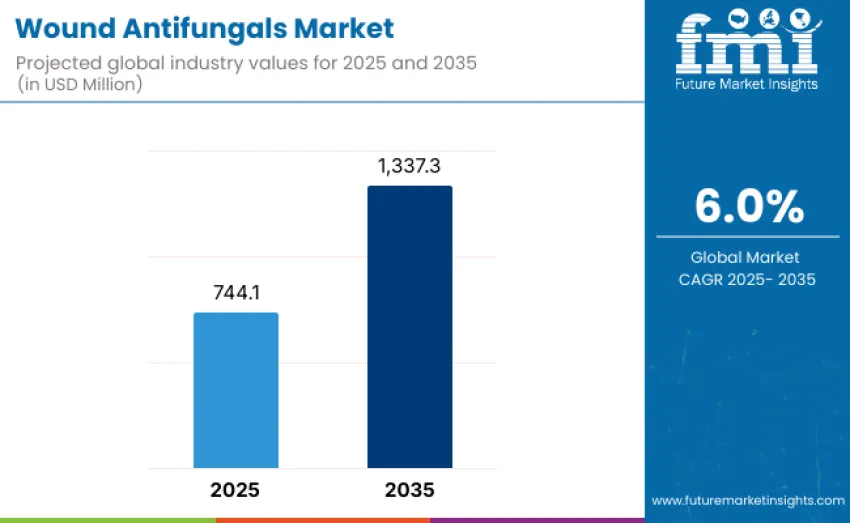

The global wound antifungals market is expected to reach USD 1,337.3 million by 2035, recording an absolute increase of USD 593.2 million over the forecast period. This market is valued at USD 744.1 million in 2025 and is projected to grow at a CAGR of 6.0% over the assessment period. Growth is supported by the increasing incidence of chronic and acute wounds that are prone to fungal infections, particularly among diabetic, immunocompromised, and elderly populations. Rising awareness about infection-related complications in wound management drives consistent demand for antifungal wound care products.

Technological advancements in topical antifungal formulations, including creams, gels, sprays, and dressings with enhanced bioavailability and faster healing properties, are reshaping the wound antifungals landscape. Modern systems incorporate advanced delivery mechanisms that ensure targeted therapeutic effects while minimizing systemic exposure. Integration with antimicrobial dressings and bioactive wound care materials allows comprehensive infection management across professional applications. Advanced formulation technologies enable natural healing processes that replicate optimal therapeutic environments, supporting clinical outcomes.

Government healthcare initiatives promoting advanced wound care practices, coupled with expanding availability of over-the-counter antifungal products, accelerate growth. Healthcare institutions worldwide invest in wound care infrastructure to prepare clinicians for complex wound management challenges. Clinical training programs for healthcare teams and wound care specialists drive demand for professional antifungal products that enable comprehensive infection control capabilities. Industry adoption of evidence-based protocols creates sustained investment in wound care products that will allow healthcare professionals to maintain treatment efficacy.

Between 2025 and 2030, the wound antifungals market is projected to expand from USD 744.1 million to USD 996.6 million, representing a 42.6% share of the total forecast growth for the decade. This phase will be shaped by rising demand for professional wound care solutions and advanced antifungal treatment protocols, product innovation in topical formulations and delivery system optimization, as well as expanding integration with comprehensive wound management programs. Companies are establishing competitive positions through investment in advanced antifungal technologies.

From 2030 to 2035, growth is forecast from USD 996.6 million to USD 1,337.3 million, adding USD 340.7 million, constituting 57.4% of overall ten-year expansion. This period is expected to be characterized by expansion of specialized antifungal dressings, including combination therapies and integrated wound care systems tailored for specific clinical applications, strategic collaborations between pharmaceutical manufacturers and healthcare providers, and enhanced focus on evidence-based treatment protocols and patient outcome optimization. Growing emphasis on chronic wound management will drive demand for advanced antifungal solutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 744.1 million |

| Market Forecast Value (2035) | USD 1,337.3 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The wound antifungals market grows worldwide due to increasing incidence of chronic and acute wounds that are prone to fungal infections, particularly among diabetic, immunocompromised, and elderly populations. Rising awareness about infection-related complications in wound management and growing emphasis on preventing hospital-acquired infections drive consistent demand for antifungal wound care products. Advancements in topical antifungal formulations, including creams, gels, sprays, and dressings with enhanced bioavailability and faster healing properties, expand clinical adoption across hospitals, outpatient settings, and home care environments.

The rising prevalence of diabetic foot ulcers, surgical site infections, and burns intensifies the need for targeted antifungal interventions to reduce healing time and prevent secondary bacterial infections. Government healthcare initiatives promoting advanced wound care practices, coupled with expanding availability of over-the-counter antifungal products, propel penetration in both developed and emerging economies. Growing integration of antifungal agents into antimicrobial dressings and bioactive wound care materials reshapes treatment protocols toward combination therapies that enhance patient outcomes.

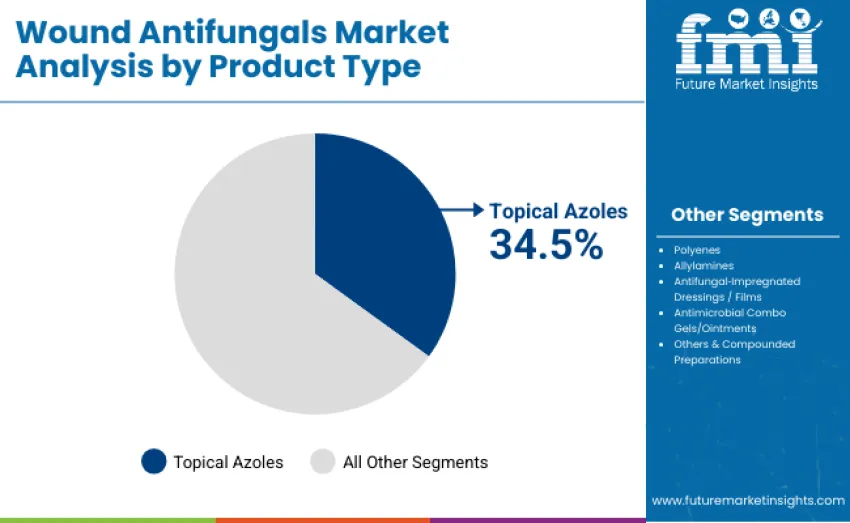

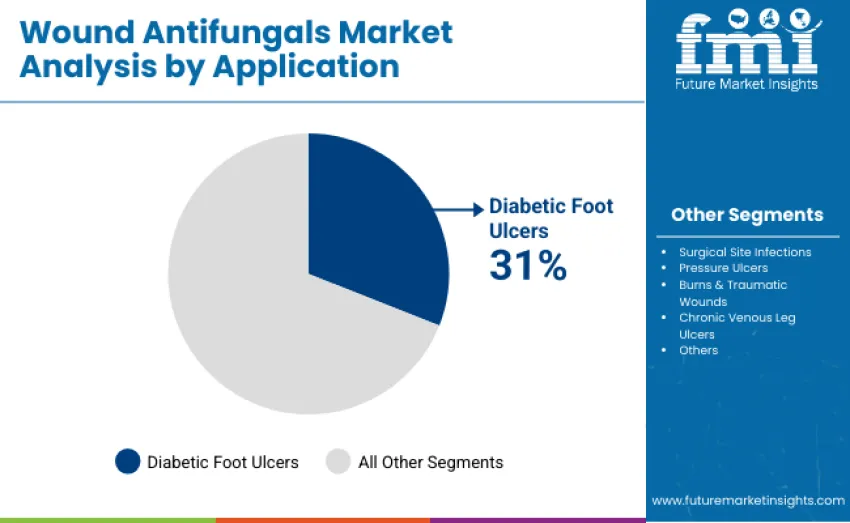

The wound antifungals market is segmented by product type, application, and region. By product type, division includes topical azoles, polyenes, allylamine, antifungal impregnated dressings/films, antimicrobial combo gels/ointments, and others & compounded preparations. Based on application, categorization covers diabetic foot ulcers, surgical site infections, pressure ulcers, burns & traumatic wounds, chronic venous leg ulcers, and others. Regionally, segmentation spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The topical azoles segment represents the dominant force, capturing 34.5% of total revenue in 2025. This category includes clotrimazole and miconazole formulations, widely recognized for their broad-spectrum antifungal efficacy, ease of application, and strong clinical adoption across hospitals, outpatient clinics, and home care settings. Leadership stems from critical role in standard wound care protocols, providing effective management of fungal infections in acute and chronic wounds and promoting faster healing outcomes.

Key advantages driving the Topical Azoles segment include:

The diabetic foot ulcers segment represents the leading application with 31% of total revenue in 2025. Leadership is driven by rising global prevalence of diabetes and increased susceptibility of diabetic wounds to fungal infections, making targeted antifungal treatments critical for preventing complications and promoting faster healing. Surgical site infections account for 19%, reflecting the need for infection control in postoperative care, while pressure ulcers serve hospital and long-term care settings.

Key market dynamics supporting application preferences include:

The wound antifungals market is driven by several key factors reflecting growing clinical demand and evolving healthcare practices. Rising prevalence of chronic and acute wounds, including diabetic foot ulcers, pressure ulcers, and surgical site infections, increases the need for effective antifungal treatments to prevent complications and promote faster healing. Expanding diabetic and immunocompromised patient populations worldwide are particularly susceptible to fungal wound infections, driving consistent adoption of targeted antifungal therapies in hospitals, clinics, and home care settings.

Growing awareness among healthcare providers and patients regarding infection prevention and advanced wound care protocols supports integration of topical azoles, antifungal dressings, and combination therapies into standard wound management practices. Restraints include high product costs, which can limit access in low- and middle-income regions, and risk of antifungal resistance that may reduce treatment effectiveness over time. Limited availability of advanced antifungal formulations and specialized dressings in certain markets can moderate growth.

Key emerging trends include development of combination therapies that integrate antifungal and antibacterial agents, increasing use of antifungal-impregnated dressings for chronic and hard-to-heal wounds, and adoption of innovative topical formulations with enhanced bioavailability and faster healing properties. Regional growth is particularly notable in Asia-Pacific, where government healthcare initiatives, rising diabetic populations, and expanding access to advanced wound care products drive expansion. Research into next-generation antifungal therapies, including bioactive dressings and sustained-release formulations, shapes product innovation.

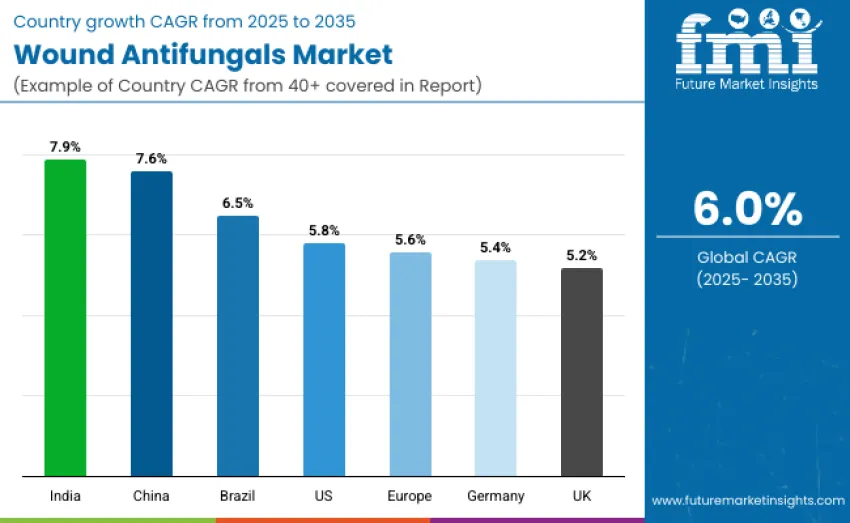

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8 % |

| Brazil | 6.5 % |

| China | 7.6 % |

| India | 7.9 % |

| Europe | 5.6 % |

| Germany | 5.4 % |

| United Kingdom | 5.2 % |

The wound antifungals market is experiencing global growth, with India leading at a CAGR of 7.9%, driven by rising chronic wounds and government-backed initiatives. China follows at 7.6%, benefiting from healthcare investments and diabetes management programs. Brazil shows strong growth at 6.5%, spurred by rising chronic wound awareness. The USA has a steady growth rate of 5.8%, supported by its mature healthcare system. Germany leads Europe at 5.4%, the U.K. show consistent progress at 5.3% and 5.2%, respectively. Overall, Europe grows at 5.6%, with established markets providing stability.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

In India, the wound antifungals market is projected to grow at a CAGR of 7.9% through 2035. Growth is driven by technological advancements in antifungal formulations, topical therapies, and impregnated dressings that enhance treatment efficacy. Healthcare professionals are implementing standardized wound antifungal protocols and advanced dressing workflows to improve patient outcomes while meeting clinical efficacy standards required in modern wound management. National and regional healthcare programs promoting chronic wound care and infection control sustain demand for antifungal wound products.

Key market factors:

China demonstrates the strongest growth potential with a CAGR of 7.6% through 2035. Leadership is supported by advanced healthcare infrastructure, which strengthens product awareness, distribution efficiency, and adoption across professional and institutional channels. Growth concentrates in major urban clusters, including Beijing, Shanghai, Shenzhen, and Hangzhou, where technology-driven industries and healthcare ecosystems create enabling environments for wound antifungal deployment. Distribution channels through hospitals, specialty clinics, and pharmaceutical networks facilitate rapid availability.

Key market factors:

Germany's wound antifungals market demonstrates structured adoption across hospitals, clinics, and home care settings, with documented case studies showing improvements in patient outcomes and infection control through standardized antifungal treatment protocols. Leading healthcare centers and chronic wound management programs showcase integration of antifungal dressings, topical therapies, and advanced treatment workflows, leveraging clinical expertise and strong healthcare infrastructure. Healthcare professionals emphasize treatment efficacy, safety, and patient adherence, creating demand for high-quality antifungal solutions. Growth maintains steady progress with a CAGR of 5.4% through 2035.

Key development areas:

The Brazilian wound antifungals market demonstrates structured adoption across hospitals, clinics, and home care settings, with documented case studies showing improvements in patient outcomes and infection control through standardized antifungal treatment protocols. Major healthcare centers and chronic wound management programs showcase integration of antifungal dressings, topical therapies, and advanced treatment workflows, leveraging clinical expertise and local healthcare infrastructure. Healthcare professionals emphasize treatment efficacy, safety, and patient adherence, driving demand for high-quality antifungal solutions. Growth demonstrates strong momentum with a CAGR of 6.5% through 2035.

Key development areas:

The USA wound antifungals market demonstrates mature adoption across hospitals, clinics, and home care settings, with documented integration into established chronic wound management programs and home care initiatives. Major healthcare networks and specialized wound care centers showcase the use of antifungal dressings, topical therapies, and advanced treatment protocols, leveraging clinical expertise and strong healthcare infrastructure. Growth maintains steady progress with a CAGR of 5.8% through 2035, driven by high patient volumes, well-developed chronic wound care programs, and mature healthcare ecosystem supporting widespread clinician adoption.

Key market characteristics:

In the United Kingdom, adoption of wound antifungal treatments accelerates across hospitals, clinics, and home care settings in London, Manchester, Bristol, and Edinburgh, with documented case studies showing improvements in patient outcomes and infection control through standardized antifungal protocols. Growth demonstrates solid potential with a CAGR of 5.2% through 2035, driven by expanding chronic wound care infrastructure, increased awareness of advanced wound management practices, and government healthcare initiatives supporting community and outpatient care programs. Healthcare professionals implement antifungal dressings, topical therapies, and integrated treatment workflows.

Market development factors:

The wound antifungals market in Europe is projected to grow from USD 208.3 million in 2025 to USD 361.1 million by 2035, registering a CAGR of 5.6% over the forecast period, witnessing steady growth driven by expanding chronic wound care programs and improved healthcare infrastructure. Germany shows a CAGR of 5.4%, supported by advanced healthcare facilities and structured chronic wound management initiatives.

The United Kingdom records a CAGR of 5.2%, reflecting expansion of community healthcare programs and chronic wound management initiatives. Italy maintains steady growth through hospital-based wound care programs and specialized treatment centers. Spain demonstrates consistent progress through healthcare modernization and chronic disease management programs. The Netherlands shows stable advancement through advanced healthcare infrastructure and clinical protocol standardization. Nordic countries record moderate growth through comprehensive healthcare systems and wound care specialization programs.

The Japanese Wound Antifungals Market is characterized by a mature, quality-focused landscape, where standardized antifungal treatment protocols are widely adopted across hospitals, clinics, and home care settings. Japan’s commitment to clinical precision and treatment efficacy drives demand for high-quality antifungal products, essential for chronic wound management. Strong partnerships between pharmaceutical manufacturers, healthcare providers, and clinical associations ensure antifungal solutions are integrated into established care workflows, optimizing infection control and patient outcomes. Healthcare professionals in Japan prioritize advanced wound management practices to maintain rigorous standards and ensure consistent results in wound care.

The South Korean Wound Antifungals Market is marked by a growing presence of international pharmaceutical providers. Companies maintain strong positions by offering comprehensive product support, clinical guidance, and technical services. Emphasis is placed on advanced chronic wound care, with hospitals, clinics, and home care providers demanding antifungal solutions that align with national healthcare programs. Regional distributors and healthcare networks expand market share through partnerships with international suppliers, offering specialized services such as Korean-language clinical guidance and tailored support. Collaborations between multinational manufacturers and Korean clinical associations improve service models, merging global product quality with local expertise.

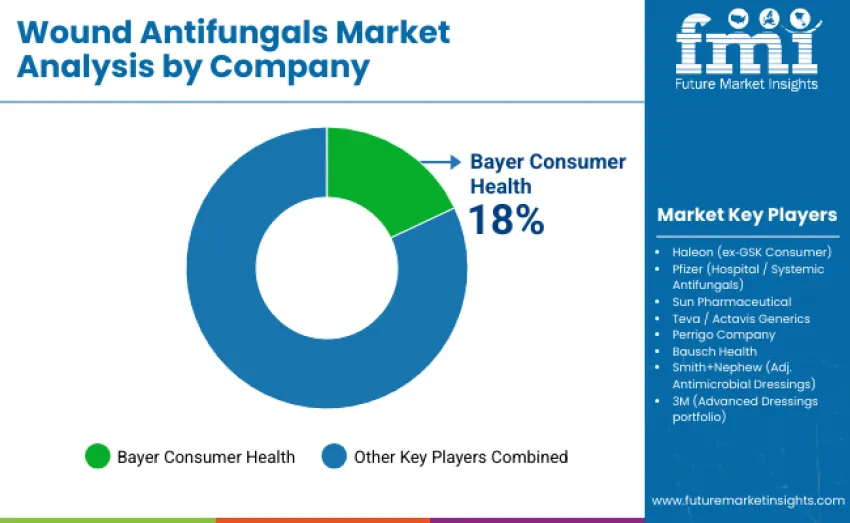

The global wound antifungals market is moderately concentrated, with 12–15 players. The top three companies, Bayer Consumer Health (18%), Haleon (formerly GSK Consumer), and Pfizer (Hospital/Systemic Antifungals), collectively control around 55–60% of the global market share. Their dominance stems from established brand recognition, extensive clinical validation, and comprehensive product portfolios. These companies lead the competition with formulation efficacy, a wide spectrum of antifungal activity, ease of application, and seamless integration with wound management protocols, rather than competing solely on price.

Other major players, including Sun Pharmaceutical, Teva/Actavis Generics, Perrigo Company, Bausch Health, Smith+Nephew (Advanced Antimicrobial Dressings), and 3M (Advanced Dressings Portfolio), sustain competitive advantages through robust research pipelines, broad distribution networks, and proven clinical performance. These companies continue to invest in novel topical formulations, impregnated dressing technologies, and delivery systems, defending their positions and expanding into hospital, clinic, and home care markets globally.

Product specialists target niche segments like diabetic foot ulcer care, chronic wound management, and burn-related infections, providing differentiated capabilities in specialized dressings, combination therapies, or portable treatment solutions. Emerging manufacturers add competitive pressure through rapid innovation, novel formulations, and cost-effective alternatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 744.1 million |

| Product Type | Topical Azoles, Polyenes, Allylamine, Antifungal Impregnated Dressings/Films, Antimicrobial Combo Gels/Ointments, Others & Compounded Preparations |

| Application | Diabetic Foot Ulcers, Surgical Site Infections, Pressure Ulcers, Burns & Traumatic Wounds, Chronic Venous Leg Ulcers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, and 40+ countries |

| Key Companies Profiled | Bayer Consumer Health, Haleon (ex GSK Consumer), Pfizer (Hospital/Systemic Antifungals), Sun Pharmaceutical, Teva/Actavis Generics, Perrigo Company, Bausch Health, Smith+Nephew (Adj. Antimicrobial Dressings), 3M (Advanced Dressings portfolio) and Others |

| Additional Attributes | Dollar sales in the wound antifungals market are driven by product type, application categories, and regional trends across North America, Europe, Asia-Pacific, and Latin America. Key factors include competitive dynamics, distribution networks, technical specifications, clinical integration, and innovative antifungal delivery systems |

The global wound antifungals market is valued at USD 744.1 million in 2025.

The market is projected to reach USD 1,337.3 million by 2035.

The market will grow at a CAGR of 6.0% from 2025 to 2035.

Topical Azoles lead the market with a 34.5% share in 2025.

Key players include Bayer Consumer Health, Haleon (ex-GSK Consumer), Pfizer (Hospital/Systemic Antifungals), Sun Pharmaceutical, and Teva/Actavis Generics.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wound Wash Market Size and Share Forecast Outlook 2025 to 2035

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Wound Skin Care Market - Demand & Forecast 2025 to 2035

Wound Stimulation Therapy Market Insights – Demand and Growth Forecast 2025 to 2035

Wound Care Surfactant Market Insights – Demand and Growth Forecast 2025 to 2035

Analysis and Growth Projections for Wound Healing Nutrition Market

Wound Irrigation Systems Market Growth - Trends & Forecast 2025 to 2035

Wound Debridement Products Market Analysis - Growth & Forecast 2025 to 2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Wound Measurement Devices Market

Wound Irrigation Devices Market

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Spiral Wound Membrane Market

Vaginal Antifungals Market Size and Share Forecast Outlook 2025 to 2035

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA