanced stimulation techniques to extend production life and optimize yields, thereby driving the consumption of stimulation materials.

Oil wells, particularly in unconventional formations, demand precise material performance to ensure effective fracture propagation and long-term conductivity. The increased drilling of horizontal wells and the adoption of complex completion designs have necessitated customized material formulations capable of withstanding high pressures and varying reservoir chemistries.

In addition, the drive to reduce environmental impact and water usage has led to a shift toward stimulation materials with improved efficiency and lower ecological footprint. These evolving technical and regulatory expectations have contributed to the segment’s sustained growth.

Hydraulic fracturing is expected to represent 52.6% of the revenue share in the well stimulation materials market in 2025, establishing it as the dominant extraction method. This segment’s growth has been fueled by its effectiveness in unlocking hydrocarbons from low-permeability formations and revitalizing underperforming wells. The widespread implementation of hydraulic fracturing across shale plays and tight oil reservoirs has created a strong demand for high-quality stimulation materials that can endure intense downhole conditions.

Technological advances in fracturing fluid systems and proppant delivery mechanisms have allowed more controlled and efficient operations, enhancing the method’s economic and operational viability. The shift toward horizontal drilling and multi-zone completions has further elevated the requirement for stimulation materials with enhanced stability and performance.

Additionally, increasing focus on real-time monitoring and data-driven fracture modeling has intensified the demand for materials that integrate well with smart completion strategies. As hydraulic fracturing remains central to global unconventional resource development, its role in shaping material requirements is expected to grow further.

Rising global demand for enhanced oil and gas recovery is increasing need for high-performance well stimulation materials. Expanding production in mature fields and renewable-linked geothermal activity are accelerating adoption of specialized blends and service solutions.

Operators in oil, gas, and geothermal sectors are increasingly using stimulant blends such as acidizing fluids, proppants, and polymer-based friction reducers that optimize permeability and improve well flow. Materials customized for varying downhole conditions—like high temperature, salinity or acidic environments—are essential to avoid formation damage. Demand is strong in mature reservoirs where secondary and tertiary recovery steps extend production life. Fracturing jobs rely on consistent proppant quality and viscosity modifiers to control fracture geometry. Enhanced geothermal systems require materials resilient to thermal cycling and dissolved mineral stress. Strict environmental regulations prompt use of biodegradable or low-toxicity formulations. Precision in material selection is critical to maximize stimulation effectiveness while minimizing operational risk and maintaining reservoir integrity.

Market growth is being fostered through partnerships between material suppliers and end users to co-develop PPE alloy grades tailored for specific product requirements such as flame retardant properties or impact resistance. Local compounding hubs near electronics and automotive clusters reduce lead time and allow just-in-time delivery of custom resin blends. Suppliers offering small batch trials, performance testing, and supply agreements help manufacturers validate adoption. Platforms combining resin supply with application support and lifecycle testing enable smoother integration into existing molding processes. Industry collaborations in sectors like telecommunication hardware and power distribution equipment create demand for specialized PPE alloy grades. These strategies support broader adoption across performance-driven industrial applications.

Global fluctuations in oil pricing directly influence operators’ willingness to invest in stimulation materials. In price downturns, companies defer or scale back hydraulic fracturing and acidizing projects, reducing demand for proppants, fluids, and additives. Planning procurement becomes difficult under price uncertainty and affects revenue forecasting for material suppliers. Low commodity prices also pressure service companies to seek cost-cutting, often choosing lower-grade or fewer treatments per well. In mature basins, operators may delay secondary stimulation, further limiting volume growth. Without long-term contracts or diversified end-use segments, stimulation material manufacturers face cyclical demand that undermines investment planning and production scaling.

Expanding production from shale, tight oil, and maturing reservoirs offers strong market potential. Operators targeting unconventional formations rely heavily on hydraulic fracturing using specialized proppants and fluid systems tailored for low-permeability rock. Additionally, redevelopment of aging conventional wells increases demand for acidizing and stimulation treatments. Emerging markets in Asia‑Pacific, Latin America, and parts of Africa are ramping up well stimulation activity to improve recovery rates in older fields. Suppliers offering high-conductivity engineered proppants or fluid additives optimized for acidizing or hydraulic fracturing in complex geology capture preference in these applications, driving volume growth tied to global energy production trends.

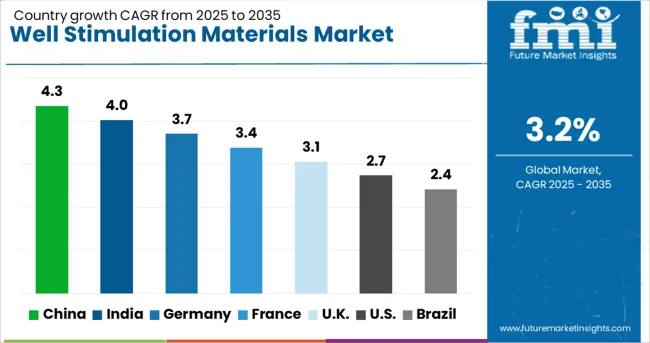

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.1% |

| USA | 2.7% |

| Brazil | 2.4% |

China, part of the BRICS group, is forecasted to grow at a 4.3% CAGR from 2025 to 2035, supported by the continued development of tight gas and shale plays requiring large volumes of proppants and friction reducers. India follows at 4.0%, where exploration programs in marginal fields and unconventional basins are driving demand for acidizing fluids and crosslinked gels. Among OECD countries, Germany is expanding at 3.7%, with demand concentrated in controlled stimulation of mature gas wells and research-led reservoir enhancement initiatives.

France, with a growth rate of 3.4%, is seeing gradual use of biodegradable and low-impact stimulation additives in geothermal and oil redevelopment wells. The United Kingdom, at 3.1%, maintains consumption levels through targeted stimulation work in declining North Sea wells and advanced onshore test sites. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

China is witnessing a CAGR of 4.3% in the well stimulation materials market, driven by rising oil and gas exploration and increasing adoption of hydraulic fracturing. Domestic producers are scaling up manufacturing of proppants, gelling agents, and friction reducers to meet demand from unconventional resource development. Innovations in water-based fluid systems and polymer blends are improving stimulation efficiency. Shale formations in Sichuan and Ordos basins are fueling demand for high-performance materials capable of withstanding high pressure and temperature. Chinese firms are also exporting stimulation chemicals to Southeast Asia and Africa. The government is supporting technology localization to reduce dependence on imports and improve cost competitiveness. Advanced logistics and onsite blending systems are ensuring timely delivery of materials to remote drilling locations. Research collaborations are ongoing to develop eco-friendly stimulation materials with minimal formation damage.

India is recording a CAGR of 4% in the well stimulation materials market, propelled by increased activity in oil and gas extraction and the push for domestic energy production. Public and private sector collaborations are boosting demand for cost-effective stimulation solutions, particularly in coal bed methane and tight gas fields. Local companies are producing guar gum-based gelling agents and sand-based proppants tailored for Indian reservoirs. Emphasis is placed on reducing freshwater usage by introducing recyclable and low-residue fluid systems. Imports of specialty chemicals are being balanced with local production to maintain affordability. Drilling activities in Assam, Rajasthan, and the Krishna-Godavari basin are key demand drivers. Training programs are improving field application efficiency, while government energy policies support innovation. Supply chains are being strengthened through regional storage and blending hubs.

In Germany, the well stimulation materials market is expanding at a CAGR of 3.7%, led by efforts to enhance geothermal energy extraction and reservoir productivity. The use of chemical additives is guided by stringent environmental regulations, prompting the development of biodegradable and non-toxic formulations. Local suppliers are providing high-purity polymers, crosslinkers, and proppants for use in controlled stimulation procedures. Pilot geothermal projects are testing thermally stable fluid systems designed for low-permeability formations. Collaborative research with universities is aiding in the development of new materials that reduce formation damage and improve flowback efficiency. Application in energy storage caverns and underground heat exchangers is also contributing to demand. Product traceability and documentation are emphasized to meet regulatory reporting standards. Germany continues to invest in sustainable well stimulation practices aligned with its long-term energy goals.

France is experiencing a 3.4 % CAGR in the well stimulation materials market, supported by geothermal energy development and enhanced recovery techniques in mature reservoirs. Regulations around chemical usage are shaping the market toward safer and more environmentally compatible stimulation materials. French companies are investing in research for green proppants, water-soluble breakers, and low-toxicity surfactants. Most demand is coming from geothermal fields in eastern and central regions, where stimulation improves thermal output and well lifespan. Advanced monitoring is helping optimize chemical dosing and flow control. Government policies favor clean technologies, encouraging transition away from hydrocarbon-based additives. Import substitution is limited, with a focus on regional production for quicker delivery. Fluid compatibility and well integrity are primary factors in material selection. Industry partnerships are fostering product development in line with EU energy standards.

The United Kingdom well stimulation materials market is growing at a CAGR of 3.1 %, supported by a mix of geothermal energy development and rehabilitation of legacy oil wells. Focus is on reducing environmental impact through the use of biodegradable and low-risk additives. Domestic suppliers are providing stimulation chemicals suited for use in populated and environmentally sensitive areas. Offshore oil platforms are continuing to apply stimulation treatments to maintain reservoir pressure and boost recovery. Research is ongoing into seawater-compatible fluid systems and biodegradable friction reducers. The UK market also benefits from regulatory support for enhanced energy extraction efficiency. Fluid systems are being designed for modular deployment in constrained offshore setups. Integration of real-time monitoring with dosing units is increasing operational control during stimulation treatments.

The well stimulation materials market is moderately consolidated and segmented into Tier 1 and Tier 2 suppliers, comprising global chemical corporations and specialized mining companies that support enhanced oil and gas recovery operations. Tier 1 suppliers are typically large-scale chemical manufacturers offering comprehensive portfolios of specialty materials essential to hydraulic fracturing (fracking), acidizing, and other well stimulation techniques.

These companies provide surfactants, friction reducers, scale inhibitors, biocides, and crosslinkers designed to improve reservoir permeability, minimize formation damage, and maximize hydrocarbon flowback. Their formulations are engineered for complex geological environments, enabling higher extraction efficiency while maintaining compatibility with formation chemistry and produced fluids.

These suppliers often operate globally, backed by integrated research and development capabilities, on-site technical services, and long-term relationships with major oilfield service providers and E&P operators. Tier 2 suppliers play a crucial role in the supply of granular materials, fluid enhancers, and gelling systems.

These include companies focused on the production and refinement of high-purity proppants such as silica sand, resin-coated sand, and ceramic particles used to keep fractures open during stimulation. Additionally, they offer gelling agents, clay stabilizers, and rheology modifiers that enhance fluid transport and control during downhole deployment. Tier 2 suppliers are vital for regional shale and tight oil plays, where consistent material quality and logistical efficiency are critical to operational success.

Halliburton formally unveiled the OCTIV® Auto Frac service on September 19, 2024, as part of its OCTIV® intelligent fracturing platform. This autonomous job control technology digitizes and automates frac operations, enabling completion designs to be executed exactly, with no human intervention.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.6 Billion |

| Product Type | Proppants, Completion Fluids, Stimulation Chemicals, Perforating Guns, and Other Stimulation Materials |

| Application | Oil Wells, Gas Wells, Geothermal Wells, and Other Applications |

| Extraction Method | Hydraulic Fracturing, Acid Stimulation, Nitrogen Injection, CO2 Injection, and Other Extraction Methods |

| Company Size | Large Companies, Medium-Sized Companies, and Small Companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ChevronPhillipsChemicalCompany(Chevron USA.Inc.,Phillips66Company), LindeGroup, FMCCorporation, SolvayS.A, AkzoNobelN.V., BadgerMiningCorporation, and USA Silica |

| Additional Attributes | Dollar sales by material type including proppants such as sand, ceramic, and resin-coated, base fluids like polymer gels and surfactants, acids including hydrochloric and hydrofluoric, and additives such as biocides and corrosion inhibitors. Demand is driven by hydraulic fracturing and acidizing in shale, tight oil, and geothermal wells. Innovation focuses on bio-based and nanoparticle-enhanced formulations. Costs are influenced by raw material sourcing and regulations, with rising use in unconventional and offshore drilling. |

The global well stimulation materials market is estimated to be valued at USD 20.6 billion in 2025.

The market size for the well stimulation materials market is projected to reach USD 28.3 billion by 2035.

The well stimulation materials market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in well stimulation materials market are proppants, completion fluids, stimulation chemicals, perforating guns and other stimulation materials.

In terms of application, oil wells segment to command 47.2% share in the well stimulation materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Well Casing Market Size and Share Forecast Outlook 2025 to 2035

Wellness Tourism Market Report – Growth & Demand 2025 to 2035

Wellness Services Market Trends - Growth & Forecast 2025 to 2035

Wellbore Cleaning Tool Market Size, Share, Trend & Forecast 2024-2034

Wellhead System Market

Swellable Packers Market Growth - Trends & Forecast 2025 to 2035

Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Jewellery Box Market

Oilwell Completion Tools Market Analysis - Size, Share & Forecast 2025 to 2035

Global Pet Wellness Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

Sexual Wellness Market Size and Share Forecast Outlook 2025 to 2035

Dipper Wells and Accessories Market - Sanitary Utensil Rinsing 2025 to 2035

Corporate Wellness Solution Market Size and Share Forecast Outlook 2025 to 2035

Corporate Wellness Software Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Workplace Wellness Market Size and Share Forecast Outlook 2025 to 2035

Leather Jewellery Box Market Size and Share Forecast Outlook 2025 to 2035

UK Sexual Wellness Market Trends – Size, Share & Innovations 2025-2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Health and Wellness Product Market Analysis – Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA